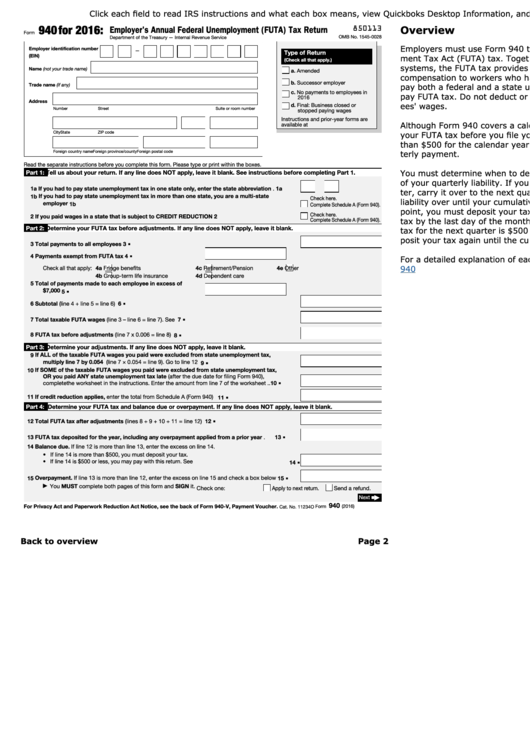

940 Form 2016

940 Form 2016 - Irs form 940 is the federal unemployment tax annual report. If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is. Complete, edit or print tax forms instantly. 4 when should an irs 940 form. Web about form 940, employer's annual federal unemployment (futa) tax return. Web unlike futa tax deposits, you’ll only need to file form 940 once a year. Employers must report and pay unemployment taxes to the irs for their employees. We need it to figure and collect the right amount of tax. Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Web follow these fast steps to edit the pdf instruction 940 form 2016 online for free:

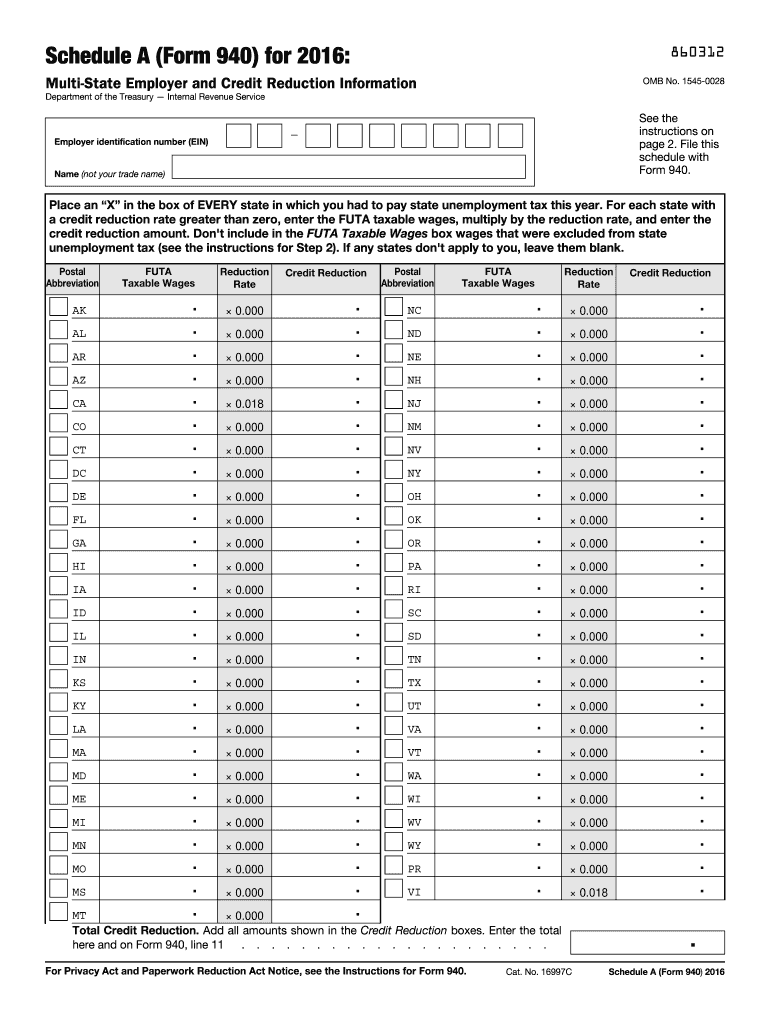

Ad get ready for tax season deadlines by completing any required tax forms today. Individual income tax return 2016. Web enter your official contact and identification details. 31 each year for the previous year. Irs use only—do not write or staple in. Ad get ready for tax season deadlines by completing any required tax forms today. Web use a instruction 940 form 2016 template to make your document workflow more streamlined. For employers who withhold taxes from employee's paychecks or who must pay. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web form 940 for 2016:

2 what is an irs 940 form 2016 pdf used for? 4 when should an irs 940 form. Sign in to the editor using your credentials or click on create. Web june 8, 2023 · 5 minute read the revised drafts of form 940 (employer’s annual federal unemployment (futa) tax return) and form 940 schedule a (multi. Web follow these fast steps to edit the pdf instruction 940 form 2016 online for free: Web 1 facts about the irs 940 2016 pdf template; Web we ask for the information on form 940 to carry out the internal revenue laws of the united states. If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is. Individual income tax return 2016. Web enter your official contact and identification details.

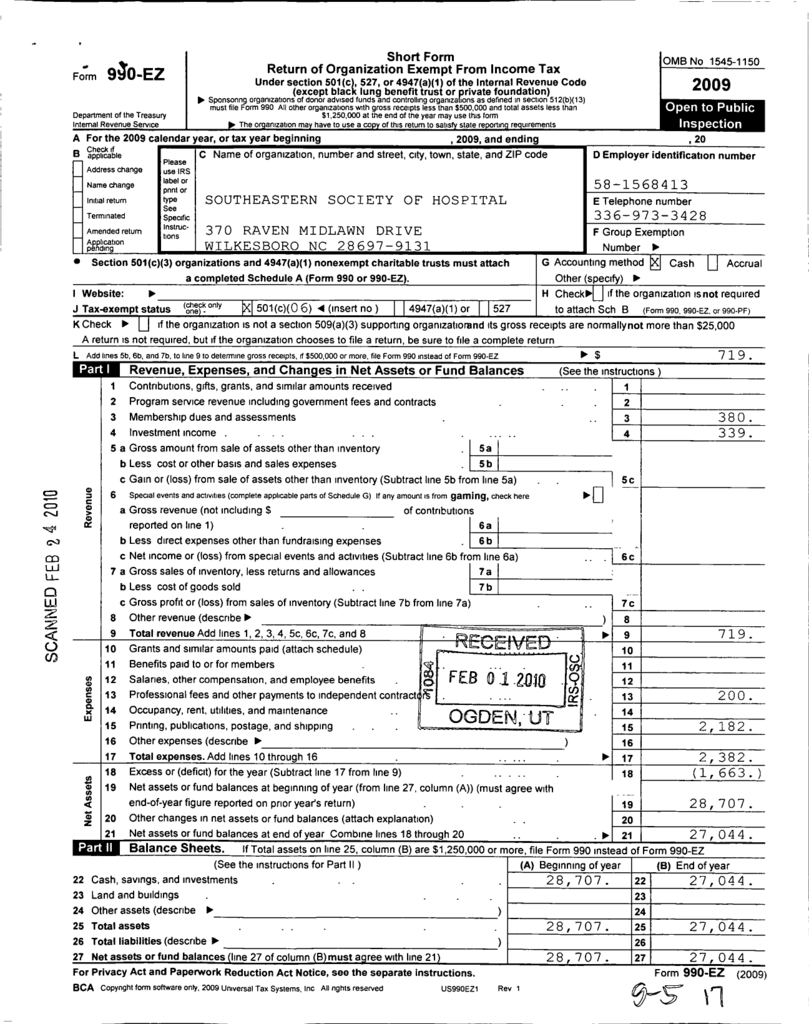

Form 940EZ 2009 Foundation Center

Register and log in to your account. Individual income tax return 2016. Web form 940 for 2016: We need it to figure and collect the right amount of tax. Employers must report and pay unemployment taxes to the irs for their employees.

How to File 940 Form with ezPaycheck Payroll Software

Web we ask for the information on form 940 to carry out the internal revenue laws of the united states. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Register and log in to your account. Easily fill out pdf blank, edit, and sign them. Web get federal tax return forms and file.

940 Form 2016 Fill Out and Sign Printable PDF Template signNow

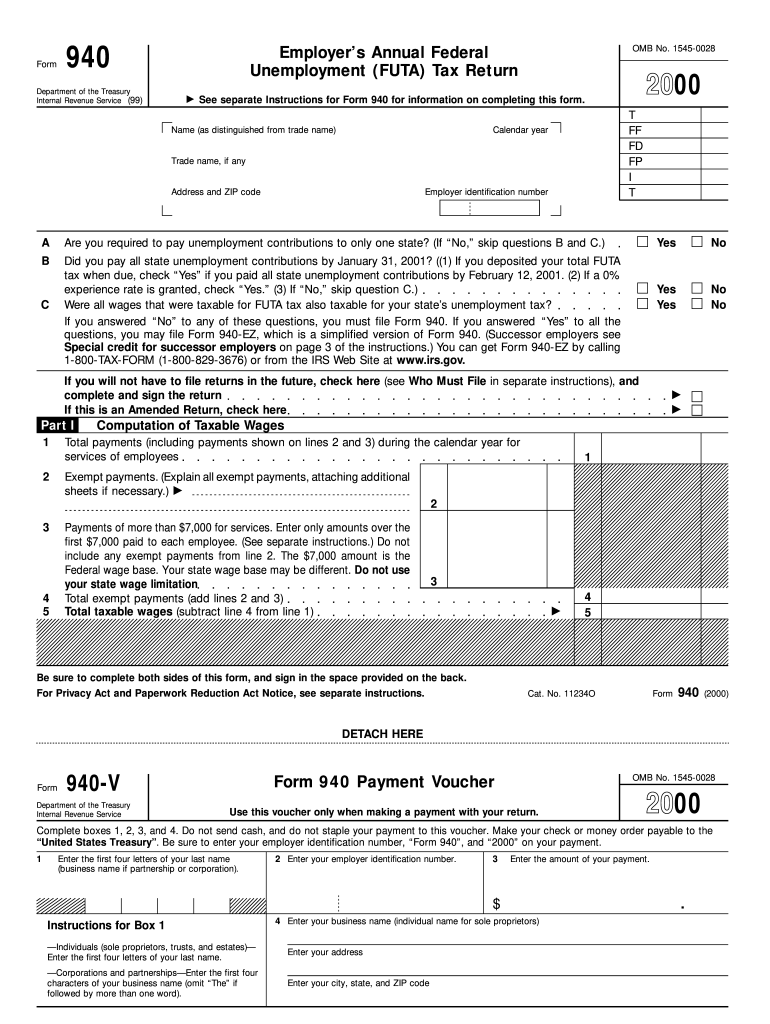

Register and log in to your account. Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service. Easily fill out pdf blank, edit, and sign them. Web irs form 940 is a form used by employers to record and remit the federal unemployment tax act (futa) tax when they pay more than $1,500 of wages.

IRS 940 Form 2016 Fillable and Editable PDF Template Pdf templates

Apply a check mark to point the choice where expected. Web use a instruction 940 form 2016 template to make your document workflow more streamlined. Web follow these fast steps to edit the pdf instruction 940 form 2016 online for free: Ad get ready for tax season deadlines by completing any required tax forms today. Web irs form 940 is.

940 Form Fill Out and Sign Printable PDF Template signNow

Employers must report and pay unemployment taxes to the irs for their employees. Easily fill out pdf blank, edit, and. Web follow these fast steps to edit the pdf instruction 940 form 2016 online for free: Web unlike futa tax deposits, you’ll only need to file form 940 once a year. Web form 940 is due on jan.

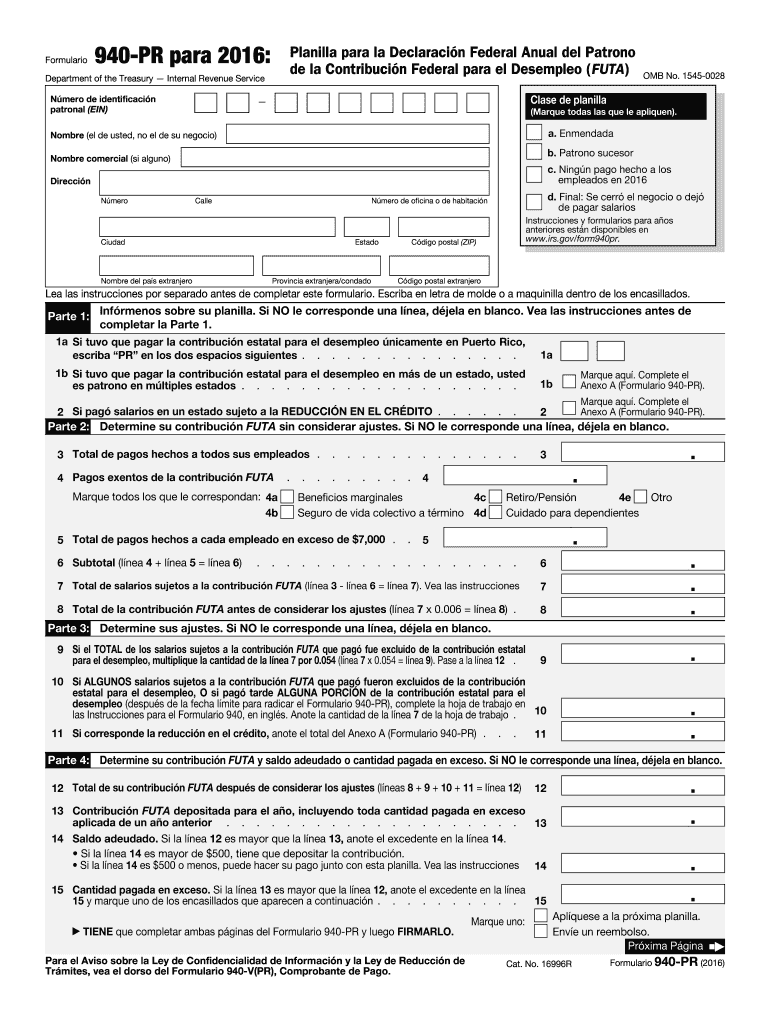

940 Pr Form Fill Out and Sign Printable PDF Template signNow

Web unlike futa tax deposits, you’ll only need to file form 940 once a year. If the amount of federal unemployment tax due for the year has been paid, the form 940 due date is. Department of the treasury—internal revenue service (99) irs use only—do not write or staple in this space. Web enter your official contact and identification details..

Fillable Form 940 Employer's Annual Federal Unemployment (futa) Tax

Web enter your official contact and identification details. Employers must report and pay unemployment taxes to the irs for their employees. Upload, modify or create forms. 31 each year for the previous year. Irs form 940 is the federal unemployment tax annual report.

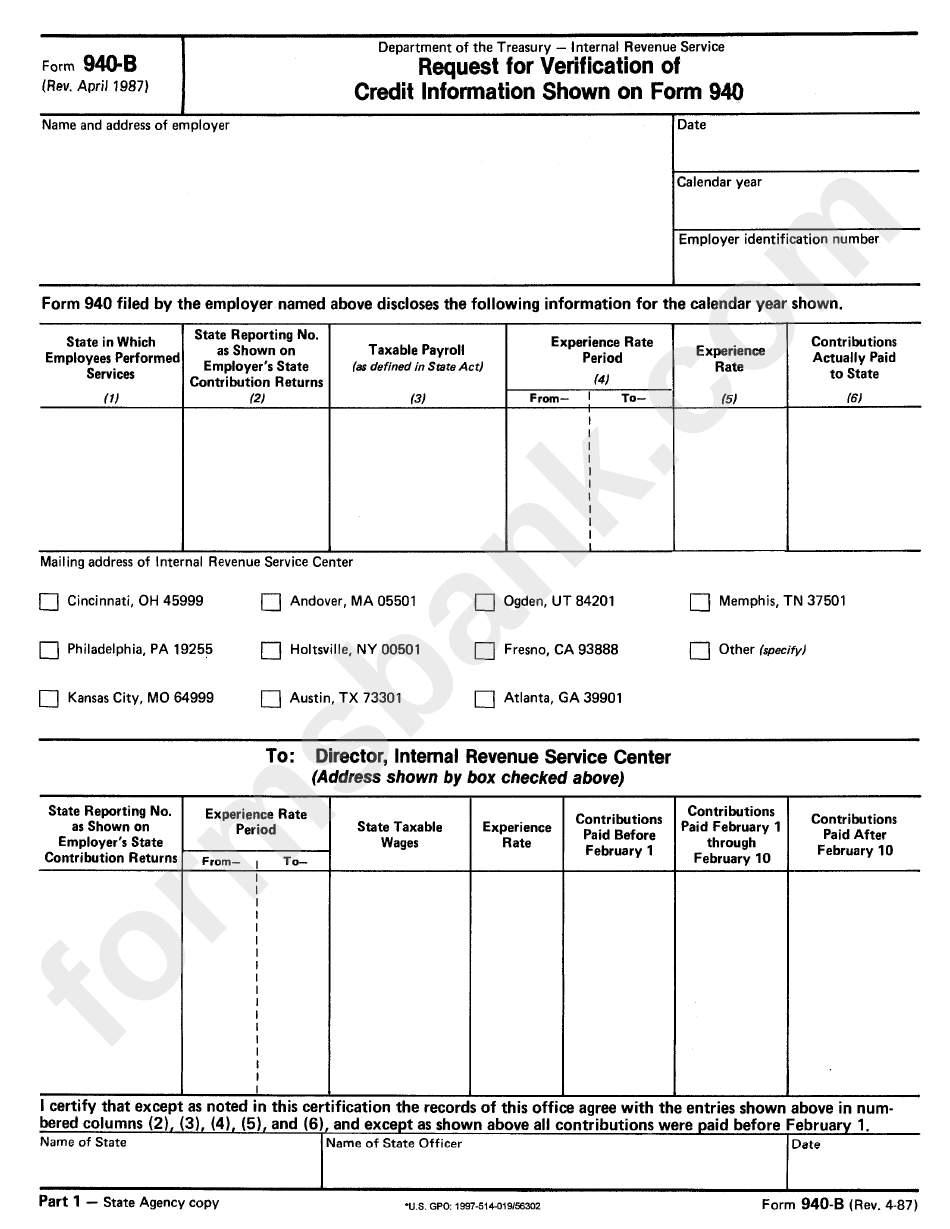

Form 940B Request For Verification Of Credit Information Shown On

Easily fill out pdf blank, edit, and sign them. You must file your form 940 for 2022 by january 31, 2023. Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service. Web we ask for the information on form 940 to carry out the internal revenue laws of the united states. Future developments for the.

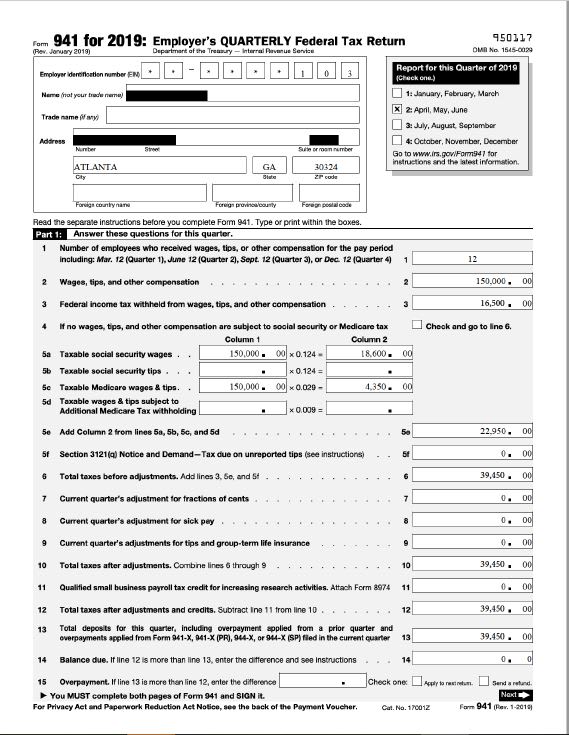

Prepare 941 and 940 form by Sandeep_kc Fiverr

Web form 1040 department of the treasury—internal revenue service (99) u.s. Web enter your official contact and identification details. Ad get ready for tax season deadlines by completing any required tax forms today. Web we ask for the information on form 940 to carry out the internal revenue laws of the united states. Complete, edit or print tax forms instantly.

Apply A Check Mark To Point The Choice Where Expected.

Easily fill out pdf blank, edit, and sign them. Web complete 2016 form 940. Individual income tax return 2016. Web we ask for the information on form 940 to carry out the internal revenue laws of the united states.

Web Use A Instruction 940 Form 2016 Template To Make Your Document Workflow More Streamlined.

Web enter your official contact and identification details. Web irs form 940 is a form used by employers to record and remit the federal unemployment tax act (futa) tax when they pay more than $1,500 of wages to employees during a. 31 each year for the previous year. Future developments for the latest information about.

Employers Must Report And Pay Unemployment Taxes To The Irs For Their Employees.

Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Web street suite or room number city state zip code foreign country name foreign province/county foreign postal code type of return (check all that apply.) amended. Easily fill out pdf blank, edit, and. Try it for free now!

Web Unlike Futa Tax Deposits, You’ll Only Need To File Form 940 Once A Year.

Complete, edit or print tax forms instantly. Web about form 940, employer's annual federal unemployment (futa) tax return. Web form 1040 department of the treasury—internal revenue service (99) u.s. Double check all the fillable fields to ensure total accuracy.