Can Form 5227 Be Electronically Filed

Can Form 5227 Be Electronically Filed - Web this document contains proposed regulations amending the rules for filing electronically and affects persons required to file partnership returns, corporate income. 5227 (2022) form 5227 (2022) page. Web question can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed? Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return), posted on the irs website dec. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Filing your return electronically is faster, safer. Can a pooled income or charitable lead trust return with form 1041. Web can form 5227 be electronically filed? 5227 (2021) form 5227 (2021) page. The form is available in the 1041 fiduciary return by completing applicable screens on the 5227 tab.

Yes, you can file an original form 1040 series tax return electronically using any filing status. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically. The form is available in the 1041. Web you can also electronically file the 5227. Web can form 5227 be electronically filed? Form 5227 faqs the following includes answers to common questions about form 5227. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Web by michael cohn december 09, 2021, 5:27 p.m. The form is available in the 1041 fiduciary return by completing applicable screens on the 5227 tab.

2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Web you can also electronically file the 5227. Answer form 1041 may be electronically filed, but form. The form is available in the 1041. Web can form 5227 be electronically filed? Web by michael cohn december 09, 2021, 5:27 p.m. Web question can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed? Web this document contains proposed regulations amending the rules for filing electronically and affects persons required to file partnership returns, corporate income. Find more ideas labeled with. Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return), posted on the irs website dec.

2020 Form IRS 5227 Fill Online, Printable, Fillable, Blank pdfFiller

Find more ideas labeled with. 5227 (2021) form 5227 (2021) page. Web can form 5227 be electronically filed? Yes, you can file an original form 1040 series tax return electronically using any filing status. Web this document contains proposed regulations amending the rules for filing electronically and affects persons required to file partnership returns, corporate income.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). 5227 (2022) form 5227 (2022) page. Web can form 5227 be electronically filed? Web question can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed? Web you can also electronically file the 5227.

How To Know Your Electronically Filed Tax Return Was Really Filed

5227 (2022) form 5227 (2022) page. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Beginning tax software year 2022, electronic filing is available for both forms 5227 and 1041 when the type of return being filed is a charitable lead trust or pooled income. Find more ideas labeled with. This requires a separate.

급여 규정(정규직)(작성방법 포함) 부서별서식

The form is available in the 1041. Can a pooled income or charitable lead trust return with form 1041. Form 5227 faqs the following includes answers to common questions about form 5227. Answer form 1041 may be electronically filed, but form. Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return), posted on the.

Which IRS Form Can Be Filed Electronically?

Web electronic filing of form 5227 is expected to be available in 2023, and the irs will announce the specific date of availability when the programming comes online. Can a pooled income or charitable lead trust return with form 1041. Web question can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed?.

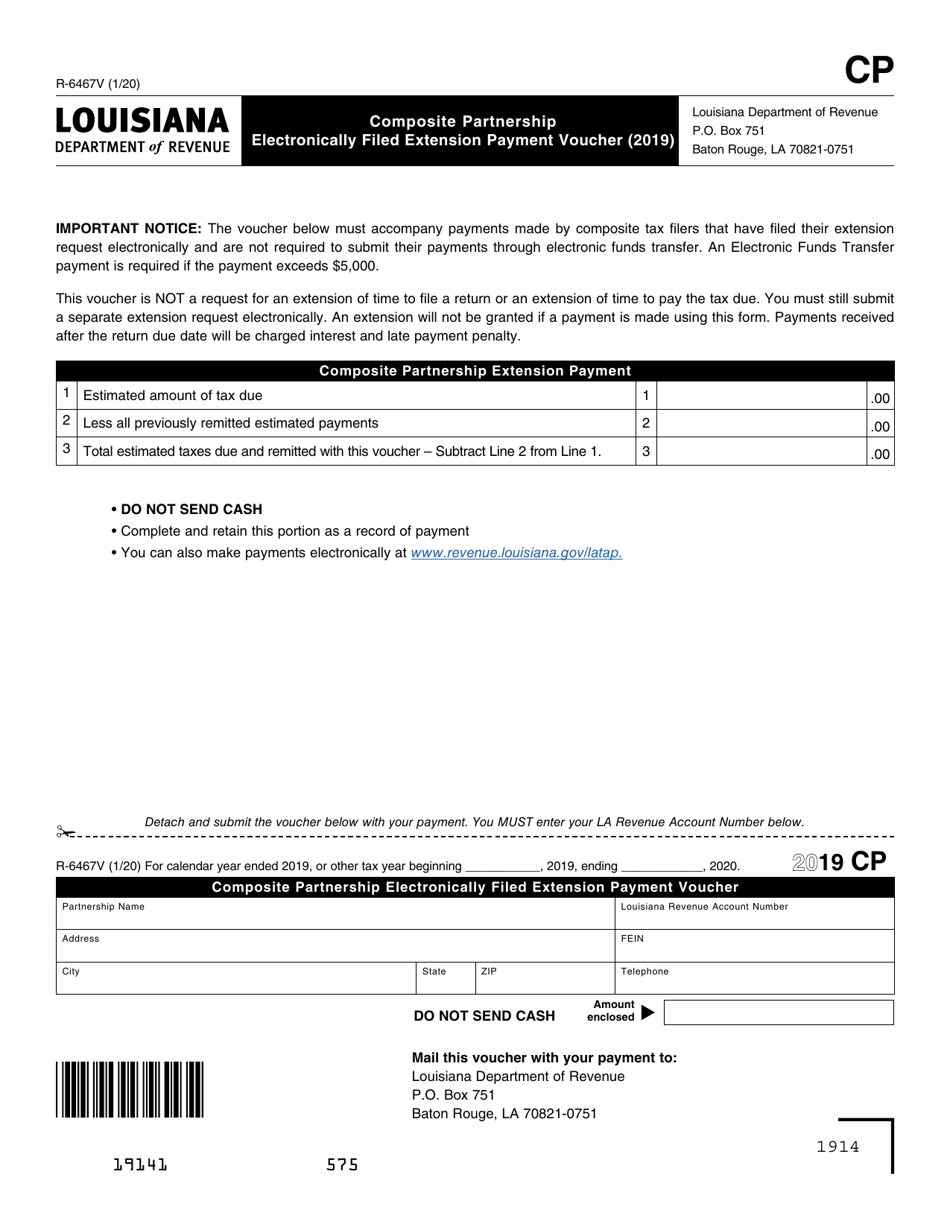

Form R6467V Download Fillable PDF or Fill Online Composite Partnership

Web by michael cohn december 09, 2021, 5:27 p.m. Beginning tax software year 2022, electronic filing is available for both forms 5227 and 1041 when the type of return being filed is a charitable lead trust or pooled income. Web question can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed? Web.

Fill Free fillable F5227 2019 Form 5227 PDF form

5227 (2021) form 5227 (2021) page. Yes, you can file an original form 1040 series tax return electronically using any filing status. Form 5227 faqs the following includes answers to common questions about form 5227. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Beginning tax software year 2022, electronic filing is available for.

Filing 20686047 Electronically Filed 11/18/2014 114328 AM

Filing your return electronically is faster, safer. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Why am i receiving critical diagnostic 14166? Find more ideas labeled with. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a).

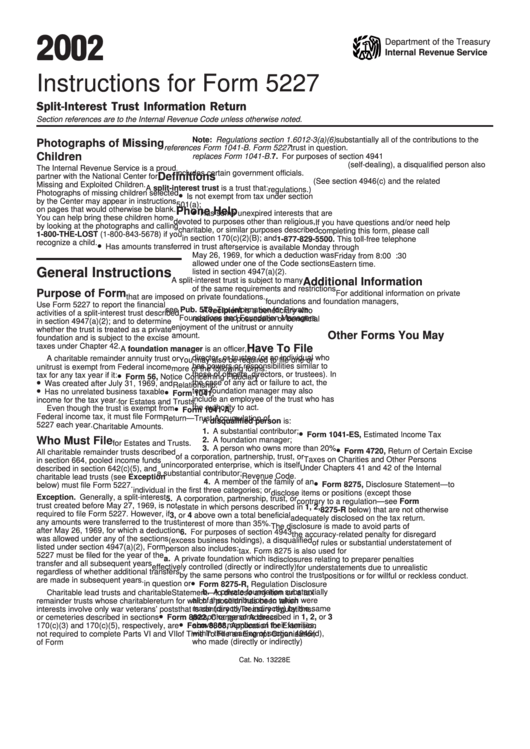

Instructions For Form 5227 printable pdf download

Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return), posted on the irs website dec. Web the following includes answers to common questions about form 5227. Web by michael cohn december 09, 2021, 5:27 p.m. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Web electronic filing.

Form R2868V Download Fillable PDF or Fill Online Individual Tax

Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return), posted on the irs website dec. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Web this document contains proposed regulations amending the rules for filing electronically and affects persons required to file partnership returns, corporate income. Beginning.

Why Am I Receiving Critical Diagnostic 14166?

5227 (2021) form 5227 (2021) page. Filing your return electronically is faster, safer. Can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically. Web you can also electronically file the 5227.

Web The Following Includes Answers To Common Questions About Form 5227.

Web can form 5227 be electronically filed? 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Web electronic filing of form 5227 is expected to be available in 2023, and the irs will announce the specific date of availability when the programming comes online. The form is available in the 1041 fiduciary return by completing applicable screens on the 5227 tab.

Can A Pooled Income Or Charitable Lead Trust Return With Form 1041.

Web by michael cohn december 09, 2021, 5:27 p.m. Form 5227 faqs the following includes answers to common questions about form 5227. The form is available in the 1041. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a).

This Requires A Separate Export.

Answer form 1041 may be electronically filed, but form. Web question can a pooled income or charitable lead trust return with form 1041 and form 5227 be electronically filed? Find more ideas labeled with. Beginning tax software year 2022, electronic filing is available for both forms 5227 and 1041 when the type of return being filed is a charitable lead trust or pooled income.

/https://specials-images.forbesimg.com/imageserve/525695398/0x0.jpg%3Ffit%3Dscale)