Can Irs Form 1310 Be Filed Electronically

Can Irs Form 1310 Be Filed Electronically - Web depending on the circumstances, a return that includes form 1310 may or may not be able to be filed electronically. In care of addresseeelectronic filing information worksheet. If data entry on the 1310 screen does not meet the irs. Web depending on how the questions are answered on the 1310, it is possible to efile with the 1310 in certain situations. The program should tell you if its able to be efiled. Web the final return of a deceased taxpayer may be eligible for electronic filing in the following situations: Web actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. To help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital. Web this information includes name, address, and the social security number of the person who is filing the tax return. Yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer).

The first step of filing itr is to collect all the documents related to the process. Get ready for tax season deadlines by completing any required tax forms today. The program should tell you if its able to be efiled. Web 9 rows the irs has set specific electronic filing guidelines for form 1310. To help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital. Web in part iii, you’ll just sign and date. Web depending on the circumstances, a return that includes form 1310 may or may not be able to be filed electronically. If data entry on the 1310 screen does not meet the irs. Web if you filed a tax return with a spouse who died in 2020 and you want to change the name of the taxpayer on the refund check, you must file form 1310 statement of person. For form 1310 to be generated, the date of death field on screen 1 must be entered to indicate the.

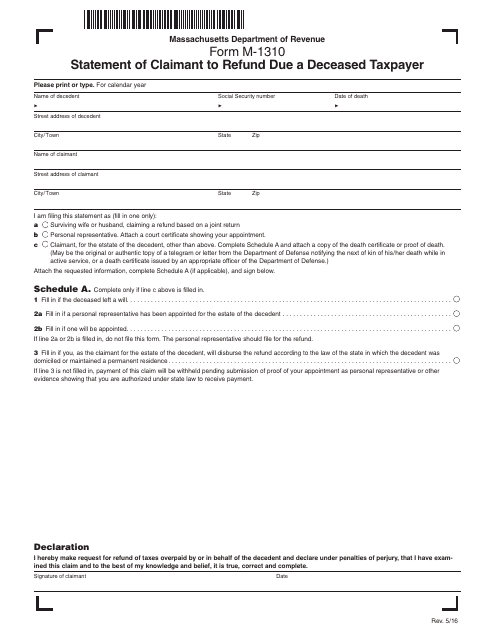

Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). An individual having salary income should collect. Then you have to provide all other required information in the. Web the final return of a deceased taxpayer may be eligible for electronic filing in the following situations: Web electronic filing guidelines for form 1310 (1040) the irs has set specific electronic filing guidelines for form 1310. In care of addresseeelectronic filing information worksheet. You can prepare the form and then mail it in to the same irs service center as the decedent's tax return would be mailed to. Filing your return electronically is faster, safer, and more. How do i file form 1310?

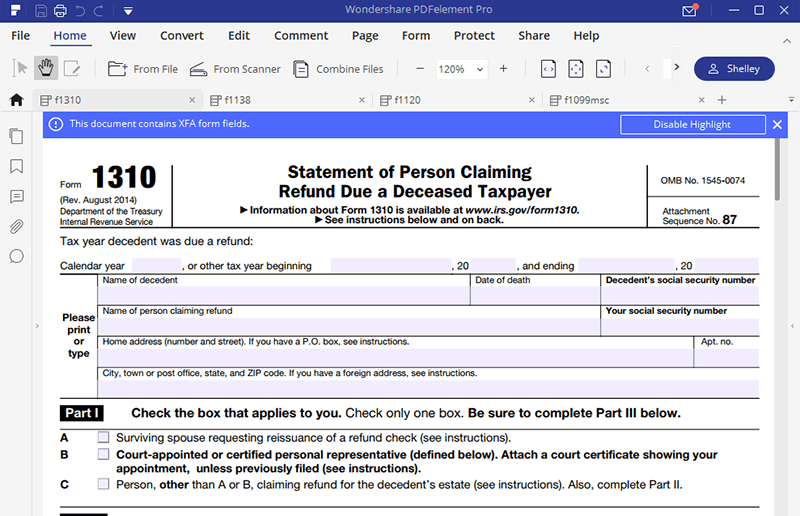

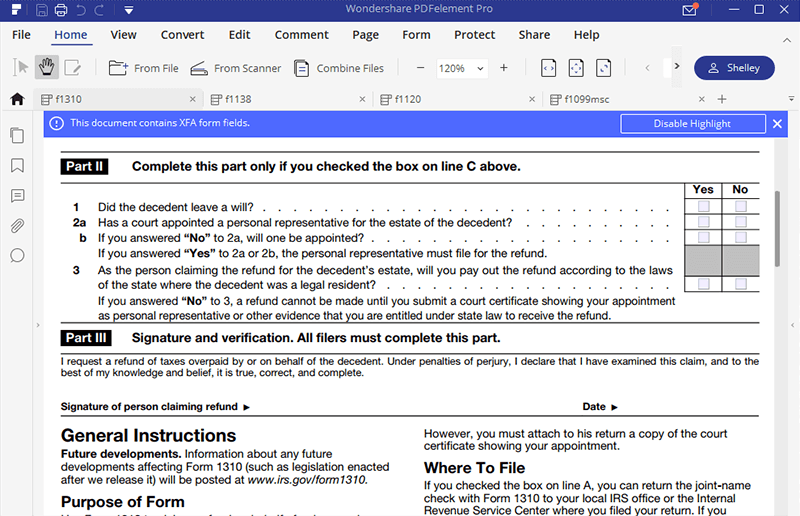

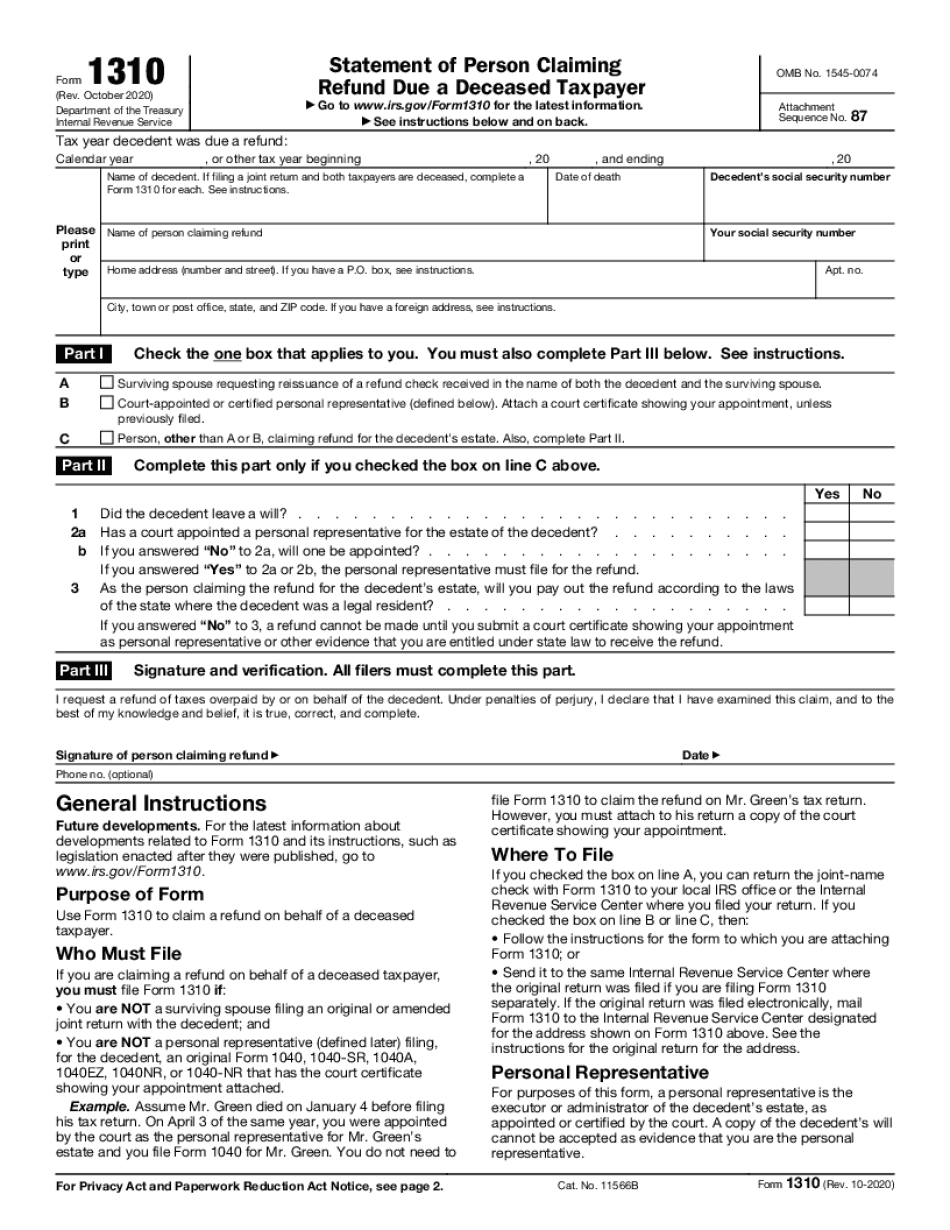

Irs Form 1310 Printable Master of Documents

Web in part iii, you’ll just sign and date. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Web electronic filing guidelines for form 1310 (1040) the irs has set specific electronic filing guidelines for form 1310. Answer the questions in the form 1310 menu appropriately,.

Irs Form 1310 Printable Master of Documents

Filing your return electronically is faster, safer, and more. An individual having salary income should collect. Web depending on how the questions are answered on the 1310, it is possible to efile with the 1310 in certain situations. In care of addresseeelectronic filing information worksheet. Web if a tax refund is due, the person claiming the refund must fill out.

Which IRS Form Can Be Filed Electronically?

Complete, edit or print tax forms instantly. Web in part iii, you’ll just sign and date. Web yes, you can file an original form 1040 series tax return electronically using any filing status. From within your taxact return ( online or desktop), click federal. Web actually, if you are the court appointed executor or personal representative, you do not have.

Form 1310 Definition

Web in part iii, you’ll just sign and date. Web yes, you can file an original form 1040 series tax return electronically using any filing status. How do i file form 1310? For form 1310 to be generated, the date of death field on screen 1 must be entered to indicate the. The first step of filing itr is to.

IRS Form 1310 How to Fill it Right

You can prepare the form and then mail it in to the same irs service center as the decedent's tax return would be mailed to. Web up to $40 cash back if the original return was filed electronically mail form 1310 to the internal revenue service center designated for the address shown on form 1310 above. Ad access irs tax.

Irs Form 1310 Printable Master of Documents

The program should tell you if its able to be efiled. Web depending on how the questions are answered on the 1310, it is possible to efile with the 1310 in certain situations. You can prepare the form and then mail it in to the same irs service center as the decedent's tax return would be mailed to. Web if.

IRS Form 1310 How to Fill it Right

Web actually, if you are the court appointed executor or personal representative, you do not have to file form 1310. How do i file form 1310? Complete, edit or print tax forms instantly. Web if you filed a tax return with a spouse who died in 2020 and you want to change the name of the taxpayer on the refund.

Irs Form 8379 Electronically Universal Network

From within your taxact return ( online or desktop), click federal. Get ready for tax season deadlines by completing any required tax forms today. You just need to attach a copy of the court certificate. Web the final return of a deceased taxpayer may be eligible for electronic filing in the following situations: Web actually, if you are the court.

Edit Document IRS Form 1310 According To Your Needs

Yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Web depending on how the questions are answered on the 1310, it is possible to efile with the 1310 in certain situations. Answer the questions in the form 1310 menu appropriately,. Web.

IRS Approves New Option for Structured Settlements!

Web yes, you can file an original form 1040 series tax return electronically using any filing status. Web depending on how the questions are answered on the 1310, it is possible to efile with the 1310 in certain situations. If data entry on the 1310 screen does not meet the irs. Web documents needed to file itr; For form 1310.

Web Depending On The Circumstances, A Return That Includes Form 1310 May Or May Not Be Able To Be Filed Electronically.

Web up to $40 cash back if the original return was filed electronically mail form 1310 to the internal revenue service center designated for the address shown on form 1310 above. Web in part iii, you’ll just sign and date. You just need to attach a copy of the court certificate. Web this information includes name, address, and the social security number of the person who is filing the tax return.

Web 9 Rows The Irs Has Set Specific Electronic Filing Guidelines For Form 1310.

Then you have to provide all other required information in the. Ad access irs tax forms. Web if a refund is due to the decedent, it may be necessary to file form 1310, statement of person claiming refund due a deceased taxpayer with the return. Get ready for tax season deadlines by completing any required tax forms today.

Web Electronic Filing Guidelines For Form 1310 (1040) The Irs Has Set Specific Electronic Filing Guidelines For Form 1310.

Web if you filed a tax return with a spouse who died in 2020 and you want to change the name of the taxpayer on the refund check, you must file form 1310 statement of person. Web depending on how the questions are answered on the 1310, it is possible to efile with the 1310 in certain situations. Yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). An individual having salary income should collect.

The Program Should Tell You If Its Able To Be Efiled.

To help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital. Web yes, you can file an original form 1040 series tax return electronically using any filing status. Web the final return of a deceased taxpayer may be eligible for electronic filing in the following situations: Web actually, if you are the court appointed executor or personal representative, you do not have to file form 1310.

:max_bytes(150000):strip_icc()/1310-RefundClaimDuetoDeceasedTaxpayer-1-292bd14843c94bf4abf09ea5d6eb9a4b.png)