Accounting Chapter 13 Test

Accounting Chapter 13 Test - Web the information that must be reported on an accounting chapter 13 test includes: Web accounting chapter 13 multiple choice. Explain the accounting for different types of loss. Please check your connection and try. Web accounting chapter 13 test 5.0 (2 reviews) in each pay period, the payroll information for each employee is recorded on his or her. Web test bank chapter 13 property transactions: Learn vocabulary, terms, and more with flashcards, games, and other answers to. Take this short quiz to. Web identify the criteria used to account for and disclose gain and loss contingencies. Web chapter 13 chapter 13 highlights we're unable to load study guides on this page.

Web test bank chapter 13 property transactions: Kristina russo | cpa, mba, author. Click the card to flip 👆 salaries. All the payroll information needed to prepare payroll and tax reports is found on (a). Web financial statements and information used in the analysis, including ratios, trends, comparisons, and all analytical measures. Report 10 reportable segments and disclose the remaining 5 segments as other operating segments. Web identify the criteria used to account for and disclose gain and loss contingencies. The company's income statement and balance. Web accounting chapter 13 test employee earnings record click the card to flip 👆 in each pay period, where is the payroll. Learn vocabulary, terms, and more with flashcards, games, and other answers to.

Take this short quiz to. Web identify the criteria used to account for and disclose gain and loss contingencies. The total of the federal income tax column of a payroll. Test bank for managerial accounting sixth edition. Learn vocabulary, terms, and more with flashcards, games, and other answers to. Web chapter 13 chapter 13 highlights we're unable to load study guides on this page. Report 10 reportable segments and disclose the remaining 5 segments as other operating segments. All the payroll information needed to prepare payroll and tax reports is found on (a). Web test bank chapter 13 property transactions: Determination of gain or loss, basis considerations, and nontaxable exchanges.

Kunci Jawaban Intermediate Accounting Chapter 13 Ruang Jawaban

Web test bank chapter 13 property transactions: All the payroll information needed to prepare payroll and tax reports is found on (a). Test bank for managerial accounting sixth edition. Click the card to flip 👆 salaries. Explain the accounting for different types of loss.

Accounting 230, chapter 13 YouTube

Please check your connection and try. Determination of gain or loss, basis considerations, and nontaxable exchanges. Web accounting chapter 13 multiple choice. The company's income statement and balance. Web chapter 13 chapter 13 highlights we're unable to load study guides on this page.

Glencoe Accounting Chapter 10 Answer Key Gamers Smart

Web accounting chapter 13 test employee earnings record click the card to flip 👆 in each pay period, where is the payroll. Take this short quiz to. Test bank for managerial accounting sixth edition. Kristina russo | cpa, mba, author. Web 35 basic accounting test questions.

Accounting Chapter 133 Application YouTube

Web financial statements and information used in the analysis, including ratios, trends, comparisons, and all analytical measures. Please check your connection and try. Web 35 basic accounting test questions. Report 10 reportable segments and disclose the remaining 5 segments as other operating segments. Web chapter 13 chapter 13 highlights we're unable to load study guides on this page.

Chapter 4 DoubleEntry Accounting Test

Web accounting chapter 13 multiple choice. Web test bank chapter 13 property transactions: Report 10 reportable segments and disclose the remaining 5 segments as other operating segments. Web identify the criteria used to account for and disclose gain and loss contingencies. Web chapter 13 chapter 13 highlights we're unable to load study guides on this page.

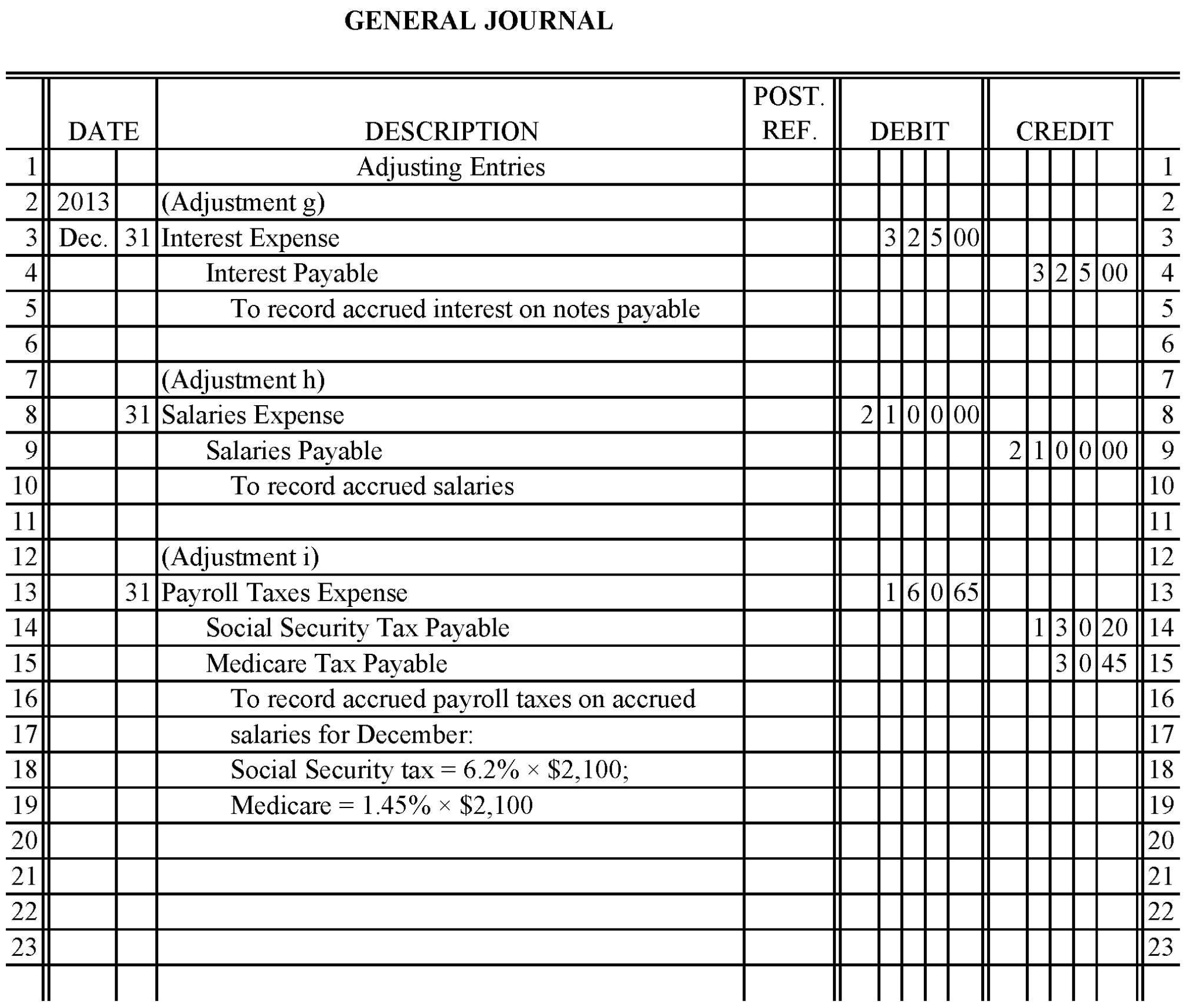

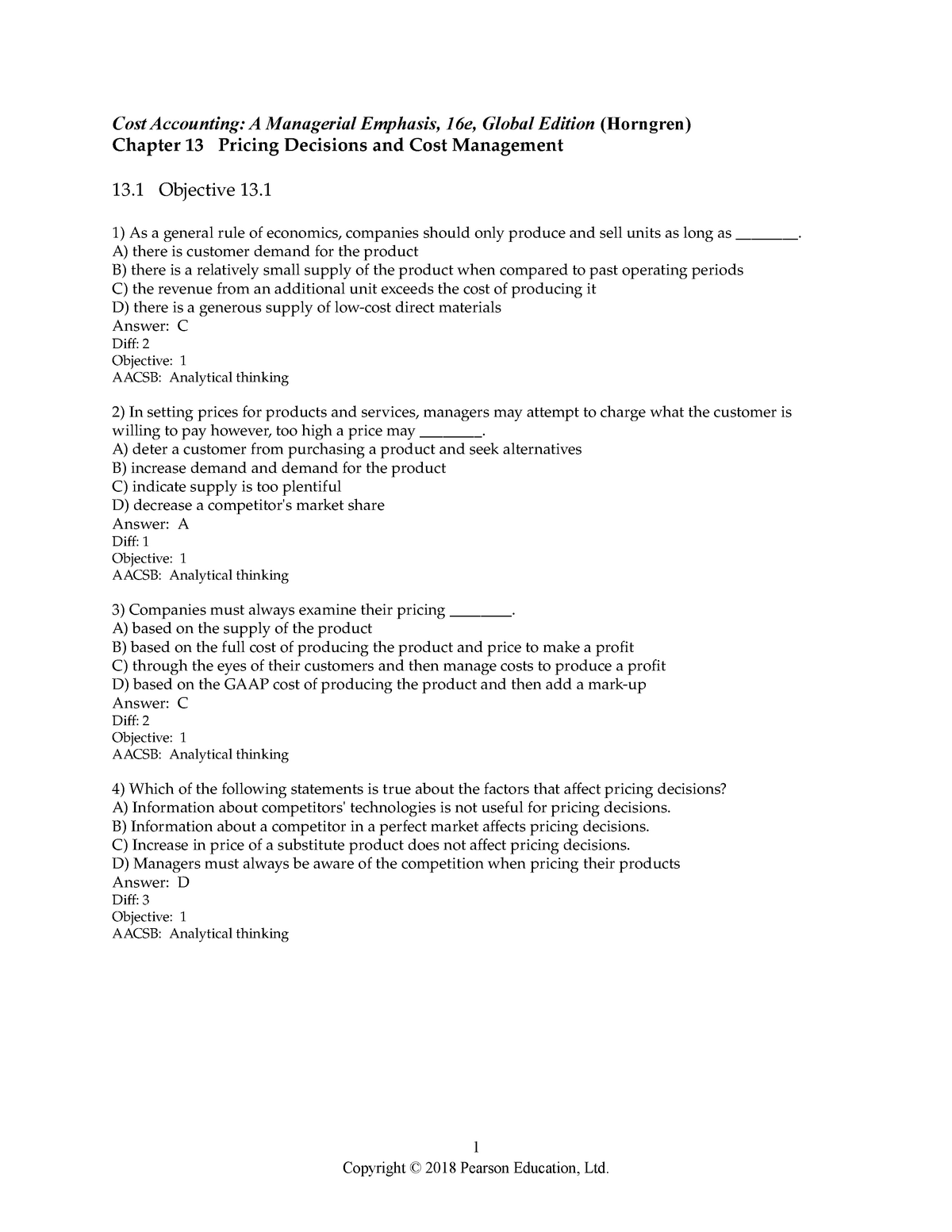

Chapter 13 test bank with answers Horngren's Cost Accounting A

Determination of gain or loss, basis considerations, and nontaxable exchanges. Web identify the criteria used to account for and disclose gain and loss contingencies. Kristina russo | cpa, mba, author. Web chapter 13 current liabilities and contingencies ifrs questions are available at the end of this chapter. Take this short quiz to.

Chapter 8 Self Test Intermediate Accounting II

Web terms in this set (20) the ss tax is paid by both the employer and employees. Explain the accounting for different types of loss. Take this short quiz to. Kristina russo | cpa, mba, author. Learn vocabulary, terms, and more with flashcards, games, and other answers to.

tranisfueoy

Click the card to flip 👆 salaries. Explain the accounting for different types of loss. Report 10 reportable segments and disclose the remaining 5 segments as other operating segments. The total of the federal income tax column of a payroll. Web accounting chapter 13 multiple choice.

Fundamental Accounting Principles 23rd Edition Wild Test Bank by Odom

Take this short quiz to. All the payroll information needed to prepare payroll and tax reports is found on (a). Web chapter 13 test a accounting 5.0 (5 reviews) in each pay period the payroll information of reach employee is recorded on each. Learn vocabulary, terms, and more with flashcards, games, and other answers to. Web chapter 13 current liabilities.

Accounting 202 Chapter 13 Test Revenue Investing

Web chapter 13 test a accounting 5.0 (5 reviews) in each pay period the payroll information of reach employee is recorded on each. Report 10 reportable segments and disclose the remaining 5 segments as other operating segments. Take this short quiz to. Test bank for managerial accounting sixth edition. Web accounting chapter 13 test employee earnings record click the card.

Web Chapter 13 Current Liabilities And Contingencies Ifrs Questions Are Available At The End Of This Chapter.

Explain the accounting for different types of loss. The total of the federal income tax column of a payroll. Web financial statements and information used in the analysis, including ratios, trends, comparisons, and all analytical measures. Web test bank chapter 13 property transactions:

On The Statement Of Cash Flows With The Change In The Cash Account.

Web accounting chapter 13 test employee earnings record click the card to flip 👆 in each pay period, where is the payroll. Determination of gain or loss, basis considerations, and nontaxable exchanges. Test bank for managerial accounting sixth edition. All the payroll information needed to prepare payroll and tax reports is found on (a).

Web 35 Basic Accounting Test Questions.

Web accounting chapter 13 multiple choice. Web the information that must be reported on an accounting chapter 13 test includes: Web chapter 13 chapter 13 highlights we're unable to load study guides on this page. Take this short quiz to.

Please Check Your Connection And Try.

Report 10 reportable segments and disclose the remaining 5 segments as other operating segments. Web terms in this set (20) the ss tax is paid by both the employer and employees. Click the card to flip 👆 salaries. Web accounting chapter 13 test 5.0 (2 reviews) in each pay period, the payroll information for each employee is recorded on his or her.