4797 Form Example

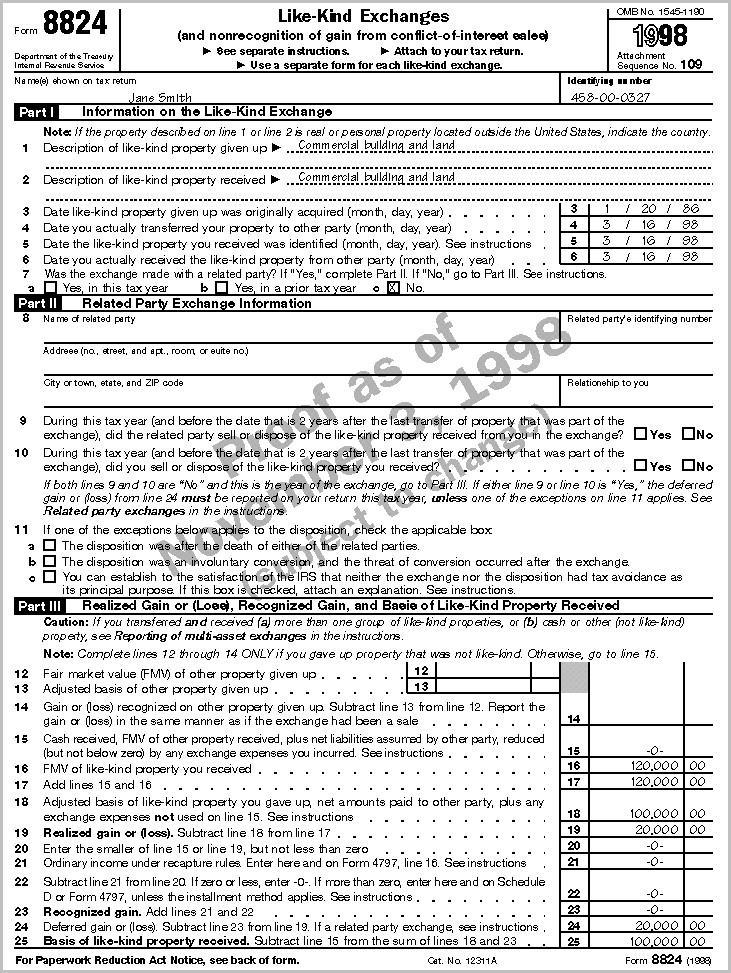

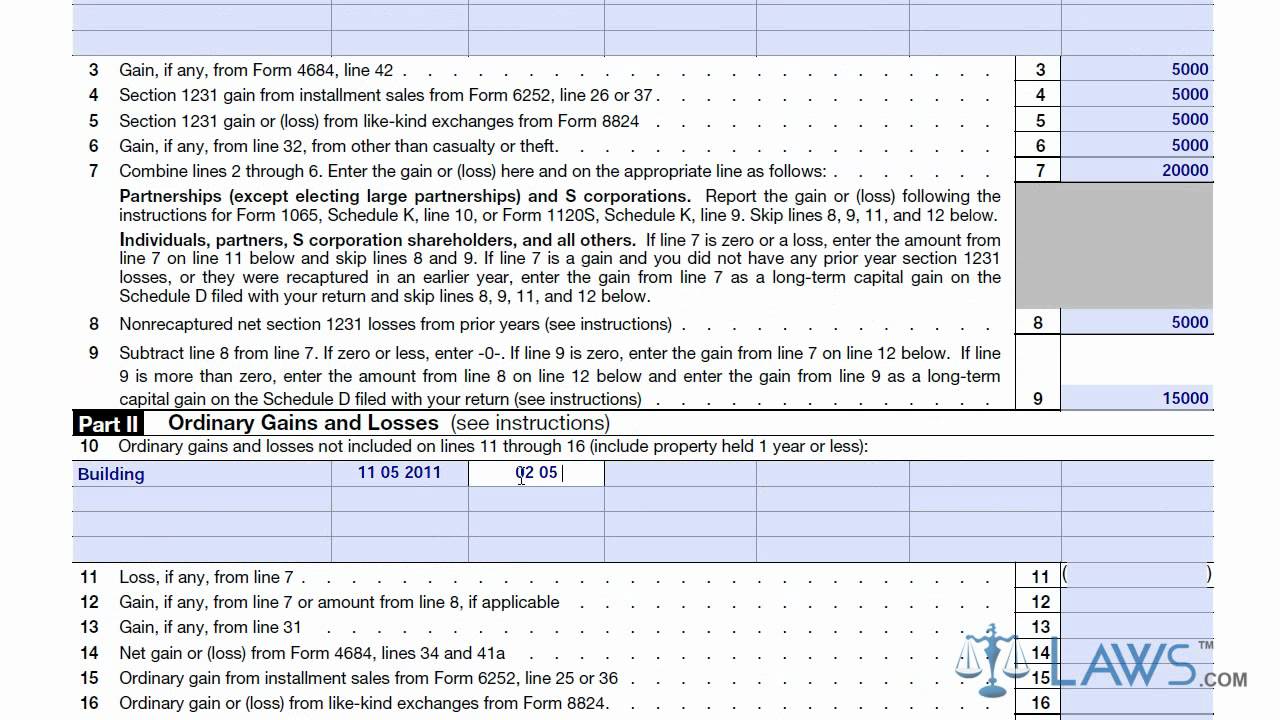

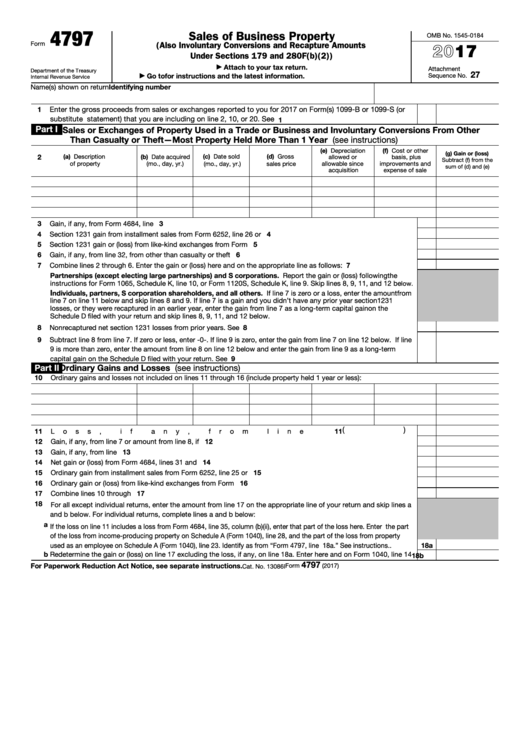

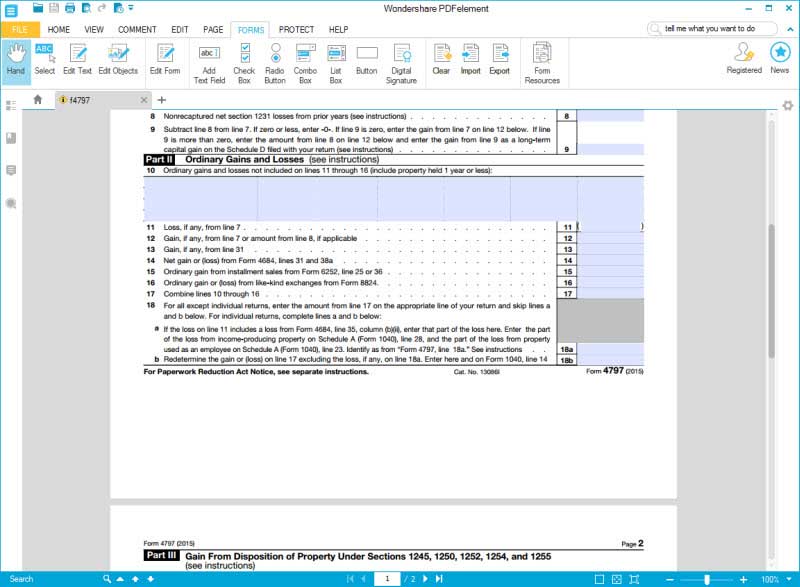

4797 Form Example - Web form 4797, sales of business property is used to report the following transactions: Web the following is an example calculation used in part iii. Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Identify as from “form 4797, line 18a.” Web department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) attach to your tax return. Web form 4797 (sales of business property), issued by the irs, is used to report financial gains made from the sale or exchange of business property. Web the disposition of each type of property is reported separately in the appropriate part of form 4797 (for example, for property held more than 1 year, report the sale of a building in part iii and land in part i). Web the irs form 4797 is a tax form distributed by the irs that is used to report the income generated by the sale or exchange of a business property. To learn how to fill various legal. Part three of irs form 4797 is the largest section and consists of 14 lines that require very specific information.

Disposition of assets that constitute a trade or business For example, owners will need to report gains on line 19 if they were realized under any of the following sections: Web the following is an example calculation used in part iii. Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. Oil, gas, geothermal, or other mineral properties. Enter here and on form 1040, line 14 form 4797(2007) for paperwork reduction act notice, see separate instructions. The sale or exchange of: Web form 4797 instructions part iii: Selling a rental property may create tax liabilities for depreciation recapture and capital gains. Web form 4797 part iii:

Web the disposition of each type of property is reported separately in the appropriate part of form 4797. Enter the name and identifying number at the top of the form. Allocated $133406 to building, $85292 land. The form requires a variety of information to. Web form 4797, sales of business property is used to report the following transactions: Property used in a trade or business. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property, including but not limited to properties that generate rental income and properties that are used for industrial, agricultural, or extractive resources. Oil, gas, geothermal, or other mineral properties. Selling a rental property may create tax liabilities for depreciation recapture and capital gains. Web identify as from “form 4797, line 18a.” see instructions redetermine the gain or (loss) on line 17 excluding the loss, if any, on line 18a.

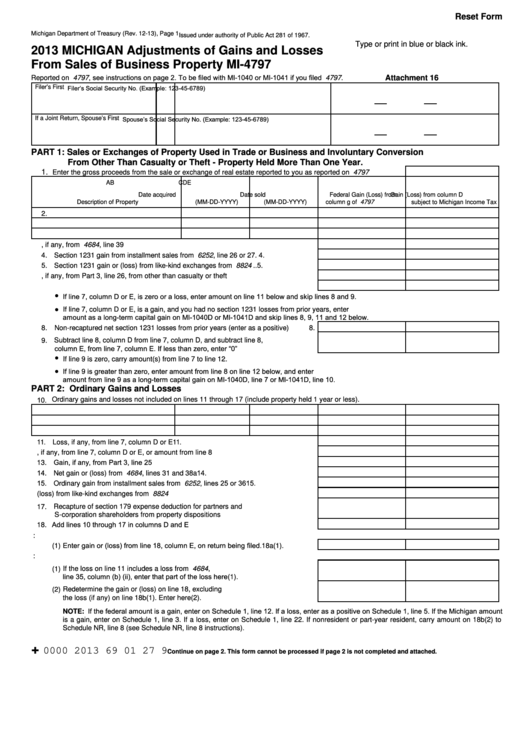

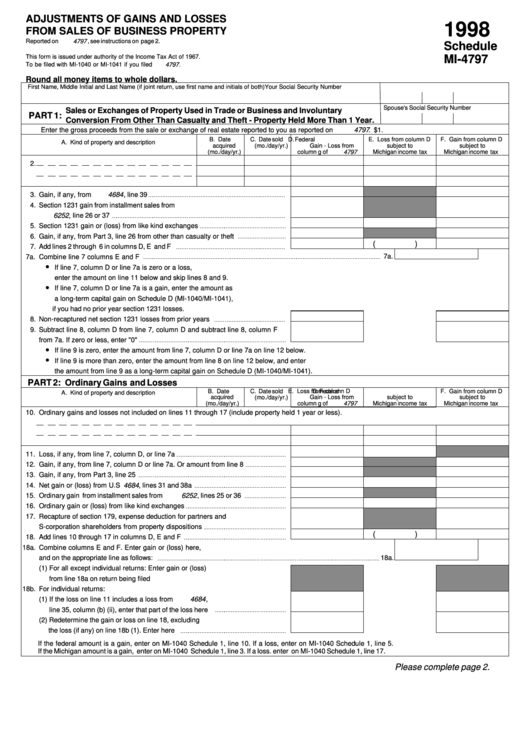

Fillable Form Mi4797 Michigan Adjustments Of Gains And Losses From

To learn how to fill various legal. Web part of form 4797. Disposition of each type of property is capital assets held in connection with a also, see pub. The sale or exchange of: Web cheryl, i have a similar but slightly different case with form 4797.

Irs 1040 Form 4797 Form Resume Examples

Gain from disposition of property. Disposition of assets that constitute a trade or business Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. Web the disposition of each type of property is reported separately in the appropriate part of form 4797. Web form.

Form 4797 YouTube

Losses from passive part of form 4797 (for example, for For example, for property held more than 1 year, report the sale of a building in part iii and the land in part i. Property used in a trade or business. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any.

Fillable Form 4797 Sales Of Business Property 2016 printable pdf

But, business owners also use form 4797 to report the sale of business property that results in a loss. On line 1, enter the gross proceeds from sales to you for the year 2022. Part three of irs form 4797 is the largest section and consists of 14 lines that require very specific information. Web to download the form 4797.

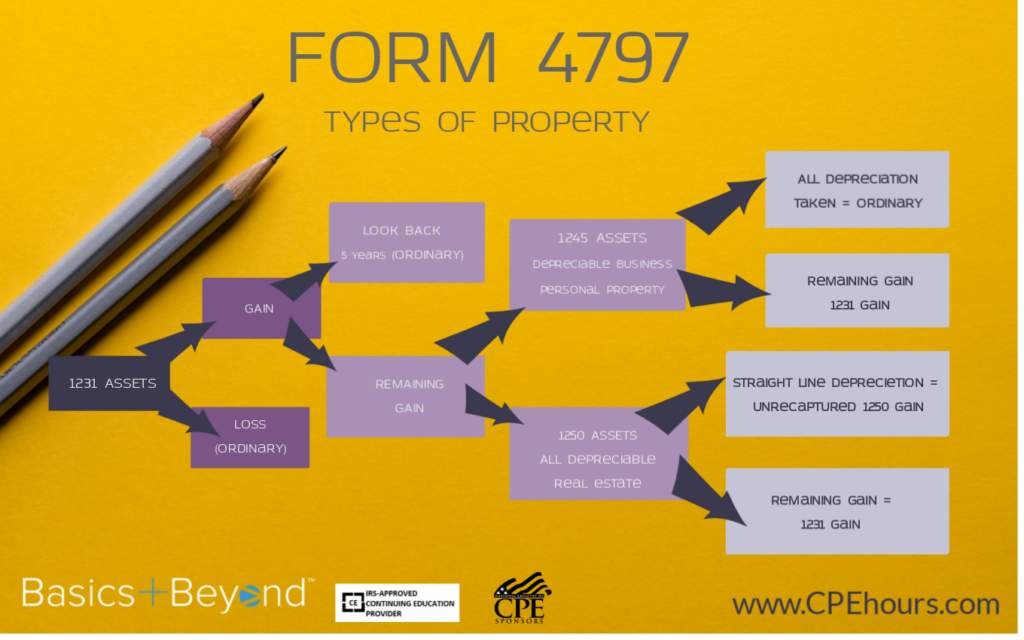

Sale of Business Assets What You Need to Know About Form 4797 Basics

When i open the form 4797, this is what i see it there. Web cheryl, i have a similar but slightly different case with form 4797. Sold house 2018 for 38100, 342900 land. Web information about form 4797, sales of business property, including recent updates, related forms and instructions on how to file. $73,200 the gain is calculated as:

IRS Form 4797 Guide for How to Fill in IRS Form 4797

Web form 4797, sales of business property is used to report the following transactions: Web form 4797 instructions part iii: Web form 4797 (sales of business property), issued by the irs, is used to report financial gains made from the sale or exchange of business property. But, business owners also use form 4797 to report the sale of business property.

How to Report the Sale of a U.S. Rental Property Madan CA

Inherited house + improvement basis=$218698 in 2014. For example, for property held more than 1 year, report the sale of a building in part iii and the land in part i. Disposition of assets that constitute a trade or business Gain from disposition of property. Part three of irs form 4797 is the largest section and consists of 14 lines.

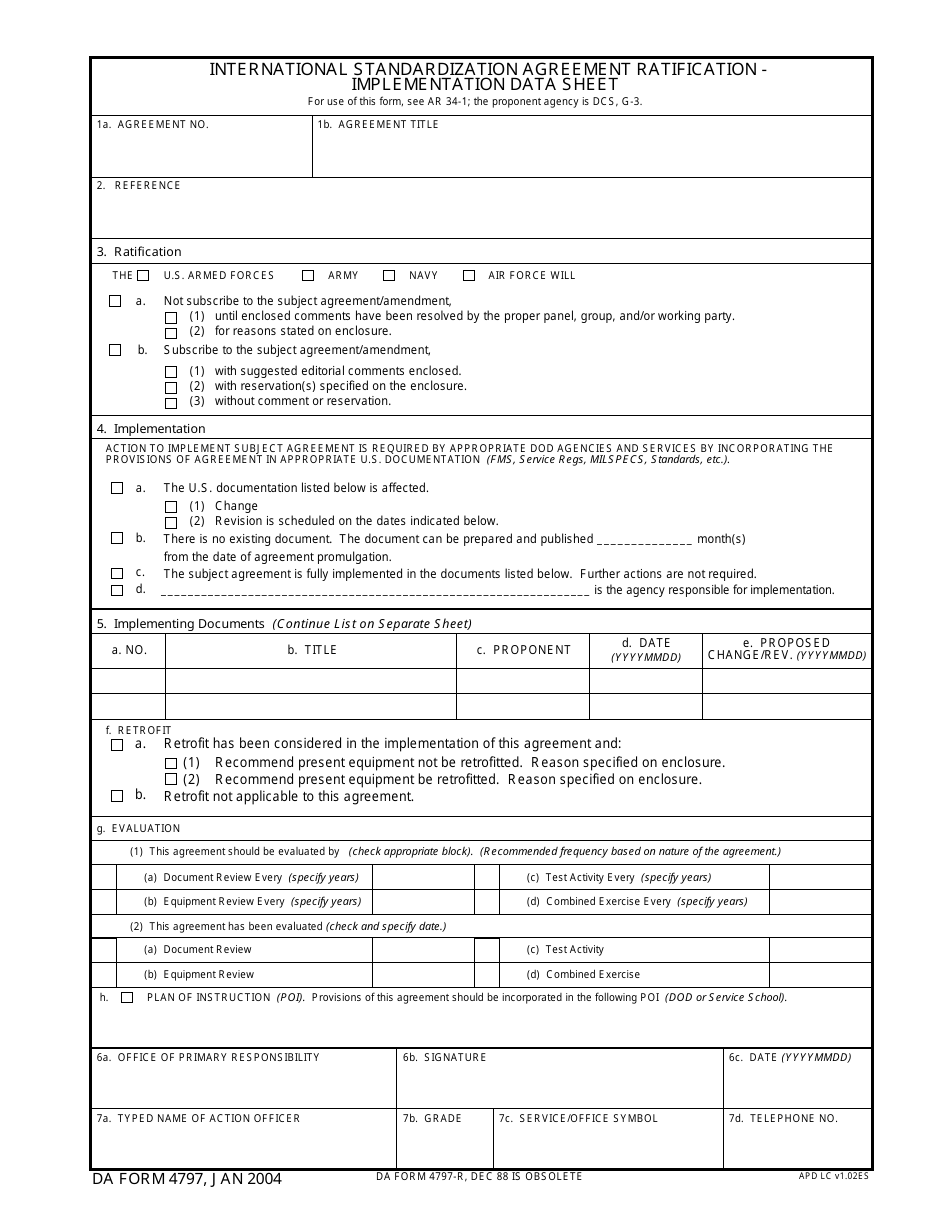

DA Form 4797 Download Fillable PDF or Fill Online International

Oil, gas, geothermal, or other mineral properties. For example, owners will need to report gains on line 19 if they were realized under any of the following sections: The properties that are covered by form 4797 include (but are not limited to): To learn how to fill various legal. Losses from passive part of form 4797 (for example, for

Fillable Schedule Mi4797 Adjustments Of Gains And Losses From Sales

On line 1, enter the gross proceeds from sales to you for the year 2022. For example, for property held more than 1 year, report the sale of a building in part iii and the land in part i. Allocated $133406 to building, $85292 land. Losses from passive part of form 4797 (for example, for First of all, you can.

2012 Form IRS Instruction 4797 Fill Online, Printable, Fillable, Blank

Web the disposition of each type of property is reported separately in the appropriate part of form 4797 (for example, for property held more than 1 year, report the sale of a building in part iii and land in part i). Web form 4797 instructions part iii: Oil, gas, geothermal, or other mineral properties. Web form 4797 is a tax.

Web The Disposition Of Each Type Of Property Is Reported Separately In The Appropriate Part Of Form 4797.

Web form 4797 instructions part iii: Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. When i open the form 4797, this is what i see it there. Web identify as from “form 4797, line 18a.” see instructions redetermine the gain or (loss) on line 17 excluding the loss, if any, on line 18a.

Disposition Of Each Type Of Property Is Capital Assets Held In Connection With A Also, See Pub.

Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property, including but not limited to properties that generate rental income and properties that are used for industrial, agricultural, or extractive resources. The properties that are covered by form 4797 include (but are not limited to): As a result, when you sell this property at a gain, you’ll report that gain on form 4797. Web form 4797 part iii:

For Example, For Property Held More Than 1 Year, Report The Sale Of A Building In Part Iii And The Land In Part I.

Web cheryl, i have a similar but slightly different case with form 4797. Web three steps followed to report the sale of a rental property are calculating capital gain or loss, completing form 4797, and filing schedule d with form 1040 at the end of the tax year. Go to www.irs.gov/form4797 for instructions and the latest information. Disposition of depreciable property not used in trade or business.

Form 4797 Is Used To Report The Details Of Gains And Losses From The Sale, Exchange, Involuntary Conversion, Or Disposition Of Certain Business Property And Assets.

But, business owners also use form 4797 to report the sale of business property that results in a loss. Identify as from “form 4797, line 18a.” The sale or exchange of: $73,200 the gain is calculated as: