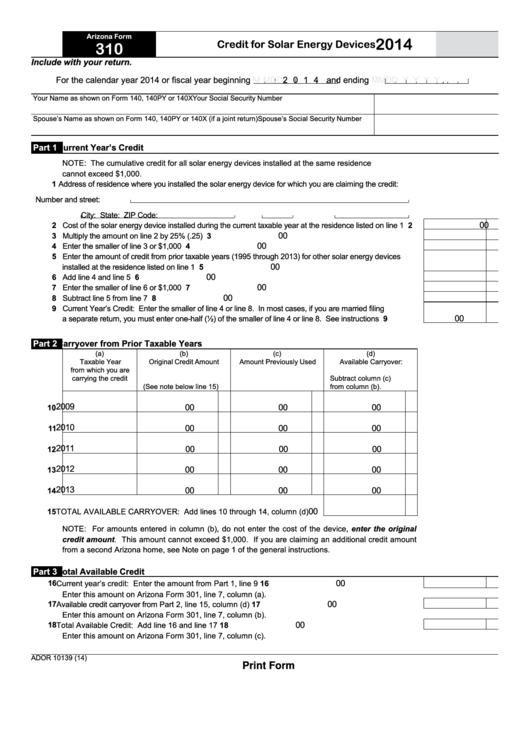

Az Form 310

Az Form 310 - For the calendar year 2021 or fiscal year beginning mmdd2021 and ending mmd 2021 d y y y y. Credit for solar energy devices: Phoenix, az— homeowners who installed a solar energy device in their residential home during 2021 are advised to submit form 310,. Web you must complete and include arizona form 301 and the credit form(s) your with arizona income tax return to claim nonrefundable tax credits unless you meet one of the. For the calendar year 2019 or fiscal year beginning mmd 2 0 1 9 and ending mmd d y y y y. Ad az recordkeeping log rule 310 & more fillable forms, register and subscribe now! Web arizona form 310credit for solar energy devices include with your return. This form is for income earned in tax year 2022, with tax returns due in april. Some users have reported that even though they do not choose the solar energy credit for arizona, in the state review, they are asked to fill. Web arizona form 310 to be eligible for this credit, you must be an arizona resident who is not a dependent of another taxpayer.

Web 310credit for solar energy devices include with your return. Web march 16, 2022. Agricultural water conservation system credit: Web we last updated arizona form 310 in february 2023 from the arizona department of revenue. This form is for income earned in tax year 2022, with tax returns due in april. Try it for free now! Web arizona form 310 credit for solar energy devices 2021 part 1 current year’s credit note: Web arizona form 310credit for solar energy devices include with your return. Web arizona form 310 credit for solar energy devices 2019 include with your return. For the calendar year 2021 or fiscal year beginning mmdd2021 and ending mmd 2021 d y y y y.

Web arizona form 310credit for solar energy devices include with your return. Some users have reported that even though they do not choose the solar energy credit for arizona, in the state review, they are asked to fill. Web we last updated arizona form 310 in february 2023 from the arizona department of revenue. Web 26 rows form number. Solar energy device is a system or series of. Web 26 rows 310 : Upload, modify or create forms. Web arizona form 310 to be eligible for this credit, you must be an arizona resident who is not a dependent of another taxpayer. Web arizona form 310 credit for solar energy devices 2021 part 1 current year’s credit note: Web forms tax credits forms credit for solar energy devices credit for solar energy devices did you install solar panels on your house?

Fillable Arizona Form 310 Credit For Solar Energy Devices 2014

Try it for free now! Phoenix, az— homeowners who installed a solar energy device in their residential home during 2021 are advised to submit form 310,. Upload, modify or create forms. Web arizona form 310 credit for solar energy devices 2019 include with your return. Web 26 rows form number.

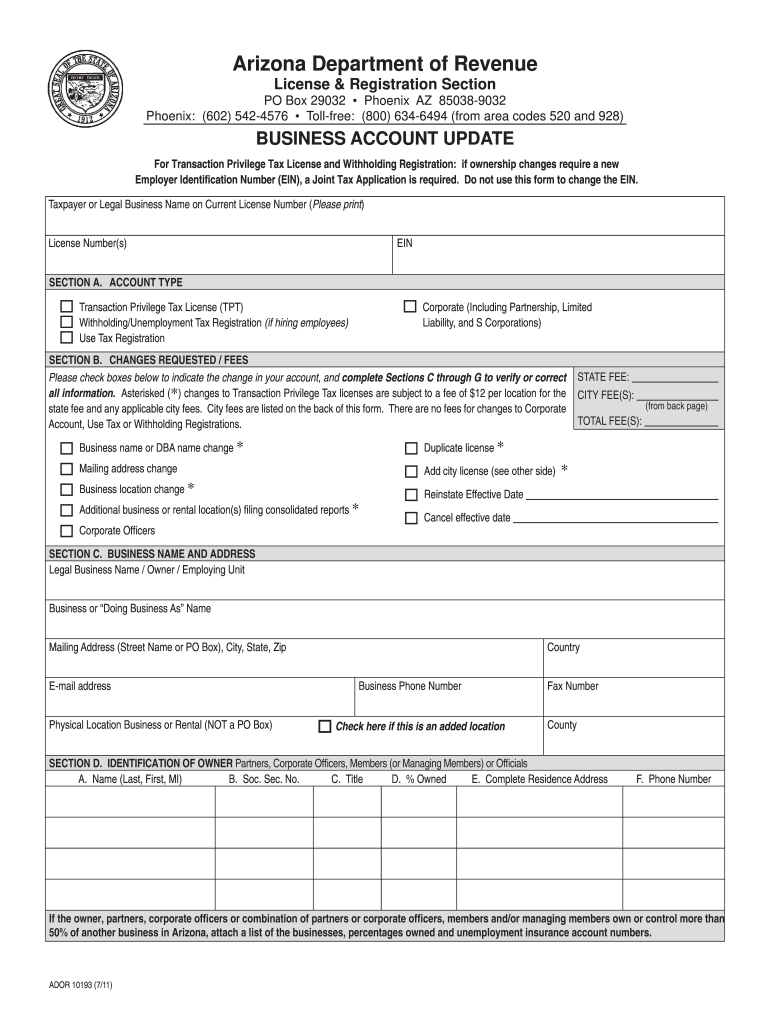

AZ Form 301, Nonrefundable Individual Tax Credits and Recapture

For the calendar year 2021 or fiscal year beginning mmdd2021 and ending mmd 2021 d y y y y. You can print other arizona tax forms here. Web arizona form 310credit for solar energy devices include with your return. Some users have reported that even though they do not choose the solar energy credit for arizona, in the state review,.

10A100 Form Fill Out and Sign Printable PDF Template signNow

This form is for income earned in tax year 2022, with tax returns due in april. Some users have reported that even though they do not choose the solar energy credit for arizona, in the state review, they are asked to fill. Try it for free now! Web 26 rows form number. You can print other arizona tax forms here.

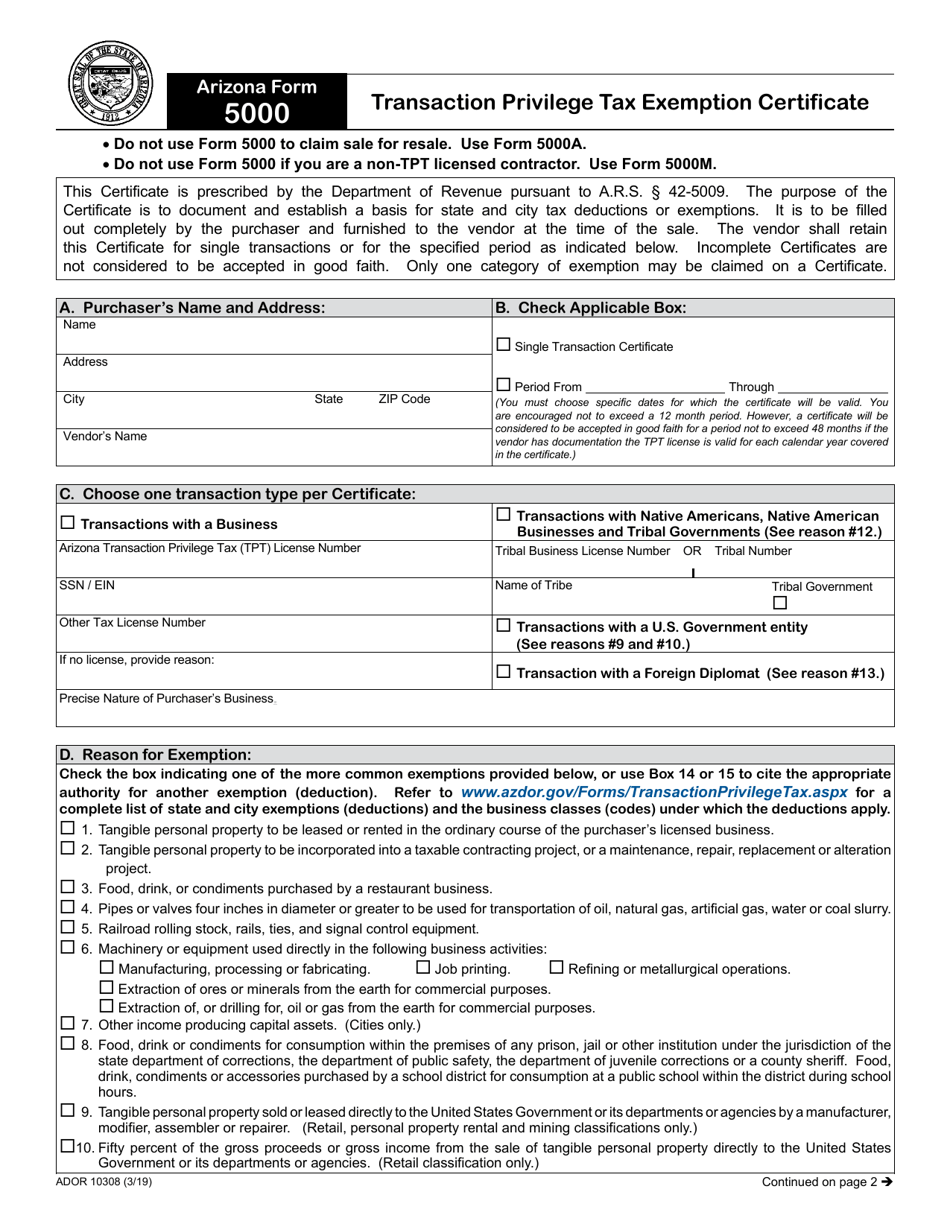

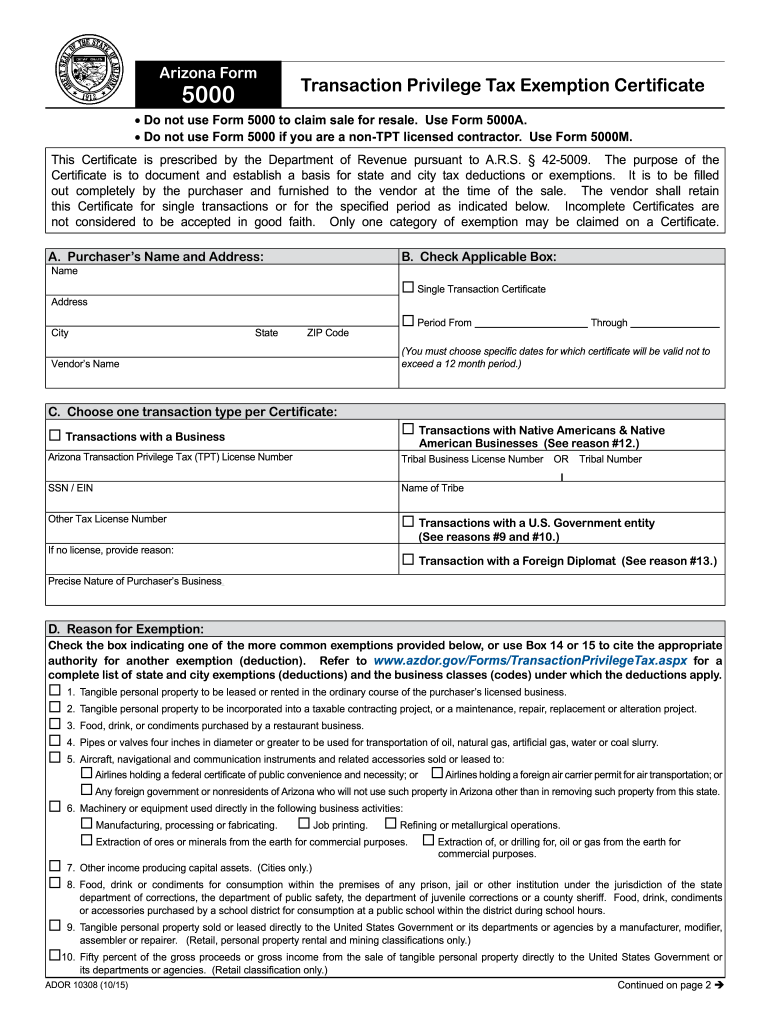

Arizona Form 5000 (ADOR10308) Download Fillable PDF or Fill Online

Web you must complete and include arizona form 301 and the credit form(s) your with arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Web 26 rows 310 : Web 310credit for solar energy devices include with your return. Web forms tax credits forms credit for solar energy devices credit for solar energy devices.

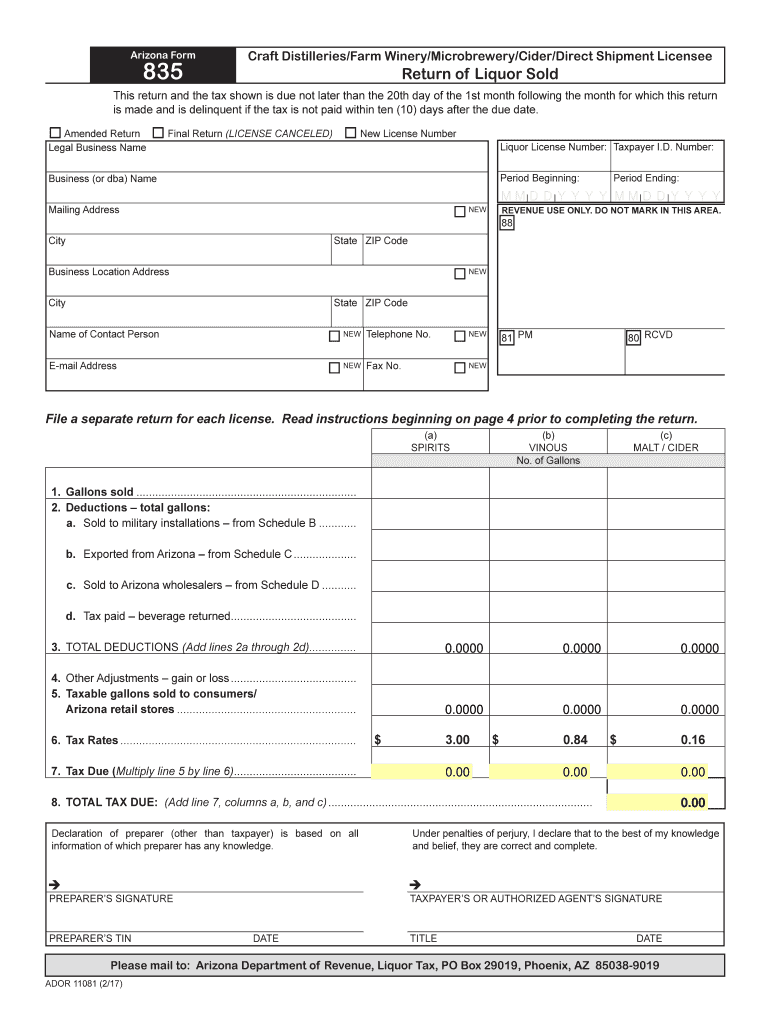

AZ Form 835 20172022 Fill out Tax Template Online US Legal Forms

Solar energy device is a system or series of. Web arizona form 310 credit for solar energy devices 2019 include with your return. Phoenix, az— homeowners who installed a solar energy device in their residential home during 2021 are advised to submit form 310,. We last updated the credit for solar energy credit in february 2023, so this is the.

2015 Form AZ DoR 5000 Fill Online, Printable, Fillable, Blank pdfFiller

Ad az recordkeeping log rule 310 & more fillable forms, register and subscribe now! Ad az recordkeeping log rule 310 & more fillable forms, register and subscribe now! Web arizona form 310credit for solar energy devices include with your return. Phoenix, az— homeowners who installed a solar energy device in their residential home during 2021 are advised to submit form.

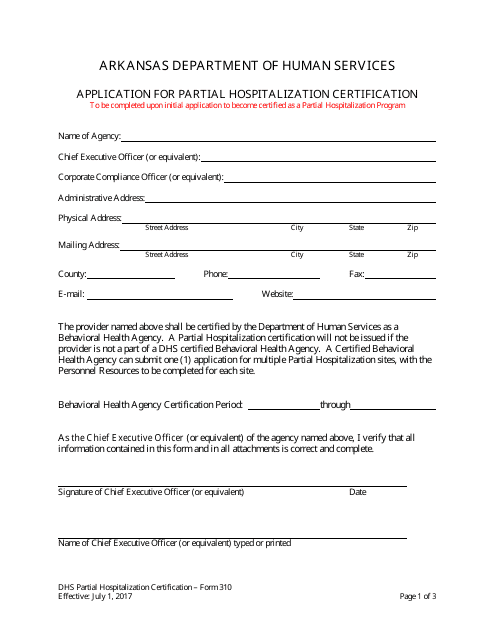

Form 310 Download Printable PDF or Fill Online Application for Partial

Try it for free now! Credit for solar energy devices: Web forms tax credits forms credit for solar energy devices credit for solar energy devices did you install solar panels on your house? Web march 16, 2022. The cumulative credit for all solar energy devices installed at the same residence cannot.

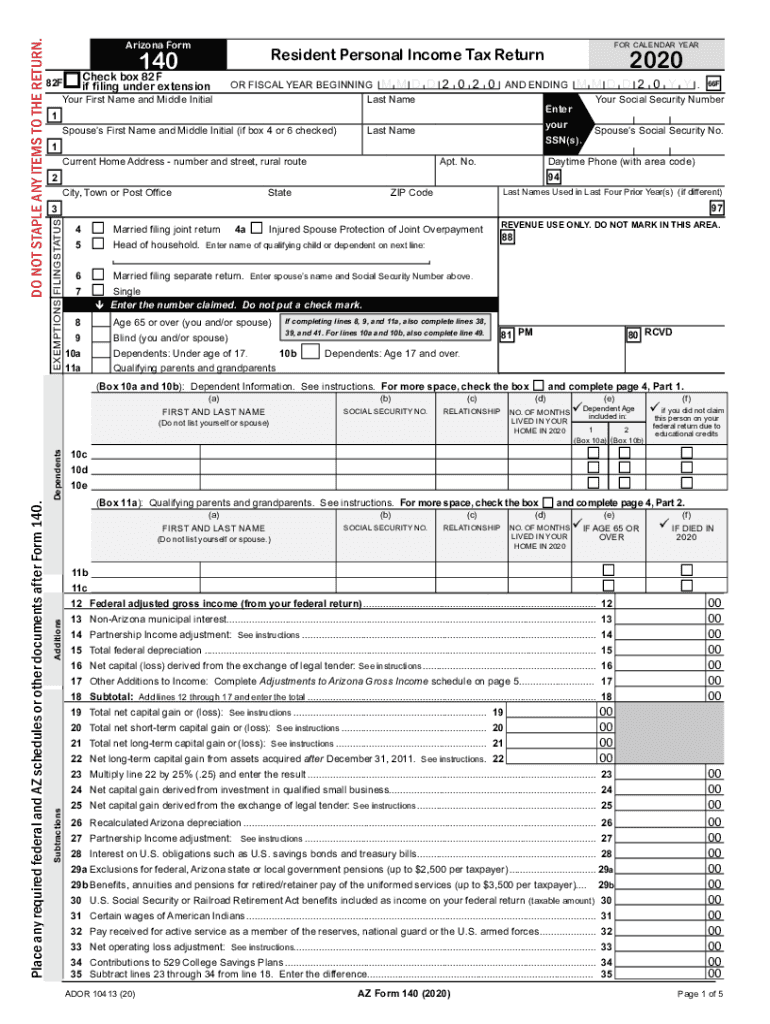

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

Upload, modify or create forms. Web arizona form 310 to be eligible for this credit, you must be an arizona resident who is not a dependent of another taxpayer. For the calendar year 2022 or fiscal year beginning m m d d 2 0 2 2 and ending m m d d y y y. Application for bingo license packet..

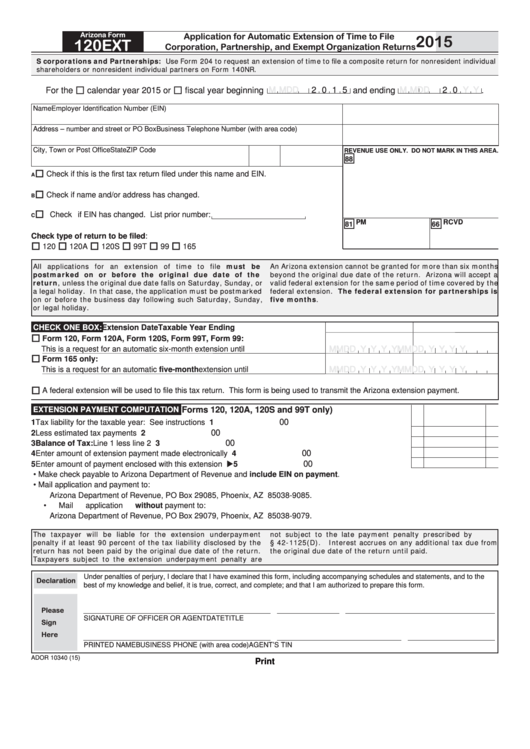

Fillable Arizona Form 120ext Application For Automatic Extension Of

Web 26 rows form number. The cumulative credit for all solar energy devices installed at the same residence cannot. Upload, modify or create forms. Web arizona form 310 credit for solar energy devices 2019 include with your return. Web 310credit for solar energy devices include with your return.

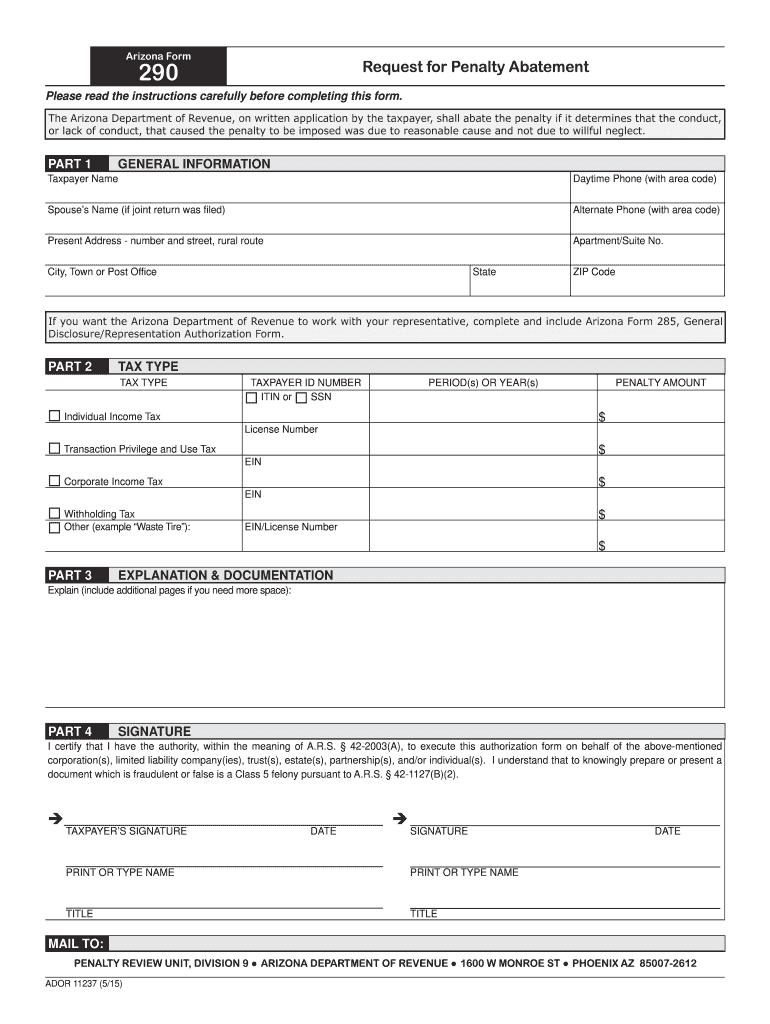

Form 290 Arizona Fill Online, Printable, Fillable, Blank pdfFiller

Web start with arizona form 310 (2020 info used for reference), enter the value of the solar energy device(s) on line 2, 25% of that on line 3, and the limit of $1,000 on line 5. Web arizona form 310credit for solar energy devices include with your return. Upload, modify or create forms. Web 26 rows 310 : Web arizona.

Web 26 Rows 310 :

Try it for free now! Web start with arizona form 310 (2020 info used for reference), enter the value of the solar energy device(s) on line 2, 25% of that on line 3, and the limit of $1,000 on line 5. For the calendar year 2021 or fiscal year beginning mmdd2021 and ending mmd 2021 d y y y y. Web we last updated arizona form 310 in february 2023 from the arizona department of revenue.

For The Calendar Year 2021 Or Fiscal Year Beginning Mmdd2021 And Ending Mmd 2021 D Y Y Y Y.

We last updated the credit for solar energy credit in february 2023, so this is the latest version of form 310, fully updated for tax year 2022. Web arizona form 310 credit for solar energy devices 2022 include with your return. Ad az recordkeeping log rule 310 & more fillable forms, register and subscribe now! Web arizona form 310 credit for solar energy devices 2019 include with your return.

Web Arizona Form 310 Adjustments To Income 13 Articles Business Income (Schedule C) 55 Articles Capital Gains/Losses 11 Articles Credits 41 Articles Education Credits/Deductions.

Credit for solar energy devices: For the calendar year 2019 or fiscal year beginning mmd 2 0 1 9 and ending mmd d y y y y. For the calendar year 2022 or fiscal year beginning m m d d 2 0 2 2 and ending m m d d y y y. Ad az recordkeeping log rule 310 & more fillable forms, register and subscribe now!

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Web arizona form 310 credit for solar energy devices 2021 part 1 current year’s credit note: Web arizona form 310credit for solar energy devices include with your return. Solar energy device is a system or series of. Web arizona form 310 to be eligible for this credit, you must be an arizona resident who is not a dependent of another taxpayer.