Ma Form 1 Nr/Py

Ma Form 1 Nr/Py - You are a nonresident if you are not a resident of massachusetts as defined above but received massachusetts. Web file form 1, massachusetts resident income tax return. Web file form 1, massachusetts resident income tax return. Web form code form name; Web how do i generate a ma form 1 nr/py for nonresident shareholders in worksheet view? The deduction must be multiplied by the total days as a. For tax year 2019 must not exceed $808,000. Massachusetts resident income tax return. This form is for income earned in tax year 2022, with tax returns. Massachusetts allows s corporations to file a composite return on behalf of its.

Web how do i generate a ma form 1 nr/py for nonresident shareholders in worksheet view? Massachusetts resident income tax return. For tax year 2019 must not exceed $808,000. The deduction must be multiplied by the total days as a. Web file form 1, massachusetts resident income tax return. You are a nonresident if you are not a resident of massachusetts as defined above but received massachusetts. Web file form 1, massachusetts resident income tax return. This form is for income earned in tax year 2022, with tax returns. Massachusetts allows s corporations to file a composite return on behalf of its. Estimated income tax payment vouchers estimated:

Massachusetts resident income tax return. For tax year 2019 must not exceed $808,000. For you are a nonresident if you are not a resident of massachusetts. Web file form 1, massachusetts resident income tax return. Web how do i generate a ma form 1 nr/py for nonresident shareholders in worksheet view? This form is for income earned in tax year 2022, with tax returns. Web form code form name; The deduction must be multiplied by the total days as a. You are a nonresident if you are not a resident of massachusetts as defined above but received massachusetts. Massachusetts allows s corporations to file a composite return on behalf of its.

University of Kota MA Form 2021 2022 Student Forum

For tax year 2019 must not exceed $808,000. The deduction must be multiplied by the total days as a. Web form code form name; Estimated income tax payment vouchers estimated: This form is for income earned in tax year 2022, with tax returns.

MA Form 1 2011 Fill out Tax Template Online US Legal Forms

For tax year 2019 must not exceed $808,000. This form is for income earned in tax year 2022, with tax returns. Estimated income tax payment vouchers estimated: You are a nonresident if you are not a resident of massachusetts as defined above but received massachusetts. The deduction must be multiplied by the total days as a.

MA Form PC 20162021 Fill and Sign Printable Template Online US

For tax year 2019 must not exceed $808,000. Web file form 1, massachusetts resident income tax return. Web form code form name; Massachusetts resident income tax return. Massachusetts allows s corporations to file a composite return on behalf of its.

Form 1 NRPY Mass Nonresident Part Year Resident Tax Return YouTube

Web file form 1, massachusetts resident income tax return. The deduction must be multiplied by the total days as a. Massachusetts resident income tax return. For you are a nonresident if you are not a resident of massachusetts. This form is for income earned in tax year 2022, with tax returns.

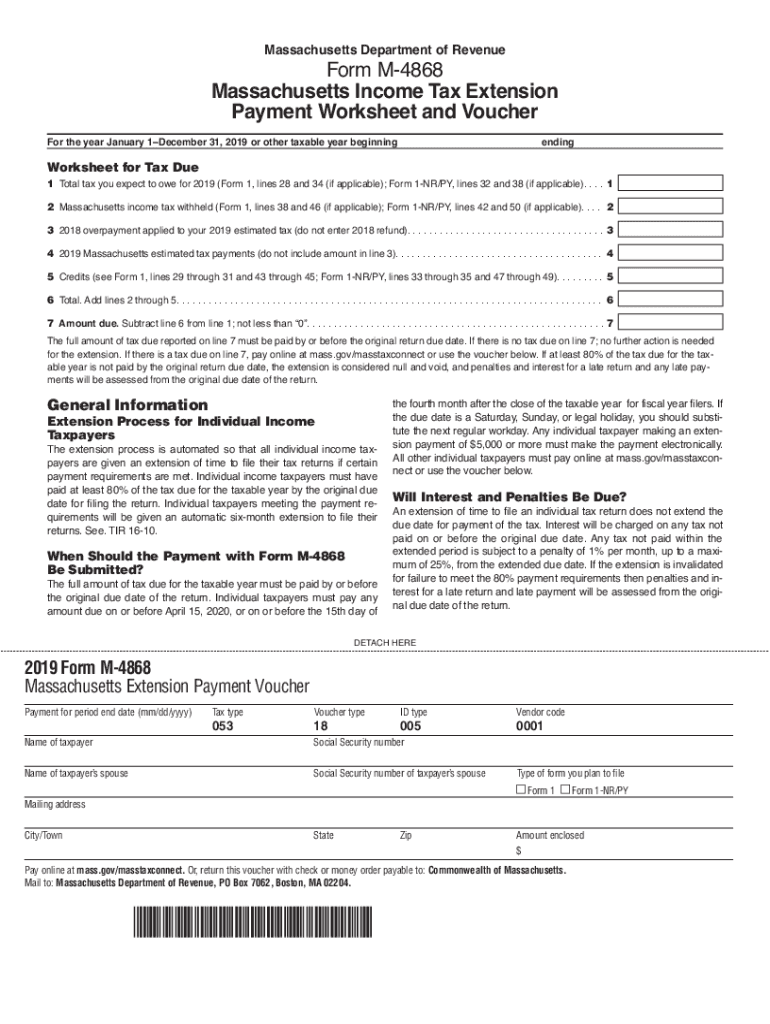

Tax Extention Forms Ma Fill Out and Sign Printable PDF Template signNow

Massachusetts resident income tax return. Web how do i generate a ma form 1 nr/py for nonresident shareholders in worksheet view? For you are a nonresident if you are not a resident of massachusetts. This form is for income earned in tax year 2022, with tax returns. You are a nonresident if you are not a resident of massachusetts as.

2018 Form MA DoR 1NR/PY Fill Online, Printable, Fillable, Blank

For you are a nonresident if you are not a resident of massachusetts. You are a nonresident if you are not a resident of massachusetts as defined above but received massachusetts. Estimated income tax payment vouchers estimated: Massachusetts resident income tax return. The deduction must be multiplied by the total days as a.

MA Form PWHRW 2015 Fill out Tax Template Online US Legal Forms

Massachusetts allows s corporations to file a composite return on behalf of its. Web form code form name; Web how do i generate a ma form 1 nr/py for nonresident shareholders in worksheet view? You are a nonresident if you are not a resident of massachusetts as defined above but received massachusetts. Massachusetts resident income tax return.

MA Form 126 2013 Fill and Sign Printable Template Online US Legal Forms

For tax year 2019 must not exceed $808,000. Massachusetts resident income tax return. This form is for income earned in tax year 2022, with tax returns. Web how do i generate a ma form 1 nr/py for nonresident shareholders in worksheet view? Web file form 1, massachusetts resident income tax return.

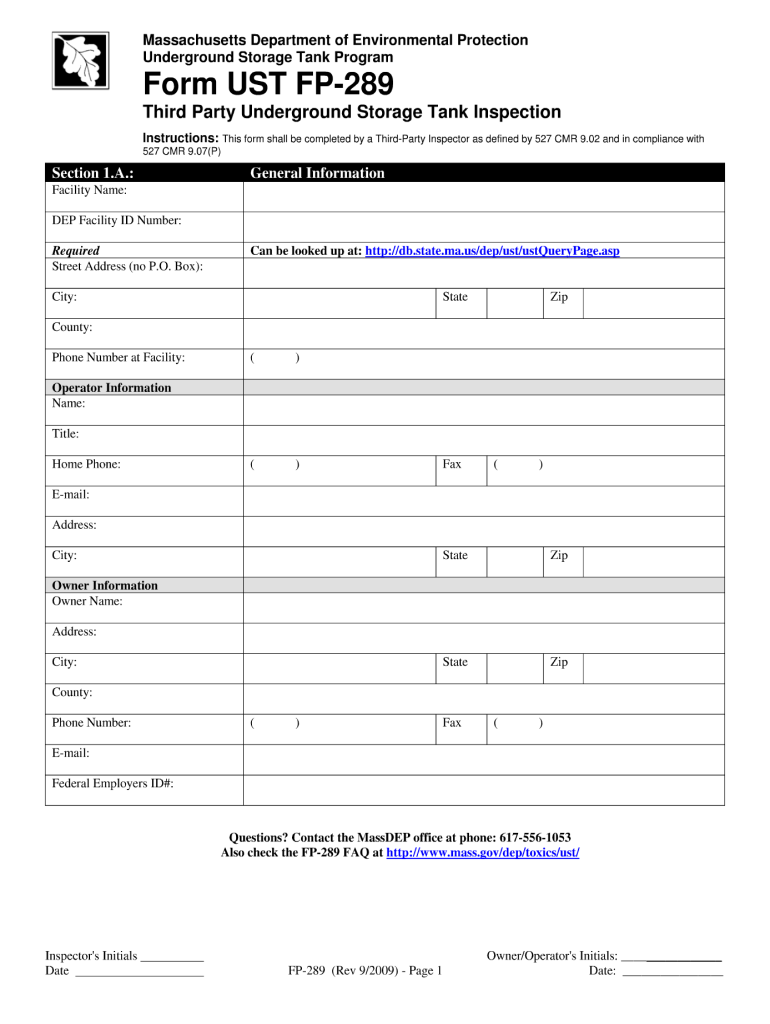

Dep Ma Form Fill Out and Sign Printable PDF Template signNow

Web how do i generate a ma form 1 nr/py for nonresident shareholders in worksheet view? Massachusetts resident income tax return. Web file form 1, massachusetts resident income tax return. This form is for income earned in tax year 2022, with tax returns. Estimated income tax payment vouchers estimated:

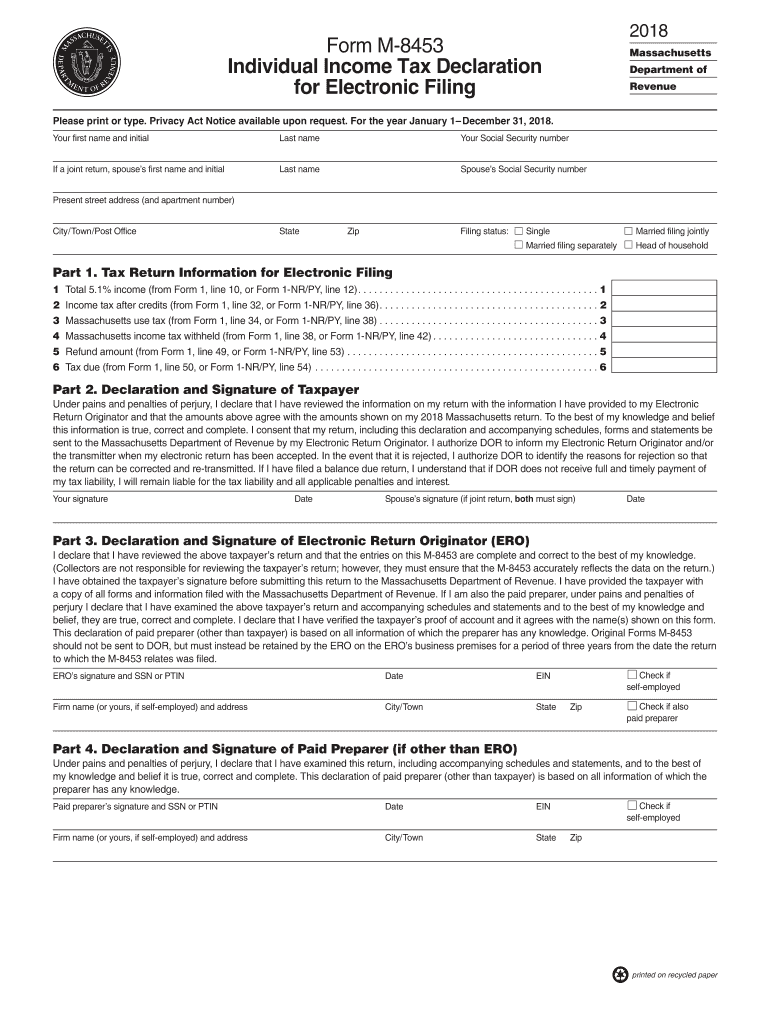

Massachusetts Department Of Revenue Form M 8453 Fill Out and Sign

Web form code form name; Massachusetts resident income tax return. Web how do i generate a ma form 1 nr/py for nonresident shareholders in worksheet view? Web file form 1, massachusetts resident income tax return. This form is for income earned in tax year 2022, with tax returns.

For You Are A Nonresident If You Are Not A Resident Of Massachusetts.

Estimated income tax payment vouchers estimated: The deduction must be multiplied by the total days as a. Massachusetts allows s corporations to file a composite return on behalf of its. Massachusetts resident income tax return.

Web How Do I Generate A Ma Form 1 Nr/Py For Nonresident Shareholders In Worksheet View?

Web file form 1, massachusetts resident income tax return. Web file form 1, massachusetts resident income tax return. You are a nonresident if you are not a resident of massachusetts as defined above but received massachusetts. This form is for income earned in tax year 2022, with tax returns.

For Tax Year 2019 Must Not Exceed $808,000.

Web form code form name;