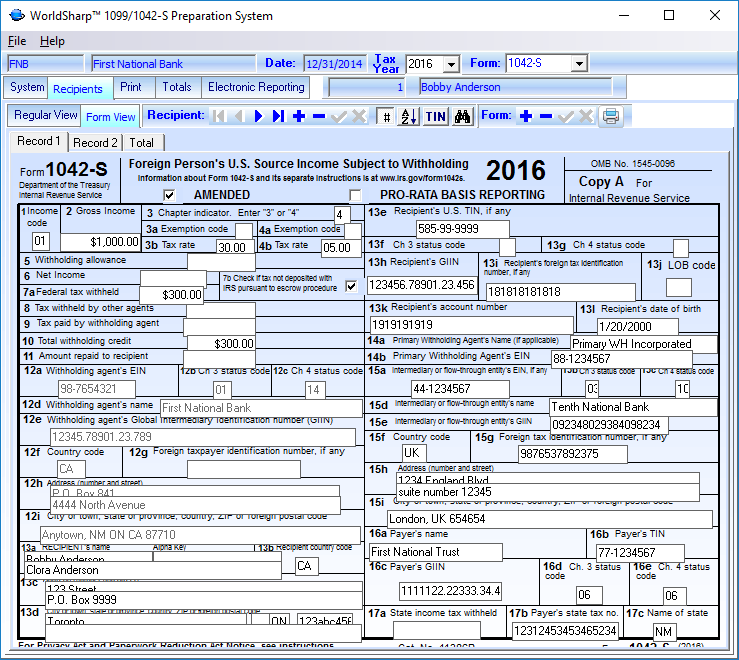

1042 -S Form

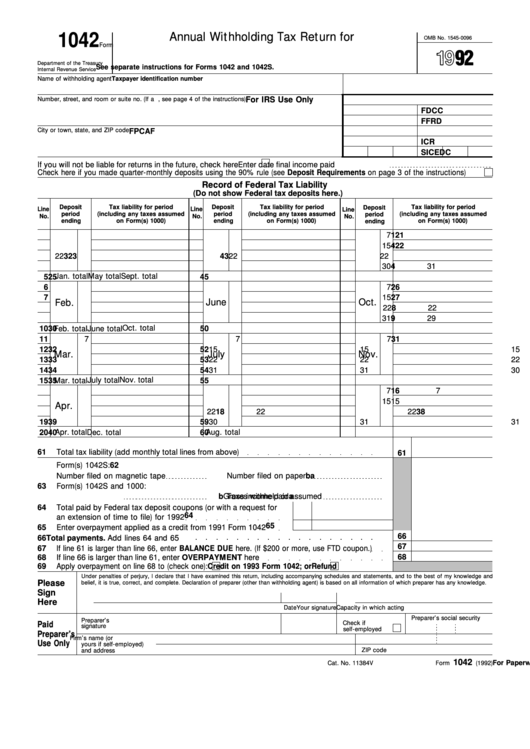

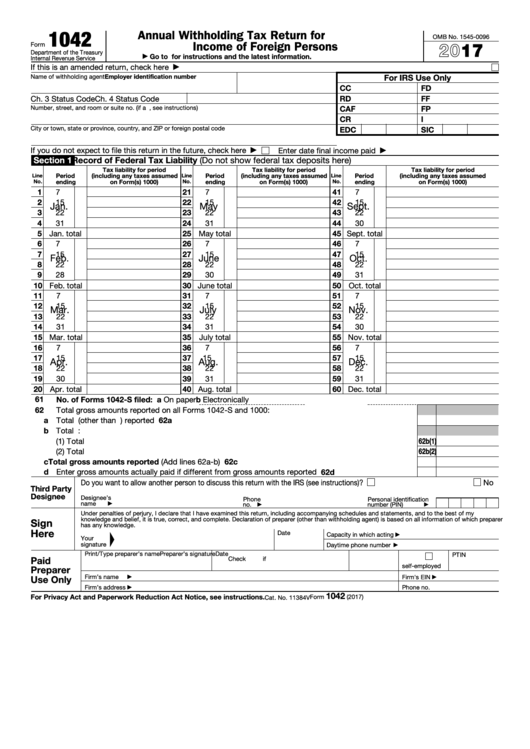

1042 -S Form - Web get federal tax return forms and file by mail. This creates a mismatch for the foreign partner, whereby the income. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web are you looking for where to file 1042 online? Web form 1042, also annual withholding tax return for u.s. Web form 1042 — annual withholding tax return for u.s. Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. You will then be able to download and print the 1042 to mail. For general information about electronic filing, see pub.

Ad get ready for tax season deadlines by completing any required tax forms today. Web are you looking for where to file 1042 online? Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Source income of foreign persons go to www.irs.gov/form1042 for. For general information about electronic filing, see pub. Web form 1042 — annual withholding tax return for u.s. Web form 1042, also annual withholding tax return for u.s. Web use form 1042 to report the following: Web form 1042, annual withholding tax return for u.s. Web electronic filing of form 1042 is available in 2023.

Web form 1042, annual withholding tax return for u.s. For general information about electronic filing, see pub. Students can also request a copy. Taxation under a tax treaty. This creates a mismatch for the foreign partner, whereby the income. Web use form 1042 to report the following: Ad get ready for tax season deadlines by completing any required tax forms today. Source income of foreign persons, is used to report tax withheld on the income of foreign persons. You will then be able to download and print the 1042 to mail. Source income of foreign persons go to www.irs.gov/form1042 for.

3.21.110 Processing Form 1042 Withholding Returns Internal Revenue

Web use form 1042 to report the following: Students can also request a copy. Irs approved tax1099.com allows you to create and submit the 1042. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them.

Form 1042 Annual Withholding Tax Return For U.s. Source Of

Web form 1042 — annual withholding tax return for u.s. Irs approved tax1099.com allows you to create and submit the 1042. Taxation under a tax treaty. Source income of foreign persons, is used to report tax withheld on the income of foreign persons. Web use form 1042 to report the following:

Form 1042S Edit, Fill, Sign Online Handypdf

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. This creates a mismatch for the foreign partner, whereby the income. Web get federal tax return forms and file by mail. Web form 1042 — annual withholding tax return for u.s. Irs approved tax1099.com allows you to create and submit the 1042.

1042 S Form slideshare

Source income of foreign persons, is used to report tax withheld on the income of foreign persons. Web get federal tax return forms and file by mail. Web form 1042 — annual withholding tax return for u.s. Web form 1042, also annual withholding tax return for u.s. Web form 1042, annual withholding tax return for u.s.

Fillable Form 1042 Annual Withholding Tax Return For U.s. Source

Persons 4 who make fdap payments to those foreign persons noted above are required to file form 1042, annual withholding tax return for u.s. Web use form 1042 to report the following: Source income of foreign persons go to www.irs.gov/form1042 for. Irs approved tax1099.com allows you to create and submit the 1042. Source income of foreign persons, is used to.

2018 2019 IRS Form 1042 Fill Out Digital PDF Sample

Web form 1042, annual withholding tax return for u.s. Web get federal tax return forms and file by mail. Web electronic filing of form 1042 is available in 2023. You will then be able to download and print the 1042 to mail. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign.

Form 1042 Annual Withholding Tax Return for U.S. Source of

Web form 1042, also annual withholding tax return for u.s. Taxation under a tax treaty. This creates a mismatch for the foreign partner, whereby the income. Web get federal tax return forms and file by mail. Ad get ready for tax season deadlines by completing any required tax forms today.

1042 Form Fill Out and Sign Printable PDF Template signNow

Source income of foreign persons, is used to report tax withheld on certain income of foreign persons. Source income of foreign persons go to www.irs.gov/form1042 for. Students can also request a copy. Web get federal tax return forms and file by mail. Web electronic filing of form 1042 is available in 2023.

The Tax Times The Newly Issued Form 1042S Foreign Person's U.S

Source income of foreign persons go to www.irs.gov/form1042 for. Web use form 1042 to report the following: Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. For general information about electronic filing, see pub. Irs approved tax1099.com allows you to create and submit the 1042.

Form 1042T Annual Summary and Transmittal of Forms 1042S (2015

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Web electronic filing of form 1042 is available in 2023. Persons 4 who make fdap payments to those foreign persons noted above are required to file form 1042, annual withholding tax return for u.s. Ad get ready for tax season deadlines by completing any.

Get Paper Copies Of Federal And State Tax Forms, Their Instructions, And The Address For Mailing Them.

Irs approved tax1099.com allows you to create and submit the 1042. Source income of foreign persons go to www.irs.gov/form1042 for. Whether a foreign freelancer is paid $100 per year or $10,000 per year, the irs still expects a. Taxation under a tax treaty.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. For general information about electronic filing, see pub. Complete, edit or print tax forms instantly. Web electronic filing of form 1042 is available in 2023.

Persons 4 Who Make Fdap Payments To Those Foreign Persons Noted Above Are Required To File Form 1042, Annual Withholding Tax Return For U.s.

The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. Web use form 1042 to report the following: You will then be able to download and print the 1042 to mail. Web are you looking for where to file 1042 online?

Students Can Also Request A Copy.

Web form 1042, annual withholding tax return for u.s. Web form 1042, also annual withholding tax return for u.s. Web get federal tax return forms and file by mail. Source income of foreign persons, is used to report tax withheld on the income of foreign persons.