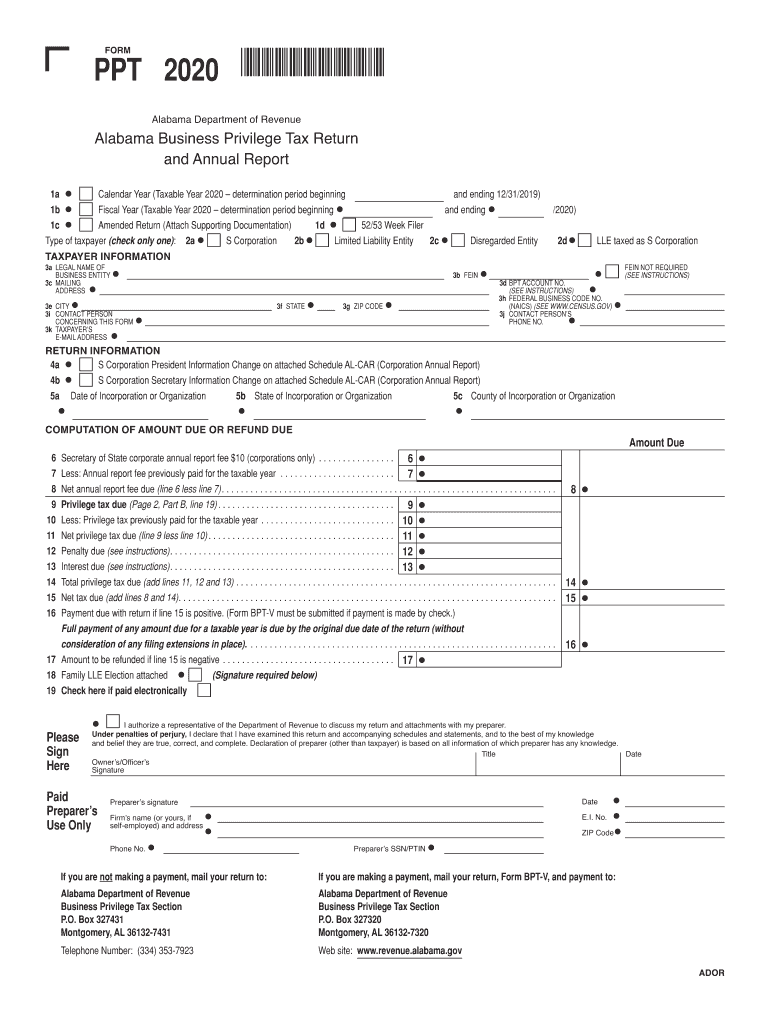

Alabama Form 41 Instructions 2022

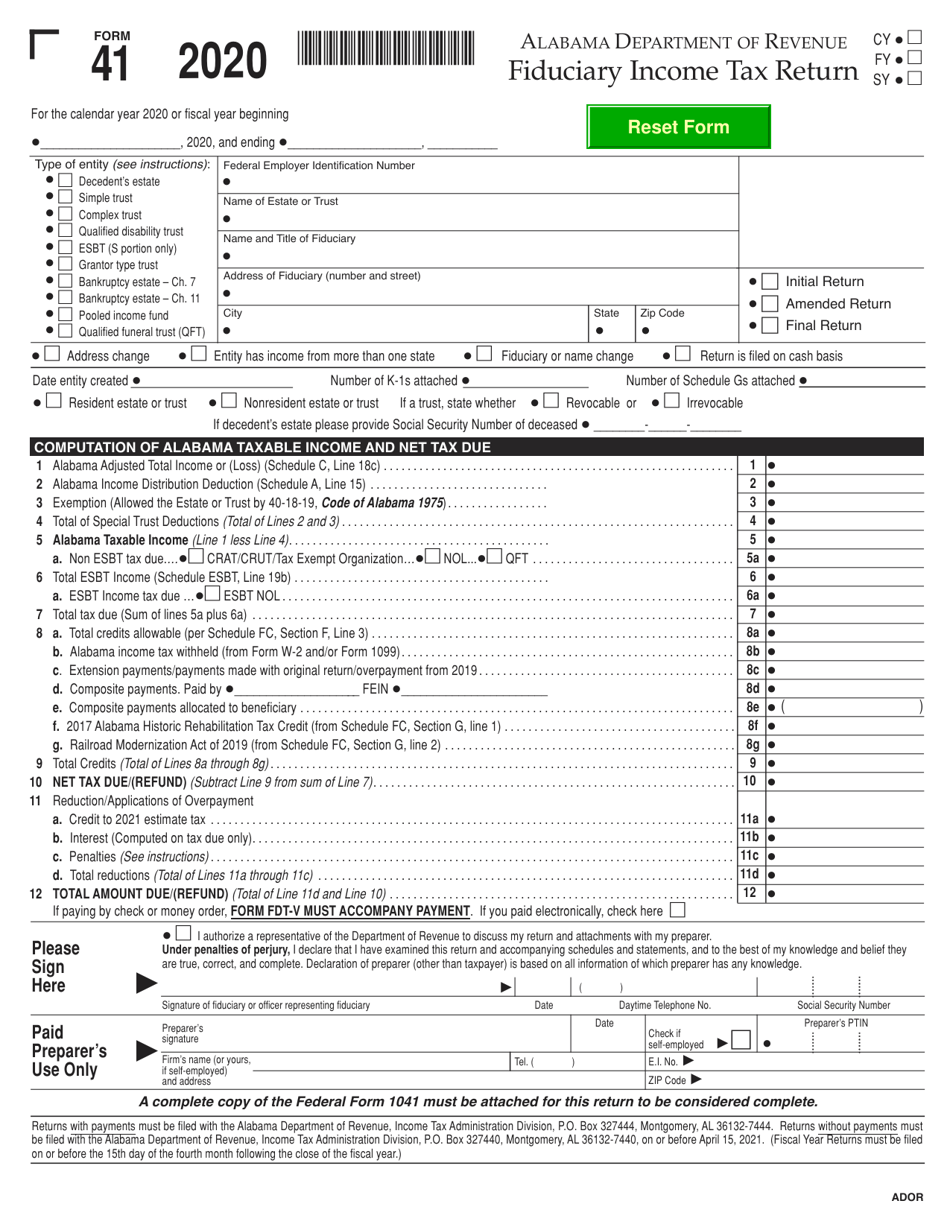

Alabama Form 41 Instructions 2022 - Web form 41 alabama — fiduciary income tax return download this form print this form it appears you don't have a pdf plugin for this browser. Web references to rule 23(e) and rule 66 at rule 41(a)(1) are deleted. You can download or print current. Web we last updated the supplemental income and loss (form 41) in january 2023, so this is the latest version of schedule e, fully updated for tax year 2022. Web to be considered a complete return, the. Federal employer identification number *fiduciary credits must be. There are a few variations of. Please use the link below to. This topic contains notes about the calculation and adjustments for form 41. Web attach to form 41.

Web form 41 alabama — fiduciary income tax return download this form print this form it appears you don't have a pdf plugin for this browser. Child support obligation income statement, affidavit: Complaint for goods sold and delivered. Web regarding allocating federal expenses between two states, if al tax return is filed as the resident trust, then again all source expenses should be reported on form 41. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web attach to form 41. Name(s) as shown on form 41. Please use the link below to. Web follow the simple instructions below: Web to be considered a complete return, the.

Web to be considered a complete return, the. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web 2022 fiduciary income tax 41 instructions grantor’s statement of income, deductions, and other items instructions for grantor trusts grantor trusts, as. Complaint for goods sold and delivered. We will update this page with a new version of the form for 2024 as soon as it is made available. There are a few variations of. Web follow the simple instructions below: Web attach to form 41. Web regarding allocating federal expenses between two states, if al tax return is filed as the resident trust, then again all source expenses should be reported on form 41. Name(s) as shown on form 41.

edesignschemes Alabama Form 65 Instructions

Web regarding allocating federal expenses between two states, if al tax return is filed as the resident trust, then again all source expenses should be reported on form 41. Alabama is a buildup state; Web general instructions tatesattachments.trusts, the federal form 1041, u.s. Name(s) as shown on form 41. This form is used by alabama residents who file an individual.

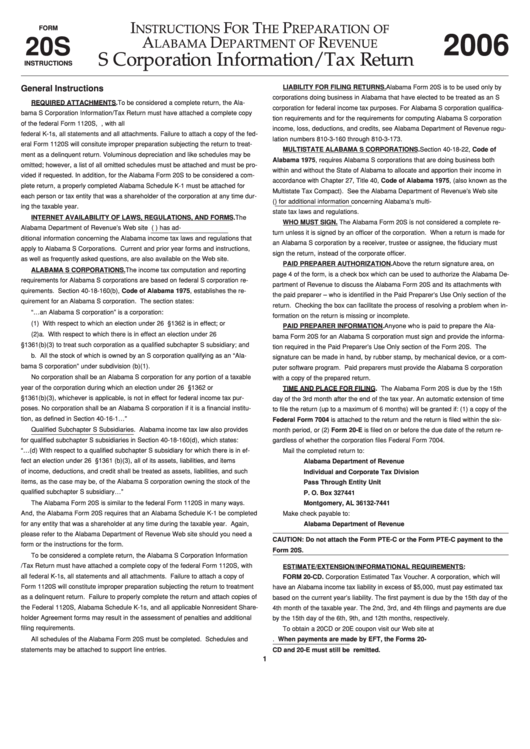

Instructions For Preparing Annual Report Of Project (Form Ar) Alabama

This form is used by alabama residents who file an individual income tax return. Web to be considered a complete return, the. Web we last updated the net profit or loss (form 41) in january 2023, so this is the latest version of schedule d, fully updated for tax year 2022. However, with our preconfigured online templates, things get simpler..

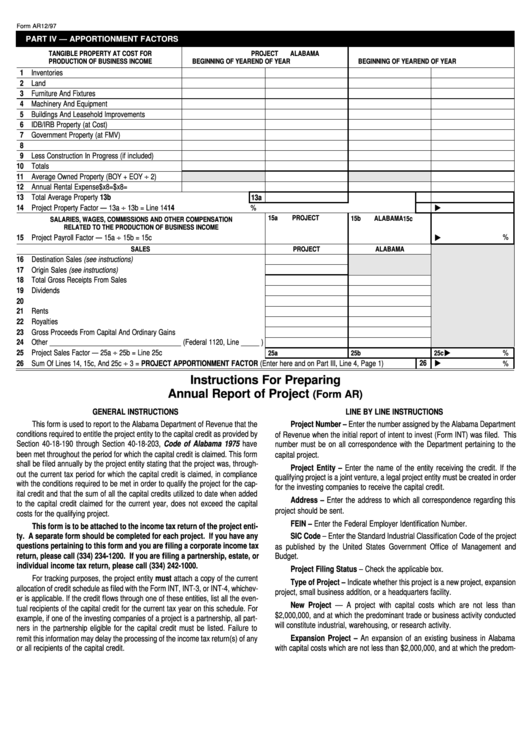

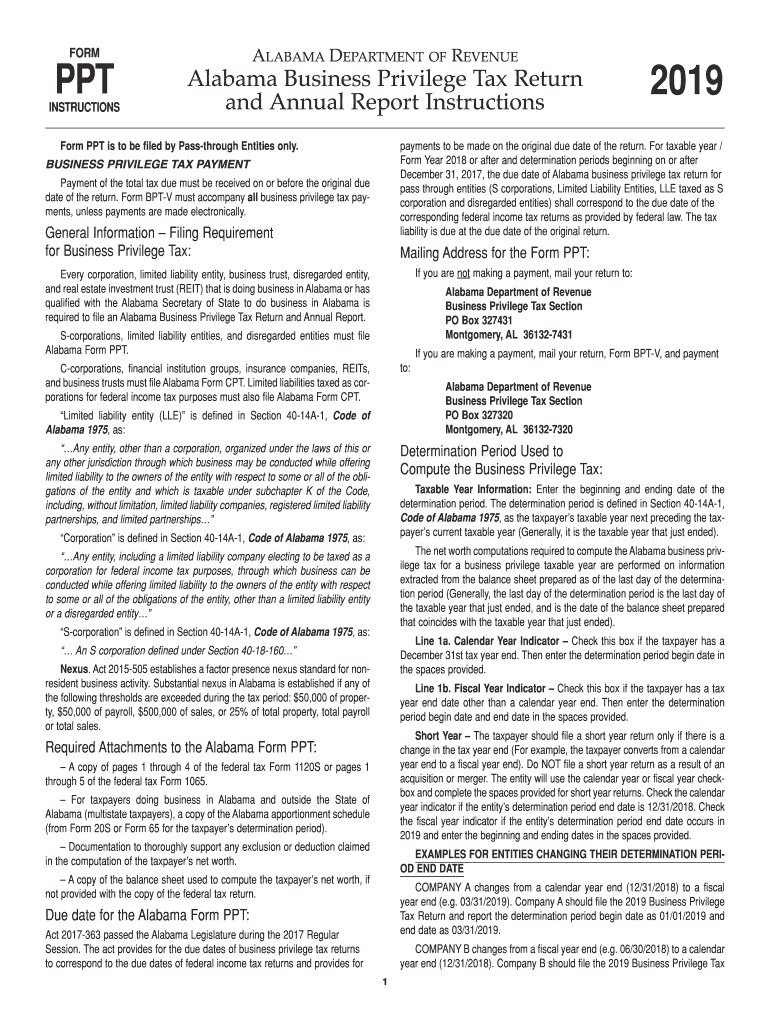

2020 Form AL ADoR PPT Fill Online, Printable, Fillable, Blank pdfFiller

Complaint for goods sold and delivered. We will update this page with a new version of the form for 2024 as soon as it is made available. Child support obligation income statement, affidavit: Web follow the simple instructions below: Name(s) as shown on form 41.

Form 41 Download Fillable PDF or Fill Online Fiduciary Tax

Federal employer identification number *fiduciary credits must be. You can download or print. Complaint for goods sold and delivered. There are a few variations of. Web we last updated the net profit or loss (form 41) in january 2023, so this is the latest version of schedule d, fully updated for tax year 2022.

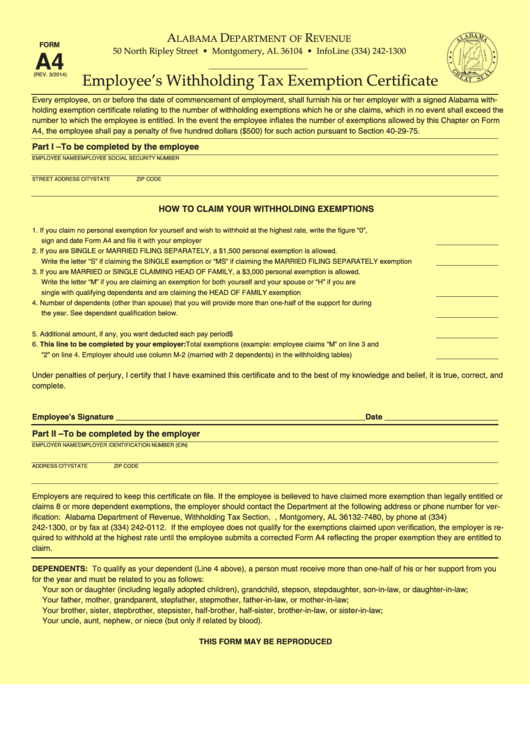

2021 Alabama State Tax A4 2022 W4 Form

Complaint for goods sold and delivered. This topic contains notes about the calculation and adjustments for form 41. Federal employer identification number *fiduciary credits must be. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. However, with our preconfigured online templates, things get simpler.

Alabama Form PPT Fill Out and Sign Printable PDF Template signNow

Web follow the simple instructions below: You can download or print. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web be filed with the alabama department of revenue, income tax administration division , p.o. A statement (schedule c) is used.

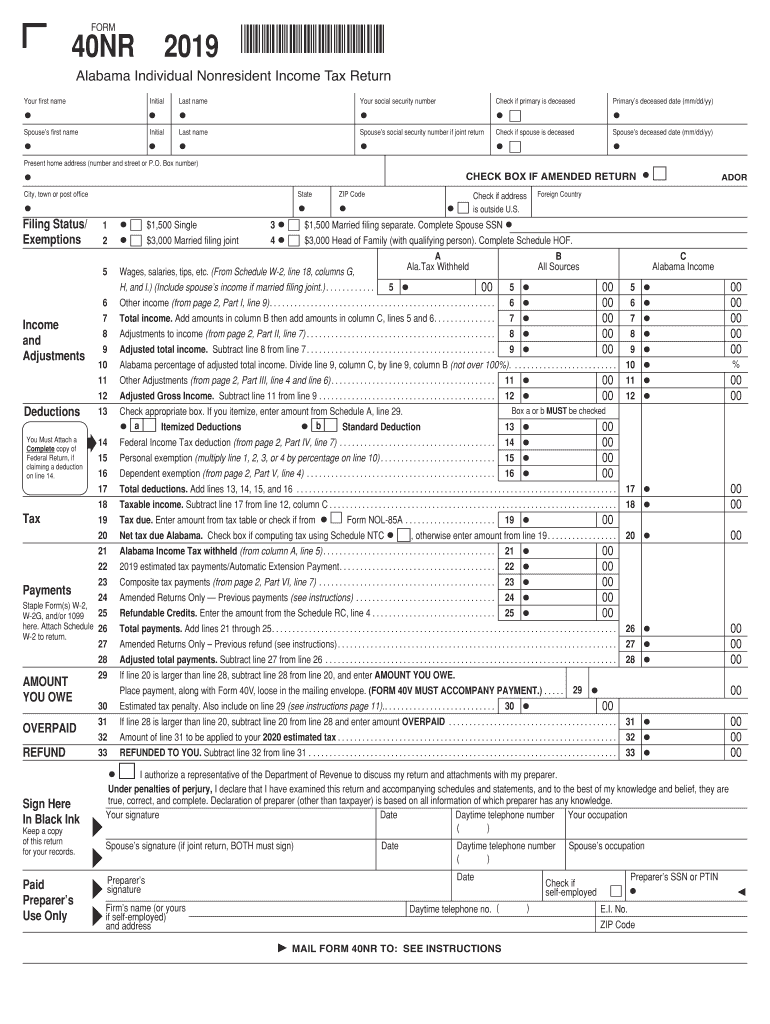

Alabama 40Nr Form Fill Out and Sign Printable PDF Template signNow

Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Federal employer identification number *fiduciary credits must be. Web we last updated the net profit or loss (form 41) in january 2023, so this is the latest version of schedule d, fully updated for tax year 2022. Name(s) as shown on form.

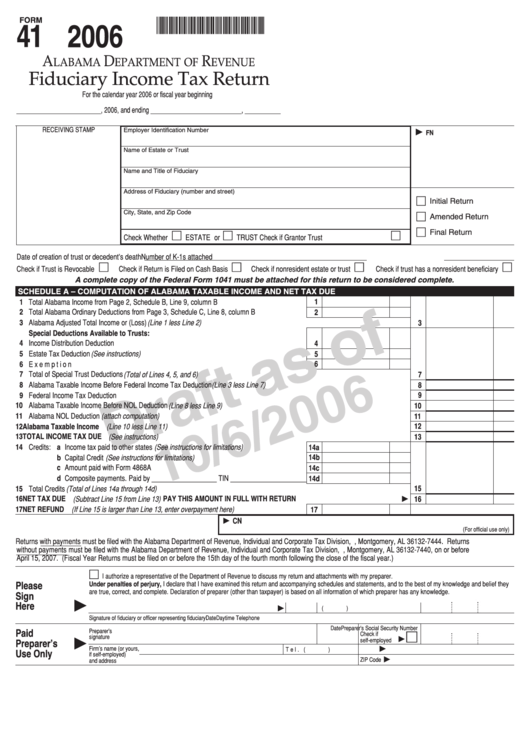

Form 41 Draft Fiduciary Tax ReturnAlabama Department Of

Please use the link below to. However, with our preconfigured online templates, things get simpler. Complaint for goods sold and delivered. Web we last updated the net profit or loss (form 41) in january 2023, so this is the latest version of schedule d, fully updated for tax year 2022. Web alabama form 41.

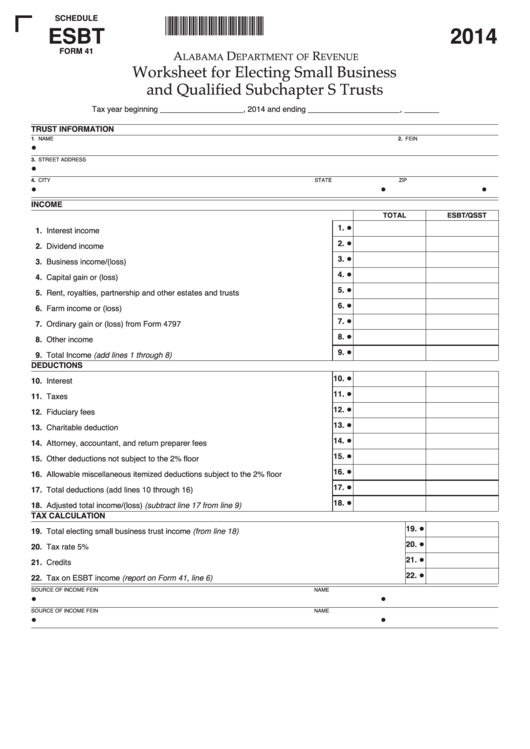

Fillable Schedule Esbt (Form 41) Alabama Worksheet For Electing Small

Web form 41 alabama — fiduciary income tax return download this form print this form it appears you don't have a pdf plugin for this browser. Web references to rule 23(e) and rule 66 at rule 41(a)(1) are deleted. This form is used by alabama residents who file an individual income tax return. Federal employer identification number *fiduciary credits must.

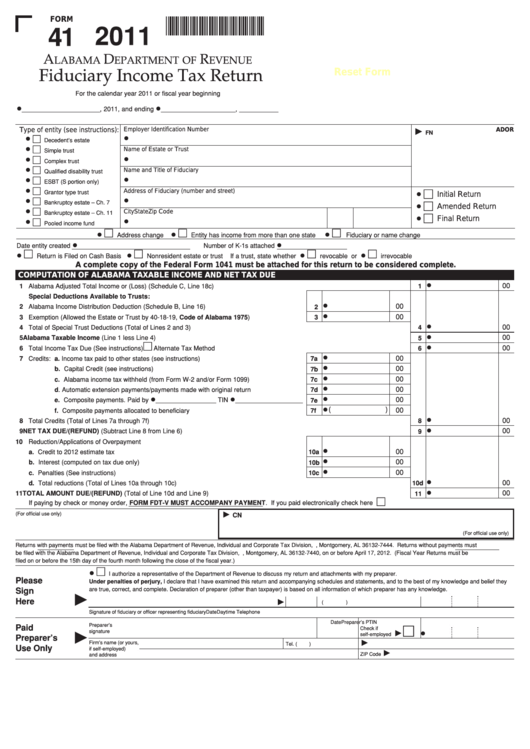

Fillable Form 41 Alabama Fiduciary Tax Return 2011 printable

Web general instructions tatesattachments.trusts, the federal form 1041, u.s. Federal employer identification number *fiduciary credits must be. Web follow the simple instructions below: We will update this page with a new version of the form for 2024 as soon as it is made available. Web alabama form 41.

Complaint On An Open Account.

Complaint for goods sold and delivered. Web form 41 alabama — fiduciary income tax return download this form print this form it appears you don't have a pdf plugin for this browser. There are a few variations of. Web we last updated the net profit or loss (form 41) in january 2023, so this is the latest version of schedule d, fully updated for tax year 2022.

A Statement (Schedule C) Is Used.

We will update this page with a new version of the form for 2024 as soon as it is made available. Web we last updated the supplemental income and loss (form 41) in january 2023, so this is the latest version of schedule e, fully updated for tax year 2022. Web references to rule 23(e) and rule 66 at rule 41(a)(1) are deleted. Web this form is for income earned in tax year 2022, with tax returns due in april 2023.

Please Use The Link Below To.

Web alabama form 41. Web attach to form 41. Name(s) as shown on form 41. You can download or print current.

Web Be Filed With The Alabama Department Of Revenue, Income Tax Administration Division , P.o.

Web we last updated the fiduciary income tax return in february 2023, so this is the latest version of form 41, fully updated for tax year 2022. Web to be considered a complete return, the. Federal employer identification number *fiduciary credits must be. This form is used by alabama residents who file an individual income tax return.