Allowance For Doubtful Accounts On The Balance Sheet Quizlet

Allowance For Doubtful Accounts On The Balance Sheet Quizlet - If the desired ending balance is $13,000, what adjusting entry should be made? Web the allowance for doubful accounts is debited and accounts receivable is credited. Debit bad debt expense for $13,000, credit allowance. Web allowance for doubtful accounts on the balance sheet: Web the estimation of the allowance for doubtful accounts affects both thevaluation of accounts receivable on the balance sheet and the amount of bad debtexpense recognized on the income statement. All receivables that are expected to be realized in cash within a year are reported. Web on december 31 the allowance account showed a credit balance of $3,000. B) appears under the heading other assets. c) is offset against total current assets. Web the allowance for doubtful accounts is reported as a (n) __________ on the balance sheet. A) increases the cash realizable value of accounts receivable.

A) increases the cash realizable value of accounts receivable. Debit bad debt expense for $13,000, credit allowance. Web on december 31 the allowance account showed a credit balance of $3,000. B) appears under the heading other assets. c) is offset against total current assets. Web the estimation of the allowance for doubtful accounts affects both thevaluation of accounts receivable on the balance sheet and the amount of bad debtexpense recognized on the income statement. Web the allowance for doubtful accounts is reported as a (n) __________ on the balance sheet. All receivables that are expected to be realized in cash within a year are reported. Web the allowance for doubful accounts is debited and accounts receivable is credited. If the desired ending balance is $13,000, what adjusting entry should be made? Web allowance for doubtful accounts on the balance sheet:

Web allowance for doubtful accounts on the balance sheet: All receivables that are expected to be realized in cash within a year are reported. B) appears under the heading other assets. c) is offset against total current assets. Web the allowance for doubtful accounts is reported as a (n) __________ on the balance sheet. Web on december 31 the allowance account showed a credit balance of $3,000. Web the estimation of the allowance for doubtful accounts affects both thevaluation of accounts receivable on the balance sheet and the amount of bad debtexpense recognized on the income statement. Debit bad debt expense for $13,000, credit allowance. If the desired ending balance is $13,000, what adjusting entry should be made? Web the allowance for doubful accounts is debited and accounts receivable is credited. A) increases the cash realizable value of accounts receivable.

What is an example of an allowance? Leia aqui What are five allowances

B) appears under the heading other assets. c) is offset against total current assets. If the desired ending balance is $13,000, what adjusting entry should be made? Web allowance for doubtful accounts on the balance sheet: All receivables that are expected to be realized in cash within a year are reported. A) increases the cash realizable value of accounts receivable.

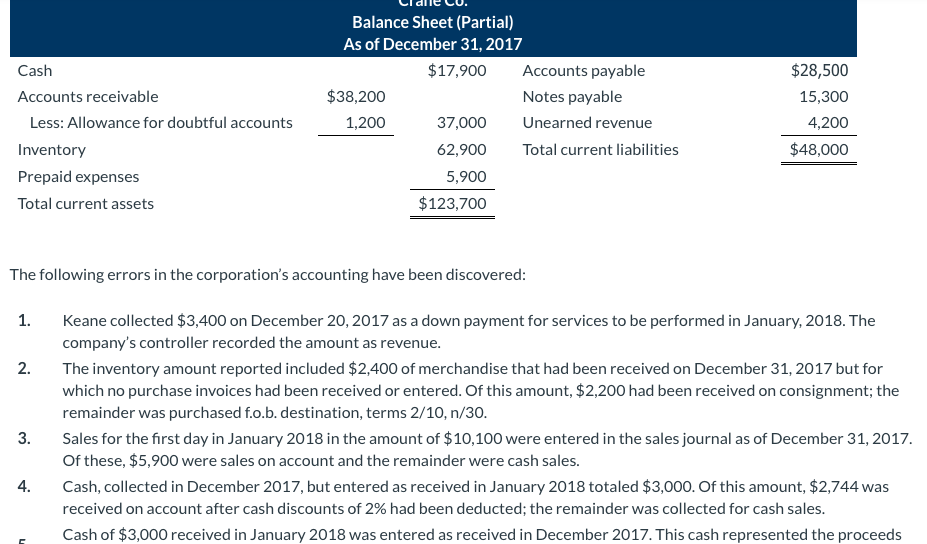

Solved 1. Estimate the balance of the Allowance for Doubtful

Web allowance for doubtful accounts on the balance sheet: All receivables that are expected to be realized in cash within a year are reported. Web the allowance for doubtful accounts is reported as a (n) __________ on the balance sheet. Debit bad debt expense for $13,000, credit allowance. B) appears under the heading other assets. c) is offset against total.

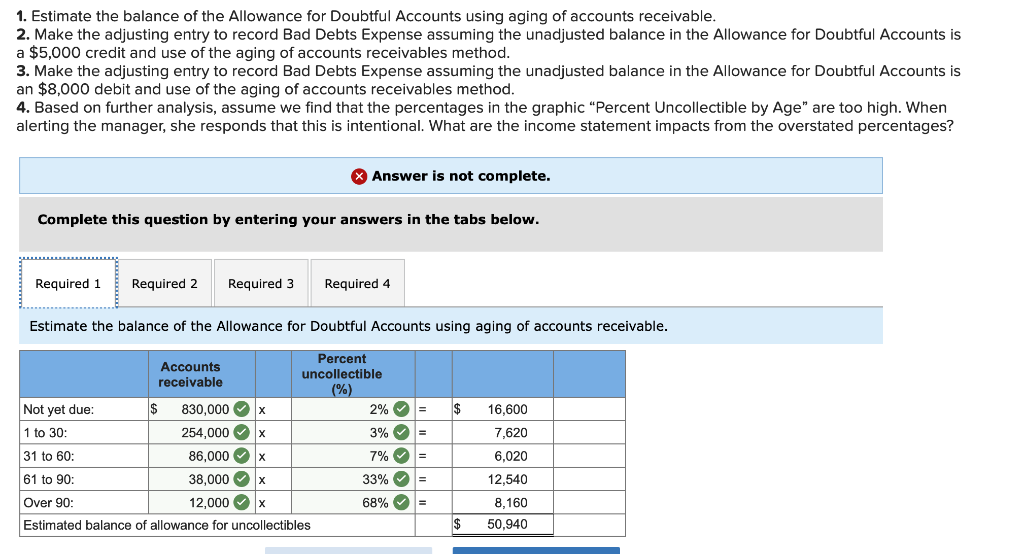

Allowance for Doubtful Accounts Accounting Corner

Web the allowance for doubtful accounts is reported as a (n) __________ on the balance sheet. Web on december 31 the allowance account showed a credit balance of $3,000. Web the allowance for doubful accounts is debited and accounts receivable is credited. A) increases the cash realizable value of accounts receivable. B) appears under the heading other assets. c) is.

Allowance for Doubtful Accounts Personal Accounting

Web the estimation of the allowance for doubtful accounts affects both thevaluation of accounts receivable on the balance sheet and the amount of bad debtexpense recognized on the income statement. B) appears under the heading other assets. c) is offset against total current assets. Web allowance for doubtful accounts on the balance sheet: Web the allowance for doubful accounts is.

PPT Chapter 7 Accounts Receivable and Notes Receivable PowerPoint

Web the allowance for doubtful accounts is reported as a (n) __________ on the balance sheet. Web the allowance for doubful accounts is debited and accounts receivable is credited. If the desired ending balance is $13,000, what adjusting entry should be made? All receivables that are expected to be realized in cash within a year are reported. A) increases the.

Allowance for Doubtful Accounts Methods of Accounting for

Debit bad debt expense for $13,000, credit allowance. Web allowance for doubtful accounts on the balance sheet: B) appears under the heading other assets. c) is offset against total current assets. Web on december 31 the allowance account showed a credit balance of $3,000. A) increases the cash realizable value of accounts receivable.

Allowance for Doubtful Accounts Definition + Examples

Debit bad debt expense for $13,000, credit allowance. If the desired ending balance is $13,000, what adjusting entry should be made? Web allowance for doubtful accounts on the balance sheet: A) increases the cash realizable value of accounts receivable. Web the allowance for doubful accounts is debited and accounts receivable is credited.

Allowance for Doubtful Accounts Overview and Examples Hourly, Inc.

A) increases the cash realizable value of accounts receivable. All receivables that are expected to be realized in cash within a year are reported. Web the allowance for doubtful accounts is reported as a (n) __________ on the balance sheet. Web on december 31 the allowance account showed a credit balance of $3,000. If the desired ending balance is $13,000,.

How to Calculate and Use the Allowance for Doubtful Accounts

If the desired ending balance is $13,000, what adjusting entry should be made? Debit bad debt expense for $13,000, credit allowance. A) increases the cash realizable value of accounts receivable. Web the allowance for doubtful accounts is reported as a (n) __________ on the balance sheet. B) appears under the heading other assets. c) is offset against total current assets.

Cash Accounts receivable Less Allowance for doubtful

Web on december 31 the allowance account showed a credit balance of $3,000. Web the allowance for doubful accounts is debited and accounts receivable is credited. Debit bad debt expense for $13,000, credit allowance. Web allowance for doubtful accounts on the balance sheet: All receivables that are expected to be realized in cash within a year are reported.

Web On December 31 The Allowance Account Showed A Credit Balance Of $3,000.

A) increases the cash realizable value of accounts receivable. If the desired ending balance is $13,000, what adjusting entry should be made? B) appears under the heading other assets. c) is offset against total current assets. All receivables that are expected to be realized in cash within a year are reported.

Web The Allowance For Doubtful Accounts Is Reported As A (N) __________ On The Balance Sheet.

Web allowance for doubtful accounts on the balance sheet: Web the estimation of the allowance for doubtful accounts affects both thevaluation of accounts receivable on the balance sheet and the amount of bad debtexpense recognized on the income statement. Web the allowance for doubful accounts is debited and accounts receivable is credited. Debit bad debt expense for $13,000, credit allowance.

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)