1099 Form For 2013

1099 Form For 2013 - What is a 1099 form? Web filling out the 1099 misc form 2013 with signnow will give better confidence that the output form will be legally binding and safeguarded. Browse & discover thousands of brands. Ad find deals on 1099 tax forms on amazon. Web follow these quick steps to change the pdf 1099 form 2013 fillable online free of charge: Web form 1099 is an informational tax form used to report different types of income to the internal revenue service (irs). Print a sample by clicking “print sample on blank paper.” this will let you see if your. Easily fill out pdf blank, edit, and sign them. Log in to the editor with your credentials or click on. Downloadable 1099 forms are for.

Shop a wide variety of 1099 tax forms from top brands at staples®. Register and log in to your account. Web follow these quick steps to change the pdf 1099 form 2013 fillable online free of charge: Save or instantly send your ready documents. Web file this form for each person to whom you made certain types of payment during the tax year. Key takeaways there are numerous. You can print and mail these forms to the 2013 address after filling. Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Collection of most popular forms in a given sphere. Browse & discover thousands of brands.

There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is. Easily fill out pdf blank, edit, and sign them. 63 2013 estimated tax payments and amount applied from 2012 return 63 if you have a qualifying child,. Key takeaways there are numerous. Web follow these quick steps to change the pdf 1099 form 2013 fillable online free of charge: Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Web select which type of form you’re printing: Ad find deals on 1099 tax forms on amazon. Fill, sign and send anytime, anywhere, from any device with pdffiller. Web 22 rows form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income.

Free 1099 Form 2013 Printable Free Printable A To Z

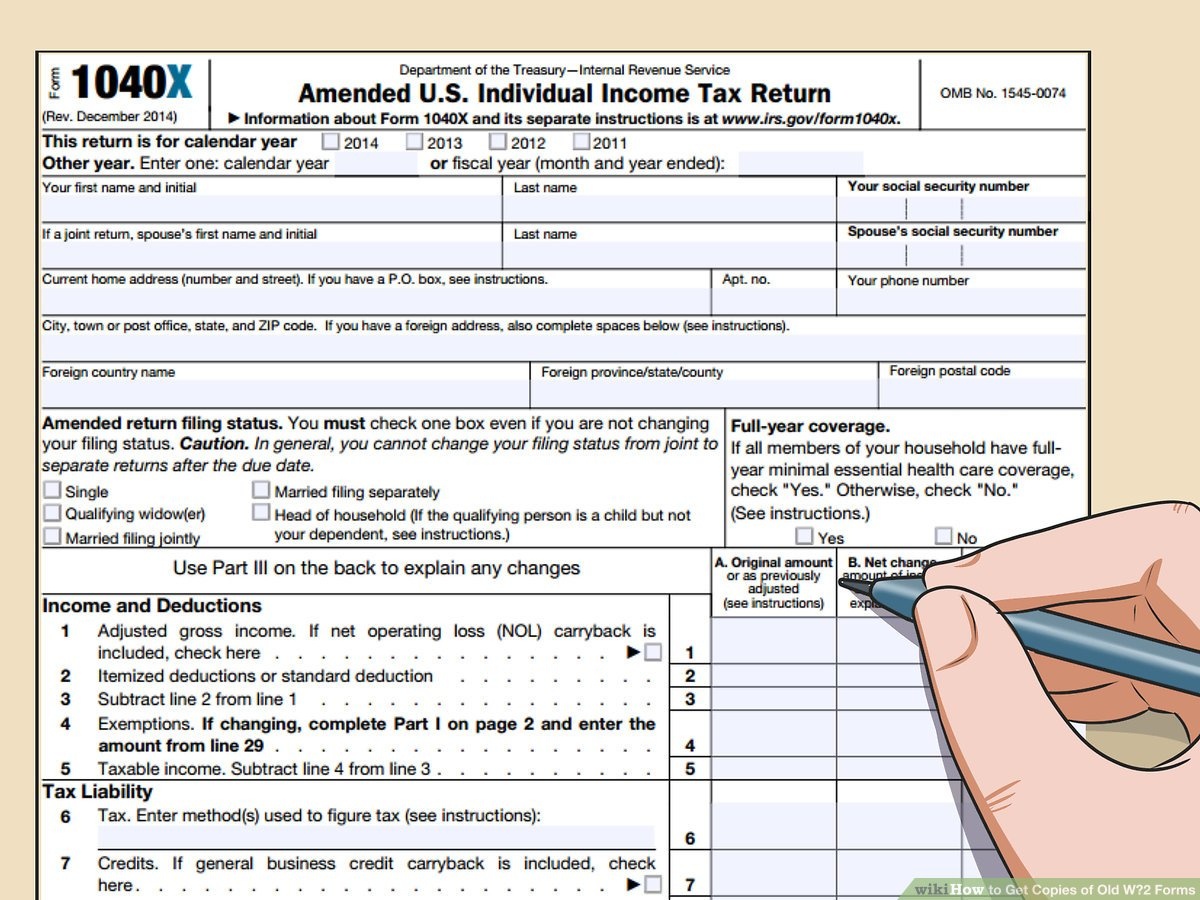

Web form 1099 is an informational tax form used to report different types of income to the internal revenue service (irs). Read customer reviews & find best sellers Web up to $40 cash back fillable 1040 form 2013. Web follow these quick steps to change the pdf 1099 form 2013 fillable online free of charge: Collection of most popular forms.

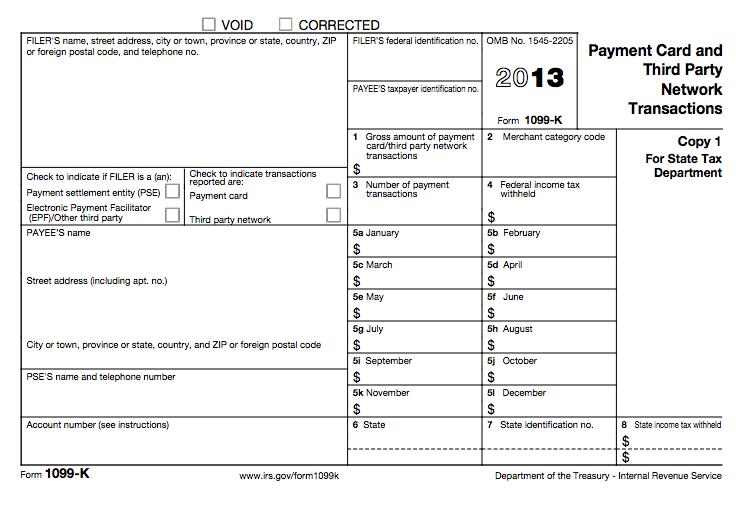

Page Not Found TaxJar Blog

The payer fills out the 1099 form and sends copies to you and the. Web up to $40 cash back fillable 1040 form 2013. Print a sample by clicking “print sample on blank paper.” this will let you see if your. Ad find deals on 1099 tax forms on amazon. Collection of most popular forms in a given sphere.

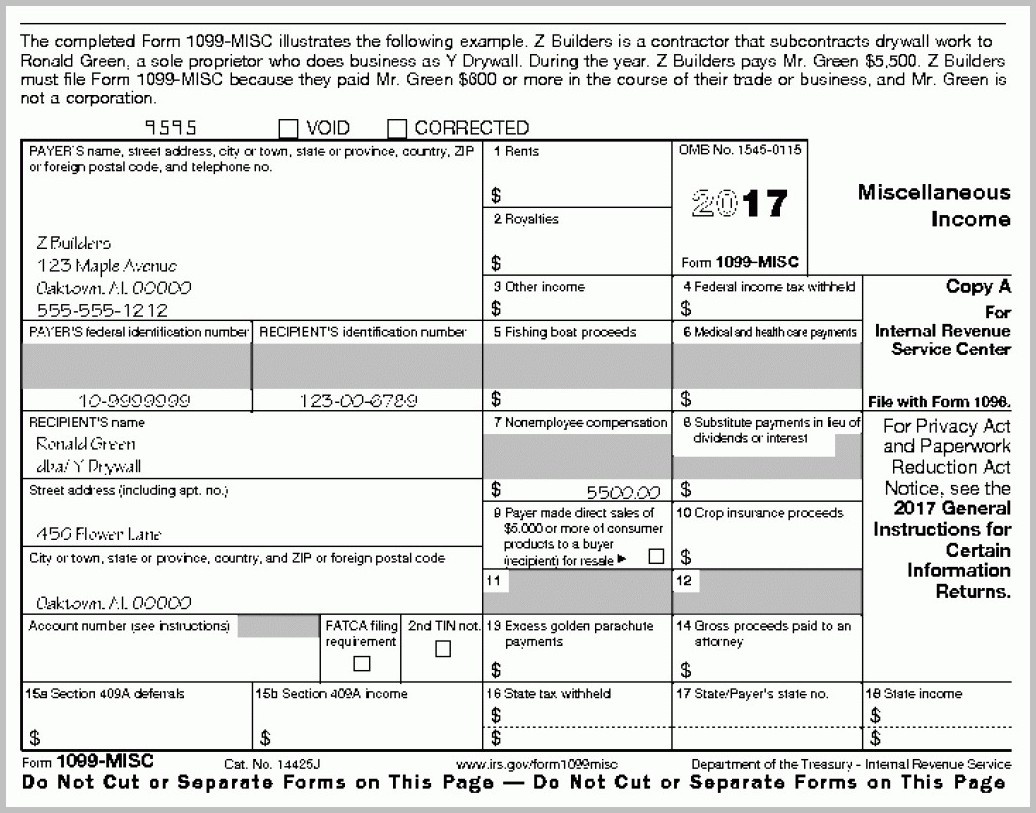

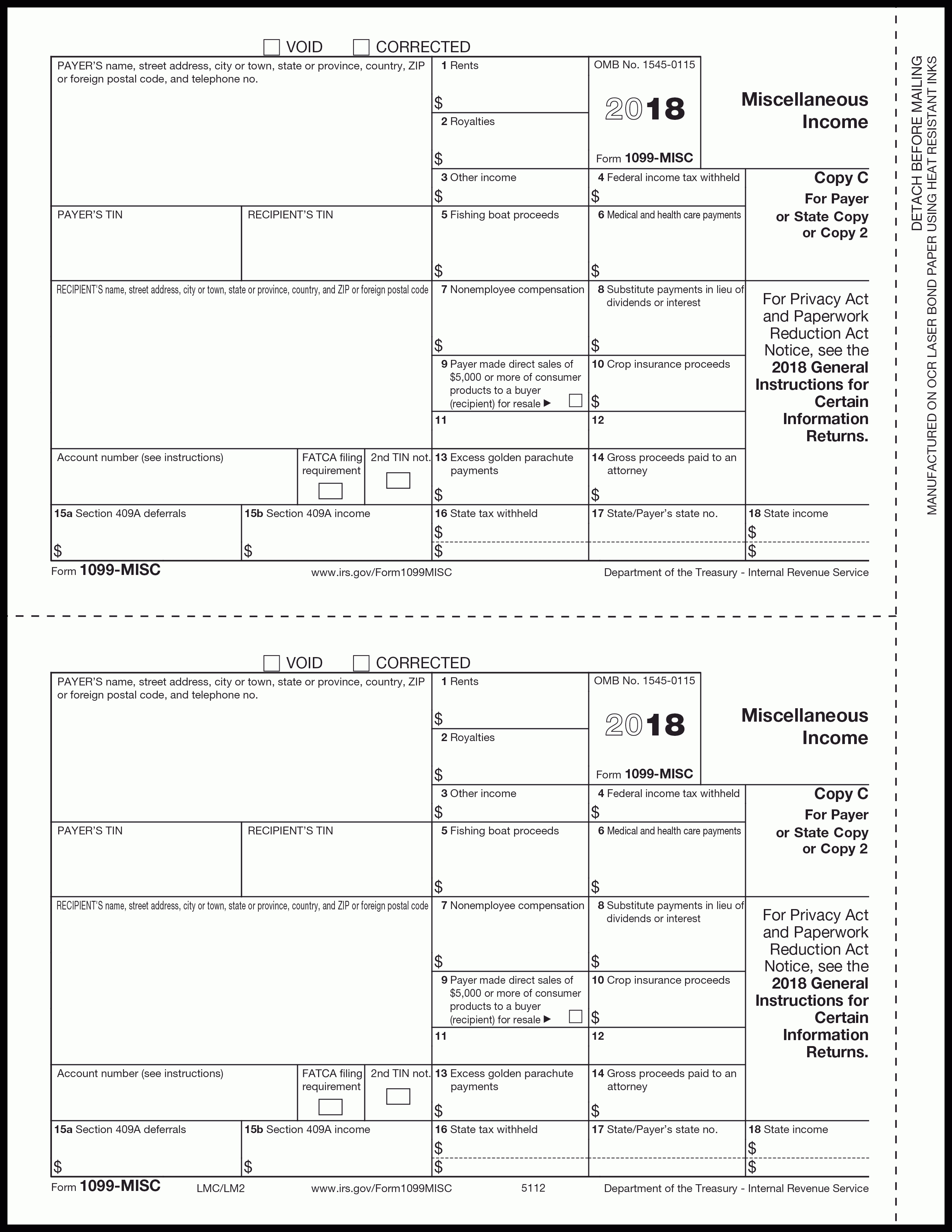

1099 Form Changes for 2013 and Dynamics AX 2012 Stoneridge Software

Ad find deals on 1099 tax forms on amazon. Key takeaways there are numerous. Web up to $40 cash back fillable 1040 form 2013. Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Browse & discover thousands of brands.

Free Printable 1099 Misc Form 2013 Free Printable

Read customer reviews & find best sellers What is a 1099 form? Ad discover a wide selection of 1099 tax forms at staples®. Register and log in to your account. You can print and mail these forms to the 2013 address after filling.

Free 1099 Form 2013 Printable Free Printable A To Z

Go to www.irs.gov/freefile to see. You can print and mail these forms to the 2013 address after filling. Log in to the editor with your credentials or click on. Web up to $40 cash back fillable 1040 form 2013. Quick guide on how to complete 1099 misc.

Fast Answers About 1099 Forms for Independent Workers

Read customer reviews & find best sellers Browse & discover thousands of brands. Web follow these quick steps to change the pdf 1099 form 2013 fillable online free of charge: You can print and mail these forms to the 2013 address after filling. Save or instantly send your ready documents.

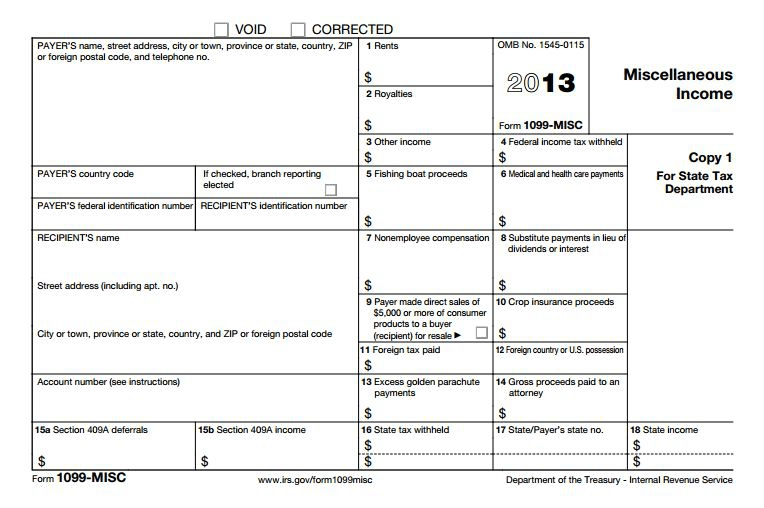

2013 Form 1099Misc Edit, Fill, Sign Online Handypdf

Easily fill out pdf blank, edit, and sign them. The payer fills out the 1099 form and sends copies to you and the. Downloadable 1099 forms are for. Web march 29, 2023, at 9:49 a.m. Fill, sign and send anytime, anywhere, from any device with pdffiller.

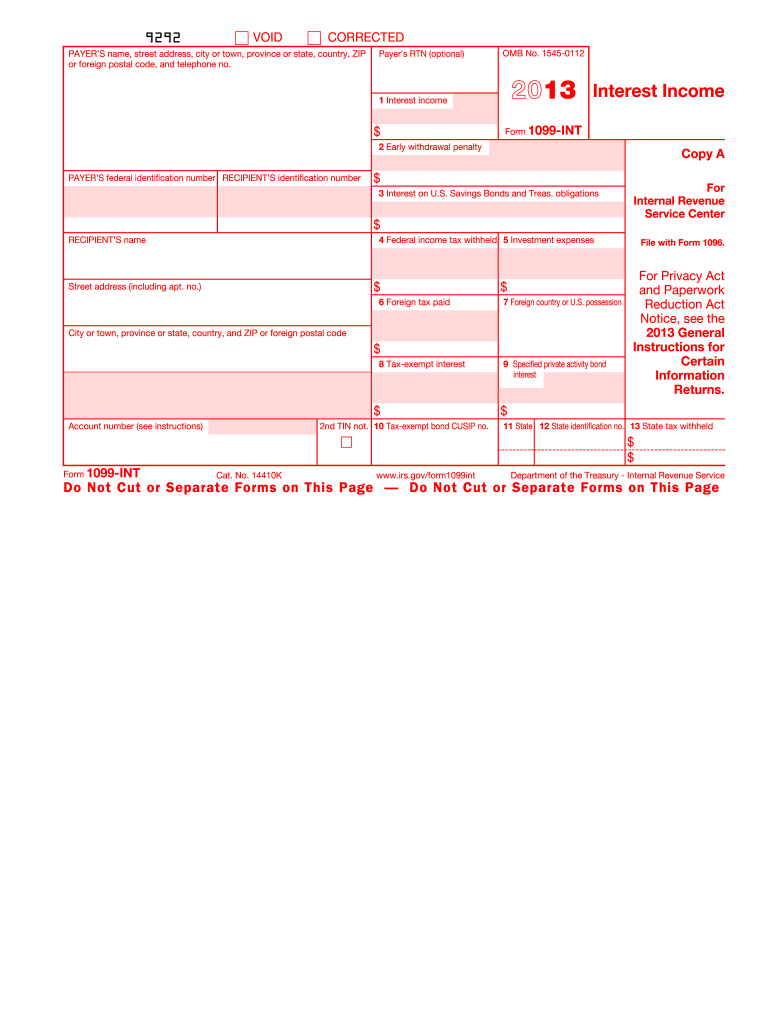

2013 Form IRS 1099INT Fill Online, Printable, Fillable, Blank pdfFiller

Web 22 rows form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income. Collection of most popular forms in a given sphere. Web select which type of form you’re printing: Web form 1099 is an informational tax form used.

Free Printable 1099 Misc Forms Free Printable

Shop a wide variety of 1099 tax forms from top brands at staples®. Web 22 rows form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income. The payer fills out the 1099 form and sends copies to you and.

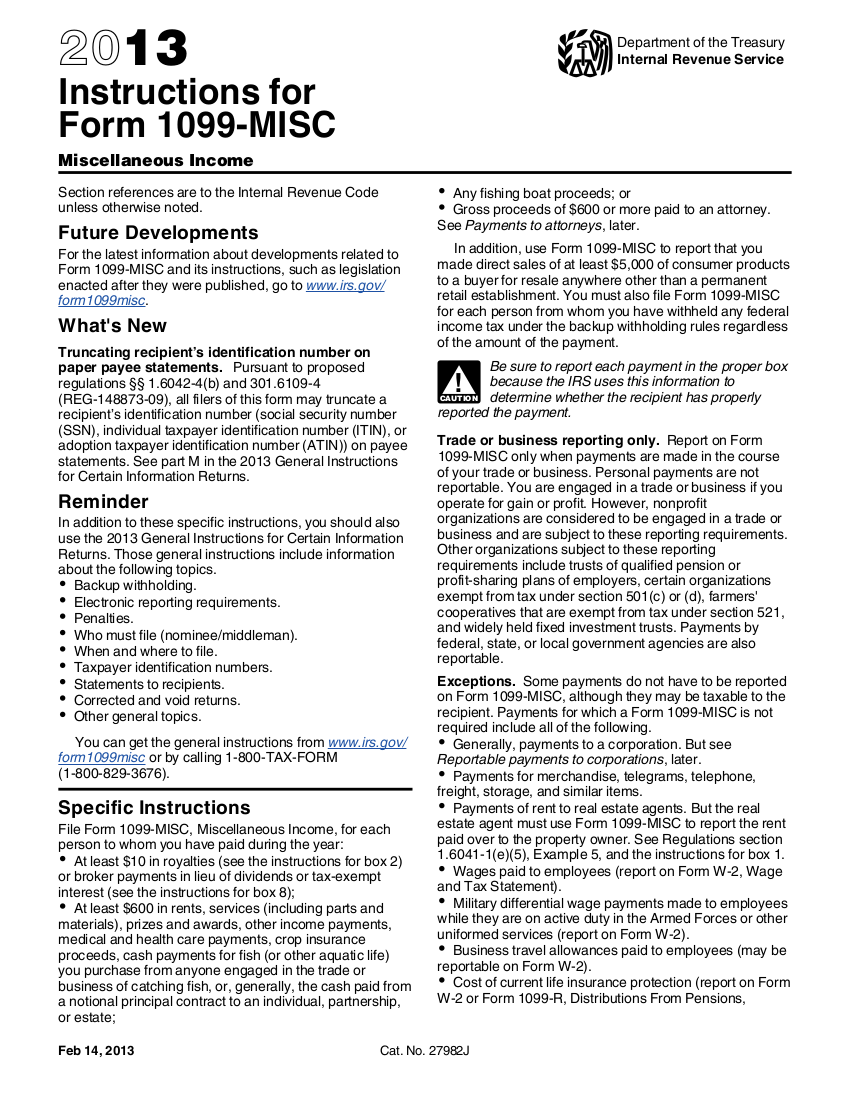

1099 (2013) Instruction Edit Forms Online PDFFormPro

The payer fills out the 1099 form and sends copies to you and the. Key takeaways there are numerous. 63 2013 estimated tax payments and amount applied from 2012 return 63 if you have a qualifying child,. Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Web file.

Log In To The Editor With Your Credentials Or Click On.

Web file this form for each person to whom you made certain types of payment during the tax year. Go to www.irs.gov/freefile to see. The payer fills out the 1099 form and sends copies to you and the. 63 2013 estimated tax payments and amount applied from 2012 return 63 if you have a qualifying child,.

Web March 29, 2023, At 9:49 A.m.

Register and log in to your account. Key takeaways there are numerous. Web 22 rows form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income. (see instructions for details.) note:

What Is A 1099 Form?

Collection of most popular forms in a given sphere. Shop a wide variety of 1099 tax forms from top brands at staples®. Fill, sign and send anytime, anywhere, from any device with pdffiller. Read customer reviews & find best sellers

Save Or Instantly Send Your Ready Documents.

Ad find deals on 1099 tax forms on amazon. Web filling out the 1099 misc form 2013 with signnow will give better confidence that the output form will be legally binding and safeguarded. Web form 1099 is an informational tax form used to report different types of income to the internal revenue service (irs). There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is.