Cp2000 Response Form Pdf

Cp2000 Response Form Pdf - Web your cp2000 might come with a response letter or form which explains the steps you need to take to approve and submit the proposed changes. Web return (form 1040x), write “cp2000” on the top of your amended federal tax return (form 1040x) and attach it behind your completed response form. You can submit your response by: Web complete the form on page seven of your letter cp 2000 to show whether you agree or disagree with the changes the irs is proposing in the letter. Web a response form, payment voucher, and an envelope. Under the internal revenue code, in many types of income, persons paying you amounts are required to report such an income to irs in. Web what is a cp2000 notice? Web you have the right to contest penalties and appeal an irs decision about your cp2000 notice. Web an installment plan, send in your response form and a completed installment agreement request (form 9465). Web taxpayers should respond to the cp2000, usually within 30 days from the date printed on the notice.

Web respond to the notice. Web you have the right to contest penalties and appeal an irs decision about your cp2000 notice. You can submit your response by: Mail using the return address on the enclosed envelope, or. Under the internal revenue code, in many types of income, persons paying you amounts are required to report such an income to irs in. Response to cp2000 notice dated month, xx, year. Web the cp2000 notice means that the income and payment information the irs has on file for you doesn't match the information you reported in your return. Web you have two options on how you can respond to a cp2000 notice. Web a response form, payment voucher, and an envelope. Web read the information in the cp2000 carefully so you know why you have been issued the notice.

Web the first step toward taking control is to open that envelope and see what sort of letter it is. If you have received a cp2000 notice from the irs, it helps to understand. Web complete the form on page seven of your letter cp 2000 to show whether you agree or disagree with the changes the irs is proposing in the letter. Web a response form, payment voucher, and an envelope. You can submit your response by: Web return (form 1040x), write “cp2000” on the top of your amended federal tax return (form 1040x) and attach it behind your completed response form. Web an installment plan, send in your response form and a completed installment agreement request (form 9465). Instructions will also be provided on what you must do next. Checking the box on the irs form may not effectively protect. Fax your documents to the fax number in the notice using.

About Privacy Policy Copyright TOS Contact Sitemap

Web taxpayers should respond to the cp2000, usually within 30 days from the date printed on the notice. Response to cp2000 notice dated month, xx, year. Web review the proposed changes and compare them to your tax return. Web the first step toward taking control is to open that envelope and see what sort of letter it is. You can.

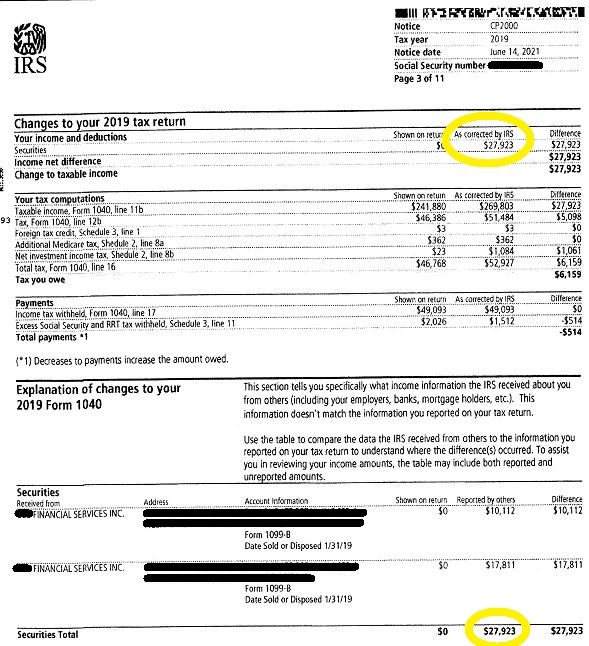

IRS Audit Letter CP2000 Sample 4

Review the information on the cp2000 carefully for accuracy. Web your cp2000 might come with a response letter or form which explains the steps you need to take to approve and submit the proposed changes. Fax your documents to the fax number in the notice using. Web respond to the notice. Web an installment plan, send in your response form.

Index of /EveryWhichWayButLoose/GK

Web an installment plan, send in your response form and a completed installment agreement request (form 9465). Web your cp2000 might come with a response letter or form which explains the steps you need to take to approve and submit the proposed changes. Web you have the right to contest penalties and appeal an irs decision about your cp2000 notice..

Understanding Your CP2000 Notice

Web an installment plan, send in your response form and a completed installment agreement request (form 9465). Web you have two options on how you can respond to a cp2000 notice. Under the internal revenue code, in many types of income, persons paying you amounts are required to report such an income to irs in. Web read the information in.

[View 44+] Sample Letter Format To Irs LaptrinhX / News

Web return (form 1040x), write “cp2000” on the top of your amended federal tax return (form 1040x) and attach it behind your completed response form. Web read the information in the cp2000 carefully so you know why you have been issued the notice. Web respond to the notice. Web review the proposed changes and compare them to your tax return..

Watch Out for IRS CP2000 Mendoza & Company, Inc.

Web return (form 1040x), write “cp2000” on the top of your amended federal tax return (form 1040x) and attach it behind your completed response form. Response to cp2000 notice dated month, xx, year. Mail using the return address on the enclosed envelope, or. You can submit your response by: Checking the box on the irs form may not effectively protect.

IRS Audit Letter CP2000 Sample 5

Web taxpayers should respond to the cp2000, usually within 30 days from the date printed on the notice. Web an installment plan, send in your response form and a completed installment agreement request (form 9465). Web an irs cp2000 notice is a form automatically generated by the irs if it seems that the income you reported on your federal tax.

IRS Audit Letter CP2000 Sample 1

Web return (form 1040x), write “cp2000” on the top of your amended federal tax return (form 1040x) and attach it behind your completed response form. Mail using the return address on the enclosed envelope, or. You can submit your response by: Web the cp2000 notice means that the income and payment information the irs has on file for you doesn't.

ads/responsive.txt Irs Cp2000 Response form Pdf Awesome Outstanding

Web you have the right to contest penalties and appeal an irs decision about your cp2000 notice. To whom it may concern, i received your notice dated month, xx,. Under the internal revenue code, in many types of income, persons paying you amounts are required to report such an income to irs in. You can submit your response by: Web.

Irs Cp2000 Example Response Letter amulette

Web the cp2000 notice means that the income and payment information the irs has on file for you doesn't match the information you reported in your return. If a timely response can’t be made, taxpayers need to call the. If you have received a cp2000 notice from the irs, it helps to understand. Web the first step toward taking control.

Web Read The Information In The Cp2000 Carefully So You Know Why You Have Been Issued The Notice.

Web review the proposed changes and compare them to your tax return. You can submit your response by: Mail using the return address on the enclosed envelope, or. Web you have the right to contest penalties and appeal an irs decision about your cp2000 notice.

Checking The Box On The Irs Form May Not Effectively Protect.

Web return (form 1040x), write “cp2000” on the top of your amended federal tax return (form 1040x) and attach it behind your completed response form. Web a response form, payment voucher, and an envelope. If you have received a cp2000 notice from the irs, it helps to understand. If a timely response can’t be made, taxpayers need to call the.

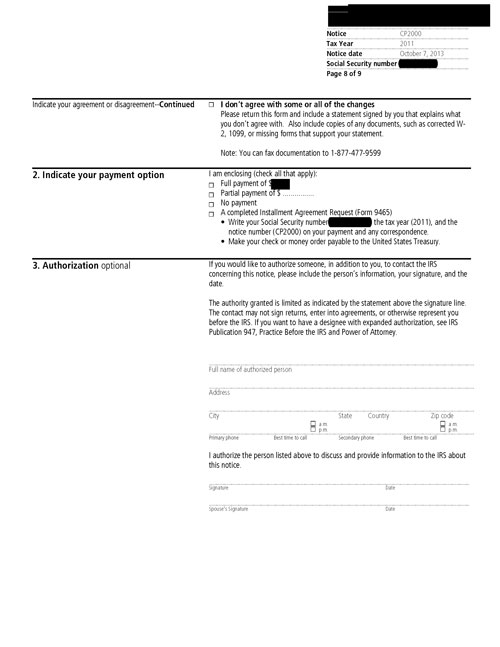

Web Complete The Form On Page Seven Of Your Letter Cp 2000 To Show Whether You Agree Or Disagree With The Changes The Irs Is Proposing In The Letter.

To whom it may concern, i received your notice dated month, xx,. Web an installment plan, send in your response form and a completed installment agreement request (form 9465). Web what is a cp2000 notice? Web return (form 1040x), write “cp2000” on the top of your amended federal tax return (form 1040x) and attach it behind your completed response form.

Web The First Step Toward Taking Control Is To Open That Envelope And See What Sort Of Letter It Is.

Fax your documents to the fax number in the notice using. Determine if you agree or disagree. Web the cp2000 notice means that the income and payment information the irs has on file for you doesn't match the information you reported in your return. Under the internal revenue code, in many types of income, persons paying you amounts are required to report such an income to irs in.

![[View 44+] Sample Letter Format To Irs LaptrinhX / News](https://www.hrblock.com/tax-center/wp-content/uploads/2018/01/Letter-2840C.png)