Arkansas Withholding Form

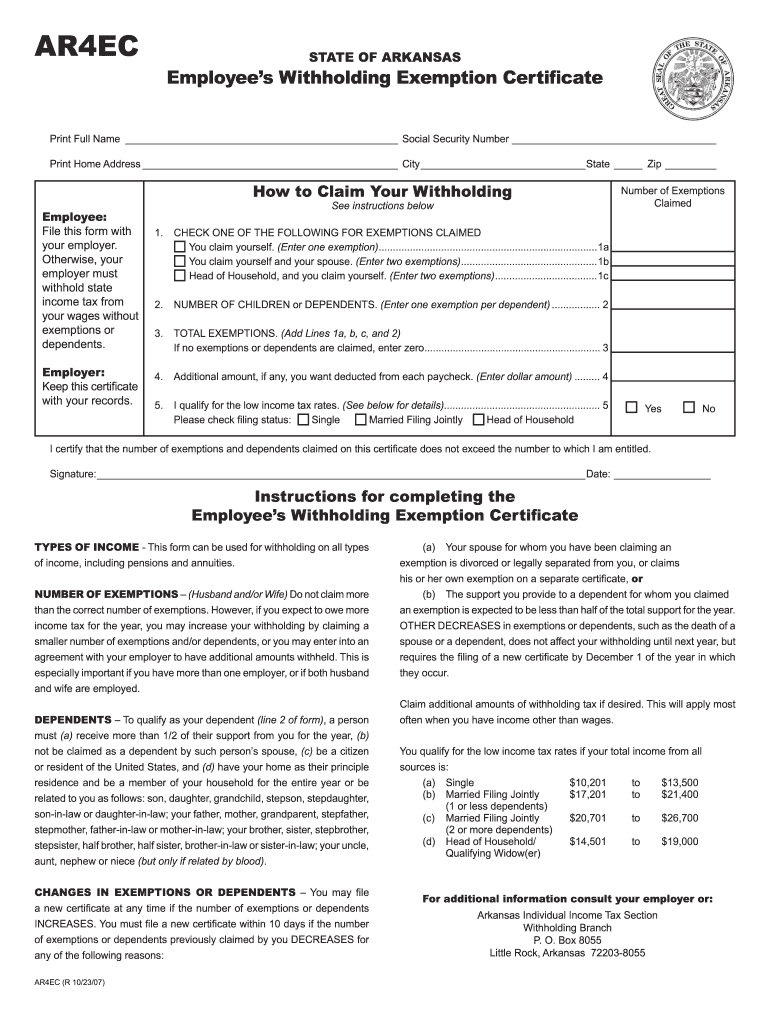

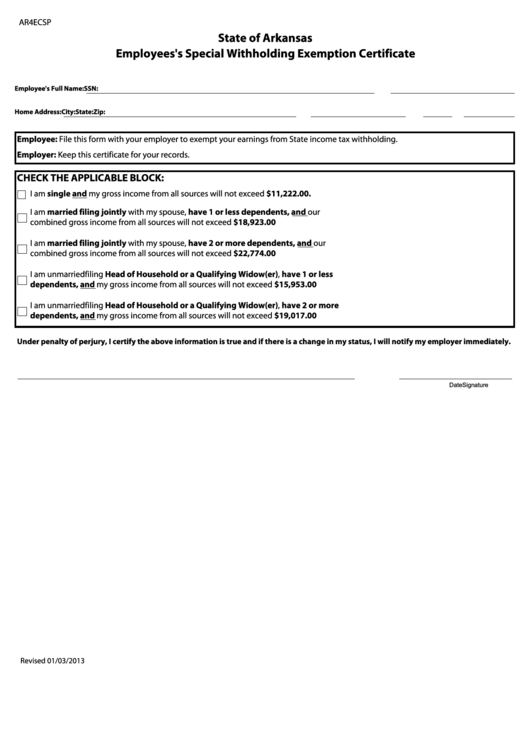

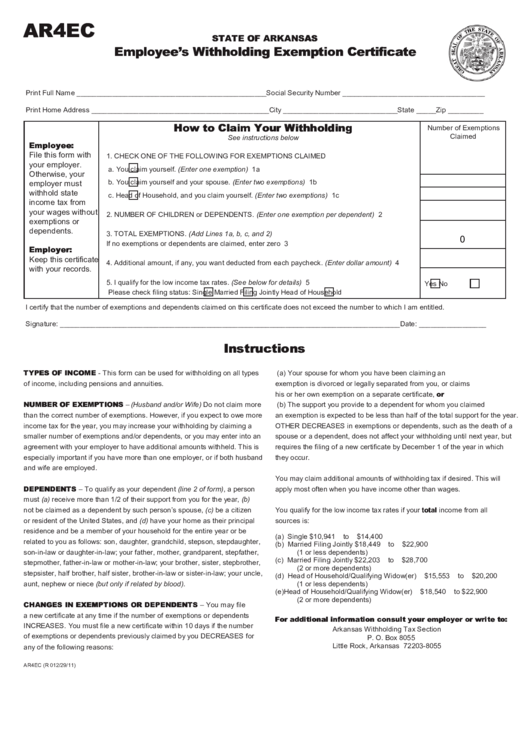

Arkansas Withholding Form - Web of wage and tax statements to the arkansas withholding tax section. File paper forms 1099 and 1096. File this form with your employer. Web individual income tax section withholding branch p.o. Check one of the following for exemptions claimed (a) you claim yourself. If too much is withheld, you will generally be due a refund. Web how to claim your withholding instructions on the reverse side 1. Withholding tax tables for low income (effective 06/01/2023) 06/05/2023. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Otherwise, your employer must withhold state income tax from your wages without see instructions below check one of the following for exemptions claimed you claim yourself.

File this form with your employer. Your withholding is subject to review by the irs. Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Check one of the following for exemptions claimed (a) you claim yourself. Otherwise, your employer must withhold state income tax from your wages without see instructions below check one of the following for exemptions claimed you claim yourself. Web withholding tax formula (effective 06/01/2023) 06/05/2023. Web of wage and tax statements to the arkansas withholding tax section. If too much is withheld, you will generally be due a refund. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. Web how to claim your withholding instructions on the reverse side 1.

If too much is withheld, you will generally be due a refund. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Web how to claim your withholding state zip number of exemptions employee: File this form with your employer. Otherwise, your employer must withhold state income tax from your wages without see instructions below check one of the following for exemptions claimed you claim yourself. (b) you claim yourself and your spouse. File paper forms 1099 and 1096. Your withholding is subject to review by the irs. To change your address or to close your business for withholding purposes, please. Check one of the following for exemptions claimed (a) you claim yourself.

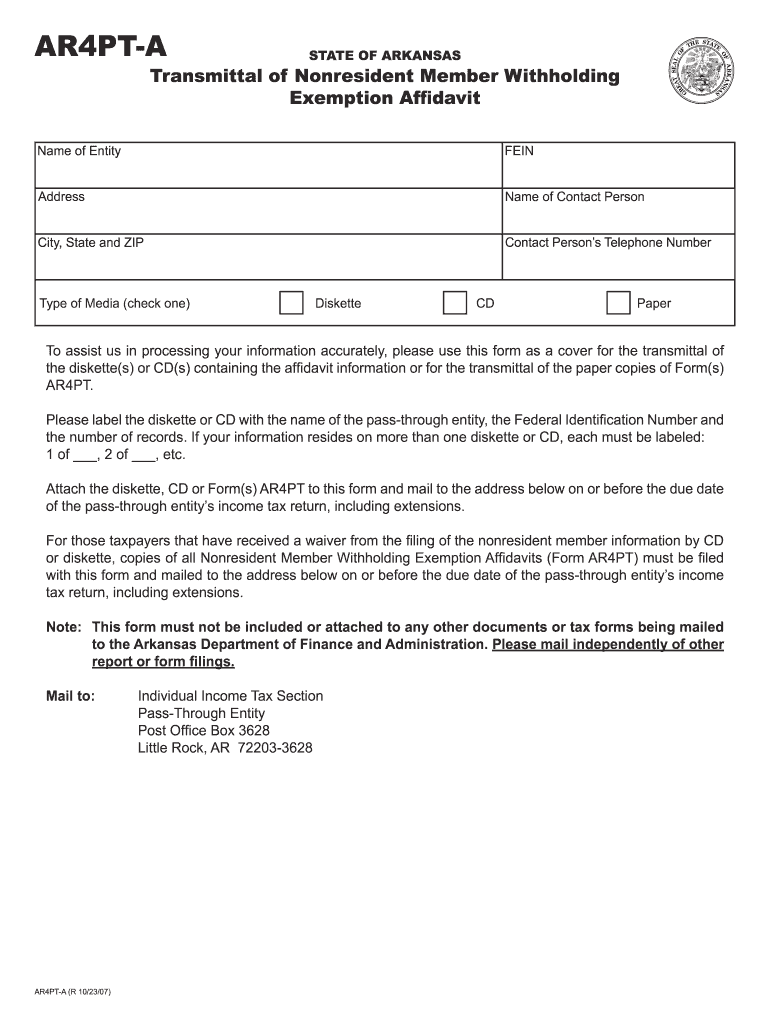

Ar4Pt Fill Out and Sign Printable PDF Template signNow

If too much is withheld, you will generally be due a refund. Your withholding is subject to review by the irs. File this form with your employer. To change your address or to close your business for withholding purposes, please. (b) you claim yourself and your spouse.

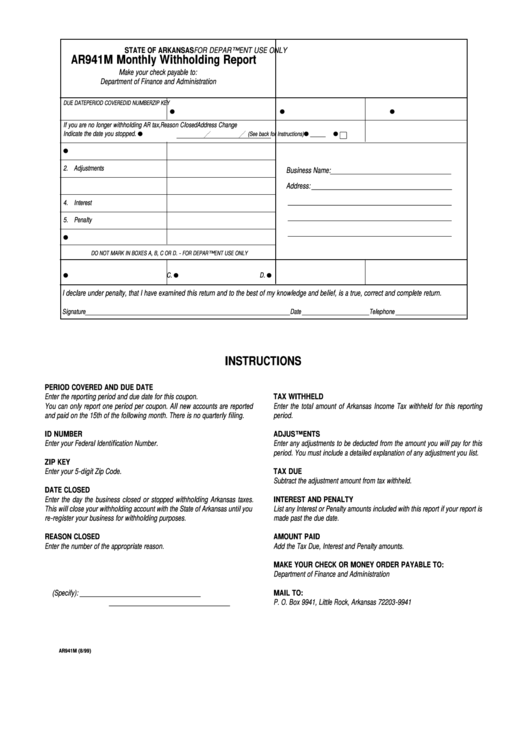

Form Ar941m State Of Arkansas Monthly Withholding Report 1999

Web how to claim your withholding state zip number of exemptions employee: Withholding tax tables for low income (effective 06/01/2023) 06/05/2023. Check one of the following for exemptions claimed (a) you claim yourself. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Web of wage and tax statements.

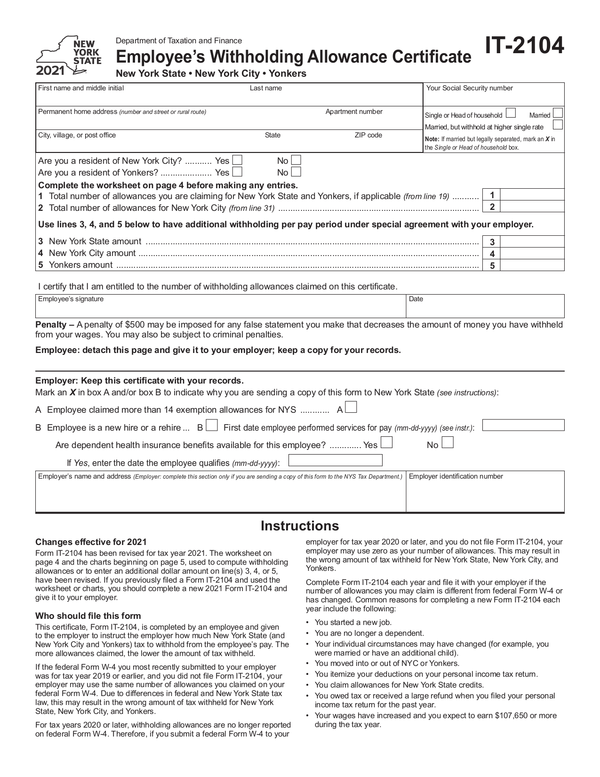

Arkansas State Withholding Form 2022

Withholding tax tables for low income (effective 06/01/2023) 06/05/2023. Web how to claim your withholding instructions on the reverse side 1. Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Check one of the following for exemptions claimed (a) you claim yourself. Your withholding is subject to review by the irs.

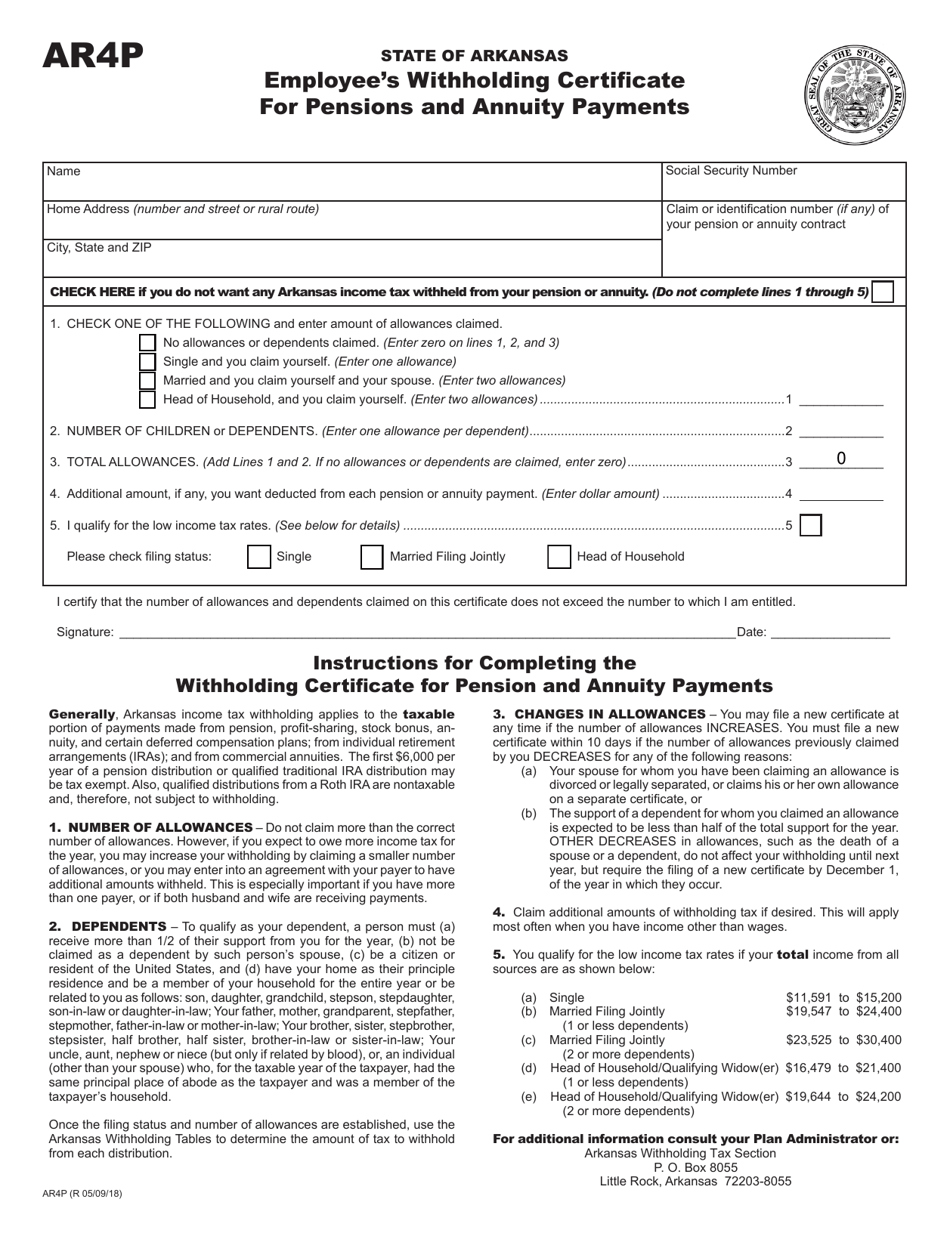

Form AR4P Download Fillable PDF or Fill Online Employee's Withholding

(b) you claim yourself and your spouse. Web of wage and tax statements to the arkansas withholding tax section. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. Check one of the following for exemptions claimed (a) you claim yourself. File this form with your employer.

Arkansas State Tax Withholding Tables 2018

Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Check one of the following for exemptions claimed (a) you claim yourself. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. Web how to claim your withholding instructions on the reverse side 1. Web individual income tax section withholding branch p.o.

Ar4ec Form Fill Online, Printable, Fillable, Blank pdfFiller

Web how to claim your withholding state zip number of exemptions employee: Check one of the following for exemptions claimed (a) you claim yourself. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. Withholding tax tables for low income (effective 06/01/2023) 06/05/2023. Otherwise, your employer must withhold state income tax from your wages without see instructions below check one of the.

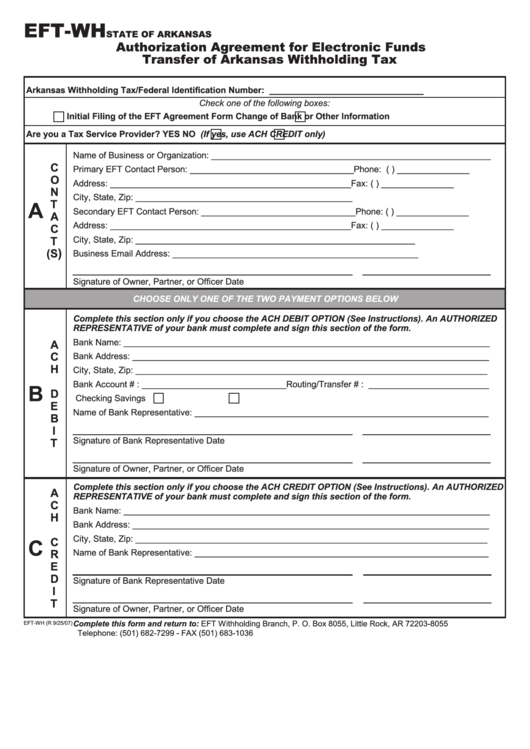

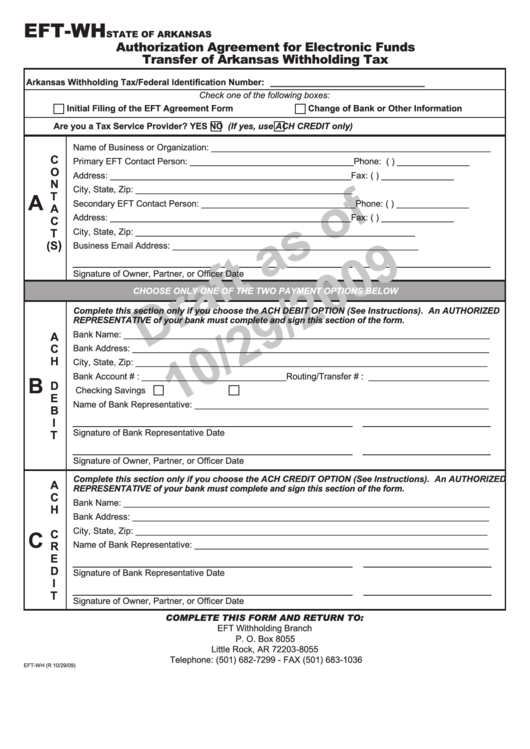

Form EftWh Authorization Agreement For Electronic Funds Transfer Of

If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Web how to claim your withholding instructions on the reverse side 1. Otherwise, your employer must withhold state income tax from your wages without see instructions below check one of the following for exemptions claimed you claim yourself. Web.

Top 16 Arkansas Withholding Form Templates free to download in PDF format

Web how to claim your withholding instructions on the reverse side 1. (b) you claim yourself and your spouse. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. Web individual income tax section withholding branch p.o. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty.

Form EftWh Draft Authorization Agreement For Electronic Funds

Withholding tax tables for low income (effective 06/01/2023) 06/05/2023. Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Web of wage and tax statements to the arkansas withholding tax section. Web how to claim your withholding state zip number of exemptions employee: Web how to claim your withholding instructions on the reverse side 1.

Fillable State Of Arkansas Employee's Withholding Exemption Certificate

Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Web how to claim your withholding instructions on the reverse side 1. Web individual income tax section withholding branch p.o. If too much is withheld, you will generally be due a refund. Web withholding tax formula (effective 06/01/2023) 06/05/2023.

File Paper Forms 1099 And 1096.

Web individual income tax section withholding branch p.o. To change your address or to close your business for withholding purposes, please. Web how to claim your withholding instructions on the reverse side 1. Web of wage and tax statements to the arkansas withholding tax section.

Otherwise, Your Employer Must Withhold State Income Tax From Your Wages Without See Instructions Below Check One Of The Following For Exemptions Claimed You Claim Yourself.

Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. Web withholding tax formula (effective 06/01/2023) 06/05/2023. If too much is withheld, you will generally be due a refund. (b) you claim yourself and your spouse.

Withholding Tax Tables For Employers (Effective 06/01/2023) 06/05/2023.

Web how to claim your withholding state zip number of exemptions employee: Your withholding is subject to review by the irs. File this form with your employer. Check one of the following for exemptions claimed (a) you claim yourself.

If Too Little Is Withheld, You Will Generally Owe Tax When You File Your Tax Return And May Owe A Penalty.

Withholding tax tables for low income (effective 06/01/2023) 06/05/2023.