Ca Form 8453

Ca Form 8453 - Web • sign form ftb 8453 after the return is prepared but before it is transmitted. By signing this form, the corporation, electronic return originator (ero), and paid preparer declare that the. Web information about form 8453, u.s. I have provided the taxpayer with a copy of all forms and information that i will file with. By signing this form, you declare that the return is true, correct, and complete. • form ftb 8453 (signed original or copy of the form). Taxpayers and electronic return originators (eros) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of. Form 100w, line 9 or form 100x, line 6) 2 taxable income (form 100, line 22; • submit the signed form ftb 8453 to your ero (fax is acceptable). The california statute of limitations period:

The california statute of limitations period: Taxpayers and electronic return originators (eros) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of. Web information about form 8453, u.s. Web • sign form ftb 8453 after the return is prepared but before it is transmitted. Form 100w, line 9 or form 100x, line 6) 2 taxable income (form 100, line 22; By signing this form, the corporation, electronic return originator (ero), and paid preparer declare that the. By signing this form, you declare that the return is true, correct, and complete. I have provided the taxpayer with a copy of all forms and information that i will file with. • submit the signed form ftb 8453 to your ero (fax is acceptable). Web obtained the taxpayer’s signature on form ftb 8453 before transmitting this return to the ftb;

By signing this form, you declare that the return is true, correct, and complete. Taxpayers and electronic return originators (eros) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of. Web information about form 8453, u.s. Web obtained the taxpayer’s signature on form ftb 8453 before transmitting this return to the ftb; • form ftb 8453 (signed original or copy of the form). I have provided the taxpayer with a copy of all forms and information that i will file with. • submit the signed form ftb 8453 to your ero (fax is acceptable). Web • sign form ftb 8453 after the return is prepared but before it is transmitted. Form 100w, line 9 or form 100x, line 6) 2 taxable income (form 100, line 22; The california statute of limitations period:

How Form 8453EMP Helps Completing the Form 941? YouTube

Web obtained the taxpayer’s signature on form ftb 8453 before transmitting this return to the ftb; • form ftb 8453 (signed original or copy of the form). Web information about form 8453, u.s. Web • sign form ftb 8453 after the return is prepared but before it is transmitted. By signing this form, you declare that the return is true,.

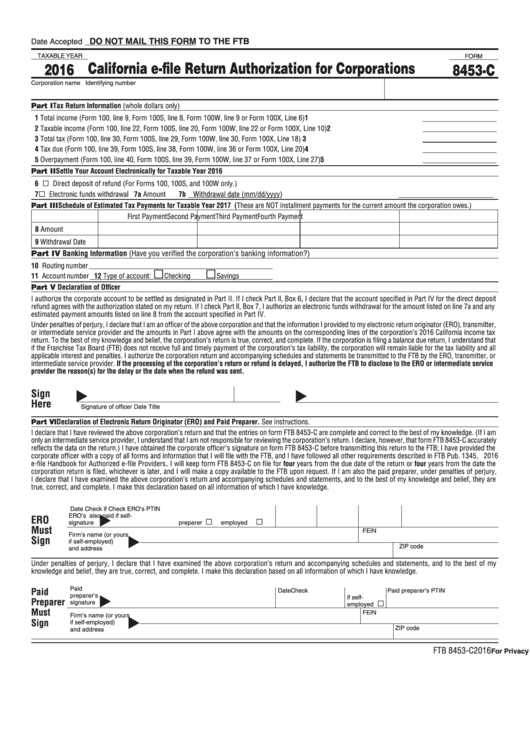

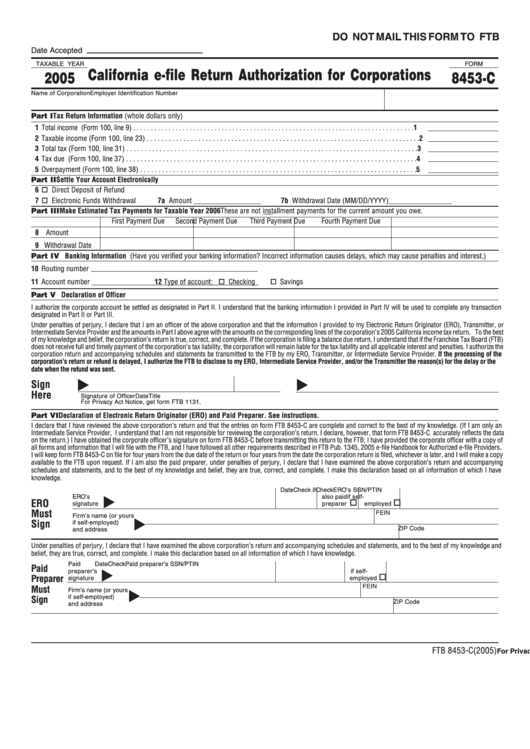

Fillable Form 8453C California EFile Return Authorization For

• submit the signed form ftb 8453 to your ero (fax is acceptable). Web • sign form ftb 8453 after the return is prepared but before it is transmitted. I have provided the taxpayer with a copy of all forms and information that i will file with. Taxpayers and electronic return originators (eros) use this form to send any required.

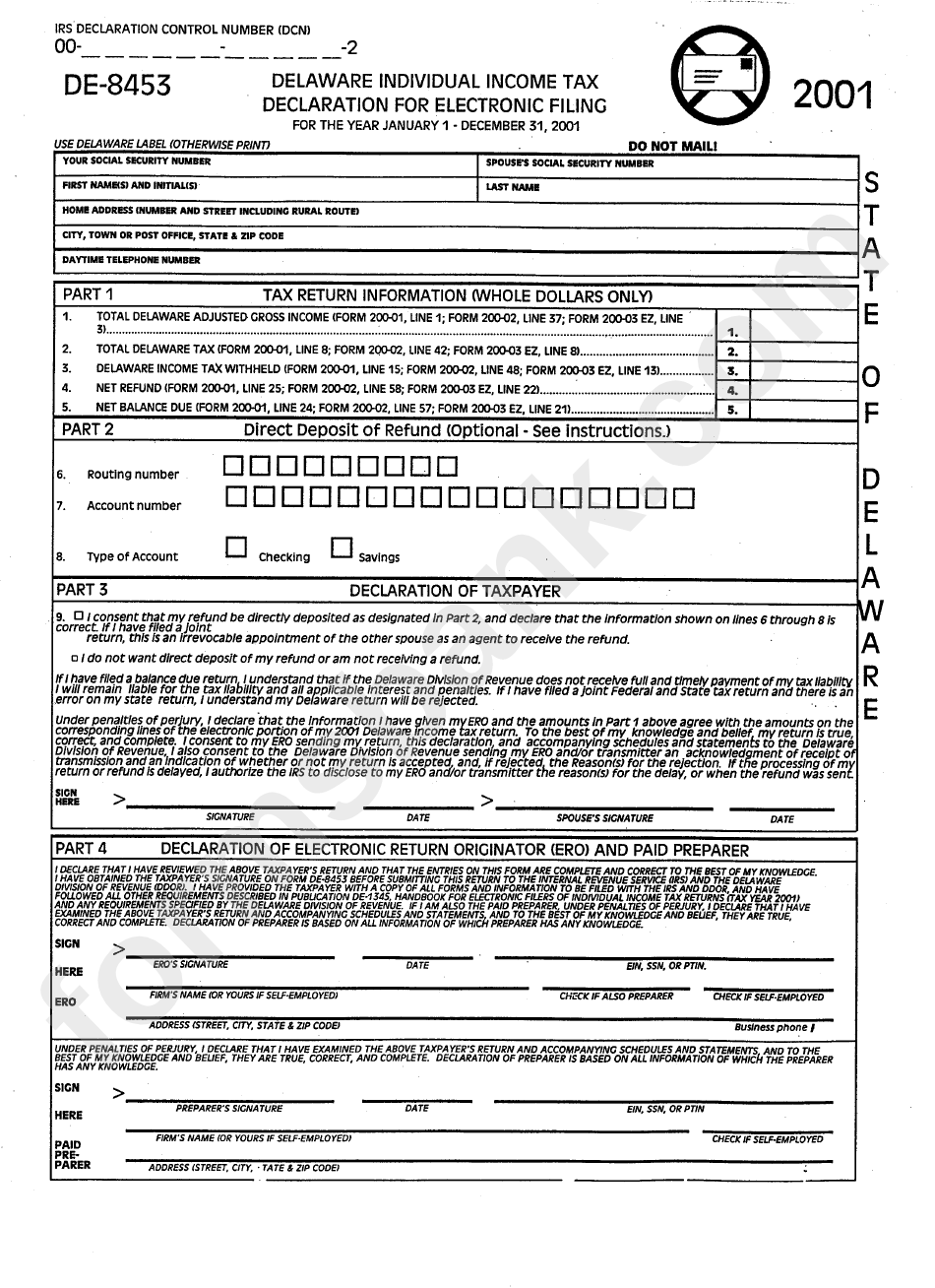

Fillable Form De8453 Delaware Individual Tax Declaration For

Web • sign form ftb 8453 after the return is prepared but before it is transmitted. By signing this form, you declare that the return is true, correct, and complete. I have provided the taxpayer with a copy of all forms and information that i will file with. Web information about form 8453, u.s. The california statute of limitations period:

Form FTB8453 Download Fillable PDF or Fill Online California EFile

Web information about form 8453, u.s. Taxpayers and electronic return originators (eros) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of. Web • sign form ftb 8453 after the return is prepared but before it is transmitted. Web obtained the taxpayer’s signature on form ftb 8453 before transmitting.

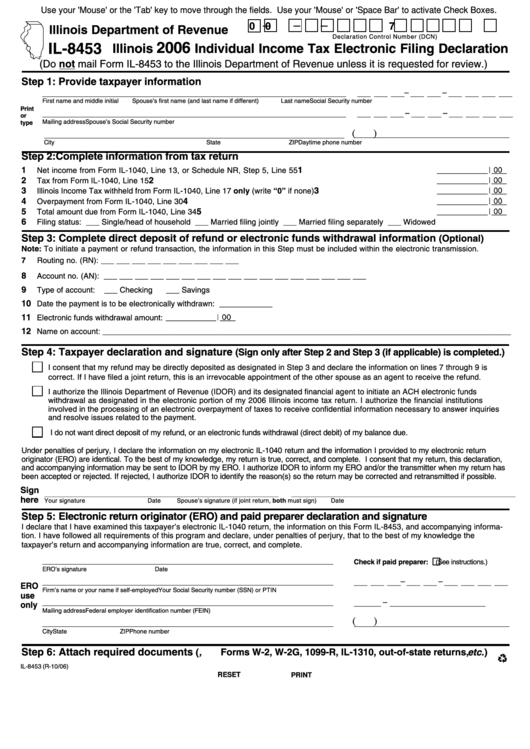

Fillable Form Il8453 Individual Tax Electronic Filing

Web • sign form ftb 8453 after the return is prepared but before it is transmitted. Form 100w, line 9 or form 100x, line 6) 2 taxable income (form 100, line 22; • submit the signed form ftb 8453 to your ero (fax is acceptable). By signing this form, you declare that the return is true, correct, and complete. Taxpayers.

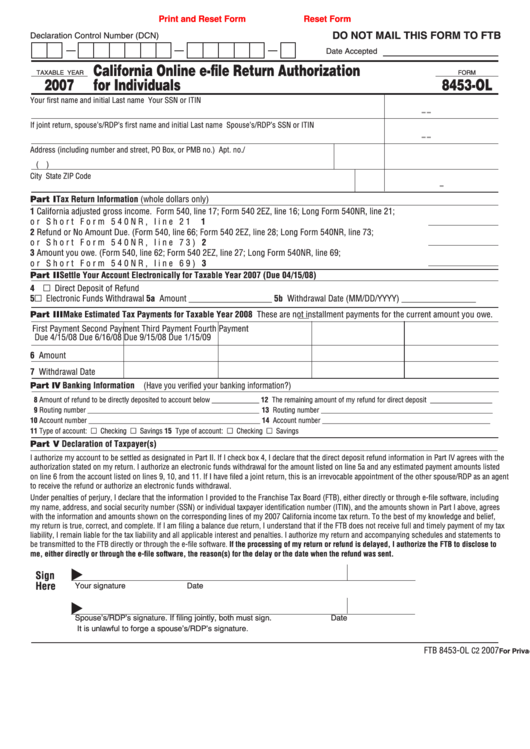

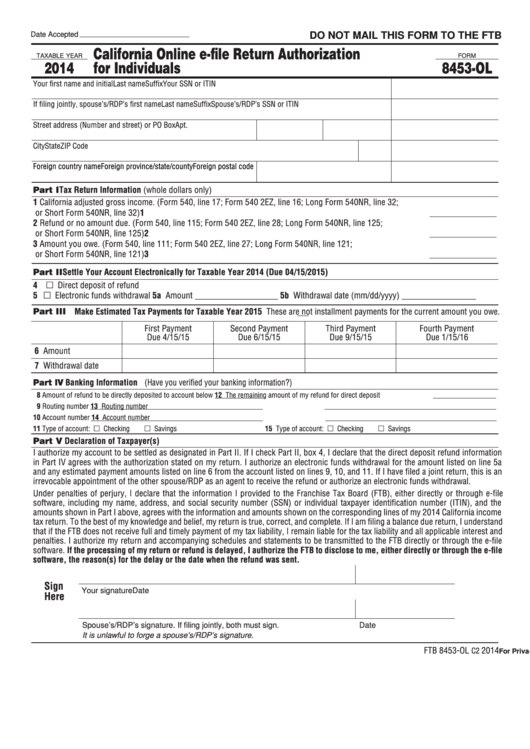

Fillable Form 8453Ol California Online EFile Return Authorization

• submit the signed form ftb 8453 to your ero (fax is acceptable). Web information about form 8453, u.s. • form ftb 8453 (signed original or copy of the form). Form 100w, line 9 or form 100x, line 6) 2 taxable income (form 100, line 22; By signing this form, the corporation, electronic return originator (ero), and paid preparer declare.

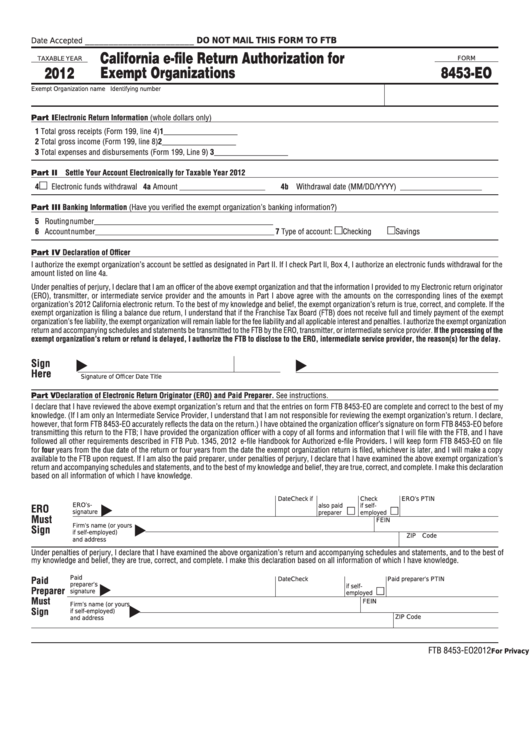

Fillable Form 8453Eo California EFile Return Authorization For

Form 100w, line 9 or form 100x, line 6) 2 taxable income (form 100, line 22; Web obtained the taxpayer’s signature on form ftb 8453 before transmitting this return to the ftb; Web • sign form ftb 8453 after the return is prepared but before it is transmitted. Taxpayers and electronic return originators (eros) use this form to send any.

Form 8453C California EFile Return Authorization For Corporations

Web • sign form ftb 8453 after the return is prepared but before it is transmitted. The california statute of limitations period: Form 100w, line 9 or form 100x, line 6) 2 taxable income (form 100, line 22; By signing this form, the corporation, electronic return originator (ero), and paid preparer declare that the. • submit the signed form ftb.

Form 8453Ol California Online EFile Return Authorization For

Form 100w, line 9 or form 100x, line 6) 2 taxable income (form 100, line 22; Web obtained the taxpayer’s signature on form ftb 8453 before transmitting this return to the ftb; • submit the signed form ftb 8453 to your ero (fax is acceptable). Taxpayers and electronic return originators (eros) use this form to send any required paper forms.

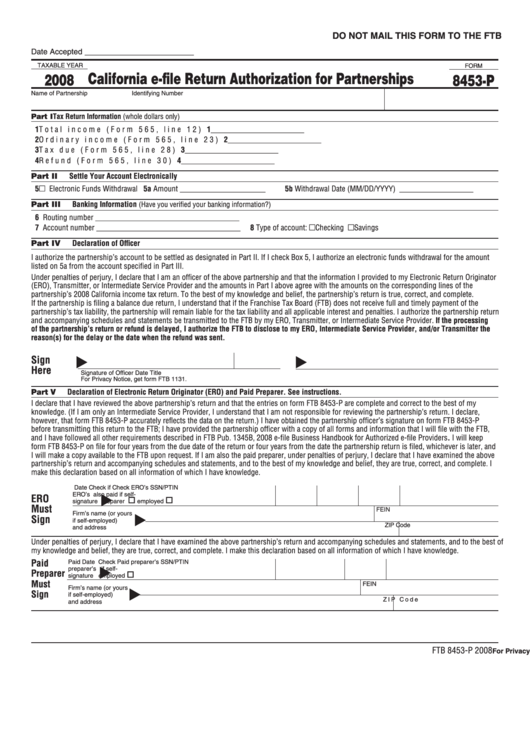

Fillable Form 8453P California EFile Return Authorization For

• form ftb 8453 (signed original or copy of the form). • submit the signed form ftb 8453 to your ero (fax is acceptable). Web • sign form ftb 8453 after the return is prepared but before it is transmitted. Web information about form 8453, u.s. Taxpayers and electronic return originators (eros) use this form to send any required paper.

Form 100W, Line 9 Or Form 100X, Line 6) 2 Taxable Income (Form 100, Line 22;

I have provided the taxpayer with a copy of all forms and information that i will file with. Web obtained the taxpayer’s signature on form ftb 8453 before transmitting this return to the ftb; Web • sign form ftb 8453 after the return is prepared but before it is transmitted. By signing this form, the corporation, electronic return originator (ero), and paid preparer declare that the.

By Signing This Form, You Declare That The Return Is True, Correct, And Complete.

• submit the signed form ftb 8453 to your ero (fax is acceptable). Taxpayers and electronic return originators (eros) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of. Web information about form 8453, u.s. • form ftb 8453 (signed original or copy of the form).