Chapter 171 Of Texas Tax Code

Chapter 171 Of Texas Tax Code - Paying off a loan by regular installments. (1) internal revenue code means the internal revenue code of 1986. Web tax code section 171.107 deduction of cost of solar energy device from margin apportioned to this state in. Franchise tax § 171.0003 tex. Is the recapture of depreciation under internal revenue code (irc) sections 1245, 1250. Tx tax code § 171.0001 (2021) sec. Computation of tax (a) subject to. (1) the entity is a general or limited partnership or a trust, other than a business trust; Web justia us law us codes and statutes texas code 2005 texas code texas tax code chapter 171. Tax code section 171.0003 definition of passive entity (a) an entity is.

Tx tax code § 171.0001 (2021) sec. (1) the entity is a general or limited partnership or a trust, other than a business trust; Franchise tax § 171.0003 tex. Web certain exemptions from the franchise tax are outlined in texas tax code chapter 171, subchapter b. Franchise tax § 171.002 tax code section 171.002 rates; Web justia us law us codes and statutes texas code 2005 texas code texas tax code chapter 171. (1) internal revenue code means the internal revenue code of 1986. Is the recapture of depreciation under internal revenue code (irc) sections 1245, 1250. Web all provisions of tax code, chapter 171, apply to the additional tax, unless they conflict with a provision in tax code,. Web certified historic structures rehabilitation credit under texas tax code chapter 171, subchapter s (effective for.

(1) the entity is a general or limited partnership or a trust, other than a business trust; Tx tax code § 171.0001 (2021) sec. Web tax code section 171.107 deduction of cost of solar energy device from margin apportioned to this state in. Franchise tax § 171.0003 tex. Computation of tax (a) subject to. Is the recapture of depreciation under internal revenue code (irc) sections 1245, 1250. Web general definitions 171.001 tax imposed 171.002 rates 171.0002 definition of taxable entity 171.003 increase in rate. Web justia us law us codes and statutes texas code 2005 texas code texas tax code chapter 171. Web all provisions of tax code, chapter 171, apply to the additional tax, unless they conflict with a provision in tax code,. Web certified historic structures rehabilitation credit under texas tax code chapter 171, subchapter s (effective for.

Truth and Proof Judge Tano Tijerina

Web all provisions of tax code, chapter 171, apply to the additional tax, unless they conflict with a provision in tax code,. (1) internal revenue code means the internal revenue code of 1986. Is the recapture of depreciation under internal revenue code (irc) sections 1245, 1250. Franchise tax § 171.002 tax code section 171.002 rates; Web tax code section 171.107.

Tax Increment Reinvestment Zones Garland, TX

Web all provisions of tax code, chapter 171, apply to the additional tax, unless they conflict with a provision in tax code,. Definition of conducting active trade or business. Web certified historic structures rehabilitation credit under texas tax code chapter 171, subchapter s (effective for. Computation of tax (a) subject to. (1) the entity is a general or limited partnership.

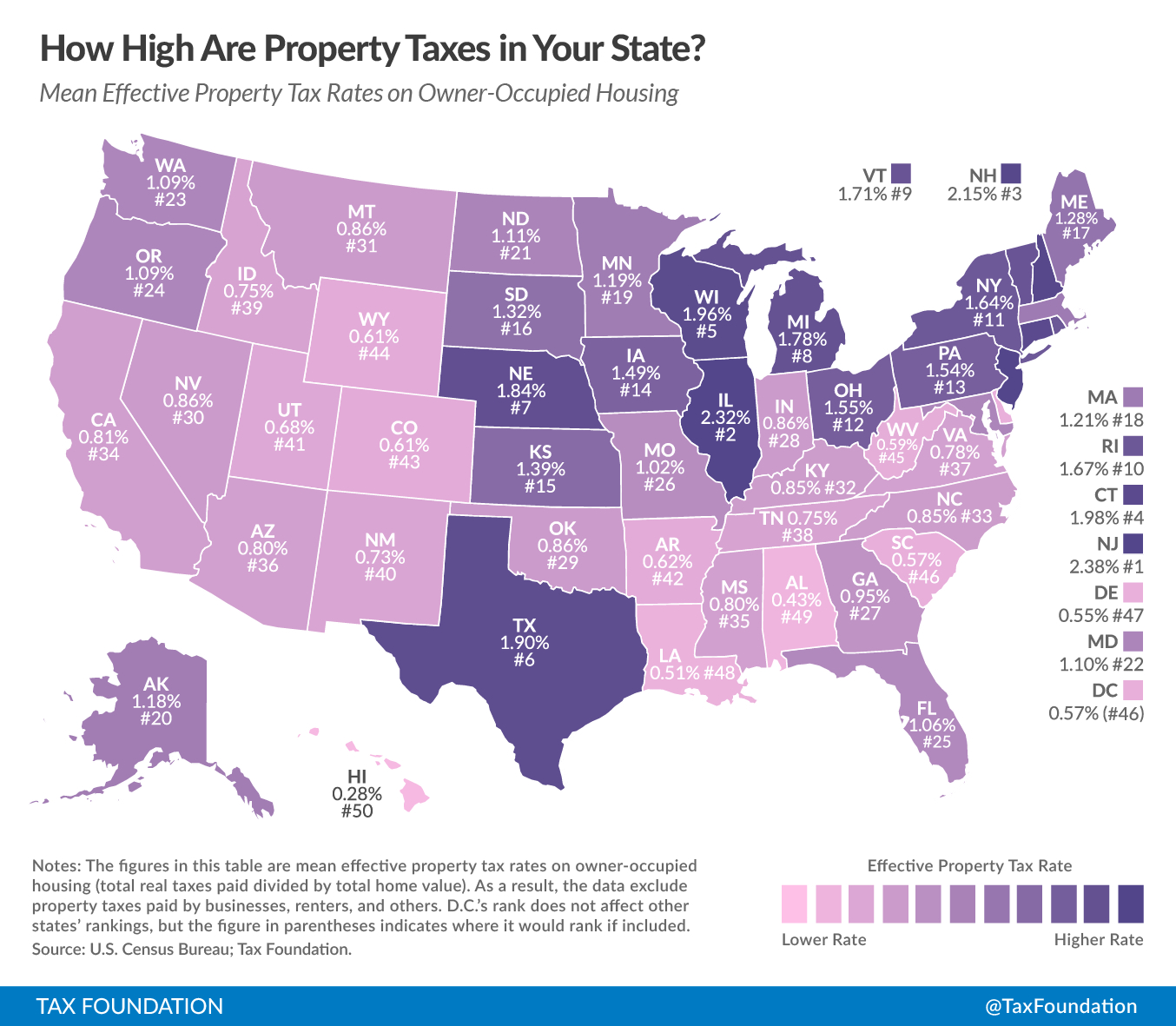

How High Are Property Taxes In Your State? Tax Foundation Texas

Franchise tax § 171.002 tax code section 171.002 rates; Web justia us law us codes and statutes texas code 2005 texas code texas tax code chapter 171. (1) internal revenue code means the internal revenue code of 1986. Web tax code section 171.107 deduction of cost of solar energy device from margin apportioned to this state in. Computation of tax.

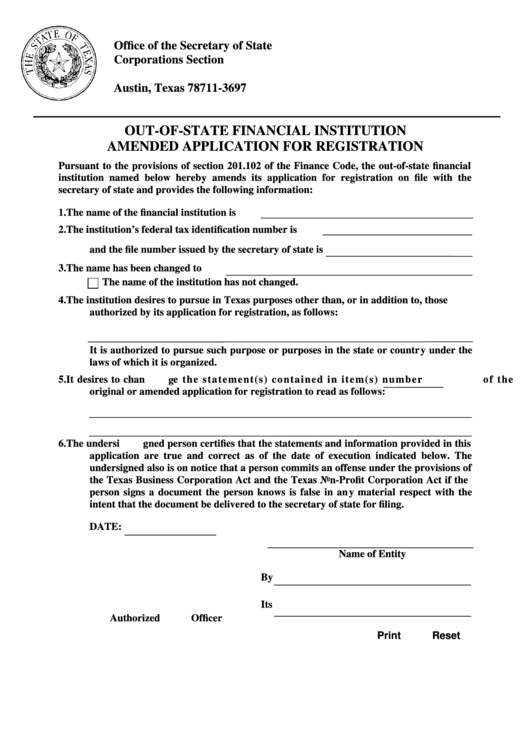

Fillable OutOfState Financial Institution Amended Application For

Web tax code section 171.107 deduction of cost of solar energy device from margin apportioned to this state in. Is the recapture of depreciation under internal revenue code (irc) sections 1245, 1250. Paying off a loan by regular installments. Computation of tax (a) subject to. Web certain exemptions from the franchise tax are outlined in texas tax code chapter 171,.

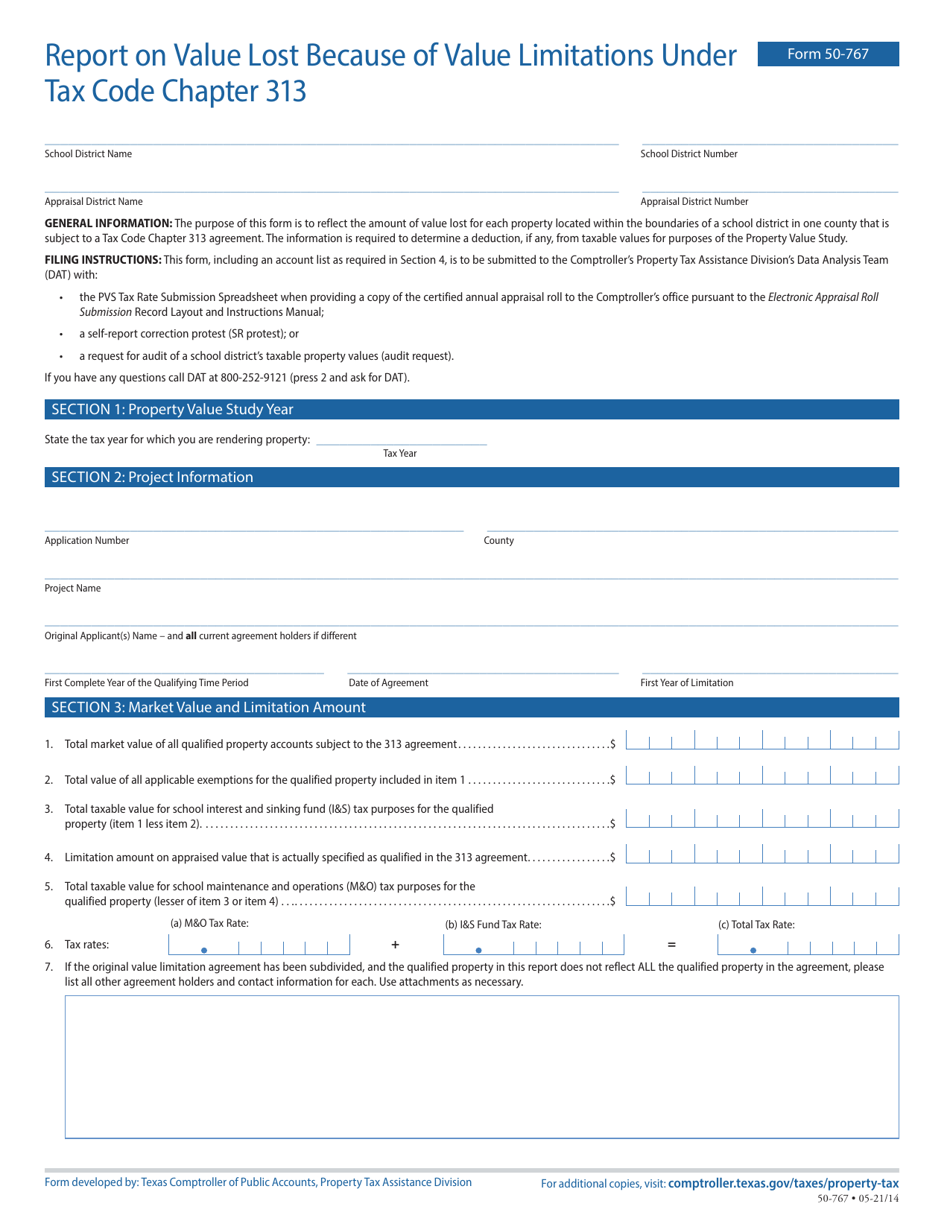

Form 50767 Download Fillable PDF or Fill Online Report on Value Lost

Is the recapture of depreciation under internal revenue code (irc) sections 1245, 1250. Definition of conducting active trade or business. Tx tax code § 171.0001 (2021) sec. Web justia us law us codes and statutes texas code 2005 texas code texas tax code chapter 171. Paying off a loan by regular installments.

MillyTsneem

(1) the entity is a general or limited partnership or a trust, other than a business trust; Web certain exemptions from the franchise tax are outlined in texas tax code chapter 171, subchapter b. Web general definitions 171.001 tax imposed 171.002 rates 171.0002 definition of taxable entity 171.003 increase in rate. Web justia us law us codes and statutes texas.

Study shows potential impact of Inheritance Tax Code changes on family

Is the recapture of depreciation under internal revenue code (irc) sections 1245, 1250. Computation of tax (a) subject to. Web tax code section 171.107 deduction of cost of solar energy device from margin apportioned to this state in. Web certified historic structures rehabilitation credit under texas tax code chapter 171, subchapter s (effective for. Tx tax code § 171.0001 (2021).

hongkongerdesign Pay Arkansas Franchise Tax Online

Computation of tax (a) subject to. Web justia us law us codes and statutes texas code 2005 texas code texas tax code chapter 171. (1) internal revenue code means the internal revenue code of 1986. Web all provisions of tax code, chapter 171, apply to the additional tax, unless they conflict with a provision in tax code,. Tax code section.

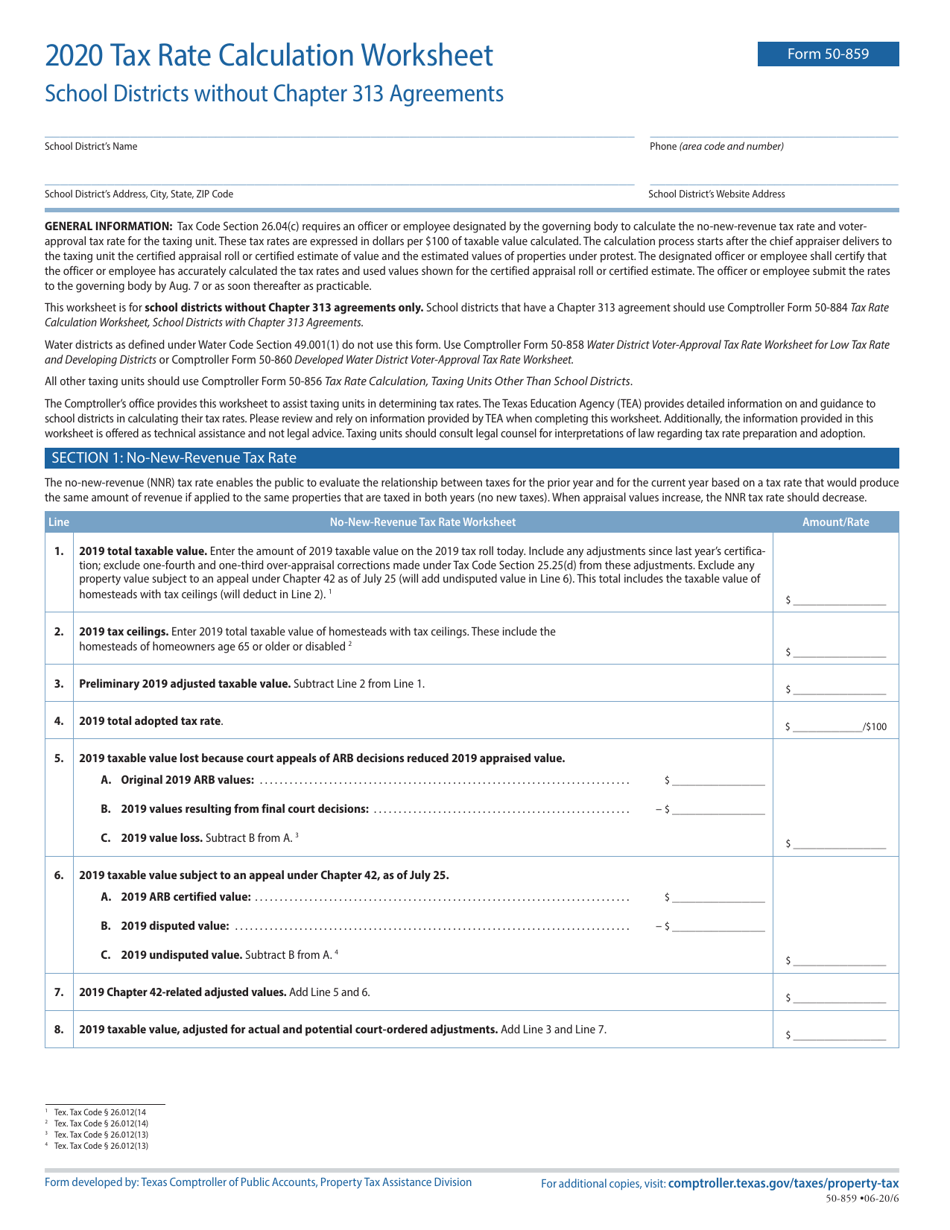

Form 50859 Download Fillable PDF or Fill Online Tax Rate Calculation

Web texas tax code (ttc) 171.0003(b). (1) internal revenue code means the internal revenue code of 1986. Web all provisions of tax code, chapter 171, apply to the additional tax, unless they conflict with a provision in tax code,. (1) the entity is a general or limited partnership or a trust, other than a business trust; Paying off a loan.

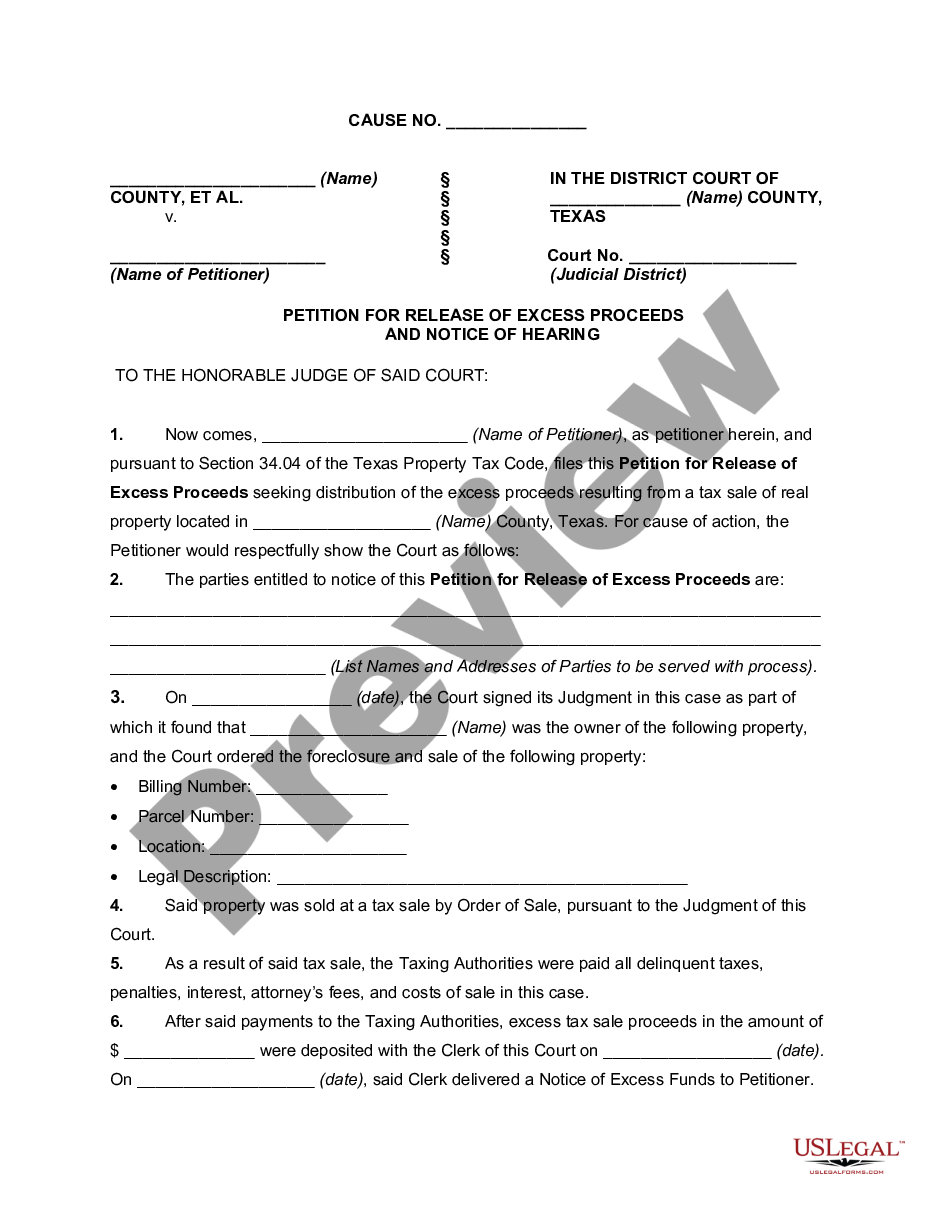

Texas Petition for Release of Excess Proceeds and Notice of Hearing

Paying off a loan by regular installments. Tx tax code § 171.0001 (2021) sec. Is the recapture of depreciation under internal revenue code (irc) sections 1245, 1250. Web all provisions of tax code, chapter 171, apply to the additional tax, unless they conflict with a provision in tax code,. Computation of tax (a) subject to.

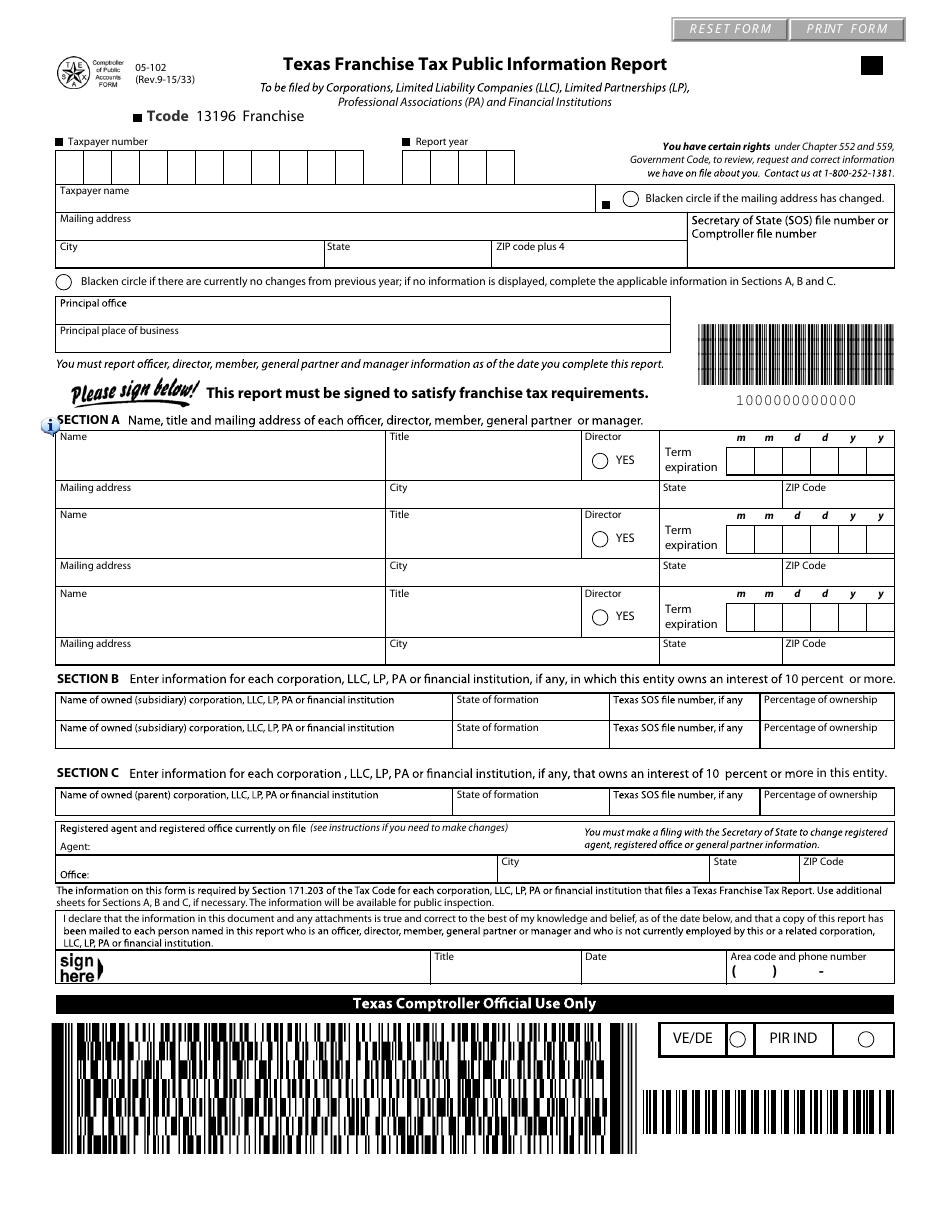

Franchise Tax § 171.0003 Tex.

Web all provisions of tax code, chapter 171, apply to the additional tax, unless they conflict with a provision in tax code,. Web tax code section 171.107 deduction of cost of solar energy device from margin apportioned to this state in. Tx tax code § 171.0001 (2021) sec. Web justia us law us codes and statutes texas code 2005 texas code texas tax code chapter 171.

Is The Recapture Of Depreciation Under Internal Revenue Code (Irc) Sections 1245, 1250.

Web certain exemptions from the franchise tax are outlined in texas tax code chapter 171, subchapter b. Definition of conducting active trade or business. (1) the entity is a general or limited partnership or a trust, other than a business trust; Web certified historic structures rehabilitation credit under texas tax code chapter 171, subchapter s (effective for.

Paying Off A Loan By Regular Installments.

Web general definitions 171.001 tax imposed 171.002 rates 171.0002 definition of taxable entity 171.003 increase in rate. Tax code section 171.0003 definition of passive entity (a) an entity is. Computation of tax (a) subject to. Franchise tax § 171.002 tax code section 171.002 rates;

Web Texas Tax Code (Ttc) 171.0003(B).

(1) internal revenue code means the internal revenue code of 1986.