8962 Form Instructions

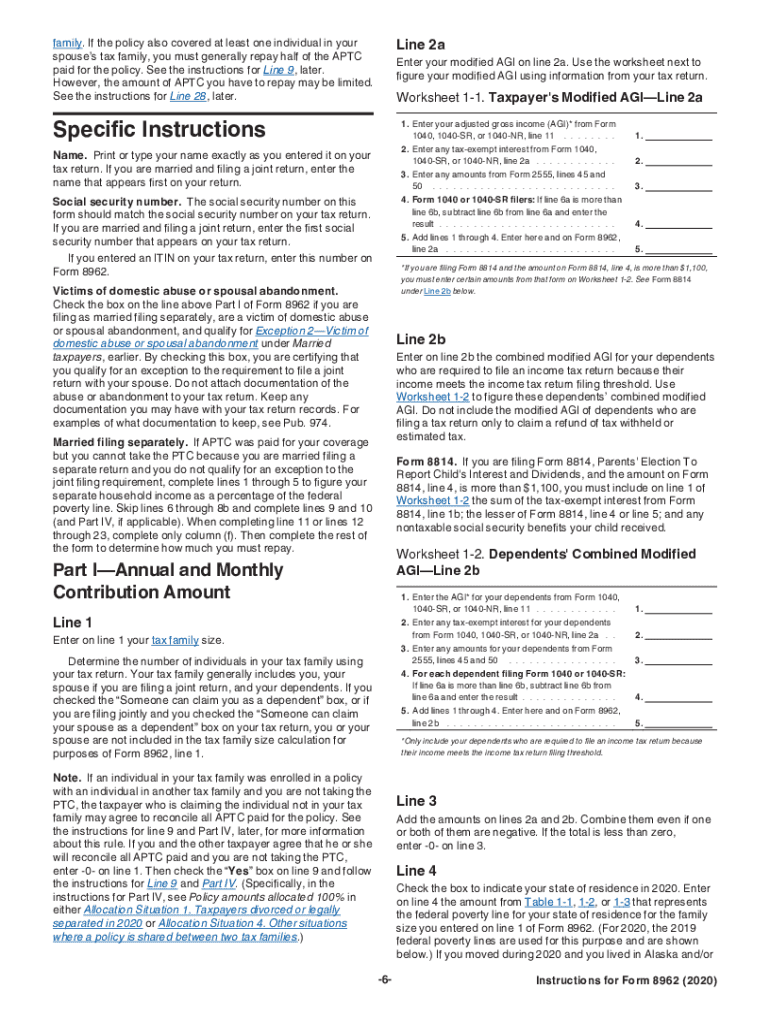

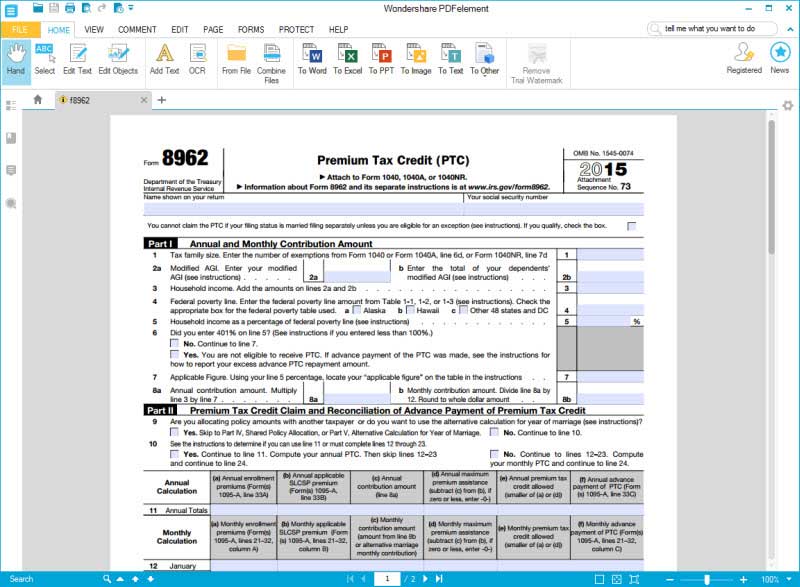

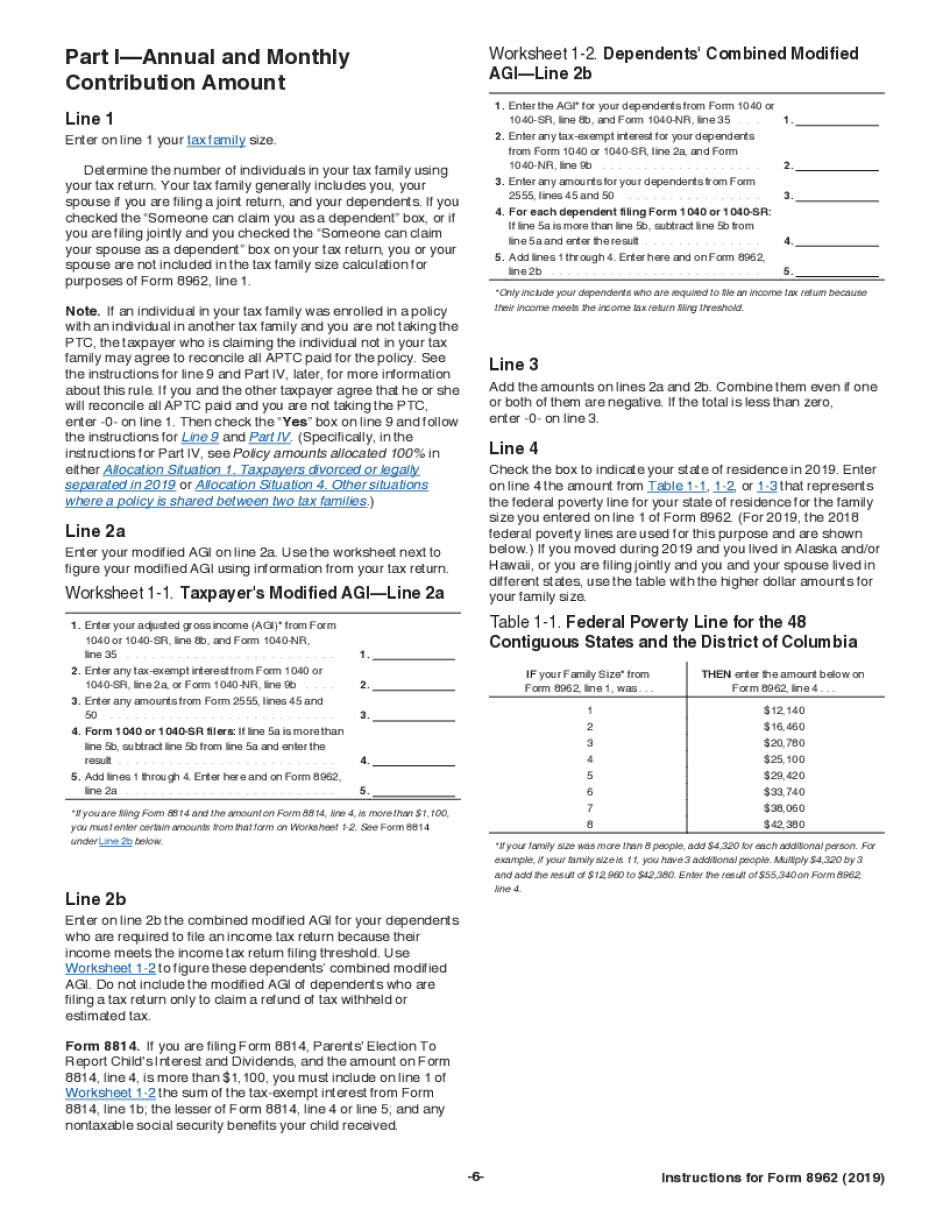

8962 Form Instructions - Go to www.irs.gov/form8962 for instructions and the latest information. You need to use 8962 form to reconcile your estimated and precise income for the yr. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Now on to part ii, premium tax credit claim and reconciliation of advance. Fill in your name as it. The american rescue plan act was signed into law on march 11, 2021, and eliminates the 2020 excess advance premium tax credit repayment for certain filers. Begin by filling in the. A complete guide step 1. Who can use form 8962? Form 8962 is used to calculate the amount of premium tax credit you’re.

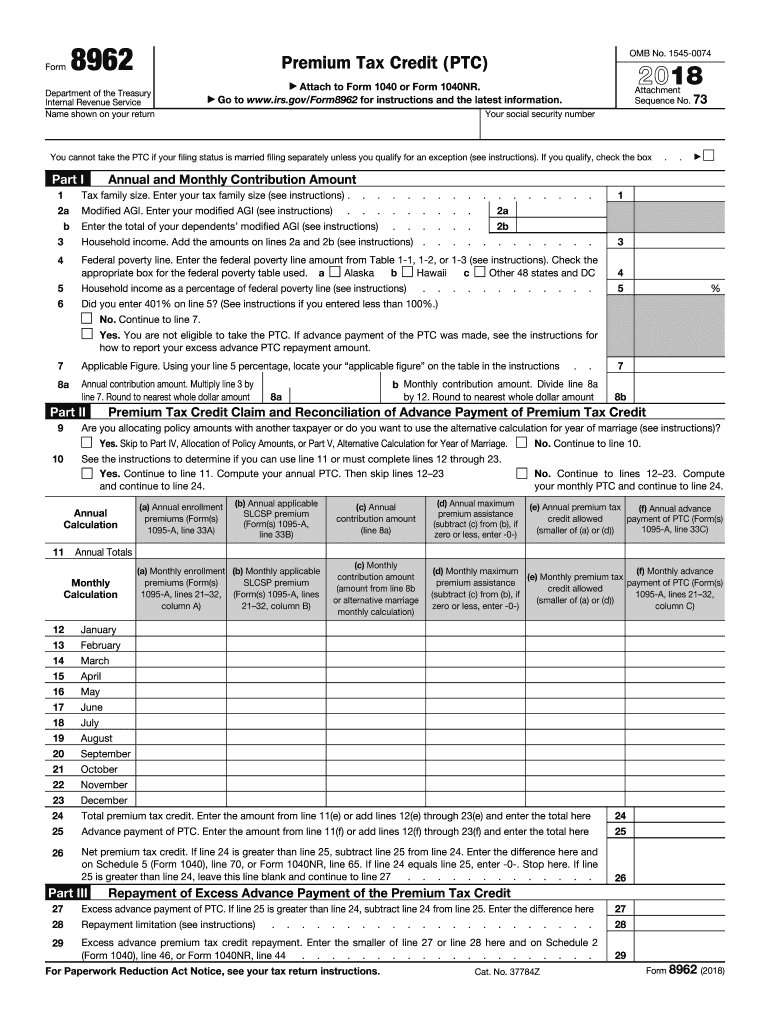

Form 8962 isn’t for everyone. Reminders applicable federal poverty line percentages. Form 8962 is used to calculate the amount of premium tax credit you’re. Web how to fill out form 8962? Form 8962 will generate, but will not be filed with the return. 73 name shown on your return your social security number a. By the end of part i, you’ll have your annual and monthly contribution amounts (lines 8a and 8b). Web updated may 31, 2023 reviewed by lea d. The american rescue plan act was signed into law on march 11, 2021, and eliminates the 2020 excess advance premium tax credit repayment for certain filers. However, eligibility is one thing;

A complete guide step 1. Web instructions for irs form 8962: Begin by filling in the. Uradu fact checked by yarilet perez what is irs form 8962: 73 name shown on your return your social security number a. Who can use form 8962? You need to use 8962 form to reconcile your estimated and precise income for the yr. Web how to fill out form 8962? First, you’ll need to obtain irs form 8962. Next, go to “part 1” of the form.

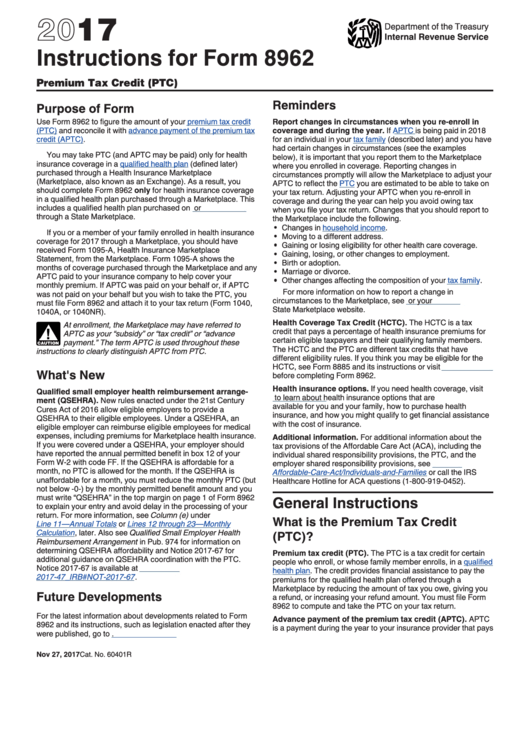

Instructions For Form 8962 Premium Tax Credit (Ptc) 2017 printable

However, eligibility is one thing; Form 8962 will generate, but will not be filed with the return. You need to use 8962 form to reconcile your estimated and precise income for the yr. Who can use form 8962? Now on to part ii, premium tax credit claim and reconciliation of advance.

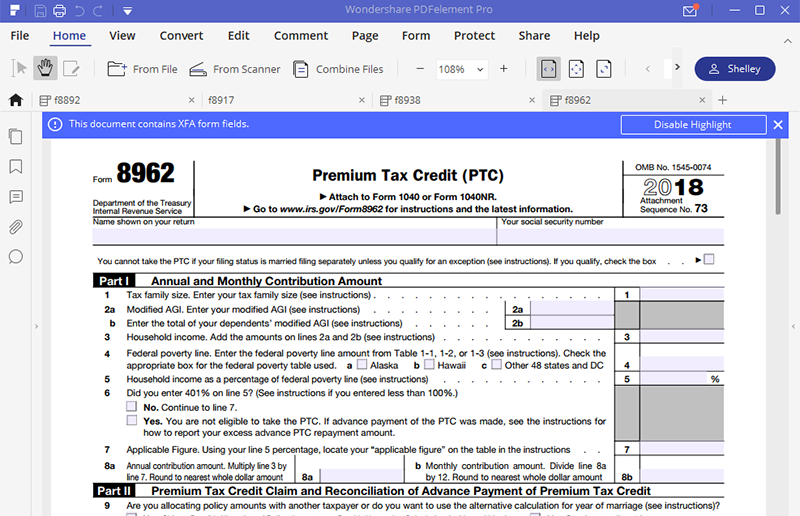

IRS Form 8962 Instruction for How to Fill it Right

You will receive a pdf file of the form. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. Next, go to “part 1” of the form. However, eligibility is one thing; You need to use 8962 form to reconcile your estimated and precise income for the yr.

Irs form 8962 Fillable Brilliant form 8962 Instructions 2018 at Models

Form 8962 will generate, but will not be filed with the return. 73 name shown on your return your social security number a. Form 8962 isn’t for everyone. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. For clients who owe excess aptc repayment:

Form 8962 Fill Out and Sign Printable PDF Template signNow

Who can use form 8962? Web updated may 31, 2023 reviewed by lea d. Begin by filling in the. You need to use 8962 form to reconcile your estimated and precise income for the yr. A complete guide step 1.

Instructions 8962 2018 2019 Blank Sample to Fill out Online in PDF

Next, go to “part 1” of the form. Begin by filling in the. A complete guide step 1. You will receive a pdf file of the form. To be eligible for this tax credit, you had to have had health insurance via the affordable care act marketplace or exchange.

2016 Form IRS Instructions 8962 Fill Online, Printable, Fillable, Blank

For clients who owe excess aptc repayment: Form 8962 is used to calculate the amount of premium tax credit you’re. Web updated may 31, 2023 reviewed by lea d. Web consult the table in the irs instructions for form 8962 to fill out the form. Qualified small employer health reimbursement arrangement (qsehra).

Form 8962 Fill Out and Sign Printable PDF Template signNow

Now, you will begin the filing procedure. The irs uses form 8962 to reconcile the tax credit the well being plan obtained based mostly on the individual’s estimated revenue with the amount of his or her actual earnings, as reported on their federal tax return. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions.

irs form 8962 instructions Fill Online, Printable, Fillable Blank

First, you’ll need to obtain irs form 8962. You will receive a pdf file of the form. Web consult the table in the irs instructions for form 8962 to fill out the form. By the end of part i, you’ll have your annual and monthly contribution amounts (lines 8a and 8b). You need to use 8962 form to reconcile your.

IRS Form 8962 Instruction for How to Fill it Right

A complete guide step 1. Uradu fact checked by yarilet perez what is irs form 8962: Qualified small employer health reimbursement arrangement (qsehra). Go to www.irs.gov/form8962 for instructions and the latest information. The american rescue plan act was signed into law on march 11, 2021, and eliminates the 2020 excess advance premium tax credit repayment for certain filers.

how to fill out form 8962 step by step Fill Online, Printable

Fill in your name as it. The american rescue plan act was signed into law on march 11, 2021, and eliminates the 2020 excess advance premium tax credit repayment for certain filers. For clients who owe excess aptc repayment: Form 8962 isn’t for everyone. Web see the form 8962 instructions for more information.

Next, Go To “Part 1” Of The Form.

The irs uses form 8962 to reconcile the tax credit the well being plan obtained based mostly on the individual’s estimated revenue with the amount of his or her actual earnings, as reported on their federal tax return. For clients who owe excess aptc repayment: The american rescue plan act was signed into law on march 11, 2021, and eliminates the 2020 excess advance premium tax credit repayment for certain filers. Web instructions for irs form 8962:

A Complete Guide Step 1.

By the end of part i, you’ll have your annual and monthly contribution amounts (lines 8a and 8b). Uradu fact checked by yarilet perez what is irs form 8962: 73 name shown on your return your social security number a. First, you’ll need to obtain irs form 8962.

Web Updated May 31, 2023 Reviewed By Lea D.

Now, you will begin the filing procedure. Form 8962 isn’t for everyone. However, eligibility is one thing; Web see the form 8962 instructions for more information.

Form 8962 Is Used Either (1) To Reconcile A Premium Tax Credit Advanced Payment Toward The Cost Of A Health Insurance.

Go to www.irs.gov/form8962 for instructions and the latest information. Reminders applicable federal poverty line percentages. You will receive a pdf file of the form. To be eligible for this tax credit, you had to have had health insurance via the affordable care act marketplace or exchange.