Form 8843 유학생

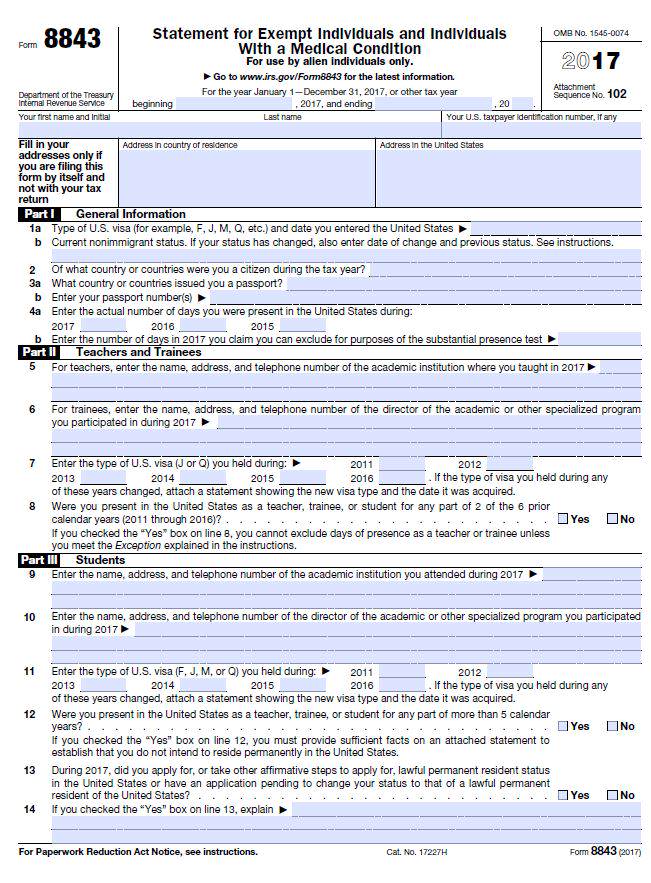

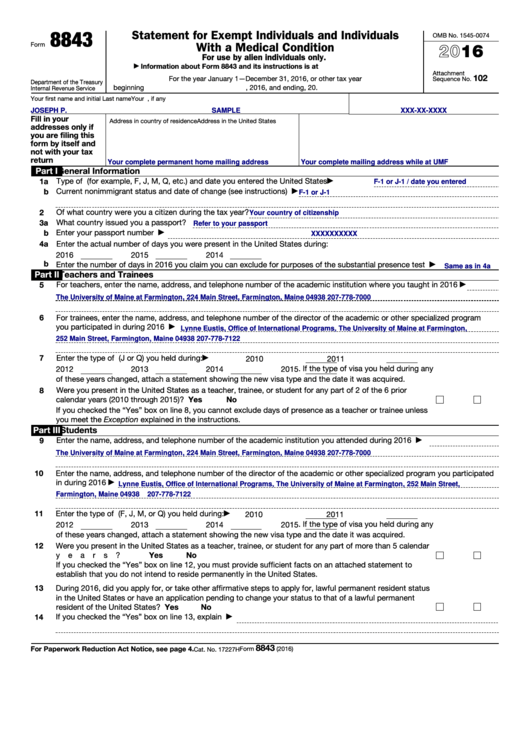

Form 8843 유학생 - Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only. You must file this form to remain in compliance. It should be filled out for every. This form records the days of presence exempted from the substantial. Physically present in the us in the previous calendar year (even for one day!) 2. Web this includes dependent spouses and children who are nonresident aliens for tax purposes. Ad access irs tax forms. Form 8843은 입국 후 거주 기간 면제 여부 등을 체크 하기 위한 양식입니다. Web below are instructions to fill out and submit form 8843 and supporting documents to the u.s. J1비자 세금보고를 할 때는 form 8843을 첨부해야 합니다.

Ad register and subscribe now to work on your irs 8843 & more fillable forms. Irs form 8843 is an information statement that is filed to the irs annually by foreign nationals. You must file this form to remain in compliance. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to. J1비자 세금보고를 할 때는 form 8843을 첨부해야 합니다. Web form 1040은 모든 텍스 신고하는 사람에게 필요한 폼이지만, 싱글인 유학생에게는 필요없는 항목이 너무 많습니다. Get ready for tax season deadlines by completing any required tax forms today. It is an informational statement required by the irs for nonresidents for tax purposes. It should be filled out for every. Web form 8843 is not a u.s.

Web 무급인턴십이기 때문에 따로 1040nr을 작성하지 않고 8843만 작성하였습니다. Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only. 유학생으로써 학비에 관하여 돈을 돌려받았다는분들,, form 8843 을 통해. Web who needs to file form 8843? J1비자 세금보고를 할 때는 form 8843을 첨부해야 합니다. Complete, edit or print tax forms instantly. Web purpose of the form. Web (2) form 8843 첨부. Web form 8843 is not a u.s. Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only.

What is Form 8843 and How Do I File it? Sprintax Blog

Web purpose of the form. J1비자 세금보고를 할 때는 form 8843을 첨부해야 합니다. 반드시 마감일 전까지 irs에 form 8843 을. 해당 사항이 없거나 0일 경우 빈칸으로 두시면 됩니다. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to.

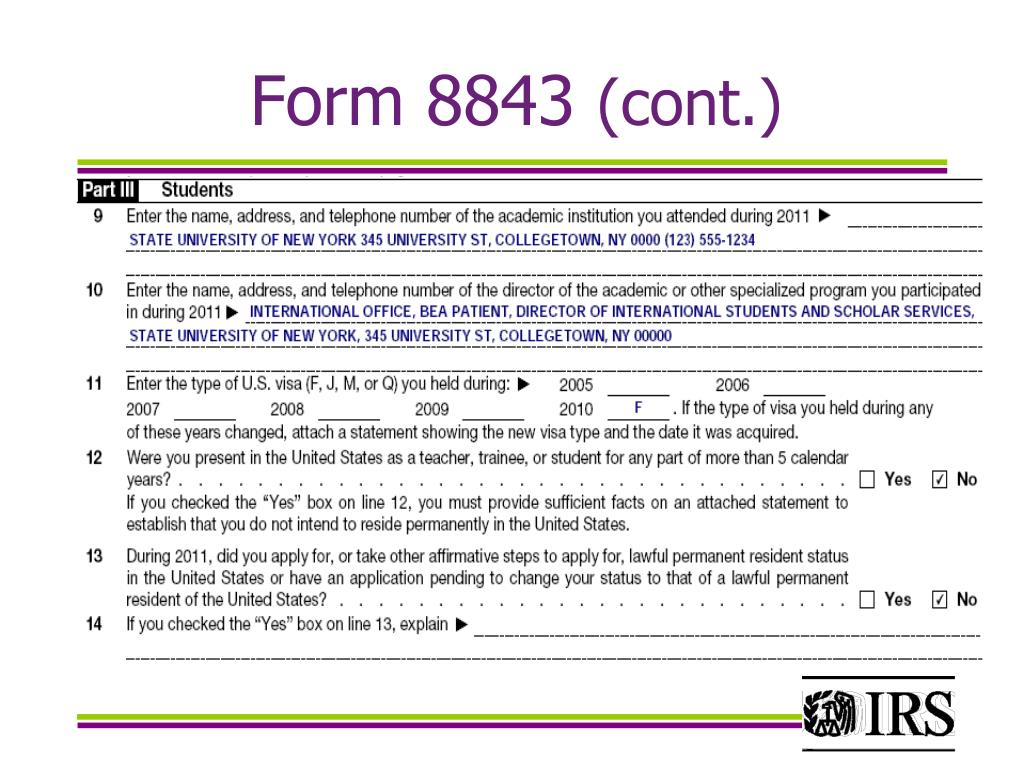

PPT Internal Revenue Service Wage and Investment Stakeholder

Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only. Get ready for tax season deadlines by completing any required tax forms today. Web 무급인턴십이기 때문에 따로 1040nr을 작성하지 않고 8843만 작성하였습니다. Students, scholars, and dependents who are at indiana university in f or.

IRS Form 8843 Editable and Printable Statement to Fill out

This form is essential for international students in the u.s. Web who needs to file form 8843? Web form 8843은 irs에서 다운 가능 합니다. Irs form 8843 is an information statement that is filed to the irs annually by foreign nationals. Web all nonresident aliens present in the u.s.

Form 8843 Statement for Exempt Individuals and Individuals with a

Irs form 8843 is an information statement that is filed to the irs annually by foreign nationals. 반드시 마감일 전까지 irs에 form 8843 을. Ad access irs tax forms. Web (2) form 8843 첨부. Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only.

Close Up Of Usa Tax Form Type 8843 Statement For Exempt Individuals And

This form is essential for international students in the u.s. Web (2) form 8843 첨부. Get ready for tax season deadlines by completing any required tax forms today. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to. Web below are instructions to fill out.

form 8843 example Fill Online, Printable, Fillable Blank

Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to. Ad register and subscribe now to work on your irs 8843 & more fillable forms. J1비자 세금보고를 할 때는 form 8843을 첨부해야 합니다. Students, scholars, and dependents who are at indiana university in f or.

PPT International Students & Scholars Who Had No U.S. in 2013

This form records the days of presence exempted from the substantial. Web (2) form 8843 첨부. Web below are instructions to fill out and submit form 8843 and supporting documents to the u.s. 유학생으로써 학비에 관하여 돈을 돌려받았다는분들,, form 8843 을 통해. Web form 8843 을 작성해서 보내는것이 주위사람들이 많이 받는 학비에 관하여 텍스 리턴인가요??

Everything you wanted to know about US tax (but were afraid to ask

Web below are instructions to fill out and submit form 8843 and supporting documents to the u.s. 매우 간단하고 미국에 거주한다면 우편비용도 얼마 들지 않으니. 유학생으로써 학비에 관하여 돈을 돌려받았다는분들,, form 8843 을 통해. It should be filled out for every. Web form 8843 is not a u.s.

Fillable Form 8843 Statement For Exempt Individuals And Individuals

J1비자 세금보고를 할 때는 form 8843을 첨부해야 합니다. Web form 8843 is not a u.s. Complete, edit or print tax forms instantly. Irs form 8843 is an information statement that is filed to the irs annually by foreign nationals. 반드시 마감일 전까지 irs에 form 8843 을.

8843 Form Tutorial YouTube

Ad access irs tax forms. Web purpose of the form. This form is essential for international students in the u.s. It is an informational statement required by the irs for nonresidents for tax purposes. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to.

Web Who Needs To File Form 8843?

Web 무급인턴십이기 때문에 따로 1040nr을 작성하지 않고 8843만 작성하였습니다. Web information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent updates, related forms, and instructions on how to. Web form 8843 is not a u.s. Get ready for tax season deadlines by completing any required tax forms today.

Ad Register And Subscribe Now To Work On Your Irs 8843 & More Fillable Forms.

It should be filled out for every. 유학생으로써 학비에 관하여 돈을 돌려받았다는분들,, form 8843 을 통해. This form records the days of presence exempted from the substantial. Web (2) form 8843 첨부.

It Is An Informational Statement Required By The Irs For Nonresidents For Tax Purposes.

Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only. Web below are instructions to fill out and submit form 8843 and supporting documents to the u.s. Complete, edit or print tax forms instantly. You must file this form to remain in compliance.

해당 사항이 없거나 0일 경우 빈칸으로 두시면 됩니다.

Ad access irs tax forms. 반드시 마감일 전까지 irs에 form 8843 을. J1비자 세금보고를 할 때는 form 8843을 첨부해야 합니다. Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only.