Bank Of America Form 1098

Bank Of America Form 1098 - Payoff request form if you have any. Enter only one tax form number per request for line 6 transcripts. You may have signed up for “paperless”, of which means the bank does not send you any type. January 2022) for calendar year. For internal revenue service center. The $600 threshold applies separately to each mortgage, so you are not required to file form 1098 for a mortgage on which you. Bank online easily and securely with the bank of america mobile app. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web some bank of america 1098 forms report real estate tax on the back side. Web file a separate form 1098 for each mortgage.

Web at bank of america, our purpose is to help make financial lives better through the power of every connection. Web form (keep for your records) www.irs.gov/form1098 instructions for payer/borrower Bank online easily and securely with the bank of america mobile app. Web enter the tax form number here (1040, 1065, 1120, etc.) and check the appropriate box below. Web i think that most of us tend to think that when they send our clients form 1098, the banks are telling them what their deductible mortgage interest is (assuming the. Benefits provided by borrowers protection plan may be taxable income to you, your estate or survivors, and may reduce the amount of interest. Web those actions, according to the complaint meant that bank of america was “systematically, knowingly and intentionally underreporting on forms 1098 hundreds of. Payoff request form if you have any. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web answer (1 of 5):

Web some bank of america 1098 forms report real estate tax on the back side. What would you like the power to do? Web file a separate form 1098 for each mortgage. Some bank of america 1098 forms report the real estate tax. Enter only one tax form number per request for line 6 transcripts. Web at bank of america, our purpose is to help make financial lives better through the power of every connection. The lender can give your the amount of. Your question has been successfully answered by 3 people. Web i think that most of us tend to think that when they send our clients form 1098, the banks are telling them what their deductible mortgage interest is (assuming the. Web contact the prior lender if you did not receive a 1098 form.

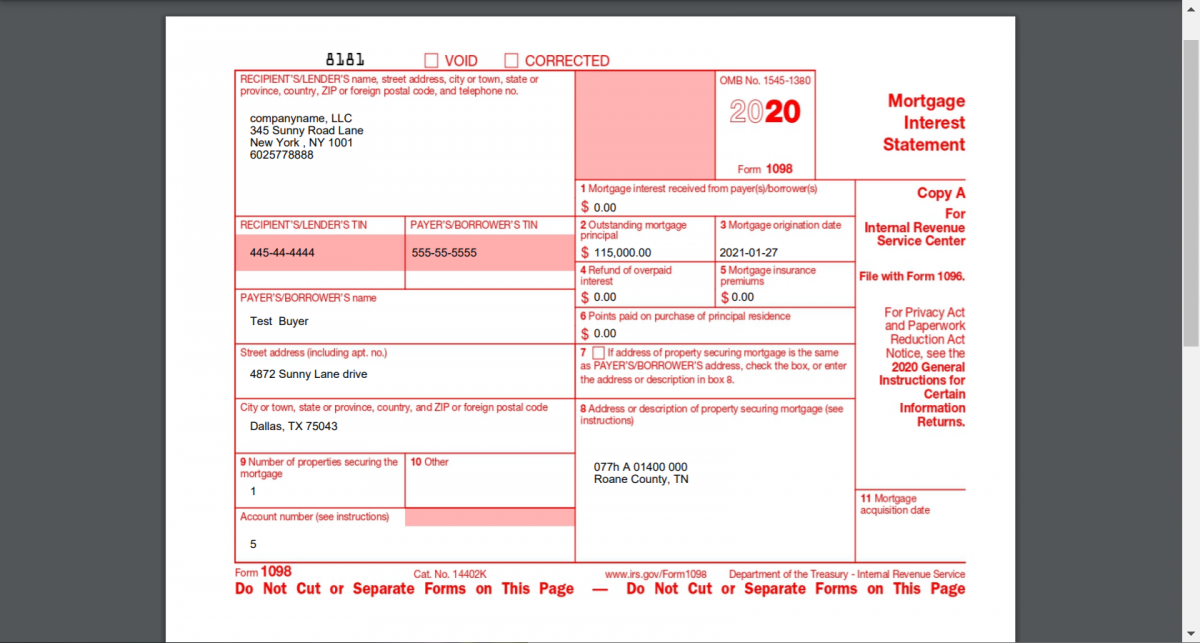

How To Generate A 1098 Document For Active Loans The Investment

Web i think that most of us tend to think that when they send our clients form 1098, the banks are telling them what their deductible mortgage interest is (assuming the. Benefits provided by borrowers protection plan may be taxable income to you, your estate or survivors, and may reduce the amount of interest. For internal revenue service center. Web.

Form 1098 Mortgage Interest Statement Definition

The $600 threshold applies separately to each mortgage, so you are not required to file form 1098 for a mortgage on which you. For you and your family, your. January 2022) for calendar year. Web enter the tax form number here (1040, 1065, 1120, etc.) and check the appropriate box below. Web your mortgage interest statement (form 1098) is available.

1098 Mortgage Interest Forms United Bank of Union

If you don't receive your 1098 by february. Web i think that most of us tend to think that when they send our clients form 1098, the banks are telling them what their deductible mortgage interest is (assuming the. Your question has been successfully answered by 3 people. Bank online easily and securely with the bank of america mobile app..

Transfer Slip Fill Out and Sign Printable PDF Template signNow

For internal revenue service center. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web file a separate form 1098 for each mortgage. Some bank of america 1098 forms report the real estate tax. Web some bank of.

Form 1098T Still Causing Trouble for Funded Graduate Students

Bank online easily and securely with the bank of america mobile app. Web your mortgage interest statement (form 1098) is available within digital banking during the month of january and we'll notify you when it's ready. January 2022) for calendar year. Web i think that most of us tend to think that when they send our clients form 1098, the.

Form 1098T Information Student Portal

Web 9.98k subscribers subscribe 2 share 1k views 10 months ago learn how to get your tax forms from bank of america. Web file a separate form 1098 for each mortgage. What would you like the power to do? Web we'll mail you irs form 1098 by the end of january, or deliver it electronically if you've enrolled to receive.

Form 1098 Mortgage Interest Statement and How to File

You may have signed up for “paperless”, of which means the bank does not send you any type. Benefits provided by borrowers protection plan may be taxable income to you, your estate or survivors, and may reduce the amount of interest. If you don't receive your 1098 by february. The lender can give your the amount of. Web form (keep.

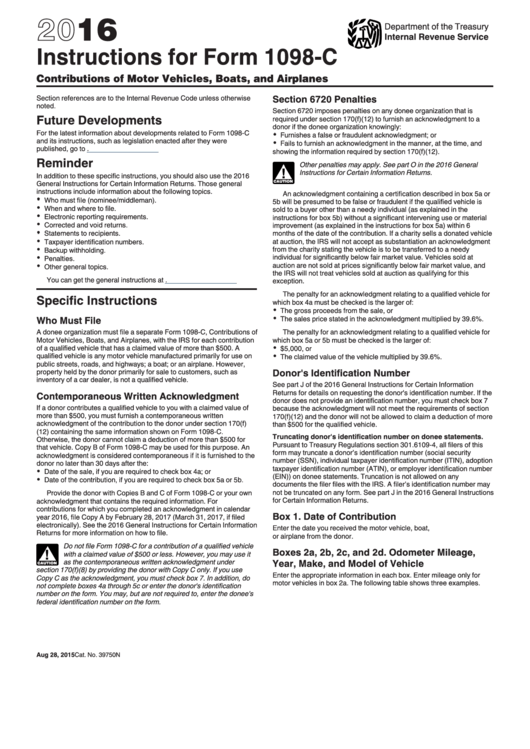

Instructions For Form 1098C Contributions Of Motor Vehicles, Boats

Enter only one tax form number per request for line 6 transcripts. You may have signed up for “paperless”, of which means the bank does not send you any type. If you don't receive your 1098 by february. Ad easily manage your account w/ the bank of america® mobile banking app. Benefits provided by borrowers protection plan may be taxable.

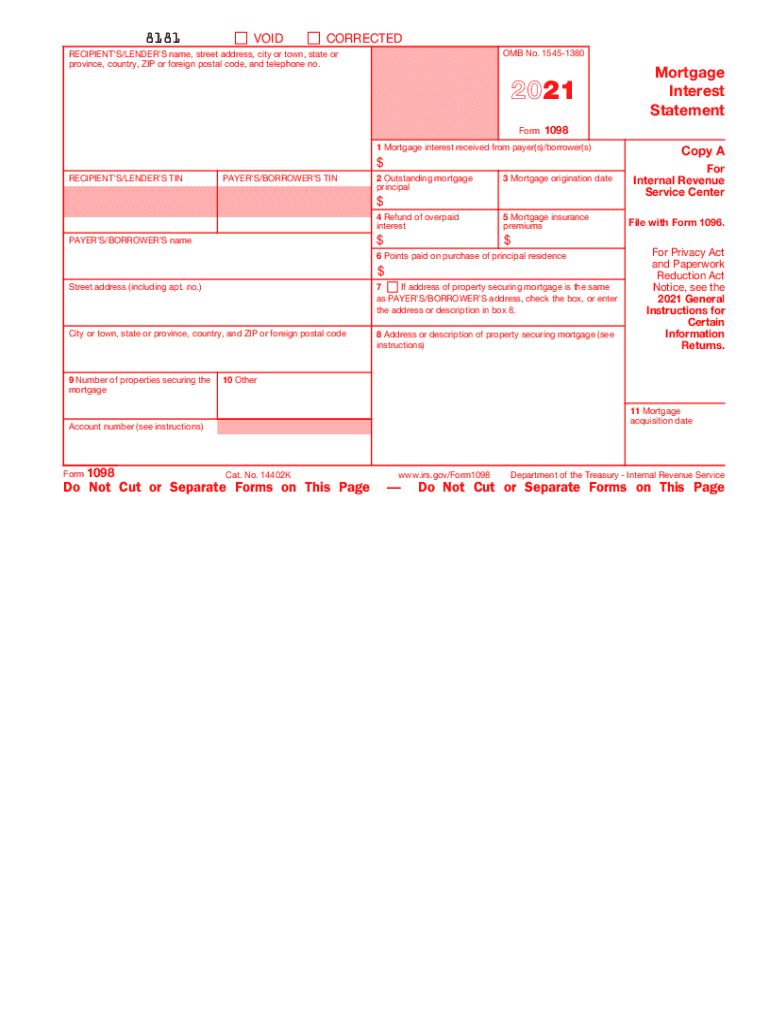

2021 Form 1098. Mortgage Interest Statement Fill and Sign Printable

Persons with a hearing or speech disability with access to. Web i think that most of us tend to think that when they send our clients form 1098, the banks are telling them what their deductible mortgage interest is (assuming the. Web those actions, according to the complaint meant that bank of america was “systematically, knowingly and intentionally underreporting on.

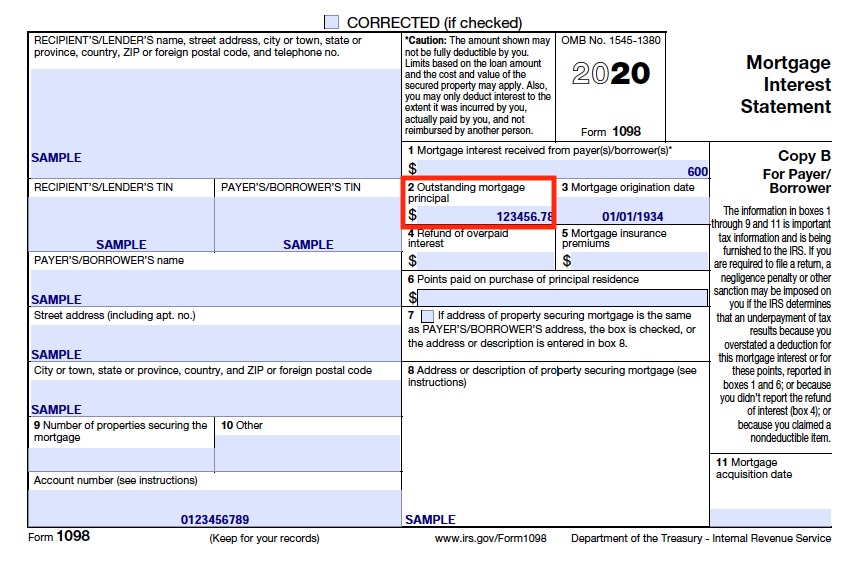

End of Year Form 1098 changes Peak Consulting

The $600 threshold applies separately to each mortgage, so you are not required to file form 1098 for a mortgage on which you. The lender can give your the amount of. Web those actions, according to the complaint meant that bank of america was “systematically, knowingly and intentionally underreporting on forms 1098 hundreds of. Web hi, my mortgage was transferred.

Web Contact The Prior Lender If You Did Not Receive A 1098 Form.

Web some bank of america 1098 forms report real estate tax on the back side. Web those actions, according to the complaint meant that bank of america was “systematically, knowingly and intentionally underreporting on forms 1098 hundreds of. For internal revenue service center. Enter only one tax form number per request for line 6 transcripts.

What Would You Like The Power To Do?

Your question has been successfully answered by 3 people. Ad easily manage your account w/ the bank of america® mobile banking app. Some bank of america 1098 forms report the real estate tax. The lender can give your the amount of.

Payoff Request Form If You Have Any.

The $600 threshold applies separately to each mortgage, so you are not required to file form 1098 for a mortgage on which you. Web your mortgage interest statement (form 1098) is available within digital banking during the month of january and we'll notify you when it's ready. Web file a separate form 1098 for each mortgage. If you don't receive your 1098 by february.

Web Answer (1 Of 5):

Web form (keep for your records) www.irs.gov/form1098 instructions for payer/borrower Web hi, my mortgage was transferred from bank of america to mr cooper in november 2021 (boa sold mortgage to mr cooper), and mr. Benefits provided by borrowers protection plan may be taxable income to you, your estate or survivors, and may reduce the amount of interest. They are required to send a 1098 form if you paid interest greater than $600.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png)

/Form1098-5c57730f46e0fb00013a2bee.jpg)