Casualty Loss Form

Casualty Loss Form - Business losses are deducted elsewhere. Web you can deduct personal casualty or theft losses only to the extent that: Web if you suffered a qualified disaster loss, you are eligible to claim a casualty loss deduction, to elect to claim the loss in the preceding tax year, and to deduct the loss without. The form has a separate column for each item lost. Web casualty loss have a casualty loss on a home you own as tenants by the entirety half of the loss, subject to the deduction limits. Then, they have to file form 1040. Casualty and theft losses can be carried. They are subject to a 10% adjusted gross income (agi). First, the taxpayer has to report their losses on form 4684. However, if the casualty loss is not the result of a federally.

Web reporting your casualty deduction. They are subject to a 10% adjusted gross income (agi). To determine the amount of your casualty loss, you. First, the taxpayer has to report their losses on form 4684. Web casualty and theft losses are reported under the casualty loss section on schedule a of form 1040. If more than four assets are lost in the casualty or theft, add additional units of screen 4684 for the fifth and additional. Web new loss cost multiplier, deviation or oterwise h modifying it’s currently approved workers' compensation rates or rating procedures must use reference filing adoption form. To report the casualty loss on your tax return, you would typically use form 4684, casualties and thefts, and transfer the deductible loss amount to schedule a. Web if you have already filed your return for the preceding year, you may claim the loss by filing an amended return, form 1040x. Then, they have to file form 1040.

Then, they have to file form 1040. Web casualty and theft losses are reported under the casualty loss section on schedule a of form 1040. Claiming the deduction requires you to complete irs form 4684. To report the casualty loss on your tax return, you would typically use form 4684, casualties and thefts, and transfer the deductible loss amount to schedule a. To determine the amount of your casualty loss, you. Neither spouse may report the. Web generating form 4684 casualty or theft loss for an individual return in lacerte this article will show you how to generate form 4684, casualties and thefts,. Web if you suffered a qualified disaster loss, you are eligible to claim a casualty loss deduction, to elect to claim the loss in the preceding tax year, and to deduct the loss without. Web if you have already filed your return for the preceding year, you may claim the loss by filing an amended return, form 1040x. However, if the casualty loss is not the result of a federally.

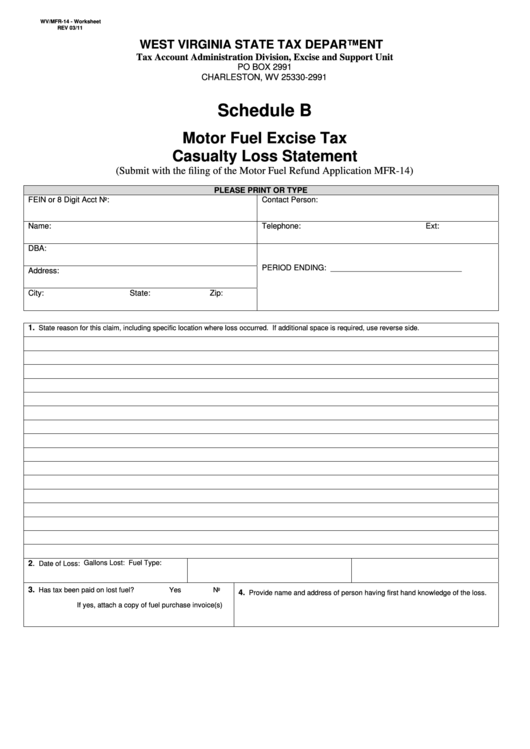

Form Wv/mfr14 Worksheet Schedule B Motor Fuel Exise Tax Casualty

Web only losses pertaining to personal property can be declared on form 4684. Web casualty or theft gain or loss (use a separate part l for each casualty or theft.) 19 description of properties (show type, location, and date acquired for each property). To determine the amount of your casualty loss, you. Neither spouse may report the. The total amount.

Personal casualty losses from natural disasters

Web how to claim a casualty loss on taxes? Web new loss cost multiplier, deviation or oterwise h modifying it’s currently approved workers' compensation rates or rating procedures must use reference filing adoption form. Web overview use this screen to complete form 4684, page 2. The amount of each separate casualty or theft loss is more than $100, and; Web.

Taxes From A To Z (2014) L Is For Lost Property

Web casualty or theft gain or loss (use a separate part l for each casualty or theft.) 19 description of properties (show type, location, and date acquired for each property). Web you can deduct personal casualty or theft losses only to the extent that: Claiming the deduction requires you to complete irs form 4684. Web if you suffered a qualified.

Home basis, not market value, key amount in calculating disaster loss

Web new loss cost multiplier, deviation or oterwise h modifying it’s currently approved workers' compensation rates or rating procedures must use reference filing adoption form. They are subject to a 10% adjusted gross income (agi). Neither spouse may report the. Web casualty and theft losses are reported under the casualty loss section on schedule a of form 1040. Web if.

casualty loss deduction example Fill Online, Printable, Fillable

Then, they have to file form 1040. The form has a separate column for each item lost. However, the rules for determining the amount of deductible loss and where the loss is. Web generating form 4684 casualty or theft loss for an individual return in lacerte this article will show you how to generate form 4684, casualties and thefts,. Web.

Form 4684 Theft and Casualty Loss Deduction H&R Block

To determine the amount of your casualty loss, you. Web if you have already filed your return for the preceding year, you may claim the loss by filing an amended return, form 1040x. Web casualty loss have a casualty loss on a home you own as tenants by the entirety half of the loss, subject to the deduction limits. First,.

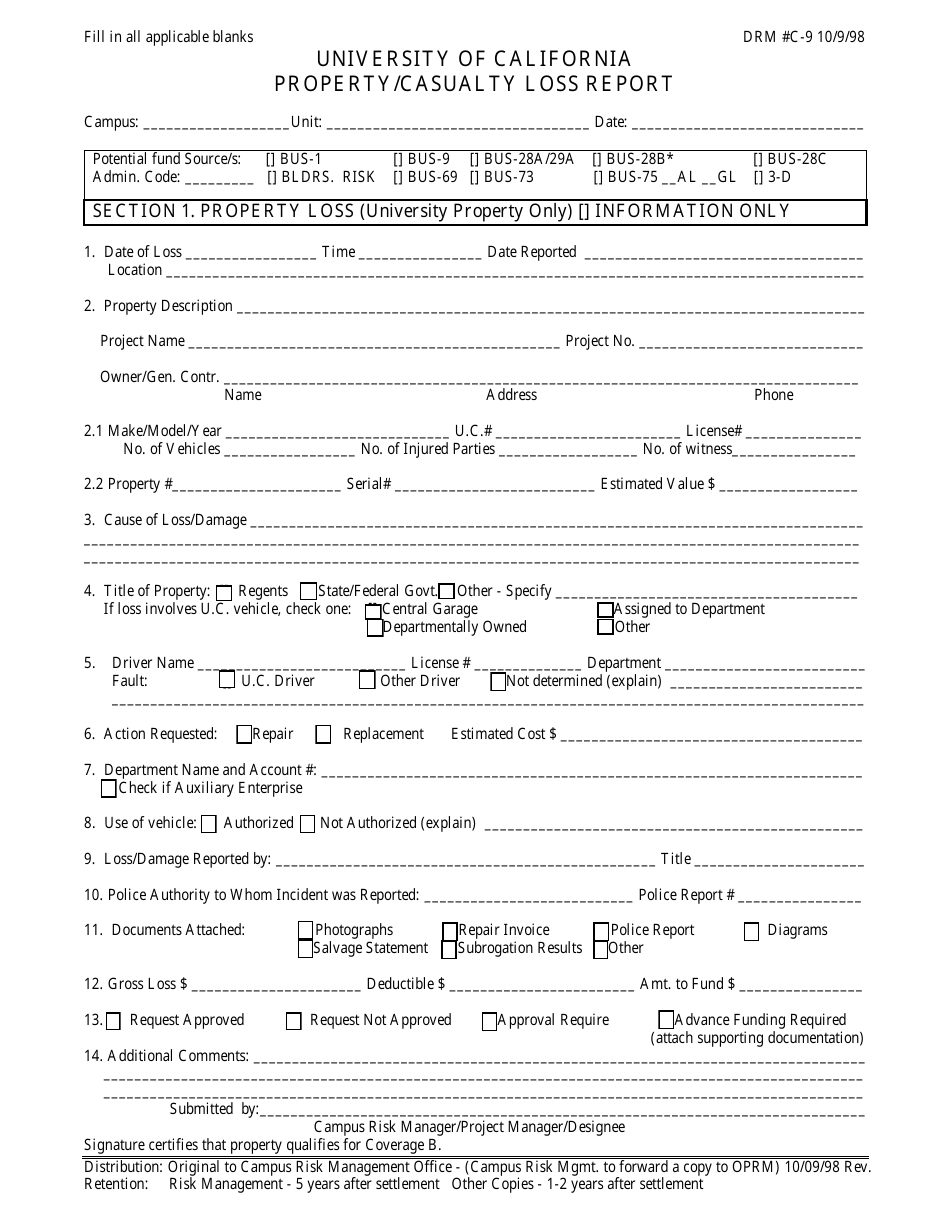

Property/Casualty Loss Report Form University of California Download

To report the casualty loss on your tax return, you would typically use form 4684, casualties and thefts, and transfer the deductible loss amount to schedule a. The form has a separate column for each item lost. Web if you have already filed your return for the preceding year, you may claim the loss by filing an amended return, form.

Guide to completing Form 4684 to Claim a Casualty Loss

Web casualty and theft losses are reported under the casualty loss section on schedule a of form 1040. Claiming the deduction requires you to complete irs form 4684. Web you can deduct personal casualty or theft losses only to the extent that: Web if you have already filed your return for the preceding year, you may claim the loss by.

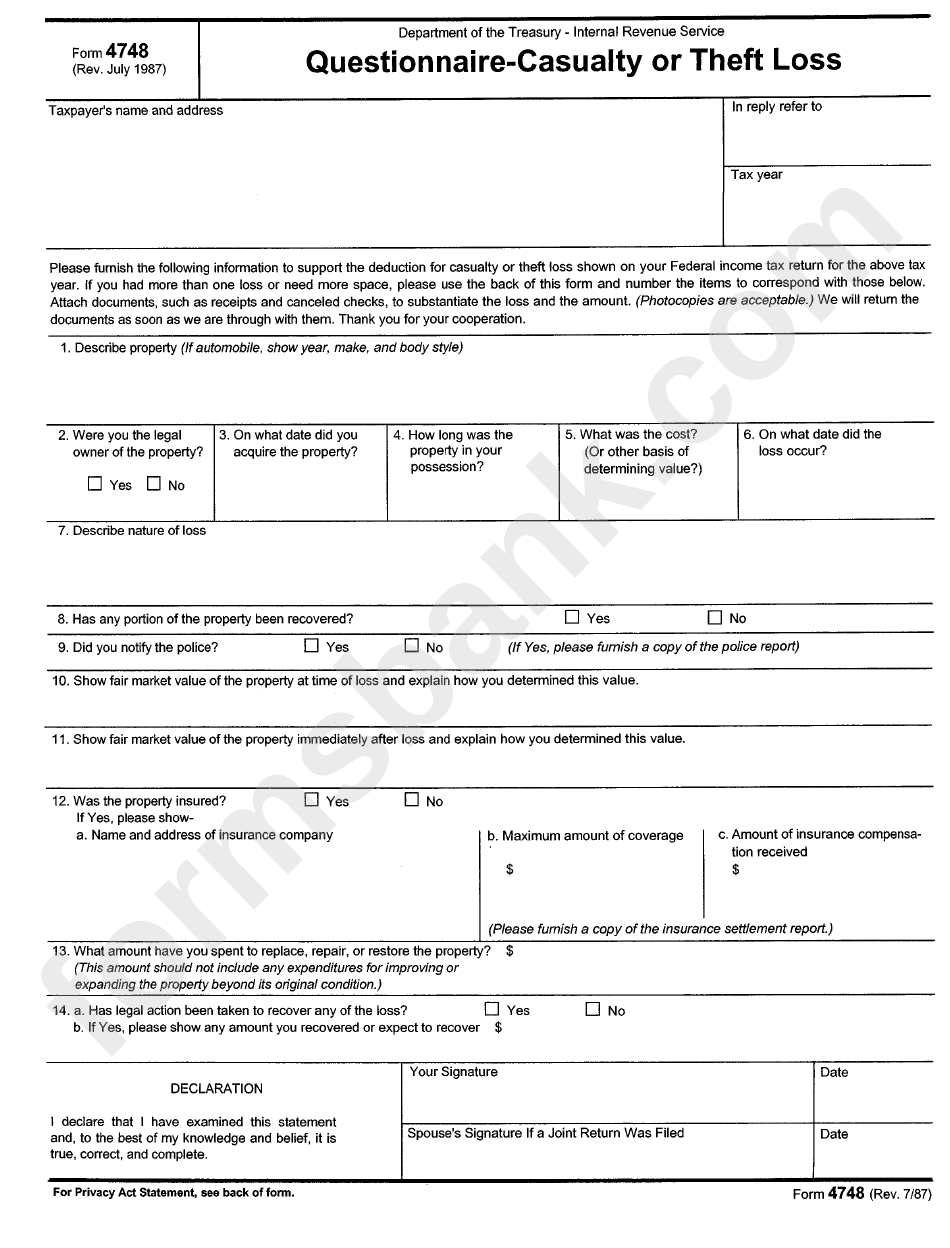

Form 4748 QuestionnaireCasualty Or Theft Loss printable pdf download

Web if you suffered a qualified disaster loss, you are eligible to claim a casualty loss deduction, to elect to claim the loss in the preceding tax year, and to deduct the loss without. To determine the amount of your casualty loss, you. Web you can deduct personal casualty or theft losses only to the extent that: Web only losses.

Personal casualty losses from natural disasters

Web casualty or theft gain or loss (use a separate part l for each casualty or theft.) 19 description of properties (show type, location, and date acquired for each property). Web reporting your casualty deduction. Neither spouse may report the. Claiming the deduction requires you to complete irs form 4684. The amount of each separate casualty or theft loss is.

If More Than Four Assets Are Lost In The Casualty Or Theft, Add Additional Units Of Screen 4684 For The Fifth And Additional.

First, the taxpayer has to report their losses on form 4684. Web generating form 4684 casualty or theft loss for an individual return in lacerte this article will show you how to generate form 4684, casualties and thefts,. The amount of each separate casualty or theft loss is more than $100, and; Web new loss cost multiplier, deviation or oterwise h modifying it’s currently approved workers' compensation rates or rating procedures must use reference filing adoption form.

To Report The Casualty Loss On Your Tax Return, You Would Typically Use Form 4684, Casualties And Thefts, And Transfer The Deductible Loss Amount To Schedule A.

Web reporting your casualty deduction. However, if the casualty loss is not the result of a federally. Web casualty loss have a casualty loss on a home you own as tenants by the entirety half of the loss, subject to the deduction limits. They are subject to a 10% adjusted gross income (agi).

Web If You Suffered A Qualified Disaster Loss, You Are Eligible To Claim A Casualty Loss Deduction, To Elect To Claim The Loss In The Preceding Tax Year, And To Deduct The Loss Without.

Then, they have to file form 1040. Claiming the deduction requires you to complete irs form 4684. Web up to 10% cash back you must complete form 4684 for all casualty losses. To determine the amount of your casualty loss, you.

Web Casualty And Theft Losses Are Reported Under The Casualty Loss Section On Schedule A Of Form 1040.

Neither spouse may report the. Web how to claim a casualty loss on taxes? Web only losses pertaining to personal property can be declared on form 4684. Web if you have already filed your return for the preceding year, you may claim the loss by filing an amended return, form 1040x.