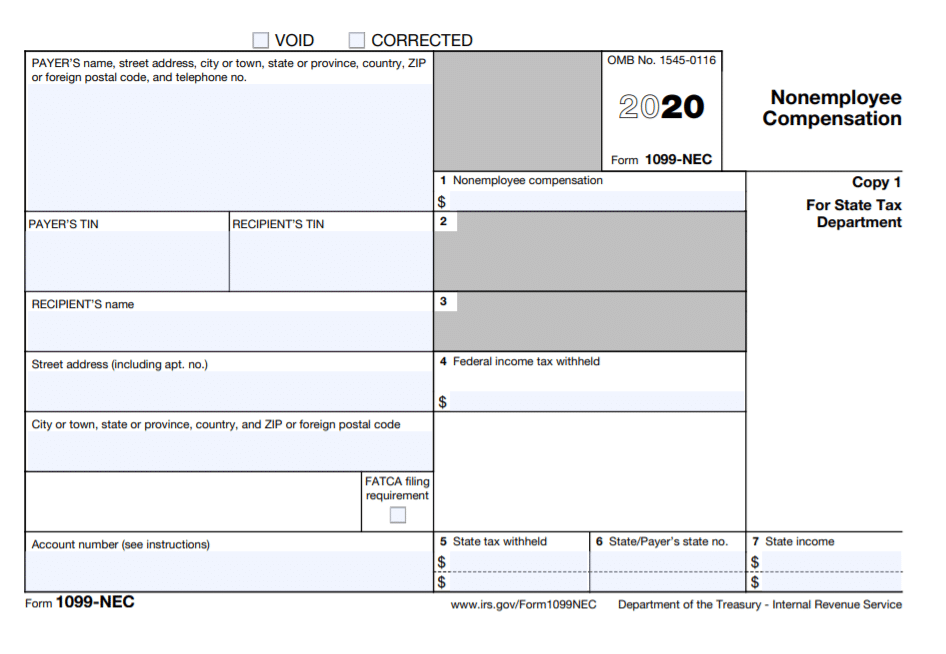

1099 Nec Form 2022 Printable

1099 Nec Form 2022 Printable - Web if those regulations are issued and effective for 2022 tax returns required to be filed in 2023, we will post an article at www.irs.gov/form1099 explaining the change. Customize the template with exclusive fillable areas. Involved parties names, places of residence and numbers etc. Simple, and easy to use no software downloads or installation required. There are 3 blank forms to 1 page. File copy a of this form with the irs by january 31, 2022. You’ll also need to file this tax form with the irs using form 1096 for 2023 payments. What to do before you print your 1099s when should you print and send your 1099s? These new “continuous use” forms no longer include the tax year. Furnish copy b of this form to the recipient by february 1, 2021.

You’ll also need to file this tax form with the irs using form 1096 for 2023 payments. Official site | smart tools. Furnish copy b of this form to the recipient by january 31, 2022. Form1099online is the most reliable and secure way to file your 1099 nec tax returns online. Customize the template with exclusive fillable areas. January 2022 on top right and bottom left corners. Web what is the 1099 nec form? Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. Persons with a hearing or speech Quickbooks will print the year on the forms for you.

Use the buttons on the top right corner of the form to print out paper copies. Official site | smart tools. Web contents can you print 1099s on plain paper? Persons with a hearing or speech January 2022 on top right and bottom left corners. You may also have a filing requirement. Furnish copy b of this form to the recipient by february 1, 2021. Current general instructions for certain information returns. You’ll also need to file this tax form with the irs using form 1096 for 2023 payments. Furnish copy b of this form to the recipient by january 31, 2022.

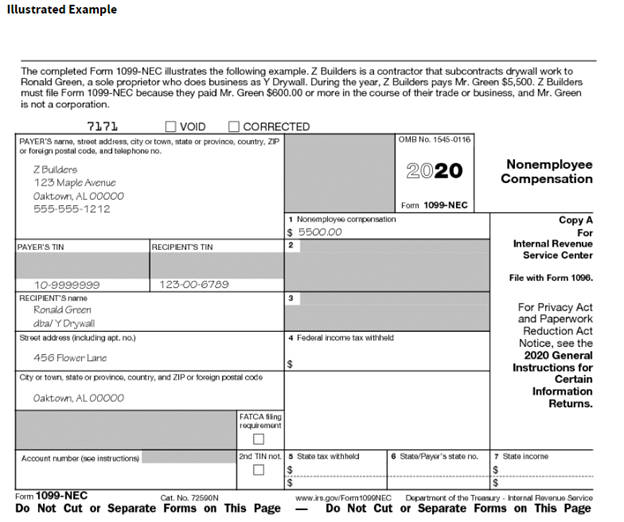

What the 1099NEC Coming Back Means for your Business Chortek

Use the buttons on the top right corner of the form to print out paper copies. Easily prepare your form 1099 nec in just minutes it’s that easy. Current general instructions for certain information returns. Form1099online is the most reliable and secure way to file your 1099 nec tax returns online. You might face substantial fines for misclassifying employees as.

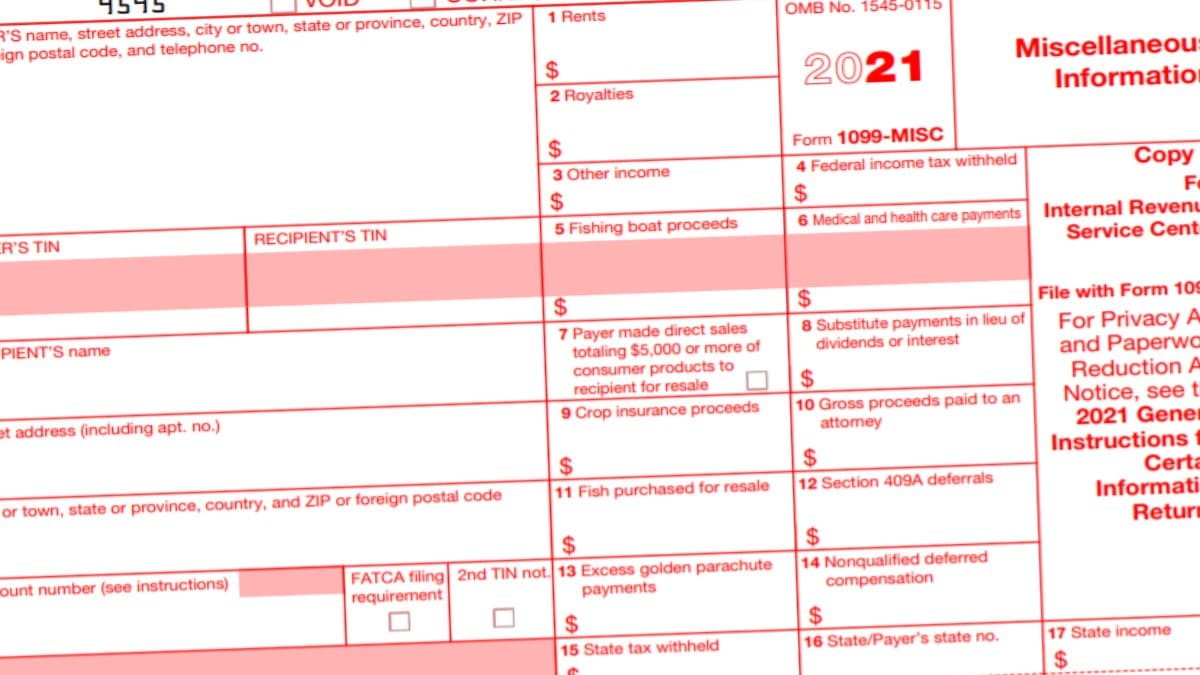

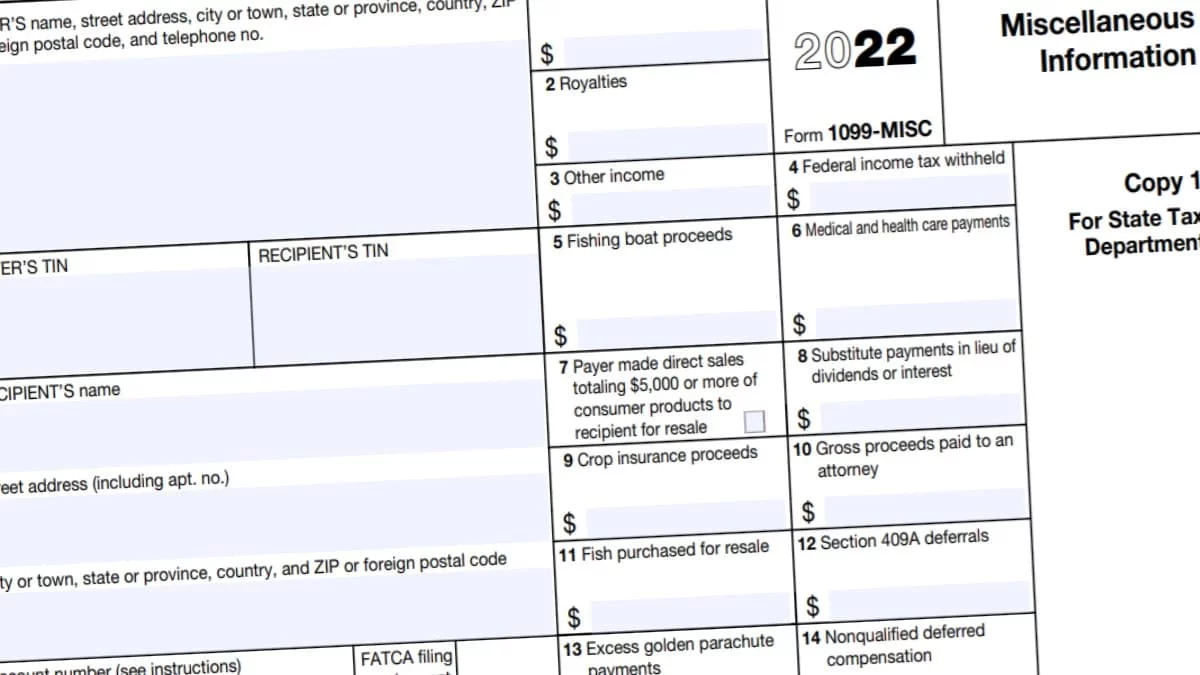

1099 MISC Form 2022 1099 Forms TaxUni

You may also have a filing requirement. Use the buttons on the top right corner of the form to print out paper copies. Web find the 1099 nec form 2021 you want. What to do before you print your 1099s when should you print and send your 1099s? Web 1099, 3921, or 5498 that you print from the irs website.

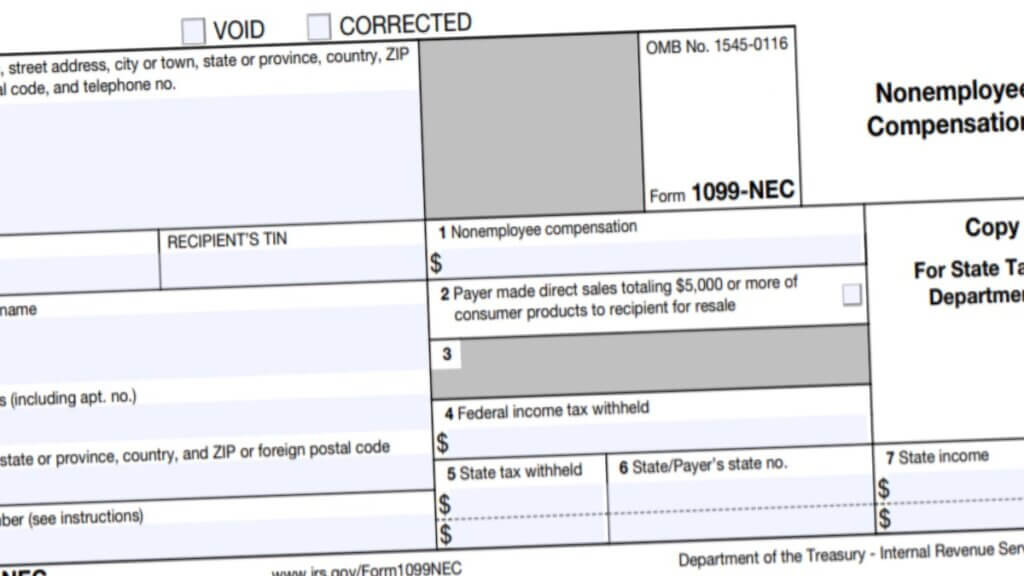

1099 NEC Form 2022

Web 1099, 3921, or 5498 that you print from the irs website. Web in order to record pay, tips, and other compensation received during the tax year, all workers must complete a form w2. File copy a of this form with the irs. What to do before you print your 1099s when should you print and send your 1099s? Web.

Nonemployee Compensation now reported on Form 1099NEC instead of Form

Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. There are 3 blank forms to 1 page. 1099 nec form 2022 is required to be filed by any individual who is an independent worker. Official site | smart tools. Web if those regulations are issued and effective for 2022 tax.

What is Form 1099NEC and Who Needs to File? 123PayStubs Blog

Web in order to record pay, tips, and other compensation received during the tax year, all workers must complete a form w2. Easily prepare your form 1099 nec in just minutes it’s that easy. File copy a of this form with the irs by january 31, 2022. Official site | smart tools. These new “continuous use” forms no longer include.

1099 NEC vs 1099 MISC 2021 2022 1099 Forms TaxUni

Web if those regulations are issued and effective for 2022 tax returns required to be filed in 2023, we will post an article at www.irs.gov/form1099 explaining the change. This applies to both federal and state taxes. You’ll also need to file this tax form with the irs using form 1096 for 2023 payments. Web what is the 1099 nec form?.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

You might face substantial fines for misclassifying employees as independent contractors. What to do before you print your 1099s when should you print and send your 1099s? Customize the template with exclusive fillable areas. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Use the buttons on the top right corner of the form to print out paper copies.

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

These new “continuous use” forms no longer include the tax year. Web 1099, 3921, or 5498 that you print from the irs website. Web 1099, 3921, or 5498 that you print from the irs website. Official site | smart tools. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec.

1099 Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

Simple, and easy to use no software downloads or installation required. You may also have a filing requirement. File copy a of this form with the irs. Persons with a hearing or speech Web contents can you print 1099s on plain paper?

1099 MISC Form 2022 1099 Forms TaxUni

Web what is the 1099 nec form? Until regulations are issued, however, the number remains at 250, as reflected in these instructions. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. See your tax return instructions for where to report. These new “continuous use” forms no longer include the tax year.

There Are 3 Blank Forms To 1 Page.

Easily prepare your form 1099 nec in just minutes it’s that easy. Use the buttons on the top right corner of the form to print out paper copies. Quickbooks will print the year on the forms for you. Customize the template with exclusive fillable areas.

Furnish Copy B Of This Form To The Recipient By February 1, 2021.

Web in order to record pay, tips, and other compensation received during the tax year, all workers must complete a form w2. You’ll also need to file this tax form with the irs using form 1096 for 2023 payments. Both the forms and instructions will be updated as needed. January 2022 on top right and bottom left corners.

Simple, And Easy To Use No Software Downloads Or Installation Required.

Until regulations are issued, however, the number remains at 250, as reflected in these instructions. Web contents can you print 1099s on plain paper? 1099 nec form 2022 is required to be filed by any individual who is an independent worker. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code.

Furnish Copy B Of This Form To The Recipient By January 31, 2022.

Official site | smart tools. Involved parties names, places of residence and numbers etc. Web if those regulations are issued and effective for 2022 tax returns required to be filed in 2023, we will post an article at www.irs.gov/form1099 explaining the change. File copy a of this form with the irs by january 31, 2022.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)