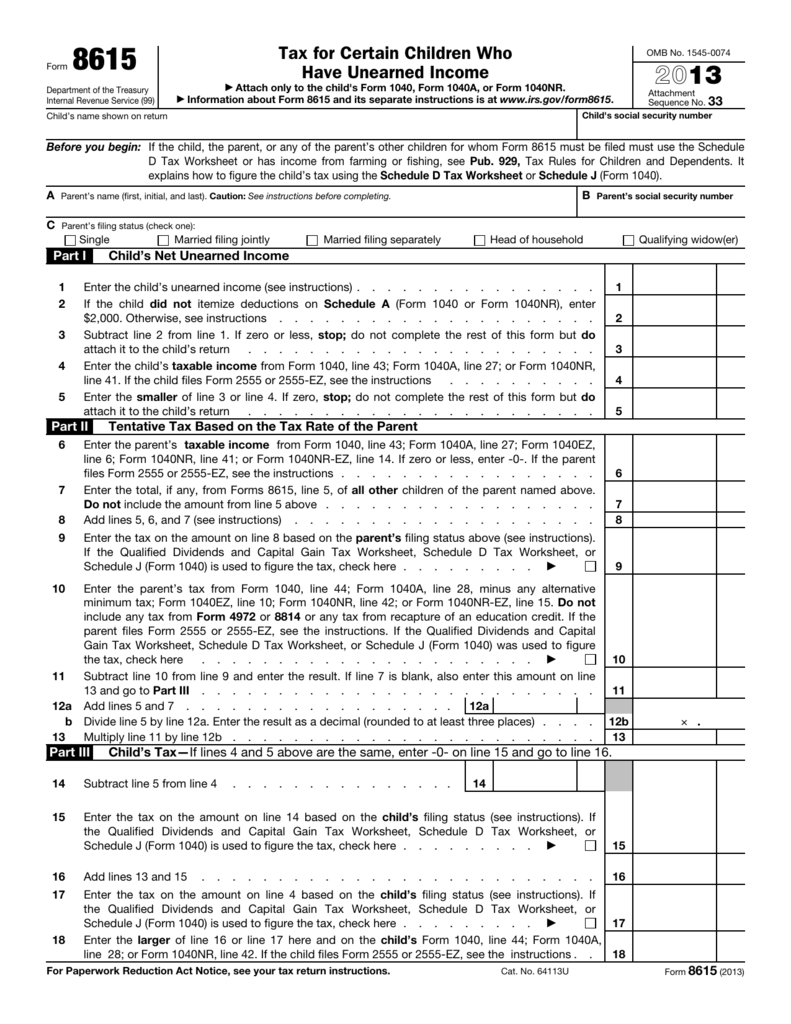

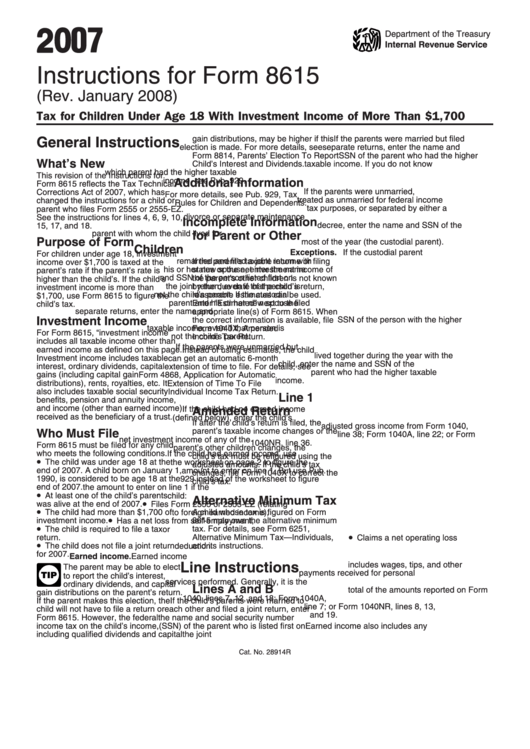

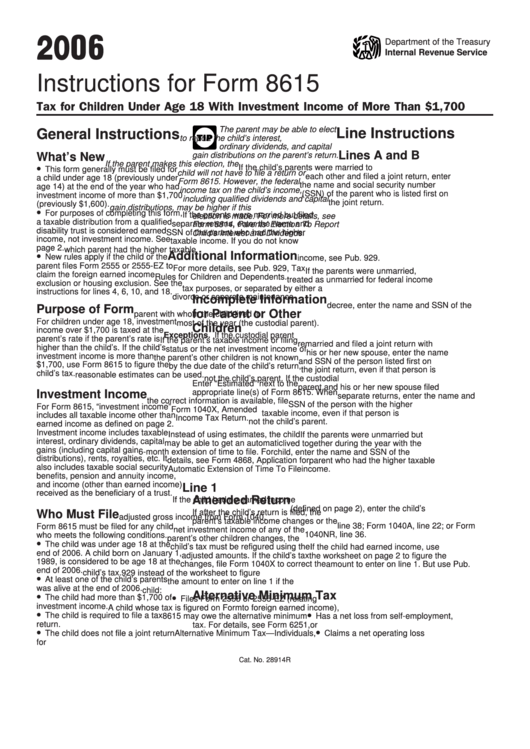

8615 Form Instructions

8615 Form Instructions - Web form 8615 must be filed for any child who meets all of the following conditions. The child had more than $2,300 of unearned income. Web this article will help resolve the following diagnostic for form 8615, tax for certain children who have unearned income: Web the form will not appear because you supported yourself. Web enter the parent’s tax from form 1040, line 44; Web form 8615 must be filed for any child who meets all of the following conditions. The child is required to. The child is required to file a tax return. Form 8615, tax for certain children who have. Web form 8615 must be filed with the child’s tax return if all of the following apply:

The child had more than $2,300 of unearned income. The child is required to. The child had more than $2,000 of unearned income. The child had more than $2,200 of unearned income. Web form 8615 must be filed with the child’s tax return if all of the following apply: Web form 8615 must be filed for any child who meets all of the following conditions. You had more than $2,300 of unearned income. Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income a attach only to the child’s form 1040 or form. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. The child is required to file a tax return.

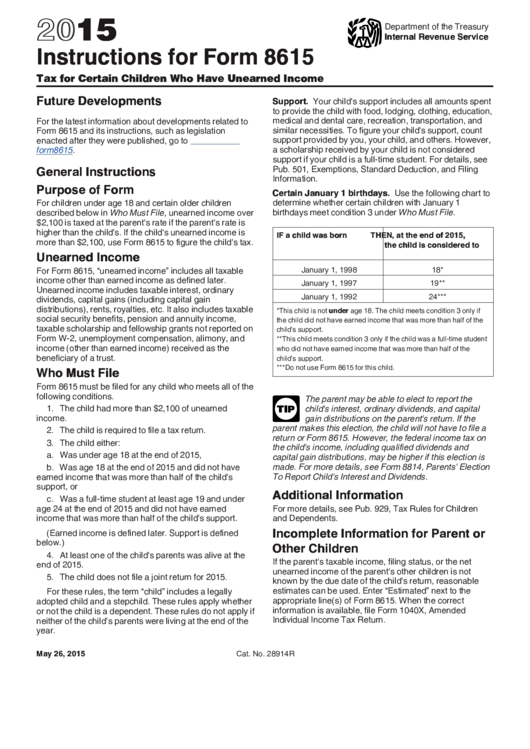

Web form 8615 must be filed if the child meets all of the following conditions: Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. The child had more than $1,100 in unearned income. Web this article will help resolve the following diagnostic for form 8615, tax for certain children who have unearned income: Web who must file form 8615 must be filed for any child who meets all of the following conditions. The child is required to file a tax return. The child is required to. The child is required to. The child had more than $2,200 of unearned income. Purpose of form for children under age 18 and certain older children described below in who must file , unearned income over $2,200.

Form 8615 Office Depot

Web form 8615 must be filed for any child who meets all of the following conditions. Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web form 8615 must be filed if the child meets all of the following conditions: The child.

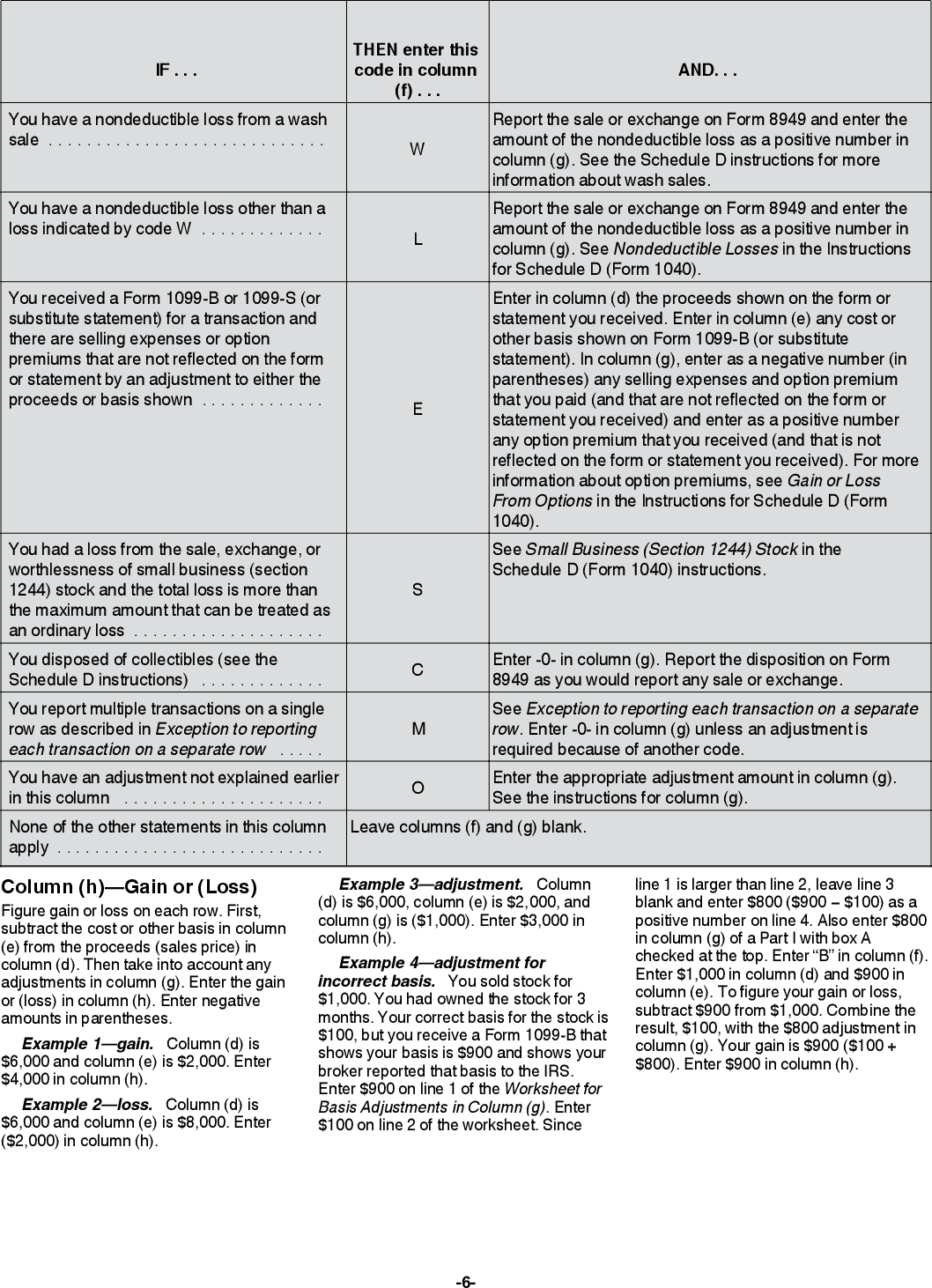

2012 IRS Form 8949 Instructions Images Frompo

The child had more than $2,200 of unearned income. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. The child is required to. Web who must file form 8615 must be filed for any child who meets.

HP OFFICEJET PRO 8615 ALL IN ONE PRINTER in Hounslow, London Gumtree

The child is required to file a tax return. Web this article will help resolve the following diagnostic for form 8615, tax for certain children who have unearned income: Web form 8615 must be filed for any child who meets all of the following conditions. The government will assume that you were living under the care of a parent and/or..

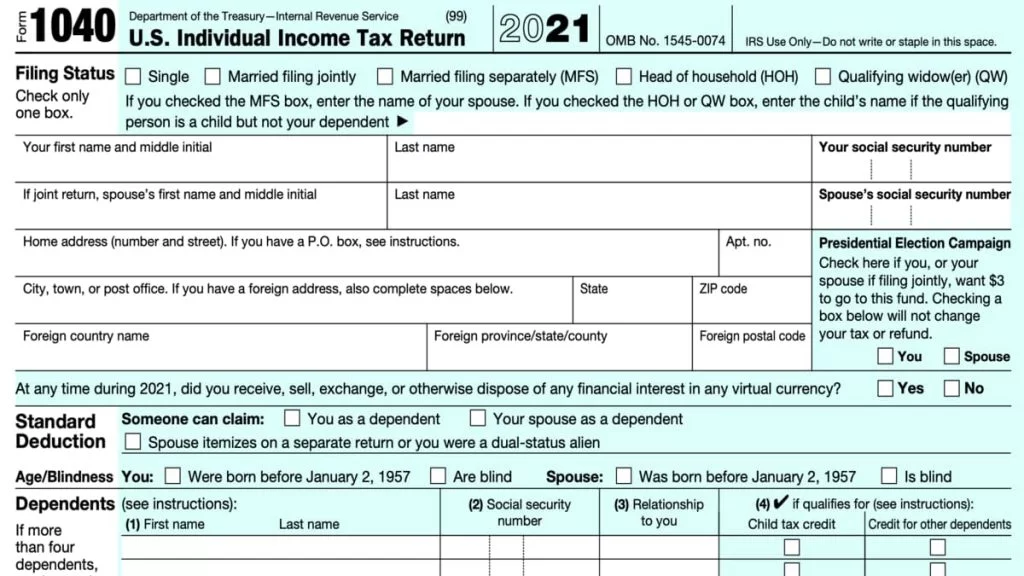

8615 Form 2023

The child is required to file a tax return. Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income a attach only to the child’s form 1040 or form. Web this article will help resolve the following diagnostic for form 8615, tax for certain children who have unearned income: The child.

OfficeJet Pro 8615 Printer Ink Cartridges YoYoInk

The child had more than $2,300 of unearned income. The child is required to. Web form 8615 must be filed for any child who meets all of the following conditions: Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. You had more.

Instructions For Form 8615 Tax For Children Under Age 18 With

The child is required to file a tax return. Form 1040a, line 28, minus any alternative minimum tax; You had more than $2,300 of unearned income. The child had more than $2,300 of unearned income. Web form 8615 must be filed for any child who meets all of the following conditions.

Form 8615 Instructions (2015) printable pdf download

Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. The.

Instructions for IRS Form 8615 Tax for Certain Children Who Have

The child is required to. The child is required to file a tax return. Purpose of form for children under age 18 and certain older children described below in who must file , unearned income over $2,200. Form 8615, tax for certain children who have. Web form 8615 must be filed for any child who meets all of the following.

LEGO Bordakh Set 8615 Instructions Brick Owl LEGO Marketplace

The child had more than $2,000 of unearned income. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. See who must file, later. The child is required to file a tax return. Web enter the parent’s tax.

Instructions For Form 8615 Tax For Children Under Age 18 With

Web enter the parent’s tax from form 1040, line 44; The child is required to. You are required to file a tax return. The child had more than $2,000 of unearned income. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,100 if you are under age 18, and in certain situations.

The Child Is Required To.

Web form 8615 must be filed for any child who meets all of the following conditions. The child had more than $2,000 of unearned income. The child had more than $2,300 of unearned income. The child is required to file a tax return.

The Government Will Assume That You Were Living Under The Care Of A Parent And/Or.

Web the form will not appear because you supported yourself. Web form 8615 must be filed with the child’s tax return if all of the following apply: You had more than $2,300 of unearned income. Purpose of form for children under age 18 and certain older children described below in who must file , unearned income over $2,200.

Web Per Irs Instructions For Form 8615:

Web form 8615 must be filed if the child meets all of the following conditions: The child is required to file a tax return. Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income a attach only to the child’s form 1040 or form. Web form 8615 must be filed for any child who meets all of the following conditions:

Web Enter The Parent’s Tax From Form 1040, Line 44;

Form 8615, tax for certain children who have. The child had more than $2,200 of unearned income. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web who must file form 8615 must be filed for any child who meets all of the following conditions.