How To Get Your Crypto.com Tax Form

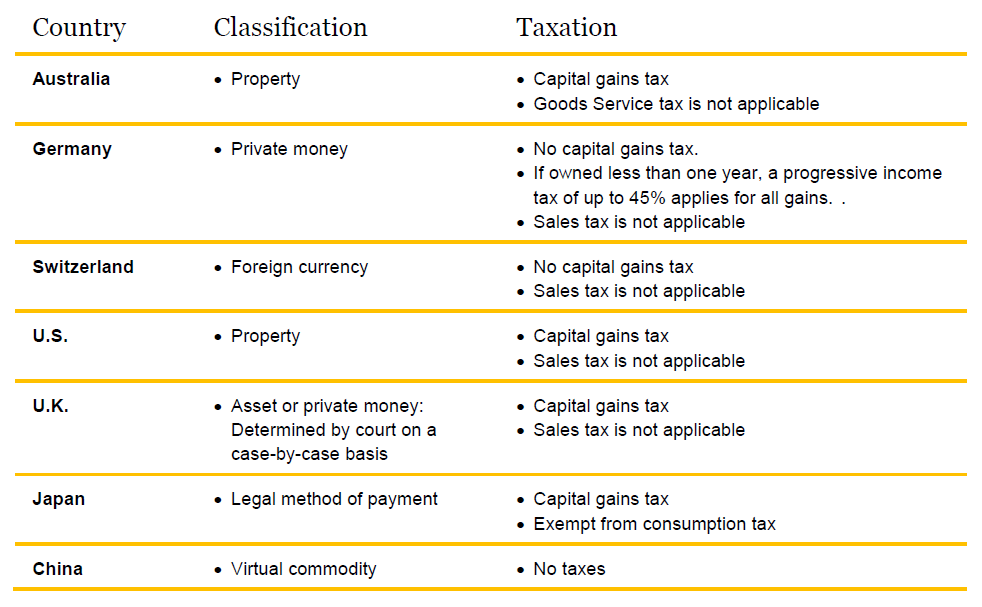

How To Get Your Crypto.com Tax Form - What’s more, this detailed crypto tax report includes the user’s transaction history and full record of capital gains and. You might need any of these crypto. Include your totals from 8949 on. Generally, the irs taxes cryptocurrency like property and investments, not currency. Web when reporting your realized gains or losses on cryptocurrency, use form 8949 to work through how your trades are treated for tax purposes. Web how to file your crypto taxes in 2023. This means all transactions, from selling coins to. Web key takeaways • the irs treats cryptocurrency as property, meaning that when you buy, sell or exchange it, this counts as a taxable event and typically results in. A wage and income transcript provides. Typically, if you expect a.

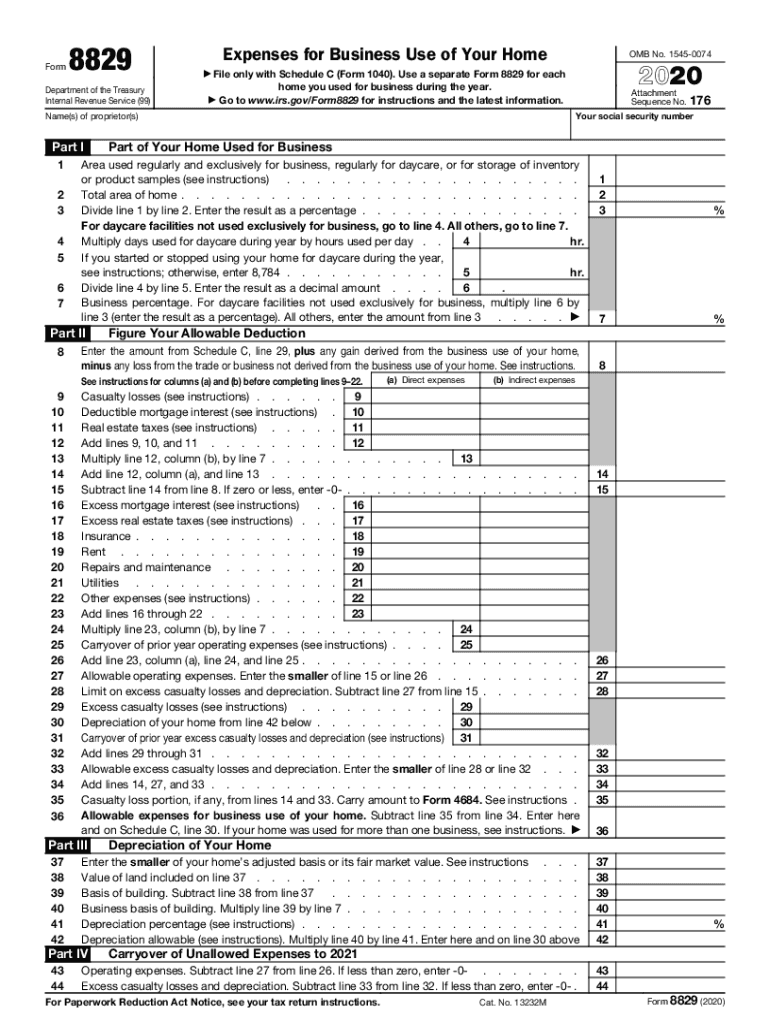

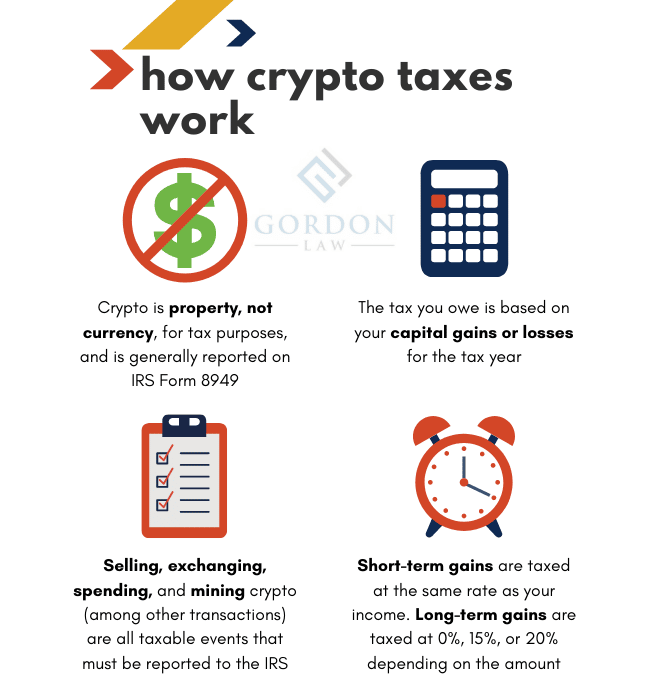

Calculate your crypto gains and losses. However, as the donor of a gift, you may be subject to gift tax (note: This means all transactions, from selling coins to. Web two forms are the stars of the show: Take into account all of your disposal events the first step to filling out your form 8949 is to take account of every one of your cryptocurrency disposals during the tax. Web download the taxact csv file under your tax reports page in crypto.com tax. Login to taxact and click help center in the top right corner. Person who has earned usd $600 or more in rewards from crypto.com. Web crypto can be taxed in two ways: Web reporting crypto activity can require a handful of crypto tax forms depending on the type of transaction and the type of account.

Generally, the irs taxes cryptocurrency like property and investments, not currency. Web it's because crypto is viewed as property and not currency. This means all transactions, from selling coins to. 19, 2021, bitcoin’s (btc) price rose 93% and ethereum (eth) grew by 495%. Login to taxact and click help center in the top right corner. Either as income (a federal tax on the money you earned), or as a capital gain (a federal tax on the profits you made from selling certain. The standard form 1040 tax return now asks whether you engaged in any virtual currency transactions during the year. Web two forms are the stars of the show: Web how to get crypto.com tax forms _____new project channel: But the good times were over by november 2021.

Cryptocurrency Tax Form Cryptocurrency Tax Forms BearTax / Any

Web there are 5 steps you should follow to file your cryptocurrency taxes: You need to know your capital gains, losses, income and expenses. Person who has earned usd $600 or more in rewards from crypto.com. Web reporting crypto activity can require a handful of crypto tax forms depending on the type of transaction and the type of account. You.

2020 Form IRS 8829 Fill Online, Printable, Fillable, Blank pdfFiller

You need to know your capital gains, losses, income and expenses. Web it's because crypto is viewed as property and not currency. Generally, the irs taxes cryptocurrency like property and investments, not currency. 19, 2021, bitcoin’s (btc) price rose 93% and ethereum (eth) grew by 495%. Web the tax situation becomes more favorable if you hold your crypto for more.

How To Get Tax Forms 🔴 YouTube

This means all transactions, from selling coins to. Web two forms are the stars of the show: Either as income (a federal tax on the money you earned), or as a capital gain (a federal tax on the profits you made from selling certain. However, as the donor of a gift, you may be subject to gift tax (note: Web.

Your Crypto Tax Questions Answered by a Tax Attorney & CPA

Web there are 5 steps you should follow to file your cryptocurrency taxes: Web the tax situation becomes more favorable if you hold your crypto for more than a year and then sell. Web when reporting your realized gains or losses on cryptocurrency, use form 8949 to work through how your trades are treated for tax purposes. Web how to.

Beginners Guide How To Make Money With Crypto Arbitrage in 2020

Select the tax settings you’d like to generate your tax reports. It only becomes a taxable. Web the tax situation becomes more favorable if you hold your crypto for more than a year and then sell. Web how is cryptocurrency taxed? Web to report your crypto tax to the irs, follow 5 steps:

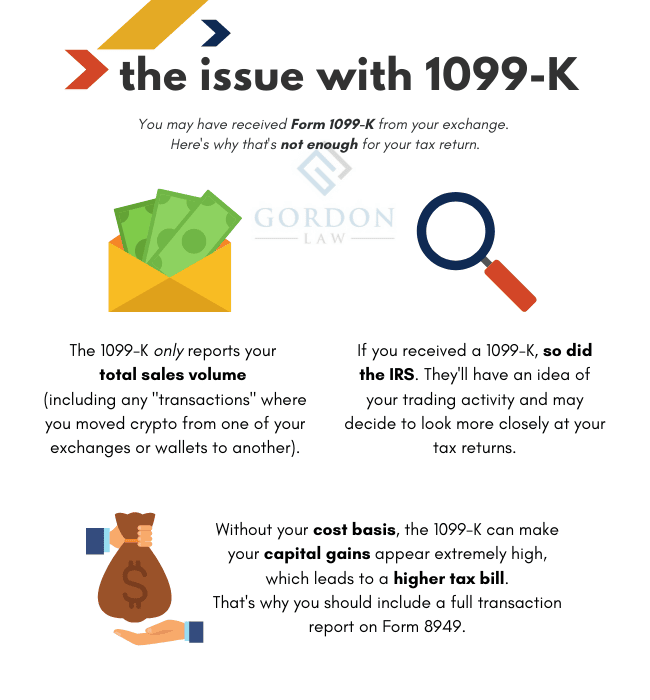

Best Country For Crypto Tax Vincendes

Select the tax settings you’d like to generate your tax reports. Web sending a gift generally is not subject to capital gains/losses. Take into account all of your disposal events the first step to filling out your form 8949 is to take account of every one of your cryptocurrency disposals during the tax. Web it's because crypto is viewed as.

Crypto Tax Calculator Free Crypto Com Tax Get Your Crypto Taxes Done

Generally, the irs taxes cryptocurrency like property and investments, not currency. You may refer to this section on how to set up your tax. A wage and income transcript provides. But the good times were over by november 2021. Web this is done in just seconds and at no cost.

Tax Introduces New Features

Web when reporting your realized gains or losses on cryptocurrency, use form 8949 to work through how your trades are treated for tax purposes. Type “ csv ” in the. Web crypto can be taxed in two ways: Either as income (a federal tax on the money you earned), or as a capital gain (a federal tax on the profits.

When You Pay Your Taxes, You Love Your Neighbor Good Faith Media

19, 2021, bitcoin’s (btc) price rose 93% and ethereum (eth) grew by 495%. It only becomes a taxable. Web capital gains and losses are taxed differently from income like wages, interest, rents, or royalties, which are taxed at your federal income tax rate (up to 37% for the. Select the tax settings you’d like to generate your tax reports. Web.

Your Crypto Tax Questions Answered by a Tax Attorney & CPA

You need to know your capital gains, losses, income and expenses. Generally, the irs taxes cryptocurrency like property and investments, not currency. Web it's because crypto is viewed as property and not currency. Typically, if you expect a. This is a distinction from income tax;.

Web How To Get Crypto.com Tax Forms _____New Project Channel:

Type “ csv ” in the. Web input your tax data into the online tax software. Web crypto can be taxed in two ways: So if you have 2k in cro then use that to buy 2k in eth, you've now held 4k worth of property.

The Standard Form 1040 Tax Return Now Asks Whether You Engaged In Any Virtual Currency Transactions During The Year.

You may refer to this section on how to set up your tax. Web how is cryptocurrency taxed? Select the tax settings you’d like to generate your tax reports. Web to report your crypto tax to the irs, follow 5 steps:

Either As Income (A Federal Tax On The Money You Earned), Or As A Capital Gain (A Federal Tax On The Profits You Made From Selling Certain.

Web download the taxact csv file under your tax reports page in crypto.com tax. But the good times were over by november 2021. Include your totals from 8949 on. Generally, the irs taxes cryptocurrency like property and investments, not currency.

Web Key Takeaways • The Irs Treats Cryptocurrency As Property, Meaning That When You Buy, Sell Or Exchange It, This Counts As A Taxable Event And Typically Results In.

Web the tax situation becomes more favorable if you hold your crypto for more than a year and then sell. Register your account in crypto.com tax step 2: Web this is done in just seconds and at no cost. It only becomes a taxable.