Accrued Interest In Balance Sheet

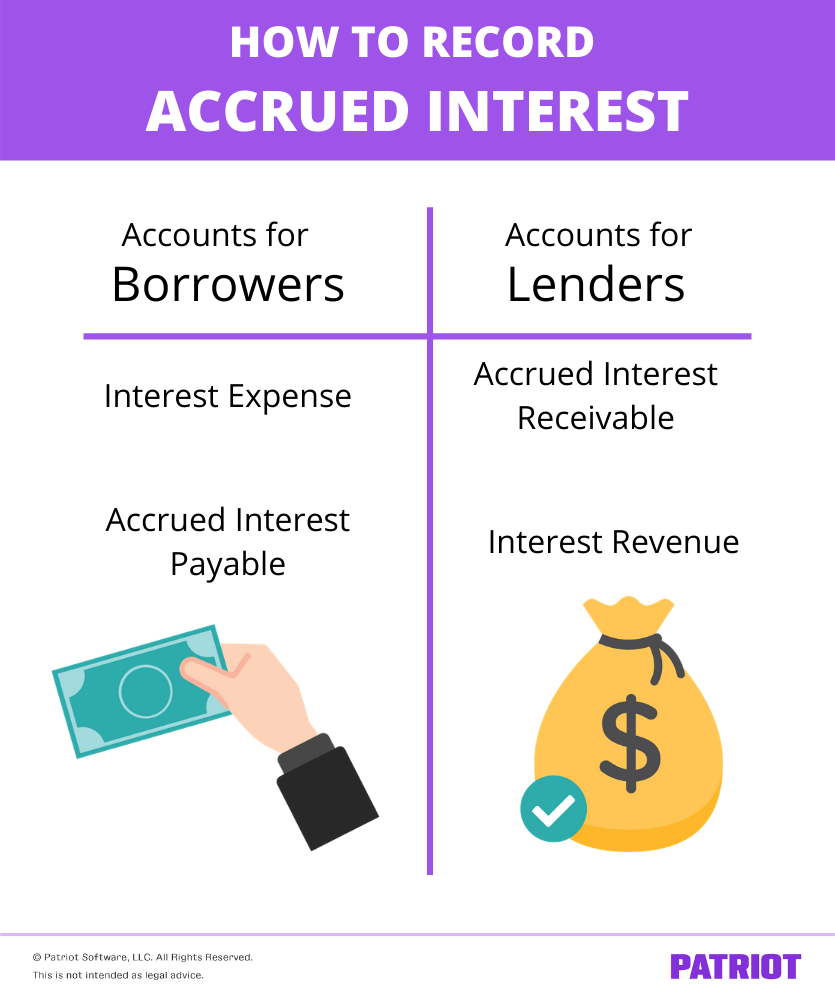

Accrued Interest In Balance Sheet - Web accrued income reported on the balance sheet. Calculate the exact number of days between the date of the last coupon payment (june 1) and your purchase date. Revenue on the income statement a current asset on the balance sheet Web for lenders, accrued interest is: The adjusting entry for accrued interest consists of an interest income and a receivable. Borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. The amount of accrued income that a corporation has a right to receive as of the date of the balance sheet will be reported in the current asset section of the balance. Web in accounting, accrued interest is reported by both borrowers and lenders:

Revenue on the income statement a current asset on the balance sheet The amount of accrued income that a corporation has a right to receive as of the date of the balance sheet will be reported in the current asset section of the balance. Web in accounting, accrued interest is reported by both borrowers and lenders: The adjusting entry for accrued interest consists of an interest income and a receivable. Web accrued income reported on the balance sheet. Borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. Web for lenders, accrued interest is: Calculate the exact number of days between the date of the last coupon payment (june 1) and your purchase date.

The adjusting entry for accrued interest consists of an interest income and a receivable. Calculate the exact number of days between the date of the last coupon payment (june 1) and your purchase date. Web for lenders, accrued interest is: Web in accounting, accrued interest is reported by both borrowers and lenders: Web accrued income reported on the balance sheet. Revenue on the income statement a current asset on the balance sheet Borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. The amount of accrued income that a corporation has a right to receive as of the date of the balance sheet will be reported in the current asset section of the balance.

What Occurs When a Company Records Accrued Interest on a Note Payable

Borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. Web accrued income reported on the balance sheet. Web for lenders, accrued interest is: Revenue on the income statement a current asset on the balance sheet Web in accounting, accrued interest is reported by both borrowers and lenders:

Are Accrued Expenses Interest Bearing

Revenue on the income statement a current asset on the balance sheet Web accrued income reported on the balance sheet. The adjusting entry for accrued interest consists of an interest income and a receivable. Borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. The amount of accrued income that a.

How to Record Accrued Interest Calculations & Examples

The adjusting entry for accrued interest consists of an interest income and a receivable. Revenue on the income statement a current asset on the balance sheet Borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. Web for lenders, accrued interest is: Calculate the exact number of days between the date.

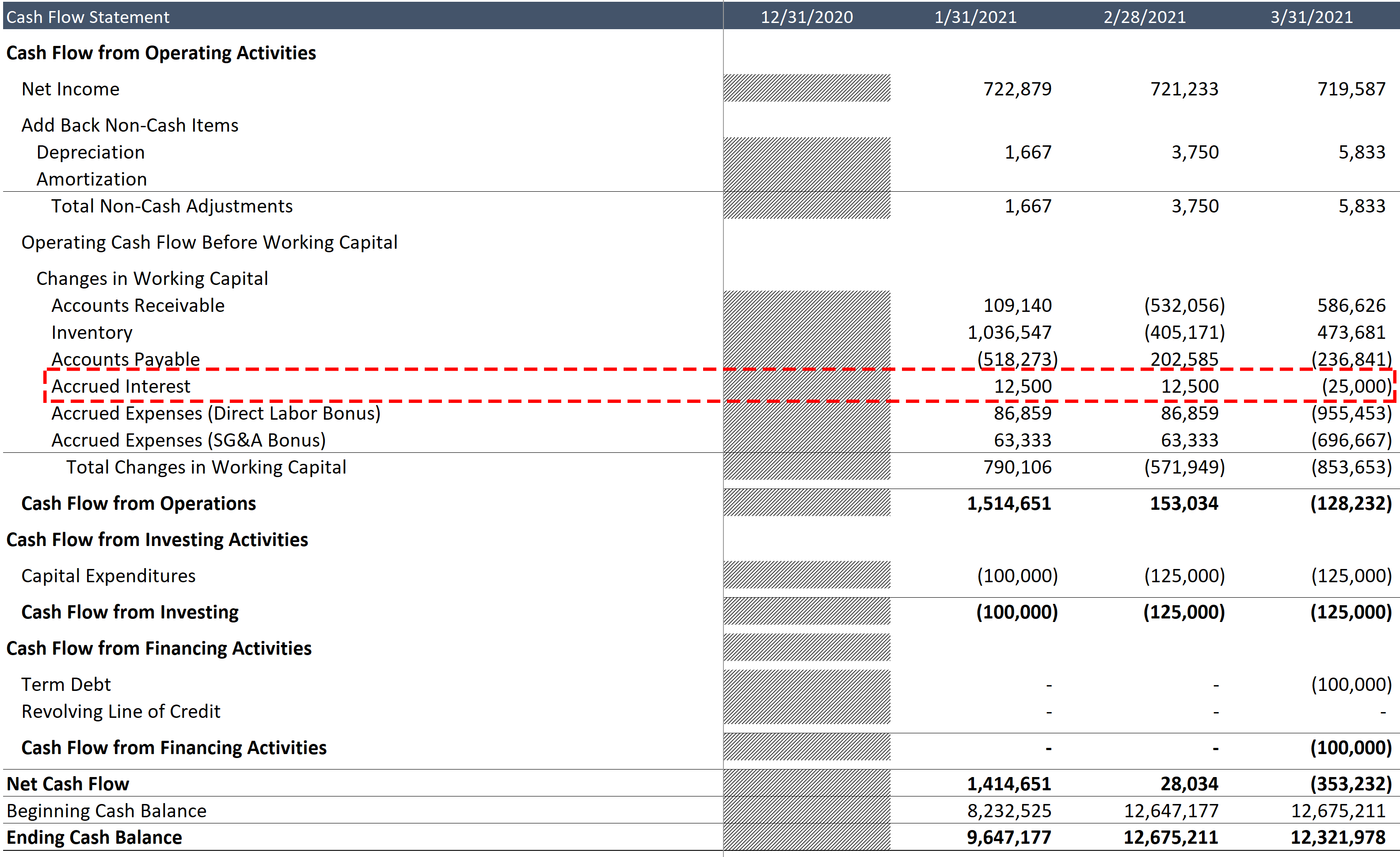

Interest Expense in a Monthly Financial Model (Cash Interest vs

The amount of accrued income that a corporation has a right to receive as of the date of the balance sheet will be reported in the current asset section of the balance. The adjusting entry for accrued interest consists of an interest income and a receivable. Web in accounting, accrued interest is reported by both borrowers and lenders: Web for.

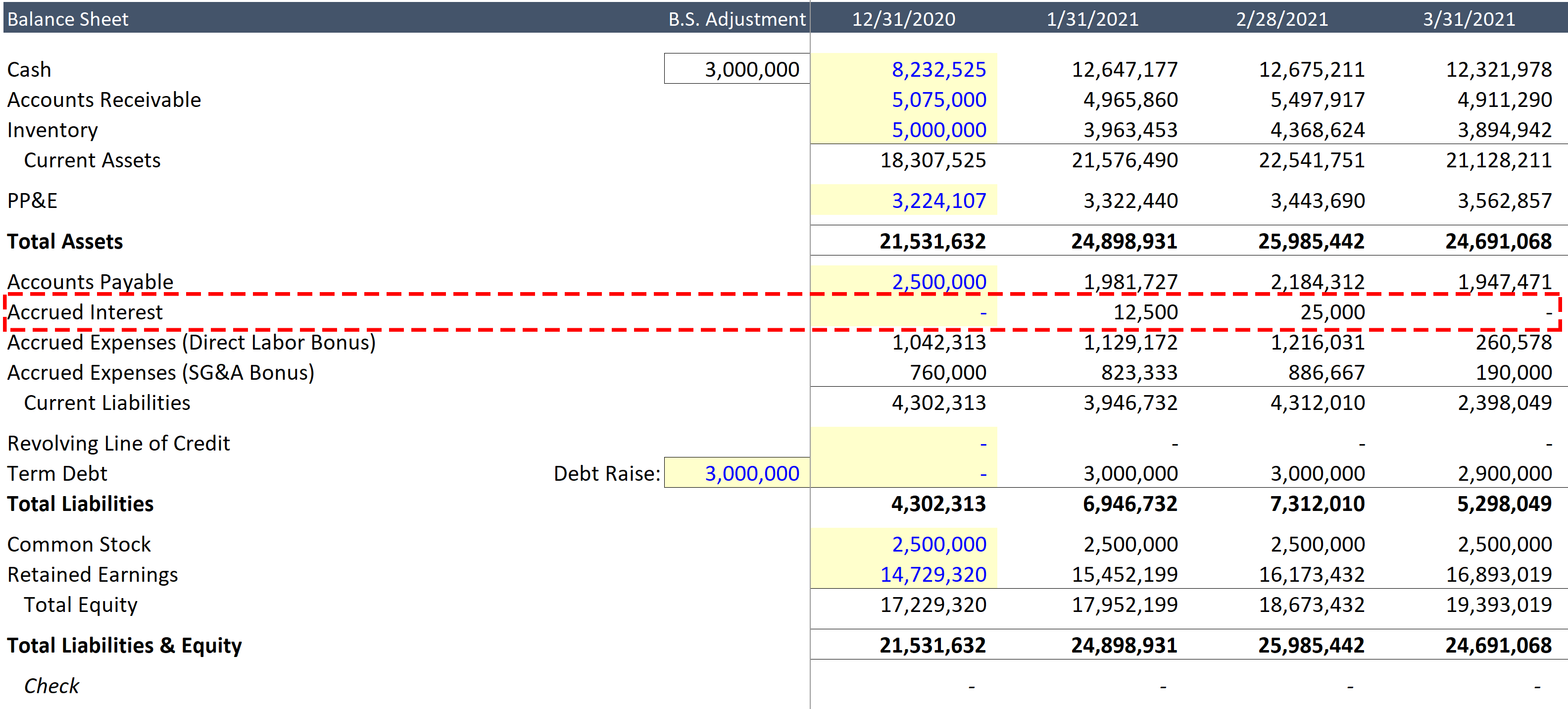

Accrued Interest Payable On Balance Sheet Financial Statement

Calculate the exact number of days between the date of the last coupon payment (june 1) and your purchase date. Web for lenders, accrued interest is: Web accrued income reported on the balance sheet. Revenue on the income statement a current asset on the balance sheet The adjusting entry for accrued interest consists of an interest income and a receivable.

Accrued Interest Formula + Loan Calculator

The adjusting entry for accrued interest consists of an interest income and a receivable. Revenue on the income statement a current asset on the balance sheet Web in accounting, accrued interest is reported by both borrowers and lenders: Web for lenders, accrued interest is: Calculate the exact number of days between the date of the last coupon payment (june 1).

Interest Expense in a Monthly Financial Model (Cash Interest vs

Calculate the exact number of days between the date of the last coupon payment (june 1) and your purchase date. Web accrued income reported on the balance sheet. The adjusting entry for accrued interest consists of an interest income and a receivable. The amount of accrued income that a corporation has a right to receive as of the date of.

Accrued Interest Payable On Balance Sheet Financial Statement

Borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. Revenue on the income statement a current asset on the balance sheet Web for lenders, accrued interest is: The adjusting entry for accrued interest consists of an interest income and a receivable. Web accrued income reported on the balance sheet.

Adjust For Accrued Interest Receivable

Revenue on the income statement a current asset on the balance sheet Web in accounting, accrued interest is reported by both borrowers and lenders: Web for lenders, accrued interest is: Web accrued income reported on the balance sheet. The adjusting entry for accrued interest consists of an interest income and a receivable.

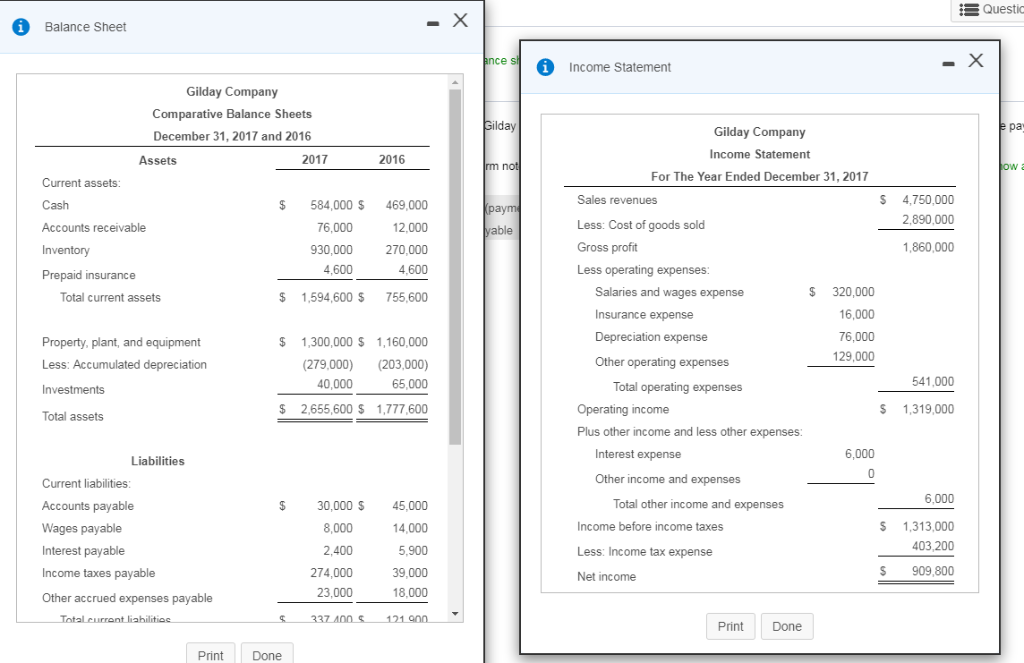

Solved Liabilities Current liabilities Accounts payable

The adjusting entry for accrued interest consists of an interest income and a receivable. Web accrued income reported on the balance sheet. Calculate the exact number of days between the date of the last coupon payment (june 1) and your purchase date. The amount of accrued income that a corporation has a right to receive as of the date of.

Calculate The Exact Number Of Days Between The Date Of The Last Coupon Payment (June 1) And Your Purchase Date.

Borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet. Web accrued income reported on the balance sheet. Web in accounting, accrued interest is reported by both borrowers and lenders: The adjusting entry for accrued interest consists of an interest income and a receivable.

The Amount Of Accrued Income That A Corporation Has A Right To Receive As Of The Date Of The Balance Sheet Will Be Reported In The Current Asset Section Of The Balance.

Web for lenders, accrued interest is: Revenue on the income statement a current asset on the balance sheet