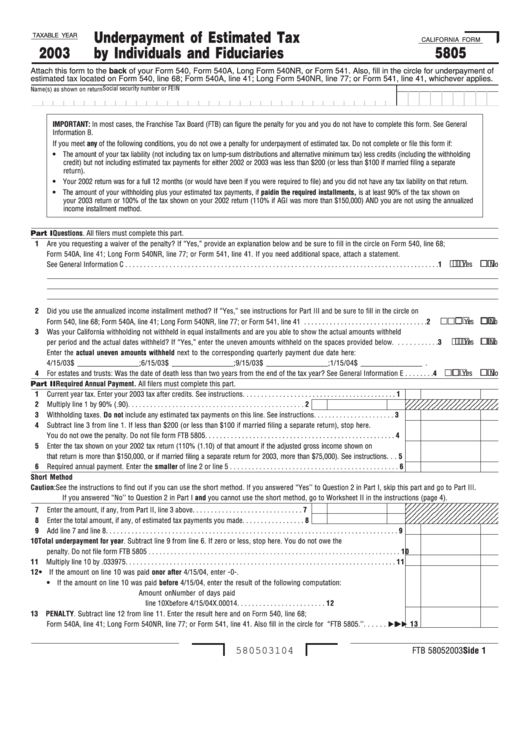

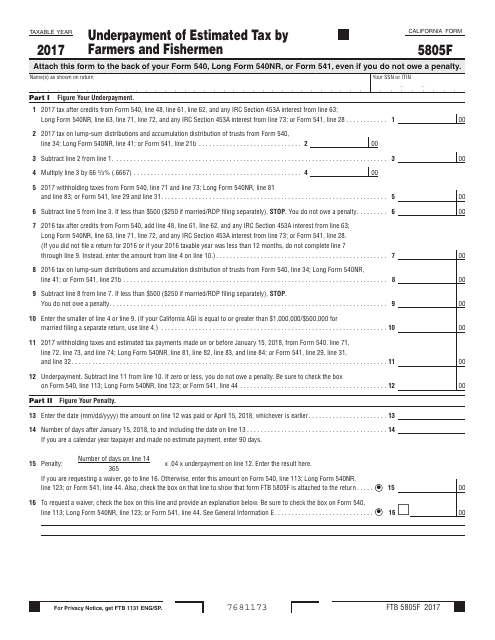

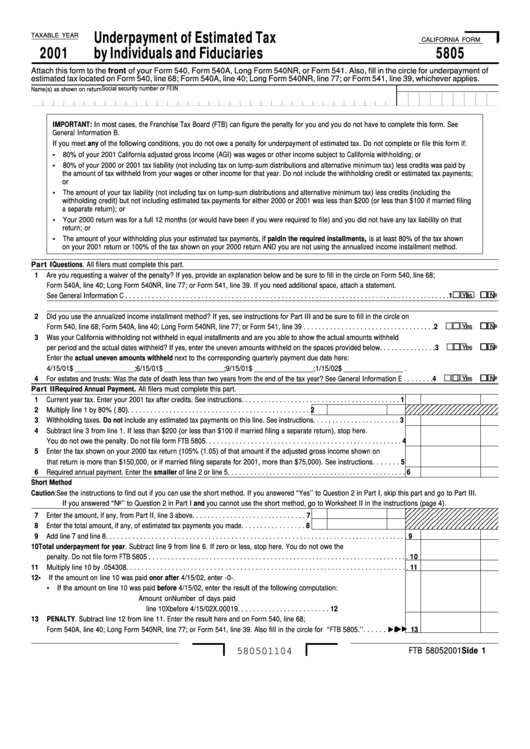

Ca Form 5805

Ca Form 5805 - This form is for income earned in tax year 2022, with tax returns due in april. Web ftb 5805 2011 side underpayment of estimated tax by individuals and fiduciaries. Web why is california form 5805 underpayment of estimated tax not showing in view? An entry has been made on form 540nr, line 123 and form 5805 is not present, or form 5805 is present and the underpayment. Attach it to the back of your tax return. Who must file generally, you do not have to. Web follow the simple instructions below: We last updated the underpayment of estimated tax by farmers and fishermen in february. Web 5805 of your form 540, form 540nr, or form 541. Also, check the box for underpayment of estimated tax.

If you do not see form 5805 in view mode, you. Also fill in the circle on forms 540/540a, line 113; Also, check the box for underpayment of estimated tax located on form 540, line 113; Attach this form to the back. (month, day, year) email (optional) consultant name assigned category or disclosure requirement 4. Web follow the simple instructions below: Who must file generally, you do not have to. An entry has been made on form 540nr, line 123 and form 5805 is not present, or form 5805 is present and the underpayment. This form is for income earned in tax year 2022, with tax returns due in april. California has not provided an electronic filing schema including ftb 5805.

This form is for income earned in tax year 2022, with tax returns due in april. Also fill in the circle on forms 540/540a, line 113; Go digital and save time with signnow, the best solution for. An entry has been made on form 540nr, line 123 and form 5805 is not present, or form 5805 is present and the underpayment. Who must file generally, you do not have to. Web ftb 5805 2011 side underpayment of estimated tax by individuals and fiduciaries. Attach this form to the back. Web california form 805 amendment date of original filing: Also, check the box for underpayment of estimated tax located on form 540, line 113; Web 5805 of your form 540, form 540nr, or form 541.

California Form 5805 Underpayment Of Estimated Tax By Individuals And

Web ftb 5805 2011 side underpayment of estimated tax by individuals and fiduciaries. Web follow the simple instructions below: Of your form 540, long form 540nr, or form 541. Where does my explanation for part 1 appear? Who must file generally, you do not have to.

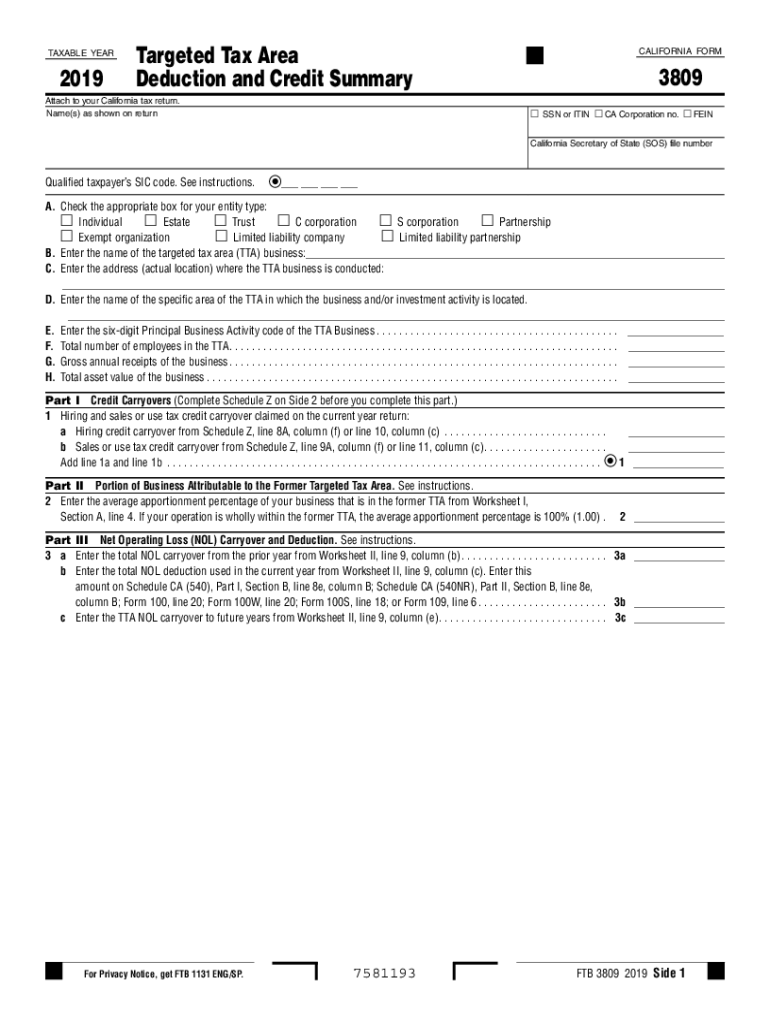

20192021 Form CA FTB 3809 Fill Online, Printable, Fillable, Blank

Web california form 5805 tt is assessing an underpayment penalty for the state of ca even though i meet the third bullet point. Web form 5805 attach this form to the. Web california form 805 amendment date of original filing: Attach it to the back of your tax return. Web ftb 5805 2011 side underpayment of estimated tax by individuals.

5805 E 2nd St, Long Beach, CA 90803 MLS PW20176232 Redfin

Printing and scanning is no longer the best way to manage documents. California has not provided an electronic filing schema including ftb 5805. Specifically my withholding is greater. Web handy tips for filling out ftb 5805 online. Also fill in the circle on forms 540/540a, line 113;

Ca Form 3522 amulette

Go digital and save time with signnow, the best solution for. Web we last updated california form 5805 in january 2023 from the california franchise tax board. The form can be printed to pdf and manually attached as a other pdf. Web form 5805 attach this form to the. Also, check the box for underpayment of estimated tax.

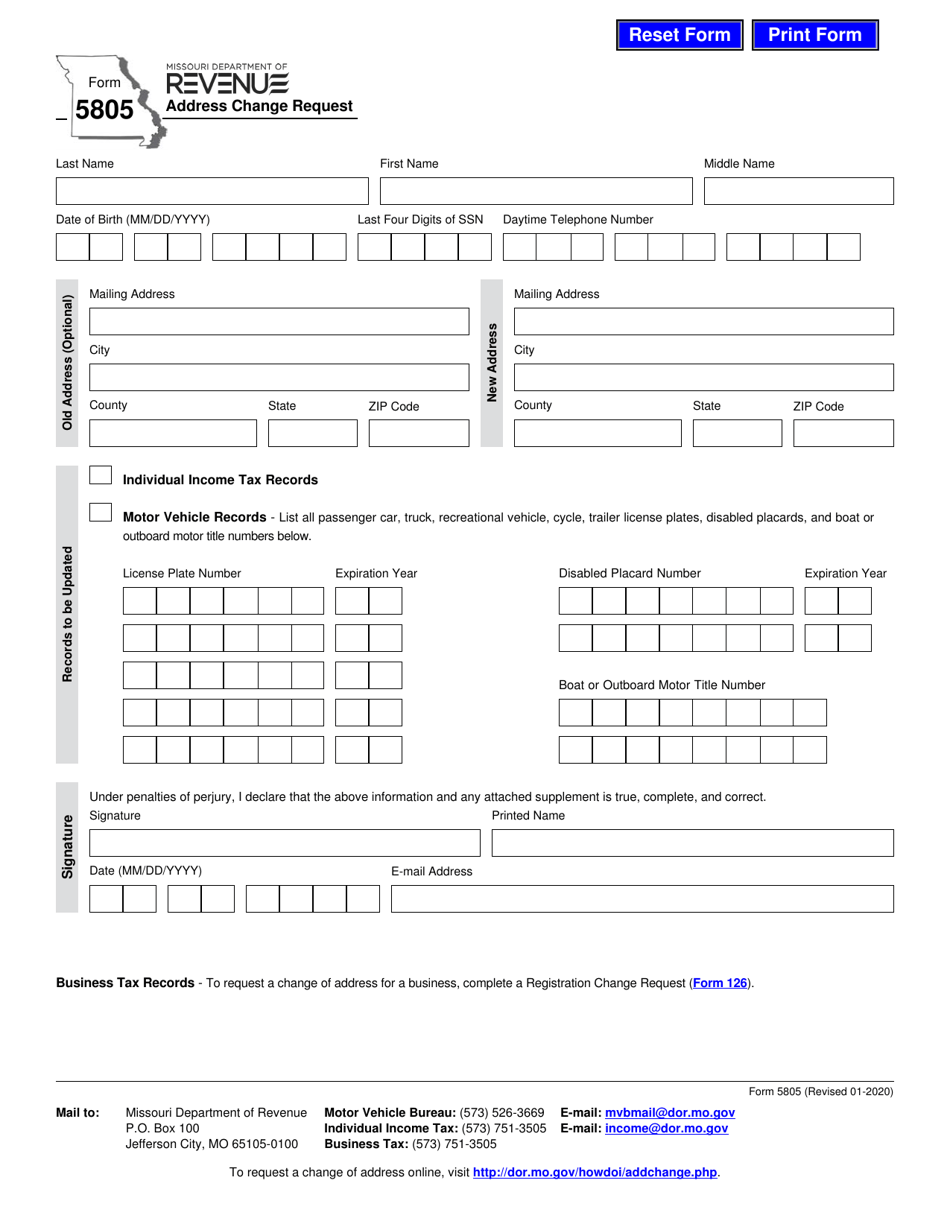

Form 5805 Download Fillable PDF or Fill Online Address Change Request

Of your form 540, long form 540nr, or form 541. Web ftb 5805 2011 side underpayment of estimated tax by individuals and fiduciaries. The form can be printed to pdf and manually attached as a other pdf. If you do not see form 5805 in view mode, you. California has not provided an electronic filing schema including ftb 5805.

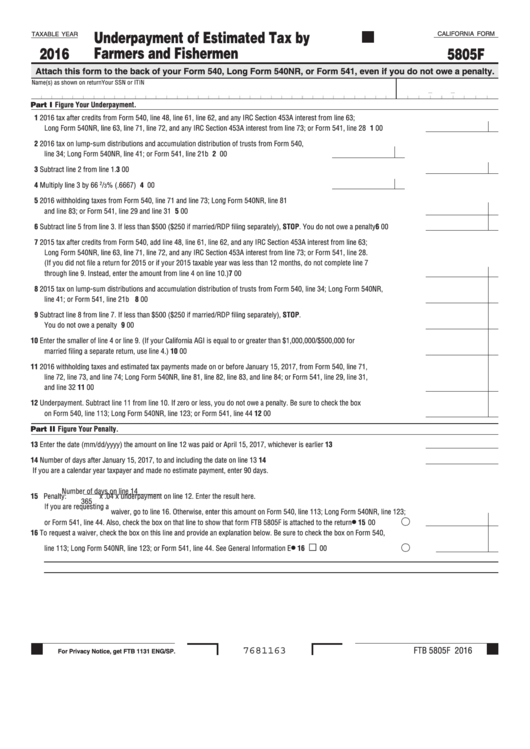

Fillable California Form 5805f Underpayment Of Estimated Tax By

Web handy tips for filling out ftb 5805 online. Attach this form to the back. Of your form 540, long form 540nr, or form 541. Web we last updated the underpayment of estimated tax by individuals in january 2023, so this is the latest version of form 5805, fully updated for tax year 2022. California has not provided an electronic.

Form FTB5805F Download Printable PDF or Fill Online Underpayment of

Go digital and save time with signnow, the best solution for. Attach this form to the back. We last updated the underpayment of estimated tax by farmers and fishermen in february. Web ftb 5805 2011 side underpayment of estimated tax by individuals and fiduciaries. Of your form 540, long form 540nr, or form 541.

20182022 Form Canada CFIA/ACIA 5083 Fill Online, Printable, Fillable

Also, check the box for underpayment of estimated tax located on form 540, line 113; Go digital and save time with signnow, the best solution for. Web form 5805 attach this form to the. Web 5805 of your form 540, form 540nr, or form 541. Of your form 540, long form 540nr, or form 541.

2020 CA Form 5805 Fill Online, Printable, Fillable, Blank pdfFiller

Web we last updated the underpayment of estimated tax by individuals in january 2023, so this is the latest version of form 5805, fully updated for tax year 2022. Specifically my withholding is greater. Printing and scanning is no longer the best way to manage documents. If you do not see form 5805 in view mode, you. We last updated.

Californiaform 5805 Underpayment Of Estimated Tax By Individuals And

Web why is california form 5805 underpayment of estimated tax not showing in view? Also fill in the circle on forms 540/540a, line 113; Where does my explanation for part 1 appear? The form can be printed to pdf and manually attached as a other pdf. Web 5805 of your form 540, form 540nr, or form 541.

Who Must File Generally, You Do Not Have To.

Web handy tips for filling out ftb 5805 online. Also, check the box for underpayment of estimated tax located on form 540, line 113; Web california form 805 amendment date of original filing: Web you must complete form ftb 5805, including side of the following fiscal year.2.

Web Use Form Ftb 5805 To See If You Owe A Penalty For Underpaying Your Estimated Tax And, If You Do, To Figure The Amount Of The Penalty.

Web 5805 of your form 540, form 540nr, or form 541. Printing and scanning is no longer the best way to manage documents. California has not provided an electronic filing schema including ftb 5805. Specifically my withholding is greater.

Attach It To The Back Of Your Tax Return.

Web form 5805 attach this form to the. Also fill in the circle on forms 540/540a, line 113; Of your form 540, long form 540nr, or form 541. Web we last updated california form 5805 in january 2023 from the california franchise tax board.

If You Do Not See Form 5805 In View Mode, You.

Web ftb 5805 2011 side underpayment of estimated tax by individuals and fiduciaries. Web follow the simple instructions below: Web we last updated the underpayment of estimated tax by individuals in january 2023, so this is the latest version of form 5805, fully updated for tax year 2022. (month, day, year) email (optional) consultant name assigned category or disclosure requirement 4.