15G Form Download For Pf Withdrawal

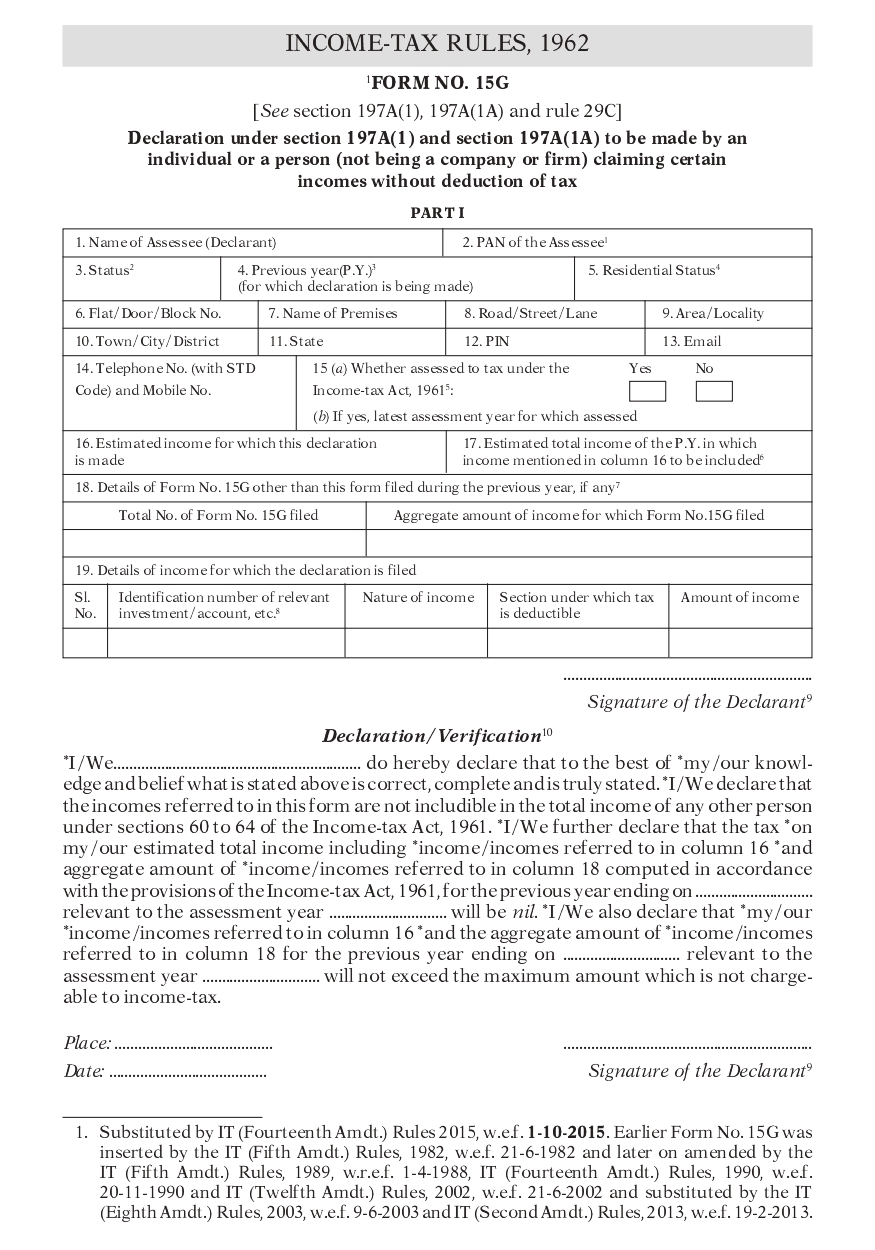

15G Form Download For Pf Withdrawal - After filling in all the required details, one must verify. Web for requests for tds exemption on fixed deposit interest payments of up to ₹ 40,000 in a particular fy, form 15g must be submitted.; Sir, 15 g is applicable for pf amount only or on pp also.my ee amount is 24000 and er amount is 11111.am i eligible for 15 g for pf withdrawal. Click here now login with the. Web visit the online services section. Details of investments in respect of which the declaration is being made: Web form 15g download pdf for pf withdrawal sample filled 2023 / finance / by ankit singh / last updated on: Web withdrawal from the account 24. Web download form 15h pdf for pf withdrawal epfo circular on tds deduction download in pdf format form 15g filled sample for pf withdrawal in. If you want to download form 15g, then you can download it by clicking on the link given below download form 15g for pf.

Web withdrawal from the account 24. If an employee withdraws his. Web visit the online services section. (details of the withdrawal made from national savings scheme) ao no. Learn all the basics how to fill, eligibility, download and rules Tds on epf or employees provident fund withdrawal: If you want to download form 15g, then you can download it by clicking on the link given below download form 15g for pf. Visit the official website of uan member website: Click here now login with the. July 7, 2023 guide to fill form 15g for pf.

Web withdrawal from the account 24. If you want to download form 15g, then you can download it by clicking on the link given below download form 15g for pf. Web the steps to download 15g form online for pf withdrawal are listed below: Web visit the online services section. Visit the official website of uan member website: Click here now login with the. Web for requests for tds exemption on fixed deposit interest payments of up to ₹ 40,000 in a particular fy, form 15g must be submitted.; Tds on epf or employees provident fund withdrawal: (details of the withdrawal made from national savings scheme) ao no. Sir, 15 g is applicable for pf amount only or on pp also.my ee amount is 24000 and er amount is 11111.am i eligible for 15 g for pf withdrawal.

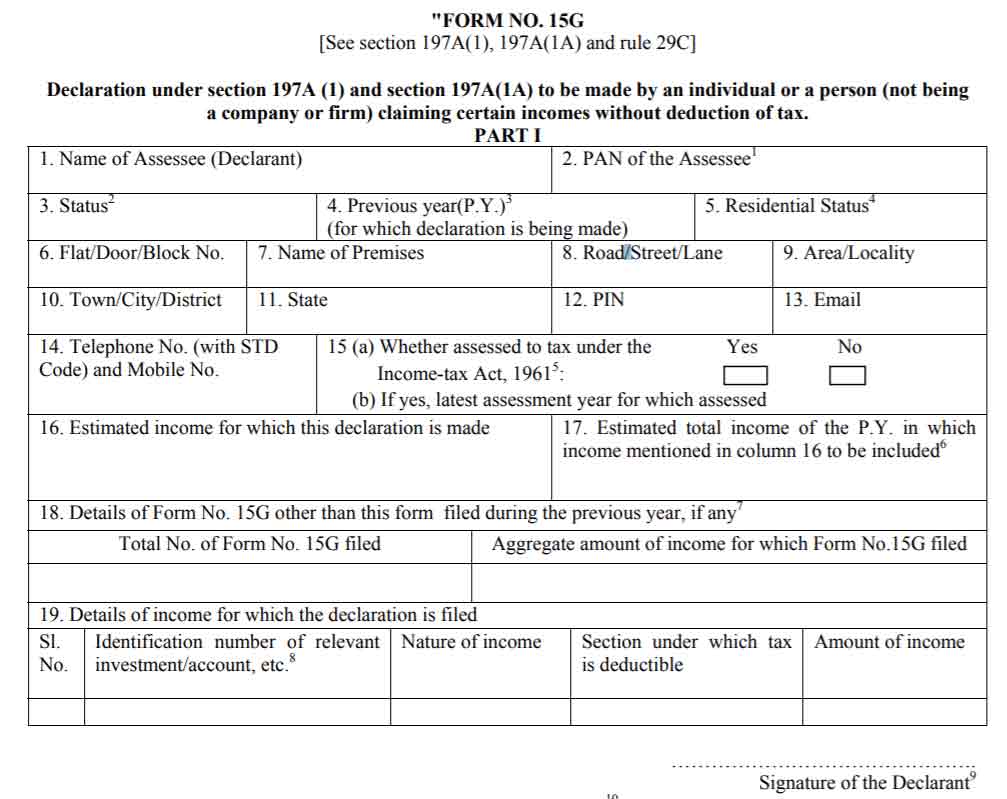

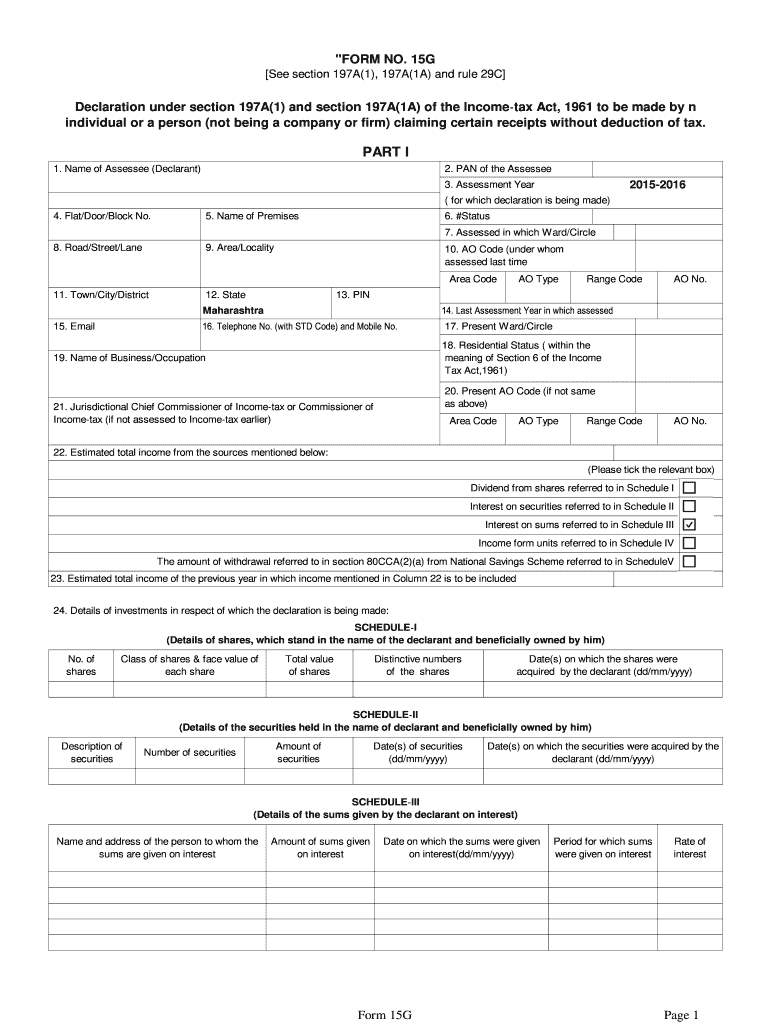

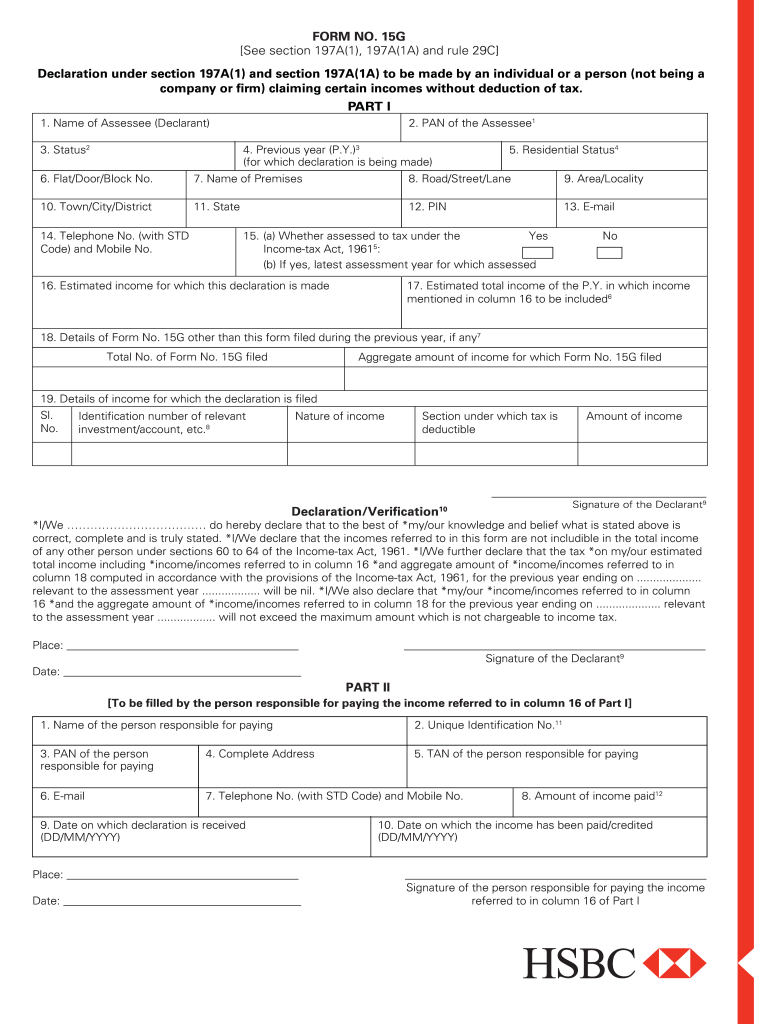

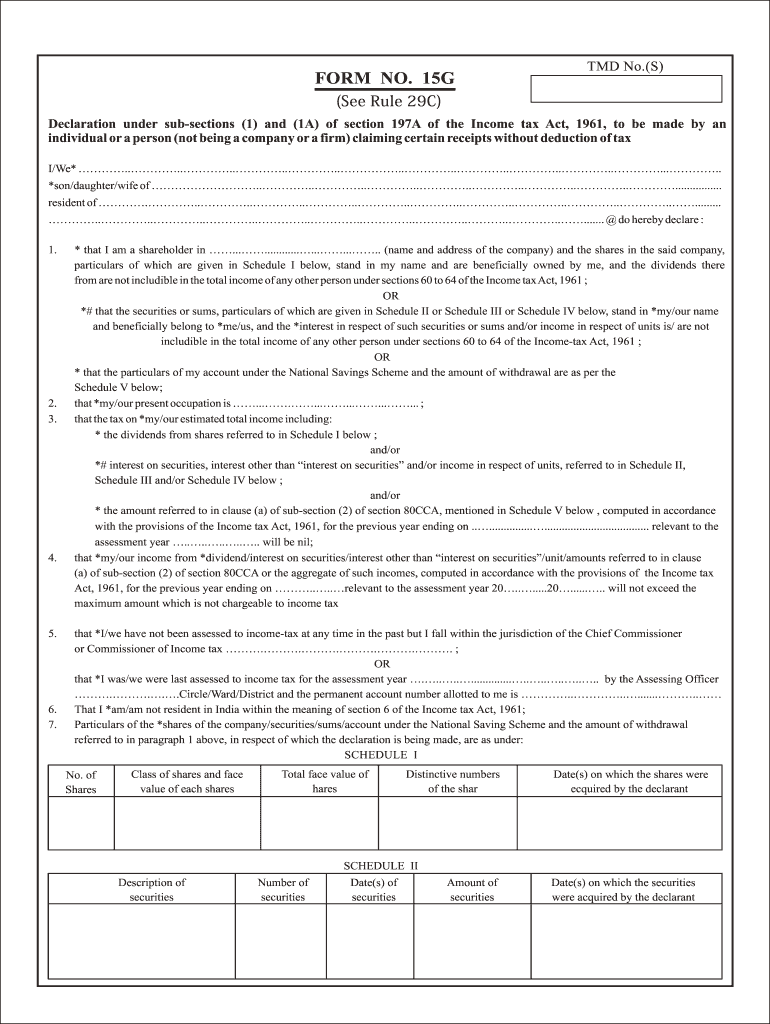

[PDF] Download PF Withdrawal Form 15G Govtempdiary

Web form 15g is generally used for withdrawal of pf. Web form 15g download pdf for pf withdrawal sample filled 2023 / finance / by ankit singh / last updated on: ’ the answer is simple — use the signnow. Details of investments in respect of which the declaration is being made: After filling in all the required details, one.

EPF Form 15G Download Sample Filled Form 15G For PF Withdrawal GST

Form 15g is an authorized document that will make sure that there is no tds deduction on the amount of interest you receive. Web visit the online services section. ’ the answer is simple — use the signnow. Click here now login with the. Web form 15g download pdf for pf withdrawal sample filled 2023 / finance / by ankit.

Form 15G How to Fill Form 15G for PF Withdrawal MoneyPiP

July 7, 2023 guide to fill form 15g for pf. Web you can access either the epfo online portal, your bank’s website or the income tax department website and search for form 15g for pf download or form. ’ the answer is simple — use the signnow. After filling in all the required details, one must verify. Visit the official.

How to Fill Form 15G for PF Withdrawal in 2021 YouTube

Sir, 15 g is applicable for pf amount only or on pp also.my ee amount is 24000 and er amount is 11111.am i eligible for 15 g for pf withdrawal. Visit the official website of uan member website: Tds on epf or employees provident fund withdrawal: Web the steps to download 15g form online for pf withdrawal are listed below:.

Form 15g Download in Word Format Fill Out and Sign Printable PDF

Web form 15g is generally used for withdrawal of pf. Web the steps to download 15g form online for pf withdrawal are listed below: Web visit the online services section. Web how to download pf withdrawal form 15g online? Web download form 15h pdf for pf withdrawal epfo circular on tds deduction download in pdf format form 15g filled sample.

Form 15g For Pf Withdrawal Pdf Fill Online, Printable, Fillable

If an employee withdraws his. Details of investments in respect of which the declaration is being made: July 7, 2023 guide to fill form 15g for pf. Web to do this, one needs to submit form 15g to avoid the deduction of tds. Web for requests for tds exemption on fixed deposit interest payments of up to ₹ 40,000 in.

Form 15g download pdf limfaera

Web how to download pf withdrawal form 15g online? If an employee withdraws his. July 7, 2023 guide to fill form 15g for pf. Web to do this, one needs to submit form 15g to avoid the deduction of tds. Web you can access either the epfo online portal, your bank’s website or the income tax department website and search.

Form 15g Sample Pdf Download Fill Online, Printable, Fillable, Blank

Web withdrawal from the account 24. July 7, 2023 guide to fill form 15g for pf. After filling in all the required details, one must verify. Visit the official website of the income tax department or the website of your bank. Details of investments in respect of which the declaration is being made:

Download Form 15G for PF Withdrawal 2022

Web download form 15h pdf for pf withdrawal epfo circular on tds deduction download in pdf format form 15g filled sample for pf withdrawal in. Click here now login with the. Visit the official website of uan member website: Details of investments in respect of which the declaration is being made: ’ the answer is simple — use the signnow.

Perfect Programs Storage 15G FOR PF WITHDRAWAL FREE DOWNLOAD

July 7, 2023 guide to fill form 15g for pf. Details of investments in respect of which the declaration is being made: ’ the answer is simple — use the signnow. Web visit the online services section. If you want to download form 15g, then you can download it by clicking on the link given below download form 15g for.

After Filling In All The Required Details, One Must Verify.

Web form 15g is generally used for withdrawal of pf. Web you can access either the epfo online portal, your bank’s website or the income tax department website and search for form 15g for pf download or form. (details of the withdrawal made from national savings scheme) ao no. Visit the official website of the income tax department or the website of your bank.

’ The Answer Is Simple — Use The Signnow.

Learn all the basics how to fill, eligibility, download and rules Web for requests for tds exemption on fixed deposit interest payments of up to ₹ 40,000 in a particular fy, form 15g must be submitted.; Web form 15g download pdf for pf withdrawal sample filled 2023 / finance / by ankit singh / last updated on: July 7, 2023 guide to fill form 15g for pf.

Web How To Download Pf Withdrawal Form 15G Online?

Web visit the online services section. Sir, 15 g is applicable for pf amount only or on pp also.my ee amount is 24000 and er amount is 11111.am i eligible for 15 g for pf withdrawal. If you want to download form 15g, then you can download it by clicking on the link given below download form 15g for pf. Click here now login with the.

Tds On Epf Or Employees Provident Fund Withdrawal:

Form 15g is an authorized document that will make sure that there is no tds deduction on the amount of interest you receive. If an employee withdraws his. Visit the official website of uan member website: Details of investments in respect of which the declaration is being made:

![[PDF] Download PF Withdrawal Form 15G Govtempdiary](https://govtempdiary.com/wp-content/uploads/2021/05/PF-Withdrawal-Form-15G.png)