Ca Form 3539

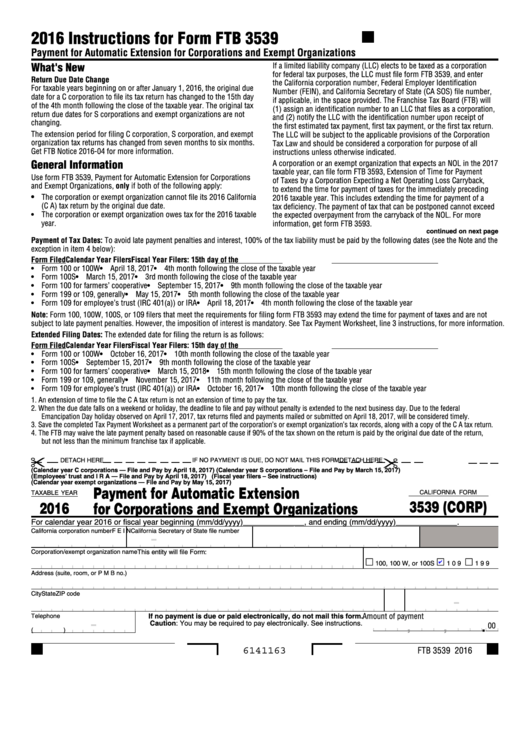

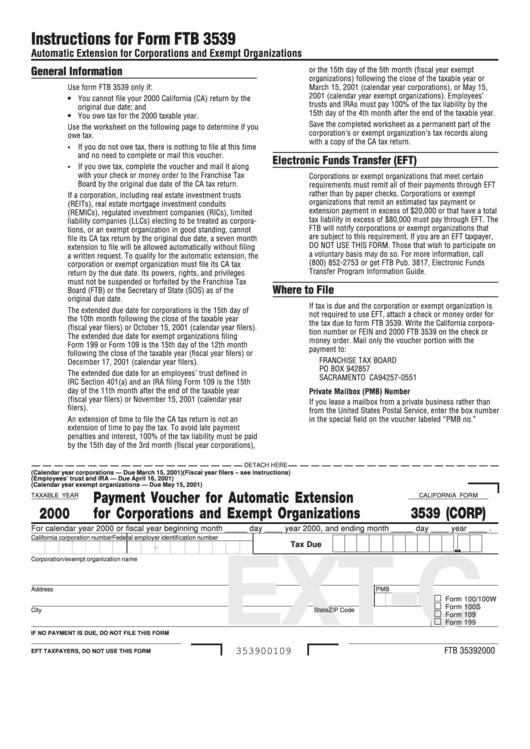

Ca Form 3539 - Cocodoc is the best place for you to go, offering you a free and modifiable version of form 3539 as you wish. That applies to contracts and agreements, tax forms and almost any other document that needs a signature. This form is used to claim tax credits for donations made to certain charitable organizations. Web california form 3539 is an important document for taxpayers in the state. Limited partnerships, limited liability partnerships or real estate mortgage investment conduit: Web form 3539 is the payment voucher for the automatic extension. • the corporation or exempt organization cannot file its 2021 california (c a) tax return by the original due date. Form 3539 is not an extension form. Web is it the case that you are looking for form 3539 to fill? To pay electronically, visit our payment options.

• the corporation or exempt organization owes tax for the 2010 taxable. This form is used to claim tax credits for donations made to certain charitable organizations. We last updated california form 3539 (corp) in january 2023 from the california franchise tax board. Web we last updated the payment for automatic extension for corps and exempt orgs in january 2023, so this is the latest version of form 3539 (corp), fully updated for tax year 2022. Web ftb.ca.gov and search for web pay. Web california form 3539 is an important document for taxpayers in the state. Web corporations and exempt organizations: This form is for income earned in tax year 2022, with tax returns due in. Web form 3539 is the payment voucher for the automatic extension. If there is no balance due with the automatic extension, form 3539 will not generate.

If there is no balance due with the automatic extension, form 3539 will not generate. Its bewildering collection of forms can save your time and boost your efficiency massively. Form 3539 is not an extension form. We last updated california form 3539 (corp) in january 2023 from the california franchise tax board. Web is it the case that you are looking for form 3539 to fill? Limited partnerships, limited liability partnerships or real estate mortgage investment conduit: If no payment is due, you do not need to file an automatic extension payment form. That applies to contracts and agreements, tax forms and almost any other document that needs a signature. Web ftb.ca.gov and search for web pay. • the corporation or exempt organization cannot file its 2010 california (ca) tax return by the original due date.

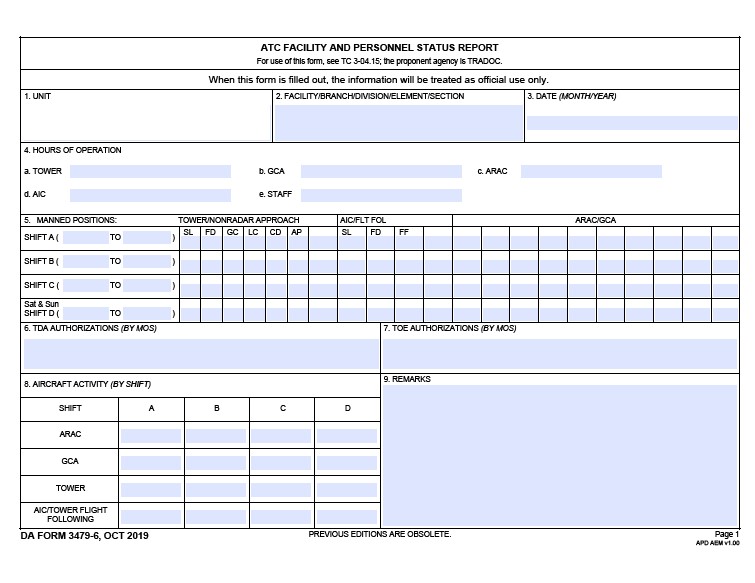

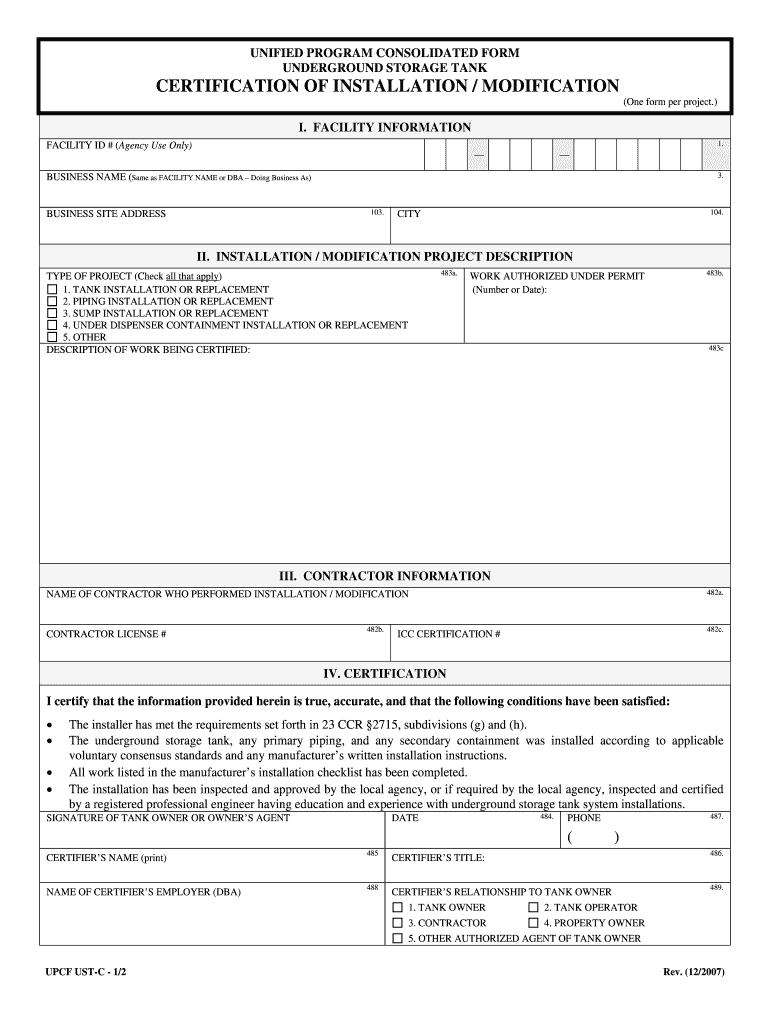

Download Fillable da Form 34796

If there is no balance due with the automatic extension, form 3539 will not generate. • the corporation or exempt organization cannot file its 2010 california (ca) tax return by the original due date. Web corporations and exempt organizations: Web ftb.ca.gov and search for web pay. California automatically extends their corporate returns.

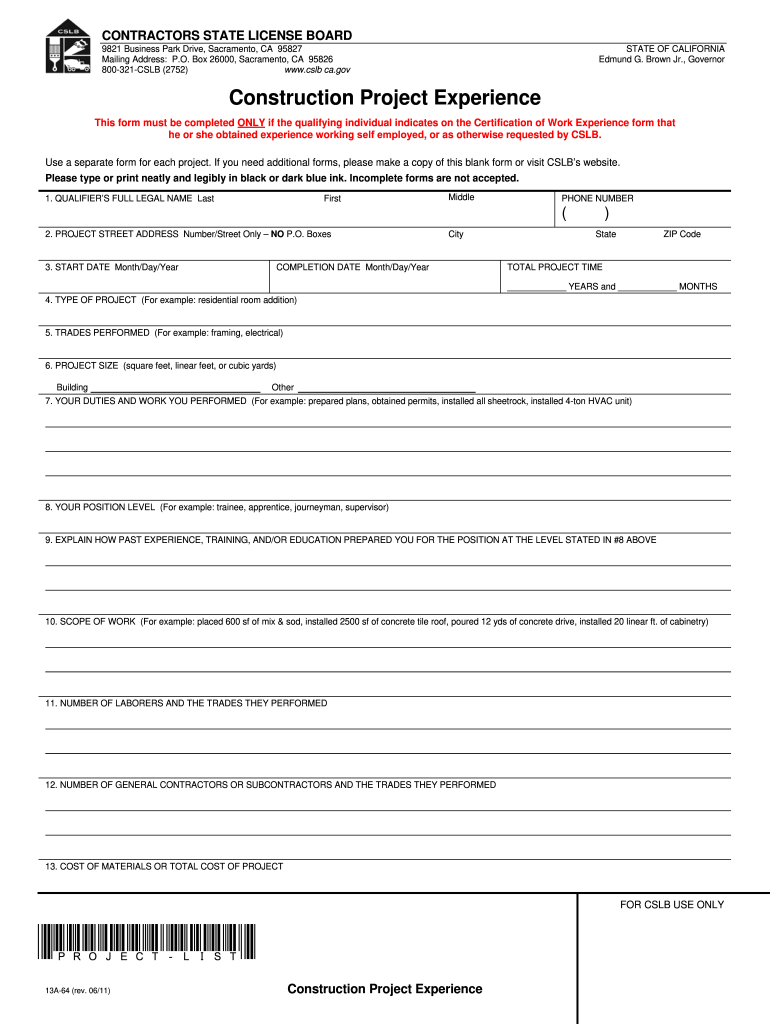

CA Form 13A64 2011 Fill and Sign Printable Template Online US

• the corporation or exempt organization cannot file its 2021 california (c a) tax return by the original due date. To pay electronically, visit our payment options. Web corporations and exempt organizations: • the corporation or exempt organization owes tax for the 2010 taxable. • the corporation or exempt organization cannot file its 2010 california (ca) tax return by the.

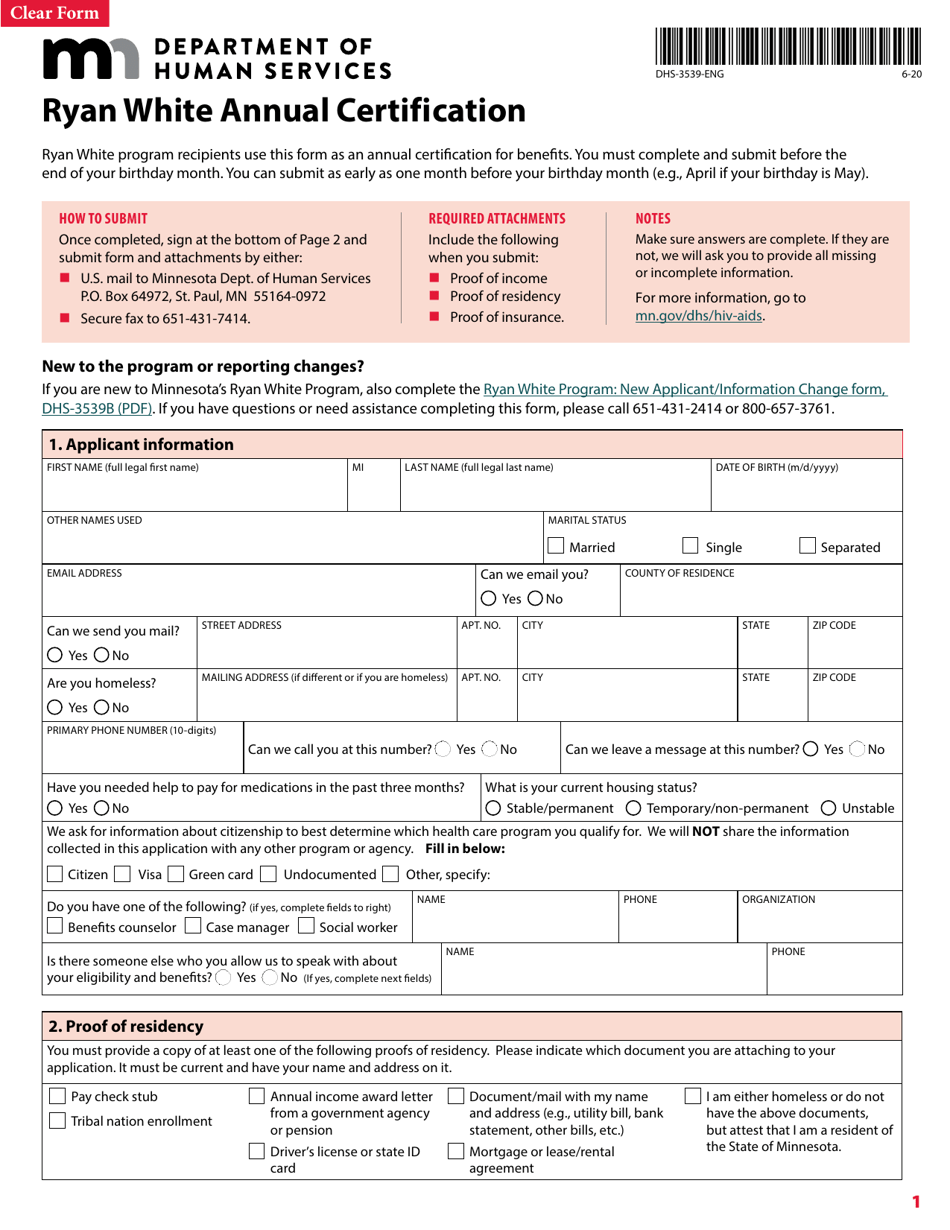

Form DHS3539ENG Download Fillable PDF or Fill Online Ryan White

Cocodoc is the best place for you to go, offering you a free and modifiable version of form 3539 as you wish. • the corporation or exempt organization cannot file its 2010 california (ca) tax return by the original due date. Limited partnerships, limited liability partnerships or real estate mortgage investment conduit: This form is used to claim tax credits.

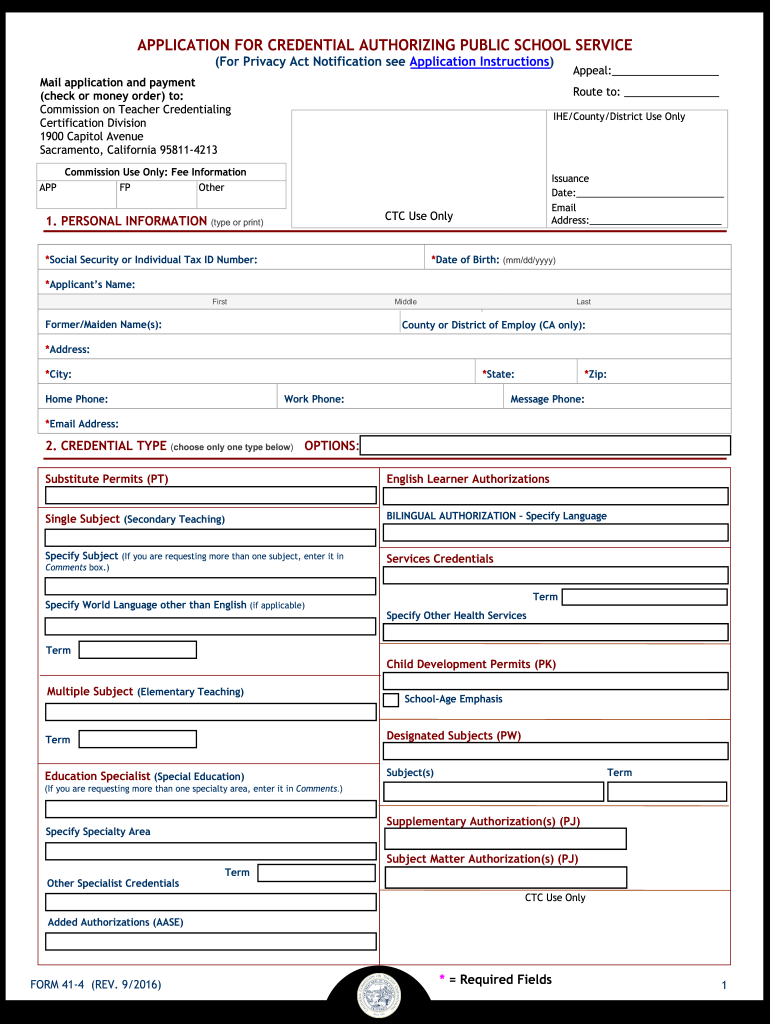

CA Form 414 2016 Fill and Sign Printable Template Online US Legal

This form is for income earned in tax year 2022, with tax returns due in. Web is it the case that you are looking for form 3539 to fill? Web form 3539 california that lots of organizations have gone paperless, the majority of are sent through electronic mail. • the corporation or exempt organization cannot file its 2010 california (ca).

Ca Form 3539 Instructions 2020 Fill Online, Printable, Fillable

Web form 3539 is the payment voucher for the automatic extension. If there is no balance due with the automatic extension, form 3539 will not generate. Web use form ftb 3539, payment for automatic extension for corporations and exempt organizations, only if both of the following apply: • the corporation or exempt organization cannot file its 2021 california (c a).

San Francisco CA Employment Litigation Attorneys Hoyer &… Flickr

To pay electronically, visit our payment options. Web we last updated the payment for automatic extension for corps and exempt orgs in january 2023, so this is the latest version of form 3539 (corp), fully updated for tax year 2022. Limited partnerships, limited liability partnerships or real estate mortgage investment conduit: • the corporation or exempt organization cannot file its.

Dl 933 Fill Out and Sign Printable PDF Template signNow

Form 3539 is not an extension form. If there is no balance due with the automatic extension, form 3539 will not generate. Web is it the case that you are looking for form 3539 to fill? That applies to contracts and agreements, tax forms and almost any other document that needs a signature. Web corporations and exempt organizations:

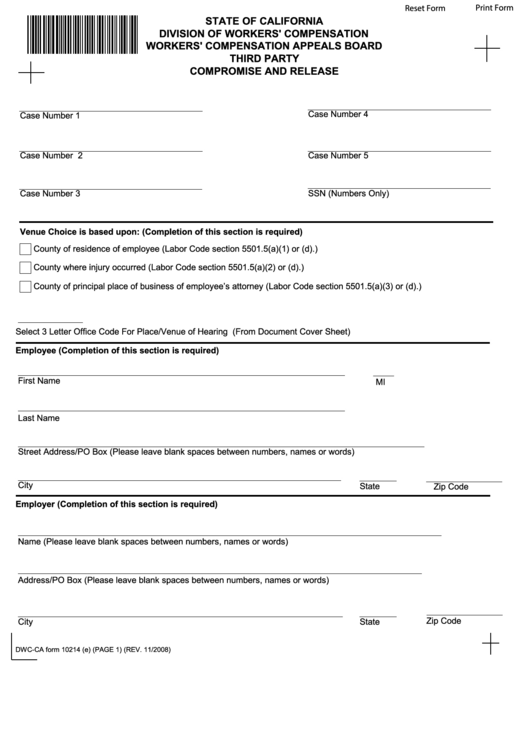

Fillable DwcCa Form 10214 State Of California Division Of Workers

Form 3539 is not an extension form. • the corporation or exempt organization cannot file its 2010 california (ca) tax return by the original due date. This form is for income earned in tax year 2022, with tax returns due in. Web california form 3539 is an important document for taxpayers in the state. Cocodoc is the best place for.

Fillable California Form 3539 (Corp) Payment For Automatic Extension

Cocodoc is the best place for you to go, offering you a free and modifiable version of form 3539 as you wish. • the corporation or exempt organization owes tax for the 2010 taxable. Web use form ftb 3539, payment for automatic extension for corporations and exempt organizations, only if both of the following apply: If no payment is due,.

California Form 3539 (Corp) Payment Voucher For Automatic Extension

This form is used to claim tax credits for donations made to certain charitable organizations. That applies to contracts and agreements, tax forms and almost any other document that needs a signature. Web form 3539 is the payment voucher for the automatic extension. Web we last updated the payment for automatic extension for corps and exempt orgs in january 2023,.

Web Corporations And Exempt Organizations:

We last updated california form 3539 (corp) in january 2023 from the california franchise tax board. • the corporation or exempt organization cannot file its 2021 california (c a) tax return by the original due date. Cocodoc is the best place for you to go, offering you a free and modifiable version of form 3539 as you wish. To pay electronically, visit our payment options.

Web Use Form Ftb 3539, Payment For Automatic Extension For Corporations And Exempt Organizations, Only If Both Of The Following Apply:

Web ftb.ca.gov and search for web pay. That applies to contracts and agreements, tax forms and almost any other document that needs a signature. • the corporation or exempt organization cannot file its 2010 california (ca) tax return by the original due date. Web is it the case that you are looking for form 3539 to fill?

Web California Form 3539 Is An Important Document For Taxpayers In The State.

• the corporation or exempt organization owes tax for the 2010 taxable. Limited partnerships, limited liability partnerships or real estate mortgage investment conduit: California automatically extends their corporate returns. This form is for income earned in tax year 2022, with tax returns due in.

If No Payment Is Due, You Do Not Need To File An Automatic Extension Payment Form.

Its bewildering collection of forms can save your time and boost your efficiency massively. Use form ftb 3539, payment for automatic extension for corps and exempt orgs, only if both of the following apply: It's important to understand which organizations are eligible for the tax credit, and how to complete the form correctly. Web form 3539 is the payment voucher for the automatic extension.