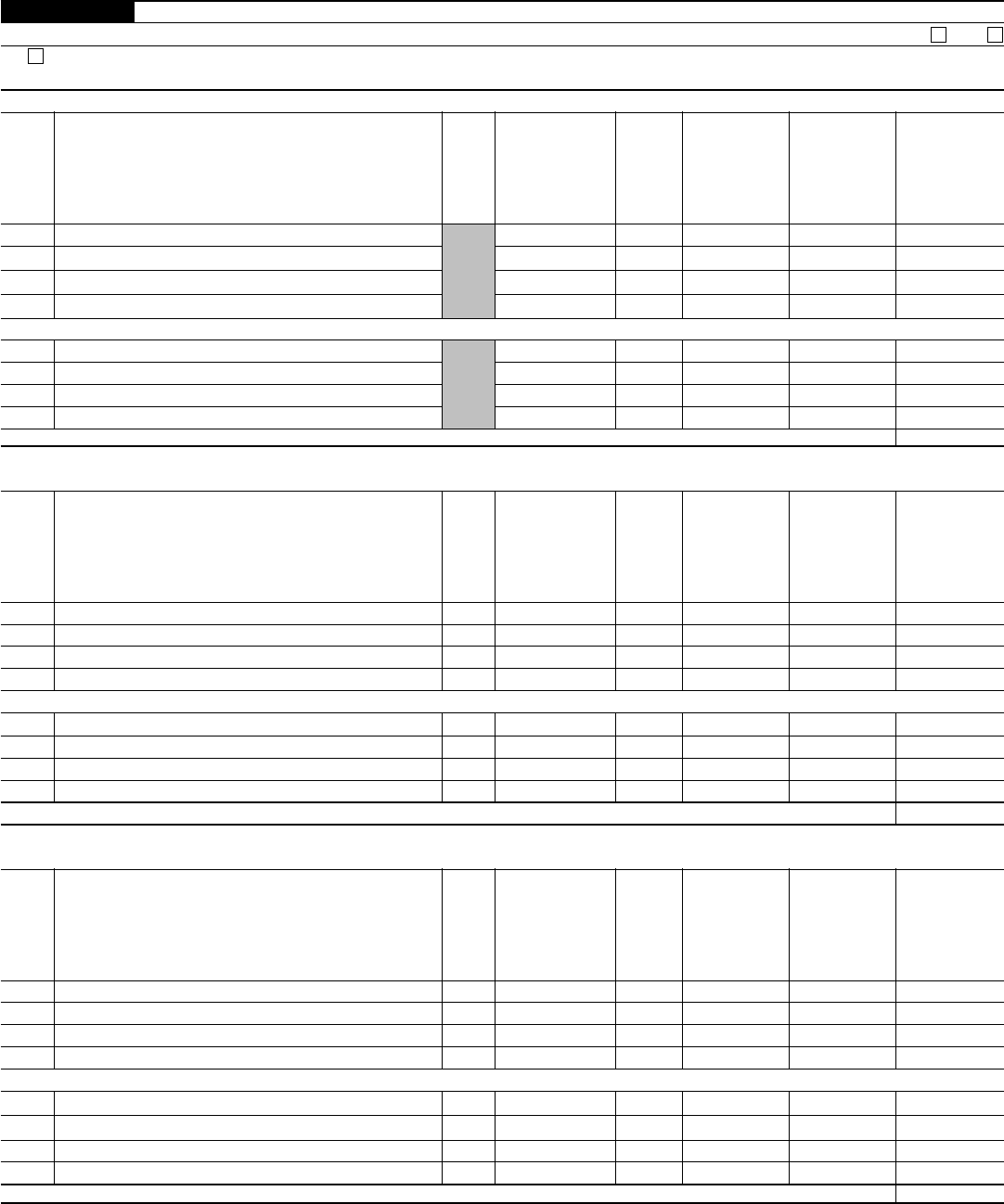

2012 Form 709 Instructions

2012 Form 709 Instructions - Instructions for form 709, united states gift (and generation. Web the form 709 instructions currently provide: Citizens accountable for their annual excludable amount of $15,000 and lifetime gift and estate tax exemption of $11.4 million. Web if you’ve figured out you must fill out a form 709, follow the instructions below. Web in late september, the service posted on the irs website the new draft form 709 for reporting 2012 gifts and draft instructions for the form 709. Certain types of financial gifts may qualify as exclusions for the gift tax. The times of frightening complex legal and tax documents are over. Complete, edit or print tax forms instantly. First, complete the general information section on part one of the form. Web follow the simple instructions below:

Read the instructions before attempting to complete the form. Get ready for tax season deadlines by completing any required tax forms today. Web the form 709 instructions clearly provide that no return is required on gifts to a spouse, in general. This new form has also. Web form 709 (2010) page 2 schedule a computation of taxable gifts (including transfers in trust) (see instructions) a does the value of any item listed on schedule a reflect any. Web the irs form 709 instructions are both invaluable and authoritative. (for gifts made during calendar year 2022) see instructions. Web the form 709 instructions currently provide: Web if you’ve figured out you must fill out a form 709, follow the instructions below. The times of frightening complex legal and tax documents are over.

Web follow the simple instructions below: Read the instructions before attempting to complete the form. Certain types of financial gifts may qualify as exclusions for the gift tax. This new form has also. Web in late september, the service posted on the irs website the new draft form 709 for reporting 2012 gifts and draft instructions for the form 709. (for gifts made during calendar year 2022) see instructions. The times of frightening complex legal and tax documents are over. Web form 709 (2010) page 2 schedule a computation of taxable gifts (including transfers in trust) (see instructions) a does the value of any item listed on schedule a reflect any. Web the irs form 709 instructions are both invaluable and authoritative. First, complete the general information section on part one of the form.

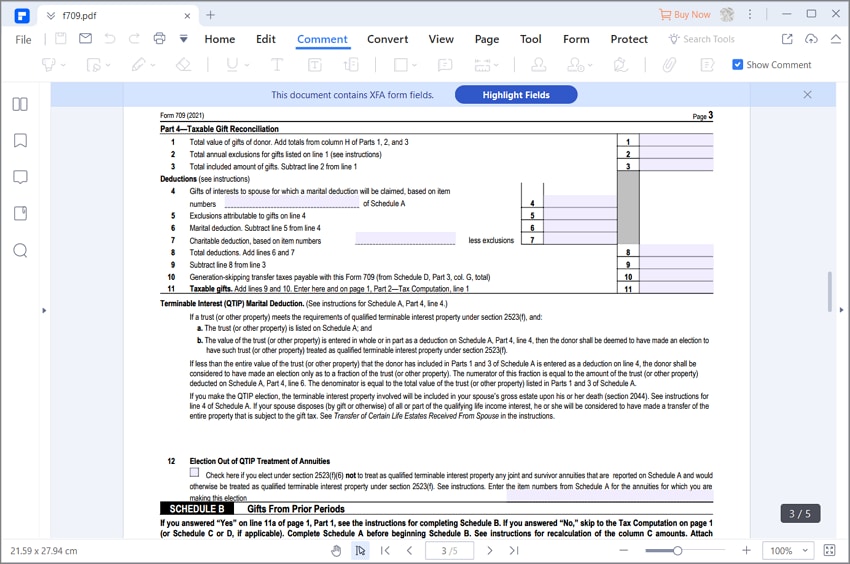

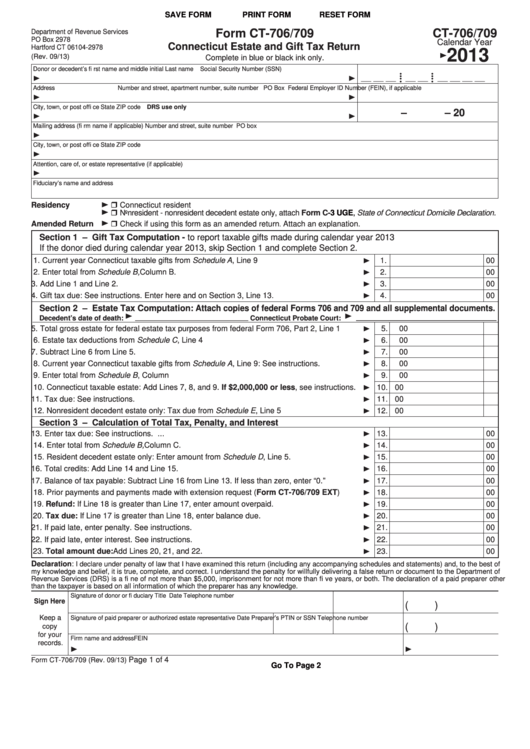

2013 Form 709 Edit, Fill, Sign Online Handypdf

“if you are required to file a return to report noncharitable gifts and you made gifts to charities, you must include all. Web form 709 (2010) page 2 schedule a computation of taxable gifts (including transfers in trust) (see instructions) a does the value of any item listed on schedule a reflect any. With us legal forms the procedure of.

Form 709 United States Gift Tax Return (2014) Free Download

Certain types of financial gifts may qualify as exclusions for the gift tax. Web the form 709 instructions currently provide: The instructions provide that a return is required on a spousal gift to make a. (for gifts made during calendar year 2022) see instructions. With us legal forms the procedure of filling out official documents.

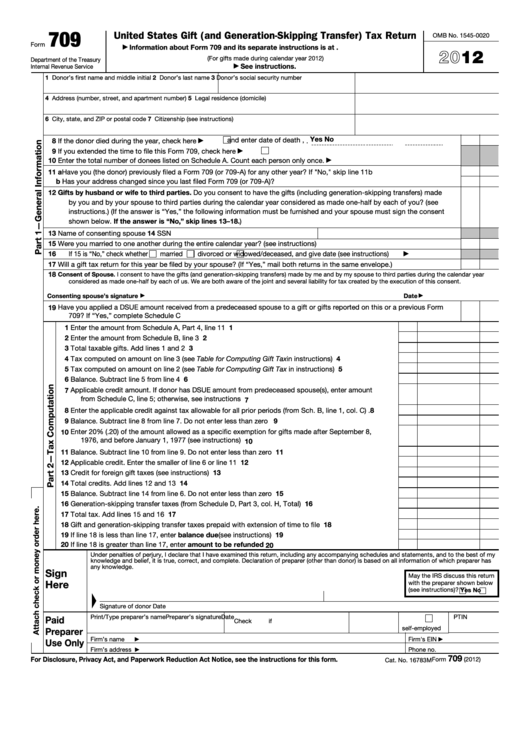

Fill Free fillable Form 709 Gift and GenerationSkipping Transfer Tax

Certain types of financial gifts may qualify as exclusions for the gift tax. Get ready for tax season deadlines by completing any required tax forms today. Web the form 709 instructions currently provide: Web form 709 (2010) page 2 schedule a computation of taxable gifts (including transfers in trust) (see instructions) a does the value of any item listed on.

Filing Form 709 Beyond the basics of gift tax returns Thompson

This new form has also. (for gifts made during calendar year 2022) see instructions. The times of frightening complex legal and tax documents are over. Web go to www.irs.gov/form709 for instructions and the latest information. With us legal forms the procedure of filling out official documents.

709 Cdph Fill Online, Printable, Fillable, Blank pdfFiller

Read the instructions before attempting to complete the form. Web the form 709 instructions clearly provide that no return is required on gifts to a spouse, in general. Web go to www.irs.gov/form709 for instructions and the latest information. Web the irs form 709 instructions are both invaluable and authoritative. Complete, edit or print tax forms instantly.

Fillable Form 709 United States Gift (And GenerationSkipping

Citizens accountable for their annual excludable amount of $15,000 and lifetime gift and estate tax exemption of $11.4 million. Get ready for tax season deadlines by completing any required tax forms today. The instructions provide that a return is required on a spousal gift to make a. Web the form 709 instructions currently provide: With us legal forms the procedure.

for How to Fill in IRS Form 709

Read the instructions before attempting to complete the form. Web the gift tax return exists to keep u.s. Web follow the simple instructions below: Web form 709 (2010) page 2 schedule a computation of taxable gifts (including transfers in trust) (see instructions) a does the value of any item listed on schedule a reflect any. First, complete the general information.

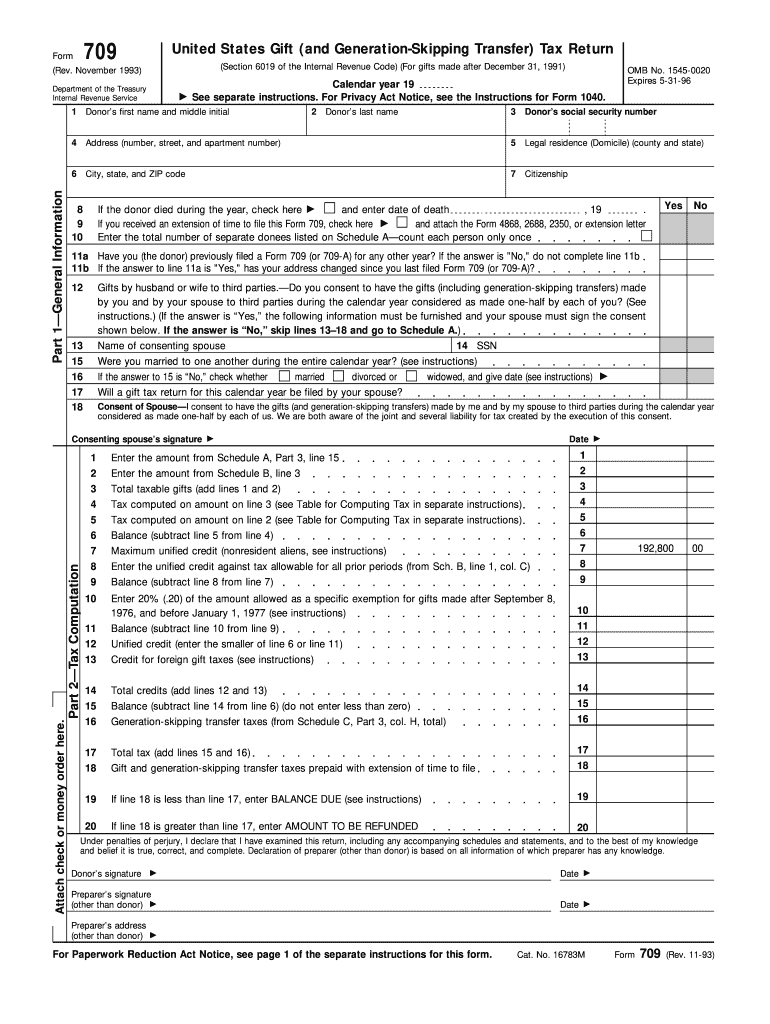

1993 Form IRS 709 Fill Online, Printable, Fillable, Blank PDFfiller

Web if you’ve figured out you must fill out a form 709, follow the instructions below. The times of frightening complex legal and tax documents are over. Citizens accountable for their annual excludable amount of $15,000 and lifetime gift and estate tax exemption of $11.4 million. Read the instructions before attempting to complete the form. The instructions provide that a.

Fillable Form Ct706/709 Connecticut Estate And Gift Tax Return

Web the irs form 709 instructions are both invaluable and authoritative. First, complete the general information section on part one of the form. Web form 709 (2010) page 2 schedule a computation of taxable gifts (including transfers in trust) (see instructions) a does the value of any item listed on schedule a reflect any. Web the form 709 instructions currently.

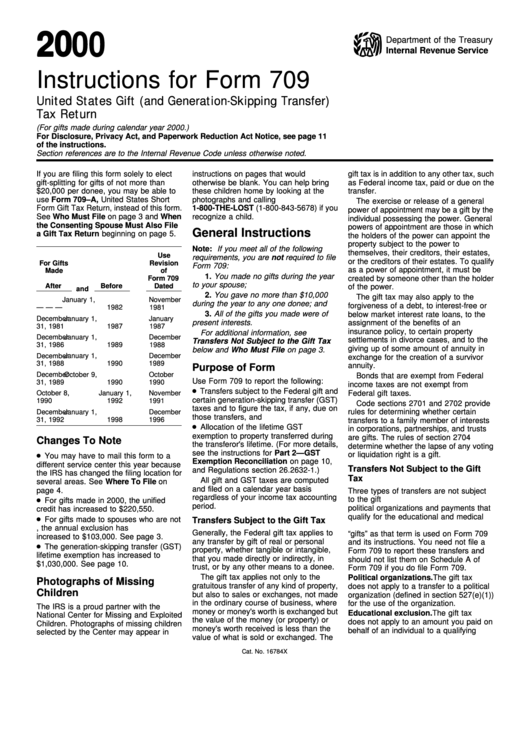

Instructions For Form 709 United States Gift (And GenerationSkipping

Citizens accountable for their annual excludable amount of $15,000 and lifetime gift and estate tax exemption of $11.4 million. Get ready for tax season deadlines by completing any required tax forms today. Certain types of financial gifts may qualify as exclusions for the gift tax. “if you are required to file a return to report noncharitable gifts and you made.

Complete, Edit Or Print Tax Forms Instantly.

Web the gift tax return exists to keep u.s. The instructions provide that a return is required on a spousal gift to make a. Citizens accountable for their annual excludable amount of $15,000 and lifetime gift and estate tax exemption of $11.4 million. Web the form 709 instructions currently provide:

The Times Of Frightening Complex Legal And Tax Documents Are Over.

Web the irs form 709 instructions are both invaluable and authoritative. Web in late september, the service posted on the irs website the new draft form 709 for reporting 2012 gifts and draft instructions for the form 709. Section references are to the internal. Web the form 709 instructions clearly provide that no return is required on gifts to a spouse, in general.

First, Complete The General Information Section On Part One Of The Form.

“if you are required to file a return to report noncharitable gifts and you made gifts to charities, you must include all. Web form 709 (2010) page 2 schedule a computation of taxable gifts (including transfers in trust) (see instructions) a does the value of any item listed on schedule a reflect any. Read the instructions before attempting to complete the form. Certain types of financial gifts may qualify as exclusions for the gift tax.

An Individual Makes One Or More Gifts To Any One Person.

Instructions for form 709, united states gift (and generation. Web follow the simple instructions below: Web if you’ve figured out you must fill out a form 709, follow the instructions below. Get ready for tax season deadlines by completing any required tax forms today.