Arizona Form 165 Instructions 2022

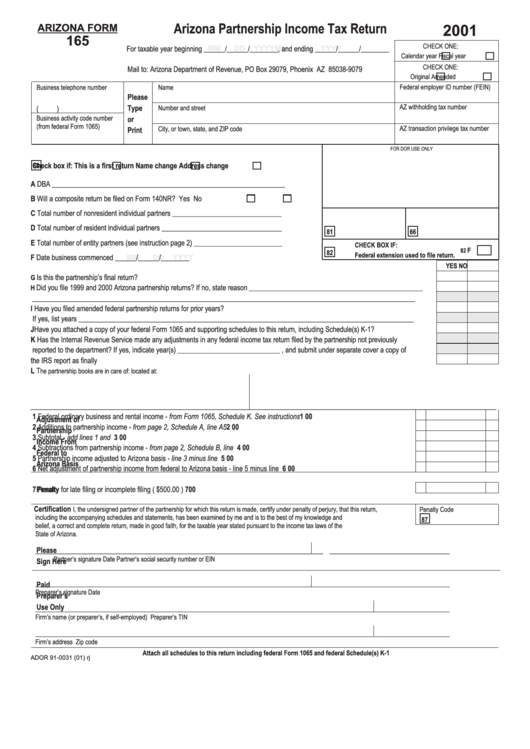

Arizona Form 165 Instructions 2022 - Business telephone number name check one: (with area code) original amended Application for automatic extension of time to file corporation, partnership, and exempt organization returns: Web general instructions who must use arizona form 165 file arizona form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every foreign partnership (syndicate, pool, etc.) required to file an arizona partnership income tax return. File arizona form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every foreign partnership (syndicate, pool, etc.) required to file an arizona partnership income tax return. Web 165 arizona partnership income tax return 2022 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. Arizona corporate or partnership income tax payment voucher For the calendar year 2022 or fiscal year beginning m m d d 2 0 2 2 and ending m m d d 2 0 y y. Web form year form instructions publish date; Who must use arizona form 165 from its operation as an nmmd.

(with area code) original amended Web form year form instructions publish date; Arizona corporate or partnership income tax payment voucher Application for automatic extension of time to file corporation, partnership, and exempt organization returns: File arizona form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every foreign partnership (syndicate, pool, etc.) required to file an arizona partnership income tax return. Business telephone number name check one: Web 165 arizona partnership income tax return 2022 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. For the calendar year 2022 or fiscal year beginning m m d d 2 0 2 2 and ending m m d d 2 0 y y. Who must use arizona form 165 from its operation as an nmmd. Web general instructions who must use arizona form 165 file arizona form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every foreign partnership (syndicate, pool, etc.) required to file an arizona partnership income tax return.

Web 165 arizona partnership income tax return 2022 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. For the calendar year 2022 or fiscal year beginning m m d d 2 0 2 2 and ending m m d d 2 0 y y. Business telephone number name check one: File arizona form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every foreign partnership (syndicate, pool, etc.) required to file an arizona partnership income tax return. Arizona corporate or partnership income tax payment voucher Who must use arizona form 165 from its operation as an nmmd. Web general instructions who must use arizona form 165 file arizona form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every foreign partnership (syndicate, pool, etc.) required to file an arizona partnership income tax return. Application for automatic extension of time to file corporation, partnership, and exempt organization returns: Web form year form instructions publish date; (with area code) original amended

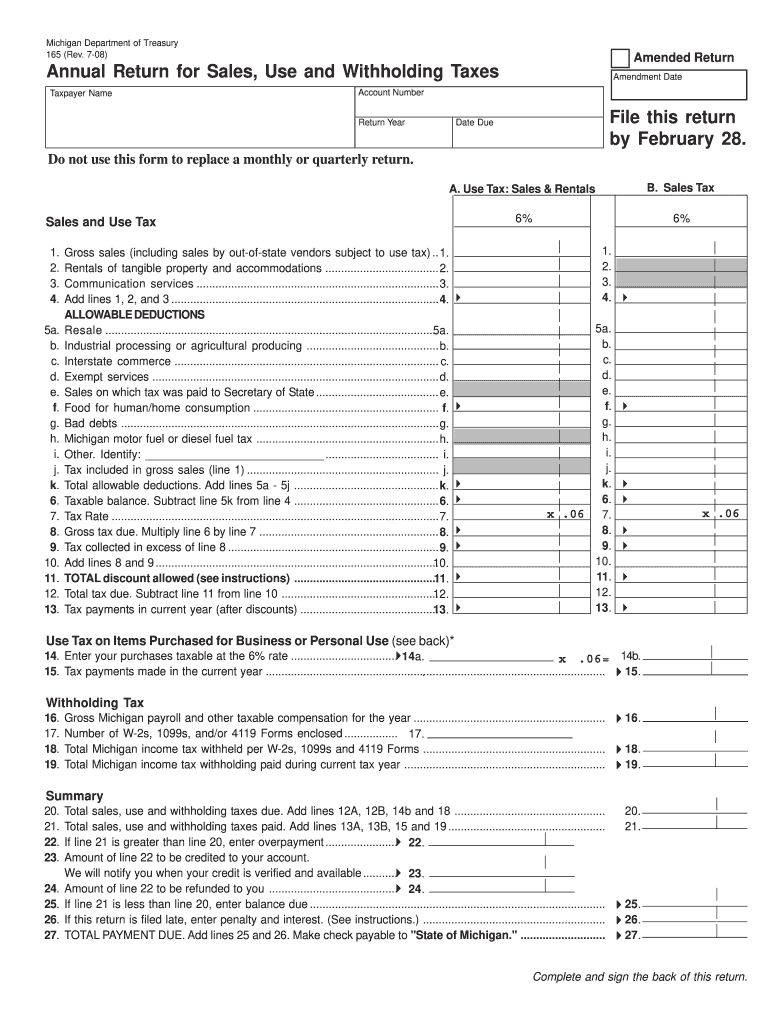

Michigan Sales Use And Withholding Tax Forms And Instructions 2022

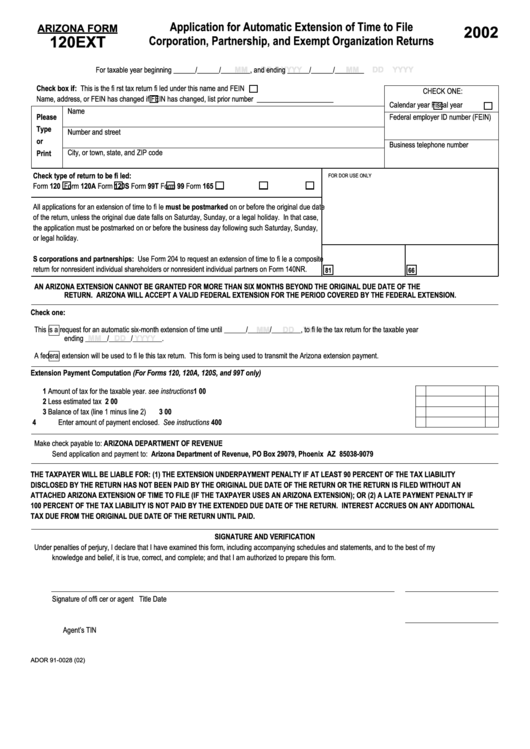

Application for automatic extension of time to file corporation, partnership, and exempt organization returns: Web 165 arizona partnership income tax return 2022 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. Arizona corporate or partnership income tax payment voucher Web general instructions who must use arizona form 165.

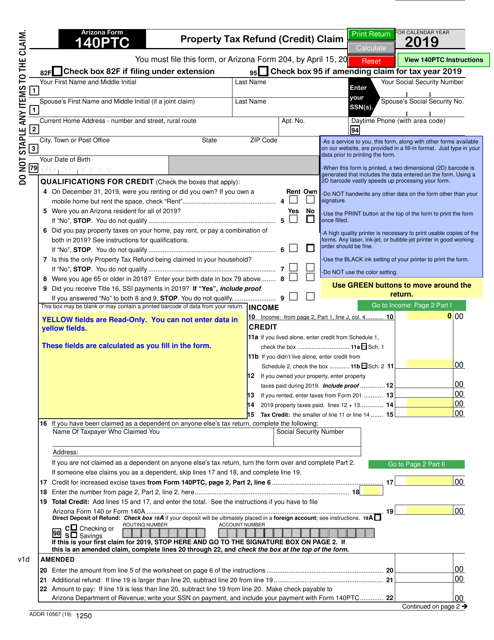

Arizona Form 140PTC (ADOR10567) Download Fillable PDF or Fill Online

Application for automatic extension of time to file corporation, partnership, and exempt organization returns: Arizona corporate or partnership income tax payment voucher Web form year form instructions publish date; Business telephone number name check one: File arizona form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every foreign partnership (syndicate, pool, etc.) required to file an.

Arizona Form 165 Arizona Partnership Tax Return 2001

Application for automatic extension of time to file corporation, partnership, and exempt organization returns: Web form year form instructions publish date; For the calendar year 2022 or fiscal year beginning m m d d 2 0 2 2 and ending m m d d 2 0 y y. File arizona form 165 for every domestic partnership including syndicates, groups, pools,.

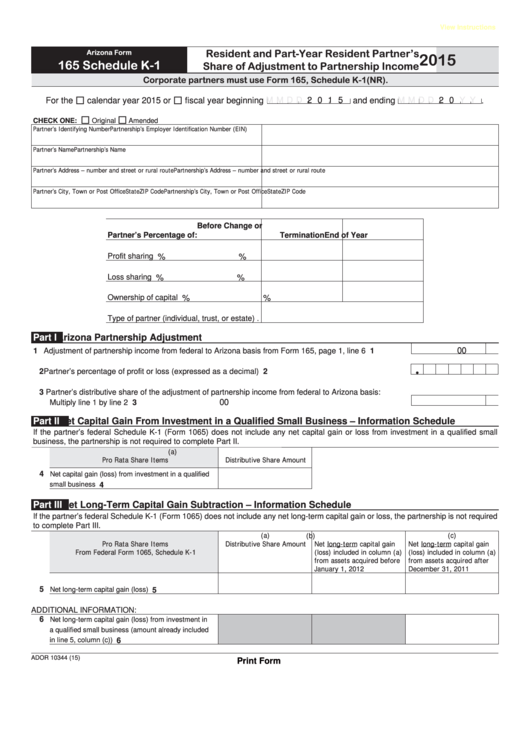

Fillable Arizona Form 165 (Schedule K1) Resident And PartYear

Web 165 arizona partnership income tax return 2022 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. Who must use arizona form 165 from its operation as an nmmd. (with area code) original amended For the calendar year 2022 or fiscal year beginning m m d d 2.

Arizona Form 120ext Application For Automatic Extension Of Time To

For the calendar year 2022 or fiscal year beginning m m d d 2 0 2 2 and ending m m d d 2 0 y y. Arizona corporate or partnership income tax payment voucher Web form year form instructions publish date; Who must use arizona form 165 from its operation as an nmmd. (with area code) original amended

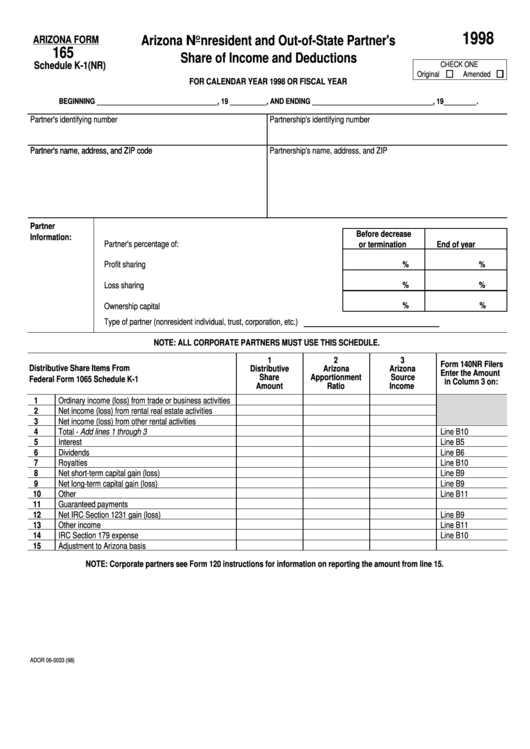

Fillable Arizona Form 165 Schedule K1 (Nr) Arizona Nonresident And

Business telephone number name check one: Web general instructions who must use arizona form 165 file arizona form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every foreign partnership (syndicate, pool, etc.) required to file an arizona partnership income tax return. For the calendar year 2022 or fiscal year beginning m m d d 2 0.

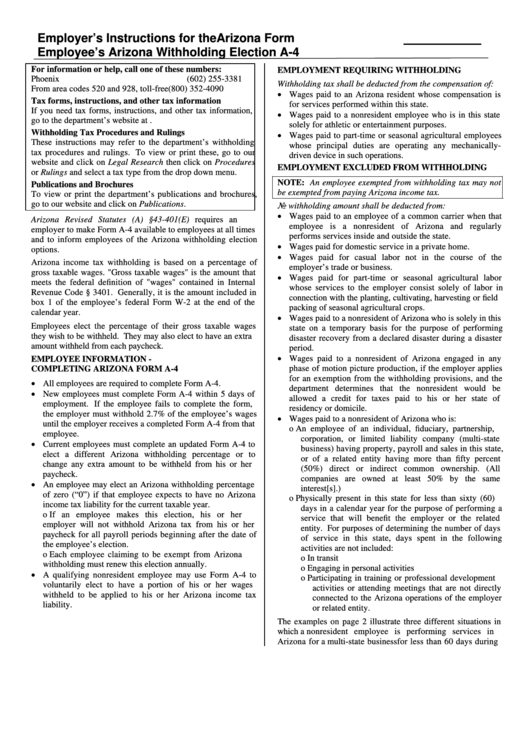

Arizona Form A4 Employer'S Instructions For The Employee'S Arizona

Application for automatic extension of time to file corporation, partnership, and exempt organization returns: Business telephone number name check one: (with area code) original amended File arizona form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every foreign partnership (syndicate, pool, etc.) required to file an arizona partnership income tax return. Web form year form instructions.

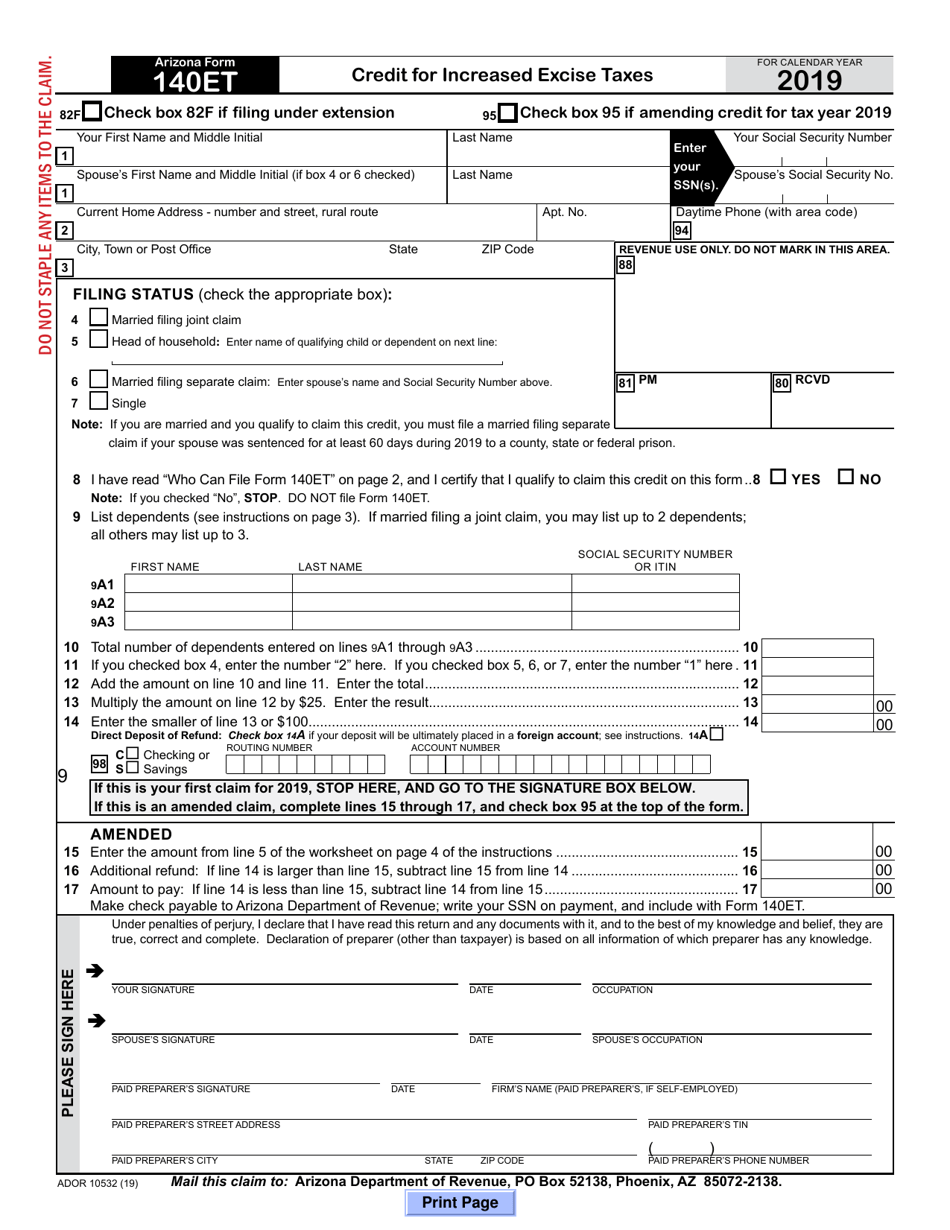

Arizona Form 140ET (ADOR10532) Download Fillable PDF or Fill Online

Web form year form instructions publish date; Web 165 arizona partnership income tax return 2022 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. Business telephone number name check one: Arizona corporate or partnership income tax payment voucher (with area code) original amended

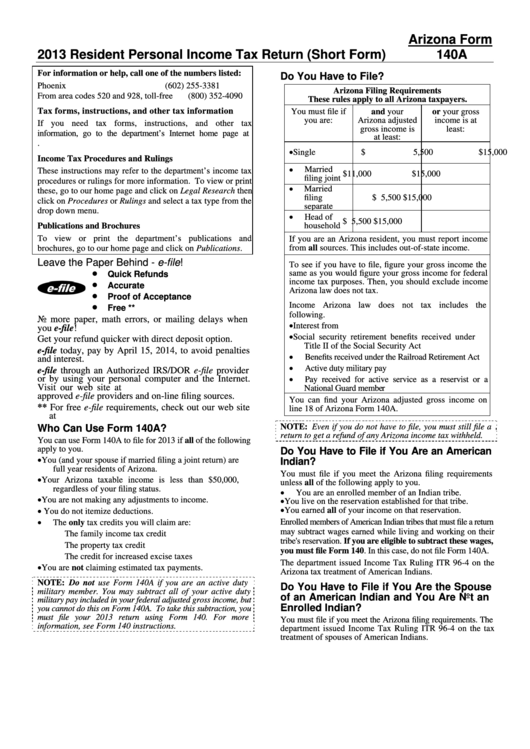

Instructions For Arizona Form 140a Resident Personal Tax

For the calendar year 2022 or fiscal year beginning m m d d 2 0 2 2 and ending m m d d 2 0 y y. Web 165 arizona partnership income tax return 2022 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. Web form year form.

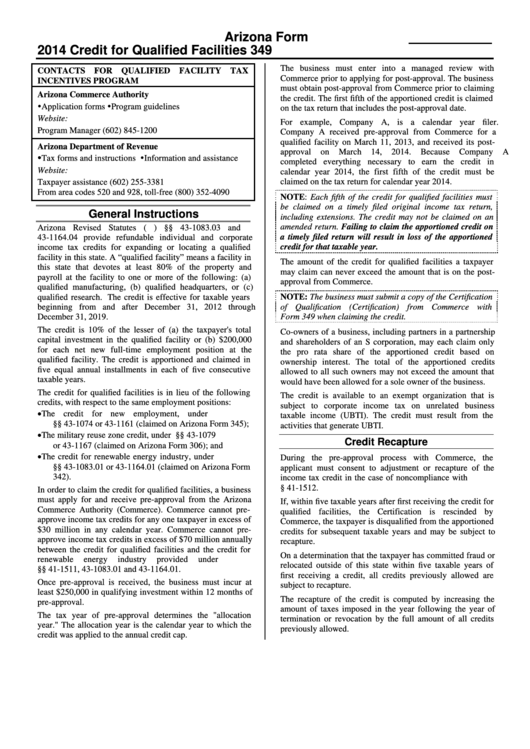

Instructions For Form 349 Arizona Credit For Qualified Facilities

(with area code) original amended Arizona corporate or partnership income tax payment voucher Web 165 arizona partnership income tax return 2022 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. For the calendar year 2022 or fiscal year beginning m m d d 2 0 2 2 and.

Arizona Corporate Or Partnership Income Tax Payment Voucher

Web form year form instructions publish date; Web general instructions who must use arizona form 165 file arizona form 165 for every domestic partnership including syndicates, groups, pools, joint ventures, and every foreign partnership (syndicate, pool, etc.) required to file an arizona partnership income tax return. Who must use arizona form 165 from its operation as an nmmd. Application for automatic extension of time to file corporation, partnership, and exempt organization returns:

File Arizona Form 165 For Every Domestic Partnership Including Syndicates, Groups, Pools, Joint Ventures, And Every Foreign Partnership (Syndicate, Pool, Etc.) Required To File An Arizona Partnership Income Tax Return.

For the calendar year 2022 or fiscal year beginning m m d d 2 0 2 2 and ending m m d d 2 0 y y. (with area code) original amended Web 165 arizona partnership income tax return 2022 form 165 is due on or before the 15th day of the 3rd month following the close of the taxable year. Business telephone number name check one: