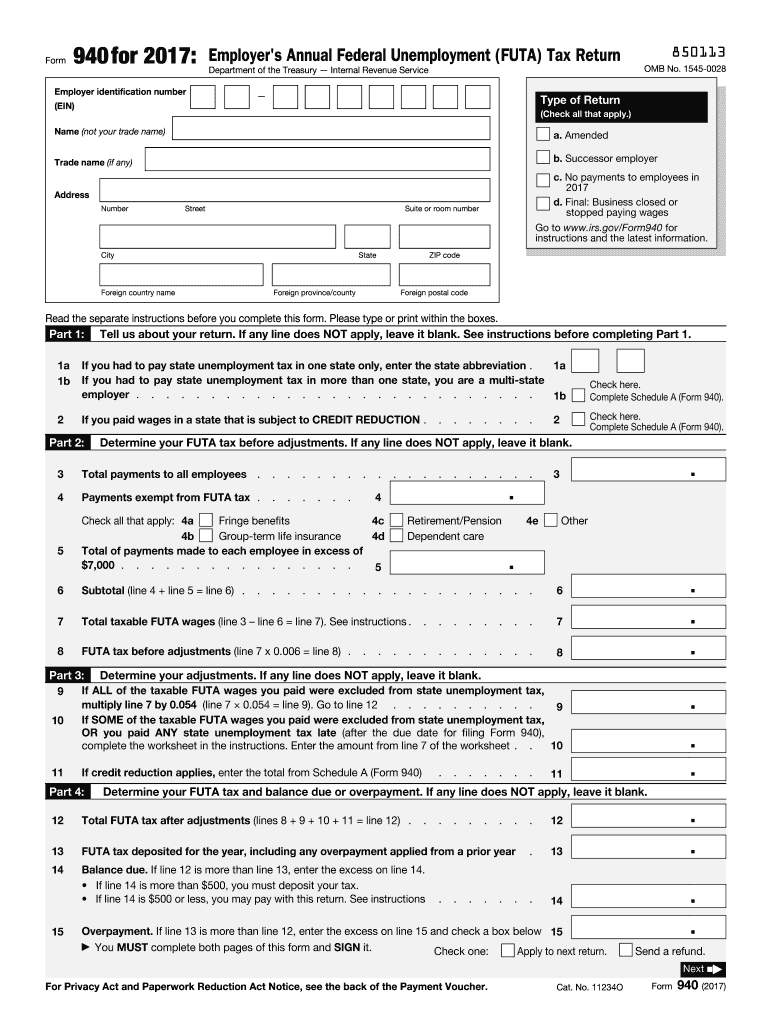

940 2017 Form

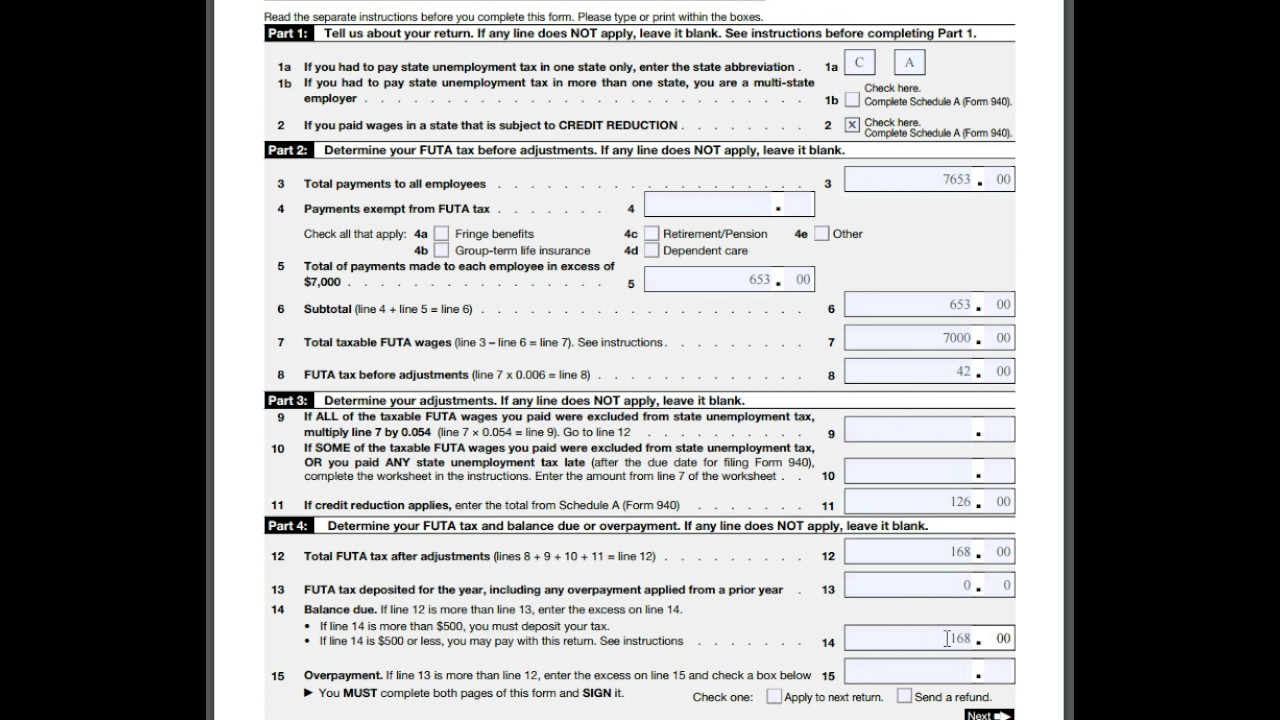

940 2017 Form - Web employer's quarterly federal tax return for 2021. Web the best way to submit the irs 940 on the internet: The unemployment tax rate typically comes out to 0.6% but can vary. To view the tax forms that are available to you in gusto, click the taxes & compliance section. Sign it in a few clicks draw your. Edu of 2017 /9—.11.2017 dated: Check here if this is an amended return. Download or email irs 940 & more fillable forms, register and subscribe now! Web cpeos must generally file form 940 and schedule r (form 940), allocation schedule for aggregate form 940 filers, electronically. For more information about a cpeo’s.

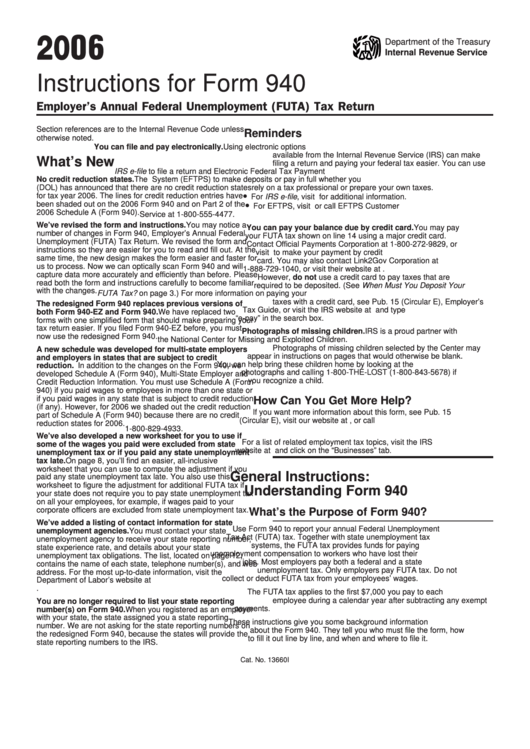

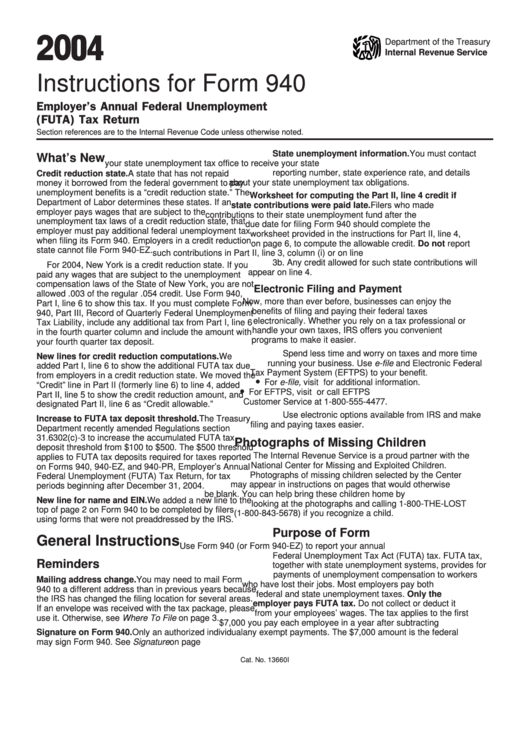

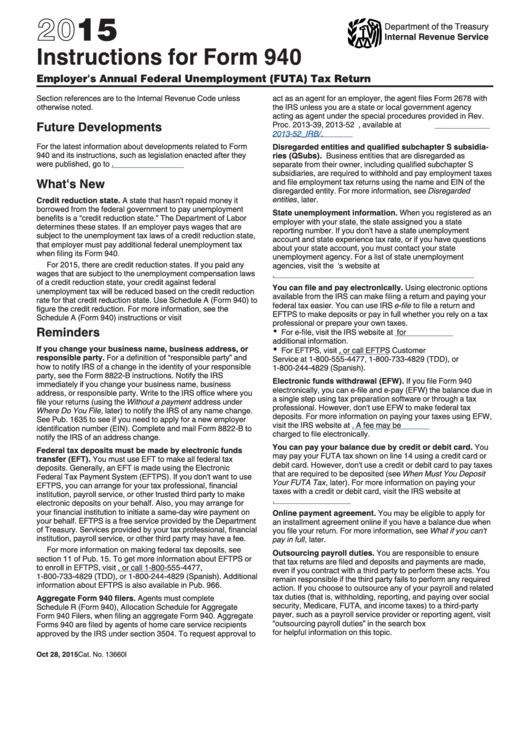

Sign it in a few clicks draw your. Web get forms, instructions, and publications. Download or email irs 940 & more fillable forms, register and subscribe now! Web 2017 california resident income tax return 540 fiscal year filers only: Web department of the treasury internal revenue service instructions for form 940 employer's annual federal unemployment (futa) tax return section references are to the internal. For more information about a cpeo’s. Web businesses must report unemployment taxes by jan. Click the button get form to open it and begin editing. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of. Sign it in a few clicks draw your signature, type.

Web landfill closure and contingency tax. Once completed you can sign your fillable form or send for signing. Web department of the treasury internal revenue service instructions for form 940 employer's annual federal unemployment (futa) tax return section references are to the internal. Web businesses must report unemployment taxes by jan. Check here if this is an amended return. Web click a state below to see which taxes and forms gusto will handle on your behalf. Edit your form 940 for 2017 online type text, add images, blackout confidential details, add comments, highlights and more. How it works upload the irs form 940. Show details this website is not affiliated with irs. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of.

Instructions For Form 940 Employer'S Annual Federal Unemployment

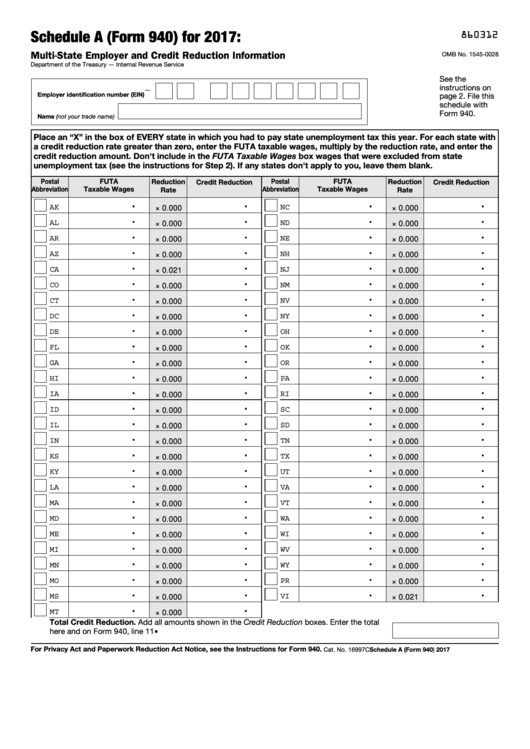

Sign it in a few clicks draw your signature, type. Web the best way to submit the irs 940 on the internet: Edit your schedule a form 940 2016 online type text, add images, blackout confidential details, add comments, highlights and more. All forms are printable and downloadable. Edit your form 940 for 2017 online type text, add images, blackout.

Barbara Johnson Blog Form 940 Instructions How to Fill It Out and Who

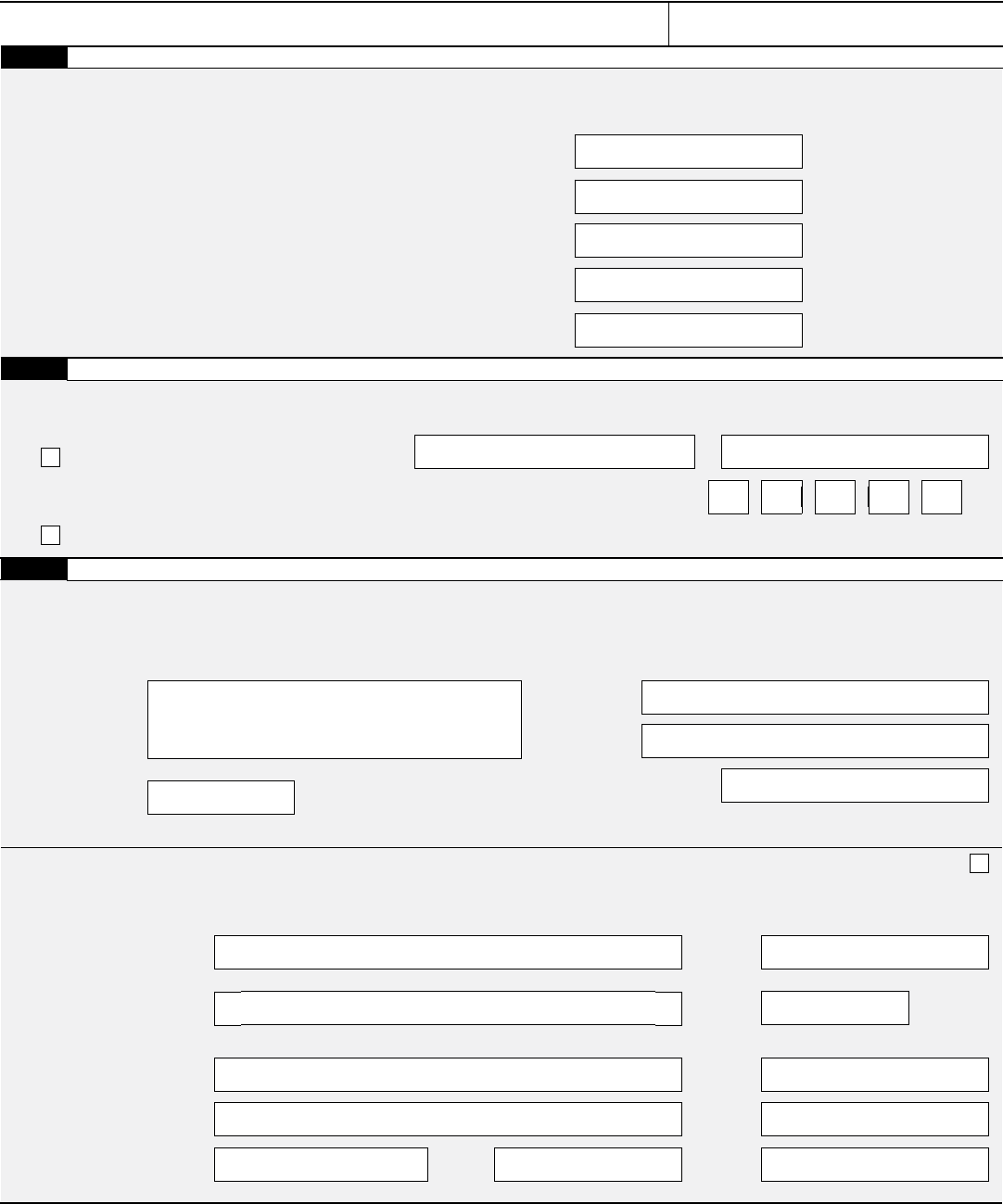

How it works upload the irs form 940. Enter month of year end: Checking a box below will not change your tax or refund. To view the tax forms that are available to you in gusto, click the taxes & compliance section. Once completed you can sign your fillable form or send for signing.

Instructions For Form 940 Employer'S Annual Federal Unemployment

Checking a box below will not change your tax or refund. Gad(adm)81/2011, dated 21.08.2017 from general administration department. How it works upload the irs form 940. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of. Click the button get form to open it and begin editing.

Instructions For Form 940 2017 printable pdf download

Web click a state below to see which taxes and forms gusto will handle on your behalf. Click the button get form to open it and begin editing. Sign it in a few clicks draw your. Edit your schedule a form 940 2016 online type text, add images, blackout confidential details, add comments, highlights and more. 31 for the previous.

940 Form Employer's Annual Federal Unemployment TAX Return FUTA YouTube

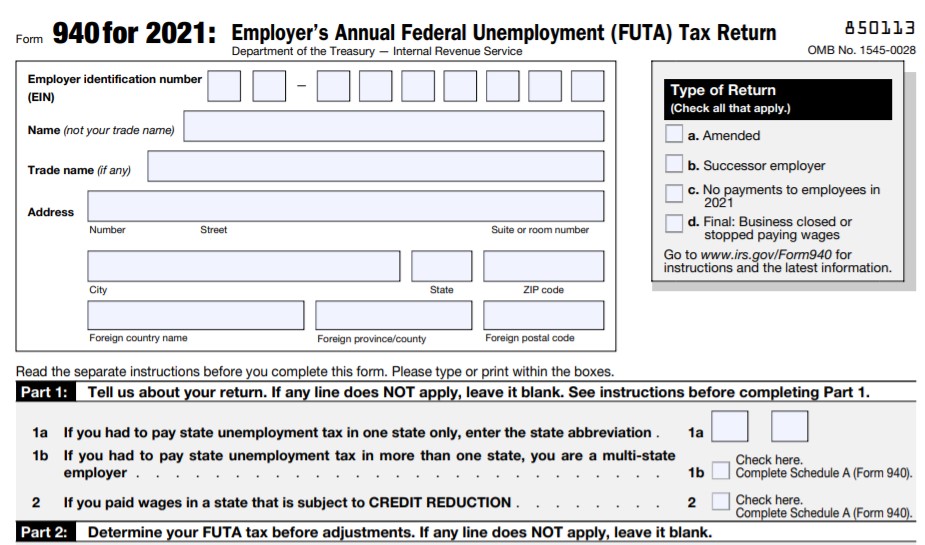

Web cpeos must generally file form 940 and schedule r (form 940), allocation schedule for aggregate form 940 filers, electronically. Sign it in a few clicks draw your. Web employer's quarterly federal tax return for 2021. Checking a box below will not change your tax or refund. Together with state unemployment tax systems, the futa tax provides funds for.

Irs form 940 2017 Fill out & sign online DocHub

Web presidential election campaign check here if you, or your spouse if filing jointly, want $3 to go to this fund. Edu of 2017 /9—.11.2017 dated: Ad get ready for tax season deadlines by completing any required tax forms today. For more information about a cpeo’s. Checking a box below will not change your tax or refund.

Fillable Schedule A (Form 940) MultiState Employer And Credit

Click the button get form to open it and begin editing. Individual income tax return (99) 2017 department of the treasury—internal revenue service. Ad get ready for tax season deadlines by completing any required tax forms today. Edit your form 940 for 2017 online type text, add images, blackout confidential details, add comments, highlights and more. Edit your form 940.

2011 Form 940 Edit, Fill, Sign Online Handypdf

Web businesses must report unemployment taxes by jan. Web presidential election campaign check here if you, or your spouse if filing jointly, want $3 to go to this fund. Edit your form 940 for 2017 online type text, add images, blackout confidential details, add comments, highlights and more. Together with state unemployment tax systems, the futa tax provides funds for..

EFile Form 940 for 2021 tax year File Form 940 Online

Once completed you can sign your fillable form or send for signing. Web 2017 california resident income tax return 540 fiscal year filers only: Check here if this is an amended return. How it works upload the irs form 940. Fill out all needed fields in the selected document utilizing our.

2010 Form 940 Fill Out and Sign Printable PDF Template signNow

Web get forms, instructions, and publications. Edit your form 940 for 2017 online type text, add images, blackout confidential details, add comments, highlights and more. Web employer's quarterly federal tax return for 2021. Web 2017 california resident income tax return 540 fiscal year filers only: Once completed you can sign your fillable form or send for signing.

Web 2017 California Resident Income Tax Return 540 Fiscal Year Filers Only:

Enter month of year end: Download or email irs 940 & more fillable forms, register and subscribe now! Download or email irs 940 & more fillable forms, register and subscribe now! Edu of 2017 /9—.11.2017 dated:

Gad(Adm)81/2011, Dated 21.08.2017 From General Administration Department.

To view the tax forms that are available to you in gusto, click the taxes & compliance section. For more information about a cpeo’s. Web landfill closure and contingency tax. Checking a box below will not change your tax or refund.

Web Businesses Must Report Unemployment Taxes By Jan.

Ad get ready for tax season deadlines by completing any required tax forms today. Web use form 940 to report your annual federal unemployment tax act (futa) tax. Check here if this is an amended return. Web use fill to complete blank online irs pdf forms for free.

Web Get Federal Tax Return Forms And File By Mail Get Paper Copies Of Federal And State Tax Forms, Their Instructions, And The Address For Mailing Them.

The unemployment tax rate typically comes out to 0.6% but can vary. Web the best way to submit the irs 940 on the internet: All forms are printable and downloadable. Ad get ready for tax season deadlines by completing any required tax forms today.