Ca Lien Release Form

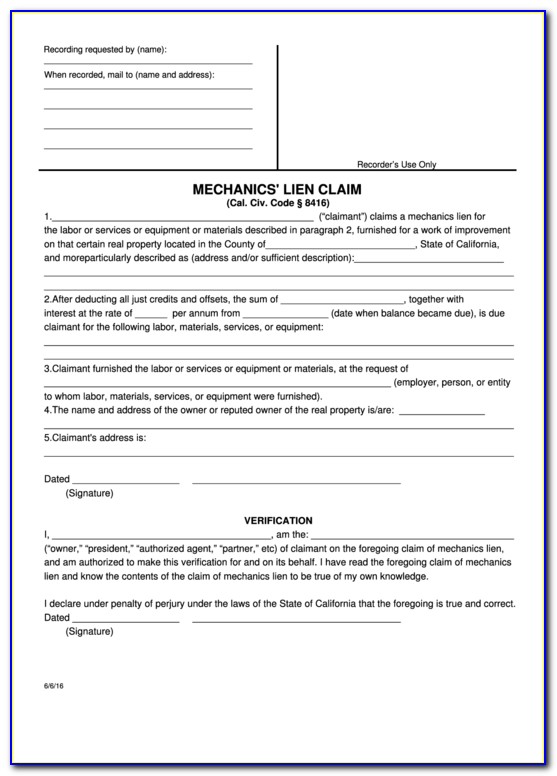

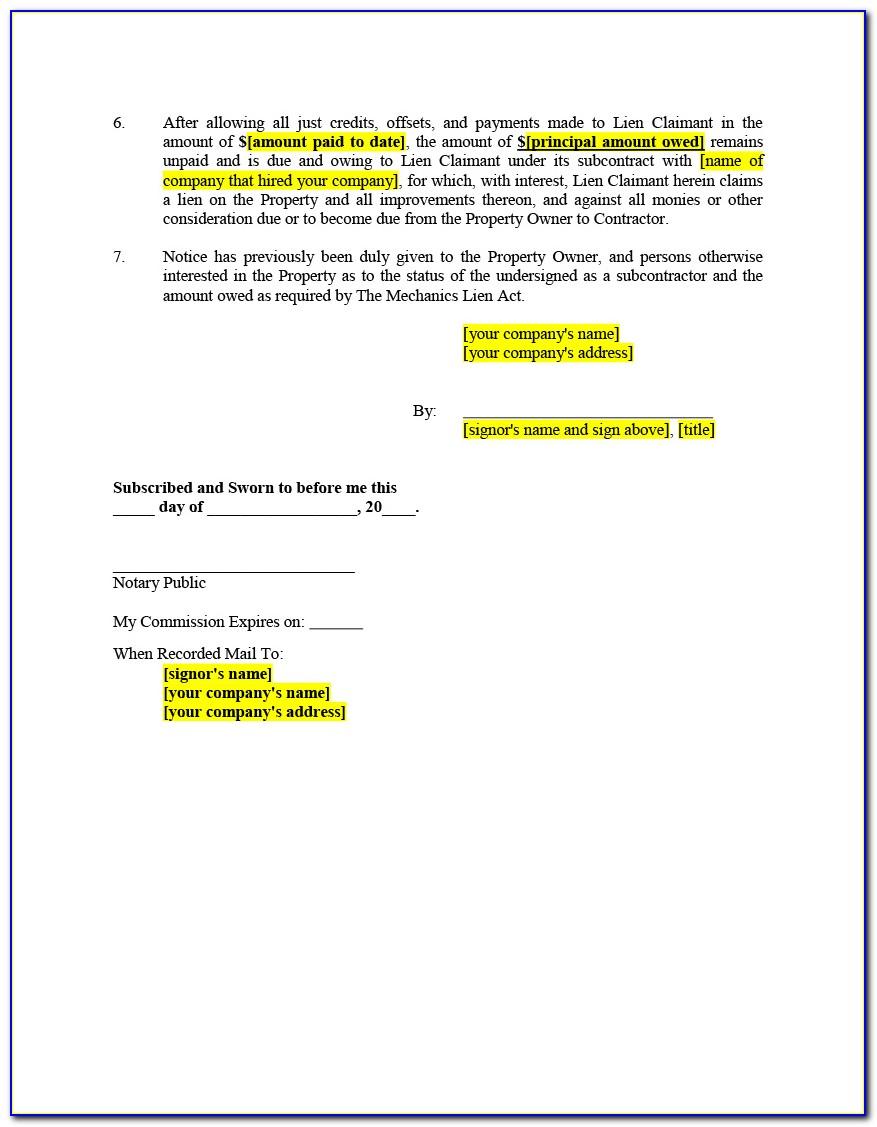

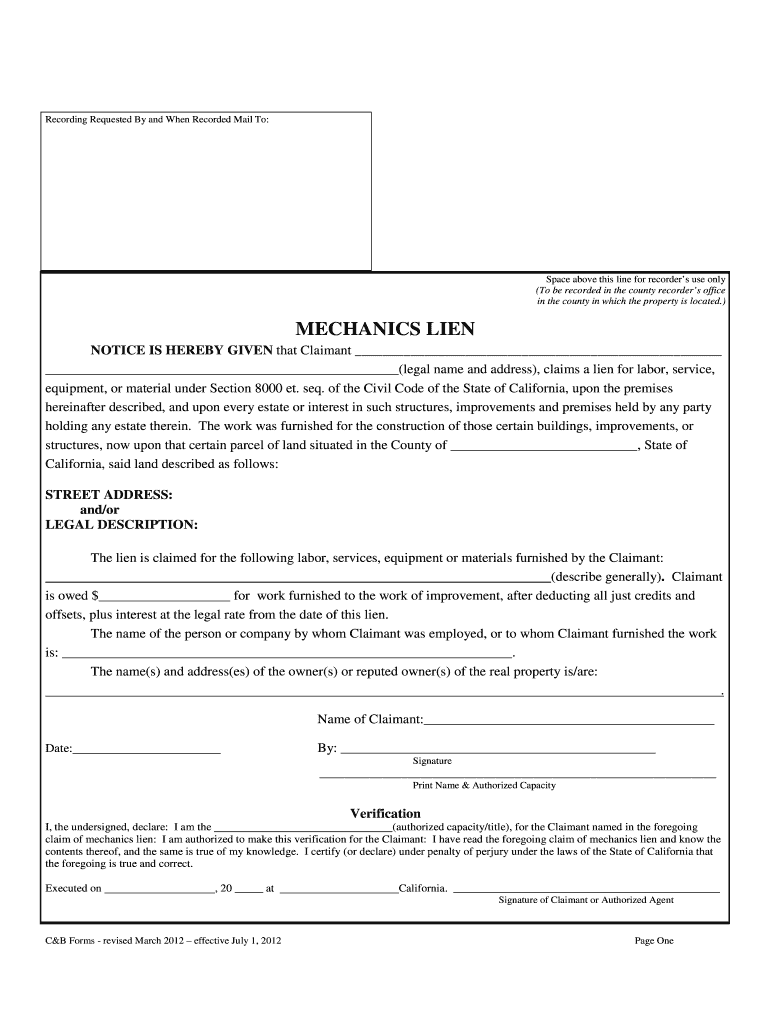

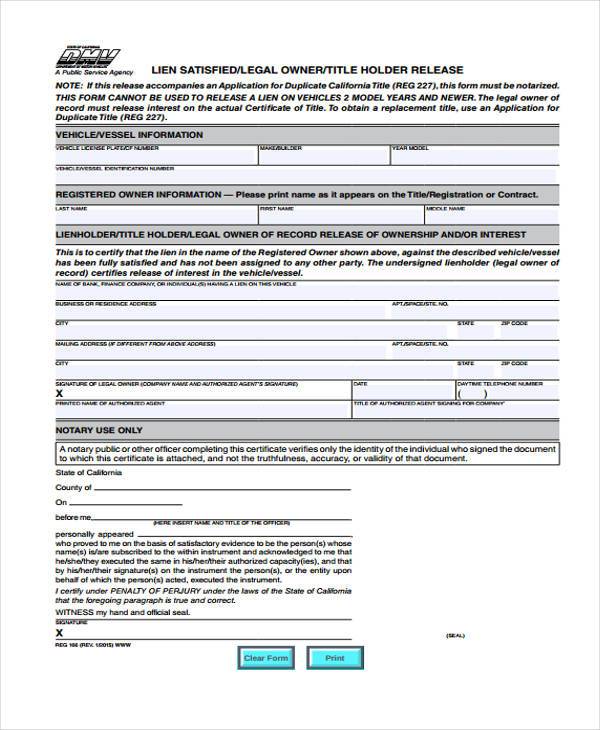

Ca Lien Release Form - If your client doesn’t have enough money to pay off all the liens or there are competing liens, visit help with liens. The forms provided here for free by levelset are compliant with the california rules. If we extend the lien, we will send a new notice of state tax lien and record or file it with the county recorder or california secretary of state. Web a claimant is a person who, if not paid, can file a lien on your property. We will begin the lien release process once the payment is posted. Web california has specific lien waiver forms that must be used by everyone on a california construction project. Conditional waiver and release upon progress payment The undersigned lienholder (legal owner of. Web this is to certify that the lien in the name of the registered owner shown above, against the described vehicle/vessel has been fully satisfied and has not been assigned to any other party. The form must be completed and signed by the lienholder, legal owner, or title holder and submitted to the dmv along with the application for.

Web california has specific lien waiver forms that must be used by everyone on a california construction project. If your client doesn’t have enough money to pay off all the liens or there are competing liens, visit help with liens. • conditional waiver and release upon progress payment • unconditional waiver and release upon progress payment • conditional waiver and release upon final payment The undersigned lienholder (legal owner of. If we extend the lien, we will send a new notice of state tax lien and record or file it with the county recorder or california secretary of state. You can download them free, or use our free system to send or request your compliant california lien waiver form. The forms provided here for free by levelset are compliant with the california rules. Web how to release a lien pay the quickest way we will release a notice of state tax lien is for you to pay your liened tax debt in full (including interest, penalties, and fees). The form must be completed and signed by the lienholder, legal owner, or title holder and submitted to the dmv along with the application for. Web a lien expires 10 years from the date of recording or filing, unless we extend it.

We will not release expired liens. Web a lien expires 10 years from the date of recording or filing, unless we extend it. Web how to release a lien pay the quickest way we will release a notice of state tax lien is for you to pay your liened tax debt in full (including interest, penalties, and fees). The forms provided here for free by levelset are compliant with the california rules. Web to be effective, the waiver and release forms must follow substantially one of the forms set forth in civil code section 3262. To be effective, the waiver and release forms must follow, substantially, one of the forms set forth in civil code sections 8132, 8134, 8136, and 8138. If we extend the lien, we will send a new notice of state tax lien and record or file it with the county recorder or california secretary of state. Web a claimant is a person who, if not paid, can file a lien on your property. Web the reg 166 form serves as a legal release of interest from the lienholder, legal owner, or title holder, allowing the owner to transfer ownership of the vehicle to a new owner without any encumbrances. Web this is to certify that the lien in the name of the registered owner shown above, against the described vehicle/vessel has been fully satisfied and has not been assigned to any other party.

FREE 8+ Sample Lien Release Forms in PDF

The undersigned lienholder (legal owner of. We will not release expired liens. • conditional waiver and release upon progress payment • unconditional waiver and release upon progress payment • conditional waiver and release upon final payment Web how to release a lien pay the quickest way we will release a notice of state tax lien is for you to pay.

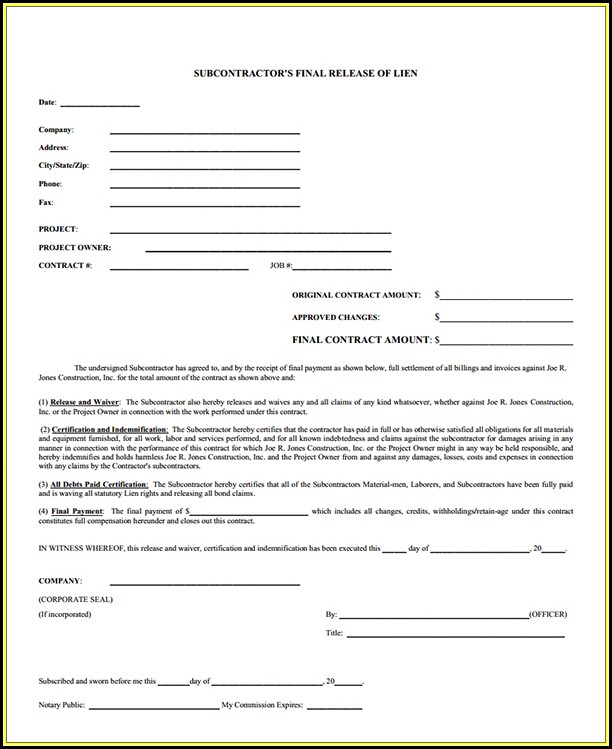

Aia Partial Release Of Lien Form Form Resume Examples 3q9JkNAyYA

Web this is to certify that the lien in the name of the registered owner shown above, against the described vehicle/vessel has been fully satisfied and has not been assigned to any other party. • conditional waiver and release upon progress payment • unconditional waiver and release upon progress payment • conditional waiver and release upon final payment We will.

Vehicle Lien Release Letter Sample

The undersigned lienholder (legal owner of. Web the reg 166 form serves as a legal release of interest from the lienholder, legal owner, or title holder, allowing the owner to transfer ownership of the vehicle to a new owner without any encumbrances. Web to be effective, the waiver and release forms must follow substantially one of the forms set forth.

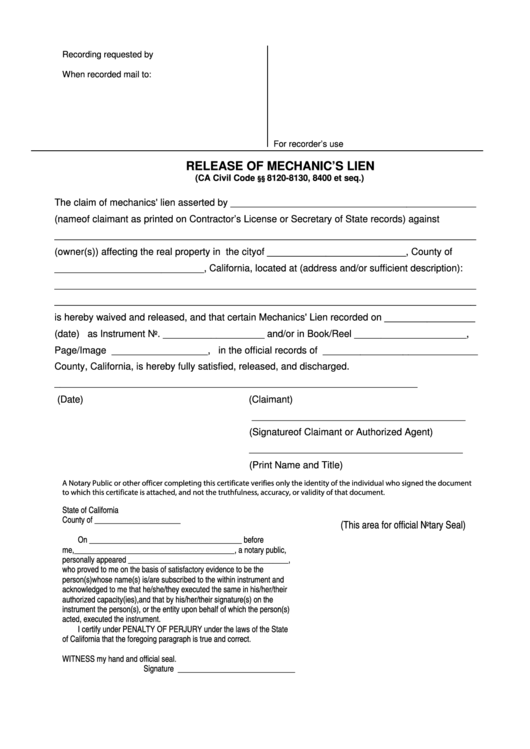

Fillable Release Of Mechanics Lien Form California printable pdf download

• conditional waiver and release upon progress payment • unconditional waiver and release upon progress payment • conditional waiver and release upon final payment The forms provided here for free by levelset are compliant with the california rules. The form must be completed and signed by the lienholder, legal owner, or title holder and submitted to the dmv along with.

CA Lien Release Forms 20042022 Fill and Sign Printable Template

Web the reg 166 form serves as a legal release of interest from the lienholder, legal owner, or title holder, allowing the owner to transfer ownership of the vehicle to a new owner without any encumbrances. If your client doesn’t have enough money to pay off all the liens or there are competing liens, visit help with liens. The forms.

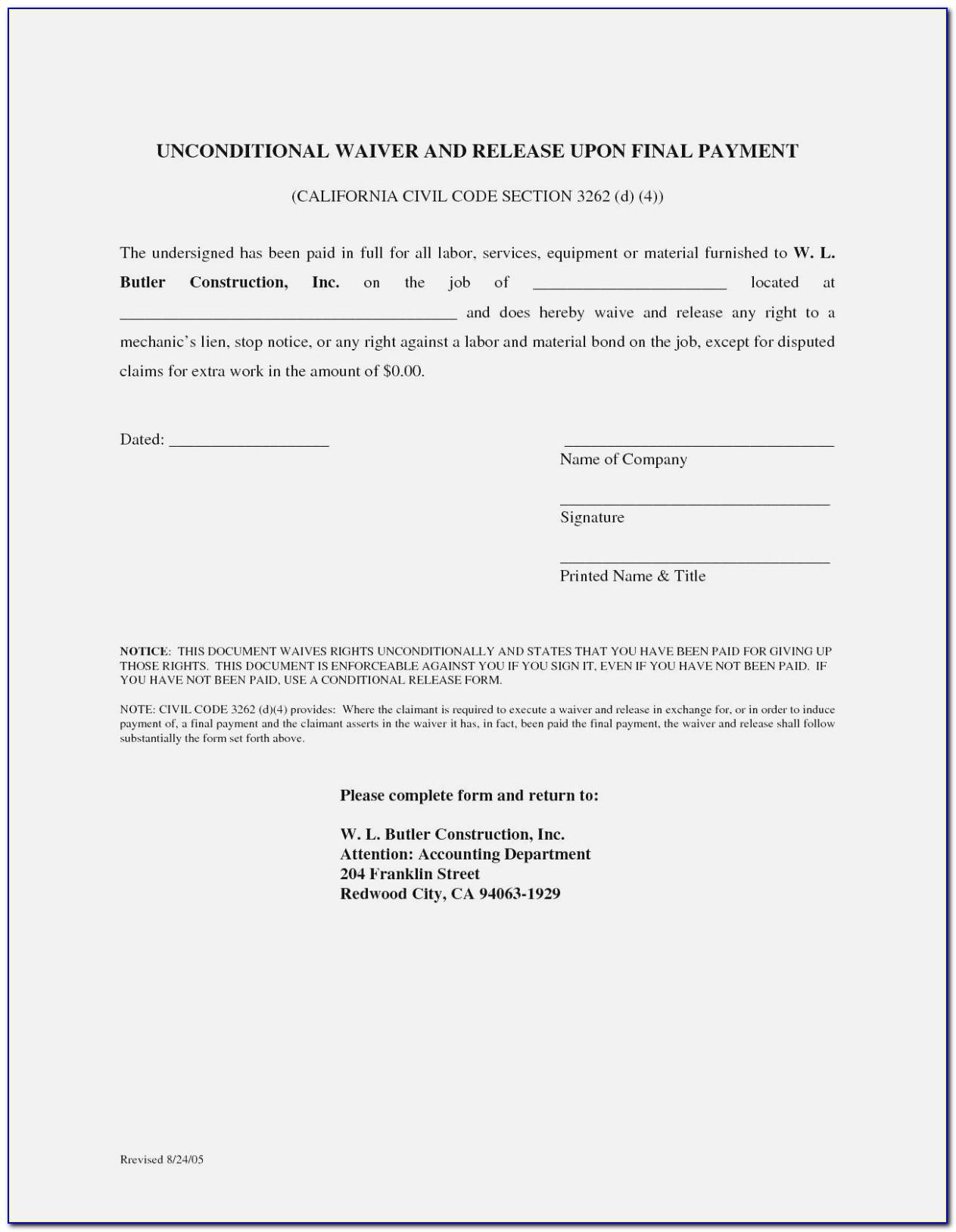

California Conditional Waiver and Release on Final Payment form

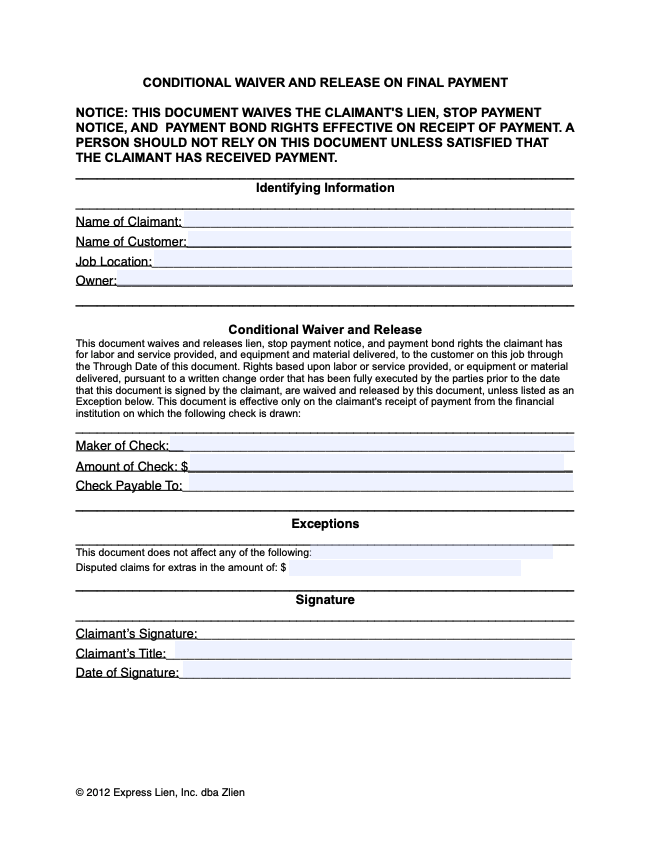

• conditional waiver and release upon progress payment • unconditional waiver and release upon progress payment • conditional waiver and release upon final payment Web a claimant is a person who, if not paid, can file a lien on your property. We will issue a release for the notice(s) of state tax lien once the payment is posted. Web to.

Blank Lien Release Form Form Resume Examples JvDXobJkVM

If we extend the lien, we will send a new notice of state tax lien and record or file it with the county recorder or california secretary of state. If your client doesn’t have enough money to pay off all the liens or there are competing liens, visit help with liens. The form must be completed and signed by the.

Mechanic's Lien Release Form Virginia

We will not release expired liens. Conditional waiver and release upon progress payment If your client doesn’t have enough money to pay off all the liens or there are competing liens, visit help with liens. Web a claimant is a person who, if not paid, can file a lien on your property. Web california has specific lien waiver forms that.

Mechanics Lien Form Fill Online, Printable, Fillable, Blank pdfFiller

Web a claimant is a person who, if not paid, can file a lien on your property. To be effective, the waiver and release forms must follow, substantially, one of the forms set forth in civil code sections 8132, 8134, 8136, and 8138. Conditional waiver and release upon progress payment We will begin the lien release process once the payment.

FREE 41+ Sample Release Forms in PDF MS Word Excel

If your client doesn’t have enough money to pay off all the liens or there are competing liens, visit help with liens. Web a claimant is a person who, if not paid, can file a lien on your property. Web how to release a lien pay the quickest way we will release a notice of state tax lien is for.

The Form Must Be Completed And Signed By The Lienholder, Legal Owner, Or Title Holder And Submitted To The Dmv Along With The Application For.

To be effective, the waiver and release forms must follow, substantially, one of the forms set forth in civil code sections 8132, 8134, 8136, and 8138. Web the reg 166 form serves as a legal release of interest from the lienholder, legal owner, or title holder, allowing the owner to transfer ownership of the vehicle to a new owner without any encumbrances. We will not release expired liens. If your client doesn’t have enough money to pay off all the liens or there are competing liens, visit help with liens.

If We Extend The Lien, We Will Send A New Notice Of State Tax Lien And Record Or File It With The County Recorder Or California Secretary Of State.

The undersigned lienholder (legal owner of. Web this is to certify that the lien in the name of the registered owner shown above, against the described vehicle/vessel has been fully satisfied and has not been assigned to any other party. We will issue a release for the notice(s) of state tax lien once the payment is posted. The forms provided here for free by levelset are compliant with the california rules.

You Can Download Them Free, Or Use Our Free System To Send Or Request Your Compliant California Lien Waiver Form.

Conditional waiver and release upon progress payment Web a claimant is a person who, if not paid, can file a lien on your property. We will begin the lien release process once the payment is posted. • conditional waiver and release upon progress payment • unconditional waiver and release upon progress payment • conditional waiver and release upon final payment

Web How To Release A Lien Pay The Quickest Way We Will Release A Notice Of State Tax Lien Is For You To Pay Your Liened Tax Debt In Full (Including Interest, Penalties, And Fees).

Web california has specific lien waiver forms that must be used by everyone on a california construction project. Web to be effective, the waiver and release forms must follow substantially one of the forms set forth in civil code section 3262. Web a lien expires 10 years from the date of recording or filing, unless we extend it.