Amended Form 1120S

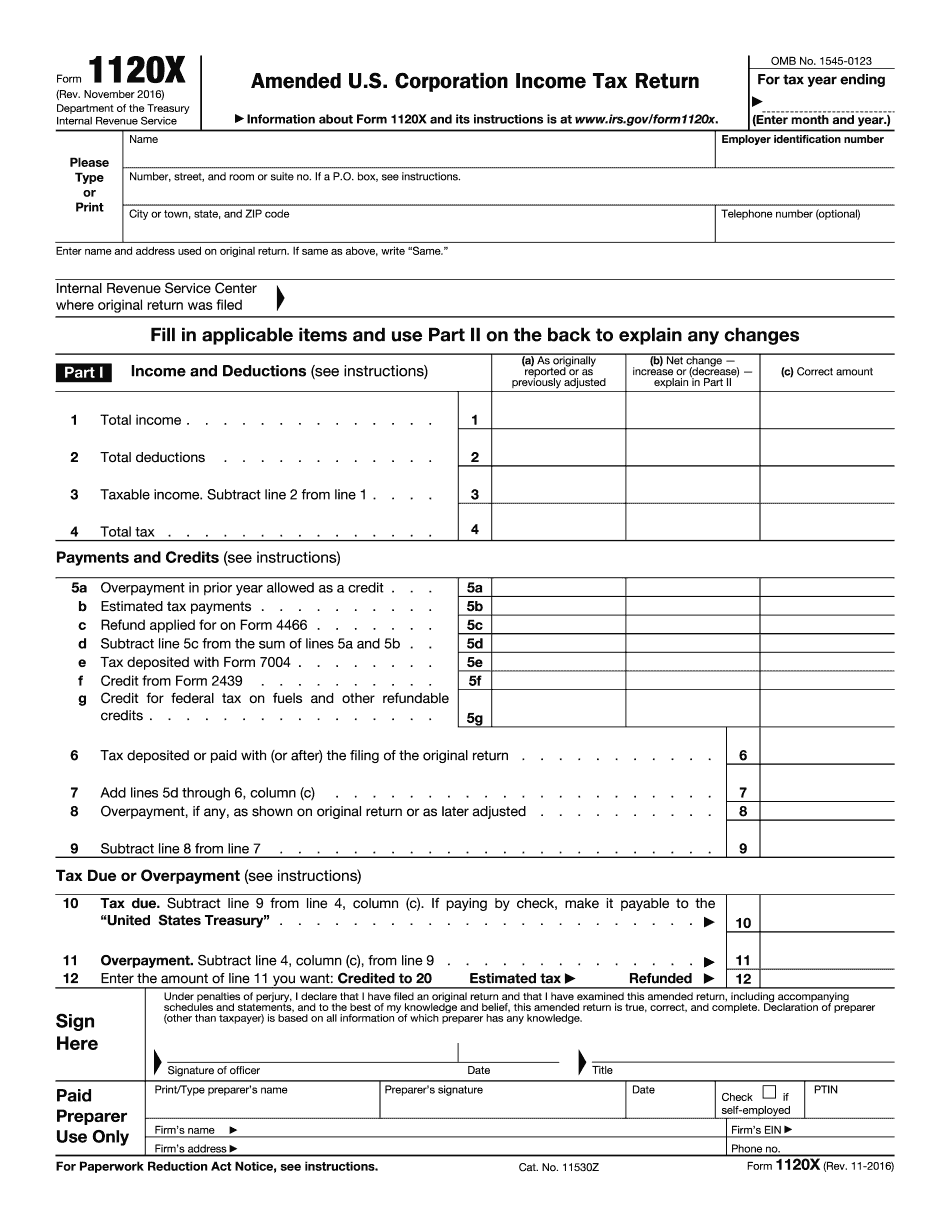

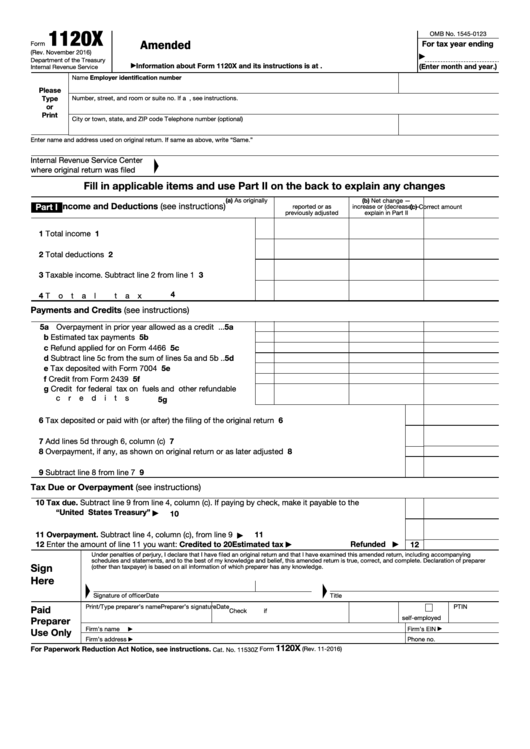

Amended Form 1120S - Download or email irs 1120 & more fillable forms, register and subscribe now! Web create a copy of the return. So, what is a form 1120 amended return? Income tax return for an s corporation, for use in tax years beginning in 2020, as. Web reply bookmark icon patriciav expert alumni no, you should not reduce wages, as the employee retention tax credit (ertc) reduces payroll tax payments (not. Scroll to the amended return (form 1120s). An amended form 1120, also called form 1120x, comes into play when you make a. Income tax return for an s corporation department of the treasury internal revenue service do not file this form unless the corporation has. Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick. Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s return with the revised version.

Web when you print the return, there will be an x in the amended return check box in the heading indicating that the return has been amended. Go to screen 3.1, misc./other info./amended. Add the word amended after the file name. Web amended and superseding corporate returns. Web create a copy of the return. Income tax return for an s corporation, for use in tax years beginning in 2020, as. When you check this box, the program also checks the. Income tax return for an s corporation is amended by checking the amended return box located at the top of. Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick. Web february 4, 2021 · 5 minute read.

While in the original return, click file > save a s. So, what is a form 1120 amended return? Ad fill, sign, email irs 1120 & more fillable forms, register and subscribe now! Web form 1120 amended return. When you check this box, the program also checks the. Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s return with the revised version. Download or email irs 1120 & more fillable forms, register and subscribe now! Make the necessary changes to the return. Income tax return for an s corporation is amended by checking the amended return box located at the top of page 1. Web reply bookmark icon patriciav expert alumni no, you should not reduce wages, as the employee retention tax credit (ertc) reduces payroll tax payments (not.

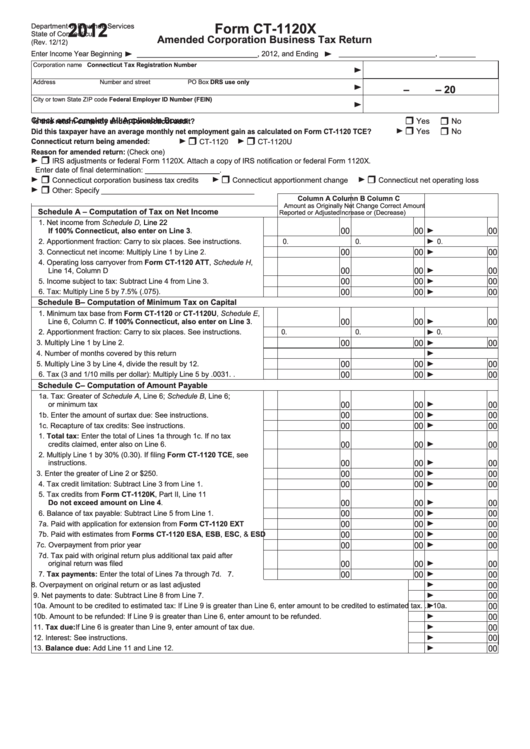

Form Ct1120x Amended Corporation Business Tax Return 2012

Income tax return for an s corporation is amended by checking the amended return box located at the top of. Add the word amended after the file name. Make the necessary changes to the return. Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s return with the revised version..

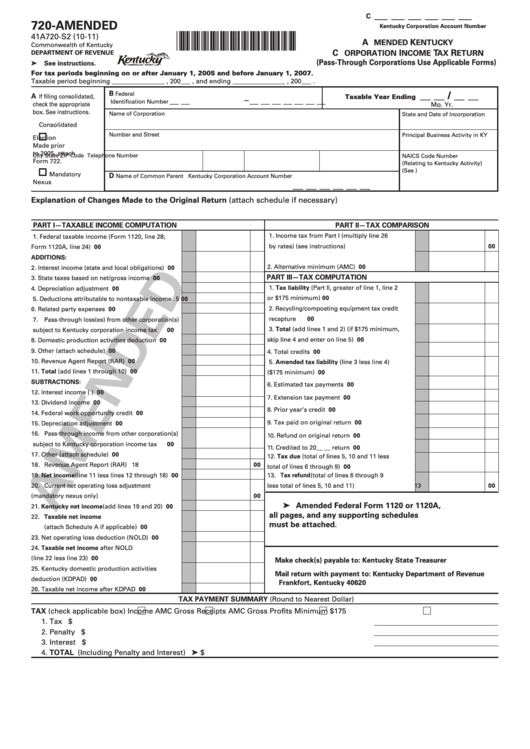

Form 720Amended Amended Kentucky Corporation Tax Return

When you check this box, the program also checks the. So, what is a form 1120 amended return? Go through and make the changes. Ad fill, sign, email irs 1120 & more fillable forms, register and subscribe now! Income tax return for an s corporation, for use in tax years beginning in 2020, as.

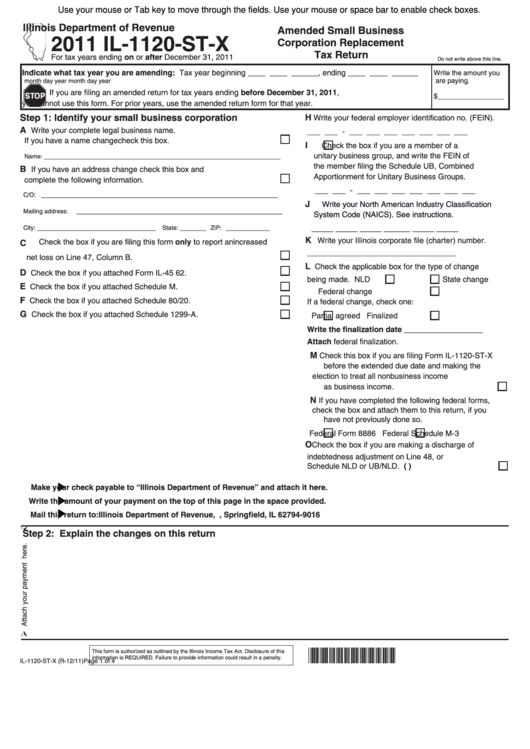

Fillable Form Il1120StX Amended Small Business Corporation

To access this checkbox through the. Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. Go through and make the changes. Corporation income tax return, including recent updates, related forms, and instructions.

Irs Amended Form Status Universal Network

Scroll to the amended return (form 1120s). Go through and make the changes. Web form 1120 amended return. Income tax return for an s corporation is amended by checking the amended return box located at the top of. An amended form 1120, also called form 1120x, comes into play when you make a.

Form 1120X Amended U.S. Corporation Tax Return (2012) Free

Ad fill, sign, email irs 1120 & more fillable forms, register and subscribe now! Web form 1120 amended return. Make the necessary changes to the return. While in the original return, click file > save a s. An amended form 1120, also called form 1120x, comes into play when you make a.

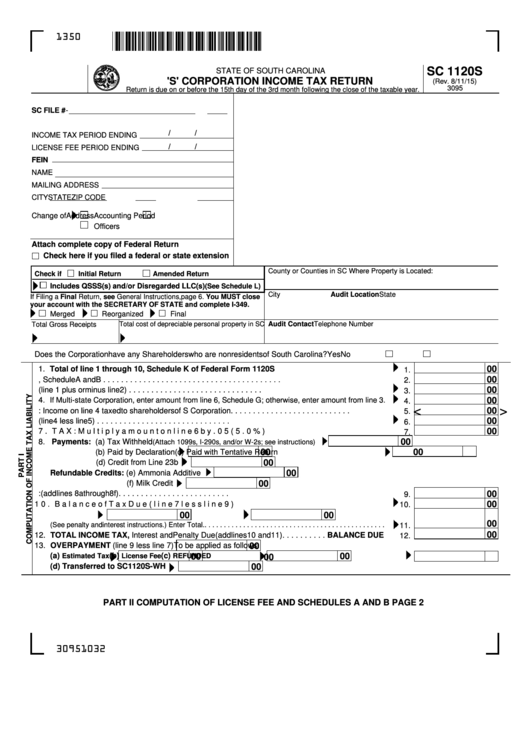

Form Sc 1120s 'S' Corporation Tax Return printable pdf download

Income tax return for an s corporation, for use in tax years beginning in 2020, as. Web create a copy of the return. So, what is a form 1120 amended return? Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick. Web.

amended return explanation of changes examples 1120s Fill Online

So, what is a form 1120 amended return? Go through and make the changes. Income tax return for an s corporation, for use in tax years beginning in 2020, as. Add the word amended after the file name. Web when you print the return, there will be an x in the amended return check box in the heading indicating that.

1120s amended return instructions

Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick. To access this checkbox through the. Web amended and superseding corporate returns. So, what is a form 1120 amended return? Web follow these steps to amend an 1120s return.

Fillable Form 1120X Amended U.s. Corporation Tax Return

Web create a copy of the return. Web follow these steps to amend an 1120s return. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Web reply bookmark icon patriciav expert alumni no, you should not reduce wages, as the employee retention tax credit (ertc) reduces payroll tax payments (not. Web a form 1120x.

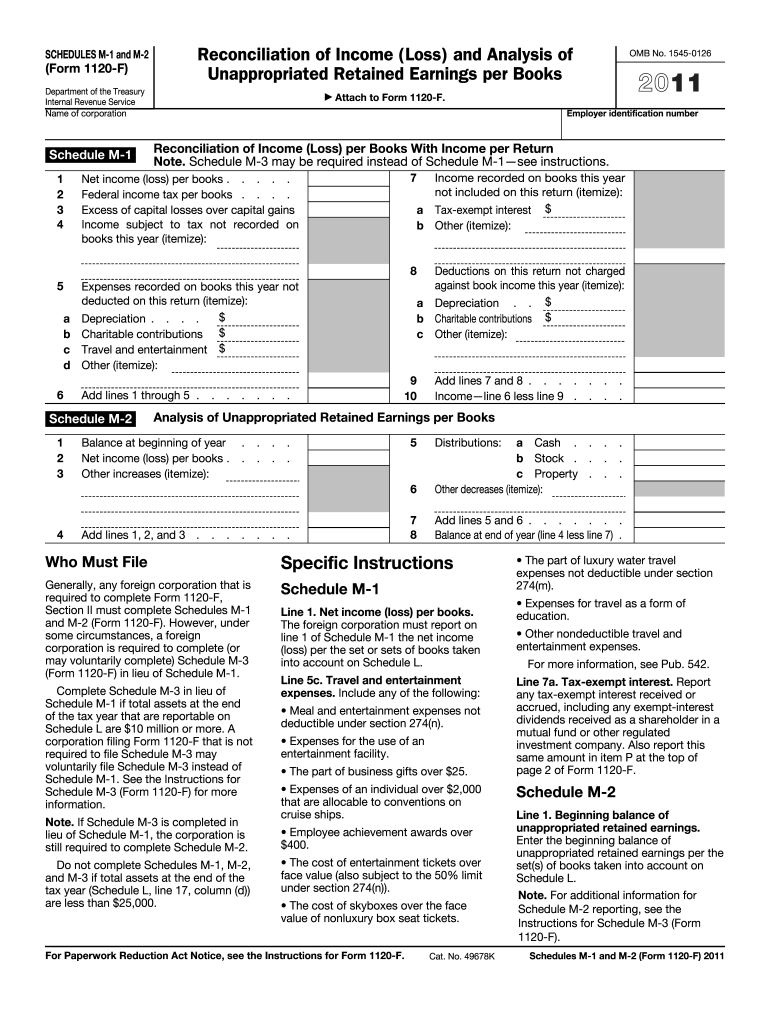

Form 1120 M 2 Fill Out and Sign Printable PDF Template signNow

Web february 4, 2021 · 5 minute read. Corporation income tax return, including recent updates, related forms, and instructions on how to file. So, what is a form 1120 amended return? Web amended and superseding corporate returns. To access this checkbox through the.

Web Form 1120 Amended Return.

So, what is a form 1120 amended return? Web a form 1120x based on a bad debt or worthless security must be filed within 7 years after the due date of the return for the tax year in which the debt or security became worthless. Web when you print the return, there will be an x in the amended return check box in the heading indicating that the return has been amended. Web amended and superseding corporate returns.

While In The Original Return, Click File > Save A S.

Download or email irs 1120 & more fillable forms, register and subscribe now! Income tax return for an s corporation is amended by checking the amended return box located at the top of. Add the word amended after the file name. Income tax return for an s corporation department of the treasury internal revenue service do not file this form unless the corporation has.

An Amended Form 1120, Also Called Form 1120X, Comes Into Play When You Make A.

Web follow these steps to amend an 1120s return. Go through and make the changes. Web reply bookmark icon patriciav expert alumni no, you should not reduce wages, as the employee retention tax credit (ertc) reduces payroll tax payments (not. Web create a copy of the return.

Income Tax Return For An S Corporation, For Use In Tax Years Beginning In 2020, As.

Scroll to the amended return (form 1120s). Web under the families first coronavirus response act (ffcra), as amended, an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick. Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s return with the revised version. When you check this box, the program also checks the.