Arizona Form 355

Arizona Form 355 - Beginning with tax year 2021, a taxpayer may elect to file a separate small business income (sbi) tax return. If you are unsure of what forms you need to file,. Web 26 rows form number title; Web election az165, page 1, question a. The categories below direct the individual to state and county forms. Forms for filing in arizona. Web arizona court forms. Tax credits forms, individual : Web arizona individual form availability schedule a (nr), itemized deductions (for nonresidents) available available form 301, nonrefundable individual tax credits and. Arizona small business income tax return.

Arizona small business income tax return. Tax credits forms, individual : Web 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return. Web credit for corporate contributions to school tuition organizations. Application for certification for qualifying charitable organization: Forms for filing in arizona. Web arizona form 352 include with your return. Web the arizona department of revenue presents an overview of form 285 the general disclosure of representation authorization form 285 is used to authorize the department. Web arizona individual form availability schedule a (nr), itemized deductions (for nonresidents) available available form 301, nonrefundable individual tax credits and. Web 26 rows form number title;

The categories below direct the individual to state and county forms. Credit for increased excise taxes: Tax credits forms, individual : Web 26 rows arizona corporate or partnership income tax payment voucher: Web election az165, page 1, question a. Web 26 rows form number title; Arizona small business income tax return. Web an arizona tax power of attorney form 285 can be used to elect a person (usually an accountant) to handle another person’s tax filing within the state of. Forms for filing in arizona. Credit for contributions to qualifying foster care charitable organizations2019 for the calendar year 2019 or fiscal year beginning.

Download Arizona Form A4 (2013) for Free FormTemplate

Web an arizona tax power of attorney form 285 can be used to elect a person (usually an accountant) to handle another person’s tax filing within the state of. Arizona small business income tax return. Web 26 rows form number title; Web 26 rows form number title; Credit for increased excise taxes:

SBA Form 355 A StepbyStep Guide to How to Fill It Out

Beginning with tax year 2021, a taxpayer may elect to file a separate small business income (sbi) tax return. Web arizona form 352 include with your return. Web 26 rows arizona corporate or partnership income tax payment voucher: If you are unsure of what forms you need to file,. Web election az165, page 1, question a.

20152022 AK Form 355 Fill Online, Printable, Fillable, Blank pdfFiller

If you are unsure of what forms you need to file,. Web the arizona department of revenue presents an overview of form 285 the general disclosure of representation authorization form 285 is used to authorize the department. Application for certification for qualifying charitable organization: Beginning with tax year 2021, a taxpayer may elect to file a separate small business income.

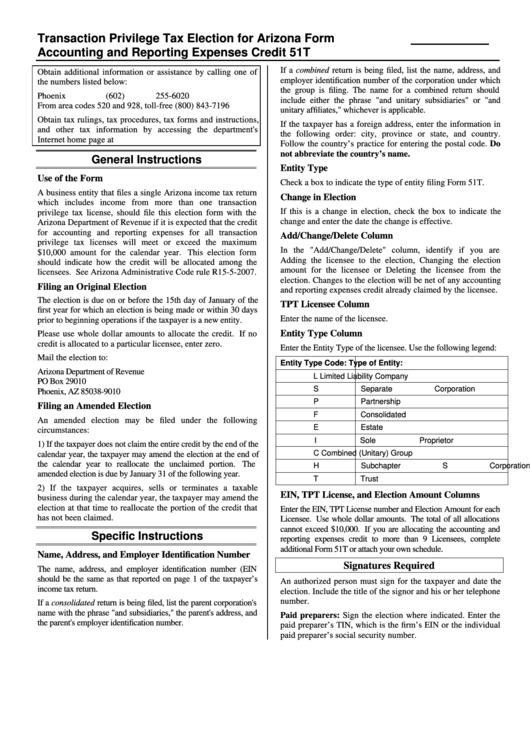

Instructions For Arizona Form 51t printable pdf download

Tax credits forms, individual : The categories below direct the individual to state and county forms. Web against subsequent years’ income tax liability. Web 26 rows form number title; Web 26 rows form number title;

Form 355 2013 Edit, Fill, Sign Online Handypdf

Web arizona court forms. Web arizona individual form availability schedule a (nr), itemized deductions (for nonresidents) available available form 301, nonrefundable individual tax credits and. Credit for contributions to qualifying foster care charitable organizations2019 for the calendar year 2019 or fiscal year beginning. Beginning with tax year 2021, a taxpayer may elect to file a separate small business income (sbi).

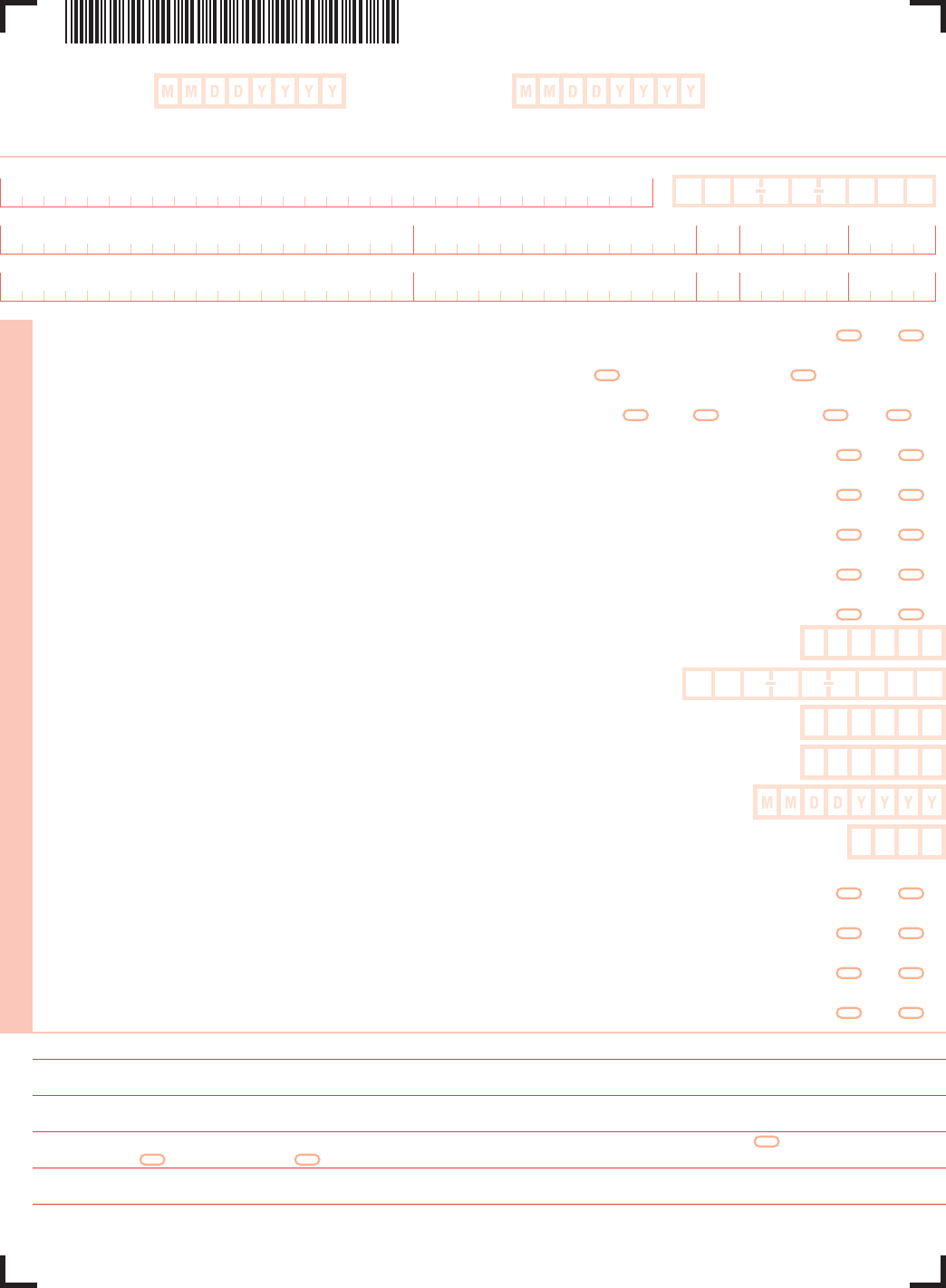

Form 355 Download Printable PDF or Fill Online Payroll Verification

Web arizona court forms. Credit for increased excise taxes: Web 26 rows arizona corporate or partnership income tax payment voucher: Web against subsequent years’ income tax liability. Web 26 rows form number title;

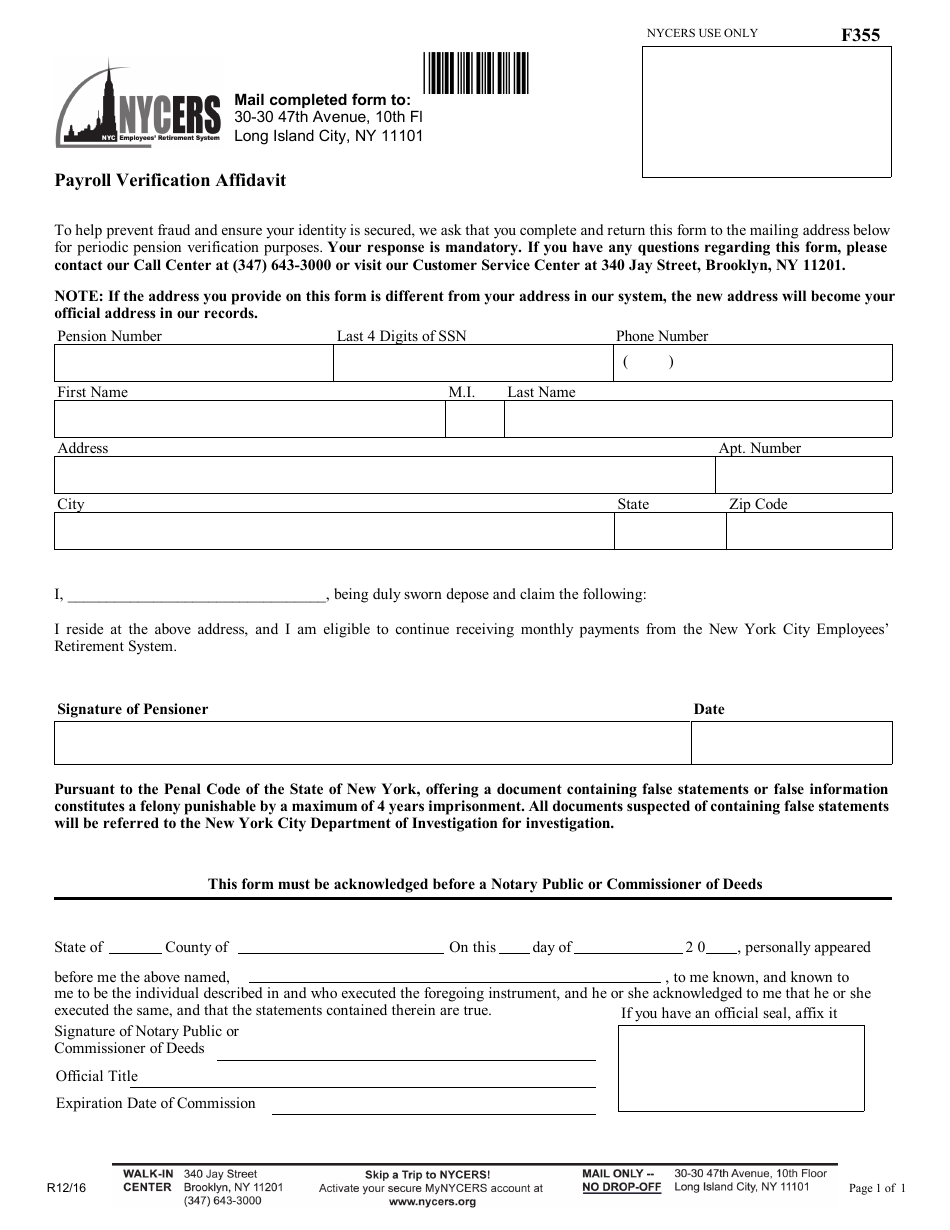

A1 qrt 2019 Fill out & sign online DocHub

Web credit for corporate contributions to school tuition organizations. Arizona small business income tax return. Filed by corporations and partnerships passing the credit through to corporate partners to claim. Web an arizona tax power of attorney form 285 can be used to elect a person (usually an accountant) to handle another person’s tax filing within the state of. Web 26.

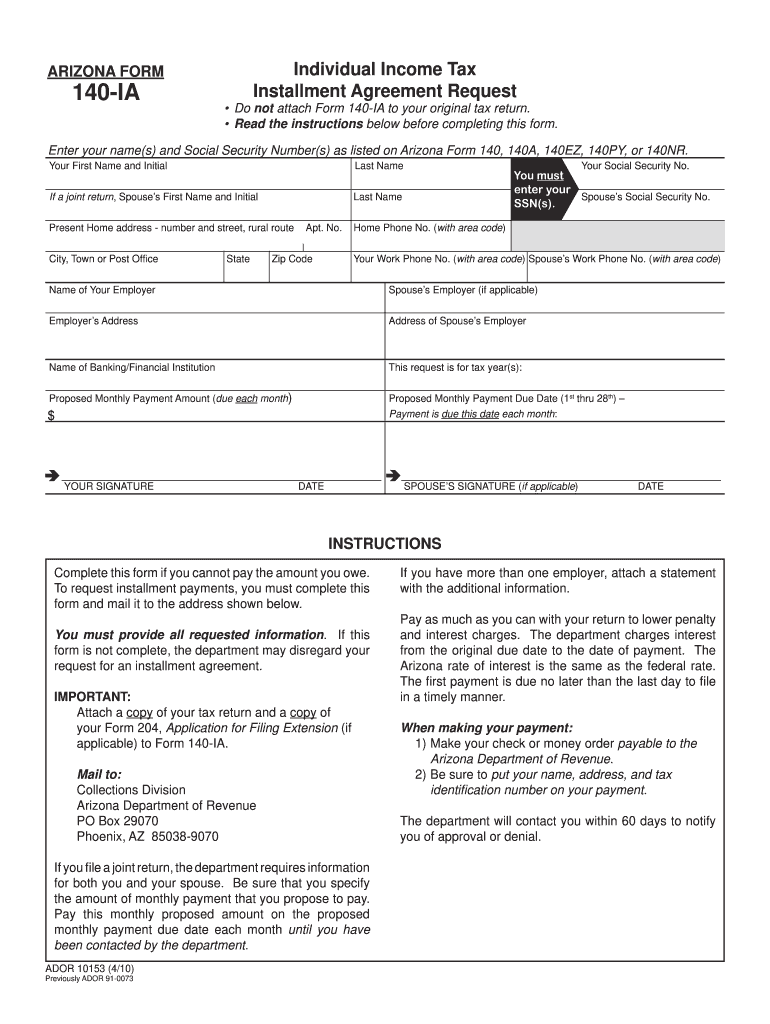

Arizona Form 140IA Arizona Department Of Revenue Fill and Sign

Web arizona individual form availability schedule a (nr), itemized deductions (for nonresidents) available available form 301, nonrefundable individual tax credits and. Web 26 rows form number title; Web election az165, page 1, question a. Filed by corporations and partnerships passing the credit through to corporate partners to claim. Web against subsequent years’ income tax liability.

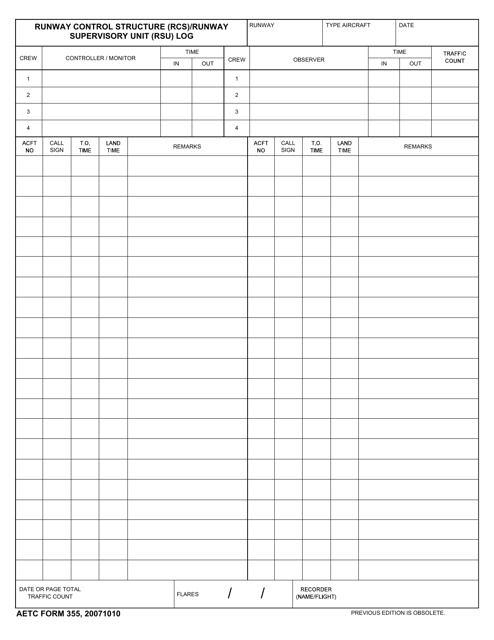

AETC Form 355 Fill Out, Sign Online and Download Fillable PDF

Credit for contributions to qualifying foster care charitable organizations2019 for the calendar year 2019 or fiscal year beginning. Tax credits forms, individual : Web an arizona tax power of attorney form 285 can be used to elect a person (usually an accountant) to handle another person’s tax filing within the state of. Web the arizona department of revenue presents an.

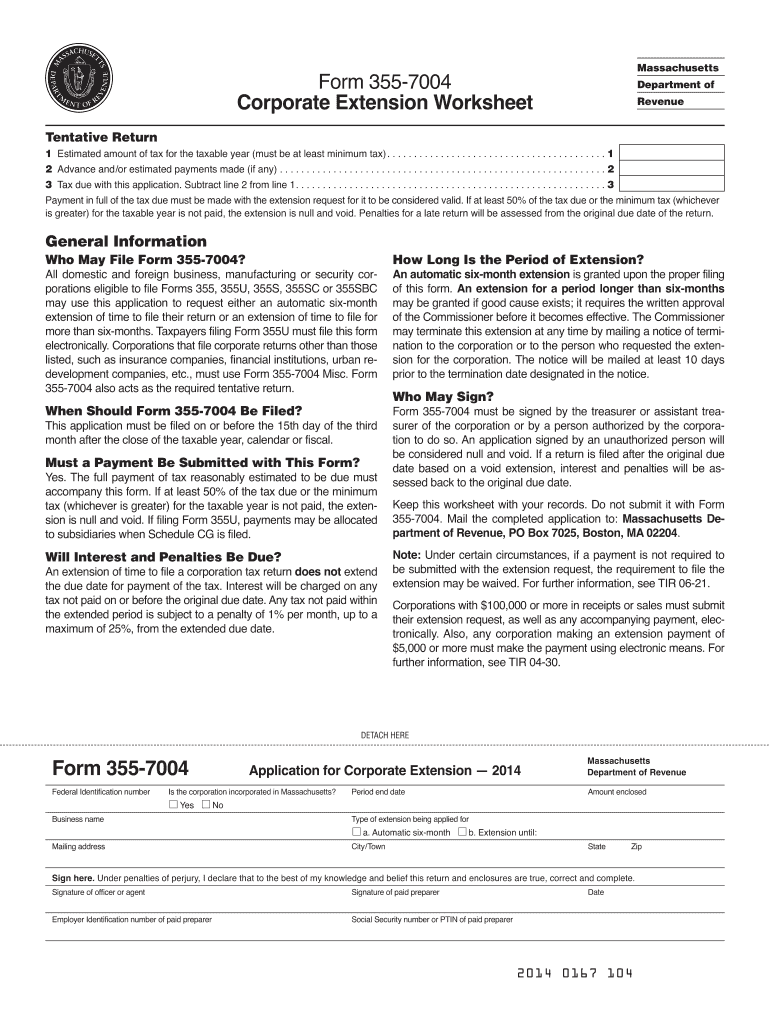

2019 Form 355 7004 Fill Out and Sign Printable PDF Template signNow

Application for certification for qualifying charitable organization: Web arizona individual form availability schedule a (nr), itemized deductions (for nonresidents) available available form 301, nonrefundable individual tax credits and. Tax credits forms, individual : Web election az165, page 1, question a. Arizona small business income tax return.

Forms For Filing In Arizona.

Tax credits forms, individual : Beginning with tax year 2021, a taxpayer may elect to file a separate small business income (sbi) tax return. Credit for contributions to qualifying foster care charitable organizations2019 for the calendar year 2019 or fiscal year beginning. Web the arizona department of revenue presents an overview of form 285 the general disclosure of representation authorization form 285 is used to authorize the department.

Web 26 Rows Form Number Title;

Web election az165, page 1, question a. Application for certification for qualifying charitable organization: Arizona small business income tax return. Web credit for corporate contributions to school tuition organizations.

Tax Credits Forms, Individual :

Web an arizona tax power of attorney form 285 can be used to elect a person (usually an accountant) to handle another person’s tax filing within the state of. Web arizona court forms. Web arizona form 352 include with your return. Web 26 rows form number title;

Web Arizona Individual Form Availability Schedule A (Nr), Itemized Deductions (For Nonresidents) Available Available Form 301, Nonrefundable Individual Tax Credits And.

Credit for increased excise taxes: Web against subsequent years’ income tax liability. Web 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return. Web 26 rows arizona corporate or partnership income tax payment voucher: