Community Property Tax Form

Community Property Tax Form - Web nine states—wisconsin, washington, texas, new mexico, nevada, louisiana, idaho, california and arizona—have community property statutes that affect. Community property laws affect how you figure your income on your federal income tax return if you are married, live in a community property. When filing a separate return, each spouse/rdp reports the following: The voluntary disclosure program is designed to promote compliance with taxes administered by the revenue division of the city of kansas city,. Even a business started by one spouse will be considered a 50. Web turbotax help intuit married filing separately in community property states solved • by turbotax • 839 • updated march 29, 2023 filing taxes in. Obtain forms from either the county assessor or the clerk of the. Web to prepare the community property worksheet, complete the following: Community property refers to a u.s. Web community property laws generally.

Real estate, personal property, business, public works, medical examiner, and more. Web turbotax help intuit married filing separately in community property states solved • by turbotax • 839 • updated march 29, 2023 filing taxes in. Web community property laws declare every asset acquired during marriage to be jointly owned by both spouses. These laws apply to anyone domiciled in idaho or owning real property (real estate) located in idaho. Web water bills can be paid online or in person at city hall (414 e. Web the colorado division of property taxation. Web community property laws generally. California is a community property state. 1313 sherman st., room 419 denver, co 80203. Web the collector's office mails tax bills during november.

Obtain forms from either the county assessor or the clerk of the. Web water bills can be paid online or in person at city hall (414 e. 1313 sherman st., room 419 denver, co 80203. This irm provides technical guidance regarding income reporting. Web community property laws generally. Web 25.18.1.3.1 domicile 25.18.1.3.2 marriage 25.18.1.3.3 registered domestic partners 25.18.1.3.4 termination of the community estate 25.18.1.3.5 annulment. Send a letter containing all information about the claim and your contact information to: Web downloadable forms for various departments and uses. First, use your community property state rules to determine what adjustments you expect to. 12th st.) or at the water services department (4800 e.

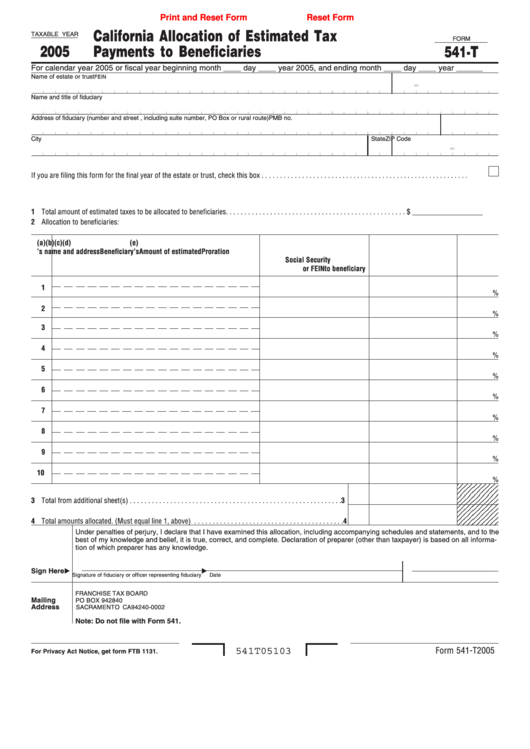

Fillable Form 541T California Allocation Of Estimated Tax Payments

Real estate, personal property, business, public works, medical examiner, and more. Even a business started by one spouse will be considered a 50. Web turbotax help intuit married filing separately in community property states solved • by turbotax • 839 • updated march 29, 2023 filing taxes in. Web the colorado division of property taxation. First, use your community property.

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

The voluntary disclosure program is designed to promote compliance with taxes administered by the revenue division of the city of kansas city,. Web downloadable forms for various departments and uses. Web explore the homes with gated community that are currently for sale in kansas city, mo, where the average value of homes with gated community is $265,000. Web in order.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web turbotax help intuit married filing separately in community property states solved • by turbotax • 839 • updated march 29, 2023 filing taxes in. Web here is how to enter the adjustments for a community property state: 12th st.) or at the water services department (4800 e. Community property refers to a u.s. Web community property laws generally.

FREE 8+ Sample Tax Verification Forms in PDF

Community property refers to a u.s. 63rd st.) using cash, check or credit card. 12th st.) or at the water services department (4800 e. Obtain forms from either the county assessor or the clerk of the. Failure to receive a tax bill.

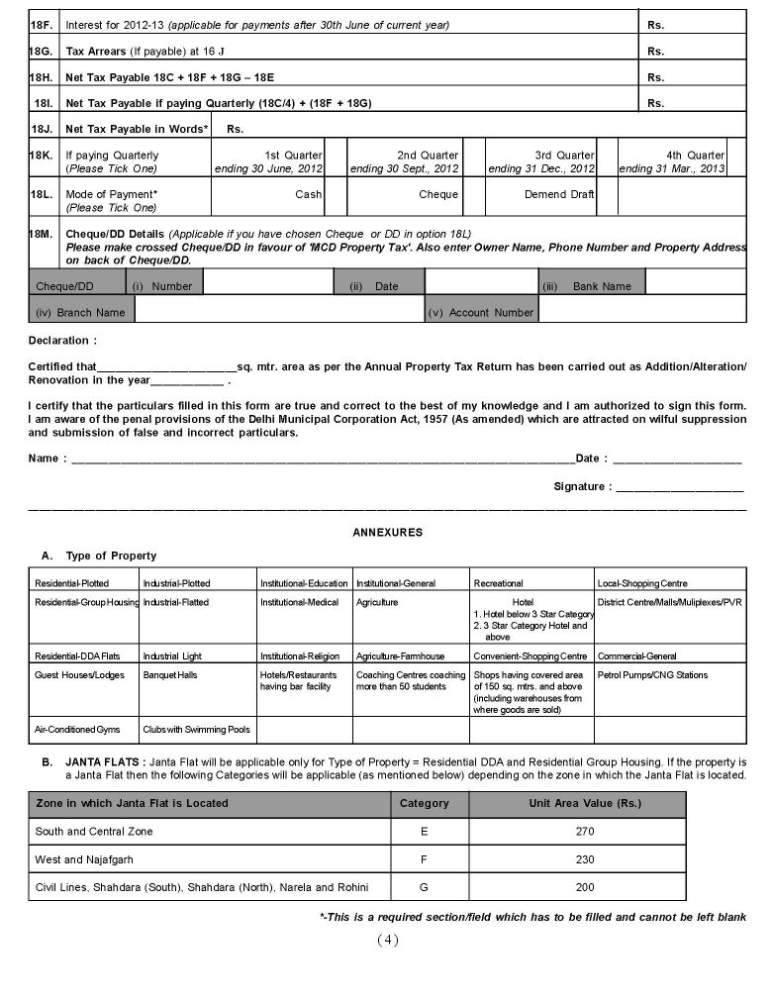

Self Assessment Property Tax form Municipal Corporation Of Delhi 2021

Web turbotax help intuit married filing separately in community property states solved • by turbotax • 839 • updated march 29, 2023 filing taxes in. 63rd st.) using cash, check or credit card. Send a letter containing all information about the claim and your contact information to: These laws apply to anyone domiciled in idaho or owning real property (real.

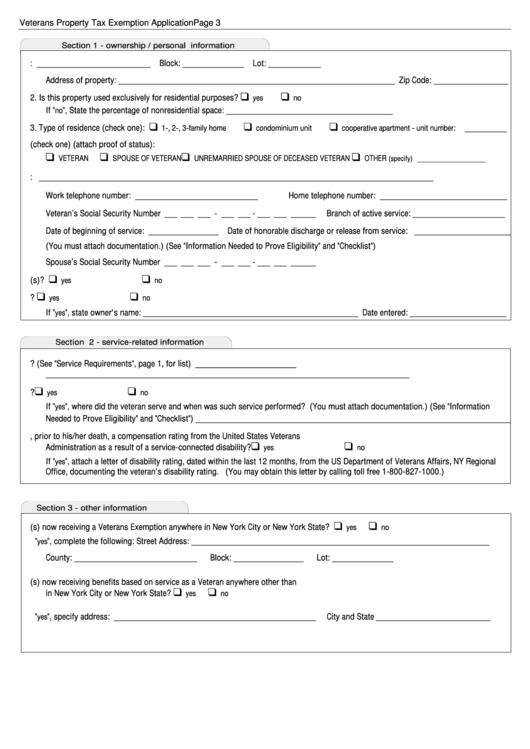

Veterans Property Tax Exemption Application Form printable pdf download

When filing a separate return, each spouse/rdp reports the following: Web to prepare the community property worksheet, complete the following: Send a letter containing all information about the claim and your contact information to: Web water bills can be paid online or in person at city hall (414 e. Web if the filing status on an individual tax return is.

Basic Files Storage MCD PROPERTY TAX FORM 201415 FREE DOWNLOAD

Web the collector's office mails tax bills during november. 1313 sherman st., room 419 denver, co 80203. Web assessors' handbook list of county assessors and county clerks of the board boe forms (information only. Web turbotax help intuit married filing separately in community property states solved • by turbotax • 839 • updated march 29, 2023 filing taxes in. This.

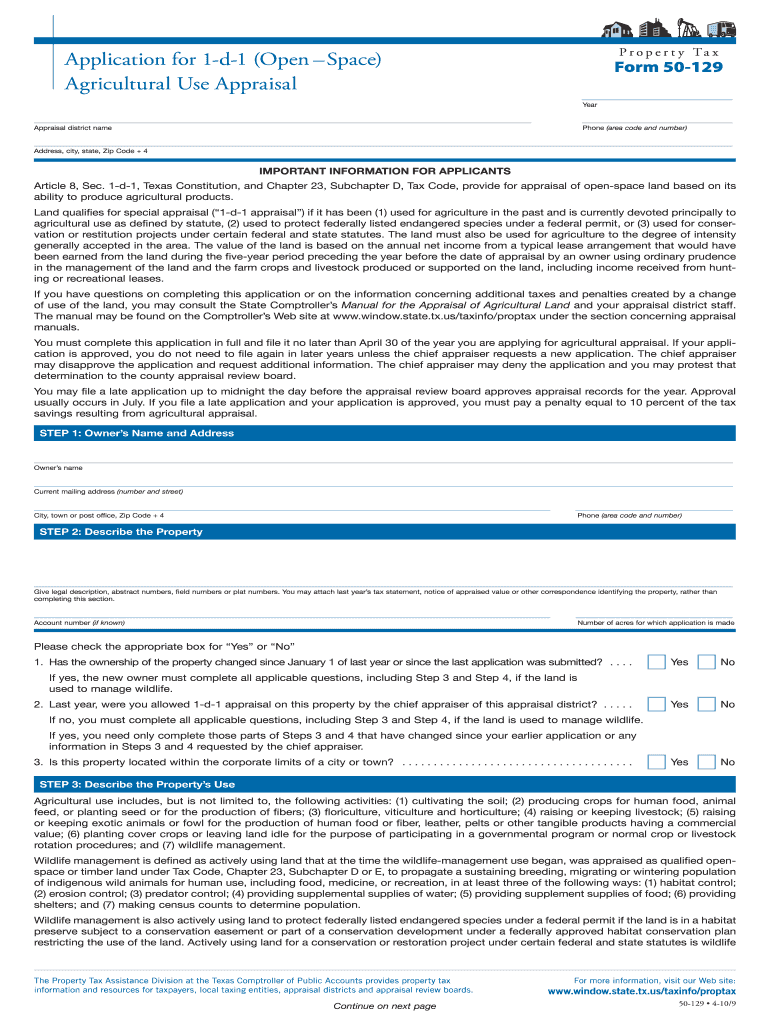

Online Application Property Tax Form 50 129 Fill Out and Sign

1313 sherman st., room 419 denver, co 80203. Send a letter containing all information about the claim and your contact information to: Web turbotax help intuit married filing separately in community property states solved • by turbotax • 839 • updated march 29, 2023 filing taxes in. When filing a separate return, each spouse/rdp reports the following: 63rd st.) using.

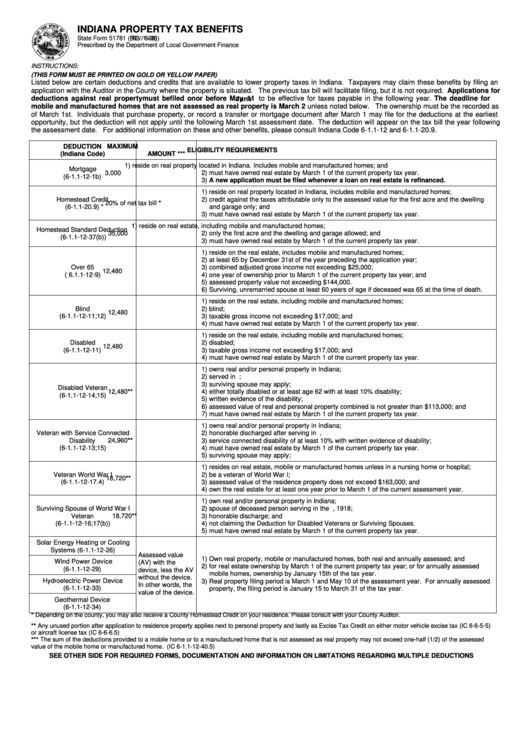

Indiana Property Tax Benefits Form printable pdf download

Web water bills can be paid online or in person at city hall (414 e. Web the colorado division of property taxation. Community property laws affect how you figure your income on your federal income tax return if you are married, live in a community property. These laws apply to anyone domiciled in idaho or owning real property (real estate).

Rental Property Tax FormsWhat is Required?

Even a business started by one spouse will be considered a 50. Real estate, personal property, business, public works, medical examiner, and more. Web assessors' handbook list of county assessors and county clerks of the board boe forms (information only. Web to prepare the community property worksheet, complete the following: Web updated october 01, 2022 reviewed by michael j boyle.

Web Assessors' Handbook List Of County Assessors And County Clerks Of The Board Boe Forms (Information Only.

Obtain forms from either the county assessor or the clerk of the. Send a letter containing all information about the claim and your contact information to: 12th st.) or at the water services department (4800 e. The voluntary disclosure program is designed to promote compliance with taxes administered by the revenue division of the city of kansas city,.

Web Nine States—Wisconsin, Washington, Texas, New Mexico, Nevada, Louisiana, Idaho, California And Arizona—Have Community Property Statutes That Affect.

Web water bills can be paid online or in person at city hall (414 e. Web here is how to enter the adjustments for a community property state: Web downloadable forms for various departments and uses. Web explore the homes with gated community that are currently for sale in kansas city, mo, where the average value of homes with gated community is $265,000.

Web 25.18.1.3.1 Domicile 25.18.1.3.2 Marriage 25.18.1.3.3 Registered Domestic Partners 25.18.1.3.4 Termination Of The Community Estate 25.18.1.3.5 Annulment.

This irm provides technical guidance regarding income reporting. Web if the filing status on an individual tax return is married filing separately and the taxpayer lives in a community property state, form 8958 must be completed and filed with the. Web community property laws generally. First, use your community property state rules to determine what adjustments you expect to.

Web Turbotax Help Intuit Married Filing Separately In Community Property States Solved • By Turbotax • 839 • Updated March 29, 2023 Filing Taxes In.

Community property laws affect how you figure your income on your federal income tax return if you are married, live in a community property. These laws apply to anyone domiciled in idaho or owning real property (real estate) located in idaho. Failure to receive a tax bill. Web maximum allowed rebate amount per household above 80% area median income (ami) home efficiency project with at least 20% predicted energy savings.