Arizona State Tax Form 2023

Arizona State Tax Form 2023 - If this email was forwarded to you and you would like to receive future emails, subscribe to the business offices email list. Because arizona electronic income tax returns are processed and accepted through the irs first, arizona’s electronic filing system for individual income tax. Web make an individual or small business income payment individual payment type options include: The new tax makes arizona’s flat rate the lowest in the country — but it was never voted on by the public. Income tax return, tax amendment, change of address. Web notable deaths in 2023 human. Web for the 2023 tax year (taxes filed in 2024), arizona will begin imposing a flat tax rate of 2.5%. Flush with a budget surplus. Payment for unpaid income tax small business payment type options include: 1, and new state forms are available for employees here who want to adjust their withholding.

Select the az form 140x by tax year below. Resident shareholder's information schedule form with instructions: Quarterly payment of reduced withholding for tax credits:. Income tax return, tax amendment, change of address. Flush with a budget surplus. For more information on this change, please visit. Keep in mind that some states will not update their tax forms for 2023 until january 2024. Choose either box 1 or box 2: State of arizona board of technical registration. In 2021, the arizona legislature passed senate bill.

Sign, mail form 140x to one of the addresses listed above. Web 1 day agothe arizona legislature on july 31, 2023, approved placing an extension of maricopa county's transportation tax on the ballot for voters before the current bill sunsets in 2025. Resident shareholder's information schedule form with instructions: Web notable deaths in 2023 human. If this email was forwarded to you and you would like to receive future emails, subscribe to the business offices email list. Arizona corporation income tax return (short form) corporate tax forms : Because arizona electronic income tax returns are processed and accepted through the irs first, arizona’s electronic filing system for individual income tax. Select the az form 140x by tax year below. Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates: Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes.

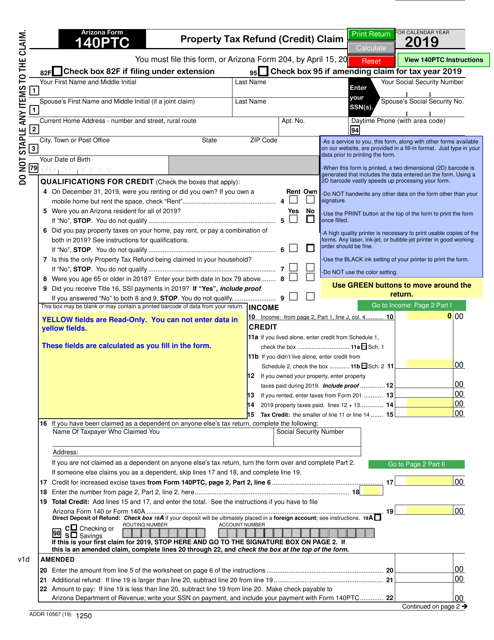

Arizona Form 140PTC (ADOR10567) Download Fillable PDF or Fill Online

Web home inspector certification renewal form. This form can be used to file an: State of arizona board of technical registration. Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates: Resident shareholder's information schedule form with instructions:

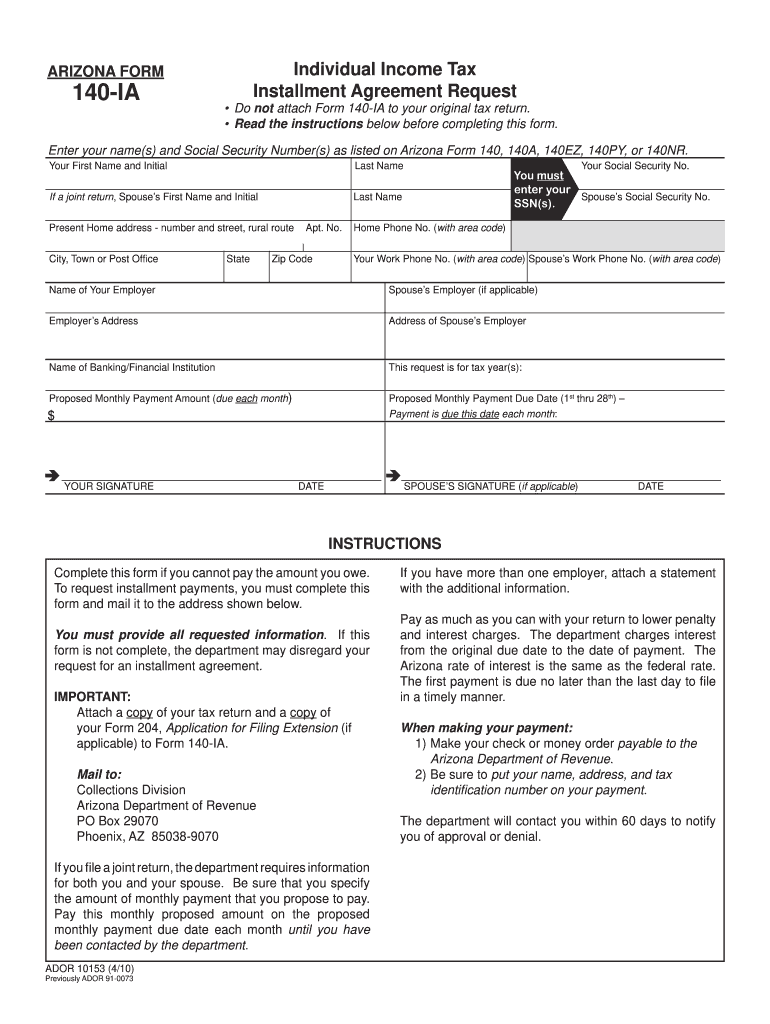

Fillable Online Arizona Form 140IA Arizona Department of Revenue Fax

You may use form 140ez if all of the following apply: It was passed by the state legislature in 2021 and enacted by gov. Employer's election to not withhold arizona taxes in december (includes instructions) withholding forms : Web new 2023 az state income tax form. Because arizona electronic income tax returns are processed and accepted through the irs first,.

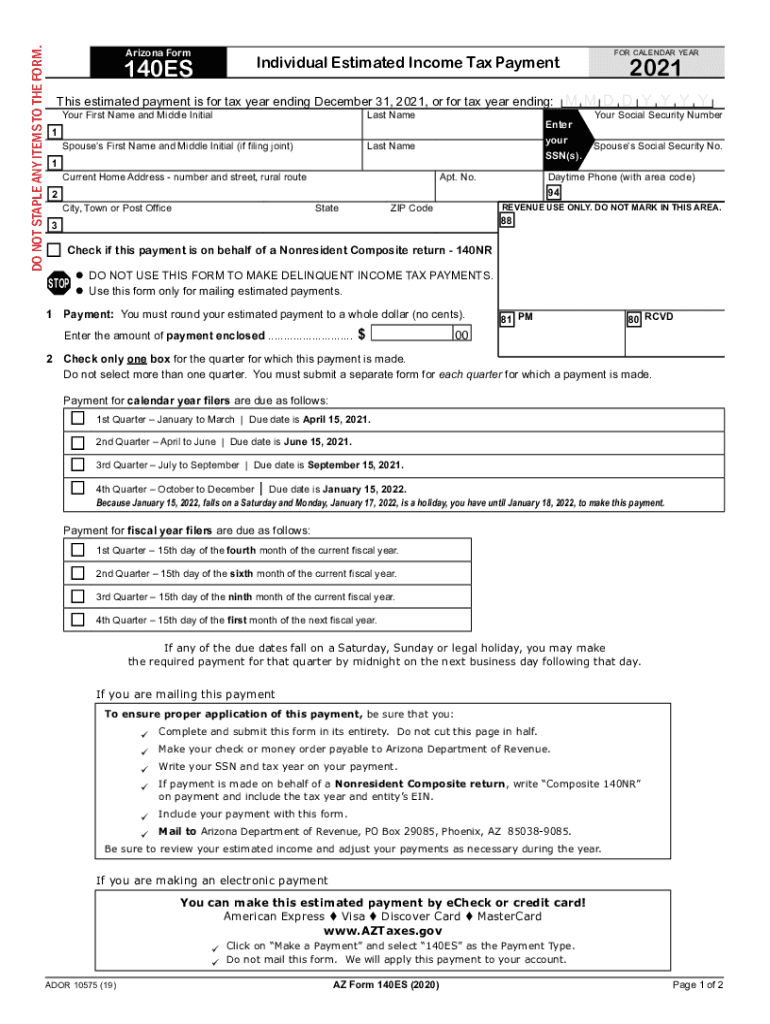

Arizona form 140 es Fill out & sign online DocHub

Web corporate tax forms : Web notable deaths in 2023 human. Web 1 day agothe arizona legislature on july 31, 2023, approved placing an extension of maricopa county's transportation tax on the ballot for voters before the current bill sunsets in 2025. Web for the 2023 tax year (taxes filed in 2024), arizona will begin imposing a flat tax rate.

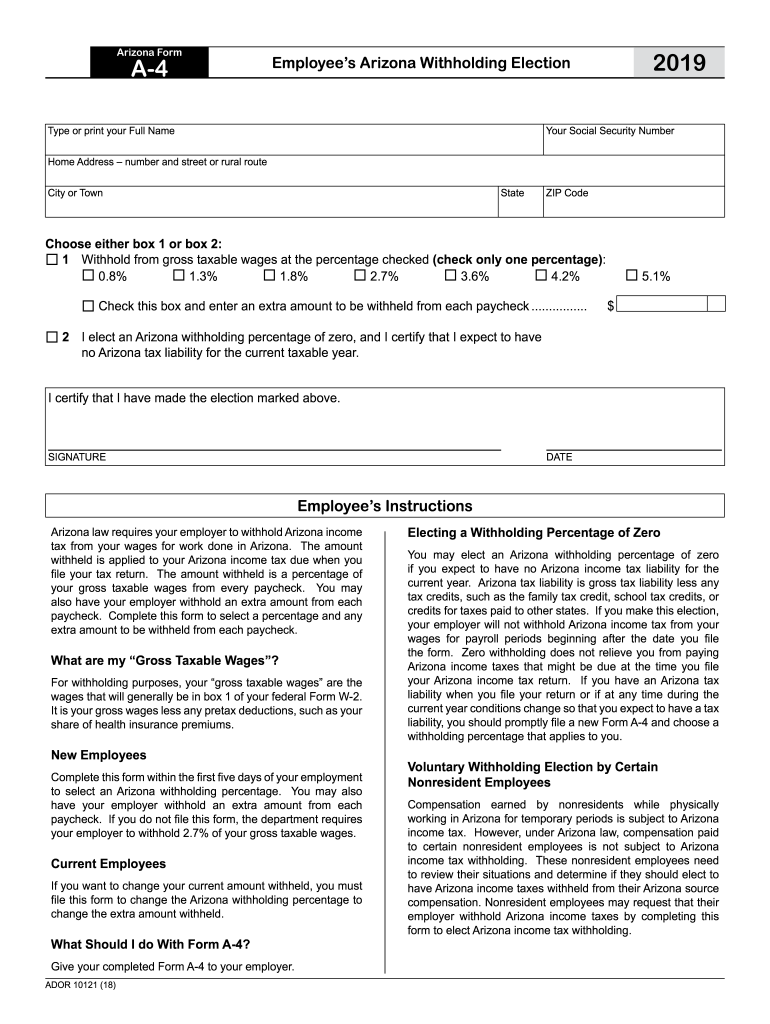

A4 Form Fill Out and Sign Printable PDF Template signNow

The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing season. Employer's election to not withhold arizona taxes in december (includes instructions) withholding forms : Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat rate of 2.5% for all residents. Check the.

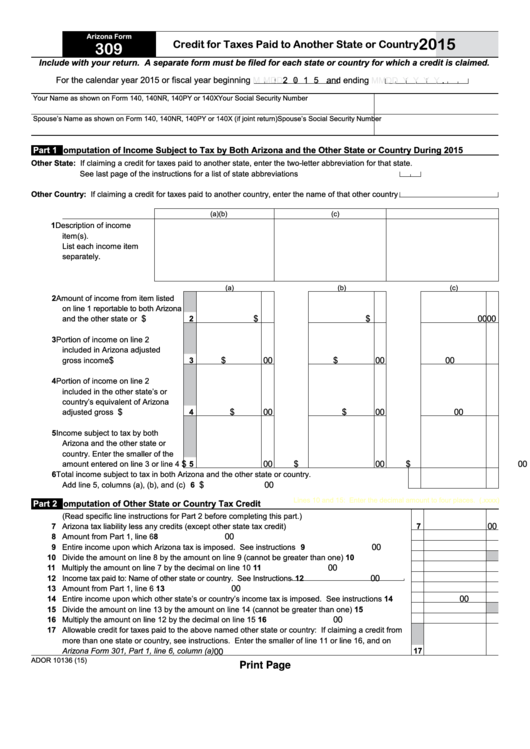

Fillable Arizona Form 309 Credit For Taxes Paid To Another State Or

Web make an individual or small business income payment individual payment type options include: Web 1 day agothe arizona legislature on july 31, 2023, approved placing an extension of maricopa county's transportation tax on the ballot for voters before the current bill sunsets in 2025. Employer's election to not withhold arizona taxes in december (includes instructions) withholding forms : Web.

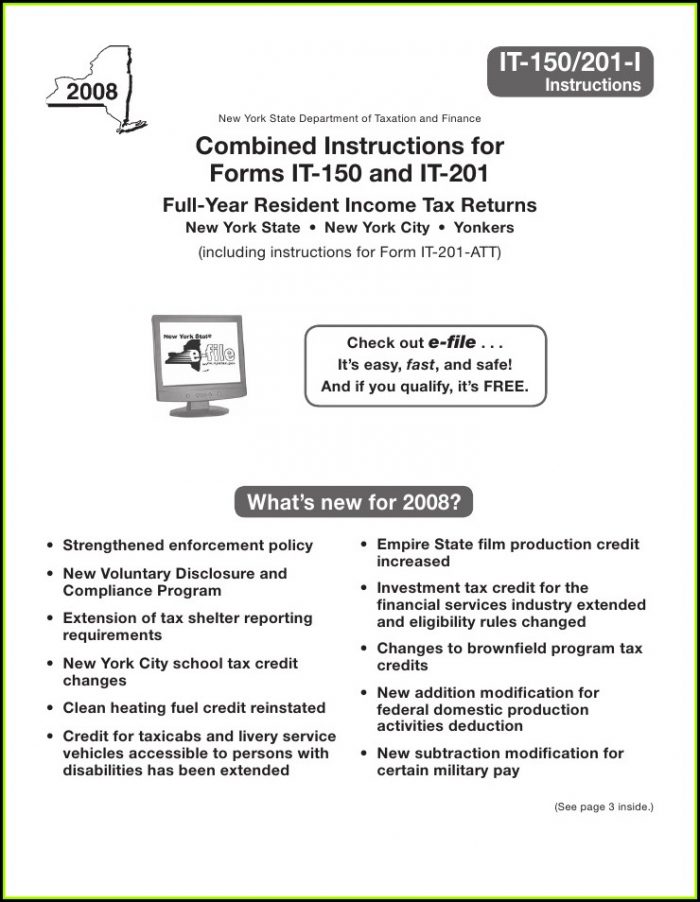

Ny State Tax Extension Form It 201 Form Resume Examples MW9pX8Z9AJ

This form can be used to file an: Web for the 2023 tax year (taxes filed in 2024), arizona will begin imposing a flat tax rate of 2.5%. Sign, mail form 140x to one of the addresses listed above. Resident shareholder's information schedule form with instructions: Previously (and for the 2022 tax year), arizonans had to pay one of two.

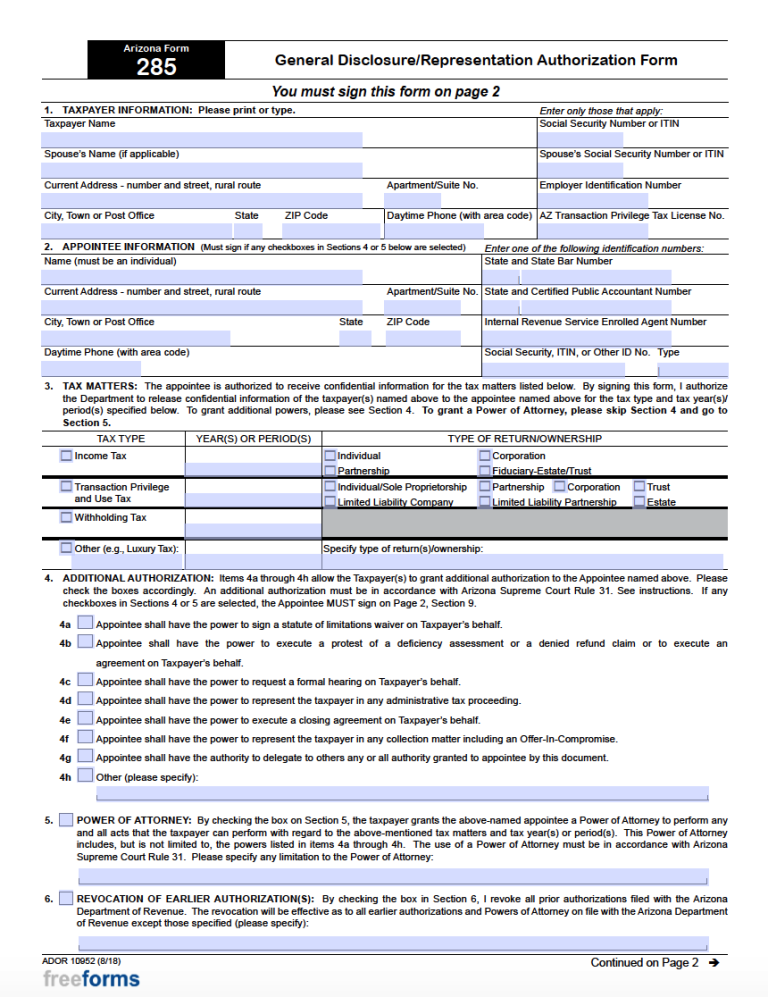

Free Arizona State Tax Power of Attorney (Form 285) PDF

Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat rate of 2.5% for all residents. Web individual income tax forms. Employer's election to not withhold arizona taxes in december (includes instructions) withholding forms : Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates: Resident shareholder's information.

Gallery of Arizona State Tax form 2018 Unique New Hire forms Template

You may use form 140ez if all of the following apply: Web make an individual or small business income payment individual payment type options include: 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Choose either box 1 or box 2: Web new 2023 az state income tax form.

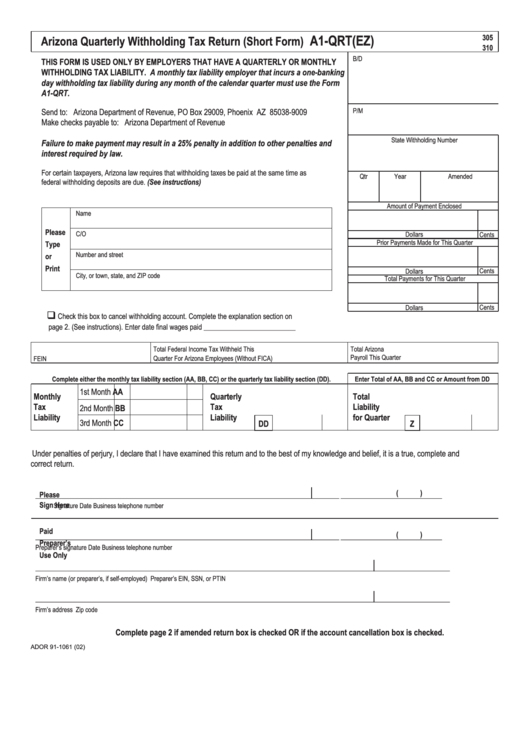

Form A1Qrt(Ez) Arizona Quarterly Withholding Tax Return (Short Form

State of arizona board of technical registration. Doug ducey for 2023, a year earlier than scheduled. Form 140 arizona resident personal income tax. You may use form 140ez if all of the following apply: Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates:

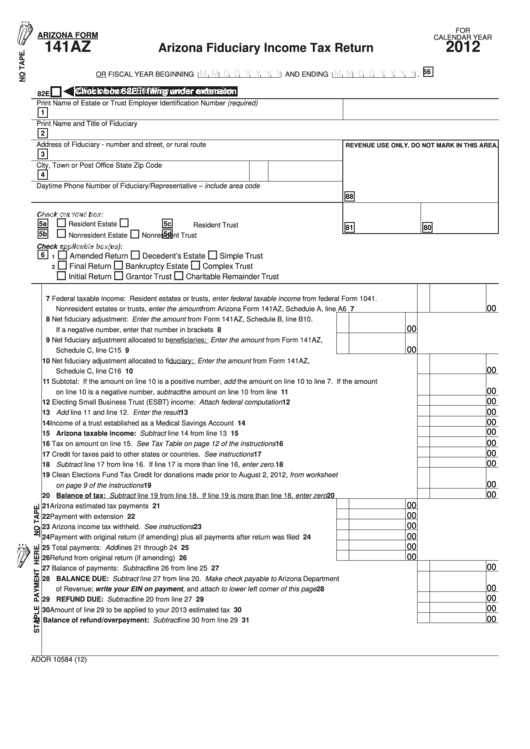

Fillable Arizona Form 141az Arizona Fiduciary Tax Return

Arizona's new rate of 2.5% for individuals kicked in jan. You are single, or if married, you and your spouse are filing a joint return. It was passed by the state legislature in 2021 and enacted by gov. Web 1 day agothe arizona legislature on july 31, 2023, approved placing an extension of maricopa county's transportation tax on the ballot.

Sign, Mail Form 140X To One Of The Addresses Listed Above.

Payment for unpaid income tax small business payment type options include: Income tax return, tax amendment, change of address. Web for the 2023 tax year (taxes filed in 2024), arizona will begin imposing a flat tax rate of 2.5%. Arizona corporation income tax return (short form) corporate tax forms :

It Was Passed By The State Legislature In 2021 And Enacted By Gov.

Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates: Web notable deaths in 2023 human. Arizona's new rate of 2.5% for individuals kicked in jan. Choose either box 1 or box 2:

Employer's Election To Not Withhold Arizona Taxes In December (Includes Instructions) Withholding Forms :

2022 arizona state income tax rates and tax brackets arizona state income tax. Web make an individual or small business income payment individual payment type options include: Your taxable income is less than $50,000 regardless of your filing status. Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat rate of 2.5% for all residents.

Web New 2023 Az State Income Tax Form.

Web july 26, 2023. State of arizona board of technical registration. Web corporate tax forms : Arizona quarterly withholding tax return: