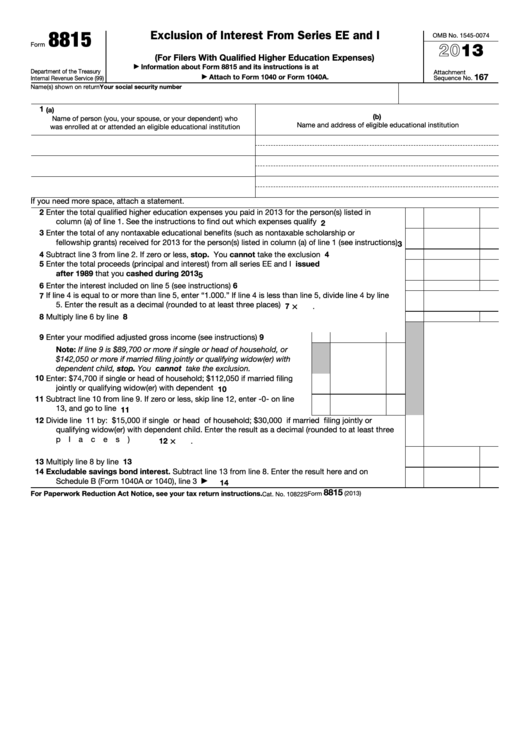

8815 Tax Form

8815 Tax Form - It accrues interest until the bond matures. Then, when the bond matures, you get the bond amount plus the accrued interest. Use form 8815 to figure the amount of any interest you may exclude. When buying a series i or electronic series ee bond, you pay the face value of the bond. Web specific instructions line 1 column (a). I'd like to exclude some us savings bond interest from tax but can't enter coverdell contributions. Savings bonds this year that were issued after 1989, you may be able to exclude from your income part or all of the interest on those bonds. You cash the qualifying savings bonds in the same tax year for which you are claiming the exclusion. Web if you cashed series ee or i u.s. If you find the form 8815 menu is starred and inaccessible, remove the amount of interest and dividends already entered under the interest and dividends.

You cash the qualifying savings bonds in the same tax year for which you are claiming the exclusion. Savings bonds issued after 1989 in december 2022, so this is the latest version of form 8815, fully updated for tax year 2022. Savings bonds issued after 1989 (for filers with qualified higher education expenses) go to www.irs.gov/form8815 for the latest information. Then, when the bond matures, you get the bond amount plus the accrued interest. You pay $1,000 for a $1,000 bond. Enter the name of the person who was enrolled at or attended an eligible educational institution or for whom you made contributions to a coverdell education savings account (coverdell esa) or a qualified tuition program (qtp). Web 1 best answer irenes intuit alumni you can add form 8815 in your turbotax by following these steps: It accrues interest until the bond matures. Web if you cashed series ee or i u.s. If you find the form 8815 menu is starred and inaccessible, remove the amount of interest and dividends already entered under the interest and dividends.

Web form 8815 department of the treasury internal revenue service exclusion of interest from series ee and i u.s. Enter the name of the person who was enrolled at or attended an eligible educational institution or for whom you made contributions to a coverdell education savings account (coverdell esa) or a qualified tuition program (qtp). Web 1 best answer irenes intuit alumni you can add form 8815 in your turbotax by following these steps: Savings bonds this year that were issued after 1989, you may be able to exclude from your income part or all of the interest on those bonds. Use form 8815 to figure the amount of any interest you may exclude. Savings bonds issued after 1989 (for filers with qualified higher education expenses) go to www.irs.gov/form8815 for the latest information. Then, when the bond matures, you get the bond amount plus the accrued interest. Web we last updated the exclusion of interest from series ee and i u.s. Savings bonds issued after 1989 in december 2022, so this is the latest version of form 8815, fully updated for tax year 2022. You paid qualified higher education expenses to an eligible institution that same tax year.

Form 8815 Edit, Fill, Sign Online Handypdf

I'd like to exclude some us savings bond interest from tax but can't enter coverdell contributions. Savings bonds this year that were issued after 1989, you may be able to exclude from your income part or all of the interest on those bonds. Use form 8815 to figure the amount of any interest you may exclude. You cash the qualifying.

Form 8815 Exclusion of Interest From Series EE and I U.S. Savings

Web if you cashed series ee or i u.s. Web we last updated the exclusion of interest from series ee and i u.s. It accrues interest until the bond matures. Web posted june 4, 2019 5:28 pm last updated june 04, 2019 5:28 pm is there a place or way to complete form 8815 in turbo tax premier? If you.

食卓を彩る甘みと旨みがギュっと詰まった御宿の伊勢えび ふるさと納税 [ふるさとチョイス]

Savings bonds issued after 1989 (for filers with qualified higher education expenses) go to www.irs.gov/form8815 for the latest information. When buying a series i or electronic series ee bond, you pay the face value of the bond. You cash the qualifying savings bonds in the same tax year for which you are claiming the exclusion. Savings bonds this year that.

GH 8815(B) TWINS DOLPHIN

It accrues interest until the bond matures. Web posted june 4, 2019 5:28 pm last updated june 04, 2019 5:28 pm is there a place or way to complete form 8815 in turbo tax premier? Web we last updated the exclusion of interest from series ee and i u.s. Then, when the bond matures, you get the bond amount plus.

Form 8815 Exclusion of Interest From Series EE and I U.S. Savings

Use form 8815 to figure the amount of any interest you may exclude. Web form 8815 department of the treasury internal revenue service exclusion of interest from series ee and i u.s. You pay $1,000 for a $1,000 bond. Savings bonds issued after 1989 in december 2022, so this is the latest version of form 8815, fully updated for tax.

Maximize Form 8815 Unlock Educational Tax Benefits Fill

You cash the qualifying savings bonds in the same tax year for which you are claiming the exclusion. It accrues interest until the bond matures. Savings bonds issued after 1989 in december 2022, so this is the latest version of form 8815, fully updated for tax year 2022. Enter the name of the person who was enrolled at or attended.

IRS 8815 2015 Fill out Tax Template Online US Legal Forms

Savings bonds issued after 1989 in december 2022, so this is the latest version of form 8815, fully updated for tax year 2022. You pay $1,000 for a $1,000 bond. Savings bonds issued after 1989 (for filers with qualified higher education expenses) go to www.irs.gov/form8815 for the latest information. Web 1 best answer irenes intuit alumni you can add form.

Fillable Form 8815 Exclusion Of Interest From Series Ee And I U.s

You pay $1,000 for a $1,000 bond. You paid qualified higher education expenses to an eligible institution that same tax year. It accrues interest until the bond matures. Web we last updated the exclusion of interest from series ee and i u.s. I'd like to exclude some us savings bond interest from tax but can't enter coverdell contributions.

Paying For College A Tax Dodge For College Students

Savings bonds issued after 1989 (for filers with qualified higher education expenses) go to www.irs.gov/form8815 for the latest information. It accrues interest until the bond matures. Web if you cashed series ee or i u.s. You cash the qualifying savings bonds in the same tax year for which you are claiming the exclusion. Web form 8815 department of the treasury.

Form 8815 Edit, Fill, Sign Online Handypdf

Web if you cashed series ee or i u.s. If you find the form 8815 menu is starred and inaccessible, remove the amount of interest and dividends already entered under the interest and dividends. You paid qualified higher education expenses to an eligible institution that same tax year. You pay $1,000 for a $1,000 bond. It accrues interest until the.

When Buying A Series I Or Electronic Series Ee Bond, You Pay The Face Value Of The Bond.

Web we last updated the exclusion of interest from series ee and i u.s. Web specific instructions line 1 column (a). You paid qualified higher education expenses to an eligible institution that same tax year. It accrues interest until the bond matures.

Web Posted June 4, 2019 5:28 Pm Last Updated June 04, 2019 5:28 Pm Is There A Place Or Way To Complete Form 8815 In Turbo Tax Premier?

You pay $1,000 for a $1,000 bond. Web 1 best answer irenes intuit alumni you can add form 8815 in your turbotax by following these steps: Then, when the bond matures, you get the bond amount plus the accrued interest. Savings bonds issued after 1989 (for filers with qualified higher education expenses) go to www.irs.gov/form8815 for the latest information.

Web If You Cashed Series Ee Or I U.s.

If you find the form 8815 menu is starred and inaccessible, remove the amount of interest and dividends already entered under the interest and dividends. Web form 8815 department of the treasury internal revenue service exclusion of interest from series ee and i u.s. You cash the qualifying savings bonds in the same tax year for which you are claiming the exclusion. Savings bonds this year that were issued after 1989, you may be able to exclude from your income part or all of the interest on those bonds.

Savings Bonds Issued After 1989 In December 2022, So This Is The Latest Version Of Form 8815, Fully Updated For Tax Year 2022.

Use form 8815 to figure the amount of any interest you may exclude. Enter the name of the person who was enrolled at or attended an eligible educational institution or for whom you made contributions to a coverdell education savings account (coverdell esa) or a qualified tuition program (qtp). I'd like to exclude some us savings bond interest from tax but can't enter coverdell contributions.

![食卓を彩る甘みと旨みがギュっと詰まった御宿の伊勢えび ふるさと納税 [ふるさとチョイス]](https://img.furusato-tax.jp/img/x/original/feature/form/details/20210608/gpfd_c3a4cc8815b475611cadcf6f134b28abfa6554db.jpg)