Az Tax Form 140

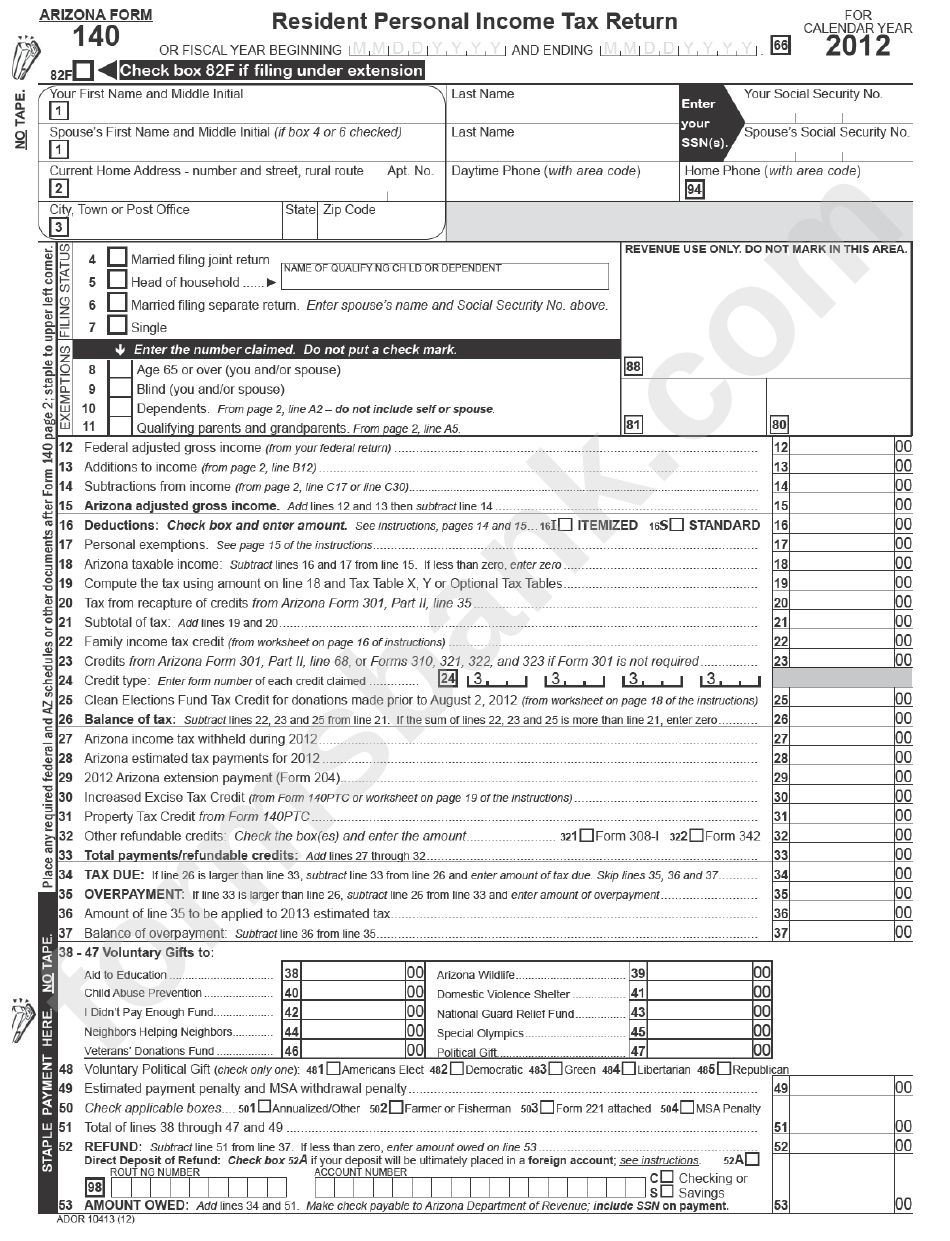

Az Tax Form 140 - If your taxable income is less than $50,000, use the optional tax tables to figure your tax. This version is for taxpayers who need a plain fillable form 140, or are filing arizona small business income tax return ( form. Complete, edit or print tax forms instantly. Get your online template and fill it in using progressive features. Download or email az form 140 & more fillable forms, register and subscribe now! Web we last updated arizona form 140 in february 2023 from the arizona department of revenue. Versions form popularity fillable &. Web resident personal income tax return. Web you may use form 140ez if all of the following apply: Web individual income tax forms;

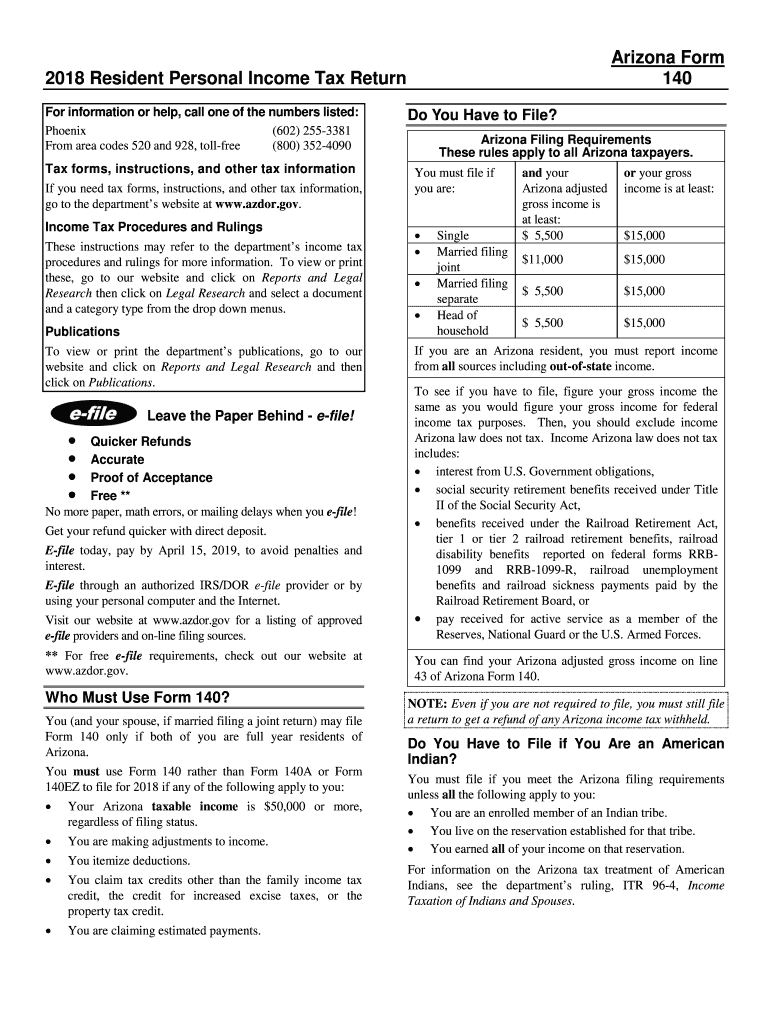

Mail to arizona department of revenue, po box 29085, phoenix, az 85038. This form should be completed after. Get your online template and fill it in using progressive features. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. This form is for income earned in tax year 2022, with tax returns due in april. If your taxable income is less than $50,000, use the optional tax tables to figure your tax. Web 2021 arizona tax tables x and y. You are single, or if married, you and your spouse are filing a joint return. Web make an individual or small business income payment. Include your payment with this form.

If your taxable income is $50,000 or more, you. Web the most common arizona income tax form is the arizona form 140. We last updated arizona form 140 tax tables in february 2023 from the. Web individual income tax forms; Web resident personal income tax return. Get your online template and fill it in using progressive features. Web ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 20 votes how to fill out and sign form 140 online? Mail to arizona department of revenue, po box 29085, phoenix, az 85038. Include your payment with this form. Web we last updated arizona form 140 in february 2023 from the arizona department of revenue.

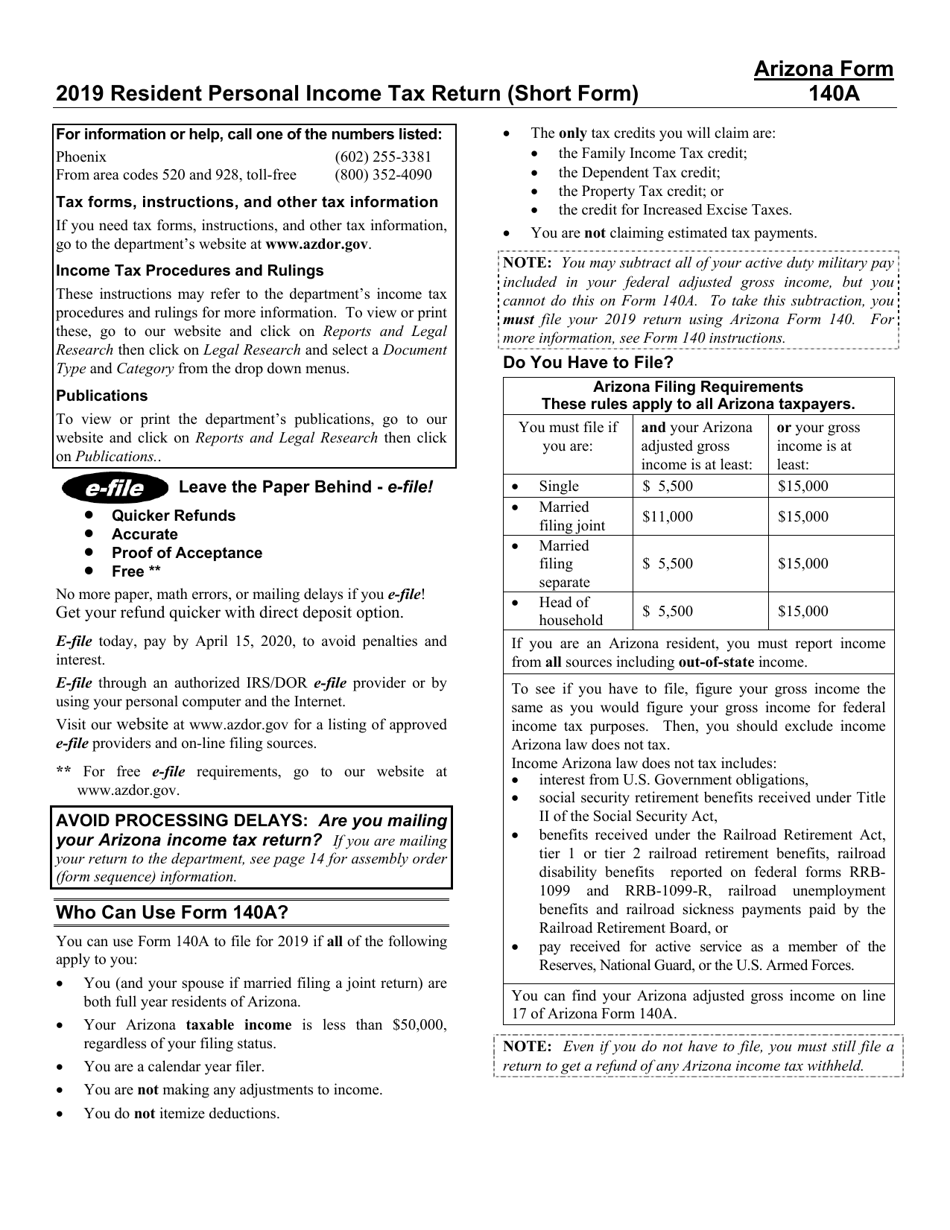

Download Instructions for Arizona Form 140A, ADOR10414 Resident

Web we last updated arizona form 140 in february 2023 from the arizona department of revenue. Web the most common arizona income tax form is the arizona form 140. If your taxable income is less than $50,000, use the optional tax tables to figure your tax. Select the right arizona 140 tax version from the list and start editing it.

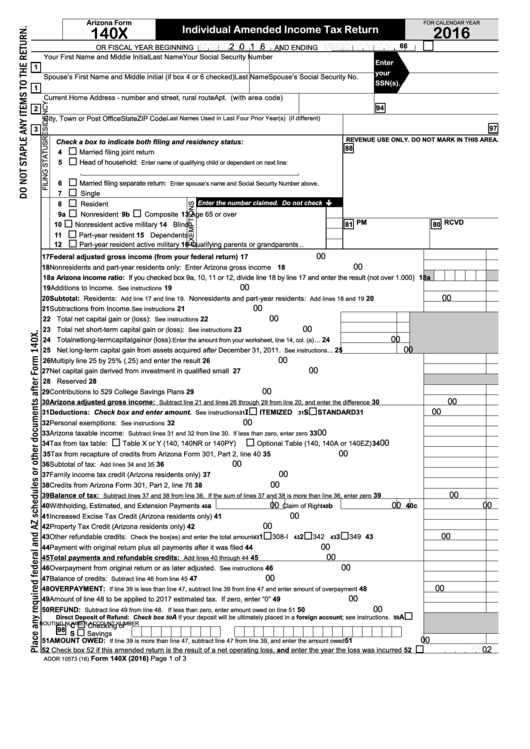

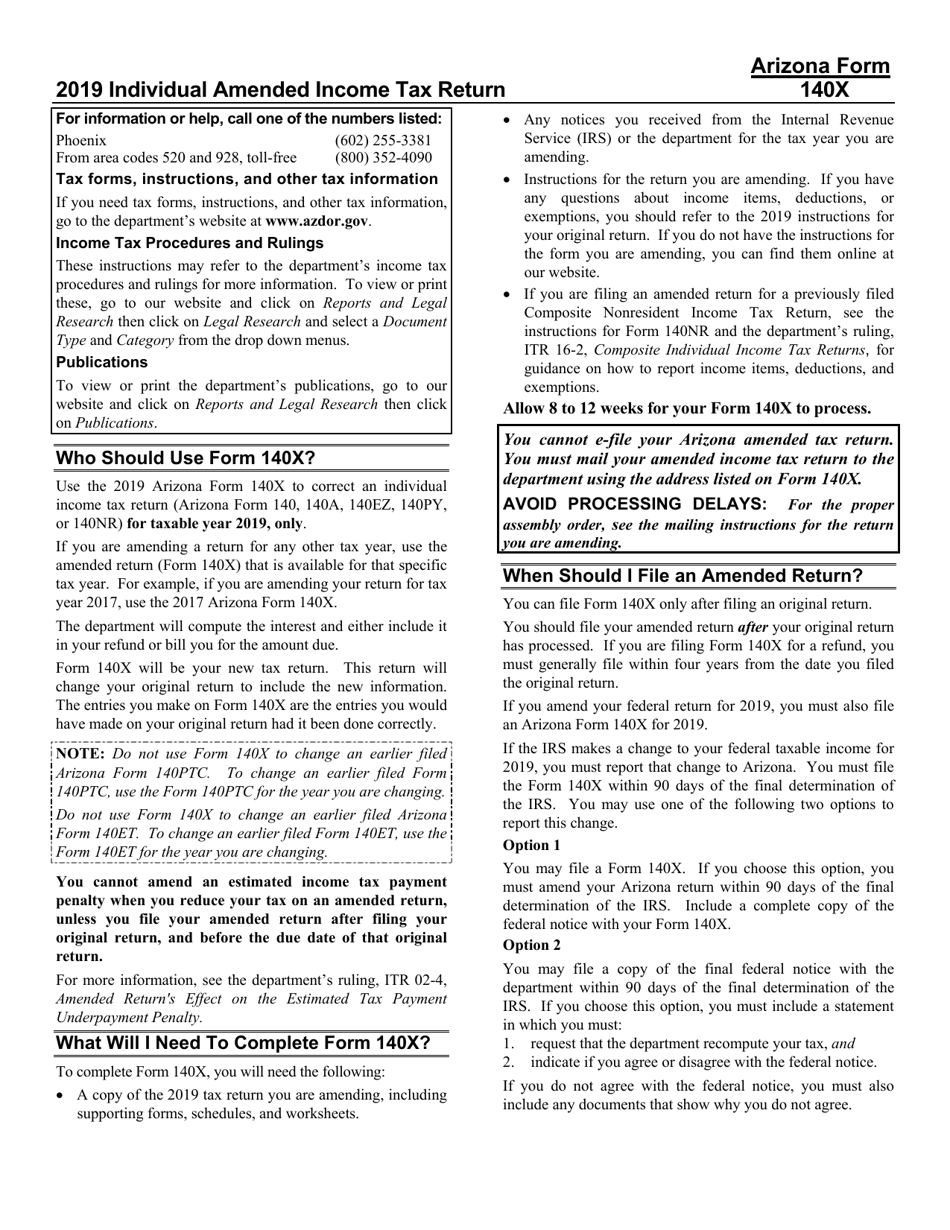

Fillable Arizona Form 140x Individual Amended Tax Return

Web personal income tax return filed by resident taxpayers. You are single, or if married, you and your spouse are filing a joint return. Register and subscribe now to work on your az form 140 & more fillable forms. Web make an individual or small business income payment. Versions form popularity fillable &.

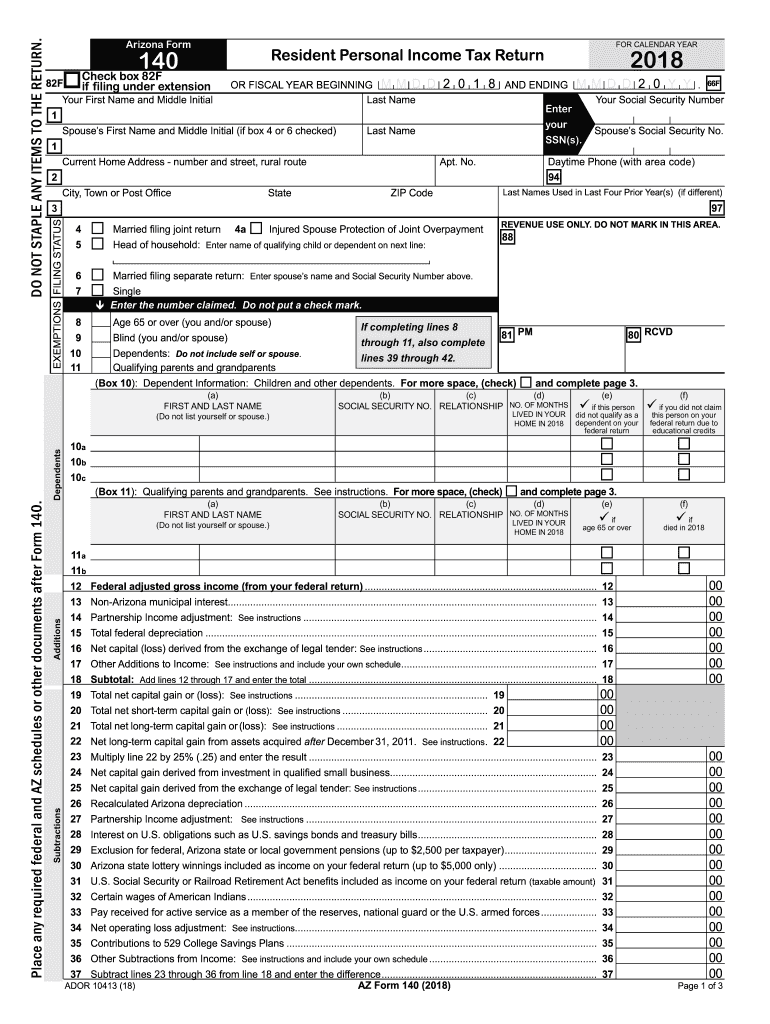

2018 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

All arizona taxpayers must file a form 140 with the arizona department of revenue. Versions form popularity fillable &. Web 2021 arizona tax tables x and y. Register and subscribe now to work on your az form 140 & more fillable forms. We last updated arizona form 140 tax tables in february 2023 from the.

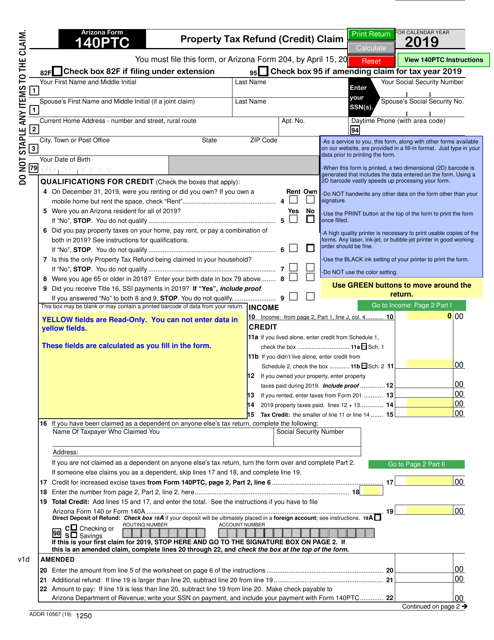

Arizona Form 140PTC (ADOR10567) Download Fillable PDF or Fill Online

Web ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 20 votes how to fill out and sign form 140 online? This version is for taxpayers who need a plain fillable form 140, or are filing arizona small business income tax return ( form. Web we've got more versions of the arizona.

Download Instructions for Arizona Form 140X, ADOR10573 Individual

Get your online template and fill it in using progressive features. Web 2021 arizona tax tables x and y. Web we've got more versions of the arizona 140 tax form. If your taxable income is less than $50,000, use the optional tax tables to figure your tax. Web download this form print this form more about the arizona form 140.

2022 Form AZ DoR 140ES Fill Online, Printable, Fillable, Blank pdfFiller

You are single, or if married, you and your spouse are filing a joint return. Web you may use form 140ez if all of the following apply: Web form 140et is an arizona individual income tax form. Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax returns due in april.

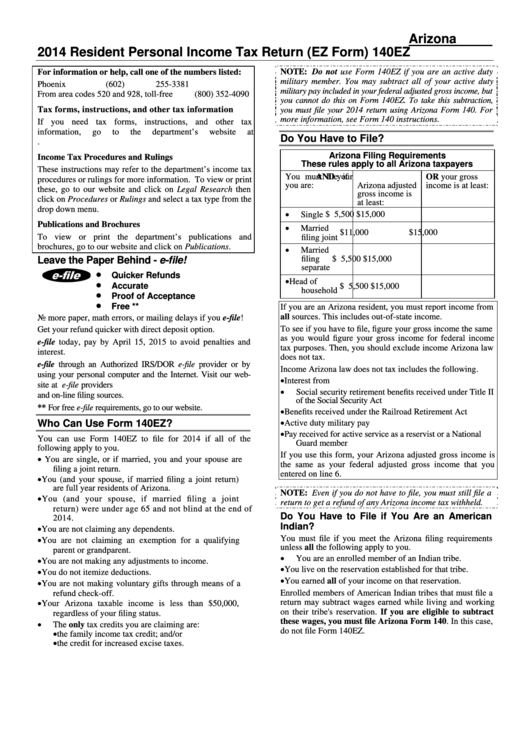

Instructions For Arizona Form 140ez Resident Personal Tax

Get your online template and fill it in using progressive features. This form is used by residents who file an individual income tax return. Web 2021 arizona tax tables x and y. Complete, edit or print tax forms instantly. This form should be completed after.

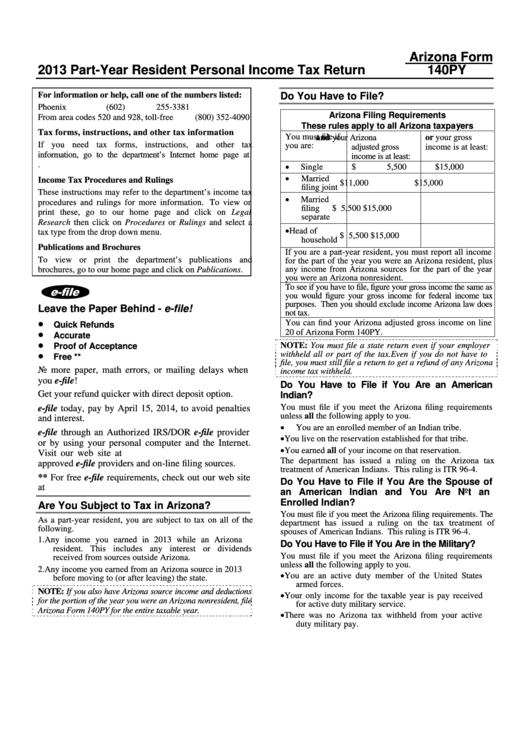

Arizona Form 140py PartYear Resident Personal Tax Return

Web ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 20 votes how to fill out and sign form 140 online? All arizona taxpayers must file a form 140 with the arizona department of revenue. Get your online template and fill it in using progressive features. Your taxable income is less than.

Printable Az 140 Tax Form Printable Form 2022

All arizona taxpayers must file a form 140 with the arizona department of revenue. Web we last updated arizona form 140 in february 2023 from the arizona department of revenue. Web we've got more versions of the arizona 140 tax form. Web you may use form 140ez if all of the following apply: Select the right arizona 140 tax version.

AZ DoR 140 Instructions 2018 Fill out Tax Template Online US Legal

Get your online template and fill it in using progressive features. If your taxable income is less than $50,000, use the optional tax tables to figure your tax. Web resident personal income tax return. Select the right arizona 140 tax version from the list and start editing it straight away! This version is for taxpayers who need a plain fillable.

We Last Updated Arizona Form 140 Tax Tables In February 2023 From The.

Get your online template and fill it in using progressive features. Web resident personal income tax return. If your taxable income is less than $50,000, use the optional tax tables to figure your tax. All arizona taxpayers must file a form 140 with the arizona department of revenue.

Versions Form Popularity Fillable &.

Web individual income tax forms; Web the most common arizona income tax form is the arizona form 140. If your taxable income is less than $50,000, use the optional tax tables to figure your tax. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona.

Web We've Got More Versions Of The Arizona 140 Tax Form.

Web personal income tax return filed by resident taxpayers. This form is for income earned in tax year 2022, with tax returns due in april. If your taxable income is $50,000 or more, you. Your taxable income is less than $50,000.

Download Or Email Az Form 140 & More Fillable Forms, Register And Subscribe Now!

Web form 140et is an arizona individual income tax form. Web you may use form 140ez if all of the following apply: Web ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 20 votes how to fill out and sign form 140 online? This version is for taxpayers who need a plain fillable form 140, or are filing arizona small business income tax return ( form.