8962 Form Instruction

8962 Form Instruction - Complete irs tax forms online or print government tax documents. How to fill out form 8962 step by step. Enter your modified agi (see instructions). 37784z form 8962 2018 page allocation of policy amounts complete the following information for up to four policy amount allocations. Even if you estimated your income perfectly, you must complete form 8962 and submit it with. Who can use form 8962? Web up to $40 cash back cat. Web see the irs instructions for form 8962 for more information and specific allocation situations. This form is required when someone on your tax return had health insurance in 2022 through. Web medicaid & chip how to apply & enroll picking a plan check if you can change plans report income/family changes new, lower costs available health care tax forms,.

Web get 📝 form 8962 with all detailed instructions on how to file online 📝 irs 8962 form for 2020 🟢 printable template in pdf 🟢 detailed guide for tax form filling Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Web up to $40 cash back cat. Who can use form 8962? Web form 8962 at the end of these instructions. Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any advance premium tax credit (aptc). Enter the number of exemptions from form 1040 or form 1040a, line 6d, or form 1040nr, line 7d 1 2 a modified agi. Ad get ready for tax season deadlines by completing any required tax forms today. Web see the irs instructions for form 8962 for more information and specific allocation situations. Even if you estimated your income perfectly, you must complete form 8962 and submit it with.

Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Form 8962 is used either (1) to reconcile a premium tax. To be eligible for this tax credit, you. Form 8962 isn’t for everyone. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Ad get ready for tax season deadlines by completing any required tax forms today. You must file form 8962 with your income tax return (form 1040 or form 1040nr) if any of the following apply to you. Enter the number of exemptions from form 1040 or form 1040a, line 6d, or form 1040nr, line 7d 1 2 a modified agi. Complete, edit or print tax forms instantly. Web community hosting for lacerte & proseries completing form 8962 premium tax credit form 8962 is used to figure the amount of premium tax credit and.

2019 Form IRS 8962 Fill Online, Printable, Fillable, Blank pdfFiller

Form 8962 is used either (1) to reconcile a premium tax. How to fill out form 8962 step by step. Web community hosting for lacerte & proseries completing form 8962 premium tax credit form 8962 is used to figure the amount of premium tax credit and. You must file form 8962 with your income tax return (form 1040 or form.

IRS Form 8962 2016 Irs forms, Irs, Household

Even if you estimated your income perfectly, you must complete form 8962 and submit it with. Enter the number of exemptions from form 1040 or form 1040a, line 6d, or form 1040nr, line 7d 1 2 a modified agi. Who can use form 8962? Form 8962 isn’t for everyone. Web if you downloaded the 2022 instructions for form 8962, premium.

Irs Form 8962 Fillable Irs Form 8962 Instruction For How To Fill It

This form is required when someone on your tax return had health insurance in 2022 through. Web community hosting for lacerte & proseries completing form 8962 premium tax credit form 8962 is used to figure the amount of premium tax credit and. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references.

Fill Free fillable Premium Tax Credit (PTC) Form 8962 PDF form

Form 8962 isn’t for everyone. Enter your modified agi (see instructions). Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Form 8962 is used either (1) to reconcile a premium tax. Ad get ready for tax season deadlines by completing any required tax.

Form 8962 Fill Out and Sign Printable PDF Template signNow

How to fill out form 8962 step by step. Web see the irs instructions for form 8962 for more information and specific allocation situations. To be eligible for this tax credit, you. Ad get ready for tax season deadlines by completing any required tax forms today. Web the purpose of form 8962 is to allow filers to calculate their premium.

how to fill out form 8962 step by step Fill Online, Printable

Who can use form 8962? Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Even if you estimated your income perfectly, you must complete form 8962 and submit it with. Web up to $40 cash back cat. To be eligible for this tax.

3 Easy Ways to Fill Out Form 8962 wikiHow

Form 8962 is used either (1) to reconcile a premium tax. Web community hosting for lacerte & proseries completing form 8962 premium tax credit form 8962 is used to figure the amount of premium tax credit and. Who can use form 8962? Enter the number of exemptions from form 1040 or form 1040a, line 6d, or form 1040nr, line 7d.

Irs form 8962 Irs form 8962 Instruction for How to Fill It Right Irs

This form is required when someone on your tax return had health insurance in 2022 through. Web if you downloaded the 2022 instructions for form 8962, premium tax credit, please be advised that there is an update to the 2nd bullet under exception 1—certain. Form 8962 isn’t for everyone. Web form 8962 at the end of these instructions. Web community.

IRS Form 8962 Instruction for How to Fill it Right

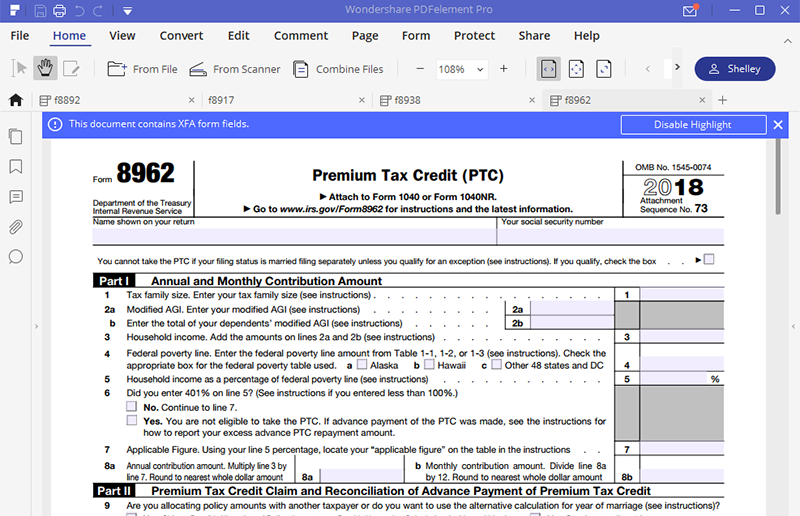

Web form 8962 at the end of these instructions. Web see the irs instructions for form 8962 for more information and specific allocation situations. 37784z form 8962 2018 page allocation of policy amounts complete the following information for up to four policy amount allocations. Web you must use form 8962 to reconcile your estimated and actual income for the year..

8962 Form App for iPhone Free Download 8962 Form for iPhone & iPad at

37784z form 8962 2018 page allocation of policy amounts complete the following information for up to four policy amount allocations. Complete irs tax forms online or print government tax documents. Web up to $40 cash back cat. How do i generate 8962 part v, alternative calculation for year of marriage?. Web form 8962 at the end of these instructions.

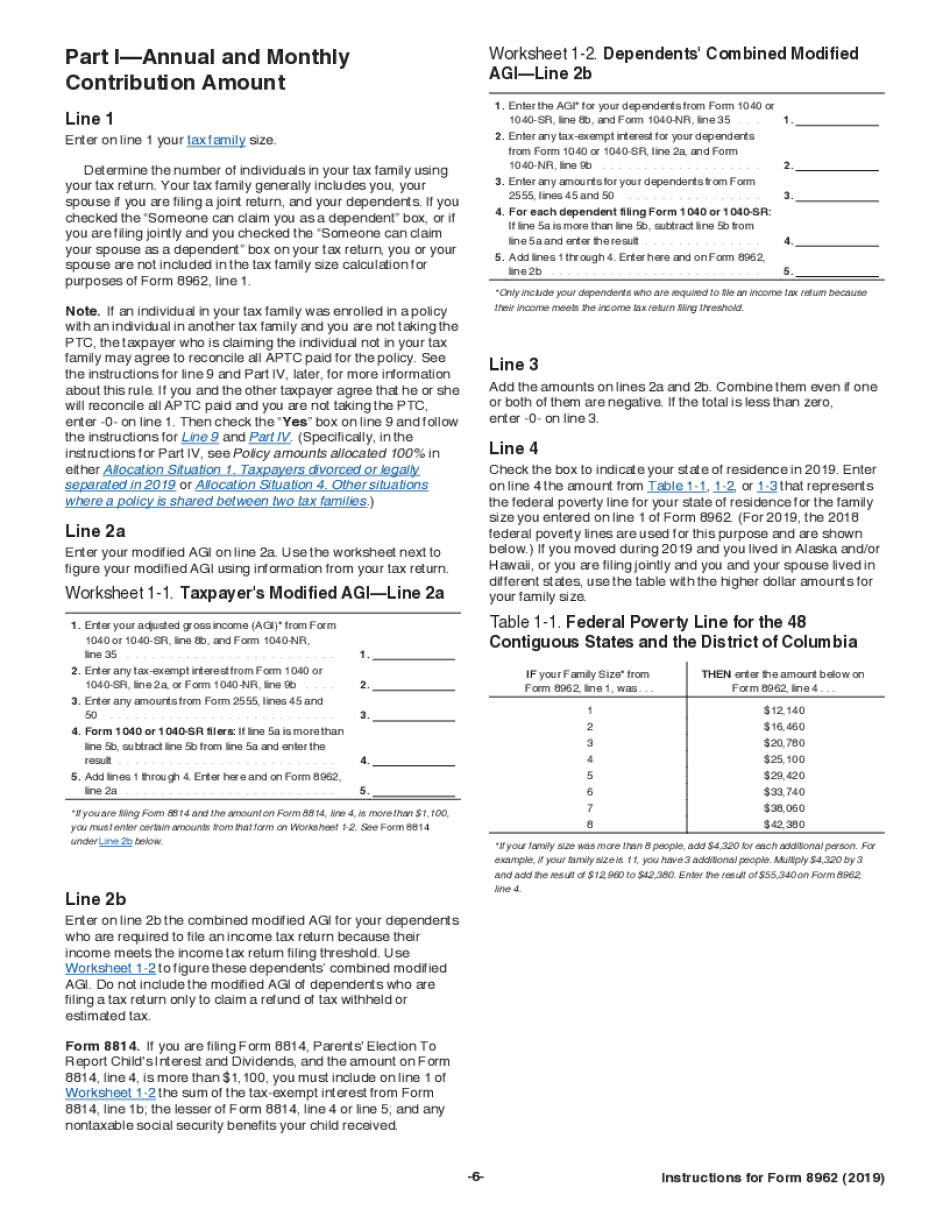

Web 1 Tax Family Size.

Even if you estimated your income perfectly, you must complete form 8962 and submit it with. 37784z form 8962 2018 page allocation of policy amounts complete the following information for up to four policy amount allocations. How to fill out form 8962 step by step. Web see the irs instructions for form 8962 for more information and specific allocation situations.

Web Instructions For Form 8962 Premium Tax Credit (Ptc) Department Of The Treasury Internal Revenue Service Section References Are To The Internal Revenue Code Unless Otherwise.

Ad get ready for tax season deadlines by completing any required tax forms today. Enter your modified agi (see instructions). This form is required when someone on your tax return had health insurance in 2022 through. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise.

Web If You Downloaded The 2022 Instructions For Form 8962, Premium Tax Credit, Please Be Advised That There Is An Update To The 2Nd Bullet Under Exception 1—Certain.

Complete irs tax forms online or print government tax documents. Web you must use form 8962 to reconcile your estimated and actual income for the year. Web medicaid & chip how to apply & enroll picking a plan check if you can change plans report income/family changes new, lower costs available health care tax forms,. Who can use form 8962?

To Be Eligible For This Tax Credit, You.

Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any advance premium tax credit (aptc). You must file form 8962 with your income tax return (form 1040 or form 1040nr) if any of the following apply to you. Web up to $40 cash back cat. Form 8962 isn’t for everyone.