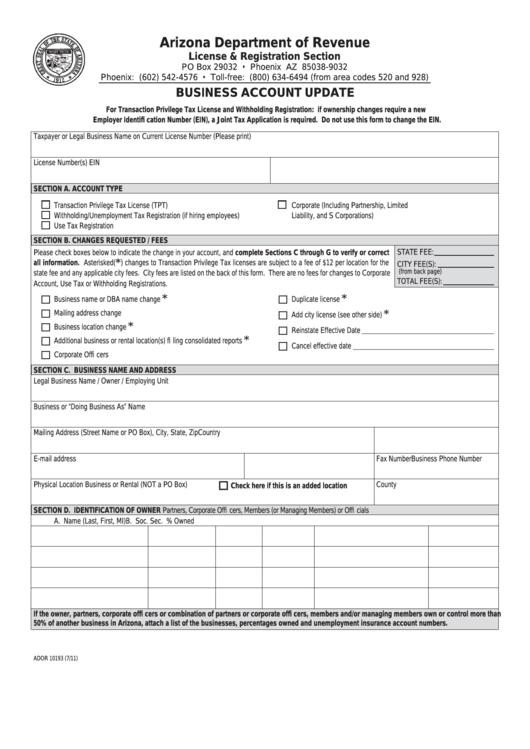

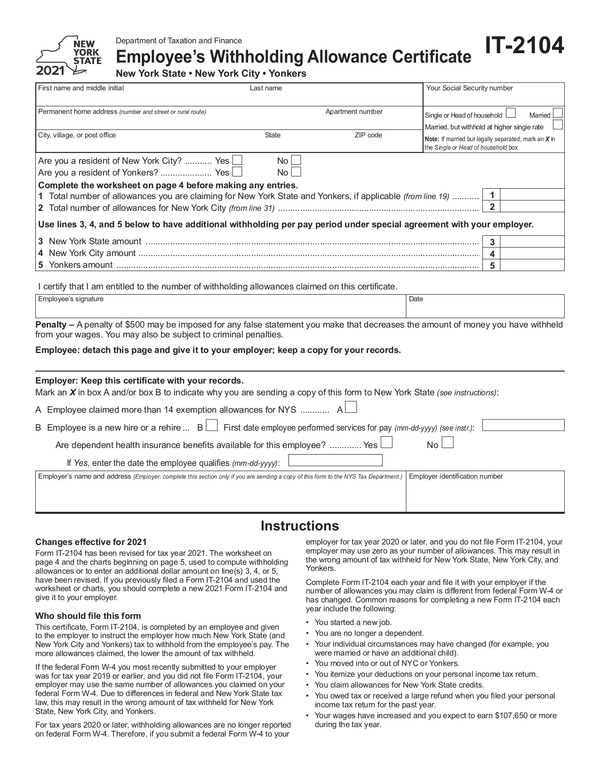

Az State Withholding Form 2022

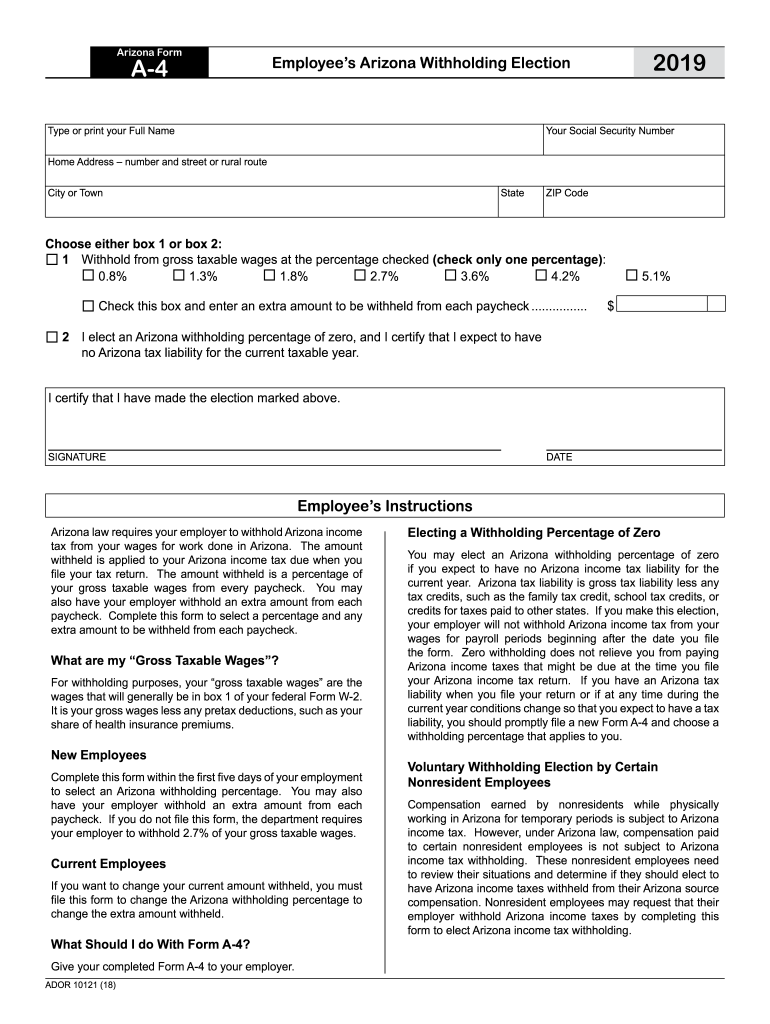

Az State Withholding Form 2022 - You can download or print. Are all employees required to. Form to elect arizona income tax withholding. Web withholding forms annuitant's request for voluntary arizona income tax withholding annuitant's request for voluntary arizona income tax withholding. Web agency human resources contact information. Web 2022 choose either box 1 or box 2: Web employees working outside of arizona must obtain their state’s tax withholding form and submit the form to the agency payroll office for processing. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options.

1 withhold from gross taxable wages at the percentage checked (check only one percentage): Are all employees required to. You can download or print. Web december 7, 2022. Web agency human resources contact information. 0.8% 1.3% 1.8% 2.7% 3.6% 4.2% 5.1% check. You can use your results. Web withholding forms annuitant's request for voluntary arizona income tax withholding annuitant's request for voluntary arizona income tax withholding. Web city or town state zip code choose either box 1 or box 2: Form to elect arizona income tax withholding.

You can use your results. Web employees working outside of arizona must obtain their state’s tax withholding form and submit the form to the agency payroll office for processing. Web 2022 choose either box 1 or box 2: Web city or town state zip code choose either box 1 or box 2: As you proceed through the tax interview on efile.com, the. Are all employees required to. Form to elect arizona income tax withholding. You can download or print. I certify that i have made the election marked above. Submitted by anonymous (not verified) on fri,.

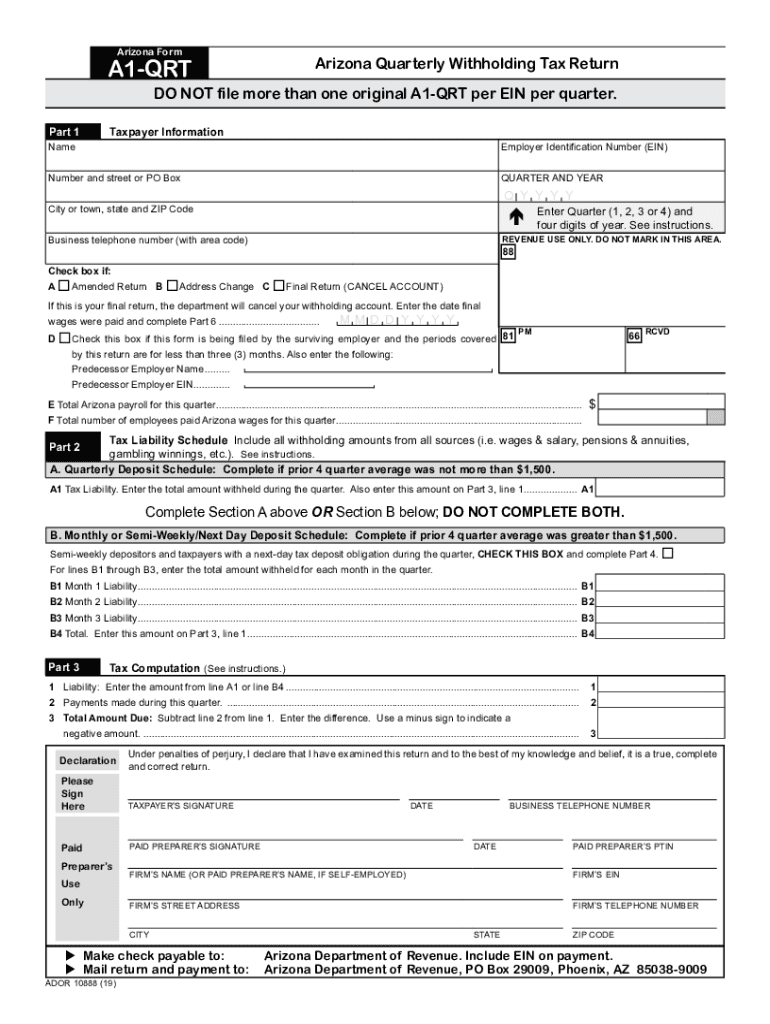

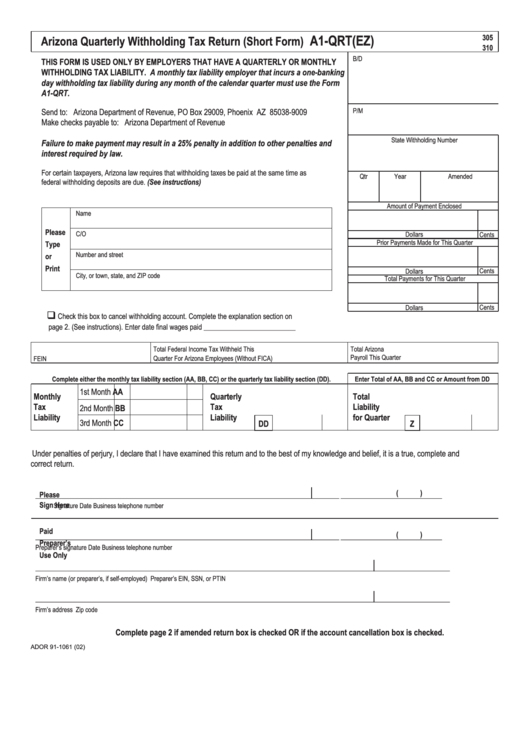

Az Quarterly Withholding Tax Form

You can download or print. Are all employees required to. As you proceed through the tax interview on efile.com, the. 0.8% 1.3% 1.8% 2.7% 3.6% 4.2% 5.1% check. Submitted by anonymous (not verified) on fri,.

AZ ADOR A1QRT 20192022 Fill out Tax Template Online US Legal Forms

Web withholding forms annuitant's request for voluntary arizona income tax withholding annuitant's request for voluntary arizona income tax withholding. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax.

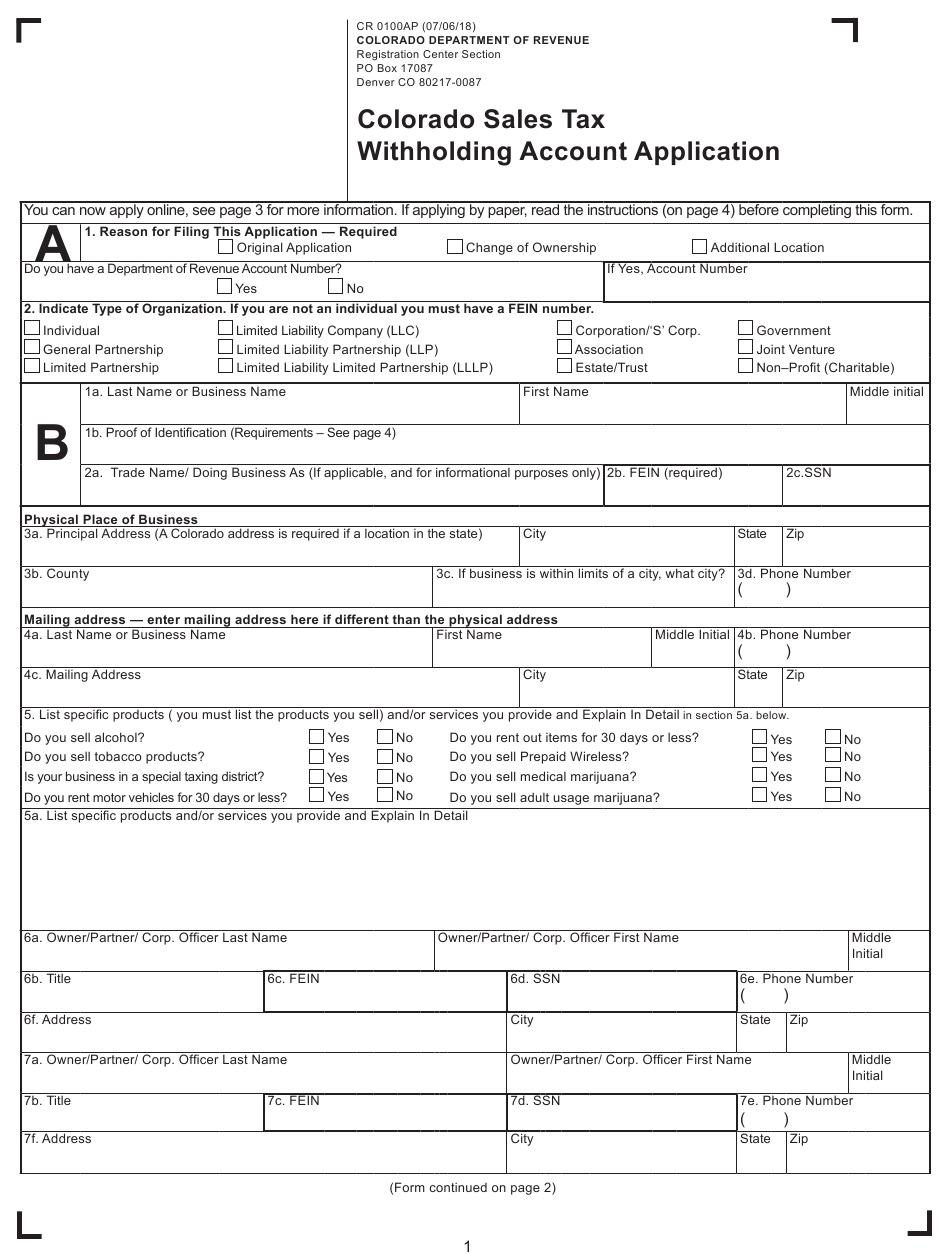

Colorado Withholding Form 2022 W4 Form

Form to elect arizona income tax withholding. Submitted by anonymous (not verified) on fri,. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. Are all employees required to. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees.

A4 Form Fill Out and Sign Printable PDF Template signNow

Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. Web home forms withholding forms arizona annual payment withholding tax return arizona annual payment withholding tax return withholding return and. Web agency human resources contact information. Web withholding forms annuitant's request for voluntary arizona income tax withholding annuitant's request for voluntary.

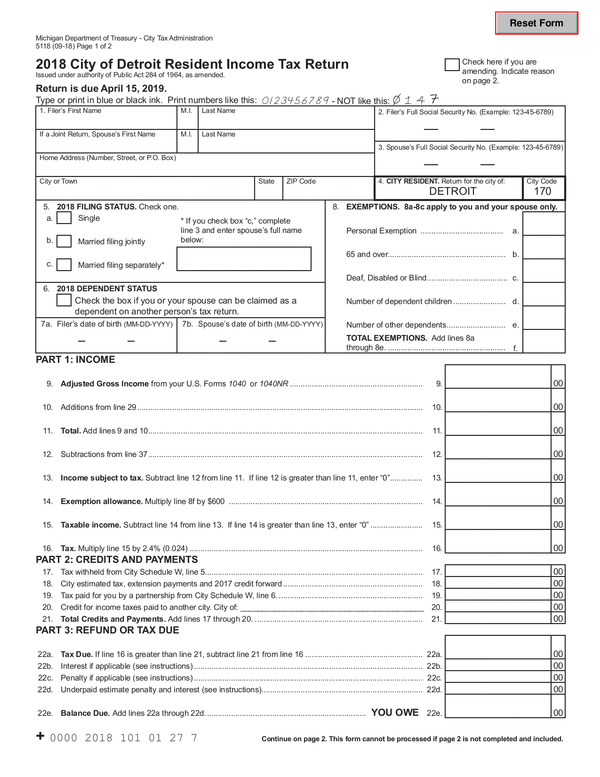

Mi State Withholding Form 2022

Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. Web home forms withholding forms arizona annual payment withholding tax return arizona annual.

Form A1Qrt(Ez) Arizona Quarterly Withholding Tax Return (Short Form

State of arizona accounting manual (saam) afis. I certify that i have made the election marked above. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Web agency human resources contact information. Are all employees required to.

Az Withholding Tax Return Form

As you proceed through the tax interview on efile.com, the. Web employees working outside of arizona must obtain their state’s tax withholding form and submit the form to the agency payroll office for processing. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income.

2022 Arizona State Withholding Form

Web december 7, 2022. Web employees working outside of arizona must obtain their state’s tax withholding form and submit the form to the agency payroll office for processing. Web 2022 choose either box 1 or box 2: 0.8% 1.3% 1.8% 2.7% 3.6% 4.2% 5.1% check. Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have.

2022 Az State Withholding Form

Web employees working outside of arizona must obtain their state’s tax withholding form and submit the form to the agency payroll office for processing. Web december 7, 2022. Web the arizona department of revenue (azdor) announced on november 1, 2022, arizona’s employees have new tax withholding options. As you proceed through the tax interview on efile.com, the. All wages, salaries,.

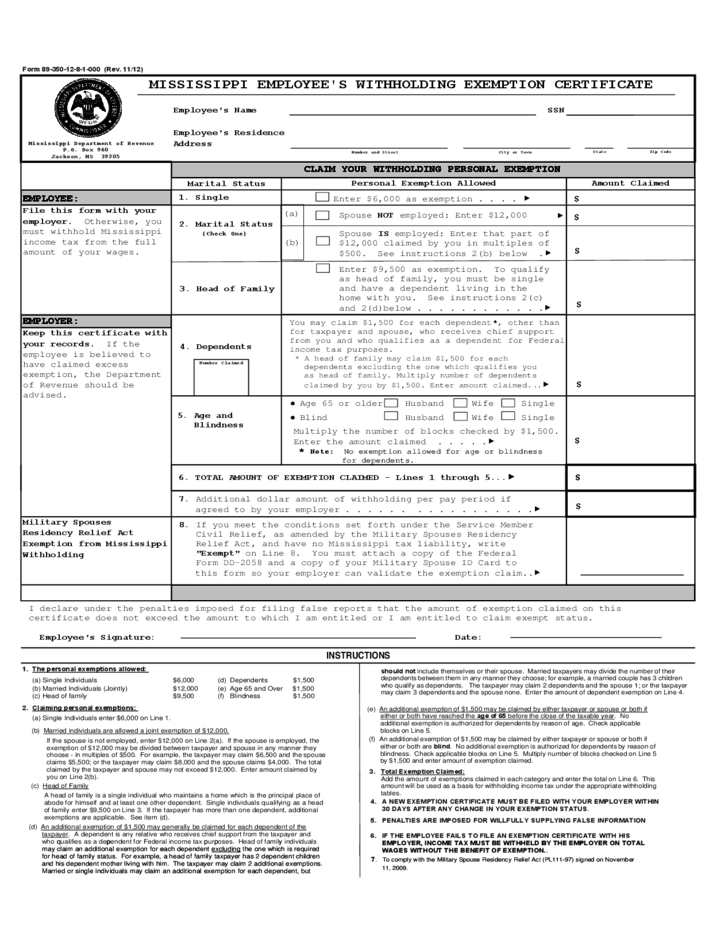

Mississippi Employee Withholding Form 2021 2022 W4 Form

Web city or town state zip code choose either box 1 or box 2: State of arizona accounting manual (saam) afis. Web 2022 choose either box 1 or box 2: 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Form to elect arizona income tax withholding.

Web Home Forms Withholding Forms Arizona Annual Payment Withholding Tax Return Arizona Annual Payment Withholding Tax Return Withholding Return And.

Web december 7, 2022. Web agency human resources contact information. Form to elect arizona income tax withholding. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding.

You Can Use Your Results.

Web withholding forms annuitant's request for voluntary arizona income tax withholding annuitant's request for voluntary arizona income tax withholding. Submitted by anonymous (not verified) on fri,. As you proceed through the tax interview on efile.com, the. You can download or print.

I Certify That I Have Made The Election Marked Above.

Web 2022 choose either box 1 or box 2: Are all employees required to. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. State of arizona accounting manual (saam) afis.

Web The Arizona Department Of Revenue (Azdor) Announced On November 1, 2022, Arizona’s Employees Have New Tax Withholding Options.

Web city or town state zip code choose either box 1 or box 2: Web employees working outside of arizona must obtain their state’s tax withholding form and submit the form to the agency payroll office for processing. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): 0.8% 1.3% 1.8% 2.7% 3.6% 4.2% 5.1% check.