1099 Nec Form 2020 Printable

1099 Nec Form 2020 Printable - Web where can you print the form 1099? All other forms of income on the 1099 misc form are due on march 31st. Since it has been a month and your quickbooks dekstop has still generated 2 copies per. If you are looking for a printable 1099 form 2020, make sure that you read the fine print. Pdf use our library of forms to quickly fill and sign your irs forms online. To order these instructions and additional forms, go to www.irs.gov/form1099nec. 03 export or print immediately. Use get form or simply click on the template preview to open it in the editor. Brand new for 2020 is the 1099 nec form. The 2021 calendar year comes with changes to business owners’ taxes.

All forms, both printable and informational, can be accessed in pdf format on the internal revenue service’s website. File copy a of this form with the irs by february 1. 01 fill and edit template. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Furnish copy b of this form to the recipient by february 1, 2021. Current general instructions for certain information returns. That said, quickbooks is already updated to print 1099's three to a page instead of two to a page. Since it has been a month and your quickbooks dekstop has still generated 2 copies per. Web where can you print the form 1099? Start completing the fillable fields and carefully type in required information.

The 2021 calendar year comes with changes to business owners’ taxes. Web quick steps to complete and design 2020 1099 nec form 2020 online: Both the forms and instructions will be updated as needed. If you are looking for a printable 1099 form 2020, make sure that you read the fine print. Furnish copy b of this form to the recipient by february 1, 2021. Pdf use our library of forms to quickly fill and sign your irs forms online. Brand new for 2020 is the 1099 nec form. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. 03 export or print immediately. All other forms of income on the 1099 misc form are due on march 31st.

1099 Nec Form 2020 Printable Customize and Print

Pdf use our library of forms to quickly fill and sign your irs forms online. To order these instructions and additional forms, go to www.irs.gov/form1099nec. For internal revenue service center. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Easily fill out pdf blank, edit, and sign them.

1099 Nec Form 2020 Printable Customize and Print

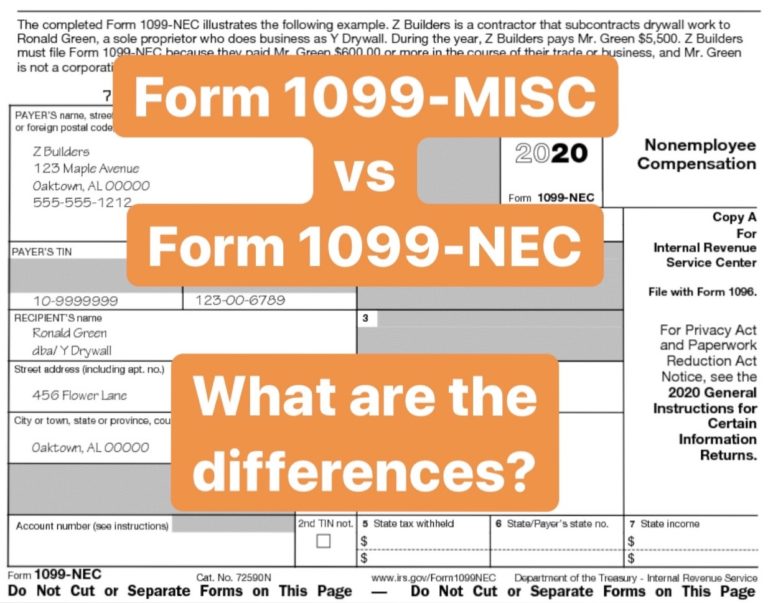

This form replaces the box 7 reporting on the 1099 misc form. Save or instantly send your ready documents. 01 fill and edit template. Easily fill out pdf blank, edit, and sign them. Both the forms and instructions will be updated as needed.

What is Form 1099NEC and Who Needs to File? 123PayStubs Blog

Start completing the fillable fields and carefully type in required information. This form replaces the box 7 reporting on the 1099 misc form. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. 1099, 3921, or 5498 that you print from the irs website. That said, quickbooks is already updated to print 1099's three to a page instead of two.

Form 1099MISC vs Form 1099NEC How are they Different?

Web quick steps to complete and design 2020 1099 nec form 2020 online: The 2021 calendar year comes with changes to business owners’ taxes. All other forms of income on the 1099 misc form are due on march 31st. Use get form or simply click on the template preview to open it in the editor. Since it has been a.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Both the forms and instructions will be updated as needed. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. If you are looking for a printable 1099 form 2020, make sure that you read the fine print. Click to expand key takeaways • the irs requires businesses to report payment of nonemployee compensation of $600 or more on form..

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. Current general instructions for certain information returns. To order these instructions and additional forms, go to www.irs.gov/form1099nec. File copy a of this form with the irs by february 1. This form replaces the box 7.

For the Love of 1099s! Preparing for JD Edwards YearEnd Circular

03 export or print immediately. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. 1099, 3921, or 5498 that you print from the irs website. Brand new for 2020 is the 1099 nec form. Both the forms and instructions will be updated as needed.

1099 Nec Form 2020 Printable Customize and Print

Brand new for 2020 is the 1099 nec form. Both the forms and instructions will be updated as needed. File copy a of this form with the irs by february 1. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. 1099, 3921, or 5498.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Current general instructions for certain information returns. This form replaces the box 7 reporting on the 1099 misc form. That said, quickbooks is already updated to print 1099's three to a page instead of two to a page. Since it has been a month and your quickbooks dekstop has still generated 2 copies per. All forms, both printable and informational,.

1099 Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

Furnish copy b of this form to the recipient by february 1, 2021. It’s another variant of the 1099 compensation form. Both the forms and instructions will be updated as needed. All other forms of income on the 1099 misc form are due on march 31st. Brand new for 2020 is the 1099 nec form.

If You Are Looking For A Printable 1099 Form 2020, Make Sure That You Read The Fine Print.

That said, quickbooks is already updated to print 1099's three to a page instead of two to a page. Click to expand key takeaways • the irs requires businesses to report payment of nonemployee compensation of $600 or more on form. 03 export or print immediately. Save or instantly send your ready documents.

Start Completing The Fillable Fields And Carefully Type In Required Information.

Web where can you print the form 1099? Furnish copy b of this form to the recipient by february 1, 2021. File copy a of this form with the irs by february 1. 01 fill and edit template.

Both The Forms And Instructions Will Be Updated As Needed.

Brand new for 2020 is the 1099 nec form. 1099, 3921, or 5498 that you print from the irs website. Because paper forms are scanned during processing, you cannot file forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the irs website. The 2021 calendar year comes with changes to business owners’ taxes.

For Internal Revenue Service Center.

Since it has been a month and your quickbooks dekstop has still generated 2 copies per. This form replaces the box 7 reporting on the 1099 misc form. Use get form or simply click on the template preview to open it in the editor. To order these instructions and additional forms, go to www.irs.gov/form1099nec.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)