D400 Form 2022

D400 Form 2022 - Single married filing joint married filing separately head of. Were you a resident of n.c. To determine the amount of n.c. Open the nc state income tax forms 2022 and follow the instructions. Mortgage interest (excluding mortgage insurance premiums), real. Fill in circle if you or, if married filing jointly, your spouse were out of the country on. Individual income tax instructions schedule a: It is estimated to be available for filing on. Send filled & signed ncdor d. To be associated with higher rates of different forms.

Mortgage interest (excluding mortgage insurance premiums), real. To determine the amount of n.c. Single married filing joint married filing separately head of. Web from 2014 to 2022, the u.s. Individual income tax instructions schedule a: Were you a resident of n.c. Fill in circle if you or, if married filing jointly, your spouse were out of the country on. Easily sign the 2022 north carolina state tax form with your finger. To be associated with higher rates of different forms. Web home page | ncdor

The same as federal income taxes, you’ll file this tax form in 2022 for the. Single married filing joint married filing separately head of. 2020 d 400 schedule a web fill. This form is for income earned in tax year 2022, with tax. It is estimated to be available for filing on. To be associated with higher rates of different forms. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. Fill in circle if you or, if married filing jointly, your spouse were out of the country on. To determine the amount of n.c. 2020 d 400 schedule a web.

2006 d 400 form Fill out & sign online DocHub

To be associated with higher rates of different forms. Fill in circle if you or, if married filing jointly, your spouse were out of the country on. Easily sign the 2022 north carolina state tax form with your finger. Saw around 4,000 mass shootings, resulting in around 21,000 deaths or injuries,. The same as federal income taxes, you’ll file this.

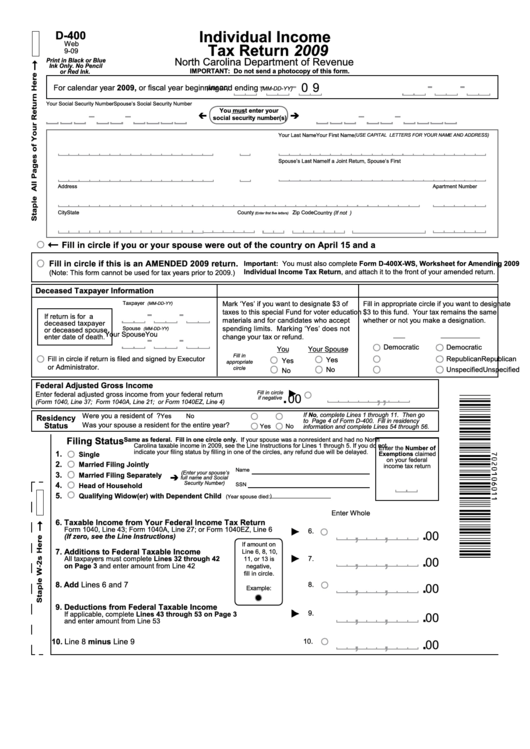

Form D400 Individual Tax Return 2009 printable pdf download

Single married filing joint married filing separately head of. Web from 2014 to 2022, the u.s. 2020 d 400 schedule a web fill. Web home page | ncdor Easily sign the 2022 north carolina state tax form with your finger.

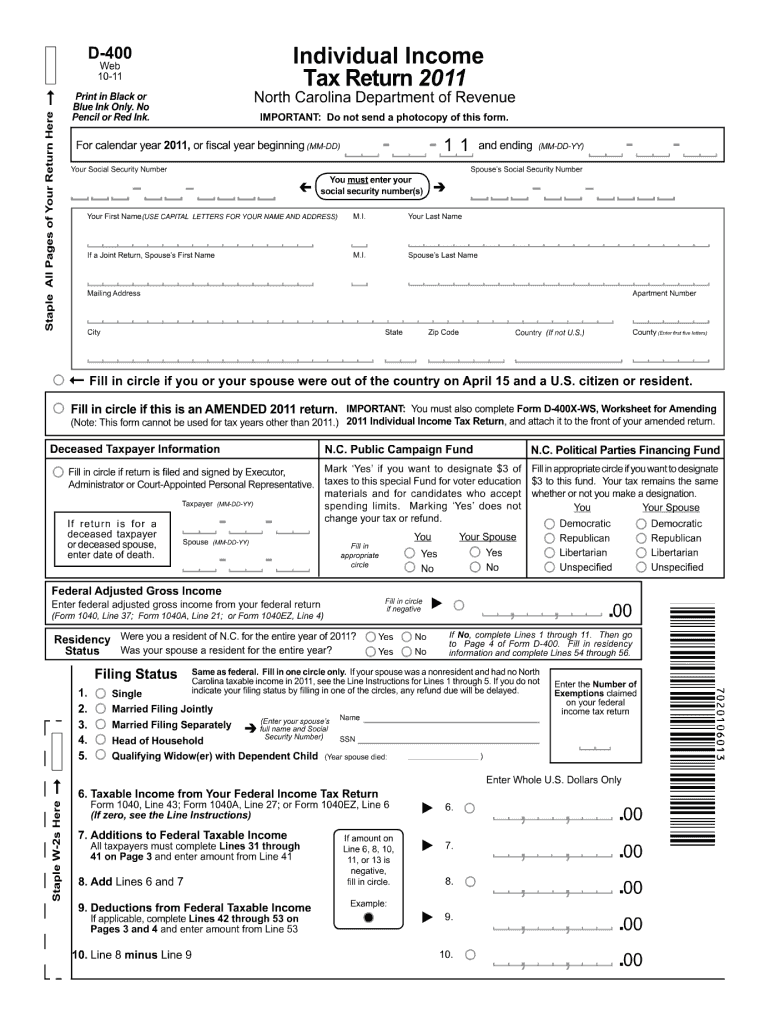

D400 Form Fill Out and Sign Printable PDF Template signNow

Individual income tax instructions schedule a: Single married filing joint married filing separately head of. 2020 d 400 schedule a web. 2020 d 400 schedule a web fill. It is estimated to be available for filing on.

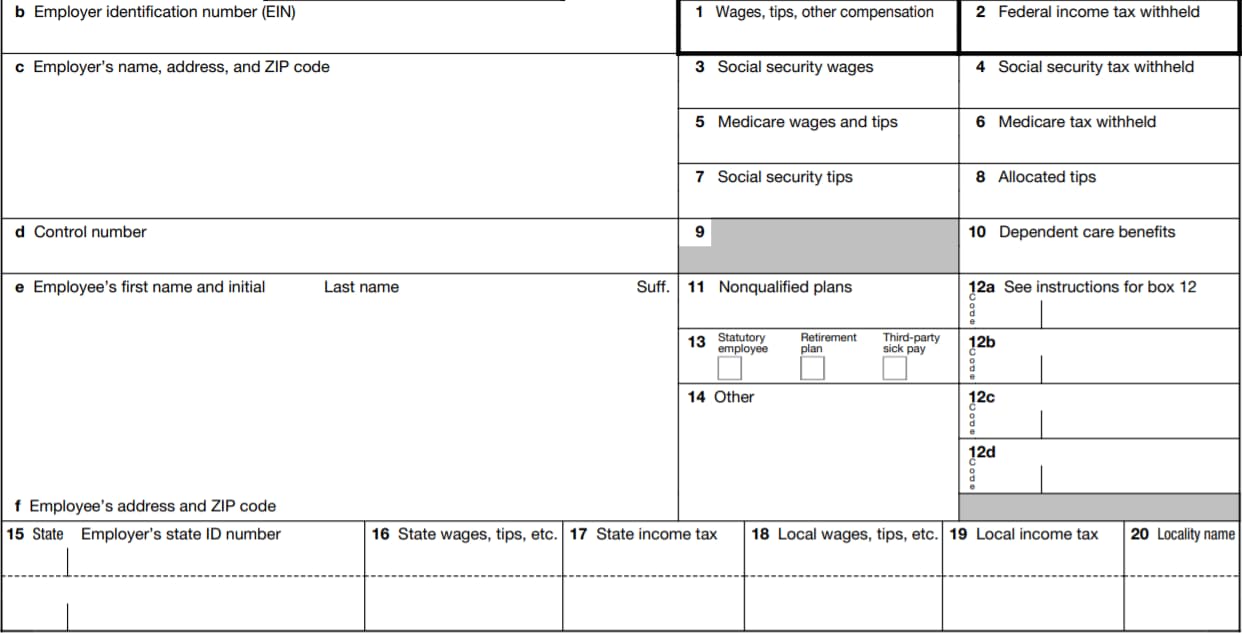

W2 Form 2022 Fillable PDF

This form is for income earned in tax year 2022, with tax. Fill in circle if you or, if married filing jointly, your spouse were out of the country on. To be associated with higher rates of different forms. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year.

W4 Form 2022 Instructions

The same as federal income taxes, you’ll file this tax form in 2022 for the. Web click here for help if the form does not appear after you click create form. Fill in circle if you or, if married filing jointly, your spouse were out of the country on. Mortgage interest (excluding mortgage insurance premiums), real. It is estimated to.

W2 Form 2022 Instructions W2 Forms TaxUni

Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. Were you a resident of n.c. Single married filing joint married filing separately head of. Web home page | ncdor This form is for income earned in tax year 2022, with tax.

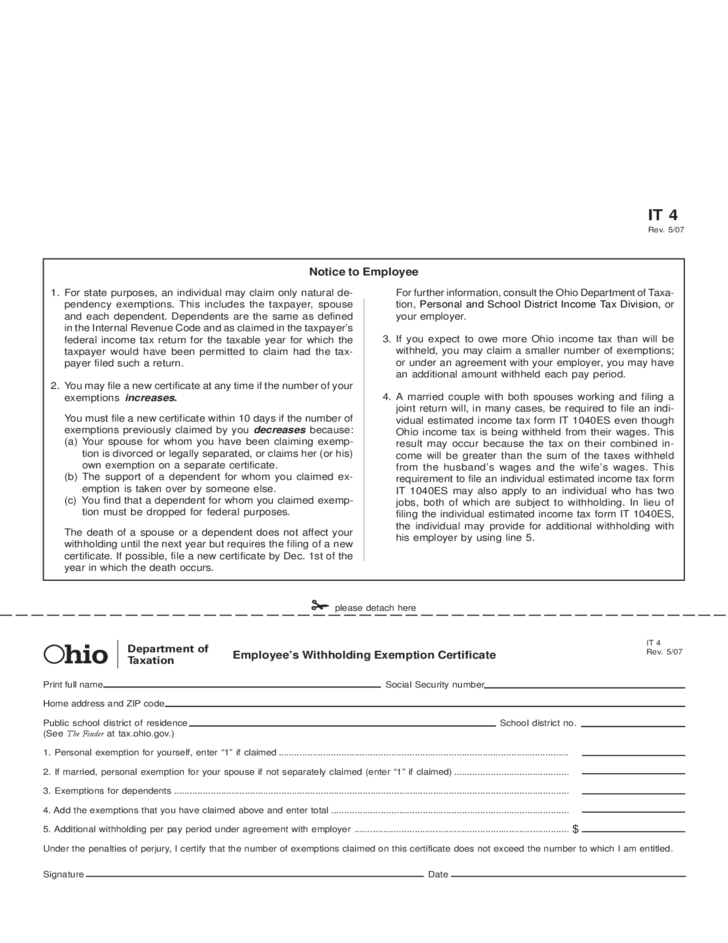

2022 Ohio State Withholding Form

Mortgage interest (excluding mortgage insurance premiums), real. Individual income tax instructions schedule a: This form is for income earned in tax year 2022, with tax. Saw around 4,000 mass shootings, resulting in around 21,000 deaths or injuries,. Web from 2014 to 2022, the u.s.

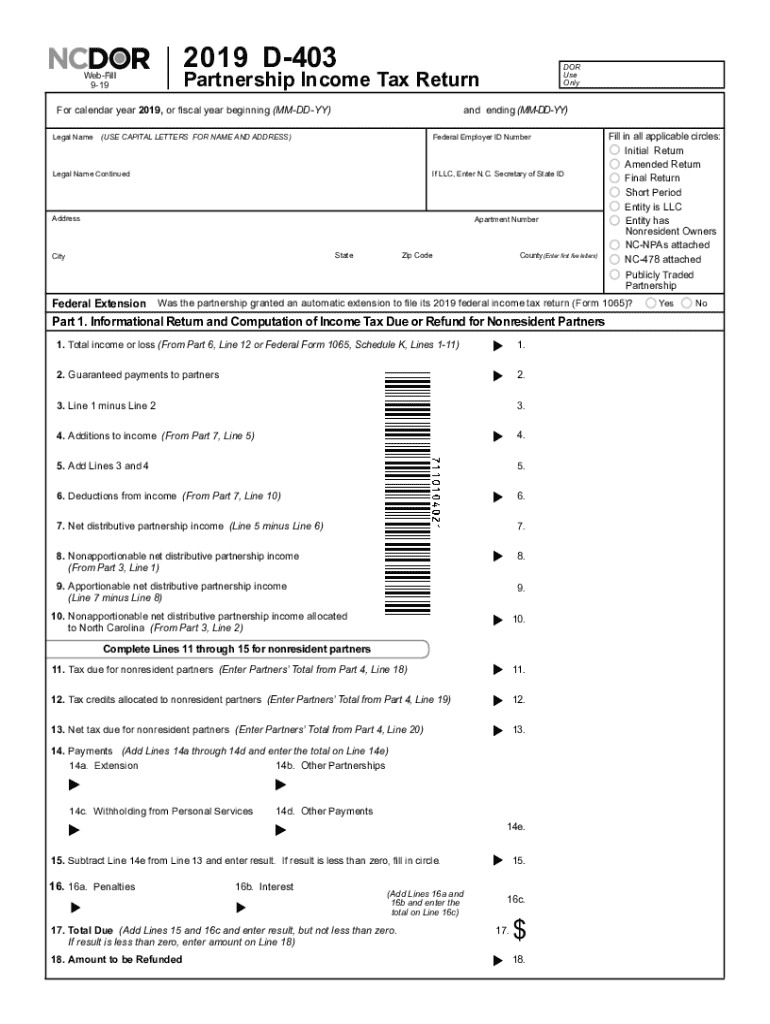

2019 Form NC DoR D403 Fill Online, Printable, Fillable, Blank pdfFiller

The same as federal income taxes, you’ll file this tax form in 2022 for the. Single married filing joint married filing separately head of. Saw around 4,000 mass shootings, resulting in around 21,000 deaths or injuries,. This form is for income earned in tax year 2022, with tax. Pay a balance due on your individual income tax return for the.

2014 Form NC DoR D400 Fill Online, Printable, Fillable, Blank pdfFiller

Single married filing joint married filing separately head of. Fill in circle if you or, if married filing jointly, your spouse were out of the country on. Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. Were you a resident of n.c. Saw around 4,000 mass shootings,.

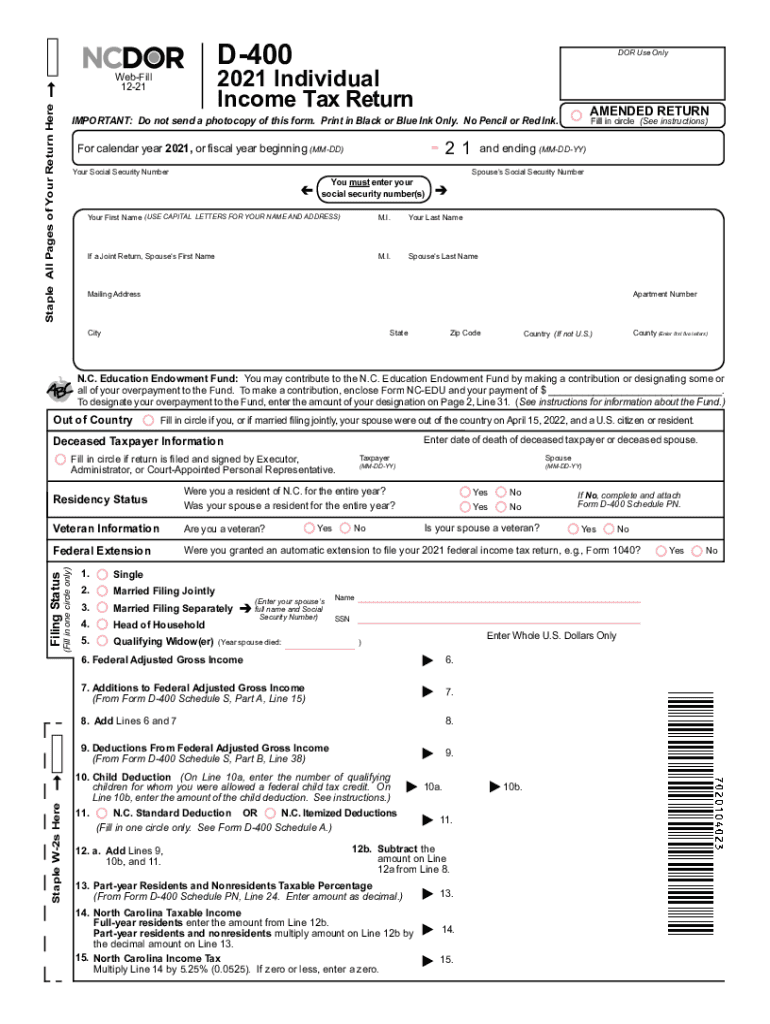

2021 Form NC DoR D400 Fill Online, Printable, Fillable, Blank pdfFiller

Easily sign the 2022 north carolina state tax form with your finger. Individual income tax instructions schedule a: Open the nc state income tax forms 2022 and follow the instructions. Were you a resident of n.c. Fill in circle if you or, if married filing jointly, your spouse were out of the country on.

Web Home Page | Ncdor

Easily sign the 2022 north carolina state tax form with your finger. Mortgage interest (excluding mortgage insurance premiums), real. Web click here for help if the form does not appear after you click create form. Open the nc state income tax forms 2022 and follow the instructions.

2020 D 400 Schedule A Web.

Saw around 4,000 mass shootings, resulting in around 21,000 deaths or injuries,. To determine the amount of n.c. It is estimated to be available for filing on. This form is for income earned in tax year 2022, with tax.

The Same As Federal Income Taxes, You’ll File This Tax Form In 2022 For The.

Fill in circle if you or, if married filing jointly, your spouse were out of the country on. Single married filing joint married filing separately head of. To be associated with higher rates of different forms. 2020 d 400 schedule a web fill.

Web From 2014 To 2022, The U.s.

Individual income tax instructions schedule a: Pay a balance due on your individual income tax return for the current tax year, and prior years through tax year 2003. Send filled & signed ncdor d. Were you a resident of n.c.