Credit Is Costly Chapter 4 Lesson 4

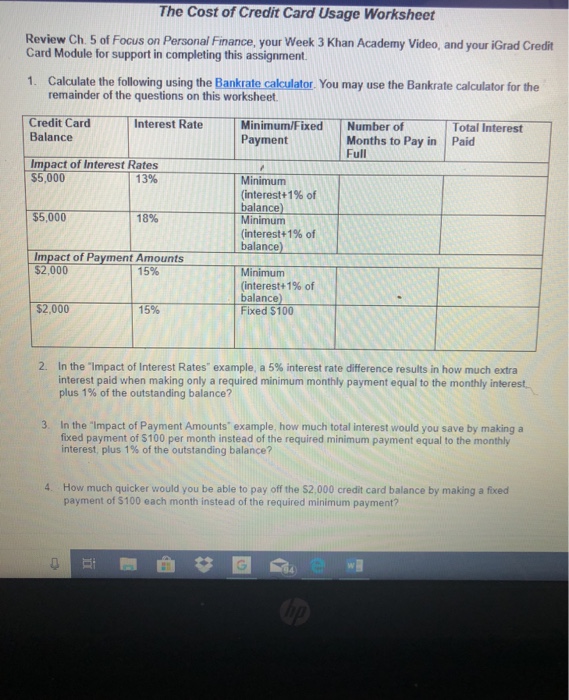

Credit Is Costly Chapter 4 Lesson 4 - $10,500 x 24/18 = $14,000. Introduction to personal finance chapter 2: Explain when this credit card company can adjust the apr. What is the annual fee for having this credit card? Explain when this credit card company can adjust the apr. Web a fee charged by a lender on entering into a loan agreement to cover the cost of processing the loan. Fair credit reporting act (1970) protects the privacy and accuracy of information in a credit check. What is the annual fee for having this credit card? Web factors that affect a credit score. If you have savings, use it to pay off high rate yet.

Click the card to flip 👆. Web credit is costly chapter 4, lesson 4 1. Web 1 / 35 flashcards learn test match created by raquel_hughes15 terms in this set (35) the federal trade commission (ftc) is one of many u.s. The role of insurance chapter 10: Credit and debt chapter 5: The key terms relating to credit are given as follows: Web also called a check card. A fee charged by a credit card company for the use of their credit. Web cost accounting chapter 4. Explain when this credit card company can adjust the apr.

Web also called a check card. Explain when this credit card company can adjust the apr. Web dave ramsey personal finance chapter 4: Fair credit reporting act (1970) protects the privacy and accuracy of information in a credit check. A fee for spending more than your credit. 4 hidden costs of credit annual fee click the card to flip 👆 a yearly fee that may be charged for having a credit card click the card to flip 👆 1 / 18 flashcards learn test match created by thompsont61 teacher terms in this set (18) annual fee a yearly fee that may be charged for having a credit card credit. Explain when this credit card company can adjust the apr. A fee charged by a credit card company for the use of their credit. Find other quizzes for life skills and more on quizizz for free! What is the annual fee for having this credit card?

Explosives Study Guide Answers

Web credit is costly chapter 4, lesson 4 1. 80% forbes 400's secret to building wealth stay debt free a yearly fee that is charged by the credit card company for the convenience of the credit card annual fee cost. Click the card to flip 👆. Explain when this credit card company can adjust the apr. $10,500 x 24/18 =.

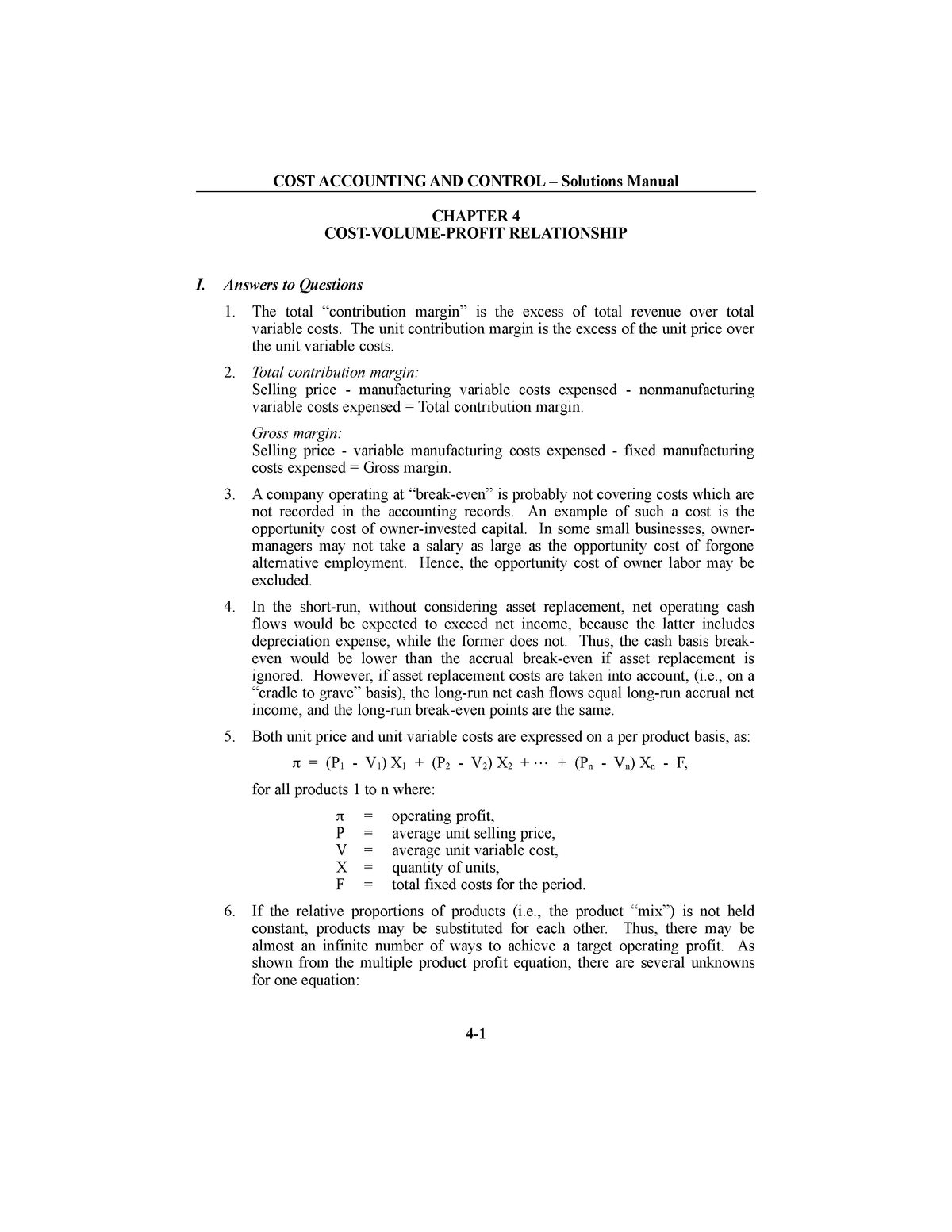

Chapter 4 Answer Cost accounting COST ACCOUNTING AND CONTROL

Web cost accounting chapter 4. If you have savings, use it to pay off high rate yet. The next chapter, chapter 5 is also available here. Federal agencies that regulate the consumer credit system and enforce the laws related to it. What is the grace period on this card?

Chapter 4Lesson 4 Key

Web true what percent of millionaires in america are first generation rich? What is the annual fee for having this credit card? 80% forbes 400's secret to building wealth stay debt free a yearly fee that is charged by the credit card company for the convenience of the credit card annual fee cost. What is the apr for. Type of.

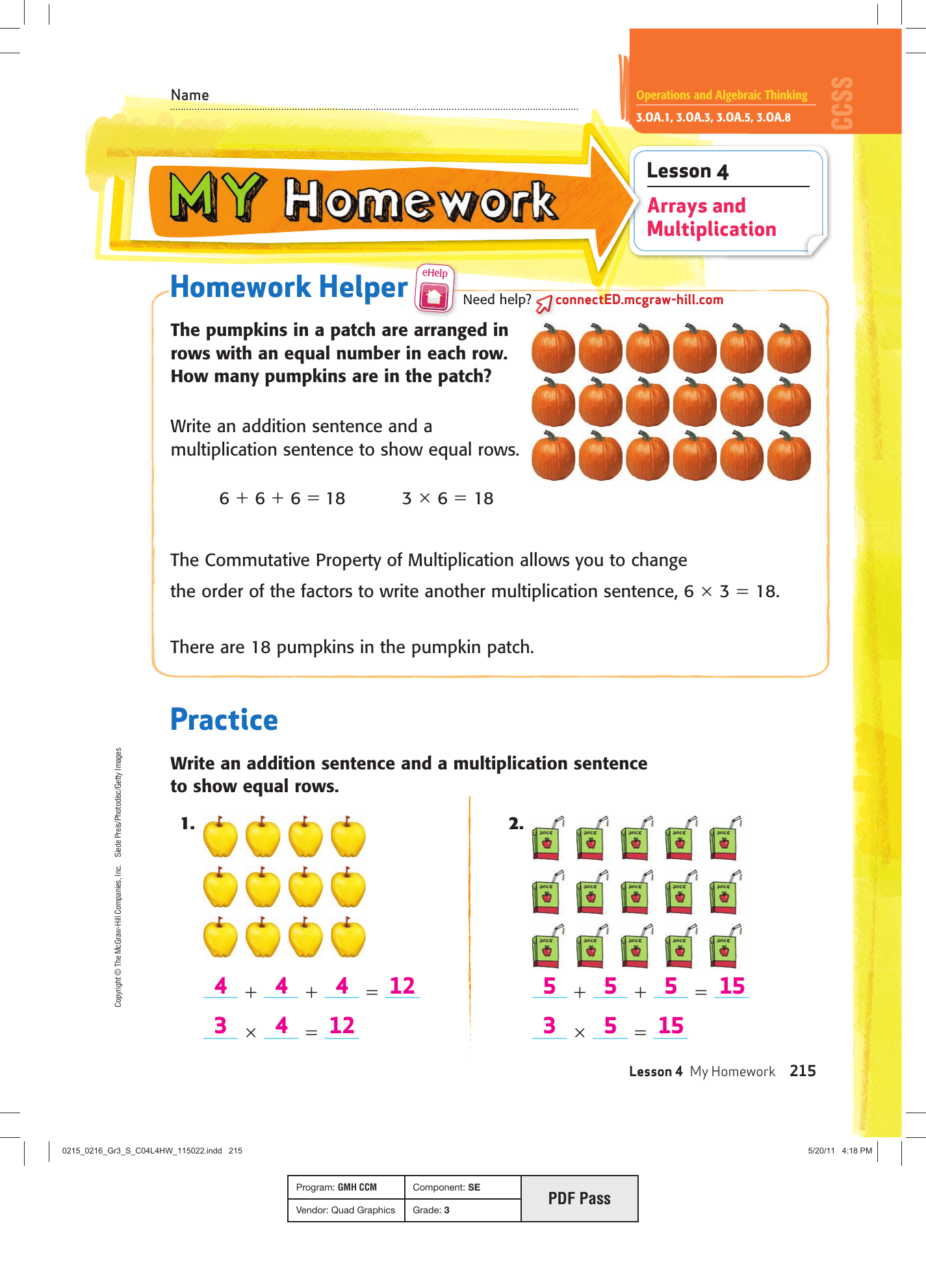

4th GRADE . Homework session ‘A’ Chapter 4 worksheet

Web a fee charged by a lender on entering into a loan agreement to cover the cost of processing the loan. If you have savings, use it to pay off high rate yet. Web also called a check card. Transfer or dead from high interest rate loans to lower rate loans, known as refinancing. What are the terms relating to.

Chapter 4 Lesson 3 YouTube

A fee charged by a credit card company for the use of their credit. Explain when this credit card company can adjust the apr. If you have savings, use it to pay off high rate yet. Credit and debt chapter 5: Introduction to personal finance chapter 2:

A&P Chapter 4, Lesson 4 YouTube

Federal agencies that regulate the consumer credit system and enforce the laws related to it. Web true what percent of millionaires in america are first generation rich? The next chapter, chapter 5 is also available here. Web credit is costly chapter 4, lesson 4 1. Transfer or dead from high interest rate loans to lower rate loans, known as refinancing.

Chapter 4 Lesson 8 Page 173 YouTube

What is the grace period on this card? The preferred method of debt. For tips for anyone with debt. Web 1 / 35 flashcards learn test match created by raquel_hughes15 terms in this set (35) the federal trade commission (ftc) is one of many u.s. Web credit is costly chapter 4, lesson 4 1.

Answers Chapter 4 Quiz Debits And Credits Payments

What is the apr for. A fee for spending more than your credit. For tips for anyone with debt. Web credit is costly chapter 4, lesson 4 1. Web cost accounting chapter 4.

Chapter 4 Lesson 5 Review YouTube

The preferred method of debt. 4 hidden costs of credit annual fee click the card to flip 👆 a yearly fee that may be charged for having a credit card click the card to flip 👆 1 / 18 flashcards learn test match created by thompsont61 teacher terms in this set (18) annual fee a yearly fee that may be.

Minimum Payments Mean Costly Consequences Chapter 4 Lesson 1

History of rental, utility payments, down payment amount, and employment history. What is the apr for. What is the annual fee for having this credit card? Explain when this credit card company can adjust the apr. Federal agencies that regulate the consumer credit system and enforce the laws related to it.

The Act Of Combining All Debts Into One Monthly Payment, Typically Extending The Terms And The Length Of Time Required To Repay The Debt.

What is the apr for. Web credit is costly chapter 4, lesson 4 1. The role of insurance chapter 10: $10,500 x 24/18 = $14,000.

The Key Terms Relating To Credit Are Given As Follows:

What is the apr for. Introduction to personal finance chapter 2: True a yearly fee that's charged by the credit card company for the convenience of the credit. What are the terms relating to credit?

Web Credit Is Costly Chapter 4, Lesson 4 1.

Web true what percent of millionaires in america are first generation rich? Web dave ramsey personal finance chapter 4: Credit and debt chapter 5: Web factors that affect a credit score.

Web Cost Accounting Chapter 4.

A fee for spending more than your credit. Fair credit reporting act (1970) protects the privacy and accuracy of information in a credit check. What is the annual fee for having this credit card? What is the grace period on this card?