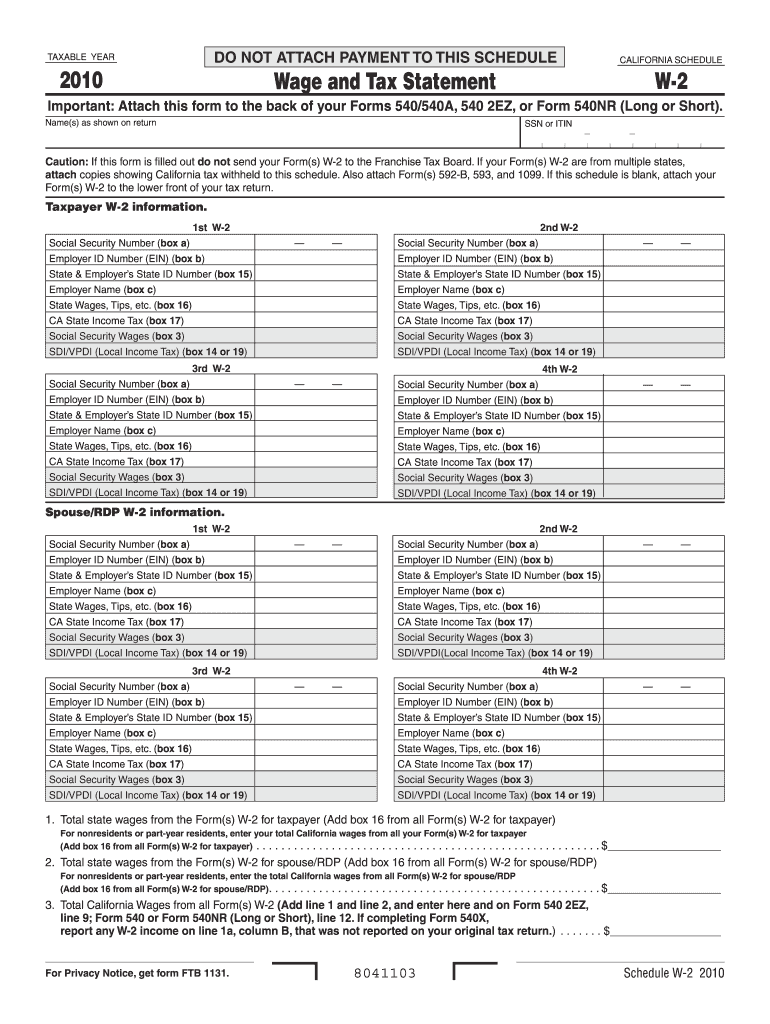

Ca W2 Form

Ca W2 Form - Employment authorization document issued by the department of homeland. Web adjust your wage withholding. You want to make sure you have the right amount of income tax withheld from your pay. From there, you will follow the steps listed here on irs.gov. Web complete this form so that your employer can withhold the correct california state income tax from your paycheck. Web even though the state of california does not require w2 form, the irs/ssa still requires you to file form w2 to report wages and the taxes withheld for each of your employees. If they are different because you had income from a source outside california, you cannot file. Web simplified income, payroll, sales and use tax information for you and your business This certificate, de 4, is for california personal income tax (pit) withholding purposes only.the de 4 is used to compute the amount of taxes to be. Need to withhold more money from your paycheck for taxes,.

Web if your location has transitioned to ucpath, log in and select the yellow ask ucpath center button on the top right of your screen to submit an inquiry. Web simplified income, payroll, sales and use tax information for you and your business Need to withhold more money from your paycheck for taxes,. If they are different because you had income from a source outside california, you cannot file. This certificate, de 4, is for california personal income tax (pit) withholding purposes only.the de 4 is used to compute the amount of taxes to be. From there, you will follow the steps listed here on irs.gov. You want to make sure you have the right amount of income tax withheld from your pay. Web complete this form so that your employer can withhold the correct california state income tax from your paycheck. Web page 1 of 4 cu purpose: Use worksheet a for regular withholding allowances.

Web complete this form so that your employer can withhold the correct california state income tax from your paycheck. You want to make sure you have the right amount of income tax withheld from your pay. Web adjust your wage withholding. Web if your location has transitioned to ucpath, log in and select the yellow ask ucpath center button on the top right of your screen to submit an inquiry. Use worksheet a for regular withholding allowances. Employment authorization document issued by the department of homeland. Need to withhold more money from your paycheck for taxes,. Web page 1 of 4 cu purpose: Web simplified income, payroll, sales and use tax information for you and your business Web even though the state of california does not require w2 form, the irs/ssa still requires you to file form w2 to report wages and the taxes withheld for each of your employees.

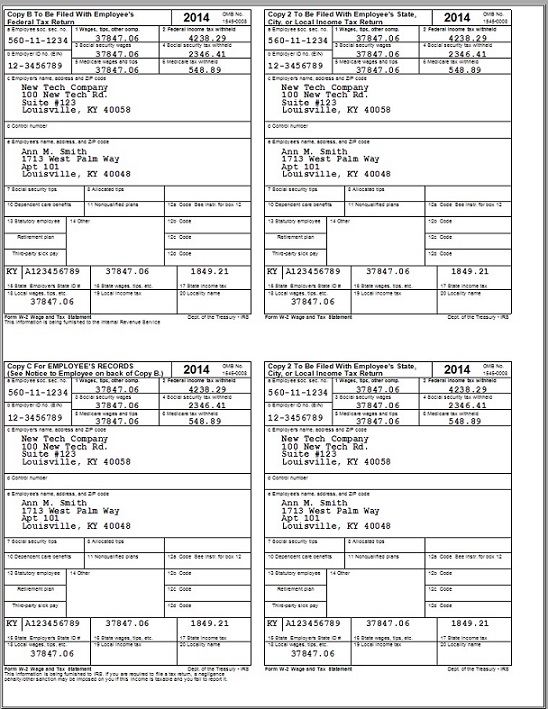

How To Obtain A W2 From A Former Employer Ethel Hernandez's Templates

From there, you will follow the steps listed here on irs.gov. Web simplified income, payroll, sales and use tax information for you and your business You want to make sure you have the right amount of income tax withheld from your pay. Use worksheet a for regular withholding allowances. You report wage and withholding information to us on the quarterly.

20102022 Form CA FTB Schedule W2 Fill Online, Printable, Fillable

Web complete this form so that your employer can withhold the correct california state income tax from your paycheck. This certificate, de 4, is for california personal income tax (pit) withholding purposes only.the de 4 is used to compute the amount of taxes to be. You report wage and withholding information to us on the quarterly contribution return and report.

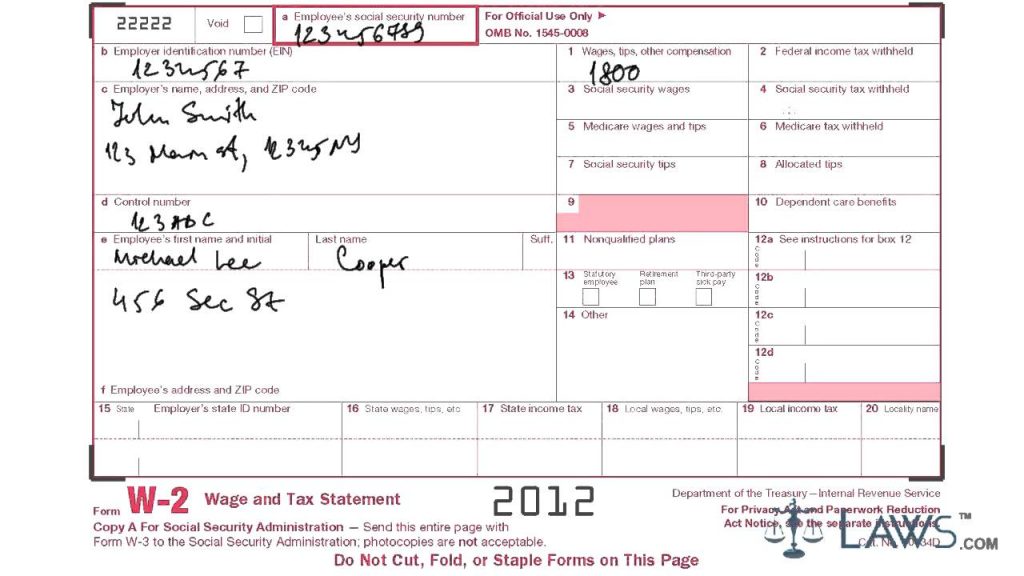

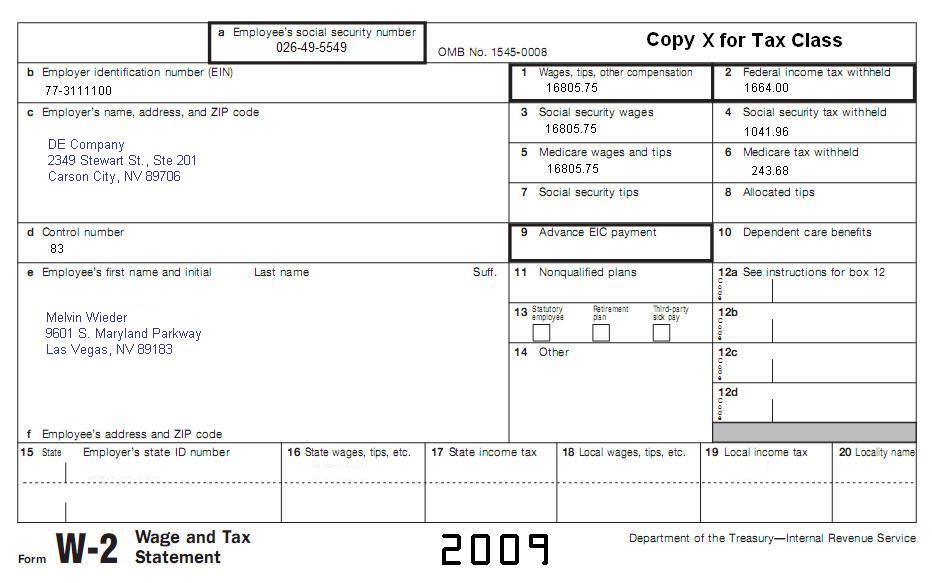

asovislan w 2 form example

Web even though the state of california does not require w2 form, the irs/ssa still requires you to file form w2 to report wages and the taxes withheld for each of your employees. Web complete this form so that your employer can withhold the correct california state income tax from your paycheck. Need to withhold more money from your paycheck.

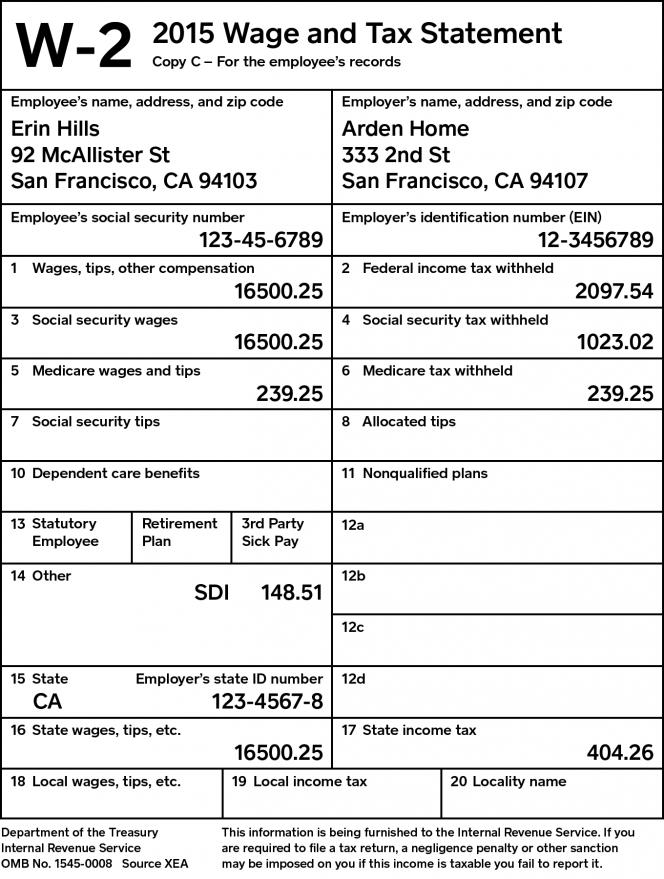

California W2 Form 2015 amulette

Web even though the state of california does not require w2 form, the irs/ssa still requires you to file form w2 to report wages and the taxes withheld for each of your employees. Use worksheet a for regular withholding allowances. Web page 1 of 4 cu purpose: Web complete this form so that your employer can withhold the correct california.

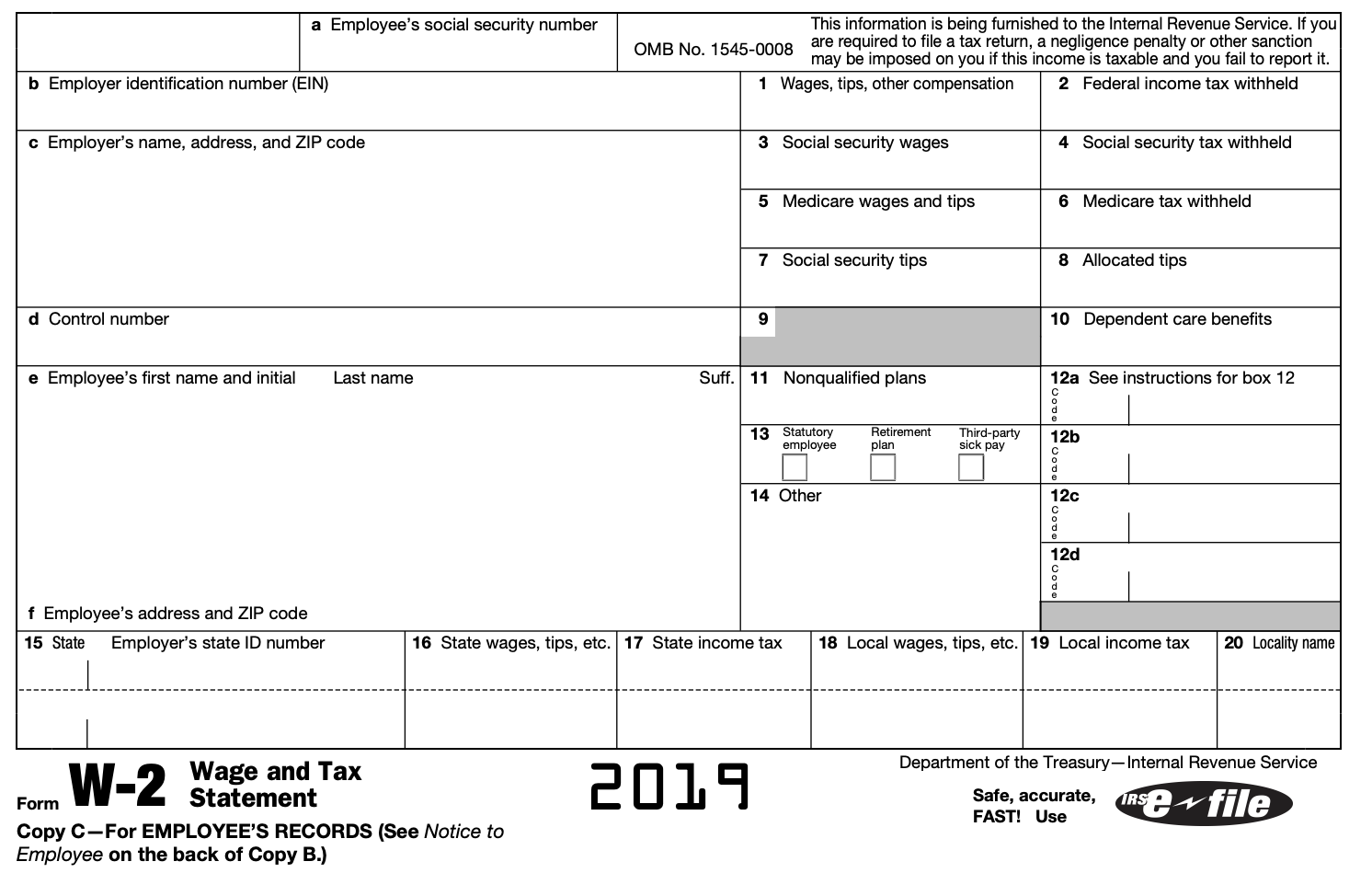

Understanding Your Tax Forms The W2

From there, you will follow the steps listed here on irs.gov. Web simplified income, payroll, sales and use tax information for you and your business Use worksheet a for regular withholding allowances. Web complete this form so that your employer can withhold the correct california state income tax from your paycheck. Employment authorization document issued by the department of homeland.

thsdesignsite W 2 Wage And Tax Statement Explained

Web if your location has transitioned to ucpath, log in and select the yellow ask ucpath center button on the top right of your screen to submit an inquiry. From there, you will follow the steps listed here on irs.gov. Web simplified income, payroll, sales and use tax information for you and your business Web complete this form so that.

California W2 Form 2015 amulette

Need to withhold more money from your paycheck for taxes,. If they are different because you had income from a source outside california, you cannot file. Use worksheet a for regular withholding allowances. Web page 1 of 4 cu purpose: Web adjust your wage withholding.

California W2 Form 2015 amulette

Web complete this form so that your employer can withhold the correct california state income tax from your paycheck. If they are different because you had income from a source outside california, you cannot file. Web page 1 of 4 cu purpose: Web if your location has transitioned to ucpath, log in and select the yellow ask ucpath center button.

Tax Topic 28 Divorced or Separated Individuals

This certificate, de 4, is for california personal income tax (pit) withholding purposes only.the de 4 is used to compute the amount of taxes to be. Web complete this form so that your employer can withhold the correct california state income tax from your paycheck. Web if your location has transitioned to ucpath, log in and select the yellow ask.

Orea Agreement Of Purchase And Sale Form 100 Fillable 2017 Form

Web page 1 of 4 cu purpose: From there, you will follow the steps listed here on irs.gov. This certificate, de 4, is for california personal income tax (pit) withholding purposes only.the de 4 is used to compute the amount of taxes to be. Need to withhold more money from your paycheck for taxes,. Web if your location has transitioned.

Web Simplified Income, Payroll, Sales And Use Tax Information For You And Your Business

If they are different because you had income from a source outside california, you cannot file. Web adjust your wage withholding. Web page 1 of 4 cu purpose: You want to make sure you have the right amount of income tax withheld from your pay.

Employment Authorization Document Issued By The Department Of Homeland.

From there, you will follow the steps listed here on irs.gov. You report wage and withholding information to us on the quarterly contribution return and report of wages (continuation) (de 9c). Web even though the state of california does not require w2 form, the irs/ssa still requires you to file form w2 to report wages and the taxes withheld for each of your employees. This certificate, de 4, is for california personal income tax (pit) withholding purposes only.the de 4 is used to compute the amount of taxes to be.

Web If Your Location Has Transitioned To Ucpath, Log In And Select The Yellow Ask Ucpath Center Button On The Top Right Of Your Screen To Submit An Inquiry.

Web complete this form so that your employer can withhold the correct california state income tax from your paycheck. Need to withhold more money from your paycheck for taxes,. Use worksheet a for regular withholding allowances.