Are Attorney Fees Deductible On Form 1041

Are Attorney Fees Deductible On Form 1041 - If only a portion is deductible under section 67(e), see instructions. Web these include a deduction for personal representatives' fees or trustees' fees, whichever is applicable, attorneys' fees, accountants' fees, custodial fees, investment advisors' fees,. Prepaid mortgage interest and qualified mortgage. Web level 1 form 1041 fiduciary fees deduction? Web yes, attorney fees are deductible on form 1040, schedule a (itemized deductions). Web what administrative expenses are deductible on form 1041? Deductions for attorney, accountant, and. Web as mentioned above, form 1041 allows for the inclusion of expenses and deductions against the estate’s income. Web line 14—attorney, accountant, and return preparer fees expenses for preparation of fiduciary income tax returns, the decedent's final individual income tax. Web legal expenses for probate are deductible, but they are deductible to the estate on the estate's income tax return (form 1041) if required to file them.

Web as mentioned above, form 1041 allows for the inclusion of expenses and deductions against the estate’s income. In this case the 1041 is required for 2020 and all of the transactions (sales happened then). Web what year are attorney fees deductible on 1041? The irs provides some guidance on what types of attorney fees are deductible on form 1041, the return for estates and trusts. Web legal expenses for probate are deductible, but they are deductible to the estate on the estate's income tax return (form 1041) if required to file them. (the same administrative expenses cannot be deducted on both the 706. Web when filing form 1040 or form 1041 for a decedent, estate, or trust, you must determine how to deduct administration fees. Web the bankruptcy estate is allowed deductions for bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs. If only a portion is deductible under section 67(e), see instructions. Fees paid to attorneys, accountants, and tax preparers.

Deductions for attorney, accountant, and. Web when filing form 1040 or form 1041 for a decedent, estate, or trust, you must determine how to deduct administration fees. Web these include a deduction for personal representatives' fees or trustees' fees, whichever is applicable, attorneys' fees, accountants' fees, custodial fees, investment advisors' fees,. It may not help, as. Web as mentioned above, form 1041 allows for the inclusion of expenses and deductions against the estate’s income. (the same administrative expenses cannot be deducted on both the 706. Fees paid to attorneys, accountants, and tax preparers. Web i usually deduct about 1/3 of attorney fees on the 1041 and 2/3 on the 706 if there is one. Web the bankruptcy estate is allowed deductions for bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs. Web can you deduct all of the attorneys fees on form 1041 even if it is substantially more than the amount of income you are claiming.

When are attorney fees tax deductible On what basis?

Web line 14—attorney, accountant, and return preparer fees expenses for preparation of fiduciary income tax returns, the decedent's final individual income tax. Web legal expenses for probate are deductible, but they are deductible to the estate on the estate's income tax return (form 1041) if required to file them. The irs provides some guidance on what types of attorney fees.

Are Attorney Fees Deductible On Form 1041? AZexplained

On form 1041, you can claim deductions for expenses such as attorney, accountant and return. Web what administrative expenses are deductible on form 1041? Fees paid to attorneys, accountants, and tax preparers. The irs provides some guidance on what types of attorney fees are deductible on form 1041, the return for estates and trusts. My attorney itemized several fees in.

A Lawyer's Blog Jon Michael Probstein, Esq. AWARDING ATTORNEY FEES

Web line 14—attorney, accountant, and return preparer fees expenses for preparation of fiduciary income tax returns, the decedent's final individual income tax. In this case the 1041 is required for 2020 and all of the transactions (sales happened then). Web attorney, accountant, and return preparer fees. Deductions for attorney, accountant, and. If only a portion is deductible under section 67(e),.

How Much Does an DUI / Bankrupcy Lawyer Cost Affordable Payments

This deduction is available for both criminal and civil attorney fees. In this case the 1041 is required for 2020 and all of the transactions (sales happened then). Web these include a deduction for personal representatives' fees or trustees' fees, whichever is applicable, attorneys' fees, accountants' fees, custodial fees, investment advisors' fees,. Web i usually deduct about 1/3 of attorney.

How Much Does A Lawyer Cost?

This deduction is available for both criminal and civil attorney fees. Web you do not deduct estate taxes on form 1041. Web yes, attorney fees are deductible on form 1040, schedule a (itemized deductions). Deductions for attorney, accountant, and. Web can you deduct all of the attorneys fees on form 1041 even if it is substantially more than the amount.

Court Rules That Property Owner, Not Towing Company, Liable For 6,000

Web yes, attorney fees are deductible on form 1040, schedule a (itemized deductions). It may not help, as. Web when filing form 1040 or form 1041 for a decedent, estate, or trust, you must determine how to deduct administration fees. Web you are required to file a fiduciary return (using irs form 1041) about 11 months after the month of.

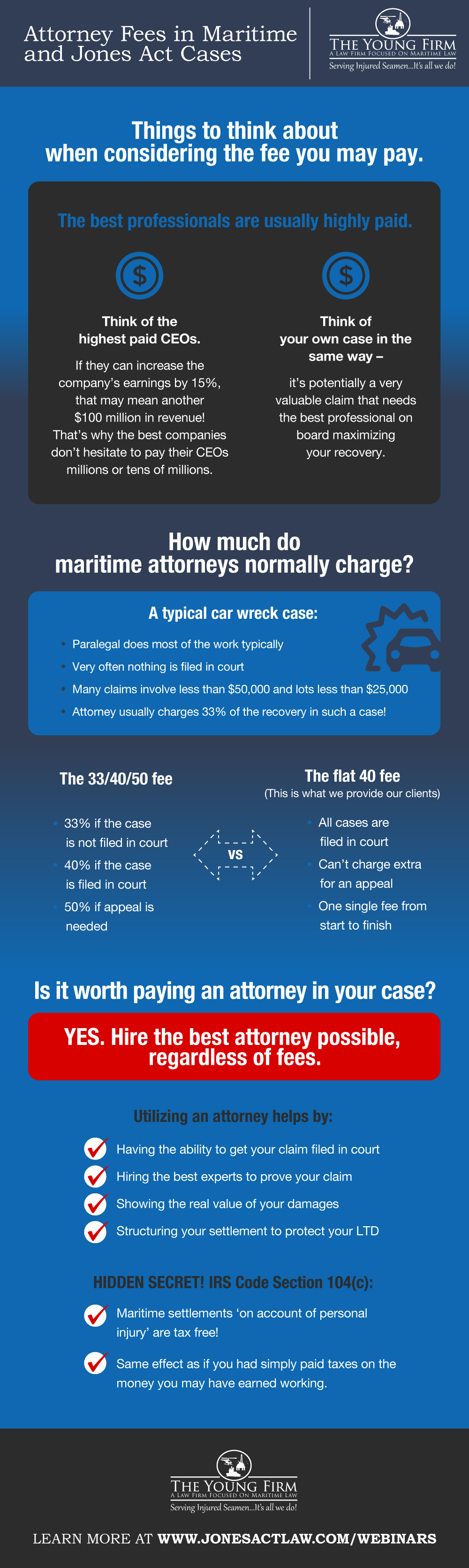

Attorney Fees in Maritime Cases The Young Firm

Fees paid to attorneys, accountants, and tax preparers. (the same administrative expenses cannot be deducted on both the 706. Web level 1 form 1041 fiduciary fees deduction? If only a portion is deductible under section 67(e), see instructions. Web you do not deduct estate taxes on form 1041.

Legal Fees for Divorce Renken Law Firm

It may not help, as. (the same administrative expenses cannot be deducted on both the 706. If only a portion is deductible under section 67(e), see instructions. Web line 14—attorney, accountant, and return preparer fees expenses for preparation of fiduciary income tax returns, the decedent's final individual income tax. Web you do not deduct estate taxes on form 1041.

Are Divorce Lawyer Fees Deductible The Renken Law Firm

Web level 1 form 1041 fiduciary fees deduction? Fees paid to attorneys, accountants, and tax preparers. Deductions for attorney, accountant, and. (the same administrative expenses cannot be deducted on both the 706. Web attorney, accountant, and return preparer fees.

Attorney Fees, First Step in Preventing Prosecutorial Misconduct

Web yes, attorney fees are deductible on form 1040, schedule a (itemized deductions). Web you are required to file a fiduciary return (using irs form 1041) about 11 months after the month of death if the estate generated $600 or more of gross income during the tax year. These can include charitable deductions,. Web as mentioned above, form 1041 allows.

Web I Usually Deduct About 1/3 Of Attorney Fees On The 1041 And 2/3 On The 706 If There Is One.

Web when filing form 1040 or form 1041 for a decedent, estate, or trust, you must determine how to deduct administration fees. In this case the 1041 is required for 2020 and all of the transactions (sales happened then). Fees paid to attorneys, accountants, and tax preparers. Web the bankruptcy estate is allowed deductions for bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs.

My Attorney Itemized Several Fees In Addition To His Fees That He Paid.

This deduction is available for both criminal and civil attorney fees. Web executor and trustee fees. Web what year are attorney fees deductible on 1041? Web level 1 form 1041 fiduciary fees deduction?

Web What Administrative Expenses Are Deductible On Form 1041?

Web you do not deduct estate taxes on form 1041. Web attorney, accountant, and return preparer fees. Web as mentioned above, form 1041 allows for the inclusion of expenses and deductions against the estate’s income. I'm filling out a 1041 form.

It May Not Help, As.

(the same administrative expenses cannot be deducted on both the 706. Deductions for attorney, accountant, and. Web you are required to file a fiduciary return (using irs form 1041) about 11 months after the month of death if the estate generated $600 or more of gross income during the tax year. If only a portion is deductible under section 67(e), see instructions.