Ach Payment Form Pdf

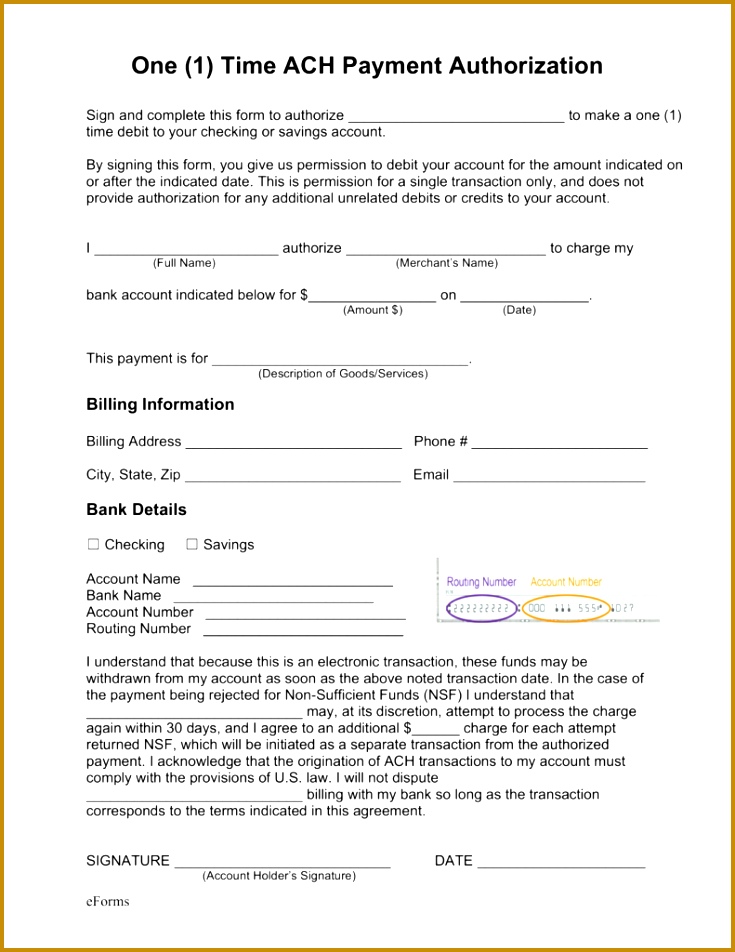

Ach Payment Form Pdf - Web this form is used for automated clearing house (ach) payments to provide payment related information to your financial institution. You must check with your financial institution to confirm that funds have been deposited. Checks are negotiable for only 90 days (reduced from 180 days). You will be charged the amount indicated below each billing period. A one (1) time ach payment authorization form is a document provides permission to a merchant or company to deduct a single payment from the account holder’s bank account. (we) authorize ________________________ (“company”) to electronically debit my (our) account (and, if necessary, electronically credit my (our) account to correct erroneous debits1) as follows: A receipt for each payment will be provided to you and the charge will appear on your bank statement as an “ach debit”. Recipients of these payments should bring this information to the attention of their financial institution when presenting this form for completion. Leave these fields blank if you want your customer to fill them out. Web recurring ach payment authorization you authorize regularly scheduled charges to your checking/savings account.

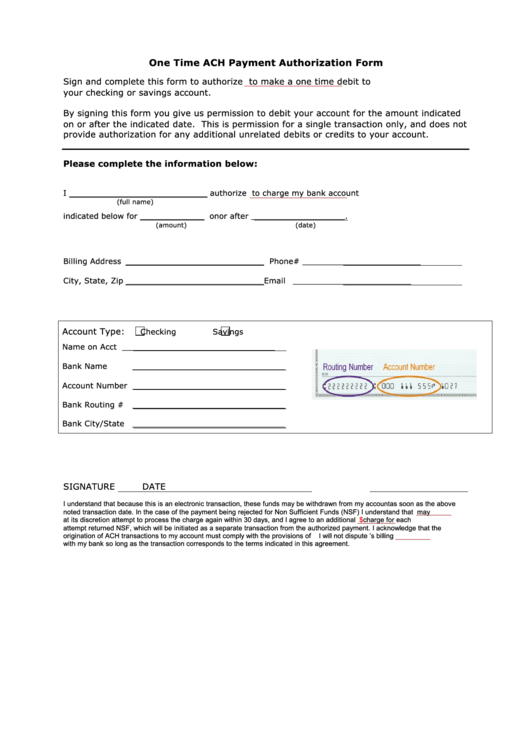

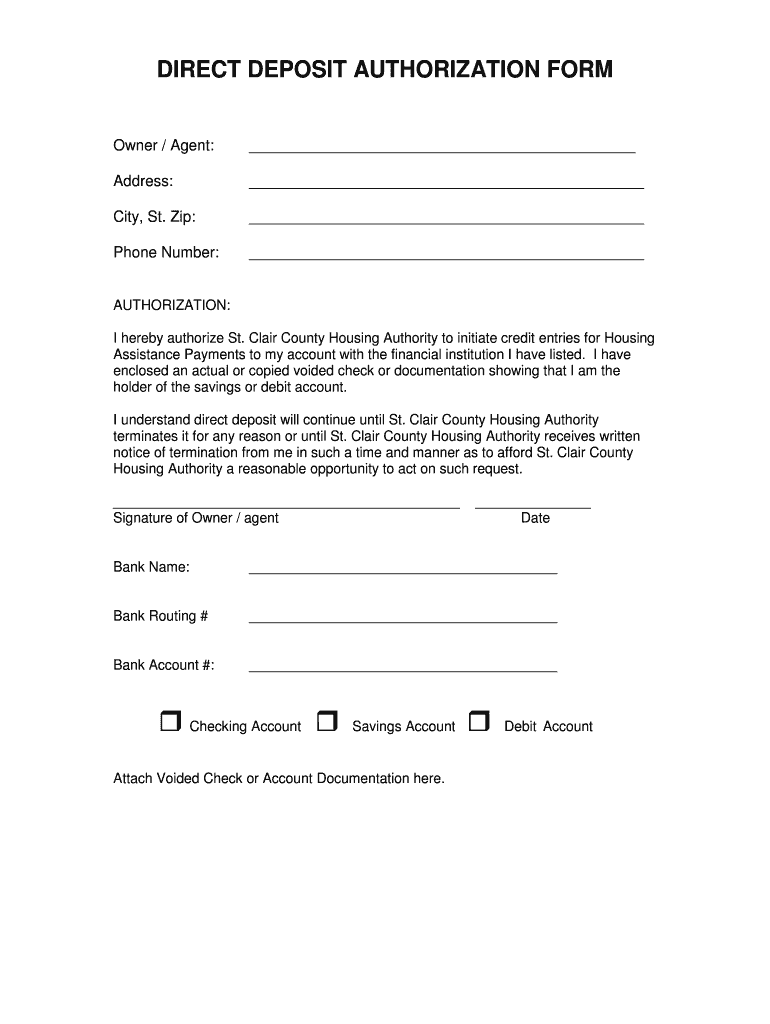

Web updated june 24, 2022. (we) authorize ________________________ (“company”) to electronically debit my (our) account (and, if necessary, electronically credit my (our) account to correct erroneous debits1) as follows: Web accounts payable to electronically deposit payments to the bank account designated above. Web recurring ach payment authorization you authorize regularly scheduled charges to your checking/savings account. Recipients of these payments should bring this information to the attention of their financial institution when presenting this form for completion. Web an ach form is an agreement that outlines payment terms between you and your customers for ach payments. A one (1) time ach payment authorization form is a document provides permission to a merchant or company to deduct a single payment from the account holder’s bank account. Leave these fields blank if you want your customer to fill them out. Checks are negotiable for only 90 days (reduced from 180 days). Web this form is used for automated clearing house (ach) payments to provide payment related information to your financial institution.

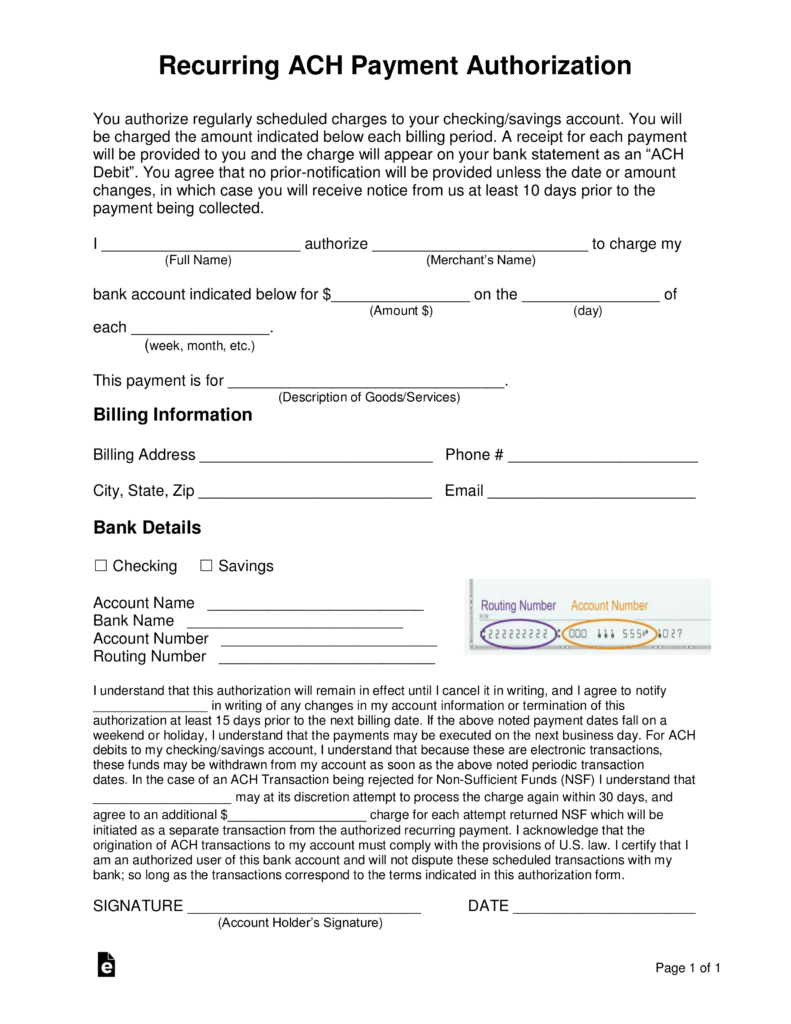

(we) authorize ________________________ (“company”) to electronically debit my (our) account (and, if necessary, electronically credit my (our) account to correct erroneous debits1) as follows: The payment will be charged at the end of each bill’s cycle or on the recurring dates specified. Recipients of these payments should bring this information to the attention of their financial institution when presenting this form for completion. Checks are negotiable for only 90 days (reduced from 180 days). Web an ach form is an agreement that outlines payment terms between you and your customers for ach payments. Please check one of the following: A recurring ach payment authorization form authorizes a creditor to deduct recurring payments from a client’s bank account. Web recurring ach payment authorization you authorize regularly scheduled charges to your checking/savings account. Recipients of these payments should bring this information to the attention of their financial institution when presenting this form for completion. You will be charged the amount indicated below each billing period.

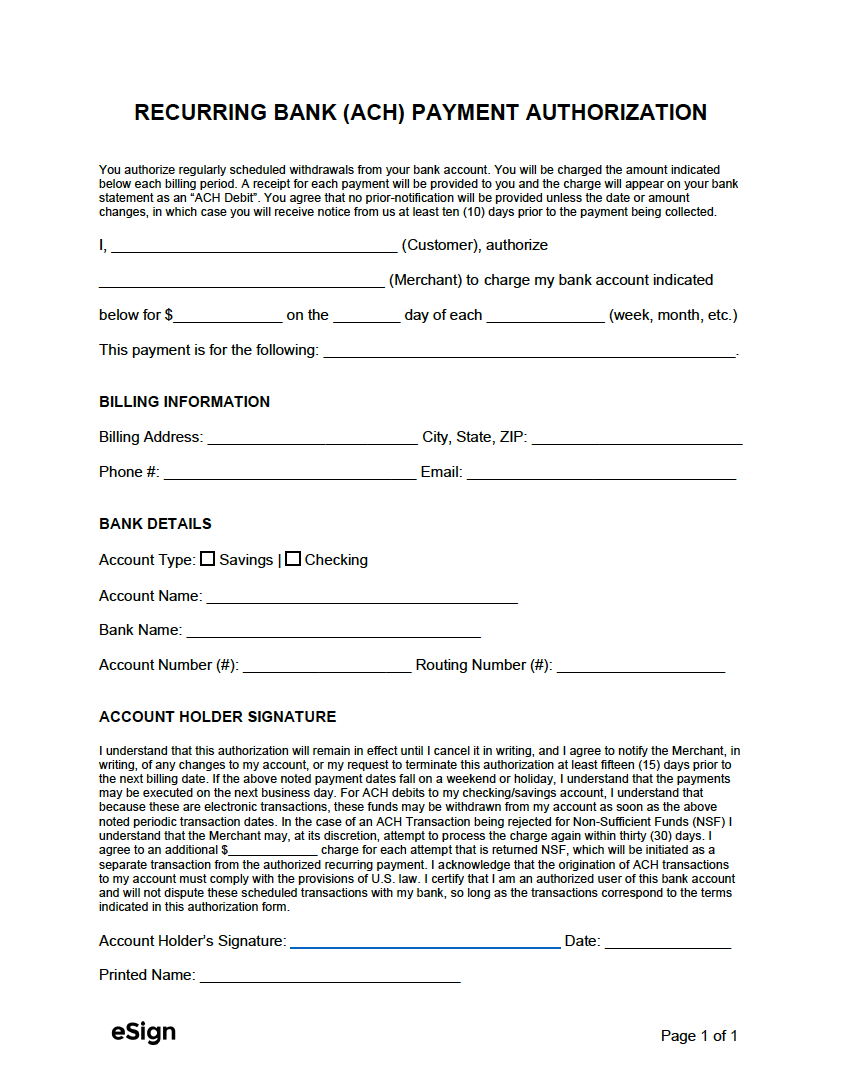

Free Recurring ACH Payment Authorization Form Word PDF eForms

(we) authorize ________________________ (“company”) to electronically debit my (our) account (and, if necessary, electronically credit my (our) account to correct erroneous debits1) as follows: Once the payment has been deducted, the form allowing permission for deduction becomes null and void. You must check with your financial institution to confirm that funds have been deposited. Web updated june 24, 2022. Checks.

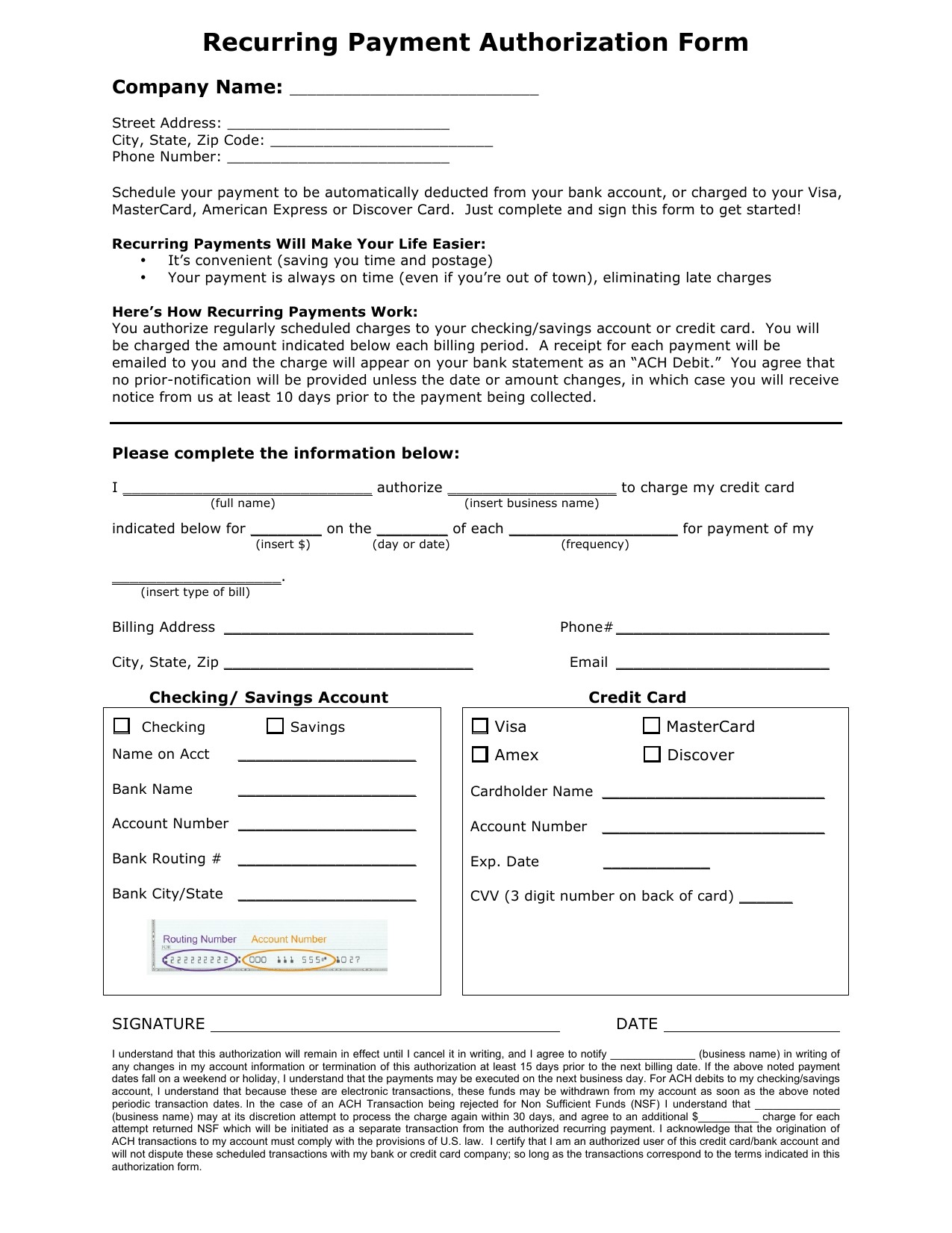

Ach Payment Form Template Templates1 Resume Examples

Recipients of these payments should bring this information to the attention of their financial institution when presenting this form for completion. You will be charged the amount indicated below each billing period. Recipients of these payments should bring this information to the attention of their financial institution when presenting this form for completion. You must check with your financial institution.

Fillable One Time Ach Payment Authorization Form printable pdf download

We offer a free tool to download your own blank ach form template pdf. (we) authorize ________________________ (“company”) to electronically debit my (our) account (and, if necessary, electronically credit my (our) account to correct erroneous debits1) as follows: Once the payment has been deducted, the form allowing permission for deduction becomes null and void. A recurring ach payment authorization form.

Ach Deposit Authorization Form Template Database

Leave these fields blank if you want your customer to fill them out. The payment will be charged at the end of each bill’s cycle or on the recurring dates specified. A recurring ach payment authorization form authorizes a creditor to deduct recurring payments from a client’s bank account. Web recurring ach payment authorization you authorize regularly scheduled charges to.

3 Ach forms Templates FabTemplatez

A one (1) time ach payment authorization form is a document provides permission to a merchant or company to deduct a single payment from the account holder’s bank account. Leave these fields blank if you want your customer to fill them out. The payment will be charged at the end of each bill’s cycle or on the recurring dates specified..

Free Credit Card / ACH Payment Authorization Forms PDF Word

The payment will be charged at the end of each bill’s cycle or on the recurring dates specified. Web accounts payable to electronically deposit payments to the bank account designated above. It is my responsibility to notify usd ap (ap@sandiego.edu or (619) 260‐4732) immediately if i believe there is a discrepancy between the amount deposited to my bank account and.

Owcp Ach Form Fill Online, Printable, Fillable, Blank pdfFiller

Checks are negotiable for only 90 days (reduced from 180 days). Recipients of these payments should bring this information to the attention of their financial institution when presenting this form for completion. Web an ach form is an agreement that outlines payment terms between you and your customers for ach payments. (we) authorize ________________________ (“company”) to electronically debit my (our).

Ach Authorization Form For Business Universal Network

Please check one of the following: Recipients of these payments should bring this information to the attention of their financial institution when presenting this form for completion. A one (1) time ach payment authorization form is a document provides permission to a merchant or company to deduct a single payment from the account holder’s bank account. It is my responsibility.

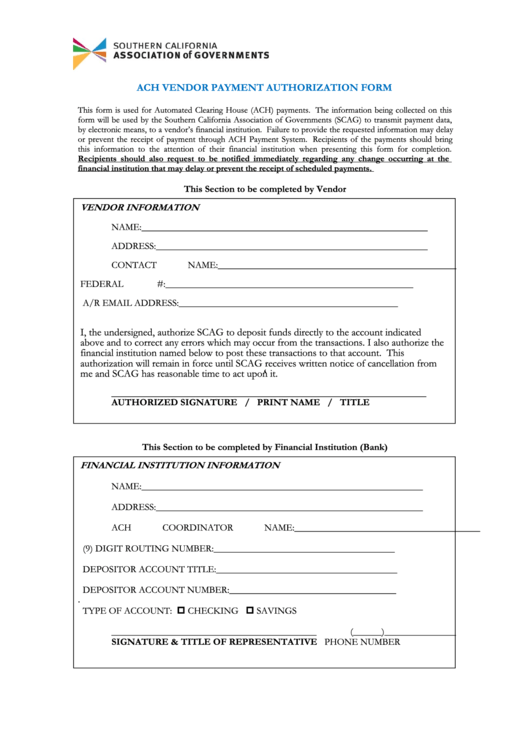

Fillable Ach Vendor Payment Authorization Form Southern California

You must check with your financial institution to confirm that funds have been deposited. Web an ach form is an agreement that outlines payment terms between you and your customers for ach payments. Web direct payment via ach is the transfer of funds from a consumer account for the purpose of making a payment. Please check one of the following:.

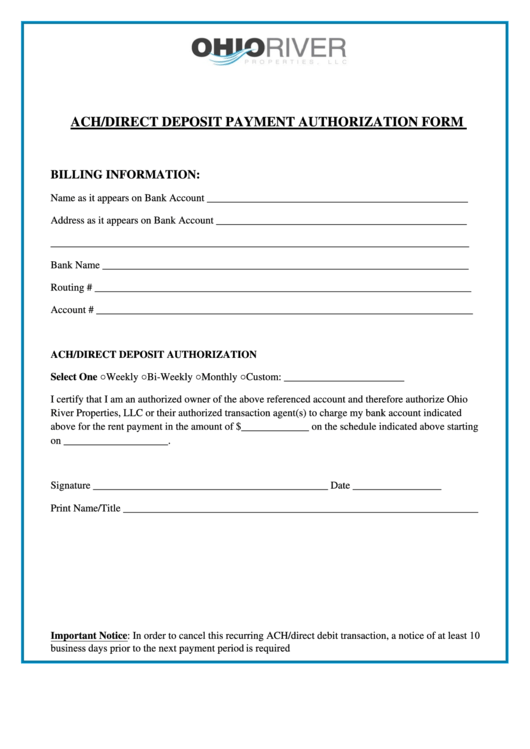

Fillable Ach/direct Deposit Payment Authorization Form Ohio River

Web recurring ach payment authorization you authorize regularly scheduled charges to your checking/savings account. (we) authorize ________________________ (“company”) to electronically debit my (our) account (and, if necessary, electronically credit my (our) account to correct erroneous debits1) as follows: A receipt for each payment will be provided to you and the charge will appear on your bank statement as an “ach.

A One (1) Time Ach Payment Authorization Form Is A Document Provides Permission To A Merchant Or Company To Deduct A Single Payment From The Account Holder’s Bank Account.

Web direct payment via ach is the transfer of funds from a consumer account for the purpose of making a payment. The payment will be charged at the end of each bill’s cycle or on the recurring dates specified. Web an ach form is an agreement that outlines payment terms between you and your customers for ach payments. Please check one of the following:

You Will Be Charged The Amount Indicated Below Each Billing Period.

Leave these fields blank if you want your customer to fill them out. (we) authorize ________________________ (“company”) to electronically debit my (our) account (and, if necessary, electronically credit my (our) account to correct erroneous debits1) as follows: Web this form is used for automated clearing house (ach) payments to provide payment related information to your financial institution. Web accounts payable to electronically deposit payments to the bank account designated above.

We Offer A Free Tool To Download Your Own Blank Ach Form Template Pdf.

Checks are negotiable for only 90 days (reduced from 180 days). Recipients of these payments should bring this information to the attention of their financial institution when presenting this form for completion. Web updated june 24, 2022. Once the payment has been deducted, the form allowing permission for deduction becomes null and void.

You Must Check With Your Financial Institution To Confirm That Funds Have Been Deposited.

A recurring ach payment authorization form authorizes a creditor to deduct recurring payments from a client’s bank account. A receipt for each payment will be provided to you and the charge will appear on your bank statement as an “ach debit”. It is my responsibility to notify usd ap (ap@sandiego.edu or (619) 260‐4732) immediately if i believe there is a discrepancy between the amount deposited to my bank account and the amount of the invoice(s) paid. Recipients of these payments should bring this information to the attention of their financial institution when presenting this form for completion.