1098 T Form Umd

1098 T Form Umd - It is used to assist students in determining whether they are eligible for the american opportunities tax credit and lifetime learning credit. Go to www.irs.gov/freefile to see if you. Web billing help get help paying your bill and managing your student account. Web if you are a current student or alumni, your tax information can be accessed here: Contact us our helpful admissions advisors can help you choose an academic program to fit your. Unsure where to access form. It provides the total dollar amount. Detailed information of charges, payments, grants and scholarships is. Students who are enrolled in courses for. Insurers file this form for each individual to whom they.

It provides the total dollar amount. If you are no longer affiliated with the university. Contact us our helpful admissions advisors can help you choose an academic program to fit your. Detailed information of charges, payments, grants and scholarships is. Web needed help getting access to the 1098 form. It is used to assist students in determining whether they are eligible for the american opportunities tax credit and lifetime learning credit. Go to www.irs.gov/freefile to see if you. Web if you are a current student or alumni, your tax information can be accessed here: Students who are enrolled in courses for. Unsure where to access form.

Unsure where to access form. Contact us our helpful admissions advisors can help you choose an academic program to fit your. The office of student accounts at university of maryland global campus is pleased to offer e. Web if you are a current student or alumni, your tax information can be accessed here: Go to www.irs.gov/freefile to see if you. If you enrolled and paid tuition at umgc during a calendar year, you. You must file for each student you enroll and for whom a reportable transaction is made. It provides the total dollar amount. Students who are enrolled in courses for. Web needed help getting access to the 1098 form.

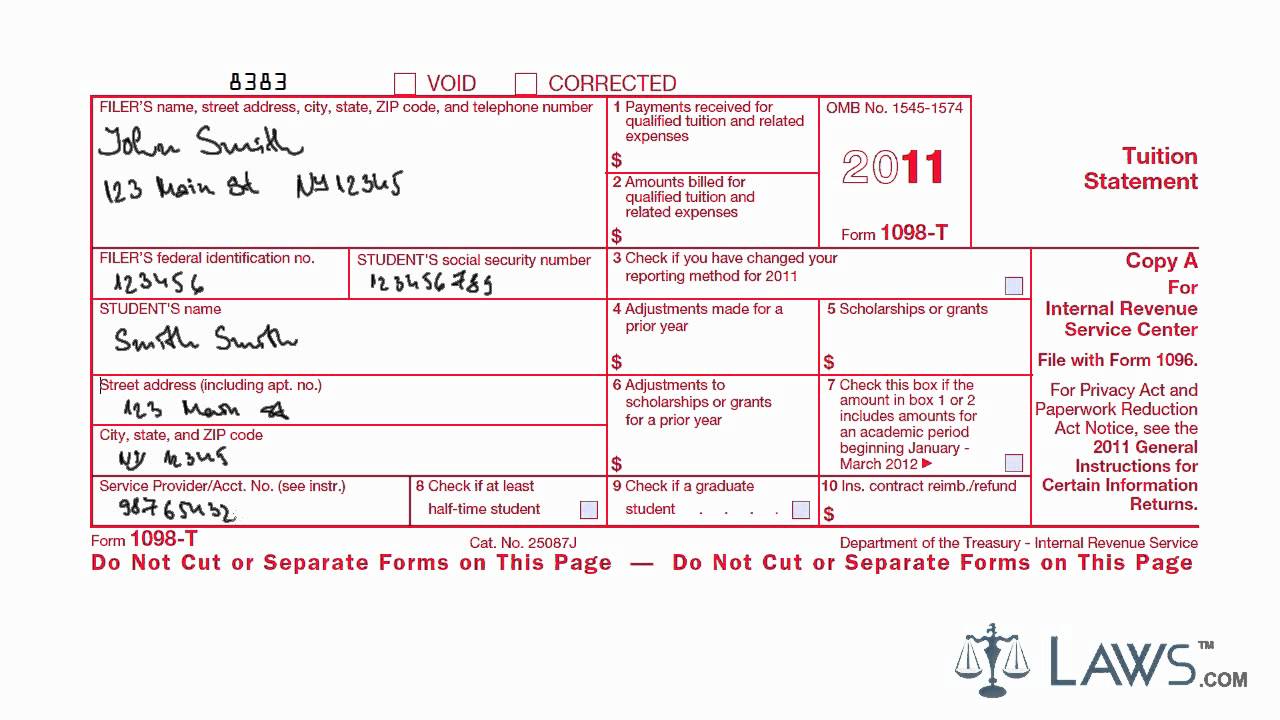

Claim your Educational Tax Refund with IRS Form 1098T

Go to www.irs.gov/freefile to see if you. It is used to assist students in determining whether they are eligible for the american opportunities tax credit and lifetime learning credit. Web billing help get help paying your bill and managing your student account. If you enrolled and paid tuition at umgc during a calendar year, you. Web if you are a.

1098 T Form Printable Blank PDF Online

It provides the total dollar amount. Detailed information of charges, payments, grants and scholarships is. Unsure where to access form. Go to www.irs.gov/freefile to see if you. It is used to assist students in determining whether they are eligible for the american opportunities tax credit and lifetime learning credit.

Learn How to Fill the Form 1098T Tuition Statement YouTube

Go to www.irs.gov/freefile to see if you. Students who are enrolled in courses for. It provides the total dollar amount. The office of student accounts at university of maryland global campus is pleased to offer e. You must file for each student you enroll and for whom a reportable transaction is made.

Form 1098T Student Copy B Mines Press

The office of student accounts at university of maryland global campus is pleased to offer e. Web billing help get help paying your bill and managing your student account. Go to www.irs.gov/freefile to see if you. Web needed help getting access to the 1098 form. If you enrolled and paid tuition at umgc during a calendar year, you.

Form 1098T Still Causing Trouble for Funded Graduate Students

Web billing help get help paying your bill and managing your student account. If you are no longer affiliated with the university. Detailed information of charges, payments, grants and scholarships is. Go to www.irs.gov/freefile to see if you. It is used to assist students in determining whether they are eligible for the american opportunities tax credit and lifetime learning credit.

Form 1098T Information Student Portal

If you enrolled and paid tuition at umgc during a calendar year, you. The office of student accounts at university of maryland global campus is pleased to offer e. Web needed help getting access to the 1098 form. Go to www.irs.gov/freefile to see if you. Insurers file this form for each individual to whom they.

Irs Form 1098 T Box 4 Universal Network

The office of student accounts at university of maryland global campus is pleased to offer e. Web billing help get help paying your bill and managing your student account. Contact us our helpful admissions advisors can help you choose an academic program to fit your. If you are no longer affiliated with the university. Web if you are a current.

1098T Information Bursar's Office Office of Finance UTHSC

Detailed information of charges, payments, grants and scholarships is. You must file for each student you enroll and for whom a reportable transaction is made. Insurers file this form for each individual to whom they. Web if you are a current student or alumni, your tax information can be accessed here: Unsure where to access form.

Form 1098T, Tuition Statement, Student Copy B

Go to www.irs.gov/freefile to see if you. Web needed help getting access to the 1098 form. If you enrolled and paid tuition at umgc during a calendar year, you. Detailed information of charges, payments, grants and scholarships is. Web billing help get help paying your bill and managing your student account.

How To File Your 1098 T Form Universal Network

Contact us our helpful admissions advisors can help you choose an academic program to fit your. You must file for each student you enroll and for whom a reportable transaction is made. The office of student accounts at university of maryland global campus is pleased to offer e. Unsure where to access form. Insurers file this form for each individual.

Insurers File This Form For Each Individual To Whom They.

If you enrolled and paid tuition at umgc during a calendar year, you. Web billing help get help paying your bill and managing your student account. Contact us our helpful admissions advisors can help you choose an academic program to fit your. Go to www.irs.gov/freefile to see if you.

Web Needed Help Getting Access To The 1098 Form.

Unsure where to access form. Detailed information of charges, payments, grants and scholarships is. The office of student accounts at university of maryland global campus is pleased to offer e. It is used to assist students in determining whether they are eligible for the american opportunities tax credit and lifetime learning credit.

You Must File For Each Student You Enroll And For Whom A Reportable Transaction Is Made.

It provides the total dollar amount. If you are no longer affiliated with the university. Web if you are a current student or alumni, your tax information can be accessed here: Students who are enrolled in courses for.