Chapter 4 Homework Accounting

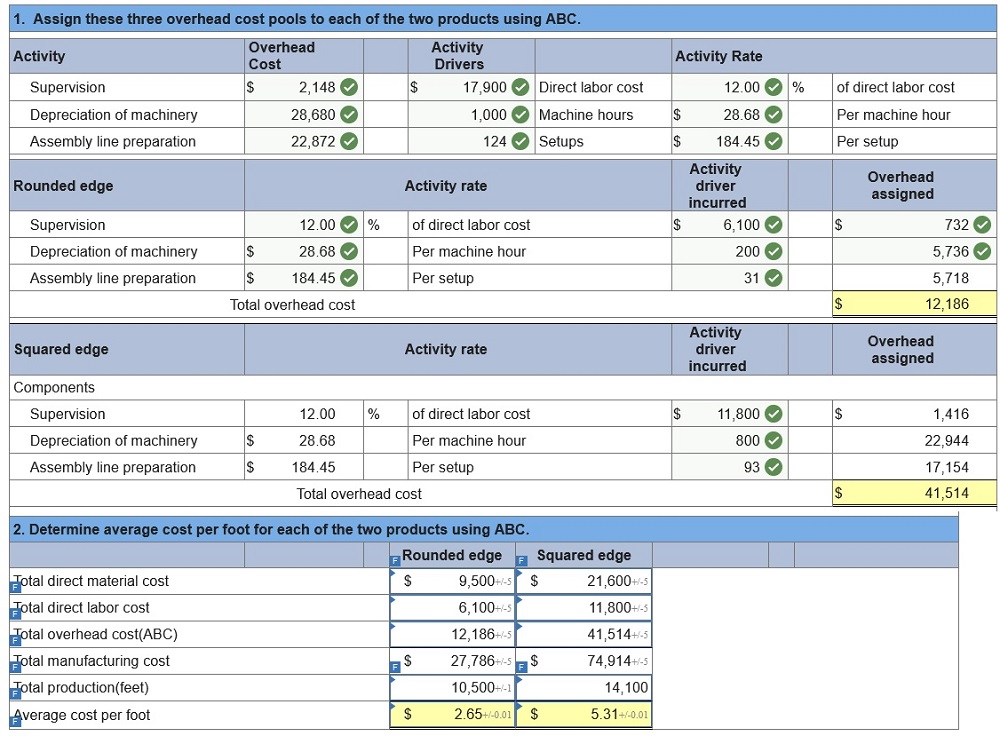

Chapter 4 Homework Accounting - Economics chapter 1 and 2 vacb. Jane is covered under her employer’s group medical expense plan as an employee. Web terms in this set (26) once the adjusted trial balance is in balance, the flow of accounts will now go into the financial statements. On the income statement, miscellaneous expenses are usually presented as the last item without regard to the dollar amount. In a worksheet, net income is entered in the following columns. 1 calculated as net sales minus cost of goods sold gross profit 2 a current asset that includes the cost to buy goods and make them ready for. Determine whether the firm reports each of the following items as part of cash and cash equivalents in the balance. Bu247 ch1 q and a. Journal entry records the accounting transactions of a business in a journal book. For this reason, when revenue is earned but not yet.

Web accounting test chapter 4. Bu247 ch1 q and a. A and c questions 1. Which of the following is a characteristic of an asset? 3.4k views 4 years ago. In this video, we go over chapter 4 homework, and maybe catch a few mistakes as they go but it is okay as it's a good way to learn connect. Va esthetics rules and regs. Jane is covered under her employer’s group medical expense plan as an employee. Jane is also covered under john’s plan as a dependent. Are the gross increases in owner's equity resulting from business activities.

For this reason, when revenue is earned but not yet. Our resource for fundamental accounting principles. Other sets by this creator. A and c questions 1. Match each phrase with its definition. Determine whether the firm reports each of the following items as part of cash and cash equivalents in the balance. These entries are passed by the company to changes its accounting records into the accruals concepts. Submit your answers in canvas before it is due. 1 calculated as net sales minus cost of goods sold gross profit 2 a current asset that includes the cost to buy goods and make them ready for. All the business transactions are recorded in the chronological order using the double entry system of accounting…

😎 Answers to accounting homework. Accounting Homework Help and Answers

In a worksheet, net income is entered in the following columns. All the business transactions are recorded in the chronological order using the double entry system of accounting… Jane is covered under her employer’s group medical expense plan as an employee. Are the gross increases in owner's equity resulting from business activities. Match each phrase with its definition.

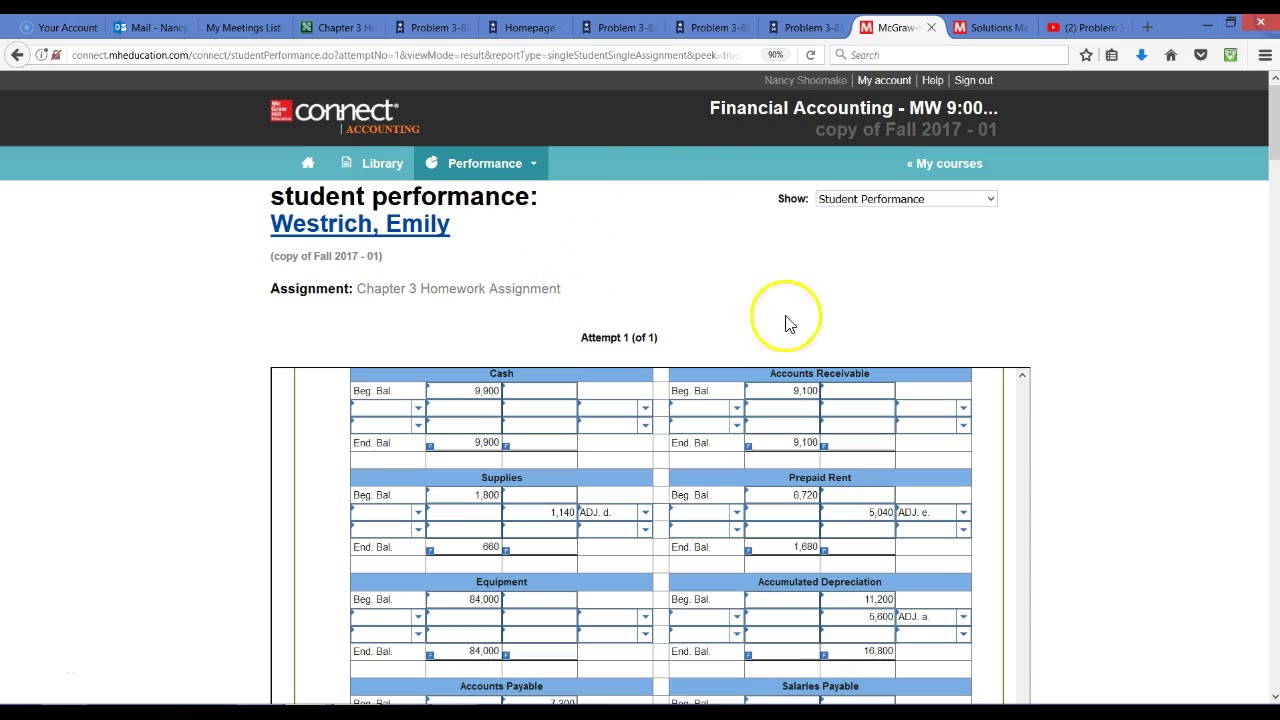

Solved connect Chapter 4Homework 500 points QS 49

These entries are passed by the company to changes its accounting records into the accruals concepts. Bu247 ch1 q and a. The revenue recognition principle mandates that revenue be reported when earned, regardless of when the revenue is collected. In this video, we go over chapter 4 homework, and maybe catch a few mistakes as they go but it is.

Show Works, Please Answers To Cengage Accounting Homework Chapter 4

Journal entry records the accounting transactions of a business in a journal book. On the income statement, miscellaneous expenses are usually presented as the last item without regard to the dollar amount. Web access fundamental accounting principles 24th edition chapter 4 solutions now. Are the gross increases in owner's equity resulting from business activities. Determine whether the firm reports each.

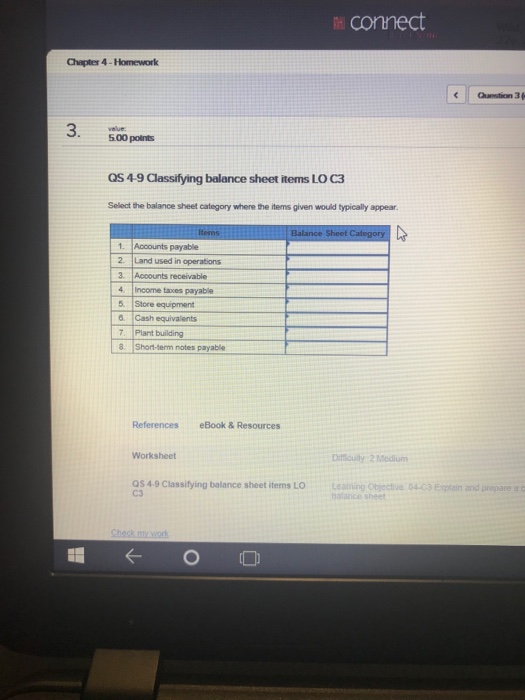

Connect Managerial Accounting Homework Chapter 4 Solutions

Economics chapter 1 and 2 vacb. Web acct 2301 chapter 4 homework. Determine whether the firm reports each of the following items as part of cash and cash equivalents in the balance. Web access fundamental accounting principles 24th edition chapter 4 solutions now. These entries are passed by the company to changes its accounting records into the accruals concepts.

Intermediate Accounting I (ACC307) 31 Homework Chapter 4 Homework Score

All the business transactions are recorded in the chronological order using the double entry system of accounting… Web acct 2301 chapter 4 homework. In a worksheet, net income is entered in the following columns. In this video, we go over chapter 4 homework, and maybe catch a few mistakes as they go but it is okay as it's a good.

Chapter 4 Homework Lecture YouTube

In this video, we go over chapter 4 homework, and maybe catch a few mistakes as they go but it is okay as it's a good way to learn connect. 3.4k views 4 years ago. Jane is covered under her employer’s group medical expense plan as an employee. Va esthetics rules and regs. Are the gross increases in owner's equity.

[Solved] Journalize the closing entries. Include Posting References

1 calculated as net sales minus cost of goods sold gross profit 2 a current asset that includes the cost to buy goods and make them ready for. All the business transactions are recorded in the chronological order using the double entry system of accounting… Other sets by this creator. Economics chapter 1 and 2 vacb. Web acct 2301 chapter.

😎 Mcgraw hill connect homework answers. Where should you go to get

Other sets by this creator. Income statements (dr) and balance sheet (cr) a worksheet is a. Web accounting test chapter 4. Which of the following is a characteristic of an asset? For this reason, when revenue is earned but not yet.

Chapter 4 Homework Accounting » Accounting Assignment Help Online

Other sets by this creator. The revenue recognition principle mandates that revenue be reported when earned, regardless of when the revenue is collected. Web the goal of accounting is to help people make better decisions about an organization than would be the case w/o accounting. All the business transactions are recorded in the chronological order using the double entry system.

Financial Accounting 101 Wiley Plus Ex. 54 YouTube

Determine whether the firm reports each of the following items as part of cash and cash equivalents in the balance. Our resource for fundamental accounting principles. Submit your answers in canvas before it is due. The revenue recognition principle mandates that revenue be reported when earned, regardless of when the revenue is collected. Economics chapter 1 and 2 vacb.

The Transaction Or Event Giving The Company The Right To The Benefit Or Control Over The Benefit Must.

Our solutions are written by chegg experts so you can be assured of the highest quality! Bu247 ch1 q and a. Submit your answers in canvas before it is due. A and c questions 1.

Which Of The Following Is A Characteristic Of An Asset?

Our resource for financial accounting includes answers to chapter. These entries are passed by the company to changes its accounting records into the accruals concepts. Jane is also covered under john’s plan as a dependent. Web acct 2301 chapter 4 homework.

3.4K Views 4 Years Ago.

Income statements (dr) and balance sheet (cr) a worksheet is a. Web terms in this set (26) once the adjusted trial balance is in balance, the flow of accounts will now go into the financial statements. Jane, age 28, and john, age 30, are married and have a son, age one. In a worksheet, net income is entered in the following columns.

Web The Goal Of Accounting Is To Help People Make Better Decisions About An Organization Than Would Be The Case W/O Accounting.

Web income statement debit column and the balance sheet credit column. 1 calculated as net sales minus cost of goods sold gross profit 2 a current asset that includes the cost to buy goods and make them ready for. Va esthetics rules and regs. The revenue recognition principle mandates that revenue be reported when earned, regardless of when the revenue is collected.

![[Solved] Journalize the closing entries. Include Posting References](https://media.cheggcdn.com/media/31f/31f67844-e301-4bf6-ac43-8c08590af58c/php3jjot6.png)