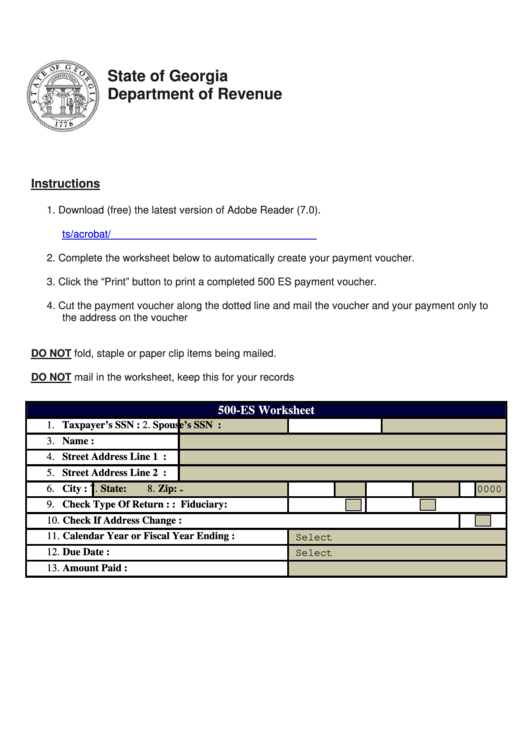

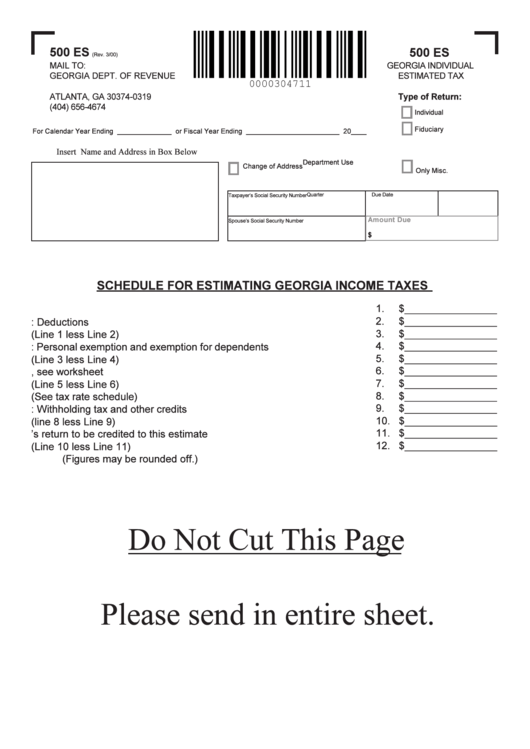

500 Es Form

500 Es Form - Web 500 es ( rev. Our fillable pdf forms will help you get a suitable document as painlessly as you can. All corporation estimated income tax payments must be made electronically. Fill out the amended computation schedule below. Web video instructions and help with filling out and completing ga estimated tax. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. Web form 500 is the general income tax return form for all georgia residents. Prepare and report accurate taxes with signnow remotely. Control catalog spreadsheet the entire security and privacy control catalog in spreadsheet format. 05/29/20) individual and fiduciary estimated tax payment voucher.

Eforms are not intended to be printed directly from your browser. Web can't find a proper 500 es form? You will have the option to print a pdf version of your eform once your filing is complete. Web how to complete form 500 es. Web how to amend form 500es if it is necessary to amend form 500es, follow these steps: Complete the name and address field located on the upper right side of coupon. Strategists at the firm had previously expected the s&p. Web form 500es corporation estimated income tax. Web summary of supplemental files: Calculate your estimated tax using the schedule in.

Web video instructions and help with filling out and completing ga estimated tax. Please use the link below to download , and you can print it directly from your computer. Eforms are not intended to be printed directly from your browser. Web summary of supplemental files: The purpose is to enable taxpayers. Complete the name and address field located on the upper right side of coupon. Prepare and report accurate taxes with signnow remotely. Web virginia form 500es corporation estimated income tax payment vouchers 2023 all corporation estimated income tax payments must be made electronically. All corporation estimated income tax payments must be made electronically. Web how to amend form 500es if it is necessary to amend form 500es, follow these steps:

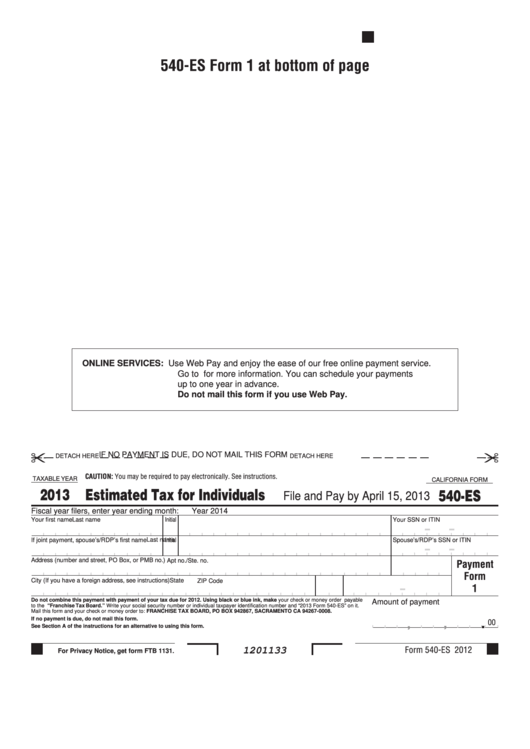

Fillable California Form 540Es Estimated Tax For Individuals 2013

Web form 500 is the general income tax return form for all georgia residents. Web can't find a proper 500 es form? Use these vouchers only if. Follow all instructions on the form. Calculate your estimated tax using the schedule in.

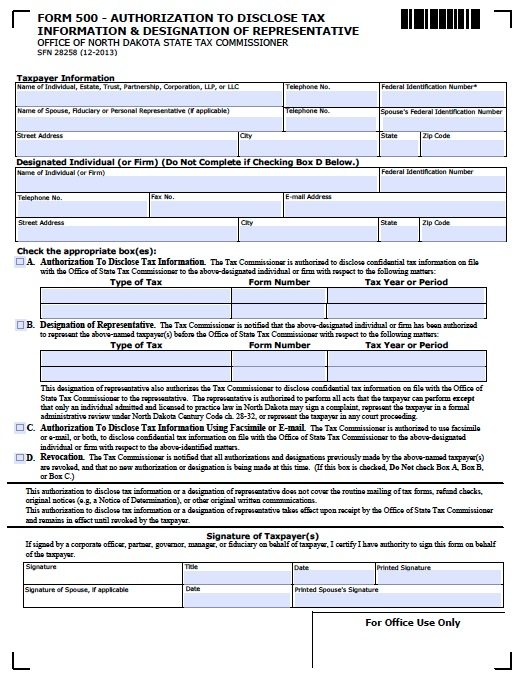

Free Tax Power of Attorney North Dakota Form 500 Adobe PDF

All corporation estimated income tax payments must be made electronically. Web can't find a proper 500 es form? Complete the name and address field located on the upper right side of coupon. Strategists at the firm had previously expected the s&p. To successfully complete the form, you must download and use the current version of.

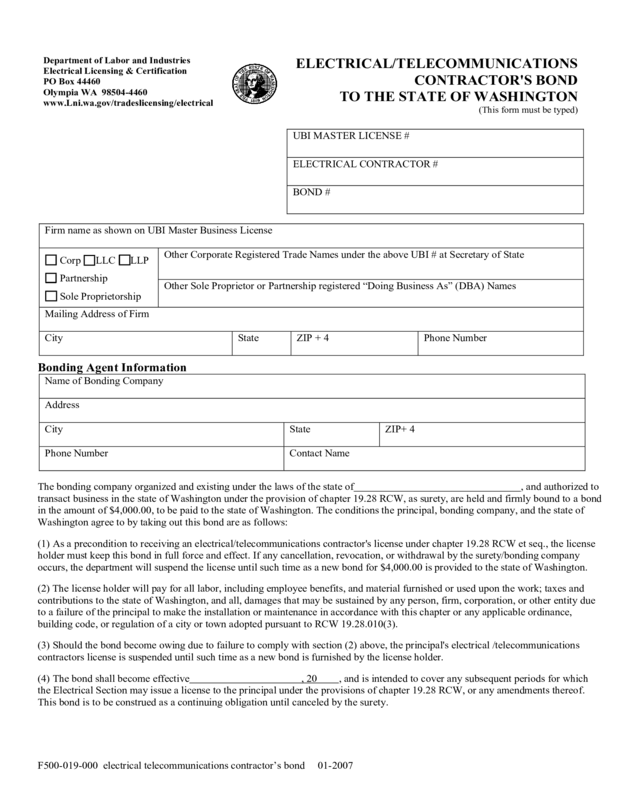

Form 500019000 Edit, Fill, Sign Online Handypdf

Calculate your estimated tax using the schedule in. Web virginia form 500es corporation estimated income tax payment vouchers 2023 all corporation estimated income tax payments must be made electronically. 05/29/20) individual and fiduciary estimated tax payment voucher. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. Follow all instructions on.

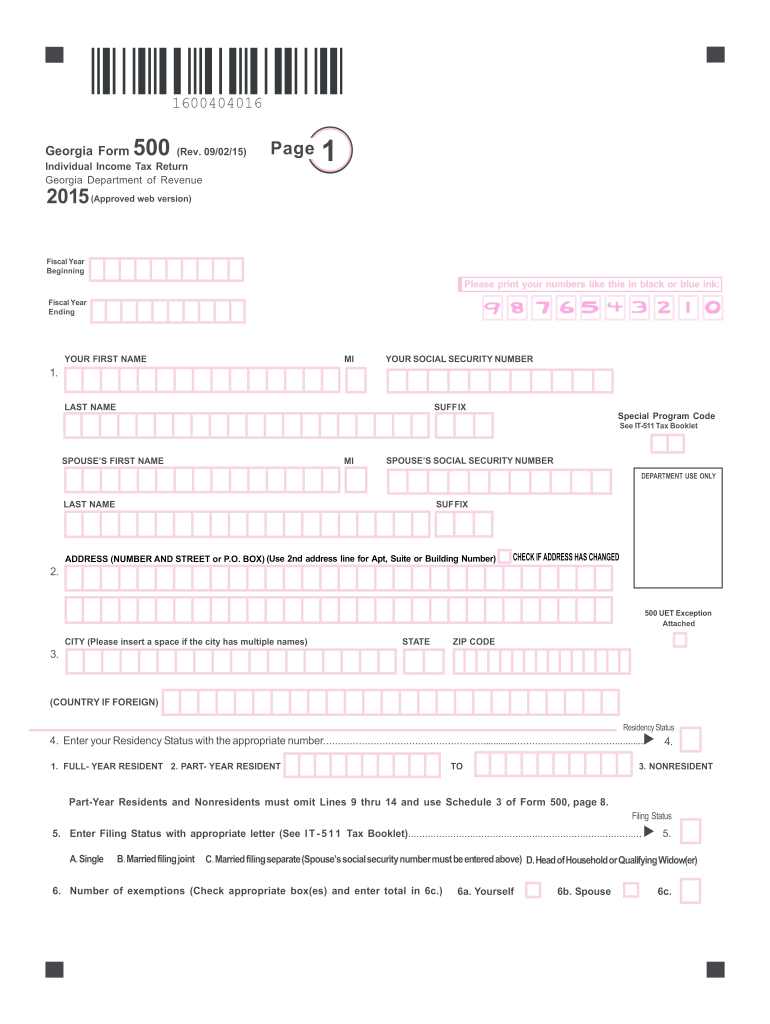

2015 Form GA DoR 500 Fill Online, Printable, Fillable, Blank pdfFiller

Web 500 es ( rev. Web can't find a proper 500 es form? Web video instructions and help with filling out and completing ga estimated tax. Please use the link below to download , and you can print it directly from your computer. 05/29/20) individual and fiduciary estimated tax payment voucher.

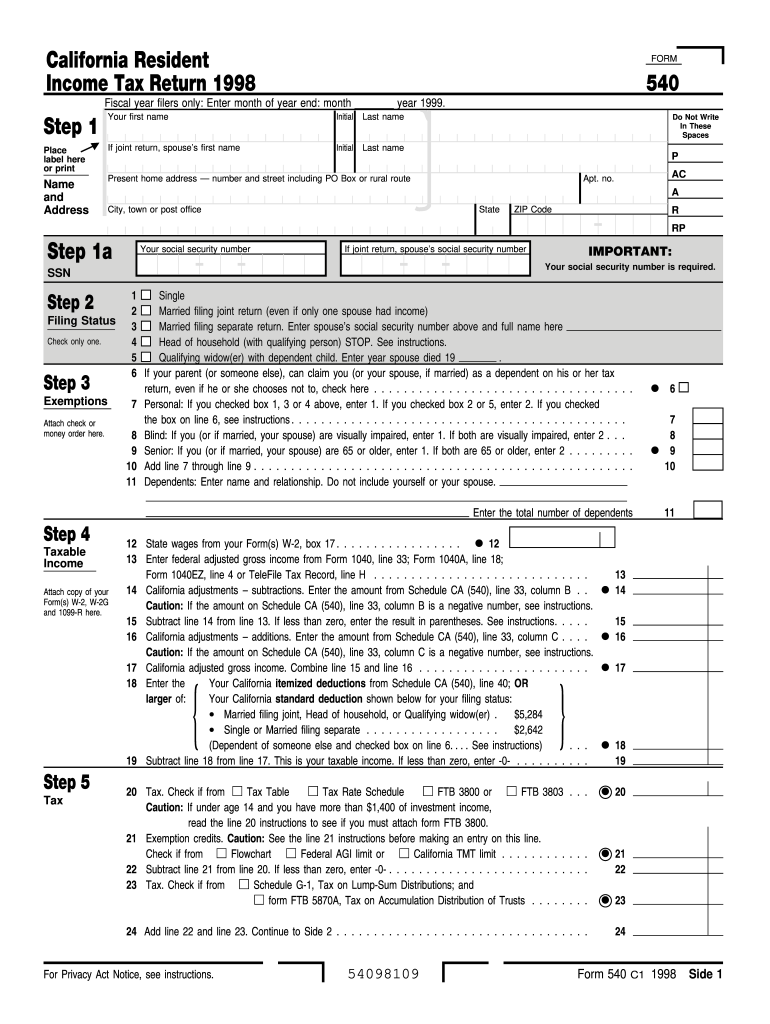

1998 Form CA FTB 540 Fill Online, Printable, Fillable, Blank pdfFiller

All corporation estimated income tax payments must be made electronically. Complete the name and address field located on the upper right side of coupon. Eforms are not intended to be printed directly from your browser. Web summary of supplemental files: Strategists at the firm had previously expected the s&p.

form 1040es 2015 Top Five Fantastic Experience Of This

Fill out the amended computation schedule below. Use these vouchers only if. All corporation estimated income tax payments must be made electronically. Web 500 es ( rev. Prepare and report accurate taxes with signnow remotely.

Fillable Form 500 Es 500Es Worksheet/individual Estimated Tax

Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. Web form 500es corporation estimated income tax. All corporation estimated income tax payments must be made electronically. Web how to amend form 500es if it is necessary to amend form 500es, follow these steps: Web video instructions and help with filling.

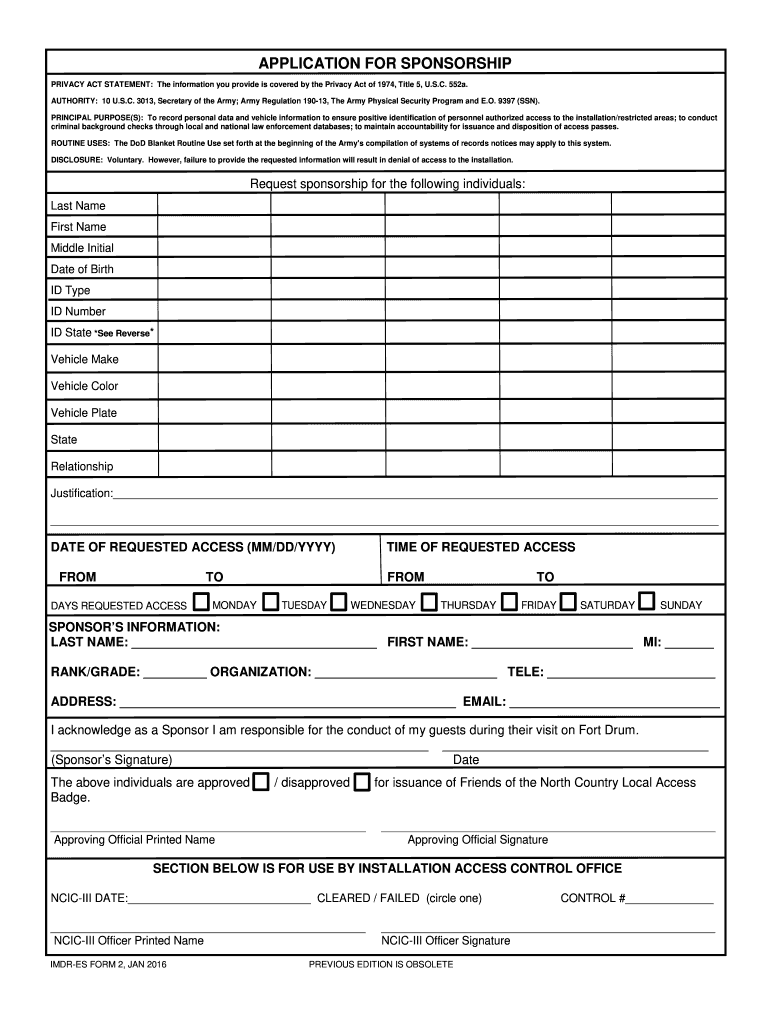

Imdr es form 2 jan 2016 Fill out & sign online DocHub

Follow all instructions on the form. Prepare and report accurate taxes with signnow remotely. To successfully complete the form, you must download and use the current version of. Save yourself time and money using our fillable web templates. Our fillable pdf forms will help you get a suitable document as painlessly as you can.

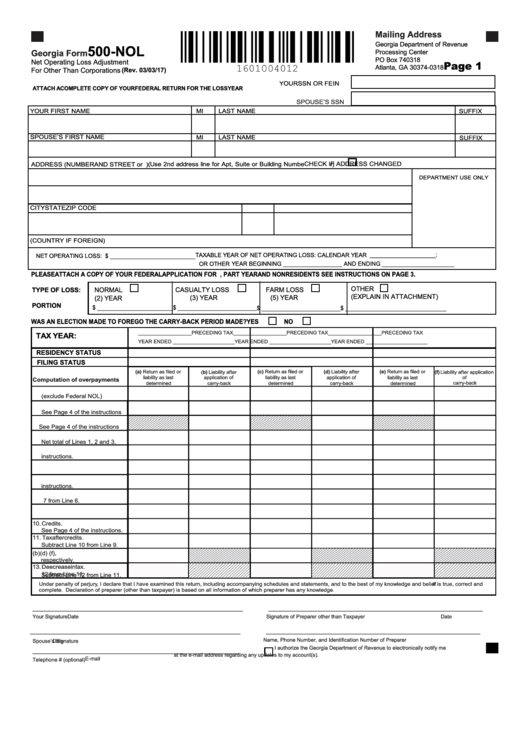

Fillable Form 500Nol Net Operating Loss Adjustment For Other

The purpose is to enable taxpayers. Strategists at the firm had previously expected the s&p. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. Complete the name and address field located on the upper right side of coupon. Use these vouchers only if.

Form 500 Es Schedule For Estimating Taxes printable

Save yourself time and money using our fillable web templates. Calculate your estimated tax using the schedule in. Please use the link below to download , and you can print it directly from your computer. Eforms are not intended to be printed directly from your browser. Web form 500 is the general income tax return form for all georgia residents.

Web How To Amend Form 500Es If It Is Necessary To Amend Form 500Es, Follow These Steps:

Please use the link below to download , and you can print it directly from your computer. Web form 500es corporation estimated income tax. Use these vouchers only if. Web 500 es ( rev.

Web Video Instructions And Help With Filling Out And Completing Ga Estimated Tax.

Complete the name and address field located on the upper right side of coupon. You will have the option to print a pdf version of your eform once your filing is complete. 05/29/20) individual and fiduciary estimated tax payment voucher. Strategists at the firm had previously expected the s&p.

Web Can't Find A Proper 500 Es Form?

To successfully complete the form, you must download and use the current version of. Save yourself time and money using our fillable web templates. Prepare and report accurate taxes with signnow remotely. Eforms are not intended to be printed directly from your browser.

Our Fillable Pdf Forms Will Help You Get A Suitable Document As Painlessly As You Can.

Follow all instructions on the form. Web virginia form 500es corporation estimated income tax payment vouchers 2023 all corporation estimated income tax payments must be made electronically. Web it appears you don't have a pdf plugin for this browser. Web form 500 is the general income tax return form for all georgia residents.