199 Tax Form

199 Tax Form - Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. Web find irs addresses for private delivery of tax returns, extensions and payments. File your form 2290 today avoid the rush. See how various types of irs form 1099 work. Get irs approved instant schedule 1 copy. Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. Web contained in the saving clause of a tax treaty to claim an exemption from u.s. Ad don't leave it to the last minute. A 1998 overpayment credited to 1999 1120 u.s.

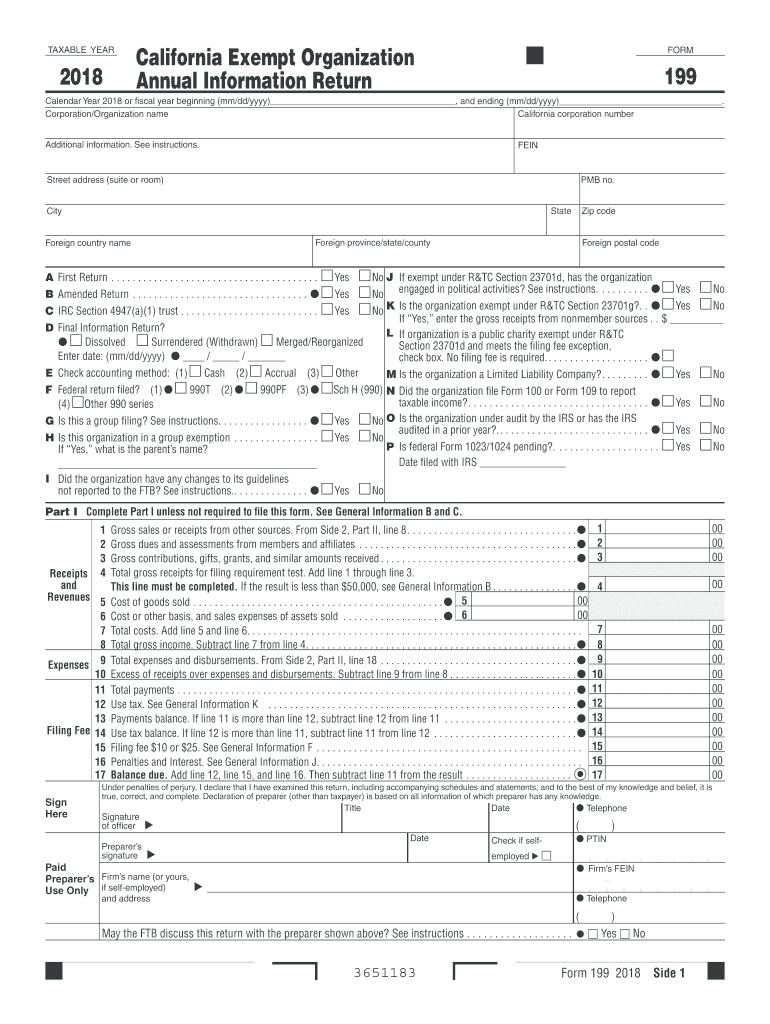

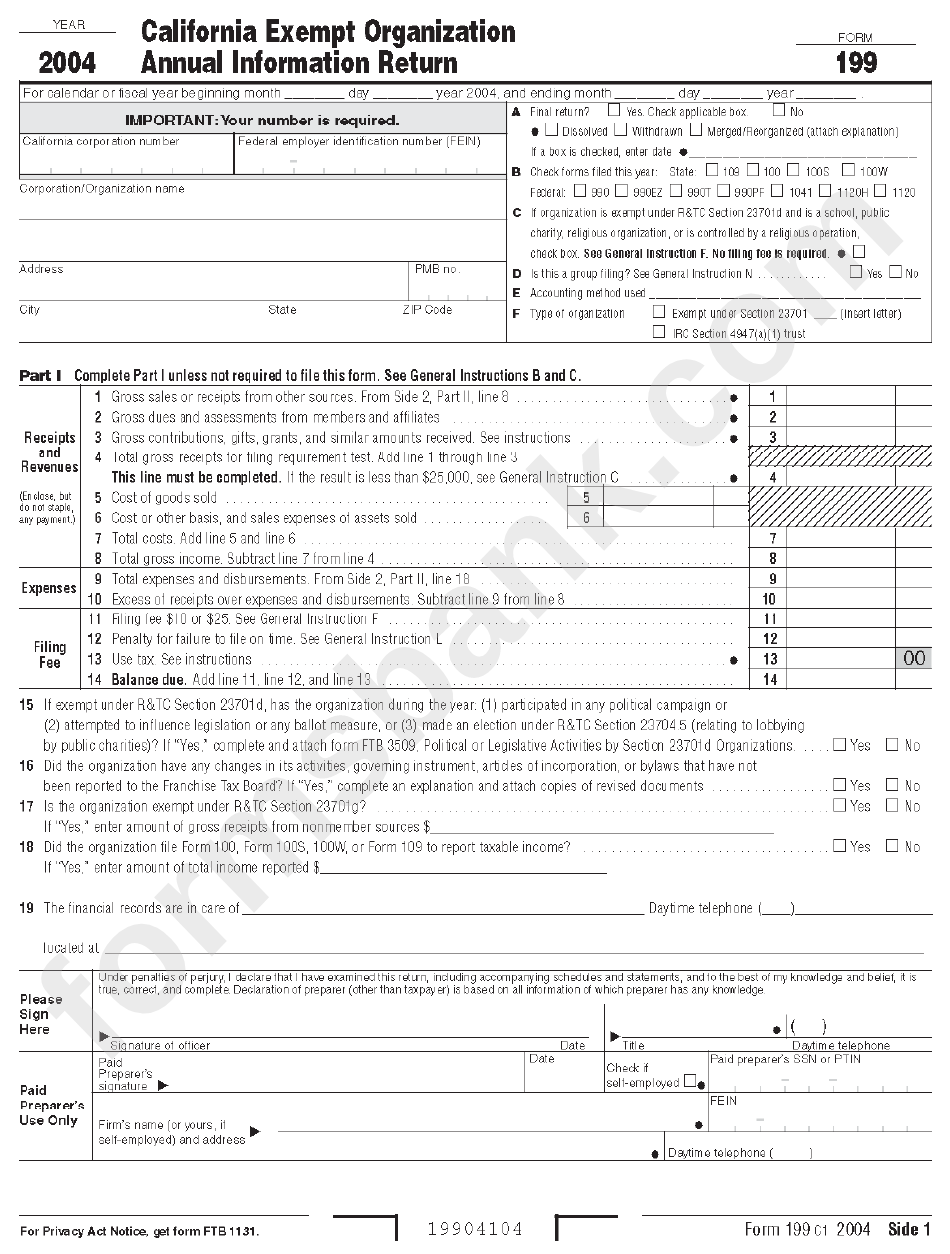

Web section 199a is a qualified business income (qbi) deduction that allows you to potentially deduct 20% of taxable income, minus capital gains. Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. Web firm’s fein telephone may the ftb discuss this return with the preparer shown above? Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. It can best be thought of as california’s version of irs form 990. Web state of california franchise tax board corporate logo. Get irs approved instant schedule 1 copy. Web contained in the saving clause of a tax treaty to claim an exemption from u.s. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. Web form 199 is called the california exempt organization annual information return.

Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. Private delivery services should not deliver returns to irs offices other than. Web for aggregration of businesses see caution: File your form 2290 today avoid the rush. Web find irs addresses for private delivery of tax returns, extensions and payments. Corporation income tax return omb no. See how various types of irs form 1099 work. For multiple rental business see how to. File your form 2290 online & efile with the irs. More about the california form 199 we last updated.

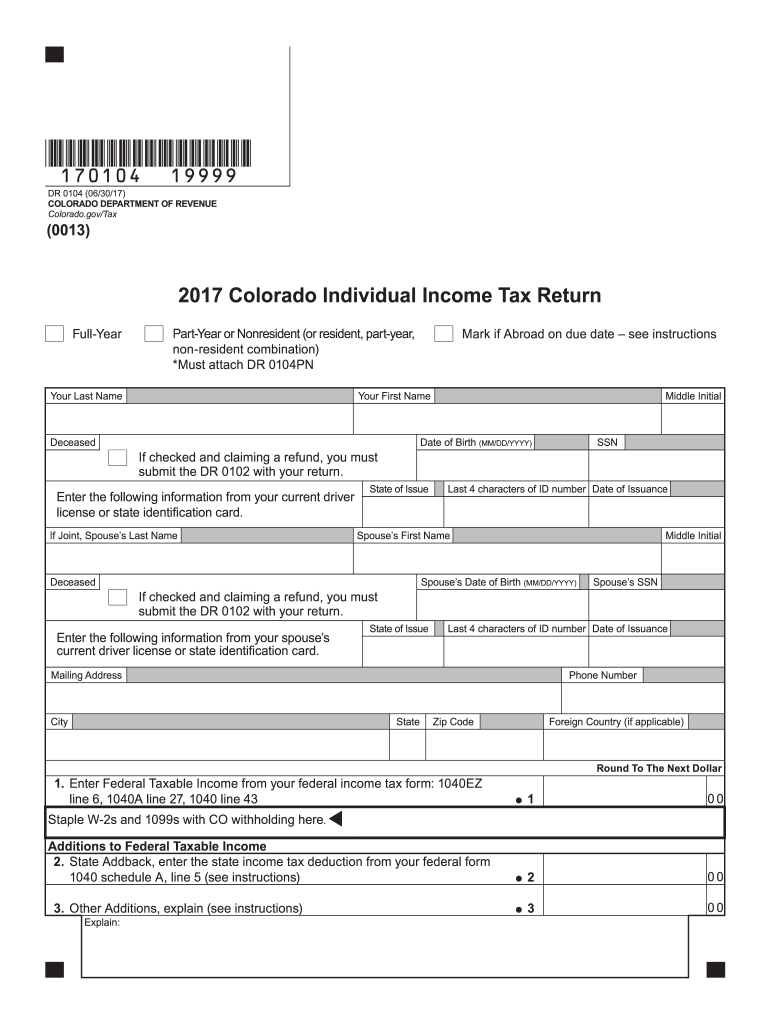

Colorado Form Tax Fill Out and Sign Printable PDF Template signNow

Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. Get irs approved instant schedule 1 copy. Web section 199a is a qualified business income (qbi) deduction that allows you to potentially deduct 20% of taxable income, minus capital gains. California exempt.

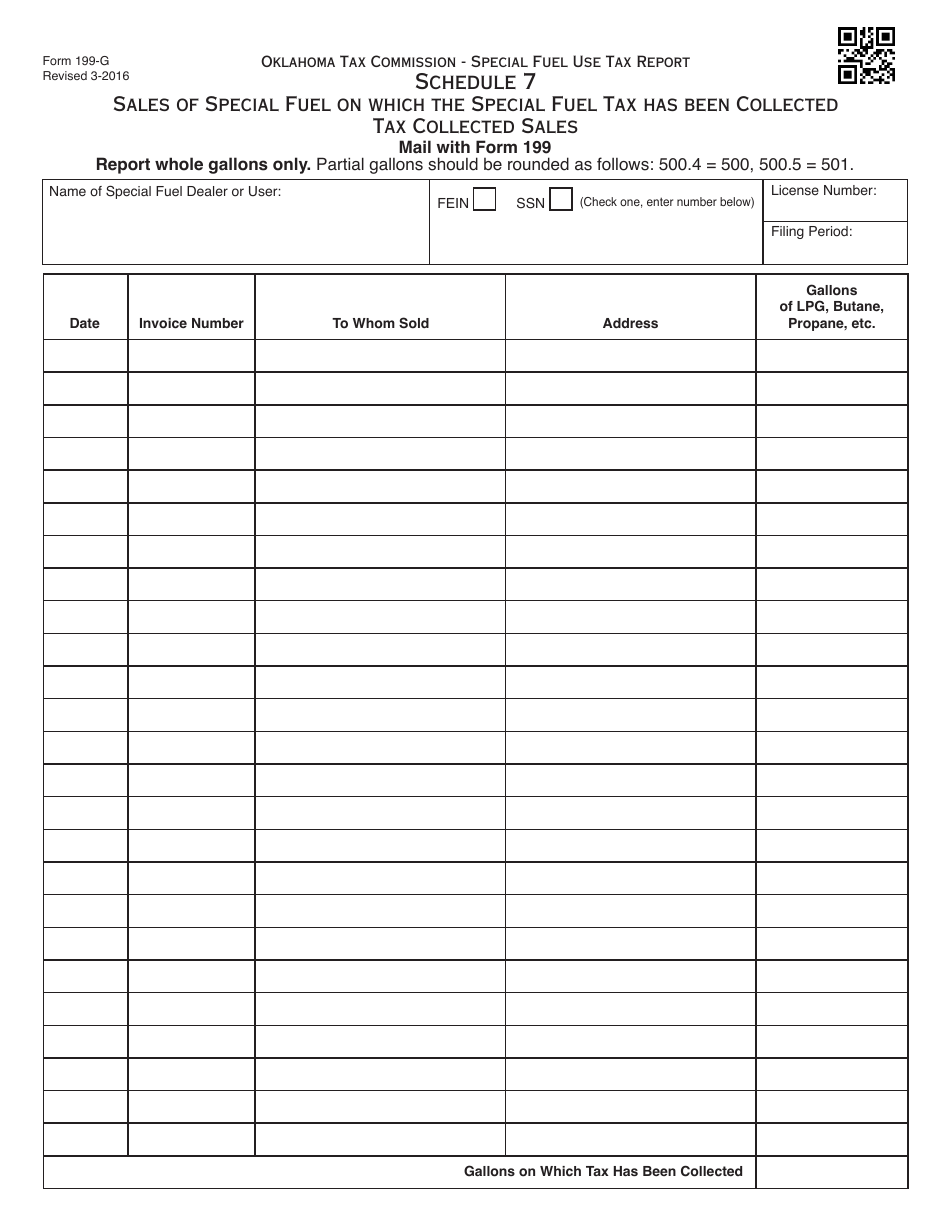

OTC Form 199G Schedule 7 Download Fillable PDF or Fill Online Sales of

Web find irs addresses for private delivery of tax returns, extensions and payments. Get irs approved instant schedule 1 copy. See how various types of irs form 1099 work. California exempt organization annual information return is used by the following organizations: Private delivery services should not deliver returns to irs offices other than.

CA FTB 199 2018 Fill out Tax Template Online US Legal Forms

Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. Web form 199 is called the california exempt organization.

2020 W9 Blank Form Calendar Template Printable throughout Free

Web find irs addresses for private delivery of tax returns, extensions and payments. Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. Web contained in the saving clause of a tax treaty to claim an exemption from u.s. California exempt organization annual information return is used.

Form 199 California Exempt Organization Annual Information Return

Web for aggregration of businesses see caution: File your form 2290 online & efile with the irs. Web find irs addresses for private delivery of tax returns, extensions and payments. Web state of california franchise tax board corporate logo. For multiple rental business see how to.

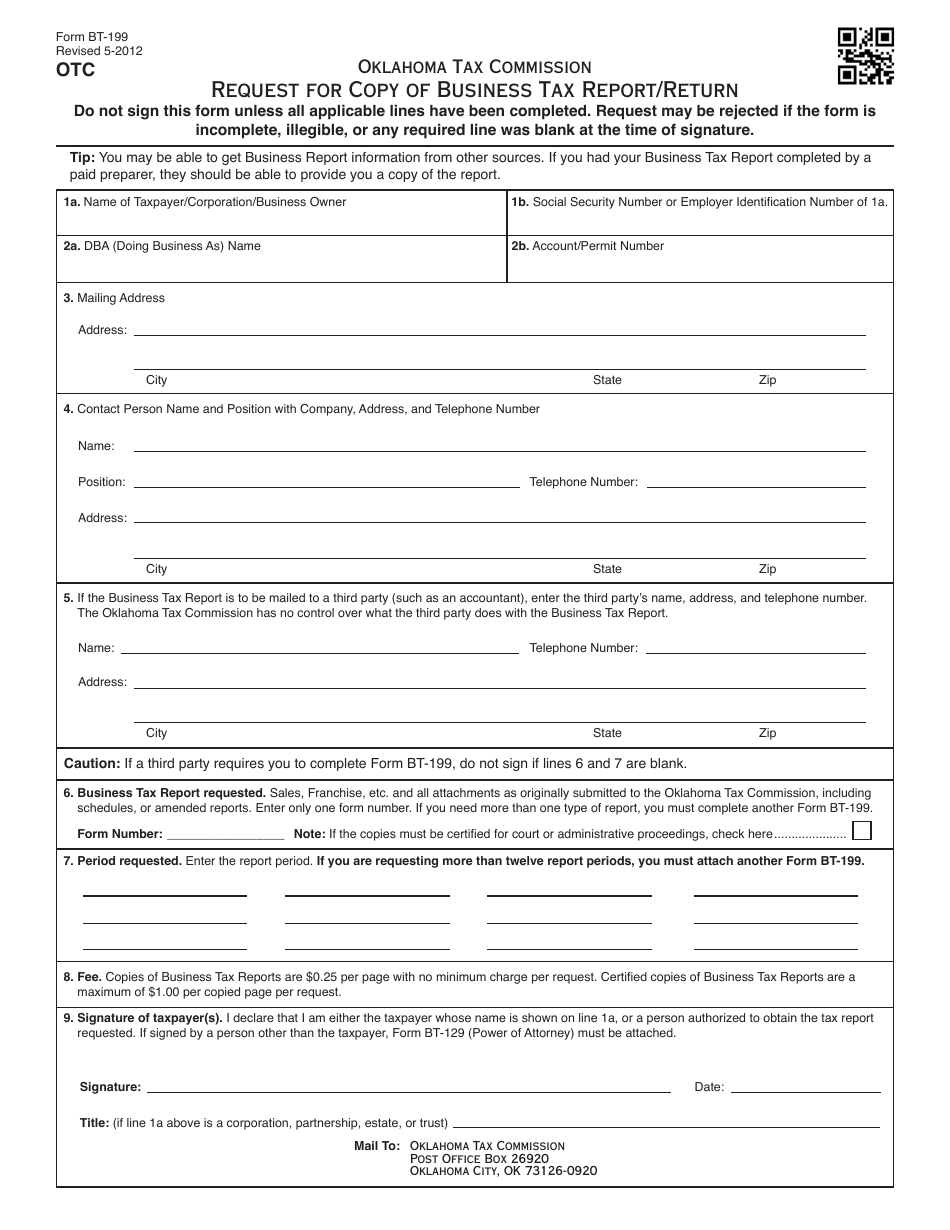

Form BT199 Download Fillable PDF or Fill Online Request for Copy of

Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Web form 199 is called the california exempt organization annual information return. For multiple rental business see how to. Web form 199, california exempt organization annual information return, is used by the following organizations: Web find irs addresses for private delivery.

What to Do with the IRS 1099C Form Cancelation of Debt Alleviate

Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. Web for aggregration of businesses see caution: Web firm’s fein telephone may the ftb discuss this return with the preparer shown above? For multiple rental business see how to. Web form 199,.

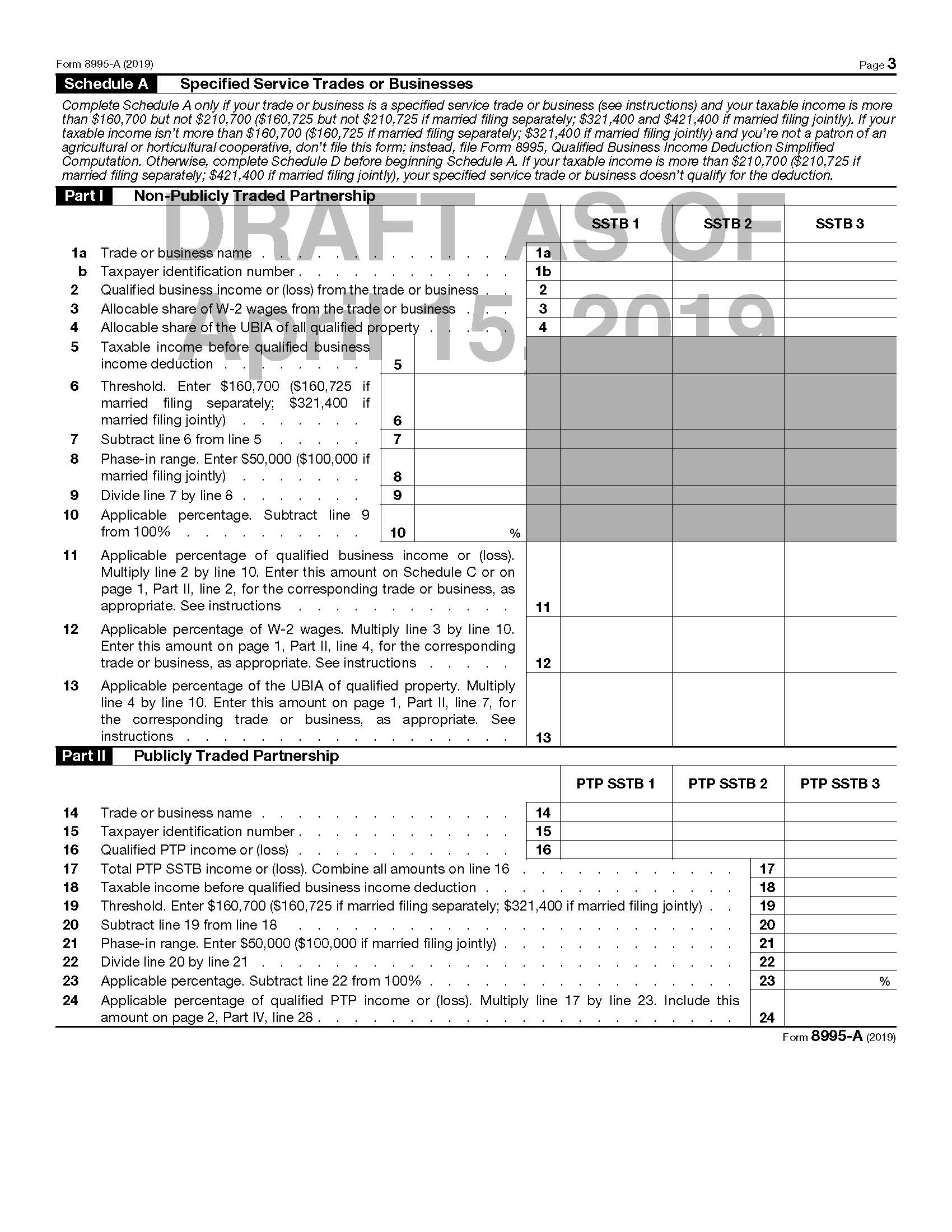

IRS Releases Drafts of Forms to Be Used to Calculate §199A Deduction on

See how various types of irs form 1099 work. It can best be thought of as california’s version of irs form 990. Web contained in the saving clause of a tax treaty to claim an exemption from u.s. Private delivery services should not deliver returns to irs offices other than. A 1998 overpayment credited to 1999 1120 u.s.

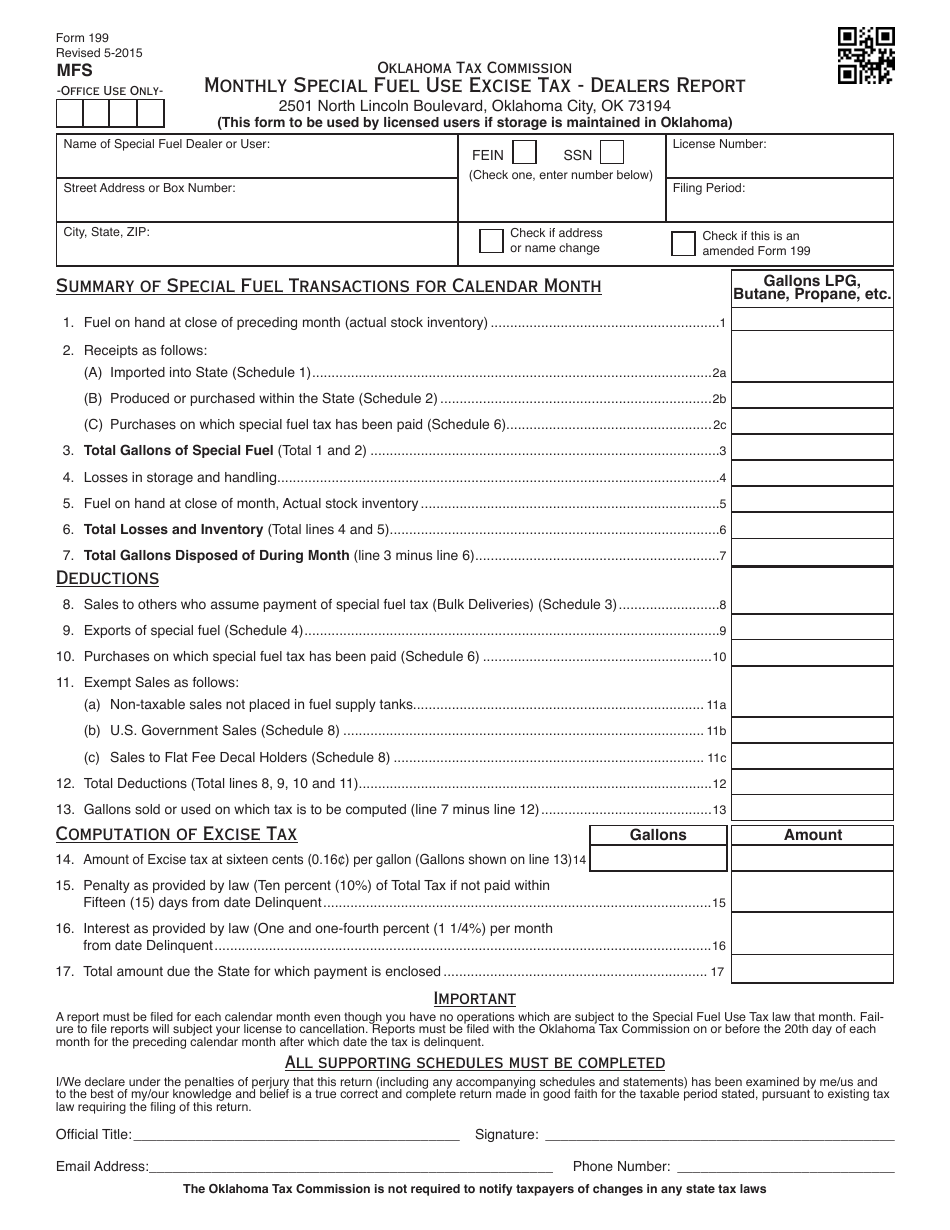

OTC Form 199 Download Fillable PDF or Fill Online Monthly Special Fuel

Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. Get irs approved instant schedule 1 copy. Web section 199a is a qualified business income (qbi) deduction that allows you to potentially deduct 20% of taxable income, minus capital gains. Web trade.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Web form 199 is called the california exempt organization annual information return. For multiple rental business see how to. Web firm’s fein telephone may the ftb discuss this return with the preparer shown above? Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax.

File Your Form 2290 Today Avoid The Rush.

Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. More about the california form 199 we last updated. Web for aggregration of businesses see caution: Web form 199, california exempt organization annual information return, is used by the following organizations:

Web Trade Or Business Is Not Subject To The Withholding Tax On Foreign Partners’ Share Of Effectively Connected Income.

Web state of california franchise tax board corporate logo. Web find irs addresses for private delivery of tax returns, extensions and payments. File your form 2290 online & efile with the irs. Get irs approved instant schedule 1 copy.

Section 199A Of The Internal Revenue Code Provides Many Owners Of Sole Proprietorships, Partnerships, S Corporations And Some Trusts And Estates, A Deduction.

It can best be thought of as california’s version of irs form 990. Yes no calendar year 2019 or fiscal year. Web firm’s fein telephone may the ftb discuss this return with the preparer shown above? A 1998 overpayment credited to 1999 1120 u.s.

For Multiple Rental Business See How To.

Web section 199a is a qualified business income (qbi) deduction that allows you to potentially deduct 20% of taxable income, minus capital gains. See how various types of irs form 1099 work. Private delivery services should not deliver returns to irs offices other than. Web contained in the saving clause of a tax treaty to claim an exemption from u.s.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)