Az Form 355

Az Form 355 - Web 26 rows form number title; Arizona corporation income tax return (short form) form 120ext. Forms for filing in arizona. Tax credits forms, individual : Web 26 rows application for certification for qualifying charitable organization. Web 26 rows arizona corporate or partnership income tax payment voucher: Web ador 11294 (19) az form 352 (2019) page 2 of 3 your name (as shown on page 1) your social security number part 2 available credit carryover if you have a carryover amount. If you are unsure of what forms you need to file,. Web arizona court forms. Application for certification for qualifying foster care charitable.

Forms for filing in arizona. Web ador 11294 (19) az form 352 (2019) page 2 of 3 your name (as shown on page 1) your social security number part 2 available credit carryover if you have a carryover amount. Web arizona corporation income tax return. If you did not elect to file a small business income tax return and the amount on. Web filed by corporations and partnerships passing the credit through to corporate partners to claim the credit for corporate contributions to school tuition organizations. Web 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return. Web 26 rows application for certification for qualifying charitable organization. Web personal income tax return (form 140, 140nr or 140py) or the small business income tax return, if filing. Web details arizona small business income tax return beginning with tax year 2021, a taxpayer may elect to file a separate small business income (sbi) tax return. Web 26 rows arizona corporate or partnership income tax payment voucher:

Application for certification for qualifying foster care charitable. Web 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return. State of arizona payment request : The categories below direct the individual to state and county forms. Forms for filing in arizona. Tax credits forms, individual : If you did not elect to file a small business income tax return and the amount on. Web 26 rows form number title; Web arizona court forms. Web personal income tax return (form 140, 140nr or 140py) or the small business income tax return, if filing.

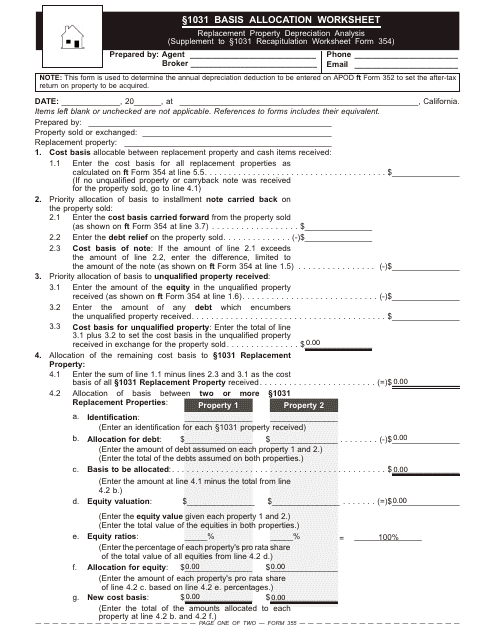

Form 355 Download Fillable PDF or Fill Online Basis Allocation

Web 26 rows application for certification for qualifying charitable organization. Web 26 rows arizona corporate or partnership income tax payment voucher: Web 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return. The categories below direct the individual to state and county forms. Forms for.

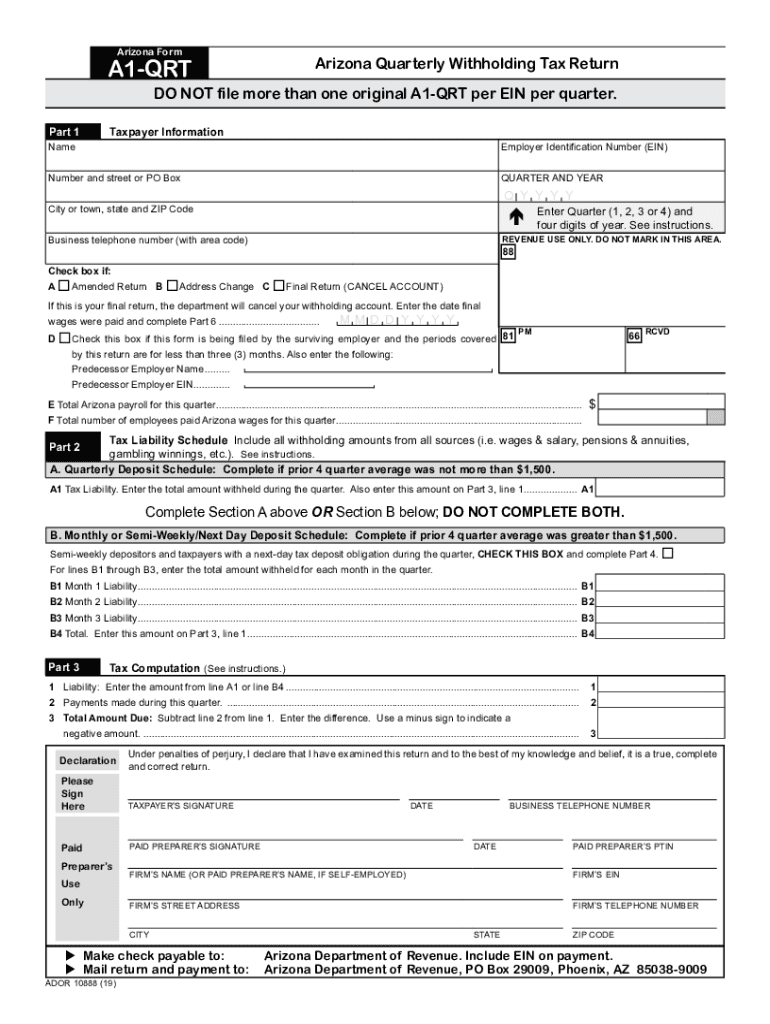

A1 qrt 2019 Fill out & sign online DocHub

The categories below direct the individual to state and county forms. Web 26 rows application for certification for qualifying charitable organization. If you are unsure of what forms you need to file,. Web ador 11294 (19) az form 352 (2019) page 2 of 3 your name (as shown on page 1) your social security number part 2 available credit carryover.

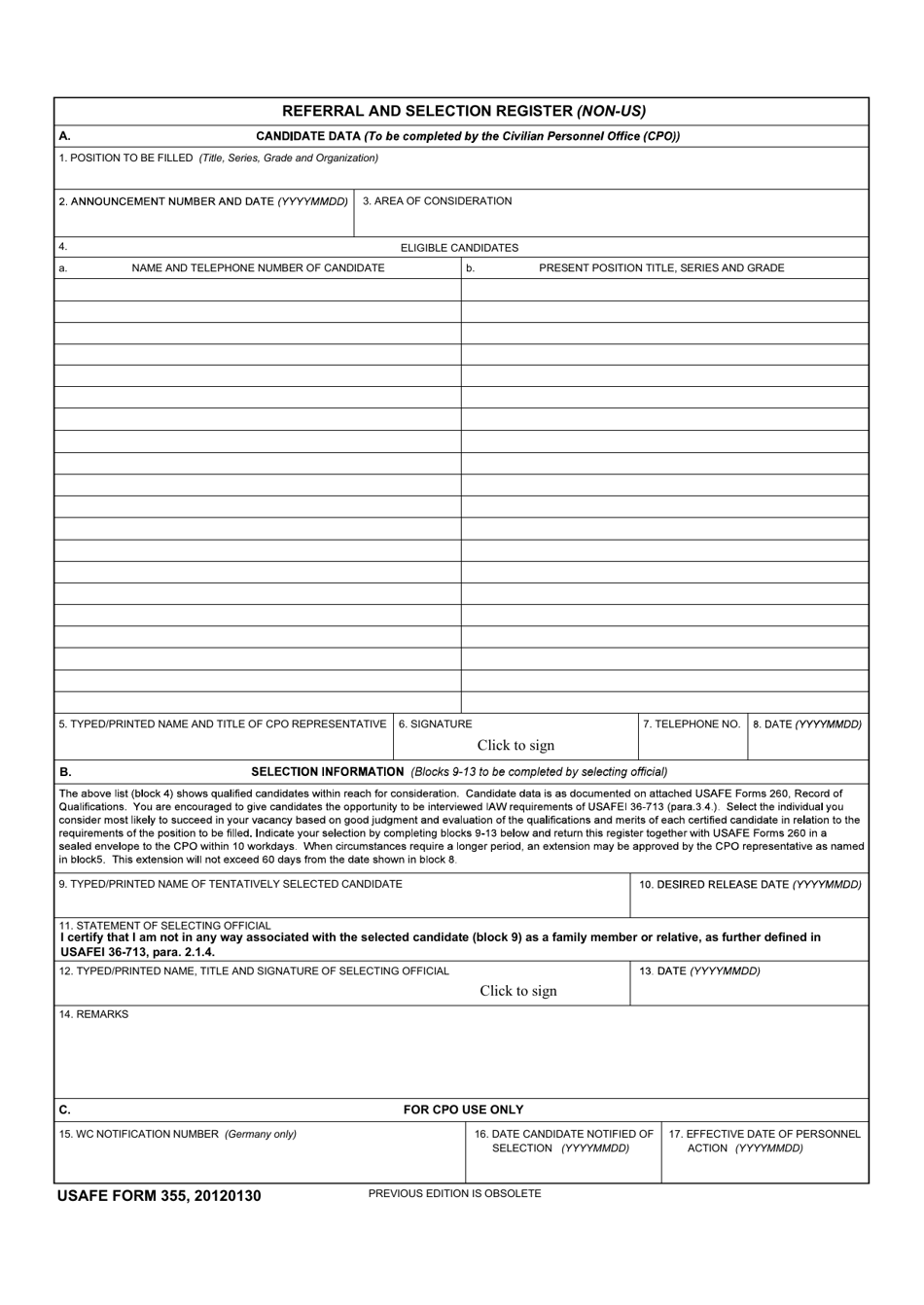

USAFE Form 355 Download Fillable PDF or Fill Online Referral and

Web 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return. Web filed by corporations and partnerships passing the credit through to corporate partners to claim the credit for corporate contributions to school tuition organizations. Application for certification for qualifying foster care charitable. Web 26.

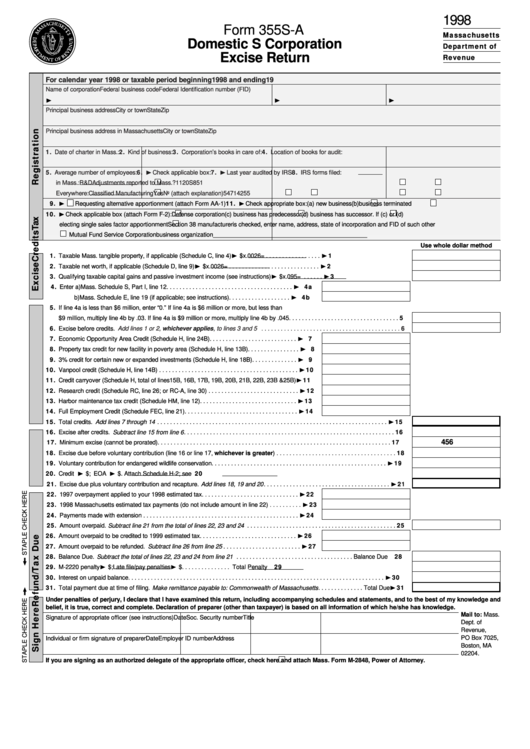

Fillable Form 355sA Domestic S Corporation Excise Return 1998

Web arizona court forms. If you did not elect to file a small business income tax return and the amount on. Web ador 11294 (19) az form 352 (2019) page 2 of 3 your name (as shown on page 1) your social security number part 2 available credit carryover if you have a carryover amount. Web 26 rows arizona corporate.

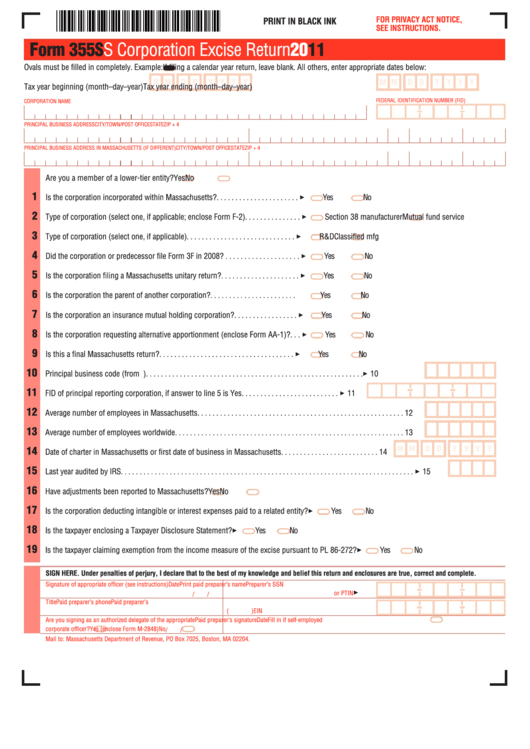

Form 355s S Corporation Excise Return 2011 printable pdf download

Tax credits forms, individual : If you did not elect to file a small business income tax return and the amount on. State of arizona payment request : Web personal income tax return (form 140, 140nr or 140py) or the small business income tax return, if filing. Web arizona corporation income tax return.

Form 355S 2016 Edit, Fill, Sign Online Handypdf

Web personal income tax return (form 140, 140nr or 140py) or the small business income tax return, if filing. Web 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return. State of arizona payment request : Web 26 rows application for certification for qualifying charitable.

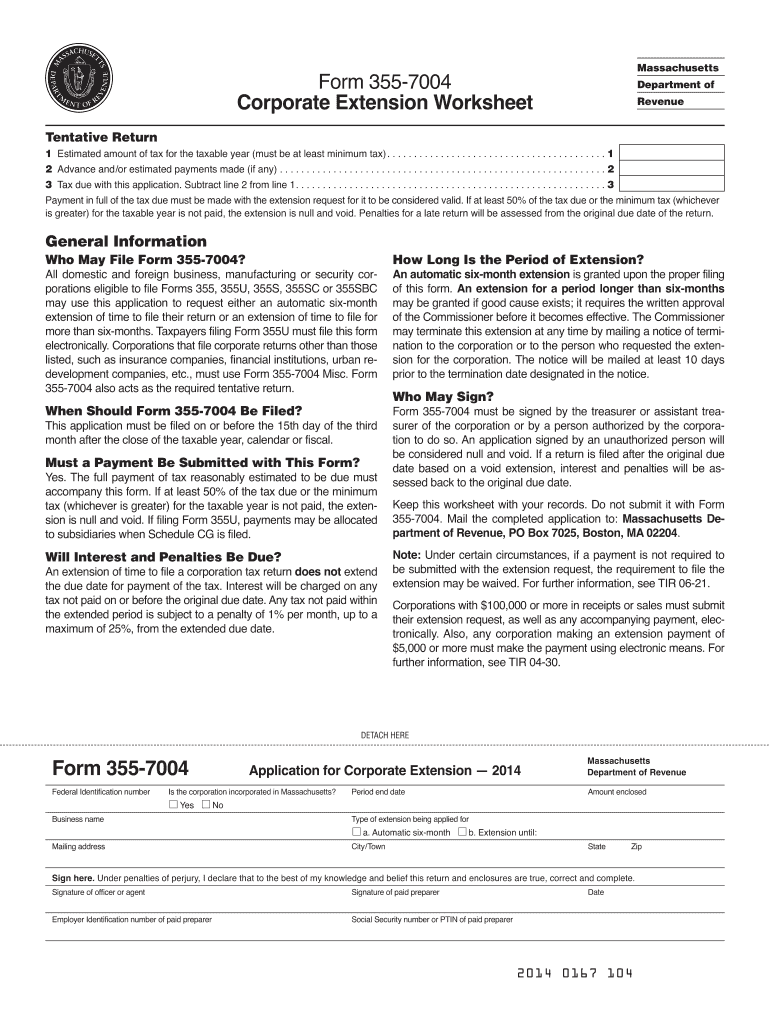

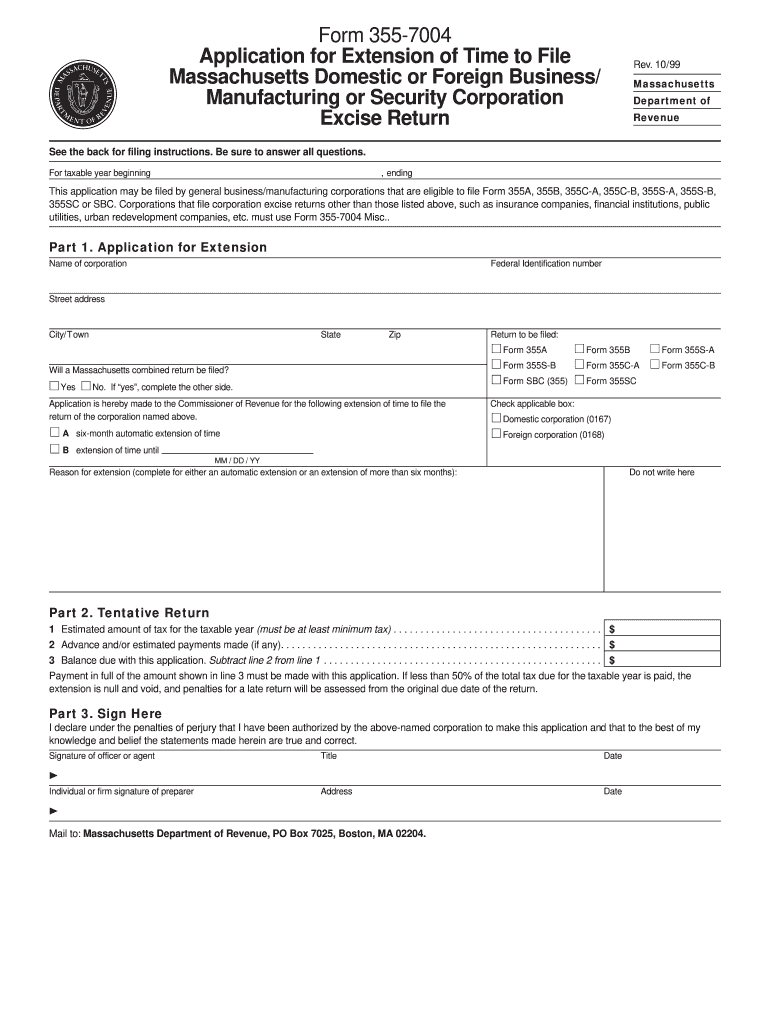

2019 Form 355 7004 Fill Out and Sign Printable PDF Template signNow

Web arizona court forms. Application for certification for qualifying foster care charitable. Web details arizona small business income tax return beginning with tax year 2021, a taxpayer may elect to file a separate small business income (sbi) tax return. If you did not elect to file a small business income tax return and the amount on. Arizona corporation income tax.

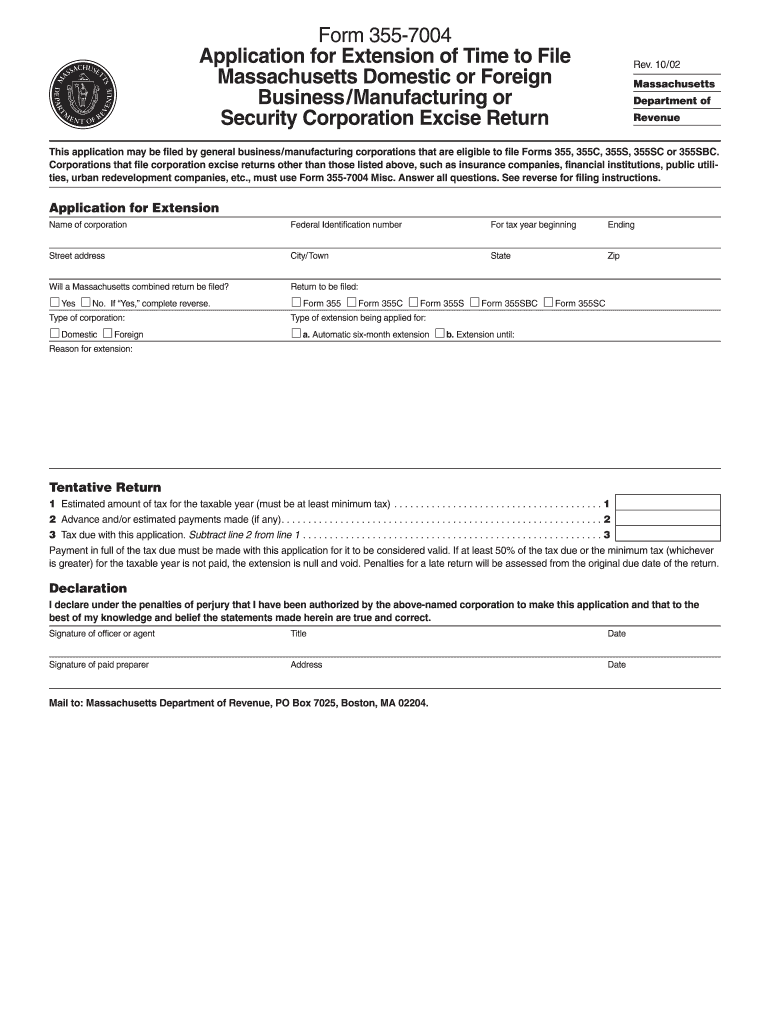

2002 Form MA 3557004 Fill Online, Printable, Fillable, Blank pdfFiller

Web 26 rows application for certification for qualifying charitable organization. If you did not elect to file a small business income tax return and the amount on. Web arizona corporation income tax return. Web ador 11294 (19) az form 352 (2019) page 2 of 3 your name (as shown on page 1) your social security number part 2 available credit.

MA 3557004 1999 Fill out Tax Template Online US Legal Forms

If you are unsure of what forms you need to file,. State of arizona payment request : Web personal income tax return (form 140, 140nr or 140py) or the small business income tax return, if filing. Web arizona court forms. Application for certification for qualifying foster care charitable.

20152022 AK Form 355 Fill Online, Printable, Fillable, Blank pdfFiller

Web 26 rows arizona corporate or partnership income tax payment voucher: If you are unsure of what forms you need to file,. Forms for filing in arizona. Web details arizona small business income tax return beginning with tax year 2021, a taxpayer may elect to file a separate small business income (sbi) tax return. Tax credits forms, individual :

Forms For Filing In Arizona.

Web 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return. Web 26 rows arizona corporate or partnership income tax payment voucher: Web filed by corporations and partnerships passing the credit through to corporate partners to claim the credit for corporate contributions to school tuition organizations. Application for certification for qualifying foster care charitable.

Web Arizona Corporation Income Tax Return.

Tax credits forms, individual : If you are unsure of what forms you need to file,. Web arizona court forms. State of arizona payment request :

Web Details Arizona Small Business Income Tax Return Beginning With Tax Year 2021, A Taxpayer May Elect To File A Separate Small Business Income (Sbi) Tax Return.

Web ador 11294 (19) az form 352 (2019) page 2 of 3 your name (as shown on page 1) your social security number part 2 available credit carryover if you have a carryover amount. The categories below direct the individual to state and county forms. Web personal income tax return (form 140, 140nr or 140py) or the small business income tax return, if filing. Arizona corporation income tax return (short form) form 120ext.

If You Did Not Elect To File A Small Business Income Tax Return And The Amount On.

Web 26 rows application for certification for qualifying charitable organization. Web 26 rows form number title;