2023 Az Withholding Form

2023 Az Withholding Form - Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. Web address state income tax withholding percentage withholding exemption, if applicable additional withholding, if desired generally, only new employees and. State employees on the hris. You can use your results. The forms feature various withholding rates, going as low as 0%. Web arizona’s individual income tax rates were substantially reduced starting with the 2022 tax year. 1 i elect to have arizona income taxes withheld from my annuity or pension payments as. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. Web notify your arizona employees of the state's new income tax rates and provide a copy of the revised 2023 form a4 for electing their withholding percentage. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue.

You can use your results. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue. Prior to january 1, 2023, individual tax rates in arizona were 2.55% and 2.98%, and employees had five withholding. Web notify your arizona employees of the state's new income tax rates and provide a copy of the revised 2023 form a4 for electing their withholding percentage. 505, tax withholding and estimated tax. Web address state income tax withholding percentage withholding exemption, if applicable additional withholding, if desired generally, only new employees and. Web change the entries on the form. Web complete this form to request that your employer withhold arizona income tax from your wages and elect an arizona withholding percentage and any additional amount to be. Doug ducey has announced that the state moved to a flat income tax rate on january 1, 2023. Web withholding forms are changing as well.

Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue. Web complete this form to request that your employer withhold arizona income tax from your wages and elect an arizona withholding percentage and any additional amount to be. 505, tax withholding and estimated tax. The forms feature various withholding rates, going as low as 0%. Submitted by anonymous (not verified) on fri,. The new arizona flat tax rate is a tax cut for all arizona taxpayers,. Web arizona’s individual income tax rates were substantially reduced starting with the 2022 tax year. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. Doug ducey has announced that the state moved to a flat income tax rate on january 1, 2023. Web address state income tax withholding percentage withholding exemption, if applicable additional withholding, if desired generally, only new employees and.

Payroll withholding calculator 2023 MonaDeimante

Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. The forms feature various withholding rates, going as low as 0%. The new arizona flat.

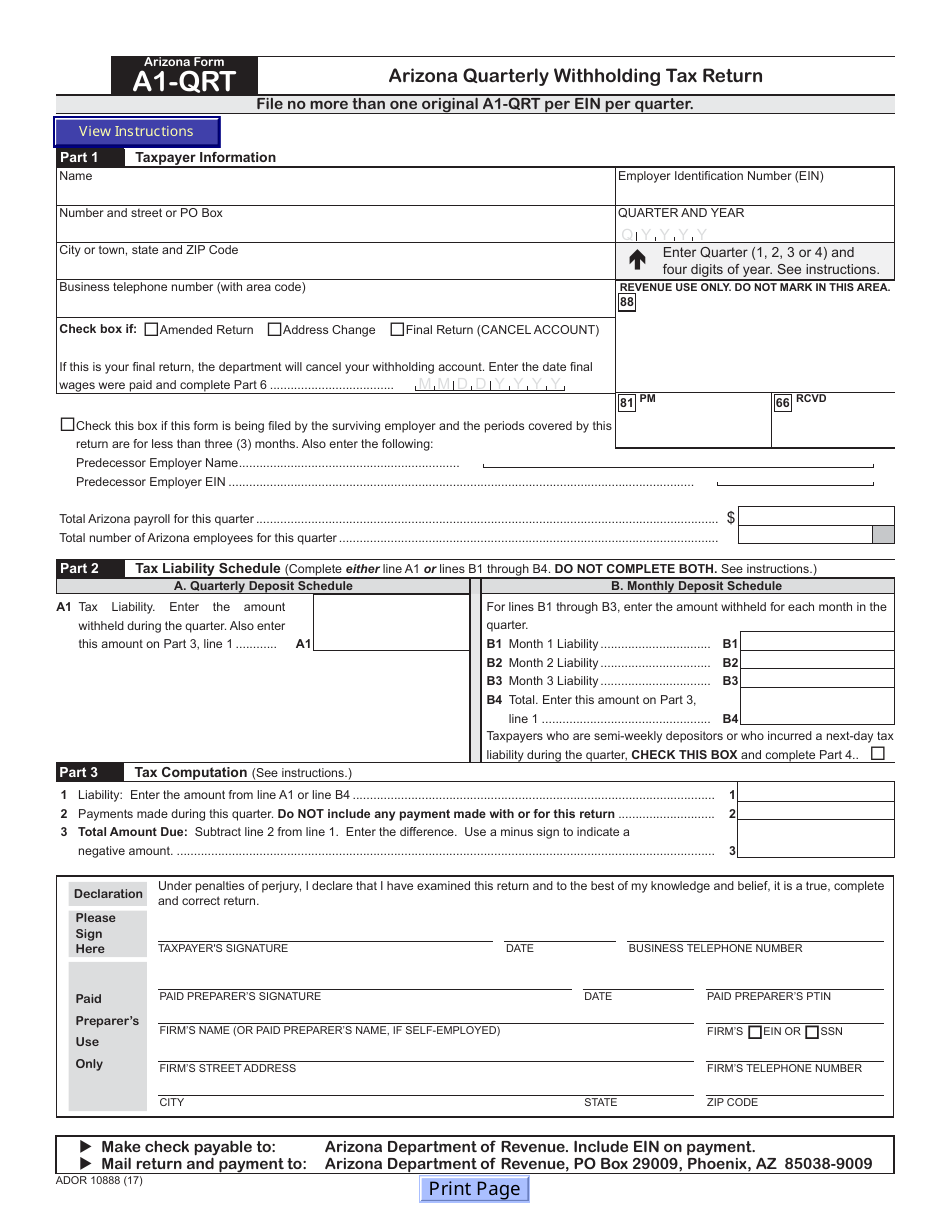

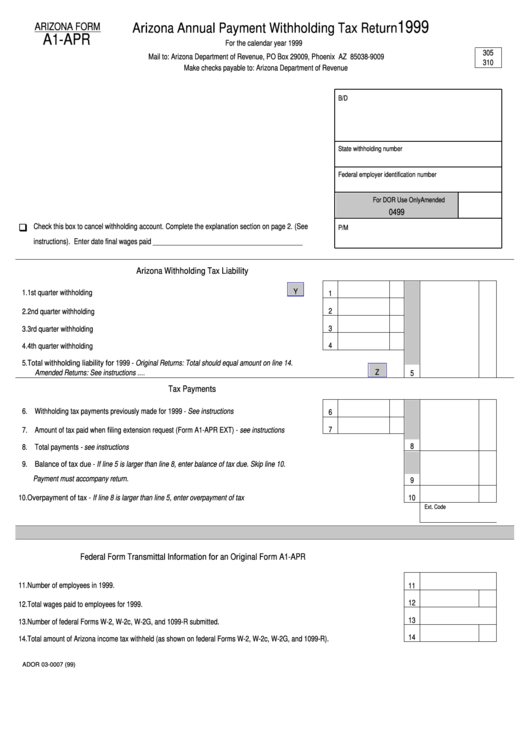

Arizona Form A1QRT (ADOR10888) Download Fillable PDF or Fill Online

505, tax withholding and estimated tax. Doug ducey has announced that the state moved to a flat income tax rate on january 1, 2023. 1 i elect to have arizona income taxes withheld from my annuity or pension payments as. State employees on the hris. You can use your results.

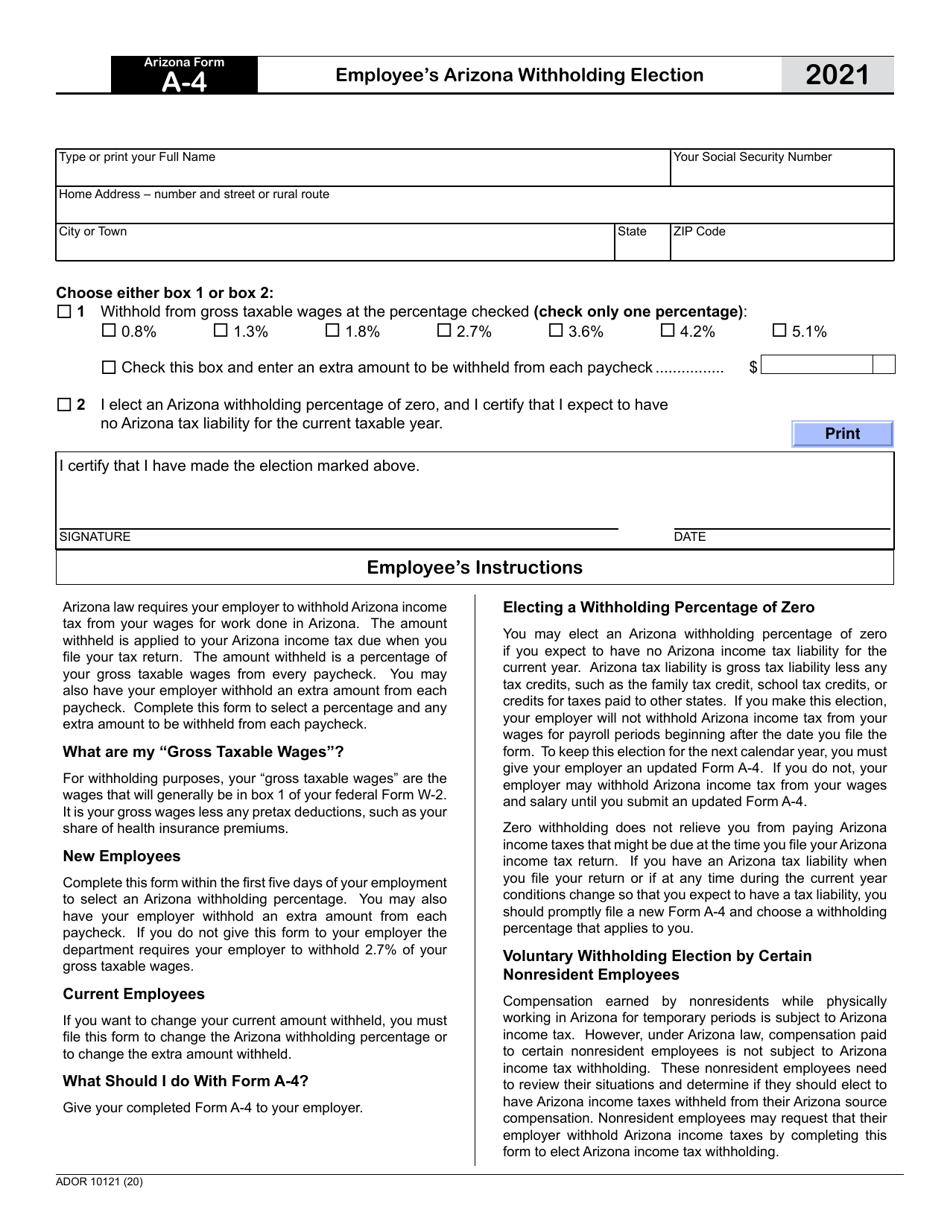

Arizona Form A4 (ADOR10121) Download Fillable PDF or Fill Online

1 i elect to have arizona income taxes withheld from my annuity or pension payments as. Prior to january 1, 2023, individual tax rates in arizona were 2.55% and 2.98%, and employees had five withholding. Web address state income tax withholding percentage withholding exemption, if applicable additional withholding, if desired generally, only new employees and. Web arizona’s individual income tax.

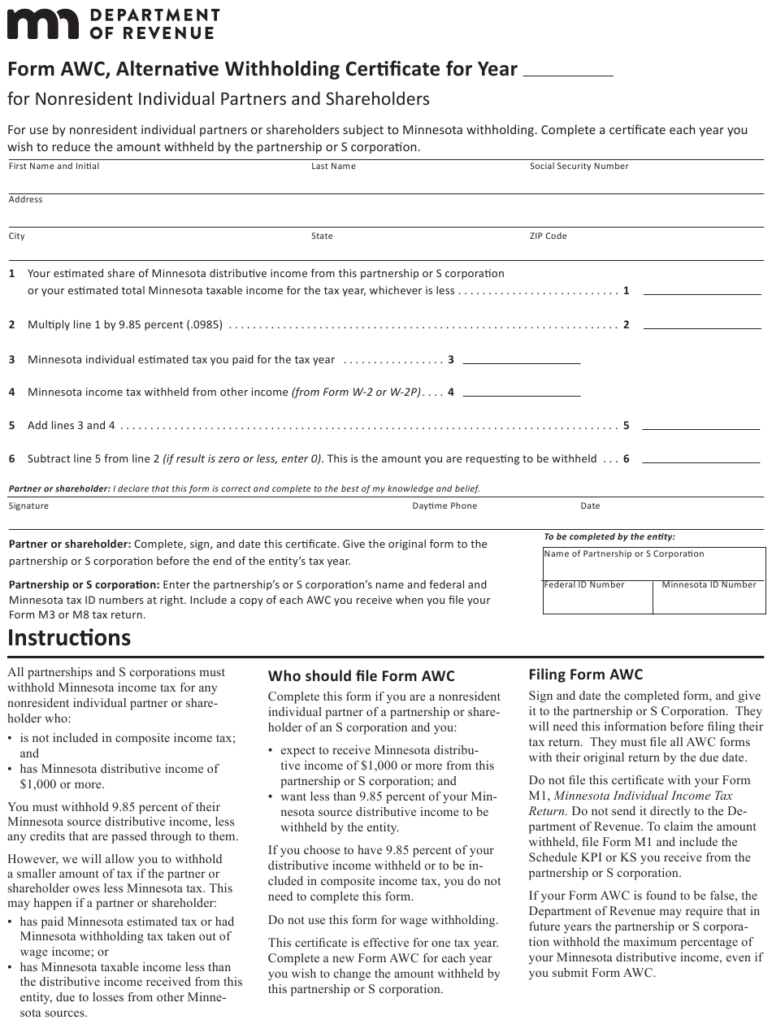

Minnesota State Withholding Form 2021 Federal Withholding Tables 2021

1 i elect to have arizona income taxes withheld from my annuity or pension payments as. Web address state income tax withholding percentage withholding exemption, if applicable additional withholding, if desired generally, only new employees and. Submitted by anonymous (not verified) on fri,. The forms feature various withholding rates, going as low as 0%. Web withholding forms are changing as.

W4 Form 2023 Printable Form IMAGESEE

Web withholding forms are changing as well. Web 20 rows withholding forms : 1 i elect to have arizona income taxes withheld from my annuity or pension payments as. You can use your results. Submitted by anonymous (not verified) on fri,.

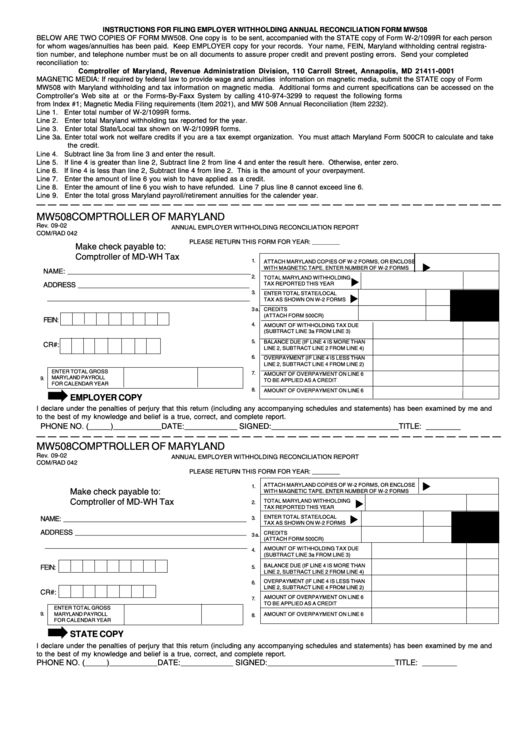

Maryland Withholding Form 2021 2022 W4 Form

Doug ducey has announced that the state moved to a flat income tax rate on january 1, 2023. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. Web withholding forms are changing as well. Submitted by anonymous (not verified) on fri,..

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

505, tax withholding and estimated tax. The new arizona flat tax rate is a tax cut for all arizona taxpayers,. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. You can use your results. Web tax rates used on arizona’s withholding.

Arizona Form A1Apr Arizona Annual Payment Withholding Tax Return

Web withholding forms are changing as well. Submitted by anonymous (not verified) on fri,. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. Doug ducey has announced that the state moved to a flat income tax rate on january 1, 2023. Web complete this form to request that your employer.

2022 Form W4 IRS Tax Forms W4 Form 2022 Printable

Prior to january 1, 2023, individual tax rates in arizona were 2.55% and 2.98%, and employees had five withholding. The new arizona flat tax rate is a tax cut for all arizona taxpayers,. The forms feature various withholding rates, going as low as 0%. 1 i elect to have arizona income taxes withheld from my annuity or pension payments as..

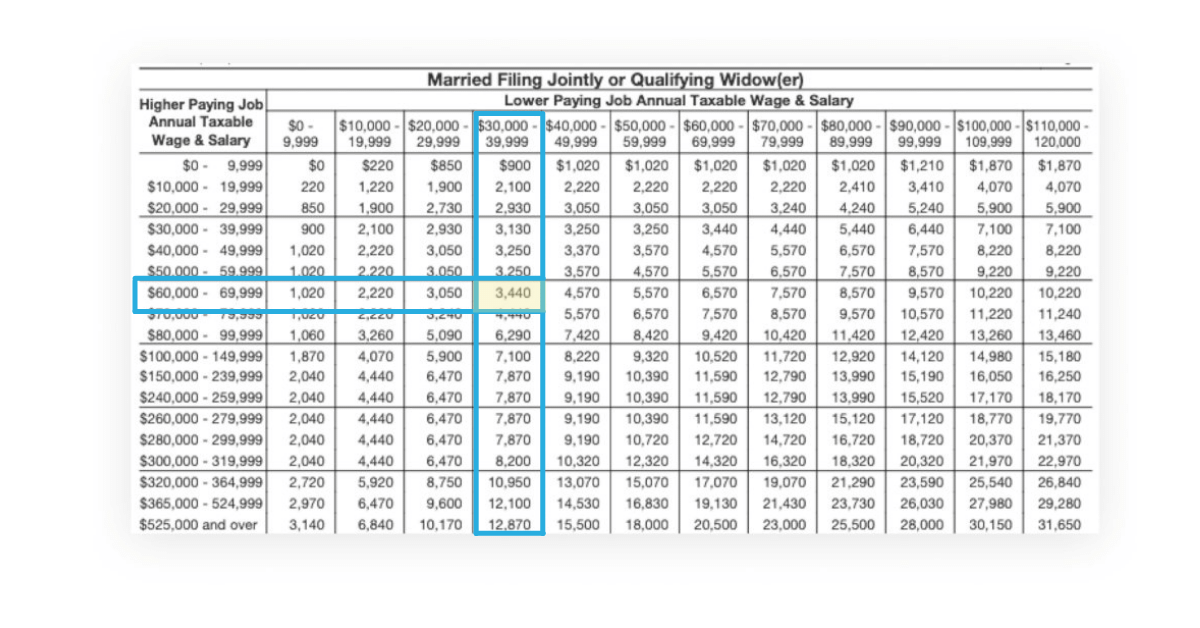

Az Tax Withholding Chart Triply

Web withholding forms are changing as well. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. Prior to january 1, 2023, individual tax rates in arizona were 2.55% and 2.98%, and employees had five withholding. Web arizona’s individual income tax rates.

Web Notify Your Arizona Employees Of The State's New Income Tax Rates And Provide A Copy Of The Revised 2023 Form A4 For Electing Their Withholding Percentage.

The forms feature various withholding rates, going as low as 0%. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue. Prior to january 1, 2023, individual tax rates in arizona were 2.55% and 2.98%, and employees had five withholding. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax.

Web Complete This Form To Request That Your Employer Withhold Arizona Income Tax From Your Wages And Elect An Arizona Withholding Percentage And Any Additional Amount To Be.

505, tax withholding and estimated tax. Web withholding forms are changing as well. 1 i elect to have arizona income taxes withheld from my annuity or pension payments as. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding.

Doug Ducey Has Announced That The State Moved To A Flat Income Tax Rate On January 1, 2023.

Web change the entries on the form. Web arizona’s individual income tax rates were substantially reduced starting with the 2022 tax year. Web 20 rows withholding forms : You can use your results.

The New Arizona Flat Tax Rate Is A Tax Cut For All Arizona Taxpayers,.

Submitted by anonymous (not verified) on fri,. State employees on the hris. Web address state income tax withholding percentage withholding exemption, if applicable additional withholding, if desired generally, only new employees and.